This research examines the effect of globalization of Korean economy on small and medium-sized entrepreneurial firms. When Korea underwent the Asian economic crisis in 1997, it reconstructed Korean venture industry and had helped fuel venture firms’ rapid growth. Therefore, this study shows the changed structure of Korean economy and the change of venture ecosystem due to the Asian financial crisis. In spite of a favorable turn of the industrial structure toward venture firms, their globalization level is reported still being low. In this study, we also examine how the Korean economy's globalization affects to the venture environments, focusing on the degree of Korea venture's globalization and role of venture capital. This study indicates that the globalization of Korean economy has played a positive role in the growth of the venture firms. However, with the growth of venture firms, small and medium venture companies have received relatively little focuses in Korean economy because the government policy of economic development has been oriented to large companies for several decades.

본 연구는 한국 경제의 세계화가 벤처기업들에 미치는 영향에 대해 탐색적 연구를 시도하였다. 한국은 1997년에 경제위기를 경험함으로써 한국 벤처 산업의 구조조정이 이루어졌으며, 또한 벤처기업들의 급속한 성장도 촉진시키는 계기가 되었다. 따라서 본 연구는 경제위기에 따른 한국 경제의 구조적 변화와 벤처 생태계의 변화를 보여주었다. 이러한 벤처기업의 산업구조적인 긍정적인 전환에도 불구하고, 벤처기업들의 세계화 수준은 여전히 낮은 상태를 보여 왔다. 또한 본 연구에서 한국 벤처기업의 세계화 정도와 벤처캐피탈의 역할에 초점을 맞춰 어떻게 한국 경제의 세계화가 벤처 환경에 영향을 주는지에 대해서도 조사하였다. 본 연구는 한국 경제의 세계화가 벤처기업들의 성장에 긍정적인 역할을 수행하고 있음을 보여주고 있다. 하지만, 벤처기업들의 이러한 성장에도 불구하고 경제개발에 관한 정부 정책이 지난 수십 년간 대기업 위주로 편중되었기 때문에 중소 벤처기업들은 한국 경제에서 큰 주목을 받지 못했다.

In the last several decades, the Korean economy experienced radical changes. Though there was rapid development after the Korean War called the "Miracle of Han River", the government led growth strategy soon bumped into its limit. Democratization with the revival of the direct presidential election system in 1987 accelerated the liberalization of Korean economy. In November 1994, Korean President Kim Young Sam declared globalization of Korea and he articulated a new national goal for Korea which included politics, economics, culture, education and so on (Ungson et al, 1997: p.3). Despite such changes made in the economic structure, Korea experienced an economic crisis in 1997 (Hong et al, 2006). The financial crisis brought huge change throughout the Korean economy in general, affecting large business groups (we call Chaebols) as well as small and medium-sized entrepreneurial firms (we call venture firms).

Throughout rigorous restructuring attempts, Chaebols began to focus more on their core lines, and the overall industrial structure also turned favorable to small and medium-sized entrepreneurial firms. Following these changes, the Korean government established KOSDAQ (Korea Securities Dealers Automated Quotation), a stock market different from the existing Korean Stock Exchange and mainly consisting of venture firms, in order to help the firms get themselves listed on the stock market. The government also legislated a special act on fostering venture firms in 1997, operated the Venture Certification System, and started to support ventures in full scale (Chung and Choi, 2008; Jung, 2008).

The purpose of this research is to study the effect of Korean economy's globalization on small and medium sized entrepreneurial firms. We will examine the changed structure of Korean economy due to the Asian financial crisis, and the effect of Korean economy's globalization on venture firms. Also, we will discuss on the direction Korean venture firms should take in the future.

Ⅱ. Overview of Korean Venture Industry

Chung et al (2008) defined the venture industry as comprised mainly of entrepreneurial companies, venture capitals, and exit markets. Here, entrepreneurial companies are one of the main cores of the venture ecosystem and always endeavor hard to create new value (Bollinger et al, 1983; Chung et al, 2008). In this study, we define a venture firm as a small and medium-sized company which, despite its high risks, is expected to attain high earnings when it succeeds in its business, and satisfies the qualifications prescribed in the government-initiated Venture Certification System. To understand the Korean venture industry properly, we have to backtrack the development process of Korean Economy. Korean economy experienced aggressive economic growth within short terms, by means of Chaebols participating in heavy and chemical industry like steel, shipbuilding, car manufacturing, and so on. However, such Chaebol-based growth strategies also generated negative side effects. While the Chaebol-oriented economic strategies boosted an aggressive economic growth of Korea, they also aggravated a balanced economic growth of the nation, weakening the unique role of small and medium-size firms and placing them as passive subcontractors to Chaebols.

