Microfinance has been an important tool for the economic growth and poverty alleviation. But the success factors and risk factors have not been synthesized in academic literature. This article has paid attention to success factors and potential risk of the Grameen Bank. Grameen Bank methodology is almost the reverse of the conventional banking methodology. Conventional banking is based on the principle that the more you have, the more you can get. Founder of Grameen Bank, Professor Yunus pointed out that, “The least you have the highest you have the priority to receive a loan”. On the basis of theoretical literature, there have been different kinds of success factors of microfinance observed in this paper. Key success factors of Grameen Bank are like these: innovation, strict administrative structure, adaptation and learning practice, incentive system. Complementary services such as business consulting and brokerage will contribute to borrowers’ economic performance development.

마이크로파이넨스 지원정책은 경제성장 및 빈곤완화를 위한 정책적 도구로 활용되고 있다. 이러한 중요성에 따라 그간 학계에서도 마이크로 파이넨스에 대한 이론적, 사례적 연구를 수행하여 왔다. 그러나, 그간의 연구들은 마이크로파이넨스에 대한 개념적 접근과 개별적 특성에 초점을 맞추어 온 관계로 이론과 프랙티스의 종합적 논의가 부족했고, 특히 마이크로파이넨스 시스템의 한계에 대해서는 관심이 미흡하였다. 이러한 문제의식에 따라 본 연구에서는 마이크로파이넨스의 대표적 사례인 방글라데시 그라민 은행의 성공 및 내재적 한계를 그간의 학술문헌과 최신 데이터를 이용하여 종합적으로 분석하였다. 주요 내용을 요약하면 다음과 같다. 그라민 은행의 대출제도는 일반 상업은행과는 반대의 형태로 운영되어 대출자의 자산이 많을수록 대출받는 금액이 큰 일반 상업은행과 달리, 그라민 은행은 대출자의 자산이나 소득이 적을수록 더 많은 대출이 가능하도록 설계되어 있다. 둘째, 그라민 은행의 성공은 혁신, 엄격한 감시통제 구조, 적응 및 학습, 인센티브 시스템 등의 복합적 요소의 결합에 의해서 가능하였다. 반면 그라민 은행 역시 금융시스템의 한 형태인 관계로 신용리크스는 내재적 리스크로 작용하고 있으며 빈곤 문제 해결에 대해 과대포장되었다는 비판도 제기된다. 그러나 분명한 것은 마이크로파이넨스 제도가 제도권 금융기관에서 자금을 융통하기 어려운 빈곤층의 금융수단으로서 작동해 왔으며, 지역사회의 빈곤문제는 물론 경제적 가치창출의 도구로서 기여한 것도 분명해 보인다. 향후 마이크로파이넨스의 건전성을 높이고, 대출자의 자립을 지원하기 위해서는 단순 대출에 머물지 않고 대출자에 대한 자문과 사업중계 등의 부가적 서비스를 제공하는 것도 고려할 사항이다.

Microfinance has been an important tool for the economic growth and poverty alleviation, as it has reached out in many different countries around the world(Wilkes, 2005). Poverty reduction has been the foremost target of microfinance institutions (MFI’s), an increase in number of MFI’s is an indicator for the growth and success of microfinance in the rural areas in Bangladesh (Ullah & Routray, 2007). There are close to 1,000 Non-government Organizations (NGO)-MFIs with microcredit services operating in more than 40,000 villages in Bangladesh. The effective coverage of MFIs stands at 10.05 million and that covers around 37 percent of all households in the country (Ahmed, 2006). Therefore, it is important to evaluate the secrets of success factors of microfinance institutions as well as Grameen Bank. The specific objectives of the present study are to identify the key success factors of Grameen Bank and provide recommendations regarding ways of improving the poverty alleviation ability of microcredit.

Generally, microfinance means small loan mostly for women, without or with little collateral including savings, insurance and other socioeconomic development programs. Microcredit programs extend small loans to very poor people for self-employment projects that generate income, allowing them to care for themselves and their families. In short, microcredit is a product of microfinance (Haque, 2011).

