Cambodia has undergone different stages of economic reforms during the past two decades. In the late 1980s, its command economy was transformed into a free market economy, which allowed market forces to set prices. In particular, individuals could act with discretion and pursue material incentive in this competitive economic system. To aid the process of the free market economy, the Cambodian government firstly enforced the protection of property rights, and subsequently adopted policies of deregulation, privatization of state-owned enterprises and liberalization of trade. In 1994, the Cambodian government enacted the Lawon Investment,which granted foreign investors a wide range of incentives and relaxed foreign investment regulations. In 1999, it became a member of ASEAN (Association of Southeast Asian Nations), which consists of ten countries with a total population of about 550 million. Under the AFTA (ASEAN Free Trade Agreement), Cambodia had agreed to reduce tariff rates on imported goods from ASEAN members, which could attract foreign investment and improve market access in the region. Trade liberalization (e.g. reform and restructuring of the tariff regime, removal of non-tariff barriers) continued in 2001. In 2003, Cambodia joined the WTO (World Trade Organization), a move aimed to foster its integration in the world economy in order to achieve higher economic growth, poverty reduction and sustainable development (Hing, 2003; IMF, 2003; US Department of State, 20051).

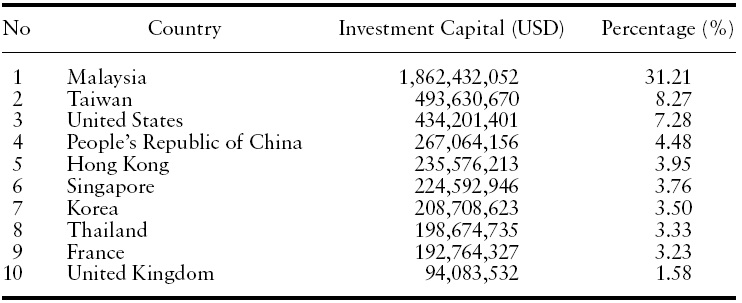

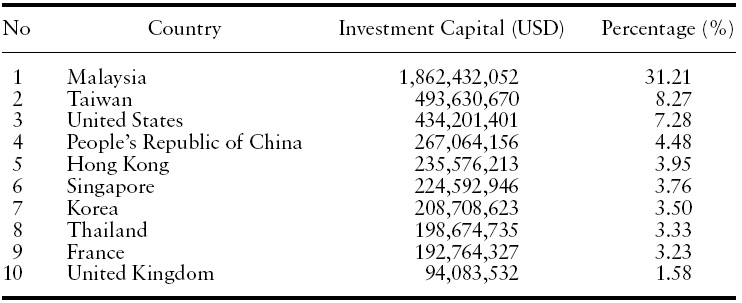

Since the introduction of the foreign investment law in the 1990s and successive stages of liberalization in trade and investment, the country has become an attractive destination for foreign direct investment (FDI), especially from Malaysia, Taiwan, the United States (US), the People’s Republic of China and Hong Kong (see Table 1). Hence, both international trade and inward FDI can play a vital role in Cambodia’s current and future phases of its economic development program for integration into the regional and the world markets, trade expansion, transfer of technology and job creation. Freeman (2002) has highlighted that inward FDI is seen as one method of boosting economic development and growth as well as assisting in the transition process for Cambodia. By the same token, Cuyvers

In general, FDI in Cambodia is highly concentrated in light industries, such as the garment and textile plus the tourism and hospitality sectors. Over the period 1994 to 2004, the garment and textile industries attracted the largest realized FDI projects, which accounted for about 30% of total foreign investment (Cuyvers

[Table 1.] Top ten countries investing in Cambodia, 1994?2002

Top ten countries investing in Cambodia, 1994?2002

In line with continued FDI inflows in the garment and tourism industries, Cambodia’s merchandise and services exports are dominated by the former and latter respectively. In 2007, garment exports accounted for about 72% of the country’s total exports while the value of the foreign exchange earnings from tourism was approximately one third of total exports (Overseas Development Institute, 2009). However, both the garment and tourism industries’ exports have high import contents. For instance, according to IMF (2003), imported materials accounted for about 55–65% of the garment industry’s exports, while in the tourism industry, up to 75% of the tourist dollar earnedwas returned to imported consumer goods. In addition, the country’s imports also include capital goods, such as machinery, owing to the low level of capital stock. Even though labor is abundant in Cambodia, there is a lack of skilled workers in industries in which productions are largely driven by machines and professional services. Therefore, in order to lessen its dependence on services imports such as commercial and professional services from abroad, developing the skills of the workforce to meet the professional and technologically needs of the industries will be the challenge in the longer term. Despite the external sector of the economy being narrowly based on the garment and tourism industries, these industries have been identified as the key growth sectors by the Council for the Development of Cambodia (CDC).This is because the sustainability of the country’s growth is dependent on these two industries, which potentially could provide the impetus to employment creation, and hence poverty reduction.

