This paper analyzes a process bywhich a market boom brought on by a temporary increase in the flow of buyers, can subsequently lead to a collapse of liquidity (speed of sale), prices and production to levels lower than before the onset of the boom. Such episodes accompany a gradual decline in the stock of goods in the market, subsequent to increases in stocks and prices that had occurred at the onset of the boom. Following Krugman (1999), these collective observations are referred to as a hangover effect.1

I consider a general model of markets subject to search frictions in the matching of buyers and sellers. Innovations to the market are deterministic, and agents have perfect foresight.The entry of buyers, and the entry of sellers (through production of new goods) in the market are subject to adjustment costs. These adjustment costs capture a fact that changes in the stocks of buyers and sellers cannot occur at an infinite rate, and allow us to analyze outcomes when there are changes to the

In this setting, an exogenous and temporary increase in the entry rate of buyers initially causes liquidity, prices and production to

As liquidity peaks and then converges down to its steady state level, the stock of goods being sold (and resold in the case of durable goods) remains large relative to its steady state level. The necessary fall of production is signaled through a fall in liquidity and prices (through a fall in the relative measure of buyers to sellers) to

A reinterpretation of the canonical Ԛ theory of investment can also generate such cycles in prices and production following a temporary increase in the demand for (durable) goods.2 What differentiates the analysis of this paper from such a model is the link between prices and production with liquidity. Liquidity determines the share of the stock of goods that is up for sale (or unemployment rate), the stock of never sold goods (inventories), and the ratio of the flow of sales to the stock of inventories. A target of the analysis is the set of stylized facts about the correlation of these variables with production, as documented by Blinder and Maccini (1991) and Bils and Kahn (2000) among others.3

An existing search-theoretic literature applied to asset markets includes Duffie

In a related paper, Kim (2009) discusses outcomes when the stock of goods is fixed. Here I allow for this stock to be determined endogenously through production of new goods which is a necessary ingredient to generate hangover effects. Related and differentiating results are detailed in the text.

The next section presents the model of markets with search frictions. Section 3 characterizes the dynamics of buyers, sellers and the stock of goods and discusses the hangover effect. Section 4 discusses welfare implications, and Section 5 discusses the rental market. The final section concludes.

1Krugman (1999) defines hangover theory as the view that recessions are a deserved, indeed necessary punishment for previous excesses. 2Reinterpret capital as the stock of good, investment as production of new goods, Ԛ as the price of the good, and rental price of capital as the rental price of the good. Adjustment cost of investment is then an adjustment cost of production. See Romer (2006) for a textbook treatment of the Ԛ-theory of investment. 3These are a countercyclical unemployment rate, procyclical inventory stock and procyclical sales/inventory ratio. 4The counterpart to the entry of buyers and sellers in the labor market model is the entry of job vacancies and unemployed workers. Adjustments costs to the entry of vacancies or unemployed workers have not been considered in the literature. A recent exception is Fujita and Ramey (2007) who consider adjustment costs of vacancies and linearize the dynamics of vacancies and unemployment around the steady state. In contrast, I emphasize the divergent and non-linear dynamics around the steady state implied by such a setting. Blanchard and Diamond (1989) have considered a flow approach to the entry of vacancies in related environments. However, their analysis did not explore the implications of the transition dynamics of market tightness (determining liquidity) which is the focus of my analysis.

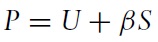

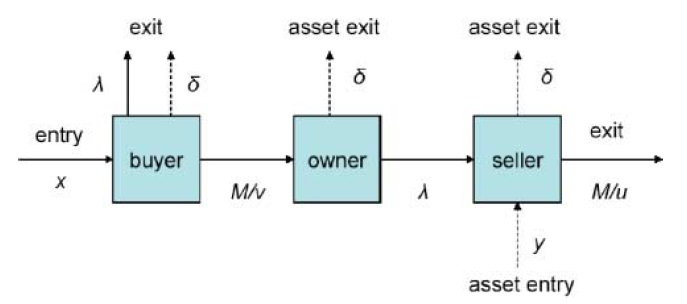

There is a market in continuous time, populated by three types of risk neutral agents who discount at constant rate