Bangladesh is the world’s most densely populated country with an estimated population of 140 million whereas about 18.7 percent of the population is ultra poor or hardcore poor needing to spend more than 80 percent of their income on food. Often even 100 percent of their income is not enough to get two square meals a day (Khan, 2007). The vulnerability of the ultra poor of this country further accentuated by repeated floods and other natural calamities. Beside this, the rural poor are largely neglected by formal credit sources. They have no access to institutional credit. Collateral requirements, complex procedures, poor communication network and inadequate banking facilities have restricted the availability of credit in the rural areas. Informal credit sources of various kinds are accessible to the rural poor, but these sources are exploitative and inadequate. Moneylenders, for example, charge interest at the rate of 10 percent per month i.e., 120 percent per year. In this context, in the early 1970s, some NGOs and MFIs introduced microcredit program targeting the poor people. Their purpose is to help the poor become self-employed and thus alleviate poverty with microcredit (Haque & Yamao, 2009). Micro-credit programs have recently aroused a lot of interest among policy makers and researchers as vehicles of poverty alleviation. The Grameen Bank has been a success story in providing credit to the rural poor in Bangladesh, and is being replicated all over the world (including in the United States) (Hassan & Tufte, 2001).

Ⅱ. The origins of Grameen Bank

Grameen Bank project was born in the village of Jobrawith Sufia Begum, a 21-year-old woman who, desperate to support herself, had borrowed about 25 cents from moneylenders charging exorbitant interest rates approaching 10 percent per day. Ms. Begum used the money to make bamboo stools that, as a condition of the loan, she sold back to the moneylenders at a price well below market value for a profit of about of 2 cents (Yunus, 2003). Ms. Begum’s desperate position could best be described as bonded labor. Yunus found 42 people in Jobra in the same poverty trap, and in 1976 he experimented by lending them small amounts of money at reasonable rates. Yunus lent a total of US$27, about 62 cents per borrower. To his pleasant surprise, all the borrowers repaid the loans, in the process convincing him that this success could be replicated across Bangladesh.

From these humble efforts emerged a new industry: microcredit—the extension of small loans and other financial and business services to entrepreneurs too poor to qualify for traditional bank loans. In 1983, it was transformed into a formal bank named Grameen Bank ("Grameen" means village), under a special law passed for its creation. The Grameen group is now a network of nearly 30 sister organizations connected to the Bangladeshi Grameen Bank, the microcredit pioneer and 2006 Nobel Peace Prize winner, Professor Dr. Muhammad Yunus, the founder of Grameen Bank and managing director, reasoned that if financial resources can be made available to the poor people on terms and conditions that are appropriate and reasonable, ‘these millions of small people with their millions of small pursuits can add up to create the biggest development wonder’. Grameen Bank is based on mutual trust, accountability, participation and creativity; currently it gives loans to about 7.5 million poor people-97 percent of whom are women-which help s the poor lift themselves out of poverty (Yunus et al., 2010).

Most of the microcredit institutions and agencies all over the world focus on women in developing countries. Observations and experience show that women are relatively low in credit risk, repaying their loans and tend more often to benefit the whole family. In another aspect, at a macro level 70 percent of the world’s poor are women. Women have a higher unemployment rate than men in virtually every country and make up the majority of the informal sector of most economies.

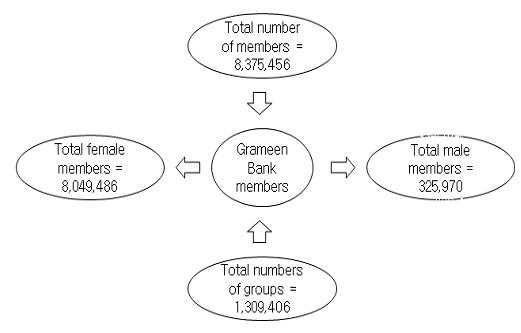

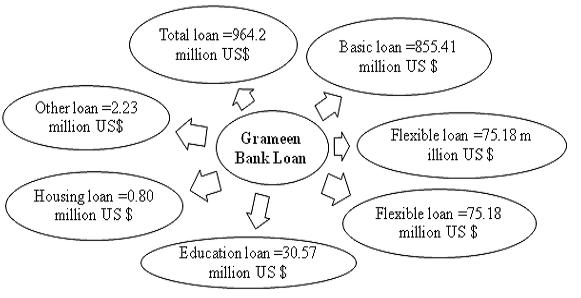

Grameen Bank operates 2,567 branches in half of Bangladesh's nearly 81,382 villages (Grameen Bank monthly report; July, 2012). Motivation towards repayment is high, with rates currently running at 98.4 percent and the bank has been profitable in every year of its existence except 1983, 1991 and 1992 (Yunus et al., 2010). Microcredit regulatory authority found in a recent survey the effective interest rate of NGO-MFIs on general loan ranges from 25 percent to 33 percent and the modal value is 29 percent. On the contrary, Grameen Bank's highest interest rate is 20 percent. There are four interest rates for loans from Grameen Bank: 20 percent for income generating loans, 8 percent for housing loans, 5 percent for student loans, and 0 percent (interest-free) loans for struggling members (beggars).