Therefore, the Chaebol-oriented economic structure played as a stumbling block to the sound development of the venture firms in Korea. As venture firms are inferior to large companies in sizes and resources, they inevitably require venture capital investments from the outside investors. Contrary to the case of U.S venture capital, Korean venture capital was developed spontaneously in mid-1980s, being a part of the government’s policy to promote the industrialization of high technology. However, most of the venture firms at that time were subjected to high risks and low returns to invest, so it was difficult to cultivate the venture capital. The venture industry was slow to expand not only because the numbers of the venture companies was small, but also the given condition of the retrieve was poor (Sung, 2001).

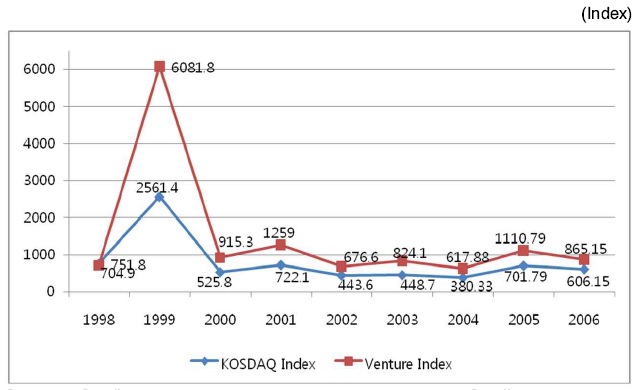

However, the Korea government started to implement aggressive supporting policies for the venture firms by establishing KOSDAQ market in 1996, and designating the special act on fostering the venture firms in 1997. The establishment of KOSDAQ market provided some advantages of capital supply to many Korean venture firms by conducting IPO(initial public offering), and the firms could also enjoy the favor of abolition of financial requisites (debt ratio, capital invasion). The venture industry started to advance gradually in the product and the financial sectors, supported by institution and policy even through the Asian Economic Crisis (Chung and Choi, 2008). Moreover, rapid spread of internet and new technology and market opportunities in IT industry opened new area for the Korean ventures. At that time, the IT industry and market were in the early stage and there was relatively small gap between Korea and developed countries in terms of technology, so the entry barrier was not high. Besides, most of firms have reduced the opportunity cost to venture new businesses by restructuring after economic crisis and the incentive for the establishment was promoted. The government’s low-interest and aggressive venture-raising policy also contributed to the explosive growth of KOSDAQ market (Sung, 2001).

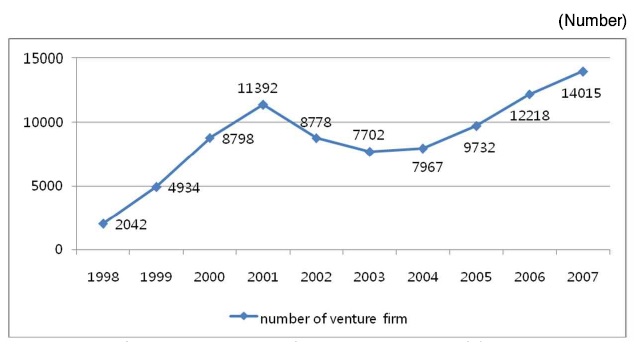

After 304 venture firms were certified as a venture by the government in May 1998, the number soared up to 11,392, growing 5-fold in 2001. Jung (2008, p.114) explains this phenomenon as the following; “At that time, the strong wind of venture firm establishment was in a frenzy to be explained by only the number of the certified-company.” The background of the people who established a venture firm were extremely diverse, not only laid-off employees by economic crisis but also working employees, university students and professors. The whole country was mad about the venture establishment. For example, Chaebols also supported the establishment institutionally, like in-house ventures. Jung (2008) diagnosed the cause of this phenomenon as a complex mix of IT venture boom over the world, the abolition of foreign investor’s KOSDAQ investment prohibition and government’s venture cultivating policy to seek for new economic breakthrough before and after the economic crisis. The number of venture firms increases steadily, followed by a downturn from 2002 to early 2004. It is due to the collapse of so called “Dot-Com Bubble” in 2001 when many IT firms faced dramatic fall.