The aim of this study is to explore the inter-linkages among FDI, the merchandise and services industries for a small transition economy in Indo-China – Cambodia5 – since FDI inflows and trade are important channels to promote growth and development for the country. For instance, the export-led growth hypothesis advocates that the free-market outward-oriented policy adopted by the Cambodian government tends to promote export growth, which is seen as one of the key determinants of economic growth (World Bank, 1993). This study contributes to the existing literature in two ways. First, an extensive literature search reveals that the causality linkages among inward FDI, exports and imports of merchandise aswell as services have not been explored at all for Cambodia despite the Cambodian government being committed to promoting FDI inflows on one hand and liberalizing international trade (both exports and imports of merchandise goods and commercial services) on the other. The present study provides more empirical evidence to the applied literature, since there is limited evidence6 with studies focused on Spain (Alguacil&Orts, 2003), Mexico (Pacheco-López, 2005) and the others on Malaysia (Samsu

Second, the opening of AFTA(ASEAN FreeTrade Area) and Cambodia’s accession to the WTO in 2003 can foster its integration in the regional and the world economies, and hence make the empirical study both pertinent and topical. Thus, the findings can shed different light on the country’s future prospects and the challenges of its integration into the region and the world economy and market. The empirical study is also useful for the formulation of trade and foreign investment policies as well as development strategies since Cambodia is committed to increasing trade and investment amongst the ASEAN members and to achieving higher growth of the economy.

The remainder of the paper is as follows. Section 2 reviews the recent empirical work on FDI-exports as well as imports linkages and their major findings. Section 3 addresses data use and availability. It also describes the methodology to undertake the empirical study – the determination of the order of integration of each variable based on unit root tests, the Granger causality (Granger, 1969, 1988) test procedure and impulse response analysis. The empirical findings are reported and analyzed in Section 4 followed by the main conclusions and policy discussions in Section 5.

1Accessed at http://www.state.gov/e/eeb/ifd/2005/41991.htm (accessed on October 1, 2007). 2The empirical approach used by Cuyvers et al. (2006) was based on simple regression analysis examining the impact of sectoral relative FDI flows on sectoral international trade position, while the current study applies the VAR Granger causality test to determine the causal linkages between inward FDI, exports and imports of merchandise (services). 3They are altogether 28 countries, which include the US, the European Union (EU), Japan and Australia. 4For instance, based on labor cost comparison in US$ per hour in apparelmanufacturing countries in 2008, Cambodia offered a lower labor cost (US$0.22/hour) than Vietnam (US$0.38/hour), China ((US$0.55–1.08/hour), Malaysia (US$1.18/hour) and Thailand (US$1.29–1.36/hour), to name a few (accessed at http://www.emergingtextiles.com/?q=com&s=contacts) (accessed on 13 August 2009). 5The other transition economies in Indo-China are Laos, and Vietnam. By a broadly defined term, a transition economy is an economy that is changing from a planned economy to a free market. Transition economies undergo economic liberalization (removal of price control and lowering trade barriers), macroeconomic stabilization where immediate high inflation is brought under control, and restructuring and privatization in order to create a financial sector and move from public to private ownership of resources.These changes oftenmay lead to increased inequality of incomes and wealth, dramatic inflation and a fall of GDP (http://en.wikipedia.org/wiki/Transition_economy). 6To make a note, most of the empirical studies (e.g. Pfaffermayr, 1994, 1996; Alguacil&Orts, 1999; Bajo-Rubio & Montero-Muñoz, 2001, etc.) examine the causal relationship between outward FDI and exports, which is somewhat unrelated to the study concerning the causal linkages between inward FDI and trade (or exports and/or imports).

Although the causal relationships between outward FDI and export trade have been studied and documented extensively, empirical evidence on the interactions between inward FDI and exports or/and imports have been limited until recent years. As noted in the literature, the causal relationship between inward FDI and exports could run both ways. For instance, foreign firms may choose to serve foreign markets through FDI by setting up a production base in the host country according to the country’s comparative cost advantage (Pugel & Lindert, 2000). Over time, the exports of the host country increase because MNCs (multinational corporations) have good access to international marketing and distribution networks, which implies that FDI inflows promote exports. After some period,MNCsmight add newfinancial capital to existing capital stockwhen their exports become competitive and profitable in the international markets, which supports the reverse causation, i.e. exports stimulate FDI inflows. Recent empirical studies supporting the view that inward FDI is instrumental in raising exports include Alguacil

In addition to the causal links between inward FDI and exports, the former also induces backward linkages, i.e. inputs (e.g. intermediate goods, capital goods, commercial and professional services, etc) are being imported from abroad or the home countries of MNCs for value added in the host country; thus, inward FDI promotes imports. If the imports of the host country are large enough to justify the establishment of production bases by foreign firms for import substitution, then the reverse causation might also occur; therefore, imports stimulate FDI inflows. Hence, the policy implication for attracting FDI inflows into the host country is to progressively liberalize trade. The findings supporting the view that inward FDI promotes imports include Alguacil and Orts (2003) (using Spain’s imports), Pacheco-López (2005) (using Mexico’s imports), and Wong