Ⅲ. Impact of Grameen Bank intervention

A significant aspect of Grameen intervention is the involvement of women in self-employment, micro-products are designed for solely the poorest women (Busse & Victoria, 2008). Hossain (1988) reported that the average worker was employed for six days per month prior to joining the bank, but access to Grameen activities increased their employment to 18 days per month. Along with employment, productivity has also increased. Alam (1988) argues that Grameen members’ increased productivity was due to their adoption of high yield variety in crop production. The status of women has also been improved through their fruitful participation in Grameen activities. Mizan (1993) has shown that the opportunities created by the Grameen Bank have made a major contribution to women’s power in family decision-making. If we put all these variables together, we can say that Grameen Bank intervention has given many women a sense of empowerment (Hashemi et al., 1996; Counts, 1996).

During crisis, Grameen Bank played an important role in reducing members’ vulnerability. Zaman (1999) examined this for the floods in 1998 and came to the conclusion that Grameen Bank as well as BRAC buildings had successfully been converted in relief and rehabilitation centers, which was highly appreciated by their members. However, Grameen Bank started offering the housing credit which has very rigorous criteria to obtain loan (Hassan & Renteria-Guerrero, 1997). At the same time as the country confronts natural calamity, Grameen Bank offers the housing loan for those who lost their houses and properties with lower interest rates. Housing is not just a social investment; it is also a site for production, processing and storage, thereby contributing to increased productivity. Moreover, these housing loans provide women with legal rights to the land and the house (Islam et al., 1989). It is no surprise that a wide range of tangible benefits have been found in the areas of health and nutrition, manifested in adequate calorie intake, higher child immunization rates, increased use of family planning practices and so forth (Todd, 1996; Schuler et al., 1997).

3.3 Reduced rural power elites

Grameen Bank intervention has also reduced its members’ dependence upon the rural power elites. First, they no longer need to go to the rich for economic help. Second, they do not need the mediation of the rural elites in dealing with Grameen, which they needed in the past when interacting with government offices. Third, since their participation in state-sponsored rural development programs is minimal, they can keep themselves aloof from the formal power elites in the rural areas. Fourth, when poor people are less dependent on the rural elites, they can exercise their voting rights independently. It is apparent that the expansion of Grameen Bank should have a positive impact upon local governance in general and the rural power structure in particular (Wahid & Rahman, 1993; Sarker & Rahman, 1999).

Grameen Bank provides loans without security and clienteles are consisted into small groups, as it has established the group monitoring process, thereby creating solidarity and reciprocal relationship among the group of borrowers (Hossain et al., 2001). Firstly, collateral free loan that is very small amount of loans and a borrower is to repay in weekly installments, which arrange over a year. Secondly, one of the most important conditions for getting a subsequent loan is the repayment of the first loan and at the same time, it has been watched to make certain jointly by the group and the bank staff.

In addition, Grameen Bank concerned to invest the more money to establish Grameen Telecom(GTC). GTC is a not-for-profit company in Bangladesh with a partial stake in Grameen Phone(GP). GTC has driven the pioneering GP program of Village Phone that enables rural poor to own a cell-phone and turn it into a profit making venture. Therefore, Grameen Bank provides loans to the poor women for buying mobile phone from these companies and women do business by offering mobile services in the rural areas that have not been linked to the nationwide telecommunication schemes, so the poorest women are able to raise income and savings (Mair & Schoen, 2007). The borrowers who were underemployed or unemployed then become self-employed and able to generate additional income (Khandker et al., 1995).

As the clienteles are from the impoverished part of society, Grameen intends to provide training on health and nourishment and create consciousness among its borrowers regarding the plantations and clean environments. It also gives advice for drinking pure and clean water and creates awareness for preserving hygiene in food and daily life (Hossain et al., 2001).

