Over its more than 25-year history, CONNECT has created and continues to evolve a system to expand the entrepreneurial capacity of the San Diego region. Drawing on more than 1,500 volunteers, CONNECT assists researchers and entrepreneurs in validating commercialization potential, developing commercial strategies and providing entrepreneurial education to grow high-tech and life sciences companies. CONNECT has assisted in the formation and development of more than 3,000 companies, which have raised more than $10 billion in funding, and has been modeled in more than 50 regions worldwide.

Key to our success has been the unique “culture of collaboration” between research organizations, capital sources, professional service providers and the established industries. CONNECT has been recognized by TIME and Entrepreneur magazines and received the 2010 Innovation in Economic Development Award from the U.S. Department of Commerce for creation of Regional Innovation Clusters. CONNECT manages the San Diego Innovation Hub (iHub) designated by the State of California Governor’s Office of Economic Development in 2010.

In 2006, CONNECT sought to answer a number of important questions for the San Diego region – How many innovative technology and life sciences companies are created as start-ups each year? What sectors appear to be growing? How much investment capital flows into the region to support the growth of these emerging companies? Are there additional key metrics that can be tracked quarterly that shed light on the robustness of San Diego’s innovation ecosystem?

The result was the creation and evolution of CONNECT’s Innovation Report. The CONNECT Innovation Report (CIR) is commissioned by CONNECT on a quarterly basis and provides an economic indicator of the strength and impact of the innovation economy. The CONNECT Innovation Report tracks the health of the San Diego innovation economy by comparing data year-on-year and quarter-to-quarter, providing a comparison across tech industry clusters to selected regions and monitoring availability of various types of capital.

The data helps policymakers and trade organizations plan and advocate effectively for our innovation economy including availability of visas and workforce training for talent in high growth clusters, building an attractive environment for capital investment, allocation of grant funding, reform of the patent system, and zoning. The Report also highlights San Diego as a world leader in innovation with world-class research, leadership and management talent.

OVERVIEW OF SAN DIEGO INNOVATION ECONOMY ASSETS REPORT

In 2011, the CONNECT Innovation Report was expanded to include an assessment of the San Diego region’s innovation economy assets. The report serves as a free resource to the community and is available on CONNECT's website.

The only publication of its kind in the Southern California region, the guide showcases the depth and breadth of the region's assets including: new products launched in the last year; listings of the 80+ research institutes; an index of the flow of key research talent that comes to San Diego’s top research institutes and universities; listings of incubators and accelerators; VCs and angel investor groups; trade organizations; the growing number of science, technology, engineering and math (STEM) education programs; and descriptions of the region’s technology sectors and near-sourcing clusters. Some of the highlights of the 70-page report include:

500+ research faculty bringing more than $1 million each of research funding to the region’s research institutions 80+ local research institutes and organizations producing cutting edge discoveries 15+ incubators, accelerators and co-working environments in San Diego 40+ programs promoting science, technology engineering and mathematics education (STEM) Maps of technology companies by industry sector cluster Descriptions of the regional cluster initiatives that have been established.

EXPANDING THE REGIONAL ASSESSMENT: SOUTHERN CALIFORNIA - A NEXUS OF INNOVATION

The data gathered as part of the initiative to gather metrics on San Diego’s innovation economy led to an expansion of scope to embark on an assessment of the innovation ecosystem assets of the entire Southern California region. The targeted audience for the resulting report included venture capital investors, limited venture partners, and corporations looking at the region for re-locating or expanding their businesses into the region.

The Los Angeles-Orange-San Diego Counties corridor is a magnet for entrepreneurial talent. Start-ups flourish quickly within its knowledge-based infrastructure. Its track record of moving from ideas to deals to products is unsurpassed. Older industrial hubs with rigid hierarchies instill adversarial practices. Southern California is open and agile. Clusters of innovation in biotech and wireless are nurtured by physical proximity to universities and research institutes. A deeprooted culture of collaboration lifts all boats and helps attract billions of dollars each year in federal and state research support. That investment propels early-stage technology and pathways to commercialization.

CONNECT’s report, Southern California: A Nexus of Innovation, offers evidence from 2009 and 2010 data that the region has outperformed expectations in all measures of R&D yield, business development and capital investment value. Its research also shows that, just as venture capital prospects have been surging, the presence of venture investors in the region has been waning. As a result, the report states, “The opportunity for a diversified, locally headquartered, regionally focused early stage fund is more present today than in any time in the past 10 years.”

The Southern California: Nexus of Innovation report concludes with a call-to-arms: “The next 10 years should bring attractive venture returns led by on-the-ground VCs because (i) the region is rich with innovation technology’starter material’ and (ii) there is not a crowd of VCs in Southern California to over-compete for investment in the best opportunities and to build the next generation of high value companies.”

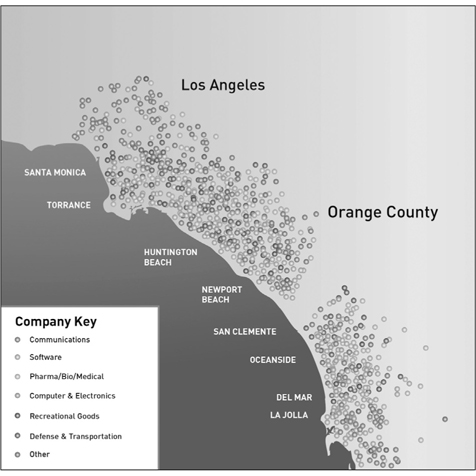

The Report shows that there is entrepreneurial talent and vigor in the region with approximately 80 new technology companies starting up each year <Fig. 1>. More research is needed to find out how they are doing, who is successful and why. These start-ups show hints of emerging clusters in the areas of biotech/pharma, software and communications. How might InSoCal CONNECT business and civic leaders assist these companies to assure full growth potential? Do they have adequate access to angel investors and venture capital? Are they connected with the region’s trade associations, institutions of higher education, and economic development officials? Providing solutions and answers to these questions is the next task for InSoCal CONNECT.