Population ecology can explain the above phenomenon. Hannan and Freeman (1989) suggest the notion of “carrying capacity”. According to them, carrying capacity defines the maximum number of organizations in a population at a given point in time. When the size of an organizational population equals the carrying capacity, the growth rate for that population will be zero. If population size exceeds the carrying capacity, the growth rate is negative (Hannan and Freeman 1989, p. 100). To be more elaborative on this, a surge of venture firms in the early 2000 in Korea continued as the size of venture population had not reached the carrying capacity, and it ceased to grow when its population size reached the carrying capacity. Afterwards, the growth rate turned negative when the size of population exceeded the carrying capacity, and the bursting of high expectations on the venture firms triggered by the Dot-Com Bubble collapse in the U.S. led to the decrease in the number of venture firms.

This phenomenon can also be seen in

Ⅲ. Globalization and Venture Industry in Korea

In the previous section we have shown the change of venture industry in Korea. In this section, we will examine how the globalization of Korean economy has affected the venture industry in Korea. First of all, we will look at the globalization of Korean economy, and then we will examine the effect of Asian crisis on Korean venture ecology. We will also look at the internationalization of Korean venture firms and the role of venture capital in Korea.

3.1 Globalization of Korean Economy

Levitt (1983) emphasizes that the development of technology drives the world toward a converging commonality and the differences in national or regional preferences has disappeared. Like his emphasis on the globalization, the entire world is becoming one single market and the notion of globalization is familiar to most people.

Korea is not an exception in the recent trend of globalization. Early in 1960s, the Korean government was determined to stimulate economic growth by promoting indigenous industrial firms. Particularly early in 1970, the government's priority was to foster the heavy and chemical industry, and the government granted the privileges of entry right to this target industry to a few firms. Also, the government erected tariff barriers and imposed a prohibition on manufacturing imports and restrictions on foreign investment, providing a monopoly position in market for those selected firms.

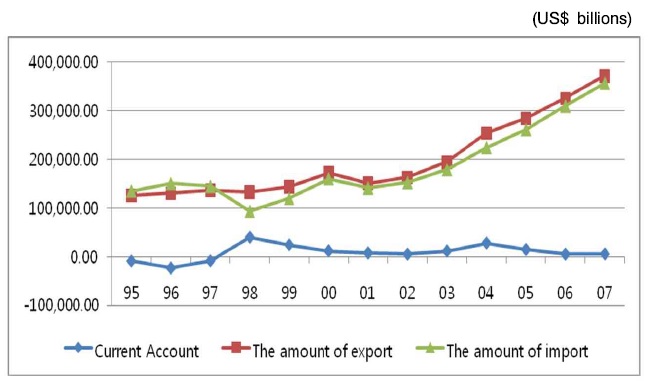

Since the 1980s, the closed door policy has been revised, and after 1988 Seoul Olympic, Korea got into the open market stream. This market opening process of Korean economy can be divided into three phases. First, around 1990, Korea became open to trade and investment liberalization. Second, after the IMF financial crisis in 1997, Korea implemented capital market liberalization. And the last, the open period which Korea underwent FTA with U.S. (Jung, 2008).

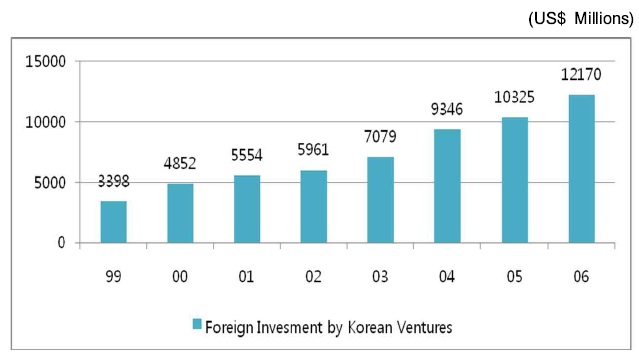

The overseas investments by venture firms show a continuous increase, 3,398 million dollars in 1999 to 12,170 million dollars in 2006

The Korean economy has continuously grown over the past several decades and, as the growth in exports and imports show, Korea aggressively participated in the trends of globalization. And the people’s mindset has also significantly matured along with the globalization. IMD reported that Korea ranked 13th of the world in the category of the people attitude for globalization in 2008 (marked 6.88 over 10, answering the question of 'Attitudes toward globalization are generally positive in your society')*.