Ⅳ. Key success factors of Grameen Bank

Grameen Bank methodology is almost the reverse of the conventional banking methodology. Conventional banking is based on the principle that the more you have, the more you can get. Founder of Grameen Bank, Professor Yunus pointed out that, "The least you have the highest you have the priority to receive a loan" (Hussain et al., 2001). On the basis of theoretical literature, there have been different kinds of success factors of microfinance observed in this paper. The structure of McCourt and Babington’s has been revealed to recognize and discover the major factors of microfinance (Hulme & Moore, 2006). They found that innovation, design and implementation, adaptation and learning practice, motivation and contribution, favorable environment are the key success factors of microfinance institution. Mamun (2012) found from his research, the highest proportions of the respondents have opined regarding the innovation, design and implementation of Grameen Bank such as group-based lending, the collateral free lending system, peer group monitoring system and the well-trained and dedicated staffs of Grameen Bank are the significant success factors of microfinance. Besides, Grameen Bank has succeeded through initiating the adaptation and learning practice as well as contributed tremendously by providing training and development program on health and nourishment for its borrowers. In addition, Grameen Bank motivates to its staffs and borrowers through providing a well-designed incentive system for staff, allocating and mobilizing resources and encouragement to be financial independence for borrowers etc.

Moreover, it is also found that some environmental issues such as ongoing population growth and unavailability of the financial service have favored to the success of Grameen Bank in Bangladesh. Following previous experiences of rural development in Bangladesh, many argue that small-scale activities, close supervision, the dedication of the bank staff and, above all, the leadership of the founder, Muhammad Yunus, are the determining factors for the apparent success of the bank. Its unique organizational and management practices and enormous institutional strength have also contributed most to its success in delivering services to the poor (Sarker, 2001).

Many researchers also has resounded the ‘innovation’ as a critical success factor in directing microfinance (Gallardo, 2000 cited in Hartungi, 2007). For example, group based lending; collateral free lending system and group monitoring system etc. are the innovation and designs of Grameen Bank. Grameen Bank offers new information technology, which has extended the effectiveness and feature of micro financial service. It has adopted Automated Tellers Machines (ATMs) and computerized administering system, which make easy the transaction such as loan payment, money transfer, saving account controlling etc. and help to obtain information quickly. Moreover, Hassan (2002) also has depicted an innovation of Grameen Bank which is group-based lending has contributed a key success of microfinance in Bangladesh. Grameen Bank introduced an exclusive group lending technique through offering the basic and flexible loan, hence increased flexibility for its borrowers and eased peer pressure among the groups (Busse & Victoria, 2008).

Grameen Bank has a well designed ‘strict administrative structure’, thus contributing to expand microfinance especially in Bangladesh (Hulme & Moore, 2006). It provides training and development program of staff in order to generate effective field workers and field level managers. Similarly, Bank Rakyat Indonesia, the larger bank in Indonesia has also been replicating Grameen Bank. It started and innovated the staff training for the period of two months, staff promotion training to a high rank, training for refresher or application trainings for at least two times annually and initiated for new rules and regulations (Hartungi, 2007). Rahman et al. (1993), in an interesting study, has found that the leadership, doctrine, program, resources and internal structure so needed to be an institution are all present in the Grameen system.

Another critical success factor of Grameen Bank is ‘adaptation and learning practice’. Grameen Bank, the most famous and successful microfinance institution, has started innovating, adapting and learning practice over the 1990s and early 2000s (Hulme & Moore, 2006). Between the year of 2001 and 2002, Grameen Bank instigated to change its service and named as Grameen Two (II) which pledged to remodel its product to customers, as it started the latest and innovative, much more flexible financial and administrative procedure. Grameen generalized system has been regarded as Grameen Two (II) which provided basic loans, housing loan, higher education loan and interest free beggar loan. It also facilitated for larger small enterprise loans (Hulme & Moore, 2006). Numerous business management experts have recommended that learning and adaptation practice are required for any kinds of organizations through adopting new methods (Senge, 1990; Drucker, 1999). For instance, adaptation practice with required transformation, one of the major successes of Grameen Bank, has been a model in Philippines.

Grameen Bank has adapted through introducing new products such as flexible loans, voluntary savings and mandatory savings etc. (Hulme & Moore, 2006). They also mentioned that it has adapted micro pension, micro insurance etc. which also contributed to the success of microfinance.

‘Incentive’ system has been employed as a successful element in innumerable business organization in order to get better performance and to reduce the turnover of well-trained staff of the organization. In addition, incentive is a leading motivational factor to conduct the behavior of people in a particular way. Hartungi (2007) argued that a well design incentive system is a critical success component of Grameen Bank. Grameen Bank offered a reward package or promotion based on merit and the active promotion on the basis of an institutional legend (Hulme & Moore, 2006). As argued by McKim & Hughart (2005), staff incentive schemes has been adopted very rapidly by many successful MFIs around the world particularly in year between 1999 and 2002. The staff incentive scheme is also very useful to recruit and maintain the well-trained staff (Braverman & Guasch, 1986; Khandker, 1998).