InSoCal CONNECT is a call to action for business leaders throughout Southern California to join together and get “connected” in order to help chart a new future for this inland region. (See <Fig. 2>) This InSoCal Innovation Assets Report is the important first step taken by business and civic leaders who have the vision, who see the potential, who know that this is the perfect time to grow and expand our Inland Southern California innovation economy.

>

InSoCal Region Poised for Emergence of New Technology Clusters ......

The InSoCal Innovation Corridor is the location of hundreds of alternative energy, manufacturing and advanced manufacturing, technology, research & development and engineering companies. The InSoCal region is poised for the emergence and growth of technology industry clusters: biotech/pharma/medical devices, software and communications. Approximately 80 new innovation start-up companies emerge each year in the region. More than 350 new technology and technology-related start-up companies have been created in the InSoCal region during the past four years.

ASSISTING OTHER REGIONS IN INNOVATION ECOSYSTEM ASSESSMENT

CONNECT has assisted with the identification of selected innovation economy assets in a number of regions including San Diego (CONNECT) and Riverside Counties (InSoCal CONNECT) in California, and is currently engaged with the Hawaii Business Roundtable and the University of Hawaii to conduct such an assessment for the State of Hawaii. The CONNECT team can collect and analyze data concerning the innovation ecosystem of a particular region (e.g. research assets, technology commercialization infrastructure, etc.), and advise that region regarding salient features, including notable strengths and gaps.

BUILD-OPERATE-TRANSFER: ENABLING A REGION TO CONDUCT ONGOING ASSETS ASSESSMENTS

In addition, CONNECT provides a “How-To-Guide” document as a supplementary deliverable outlining how to create and update the ongoing Innovation Assets Report as part of the intellectual property transfer at the end of the project. An important component in the process of the engagement with other regions is transferring the knowledge of how to conduct follow-up studies of the evolving innovation ecosystem. Methodologies are shared so that designated parties from the region can own the process and intellectual property, and so better track the development of their local economies going forward.

The list below outlines the content for the innovation assets assessment. CONNECT works with the key stakeholders in each region and their designated team to refine the list. Innovative technology companies – featured start-ups, early stage, and established companies Higher education institutions Research institutions and facilities Research talent (in universities and other research organizations who attract research grant funding) Venture capital & private equity organizations and programs Angel investor organizations and programs Incubators and accelerators, and co-working centers Industry trade organizations that support and accelerate the innovation economy Science, technology, engineering, and mathematics (STEM) education programs Regional map of innovation start-ups – 2012 Regional maps of selected, emerging and mature innovation technology & life sciences companies – 2012

To provide a better picture of the types of content – both data and the ‘messaging’ of the conclusions – we have included, in an Appendix to this paper, a number of “snapshots” of content from the various regional studies CONNECT has completed during the past two years in California.

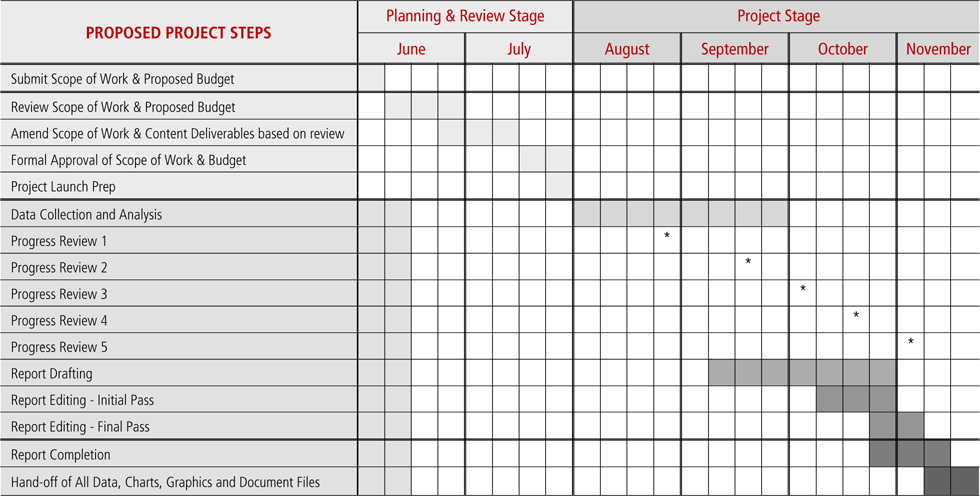

A proposed project timeline is shown in <Fig. 3>. The estimated time to initiate, conduct and complete the data collection, data compilation/analysis, drafting, document layout and production of the final Assets Report publishable document ranges between three to four months, depending on scope, culminating in the delivery of the final report and research materials and methodologies (“how-to-guide”).

We at CONNECT are eager to collaborate with regions to identify the innovation assets in their respective ecosystems as part of the larger innovation initiative in those regions. The Innovation Assets Report can serve as a branded set of comparative metrics that highlight the existing innovation infrastructure as well as help to identify gaps, priorities and potential for enhanced collaboration between the research and development community, entrepreneurs and businesses, trade organizations, industry/ regional cluster facilitators and policymakers.