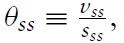

denote their ratio, which we label the tightness of the market. The flow of buyer-seller matches in the market is

denote the rate at which a good is sold, or its

A

For an owner, the arrival of the earnings reassessment shock, at rate

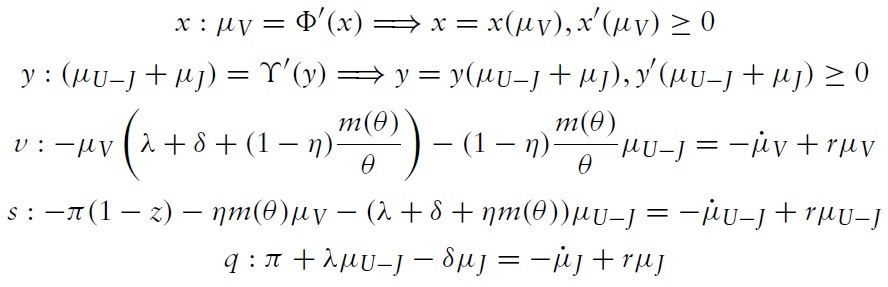

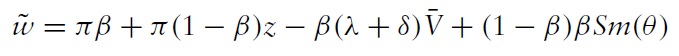

Value equations (or Bellman equations) for buyers

The flow value of buyers

plus the option value of a reassessment shock

The flow value of owners

The flow value of sellers

The surplus of a buyer-seller match is

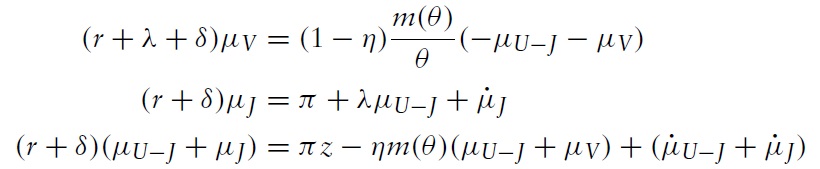

Given the path of

only (determined below), equations (asset) and (nb) specify the values

Entry into the pool of buyers is determined as follows. New buyers enter the market at rate

This completes the specification of the market. Market specific characteristics are summarized by {

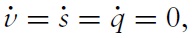

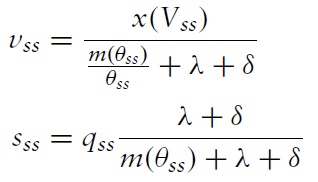

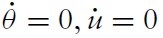

It is useful for the analysis to followto characterize values in steady stateswhere

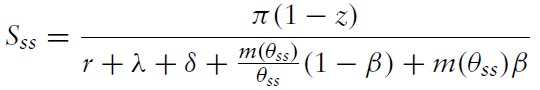

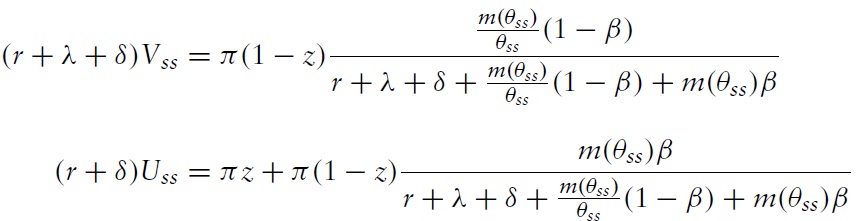

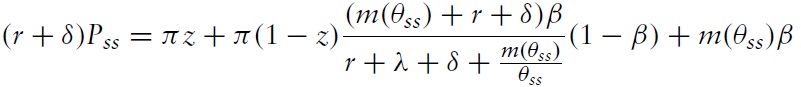

In steady states, the value of the match surplus is

Then, the steady state value of a buyer and seller are respectively given by

Thus,

is monotonically rising in

55In financial markets, where we observe actual earnings, one can think of potential buyers and owners as being optimists and sellers as pessimists, with the actual (average) earnings stream lying somewhere between π and πz. Alternatively, the gap can be interpreted as a holding cost as in Duffie et al. (2005). Downloaded by 6An important point emphasized in Kim (2009) is that the dependence of values on tightness θ, does not depend on the presence of large search frictions. In particular, setting m(θ)→∞implies