3.2 Asian Economic Crisis and the change of venture ecosystem

The Asian Crisis which first started in Thailand, Indonesia and South-East Asia had a major impact on Korea's small and large companies at the end of 1997. After a series of corporate bankruptcies, even among the major Chaebols, those who survived had to implement massive restructuring for survival. As a result, Chaebols did not pursue the diversification strategy as much as they did before the Crisis, and the government-led reform program made Chaebols to be transparent (Choe and Pattnaik, 2007).

On the other hands, the process of structural reform of the Korean economy made attractive environment for venture firms. Reconstruction after the crisis made considerable progress in fostering a positive environment for venture firm’s growth (ex, the falls of Cheabol groups, reconstruction of banks, improvement of labor market flexibility, a formation of capital market, rapid growth of IT industry).

There are three aspects of venture capital related market condition changes after crisis reconstruction. First aspect is the expansion of market structure. After the reconstruction, large companies could get ahead compared to venture firms by seizing the business opportunities in IT area and absorbing marginal funds in the market. Large companies placed the venture firms into their non-core business areas by outsourcing them or they set up the venture firms by spin-off. Second, the labor market has been changed. During the reconstruction massive unemployment has resulted, so lots of high quality human capital flowed into venture capital. After people awoke from the illusion of job stability in large companies, people started to see the possibility of growth and dynamic aspect of venture firms. Finally, there is the growth of capital market. The changes in financial market structure by financial crisis led eye-opening growth of KOSDAQ market. The growth of KOSDAQ market accelerates the inflow of capital into venture capital, and this resulted in foundation and growth of venture firms (Chung and Choi, 2008).

The Financial Services Commission (2007) estimated the size of investments by foreigners in the Korean stock markets at 282.4 billion dollars as of 2007, ranking it 9th out of the 33 major economies, and the level was the highest among the newly emerging economies (Foreigners invested 205.9 billion dollars in Taiwan, and the two nations accounted for more than a half of the total). The turnover ratio (by the aggregate value of listed stocks) in the securities markets since 1998 stood at an average of 210.5%, while the buying and selling turnover ratio of the foreign investors was a meager 81.1%. This implies that the buying and selling turnover ratio of foreign investors active in the nation is relatively low compared to Korean investors, and they follow a long-term investment pattern. An increase in this type of investment can provide a stable financial platform for growth to venture firms.

The resource dependence perspective employs a different theoretical lens to explain such phenomenon. Pfeffer and Salancik (1978) pose that organizational forms and behaviors are strongly affected by external organization rather than internal autonomous selection. The survival of organization depends on the capability which can acquire and sustain the critical resources. In these perspectives, the Korean ventures can acquire resources (for examples, new opportunity for market, high educated work forces and investment to venture capital) that are needed for gradual growth through the restructuring of conglomerates. Because there are intrinsic limitations in experience and size, the Korean ventures recognize the resource outsourcing as most critical problem. So there is rapid expansion of Korean venture from positive environmental change.