3. Data, Unit Root, and VAR-Granger Causality Tests

The candidate variables employed in this study are foreign direct investment (FDI), merchandise exports (GE), merchandise imports (GM), services exports (SC), and services imports (SD). All of the variables are measured inUSDmillions, and are at 2000 prices (i.e., 2000 = 100). The time-series data are quarterly from 1994Q4 to 2006Q4, which give effectively 52 observations. Intuitively, this number may seem insufficient as more observations might have been preferable. However, they are the available observations fromthe International Momentary Fund,

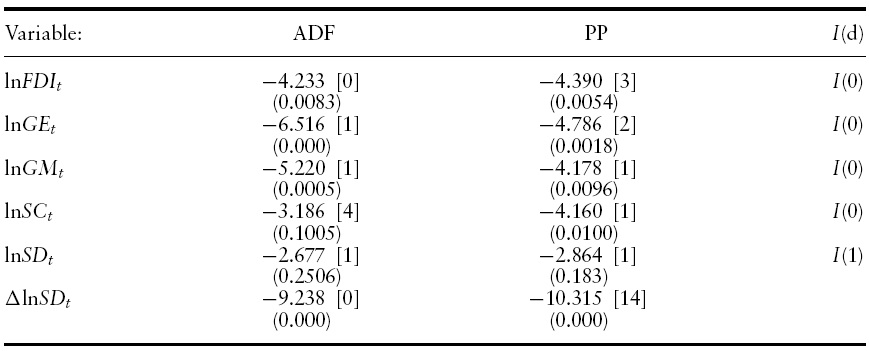

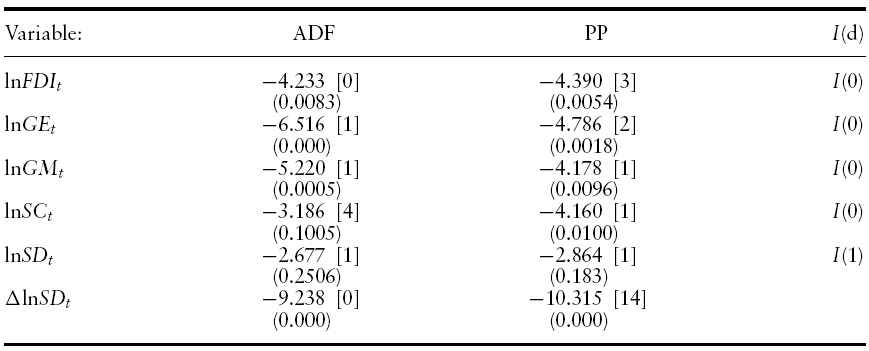

Macroeconomic time series generally tend to have unit roots, i.e. they are not stationary or their variances increase with time (Nelson & Plosser, 1992). OLS (Ordinary Least Squares) may generate spurious correlation when regressing levels of non-stationary time-series variables that contain trend components. In such situations, the Granger causality test results in a VAR framework may be misleading. Hence, it is essential to pre-test each individual time series (

Unit root tests

3.3 VAR-Granger Causality Tests

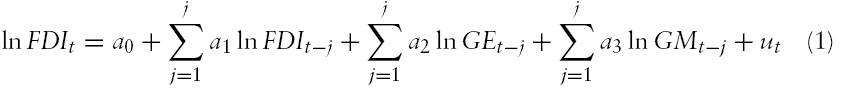

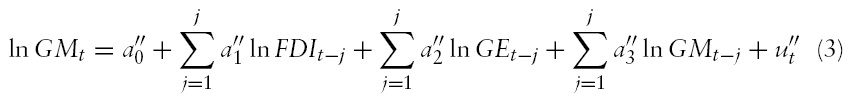

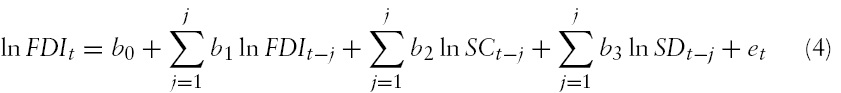

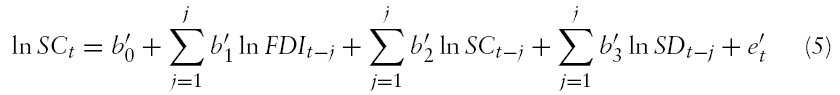

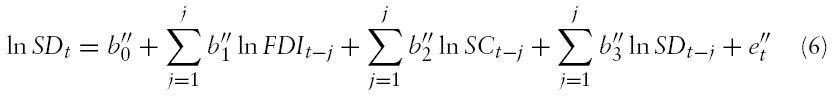

The empirical analysis based on the VAR framework allows us to conduct the Granger causality tests, impulse response study, and variance decompositions of the variables of interest to inward FDI shocks. The Granger approach seeks to determine how much of a current variable can be explained by past values of its own plus all the other variables in the system and their random error terms as well. Hence, the specification of the Granger causality test (Granger, 1969, 1988) can be written in terms of a VAR system. To ensure all the variables included in the system are stationary, the non-stationary