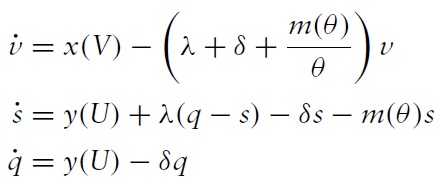

To complete the characterization of outcomes, we need to determine the paths of

where the initial

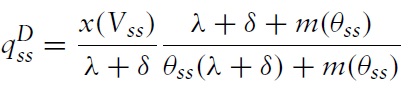

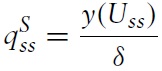

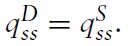

We begin with a characterization of steady state outcomes. In steady states, setting

the stock of buyers and the stock of sellers are determined by

The stock of buyers is monotonically increasing in market tightness

these two expressions imply a steady state demand function

Since

is monotonically decreasing in

Next, setting

implies a steady state supply function

Since

is monotonically increasing in

>

Theorem There exists a unique steady-state equilibrium.

Comparative statics are intuitive. A greater flow of buyers in the form of higher

4. Unemployment, Inventories and Sales

The unemployment rate of the stock of goods is the share of goods held by sellers,

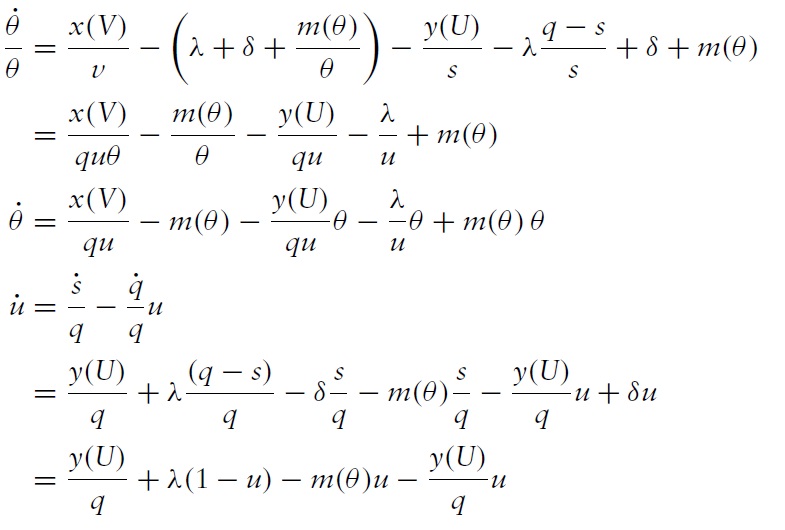

The dynamic equations (dynamics) imply the evolution of market tightness and unemployment rates are given by

All derivations and proofs are in the Appendix. Let

respectively. These equations will be applied to the analysis below of transition dynamics. The steady state tightness is given by

The steady state unemployment rate is

The stock of goods never sold, or

The evolution of inventories consists of the gross entry of new goods, minus gross exit through depreciation shocks and matches. The steady state level of inventories is given by