3.3 Globalization and Korean Venture Firm

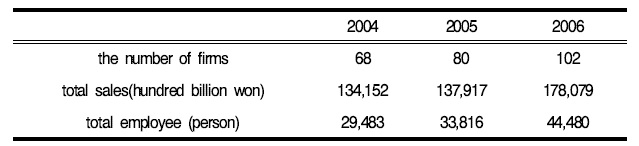

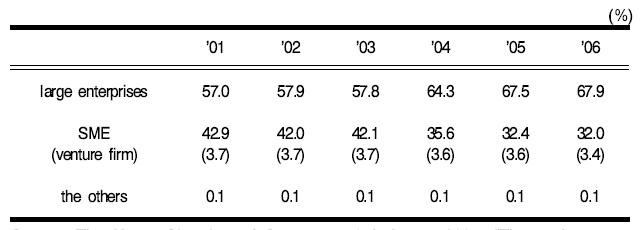

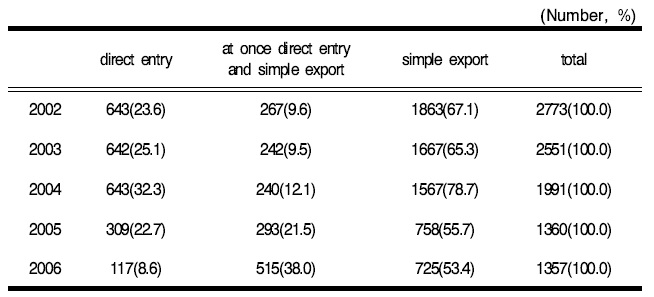

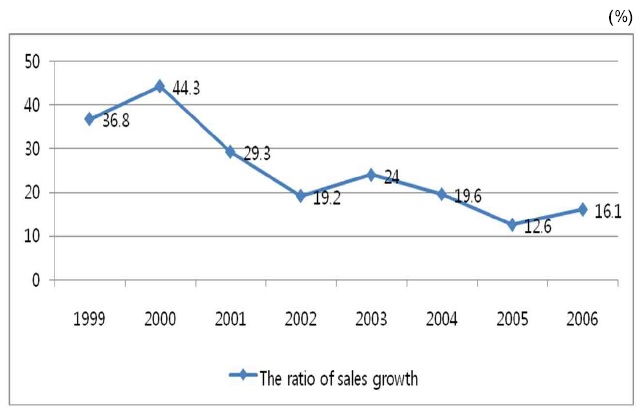

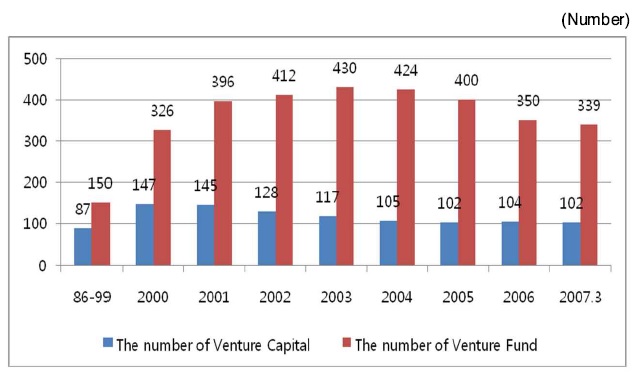

After the crisis, a favorable structure changes made venture firms to grow rapidly. The growth of venture firms is not limited to the quantity aspect, since among them some firms became enterprise of middle standing and they take the lead of Korea economy. The venture companies which show sales above hundred billion continuously increase, 68 companies by 2004, 80 companies by 2005, 102 companies by 2006 (see the The Status of the Venture Firms over Hundred Billion Won in the Sales Because Korea has small domestic market, a limitation exists in development of venture firm, and it is necessary to achieve the global standardization by globalization and the economies of scale, and to establish new markets. Also the venture firms are required to strengthen their competitiveness by acquiring developed knowledge in competing with foreign leading companies(Park and Moon, 2012). Nevertheless, the degree of internationalization of Korean ventures is still discouraged. The proportion of Korean ventures in total export is decreasing and the conglomerates are still of the greater part of the total export (see the the ratio of Export between large enterprises and SME in Korea The number of firms in foreign direct investment is decreasing and the ratio is gradually declining. That is why Korea ventures prefer to choose the export that is less risky as venture-bubble has fallen (see the The Pattern of Foreign Entry of the Korean Ventures The popular perspective in firms' internationalization process is that; a firm follows a gradual step in the internationalization process as it accumulates the knowledge and experience (Johanson and Vahlne, 1977). However, since "intrinsic limitations" like experience and size are notable in the ventures, some scholars noted that such perspective has a limitation to explain the internationalization of the ventures (Oviatt and McDougall, 1994, 1997, 1999; Kwon, 2004). Against the perspective of the gradual step in the internationalization process, they are interested in International New Venture and Born Global Venture, which firms seek the internationalization from the beginning of an establishment. This phenomenon is caused by the lack of the capability in an international marketing of Korean ventures. Also in reality, the managers of ventures are expressing the difficulty. Although the Korean IT ventures possess advanced technical expertise compared with the foreign ventures*, they face difficulties to enter a foreign market due to the lack of manpower and capabilities in the international marketing. In the result of the surveys conducted for the Korean medium-small sized enterprises, they listed up the barriers for foreign entry as the lack of capital, information deficiency and regulations of host country and home country (Lee, 2006, p.82). While the overall sales growth rate is on the decline, the turnover of the venture firms continued to increase, gradually raising its proportions in the whole Korean economy. As we have already examined, however, the weight of their exports is relatively small compared to that of the large-sized companies.