The set of reduced form equations above can be estimated by the OLS estimator. The Wald test statistic, which follows the chi-square distribution, can be used to test the causal relations in the tri-variate VAR specification.7

Since the development of the VAR methodology, impulse responses and variance decompositions have become a standard procedure to analyze the interactions between variables in VAR models (see Litterman&Weiss, 1985; Ibrahim, 2005). For instance, the impulse response functions can be used to trace the responses of interrelated variables such as merchandise exports and imports through time to an unanticipated change in FDI inflows. On the other hand, the variance decompositions reflect the proportion of the movements in the dependent variables that are due to their ‘own’ shocks as opposed to that proportion attributable to shocks due to other variables. In other words, they offer information about the relative importance of each shock to the variables in the VAR.

7As informed by the empirical literature, it is intuitively hard to accept that the exports, imports, and FDI variables are stationary in levels. If we assume this intuition is true that all of these variables are I(1) and the VAR system was estimated by the first-differenced variables, then the causality results inform us that only the services trade (service exports and service imports, individually) Grangercauses the FDI in Cambodia. Further tabular results are available from the authors. Nevertheless, following the results suggested by both the ADF and PP tests, the VAR estimates provide richer findings on the causation between FDI–merchandise trade (exports and imports) and FDI–services trade (exports and imports) (refer to Section 4).

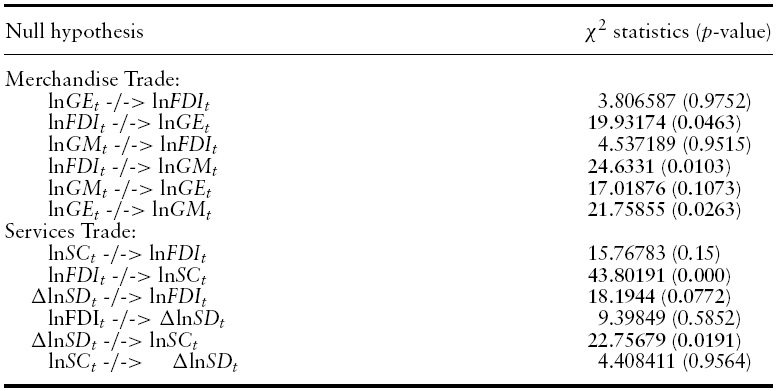

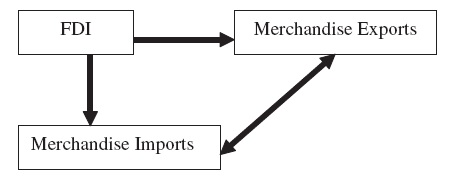

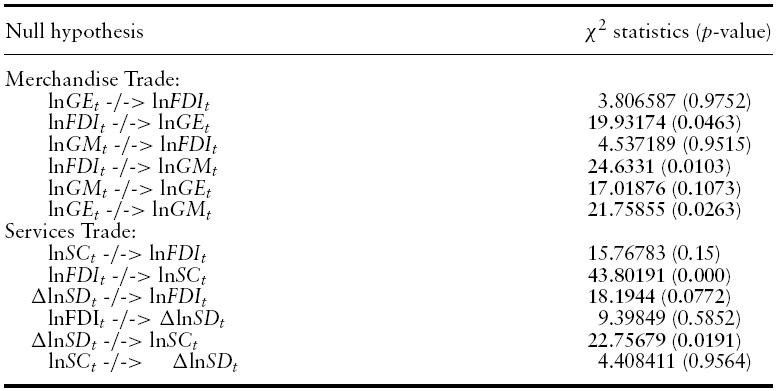

The first set of Granger-causality test results is presented in Table 3 and also depicted in Figure 1. They indicate that there is a causal relationship that runs from inward FDI to merchandise exports, which robustly supports the economic argument that inward FDI can encourage export trade for Cambodia owing to her preferential access to the third market, such as the US and the EU.8 The findings also strongly advocate the argument of backward linkages, i.e. inward FDI promotes imported inputs; because there is a low level of Cambodian participation in the manufacturing sector as the majority of the local firms lack the capital, industrial expertise, experience, and linkages to the international markets. Hence, foreign firms are highly dependent on imported intermediate and investment goods for their value added activities in the host country.

[Table 3.] VAR granger causality tests

VAR granger causality tests

A bi-directional causality between exports and imports of merchandise goods is supported by data that are found to be consistent with multinational trade and investment activities that involve backward and forward linkages. The causality relationship that runs from merchandise exports to merchandise imports implies a backward linkage when inputs of merchandise exports are being imported from abroad or the home countries of MNCs for value added in Cambodia. On the other hand, the causality running from merchandise imports to exports suggests a forward linkage when the imported inputs are being used to produce the intermediate or final outputs in Cambodia and are exported back to MNCs’ home countries or affiliates elsewhere for assembly and distribution.9 Therefore, as far as inward FDI is concerned, it not only can provide the recipient country with capital and technology but also foster linkages with – as well as between – exports and imports of merchandise goods.