The sales flow of the stock of inventories is

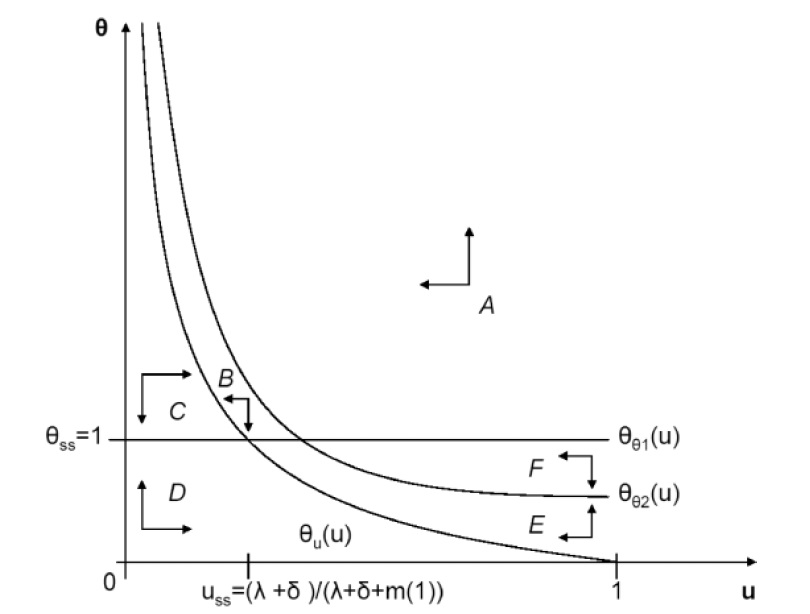

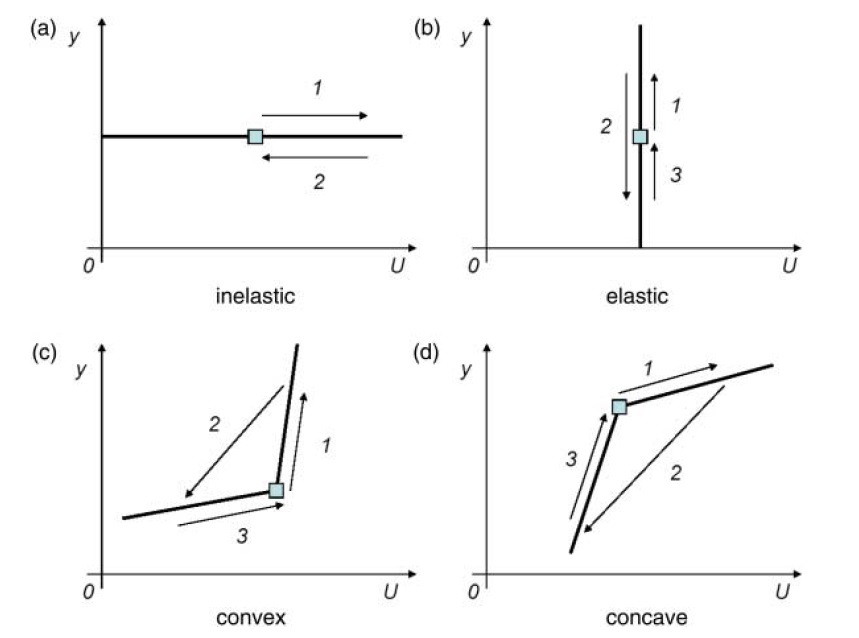

We review three special cases to gain some analytical insight into the transition dynamics.Anecessary condition for a hangover effect is that prices and/or output deviate both above

(i) temporary exogenous innovations to the flow of buyers

(ii) an elastic producer supply curve

This analysis then motivates a particular characterization of producer supply curves in the discussion of hangover effects discussed in Section 3.

>

Case 1. Inelastic supply and demand

Suppose demand and supply flows are perfectly inelastic such that the following holds.

Case 1.

is perfectly inelastic, and

is perfectly inelastic.

This implies that

Then the locus of solutions to

is given by

Note there are two solutions for

Temporary and exogenous innovations to

However, none of the transition paths are associated with hangover effects in the following sense. If innovations to

In this special case, parameters were chosen such that one of the solutions for

>

Case 2. Elastic supply and inelastic demand

Suppose supply flows are elastic, and demand flows are inelastic such that the following holds.

Case 2.

is perfectly inelastic.