Venture capital plays a very important role in the ventures operations. Venture capitals carry on financial business which receives profits through selling stocks after raising the firm's value once they invest the capital to private firms with growth potential. In the United State, venture capital has developed for themselves. The Korean venture capital on the other hand has emerged by the government's policy for creating ventures with a high-technology. Korean government provided 'the law for setting-up support to Korean medium-small sized enterprises' and encourages the venture establishment. The government loosened the regulation toward venture capitals through sustaining propulsion of law improvements for promoting venture capital businesses. As a result, venture capital could not function properly. However late in1990, the financial crisis brought a great improvement to the structure of venture industry and the incorporation of venture capital was accelerated. Particularly, the Korean government legislated the special act on fostering the venture firms in June, 1997. After the introduction of “The special law on Venture fostering”, venture firms which had technology advantages increasingly registered for KOSDAQ. But, by the late 1999, general investors indiscriminately invested in internet and IT firms and venture firms’ underwent poor financial performance. For these reasons, the funds of venture firms were a sweeping crash and KOSDAQ market entered a recession. Venture capital companies in Korea have been decreasing in terms of quantities, and there were only 147 companies left in 2000. After 2001 through 2002, Korea underwent Venture bubble collapse and reconstruction period, and registered venture capital continuously decreased ( The typical way to recover the investment of venture capital is either through IPO in stock market or M&A to other company. However, the M&A of the venture firm isn’t revitalized in Korea, IPO is the only way to recover it. In the case of America, the numbers or ratio of M&A is much higher than those of IPO, whereas the weight of IPO is bigger than M&A in Korea ( There are several reasons on the inactivity of the investment recovering by M&A in Korea. Overall, due to the poor-established institutional condition on M&A, the entrepreneur’s negative perception about M&A is main cause. In order to facilitate more investments of venture capital in the venture companies, mergers and acquisitions (M&A) need to be more encouraged as a form of strategy on collecting invested assets. As shown in M&A can not only recover the capital quickly but also be a useful strategy to achieve quick growth in the firm’s position. Still, the strict regulation and aftercare should be accompanied for the abnormal M&A; a roundabout listing M&A which disturbs capital market produces good victims. *In this survey, high ranked 5 countries are Denmark (8.29), Singapore (8.26), Hong Kong (8.00), Israel (7.73), and Chile (7.62). *According to the Research on the Actual Condition of Korean Ventures(2006), issued by the Small and Medium Business Administration, it is detected that about 48.9% of the Korea venture firm evaluate themselves their technology level as better than that of the world best. In the previous chapter, we looked into how the Korea economy’s globalization affects to the venture environment. Especially, we focused on the degree of Korea venture’s globalization and role of the venture capital. In order to facilitate more investments of venture capital in the venture companies, mergers and acquisitions (M&A) need to be more encouraged as a form of strategy on collecting invested assets. As shown in [Figure 9], the proportion of M&A’s in Korea is significantly low compared to that of the U.S. In the above section, we learned about the environment favorable to venture firms being established. Since the financial crisis, we have witnessed the government offering more support to venture firms, KOSDAQ continues to grow, and more benefits are provided to the companies. The number of stocks held by foreign investors in the KOSDAQ continued to increase, creating a favorable situation for the growth of venture companies. In this section, we will try to find the answers to the two major questions through examining the influences the globalization of the Korean economy had on the venture companies. The first question is, despite all those changes made in the industrial structure that are favorable to venture firms, how are the large companies still dominating the overall Korean economy? We are going to explain the phenomenon from the perspective of Carroll (1985). Respectively examining the large newspaper organizations, which deal with a variety of topics in broad areas, and the small ones, which focus on specific audiences, Carroll (1985) proposed the concepts of “Generalism” and “Specialism.” According to Carroll(1985 p.1266) “Organizational generalists – such as daily newspapers that rely on readers from diverse political, ethnic, occupational, and geographical origins - can operate in almost any environment because the average outcomes across a wide range of condition. In contrast, populations that survive in a specific environmental condition (or within a narrow range of environmental resources) are called specialists.” The ideas of a generalist, like Chaebols, who conduct a variety of management activities, and