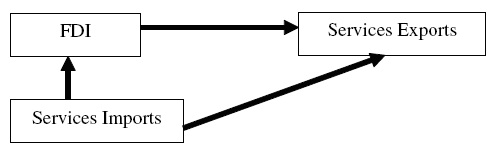

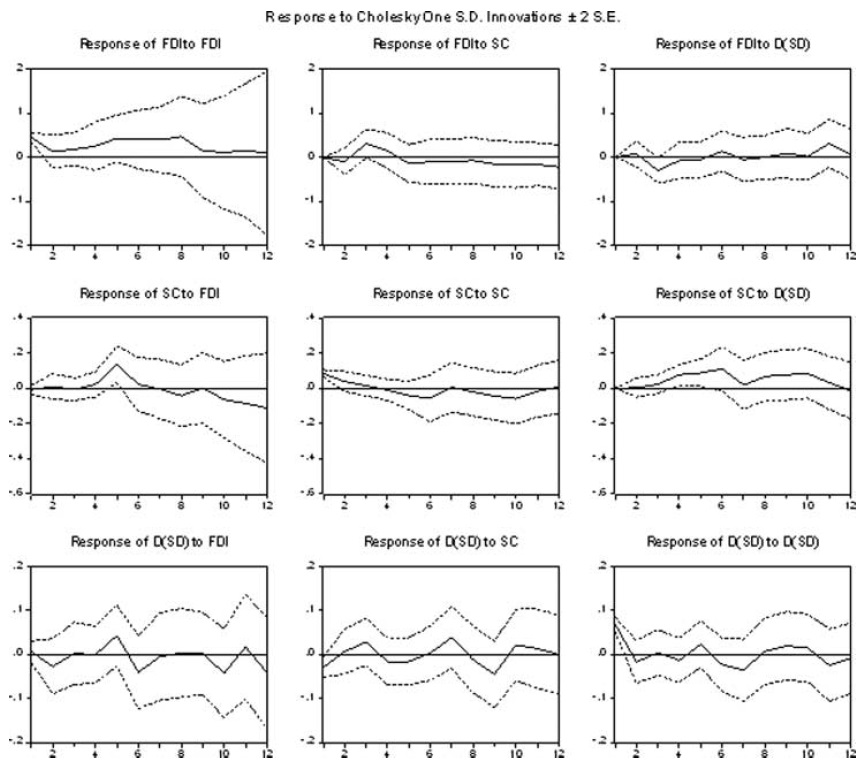

The second set of tri-variate Granger causality test results (Figure 2) show that services imports are capable of drawing FDI inflows into the country while inward FDI is able to promote services exports. Given that skilled workers are insufficient in the tourism industry, which is only second to the garment and textiles sector in terms of engine of growth (Neb, 2007), services imports such as commercial and professional services from abroad are not only instrumental in the development of the services sector but also encourage FDI inflows into the country. Over the period 1994–2004, foreign investment in the tourism and hospitality sector accounted for about 20% of the country’s total FDI in fixed capital,whichwas the second highest recipient sector after the garment and textile sector (Cuyvers