At an interior solution path where

and

The first equation is obtained from (dynamics2) after setting

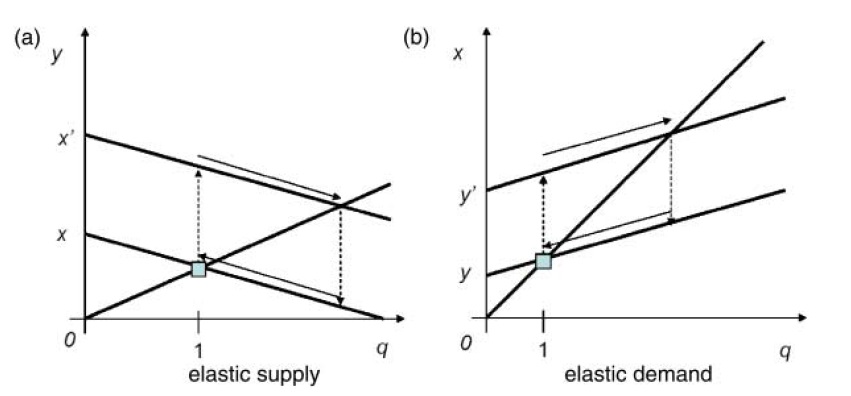

Figure 3(a) plots these loci of points in the {

(a positive demand shock) from

Following a temporary decrease in

the reverse occurs.The flowof production

>

Case 3. Inelastic supply and elastic demand

Suppose supply flows are inelastic, and demand flows are elastic such that the following holds.9

Case 3.

is perfectly inelastic, and

At an interior solution path where

and

Again, the first equation is obtained from (dynamics2) after setting

Figure 3(b) plots these loci of points in the {

(a positive supply shock) from

Meanwhile, following a temporary decrease in

7Region F exists iff the solutions 8It is possible that the transition path involves y = 0, its boundary value for a finite time interval, following both positive or negative demand shocks. At a non-interior solution path y = 0, U < U(θss = 1) such that 9This setting maps into the canonical search model of unemployment of Pissarides (2000). See the related discussion of rental markets in Section 6. 10Note that in this case, since x increasing in q in (w), we will never have a situation where x = 0, i.e. a non-interior point. Thus, in this case, we can rule out non-interior transition paths altogether.

6. Producer Supply Function and the Hangover Effect

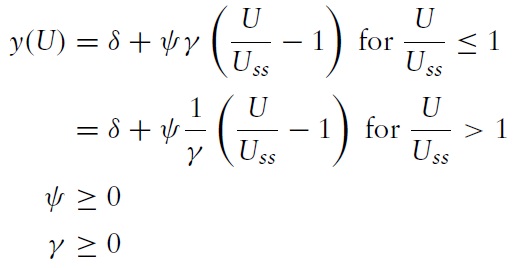

The discussion above shows that hangover effects are generated through exogenous innovations in the entry rate of buyers

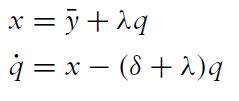

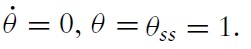

and focus on the implications of the elasticity of the supply function. This is conducted by considering a producer supply function that is (locally) characterized as

Setting

Figure 4 shows the effect of a temporary increase in the flow of buyers x on the price

Panel 4(c) shows the case for a convex supply curve (i.e.

The hangover effect plays out as follows.An exogenous and temporary increase in the entry rate of buyers initially causes liquidity

As liquidity peaks and then converges down to its steady state level, the stock of goods being sold s remains large relative to its steady state level. The necessary fall of production is signaled through a fall in liquidity and prices (a fall in the relative measure of buyers to sellers

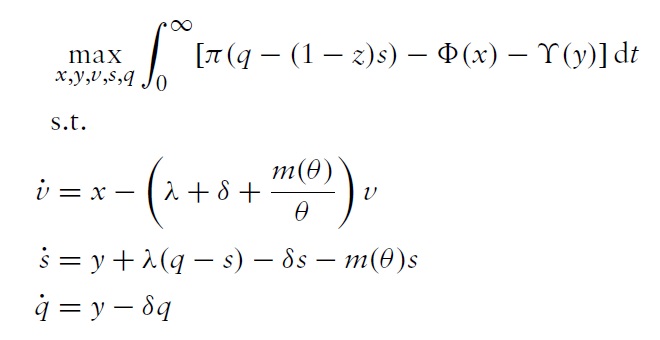

We can consider the optimization problem of a social planner who maximizes the discounted stream of earnings net of the costs of entry of buyers and producers, subject to the laws of motion for buyers, sellers and the stock of goods. The social planner problem is given by

where the initial

Proposition 1

By imposing the Hosios condition, we can interchangeably discuss decentralized outcomes and outcomes chosen by a social planner.