Hartungi (2007) has indicated that the decisive success factor, as Grameen Bank’s carried out ‘financial risk management’ through using different types of financial methods, as the lending system of microfinance are different from the conventional banking system. The fact is that the clientele’s of Grameen Bank have lower defaulting through combined group based system (Wyman, 2008). It takes financial risk to fulfill the clientele’s wants. Consequently, they are able to differentiate the stage of the customers. For instance, they also have individual lending to sustain the ongoing competition and borrower’s demand, thereby expanding to the microfinance.

Additionally, Grameen Bank branches are located in ‘the rural areas, which have favored for the success of Grameen Bank. The fact is that country’s huge population density living in rural areas led to the growth of microcredit almost all rural areas in Bangladesh (Hulme & Moore, 2006). Although Grameen Bank's primary responsibility is to provide credit, it has involved itself in different social development activities as well.

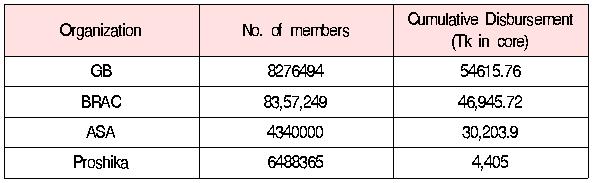

[Table 1.] Micro-credit portfolios of the ‘big four’ MFIs in Bangladesh (cumulative upto June 2010)

Micro-credit portfolios of the ‘big four’ MFIs in Bangladesh (cumulative upto June 2010)

Ⅴ. Criticism of GB and recommendations

Some scholars have raised concerns about the efficacy of the Grameen model to ensure the economic emancipation and empowerment of women (Kabeer, 1994; Todd, 1996; Wood, 1994; Goetz & Gupta, 1995). Wahid (1994) argued that Grameen Bank offers no collateral from disadvantaged borrowers, but it has high interest rates and strict rules for ensuring loan repayment. Haque & Yamao (2009) also pointed out that, heavy pressure by field workers of NGO-MFIs compelled them to borrow from other sources with an exorbitant interest rate to pay the weekly installments and savings. Having no alternative means to repay the entire loan, they felt into the problem of additional indebtness, from which a borrower never came out of the vicious circle of poverty and remained the same as they were before. They also found that the poor with certain level of income and without indebtness could improve their livelihoods after proper utilization of microcredit. In addition, NGO-MFIs disburse loan only to wealthier poor and no longer interested to the chronic or hardcore poor to reduce their severe poverty in Bangladesh, the pioneer of microcredit. Despite such criticisms, there are clear positive impacts of Grameen intervention upon the economic as well as socio-political condition of the rural poor.

However, Grameen Bank has played a tremendous role for the poorest community. It has been recommended by researcher that Grameen Bank is required to expand the organizational capability for identifying and utilizing the appropriate innovation and design for the betterment of its clients as well as create cultural innovation that will provide the transforming requirements of the marketplace. It should take sustainable development program in accordance with demands and problems of the borrowers to ensure the rural economic growth. Grameen Bank also should come forward voluntarily with microcredit schemes charging interest rate of a maximum eight to ten percent per annum. Besides, microcredit must be properly utilized for the benefits of the poorer section of society with gender balance as well as rural and urban equality.

Poverty alleviation, however, cannot be done by microcredit intervention alone. Only efficient and honest leadership of government can alleviate poverty from the country forever. In that case, NGO-MFIs can work as supporting hand for that government.

This article builds on the determinants associated with the success of Grameen Bank and the impacts of its innovation on rural livelihoods in Bangladesh, although the socioeconomic and political realities in Bangladesh are still problematic. It started with the simple idea that the rural poor can improve their socioeconomic conditions if they are provided with financial resources. Economic theories also support the notion that alleviating the liquidity constraints of the poor farm household by enhancing their access to capital will lead to increased production, more efficient allocation of resources and improve their overall economic welfare (Singh et al.,1986).

The story of Graeem Bank implies that innovation, strict administrative structure, adaptation and learning practice, incentive system should be considered in doing microfinance business and government policy implementing. It also recommends that complementary services such as consulting can be useful tool in micrcofinace business.