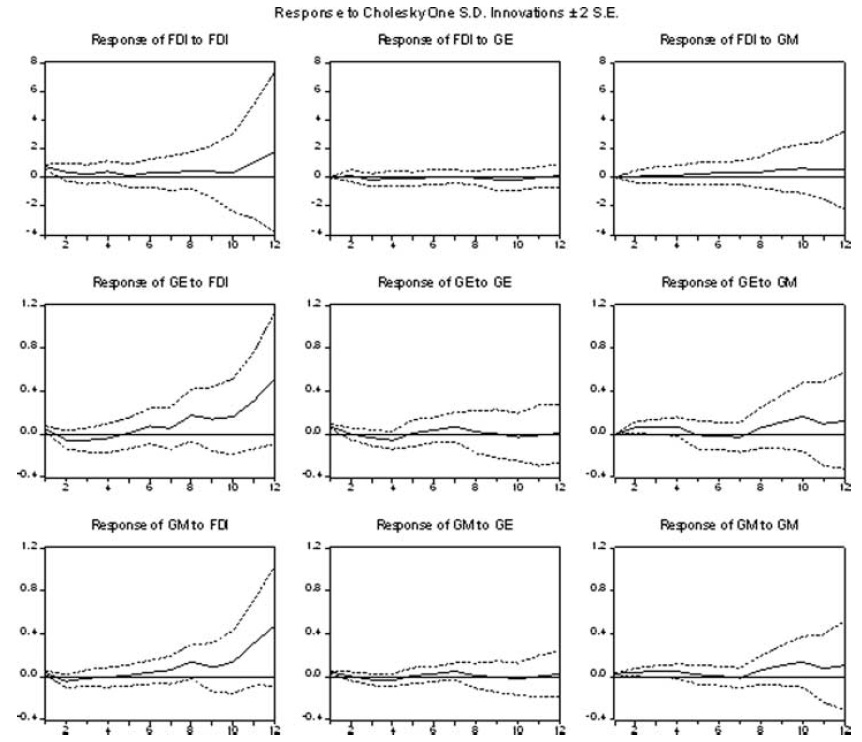

On the other hand, the impulse response graphs of each variable to the innovations of itself as well as other interrelated variables are given in Figures 3 and 4. Clearly, the merchandise exports tend to be responsive to an FDI shock (see Figure 3 for the response of merchandise exports to inward FDI). Following an unanticipated change to inward FDI, merchandise exports decrease initially and rebound after the fourth quarter, which suggests that an adverse shift in FDI inflows in Cambodia is detrimental to merchandise export trade in the short run. Concurrently, the FDI shock has a negligible effect on merchandise imports in the first quarter as illustrated in Figure 3 (for the response of merchandise imports to inward FDI), but the impact of this shock is quite drastic after five quarters, which implies that an unexpected shift in FDI inflows could raise the Cambodian trade in merchandise imports in the medium run.