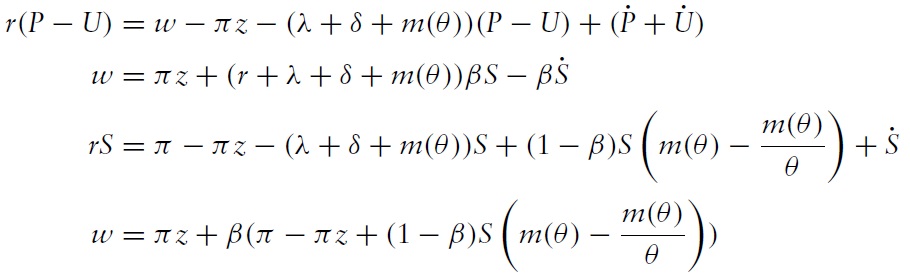

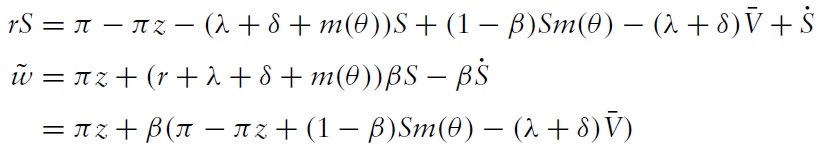

Arelated but different market structure that can be readily considered is the rental market for (durable) goods. In this case, buyers characterized above are potential

The rental rate

given

The flow value of a rented good

Given this reinterpretation, all other value equations remain the same as above in equations (asset).

Proposition 2

Thus, whether goods are transacted through transfer of ownership or through rent is irrelevant for the market dynamics and price setting outcomes of goods.11 This allows us to discuss outcomes in both types of markets interchangeably.

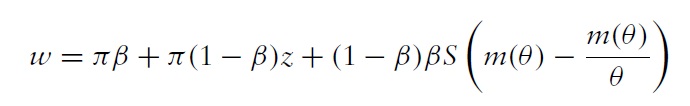

From (wage), (asset) and (nb), the rental rate can be expressed as:

This equation suggests that the rental rate w, can be inelastic relative to changes in tightness

wages are invariant to changes in

In the labor market,

The corresponding wage equation is given by:

which is increasing in

11This corresponds to the insight in the canonical search unemployment model (Pissarides, 2000) that wages (a rental rate for labor) are irrelevant for determining market tightness.

This paper has shown that markets subject to frictions in the matching of buyers and sellers can generate hangover effects in the presence of adjustment costs to the entry of buyers and sellers. The analysis extends the insights of the canonical Ԛ-theory of investment to incorporate the correlation of liquidity with prices and production over cycles resulting from temporary, positive shocks. This generates dynamics for unemployment, inventories, sales and production consistent with documented patterns over the production cycle.

A direction for further study is the relationship between liquidity and the earnings of the good (which we took as constant). This is especially pertinent in the case of factor markets such as the labor market. In such markets, factor unemployment dynamics are associated with fluctuations in the earnings or productivity of the factor. Mortensen and Pissarides (1994) provide a canonical model of (labor) unemployment where liquidity affects the selection of matches such that average labor productivity is rising in liquidity. Combining the adjustment costs studied in the current paper with that framework could generate boom-bust cycles in labor productivity and unemployment as arising from temporary, positive shocks to the entry rate of new jobs (which rent labor services). If busts can really be viewed as the hangover of booms, we can improve our understanding of episodes of recessions, which seemingly occur despite an absence of large negative shocks.