a specialist, who performs specialized management activities in specific areas, can be explained from the perspective of resource partitioning. The theory may be effectively employed in explaining the paradoxical phenomenon in which, despite the strengthening of generalism due to the continued concentration of organizational population, the opportunities of survival for the small specialist organizations still increase (Carroll, 1985). Simply put, the two groups with different strategies can coexist as they opt to minimize their potentially overlapping behaviors and divide their resources. We can find such an example in Korea as well; since the financial crisis, the large companies disposed of other lines than their core areas through restricting, allowing niche markets to venture companies. The second question should be whether the growth of venture companies inevitably requires the governmental supports. In an effort to foster venture companies, the Korean government has briskly undertaken the institutional initiatives to support venture companies. Despite those efforts, however, the globalization level of the venture companies remains at an unsatisfactory level, and so does their proportion in the nation’s total exports. It may be accounted for by the assumption that the excessive participation by the government blocks the sound functioning of the market mechanism. In Korea, the government took a wide variety of initiatives to support venture companies, including the government-led appointment of venture companies, tax reductions, and easing of the qualifications to register in KOSDAQ. In order to attain such benefits and to be qualified for the requirements set by the government, however, a number of venture companies even turned negligent of their core efforts to develop technology, and consequently, a good number of venture companies could acquire the governmental supports. However, we may not be able to say for sure whether such government-initiated supports contributed to the strengthening of the competitiveness of the companies under the fierce competition environment. We have looked how the globalization of Korean economy had an impact on venture companies. In the case of Korea, the policy of economic development was big companies oriented over several decades(Choe and Lee, 2008; Kim, 2011; Lee et al., 2012). As a result, small and medium venture companies received relatively little focuses in Korean economy. But Korea venture industry revitalized through the revolution of information technology and rapid diffusion of internet in 1990s and the financial crisis in 1997. Through the reconstruction of big companies, venture firms became relatively easy to expand in the market, and massive unemployment flowed into venture firms. The expectation of high growth of venture firms made venture capital to grow and this made venture firms to lead the growth of venture industry. From economic crisis, venture firms have been growing in a quantitative way and also among them became an enterprise of middle standing, and the amount of foreign investment by venture firms has increased(Lee, 2011). But in reality, this study reveals that the level of venture firms’ internationalization is insufficient. This is because even though they possess the high technology expertise, they lack the ability of foreign activities. Also, in the case of Korea, the proportion of IPO is a way too high compared to M&A, so we pointed out that M&A revitalization is needed to be the means of investment retrieval strategy. In this study, we have tried to find clues to the phenomenon by which the large companies still dominate the Korean economy despite the changes in the industrial structure in favor of venture companies, and to whether the governmental supports are inevitably required for their growth. Several limitations suggest caution in this research. First, in this study we did not conduct an empirical analysis. We used descriptive statistics data to examine how the globalization of Korean economy affects venture industry in Korea. There should be an additional empirical analysis. Second, because we used secondary data, reported from related organizations and associations, we could not convey the real feelings of the spot managers' perception of influencing power. While conducting this examination in a broad perspective, we felt deficiency in detailed analyses on the specific issues. We may need to make up for this in future studies. It will be more meaningful to subdivide this study and make a thorough investigation into specific topic. In spite of these, this study has some implications. First, there was little research on how the globalization of Korean economy had an impact on Korean venture companies. So this study would be the initiative study in this area. As previously pointed out, this study provides the possibility of empirical analysis through more objective statistics analysis. Second, we have reviewed the history and the change of the construction of venture firms during past decades, and also we took a view of venture firms' future and provided the future direction of venture firms. In the case of Korea, the potential of IT venture firm is very high. To make venture firms which possess the high technology expertise to be the global company, this study gives government and related organization, and venture firms the implications.).