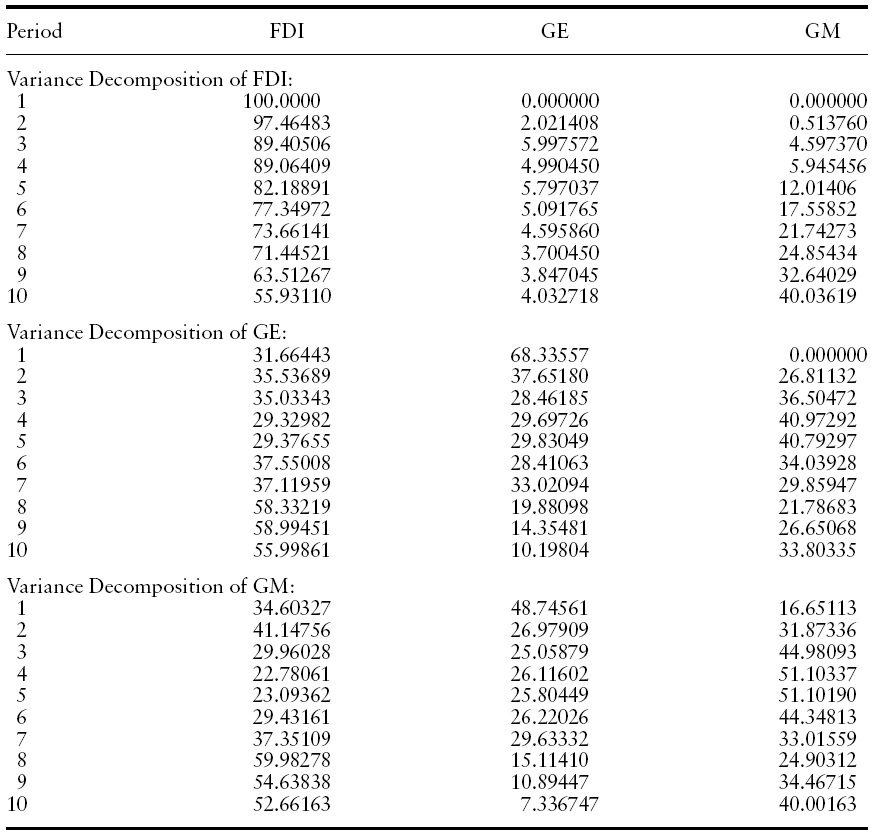

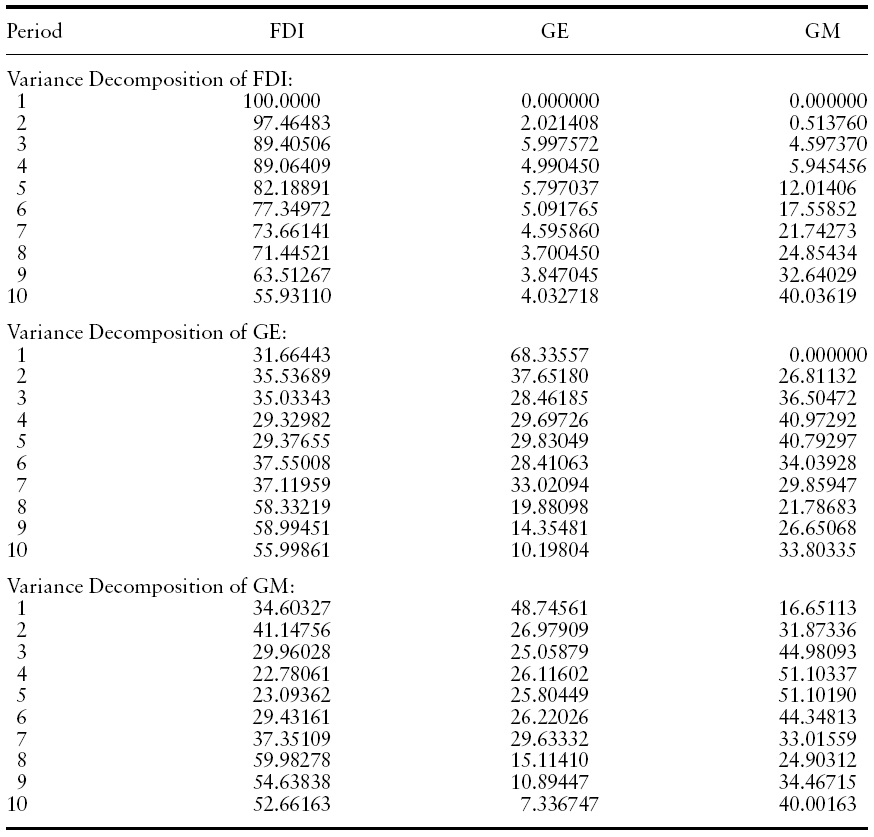

In fact, the FDI shocks account for over 58% of variations in both the merchandise exports and imports after eight quarters. On the other hand, the unpredictable shift of merchandise exports does not have significant impact on inward FDI. Table 4 presents the variance decomposition of inward FDI. Fiftysix per cent of the variance of inward FDI can be explained by unanticipated changes in the inward FDI,while an unanticipated change in merchandise imports accounts for 40%. As for the unanticipated change in merchandise exports, it only explains a negligible proportion of the variance decomposition of inward FDI.

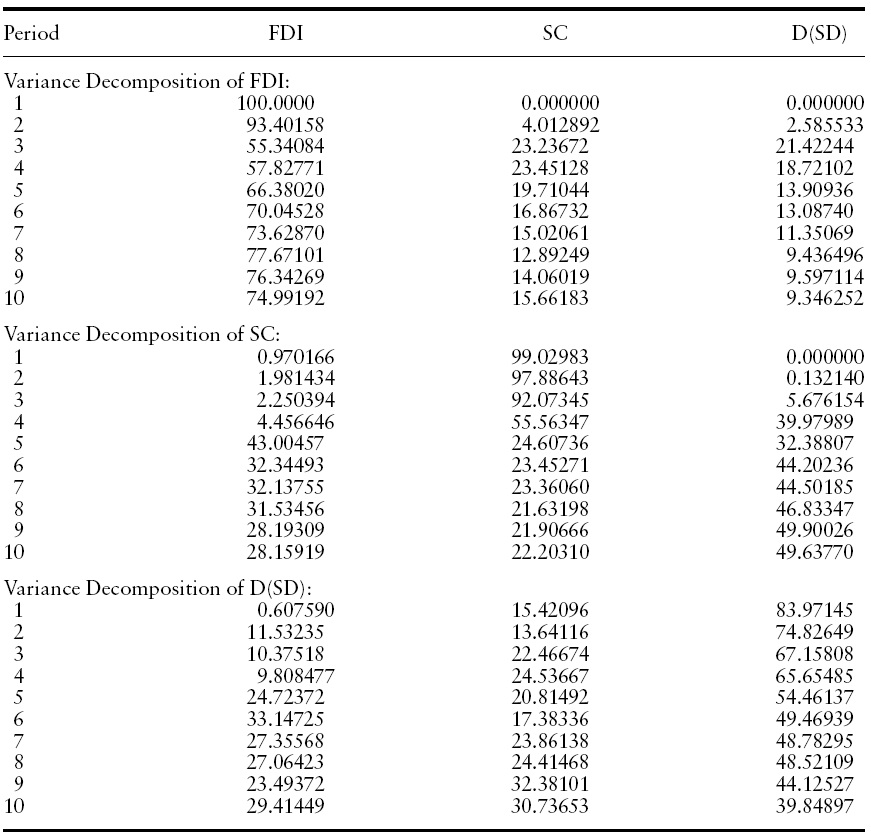

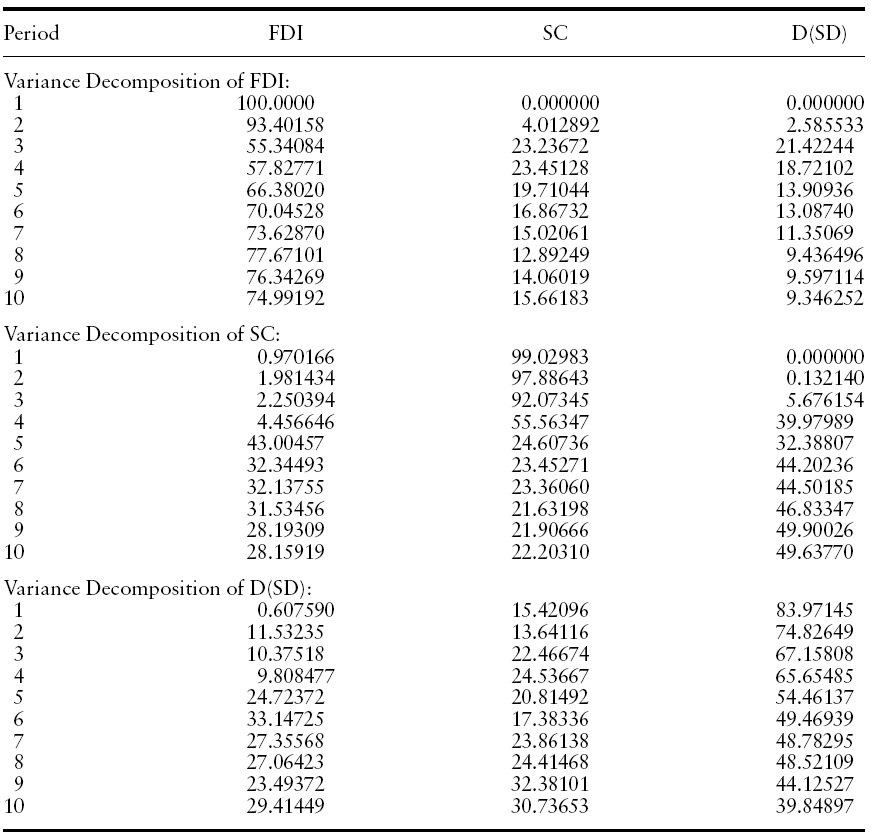

In the case of services exports, they respond positively to an inward FDI shock after four quarters and then negatively in the subsequent quarters, whereas the response of services imports is erratic over the entire time horizon as illustrated in Figure 4.

In comparison with the impulse response graphs of merchandise exports and imports to inward FDI shocks as shown in Figure 3, there is a disparity in the responses between merchandise and services trade sectors. It seems that a onestandard deviation shock to FDI inflows has a larger impact (in terms of the percentage change in magnitude) on merchandise trade than services trade in the medium run, i.e. after eight quarters. The analysis of the comparative impulse response results supports Cuyvers

8This claim may be subjected to the proportion of exports accounted for by light industries that have attracted major portions of inward FDI in Cambodia during the period under consideration. 9For details of backward and forward linkages, see Sieh-Lee (2000).

This study examines the inter-linkages between FDI inflows, merchandise and services trade for a transition economy in Indo-China – Cambodia. In light of trade and investment liberalization initiatives undertaken by the Cambodian government in the past decade, the findings indicate that FDI inflows open up an important channel for export trade both in merchandise and services, which are predominantly the garment and tourism industries. The findings show that FDI inflows Granger-cause merchandise as well as services exports, implying FDI inflows are instrumental in promoting export growth for both sectors, i.e. garment and tourism, and fostering the country’s integration in the world economy. Inherently, further liberalization in services trade (e.g. the removal of trade in services barriers) could draw FDI inflows into the country, which can be an important source of capital and technology. Owing to considerablemultinational trade and investment activities in Cambodia, the empirical evidence indicates that FDI inflows also encourage merchandise imports through backward linkages, i.e. both domestic and foreign firms in Cambodia import intermediate and investment goods from abroad for value added in the host country because the economy remains largely dependent on agriculture with a narrow manufacturing base.

Variance decompositions of FDI, merchandise exports (GE) and merchandise imports (GM) to shocks from FDI, merchandise exports (GE) and merchandise imports (GM)

Moreover, there is evidence of a causality relationship running from merchandise exports to merchandise imports, suggesting high import content of merchandise exports. Hence, in order to reduce its dependence on imports, the Cambodian government should develop supporting industries. This development strategy not only could improve its current account balance but also create employment opportunities and generate more output for the economy in the long run. However, there is no evidence of causation running from services exports to services imports, implying that outsourcing of services input from abroad in a services sector such as tourism and hospitality (travels, hotels, restaurants) is insignificant despite the fact that the economy lacks a skilled workforce. However, the evidence of reverse causality from merchandise (services) imports to merchandise (services) exports can be explained by the supply-side argument that imported inputs used for export production do stimulate exports.

Variance decompositions of FDI, services exports (SC) and services imports (SD) to shocks from FDI, services exports (SC) and services imports (SD)

The impulse response study has been applied to investigate the significance of FDI shocks to merchandise exports as well as services exports. Our findings show that the merchandise exports (which have been narrowly based on the garment sector) are relatively more vulnerable than the services exports (which are dominated by the tourism and travel-related industries) in the medium run if there is an unexpected shift in FDI inflows in Cambodia. To mitigate the possible adverse effects on the garment exports from an unexpected shift in FDI inflows, the Cambodian government should diversify its export industries with comparative advantage in labor-intensive goods (e.g. toys and footwear) and develop supporting industries for the garment sector.