] The Status of the Venture Firms over Hundred Billion Won in the Sales

).

] the ratio of Export between large enterprises and SME in Korea

).

] The Pattern of Foreign Entry of the Korean Ventures

3.4 The Role of Venture Capital

참고문헌

이미지 / 테이블

[

<Figure 1>

]

Changes in the number of venture firms(1998-2008)

[

<Figure 2>

]

Changes in the KOSDAQ and Venture index

[

<Figure 2>

]

Changes in the KOSDAQ and Venture index

[

<Figure 3>

]

The annual status of current account, the amount of export and import in Korea

[

<Figure 3>

]

The annual status of current account, the amount of export and import in Korea

[

<Figure 4>

]

Foreign investment in Korean Ventures

[

<Figure 4>

]

Foreign investment in Korean Ventures

[

<Figure 5>

]

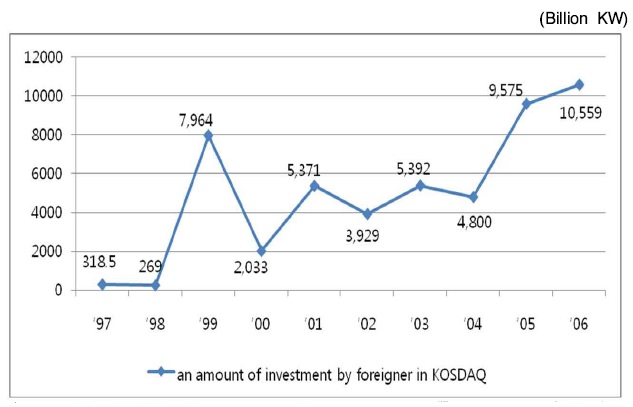

Investment by Foreign Investors in KOSDAQ

[

<Figure 5>

]

Investment by Foreign Investors in KOSDAQ

[

<Figure 6>

]

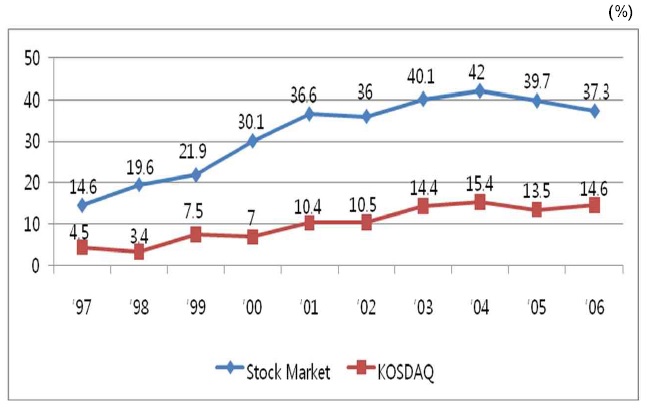

Investment by Foreign Investor in KOSDAQ and Stock Market

[

<Figure 6>

]

Investment by Foreign Investor in KOSDAQ and Stock Market

[

<Table 1>

]

The Status of the Venture Firms over Hundred Billion Won in the Sales

[

<Table 1>

]

The Status of the Venture Firms over Hundred Billion Won in the Sales

[

<Table 2>

]

the ratio of Export between large enterprises and SME in Korea

[

<Table 2>

]

the ratio of Export between large enterprises and SME in Korea

[

<Table 3>

]

The Pattern of Foreign Entry of the Korean Ventures

[

<Table 3>

]

The Pattern of Foreign Entry of the Korean Ventures

[

<Figure 7>

]

The Ratio of Sales Growth in Korean Ventures

[

<Figure 7>

]

The Ratio of Sales Growth in Korean Ventures

[

<Figure 8>

]

The Annual Pattern of Venture Capital and Venture Fund Foundation

[

<Figure 8>

]

The Annual Pattern of Venture Capital and Venture Fund Foundation

[

<Figure 9>

]

The Comparison of IPO and M&A Ratio between Korea and U.S.

[

<Figure 9>

]

The Comparison of IPO and M&A Ratio between Korea and U.S.