1. Free Market versus Government Intervention

Formulated at the time of the Latin American debt crisis in 1980s, theWashington Consensus promotes the retreat of government intervention in economic activities, including privatization of state enterprises, trade liberalization, financial liberalization and deregulation, depreciation of the exchange rate, reduction of government spending, macroeconomic stabilization and institutional reform for better protection of property rights. During the 1997 Asia Financial Crisis, this Consensus was subject to heavy criticism, particularly when the IMF asked the Thai government to cut government expenditures and tighten monetary policies. However, the problem of Asia’s fall in 1997 was mainly attributed to the twisted government-business relationship at the firm level (World Bank, 2001). It was argued that the culprit was not the global free capital markets, but the political interference with that free flow of funds. Such government interference was derisively branded as ‘crony capitalism’ or ‘moral hazard.’ At the heart of the Washington Consensus is the ideology of free market.

Indeed, neoclassical economists as well as the mainstream of economics argue that free markets are efficient and can promote growth everywhere (e.g. Hayek, 1952/2010; Friedman, 2002; Plant, 2009). They think that the best path of economic development is trade and financial liberalization with market opening at the macro level and privatization of state-owned enterprises at the micro level. Advanced technology and global capital come with market opening. A vast literature exists on the imperfections of government in allocating resources. Sappington &Stiglitz (1987) further initiate the application of the theory of incentives to privatization issues. They argue that the main difference between private and public firms centers on the ease of government intervention in firms’ production activities and government intervention results in inefficiency and corruption. Although Arrow (1962) contended that free-enterprise economies under-invest in research and invention because of risk, and markets are not perfect aggregators of information (Grossman & Stiglitz, 1976), Demsetz (1969) argues that government institutions are worse than the market.

On the other hand, the economists of dependence schools argue that the government needs to actively forge policies and shape market forces in order to promote economic growth (Wallerstein, 1979; Johnson, 1994, 2010). Keynes advocated government intervention in the advanced countries (Hayes, 2008). Gerschenkron (1962) emphasized the role of state in substituting for market in backward countries trying to catch up. The government may be helpful when there are market failures with externalities, information asymmetries and cases of natural monopoly. They view economic development as a process of dynamic, non marginal change, and the market mechanism cannot be relied upon to guide the investment process. More important, the market is likely to crash when global capital flows out in a very short time frame.With the stronger influence of global capital, the role of the government becomes rather complicated.

In its policy research report on the East Asian miracle, World Bank (1993) acknowledges the frequent occurrences of sectoral intervention in the East Asian growth processes, even though it tries to argue that industrial policy was not effective. It conceded by saying that government intervention was not harmful, although still not helpful. Besides getting the fundamentals right, should the government selectively intervene into the economic activities, particularly when there is a financial crisis?

2. International Trade, Foreign Investment and China’s Economic Growth

China is the world’s fastest-growing major economy, with average growth rates of 10% for the past 30 years. China’s growth comes from huge state investment in infrastructure and heavy industry, from private sector expansion in light industry and from exports. Similarly to other Asian economies, the Chinese economy has grown fast with accumulation of physical and human capital, technological progress through international technology spillovers and domestic research, and construction of infrastructures. In contrast to some Latin American countries in previous decades, the Chinese government remains a strong government, tightly controlling the monetary and fiscal tools, and owning many large firms. Although the system of central planning has been abolished, and the market economic system has been installed, the government heavily and frequently intervenes in economic activities.1

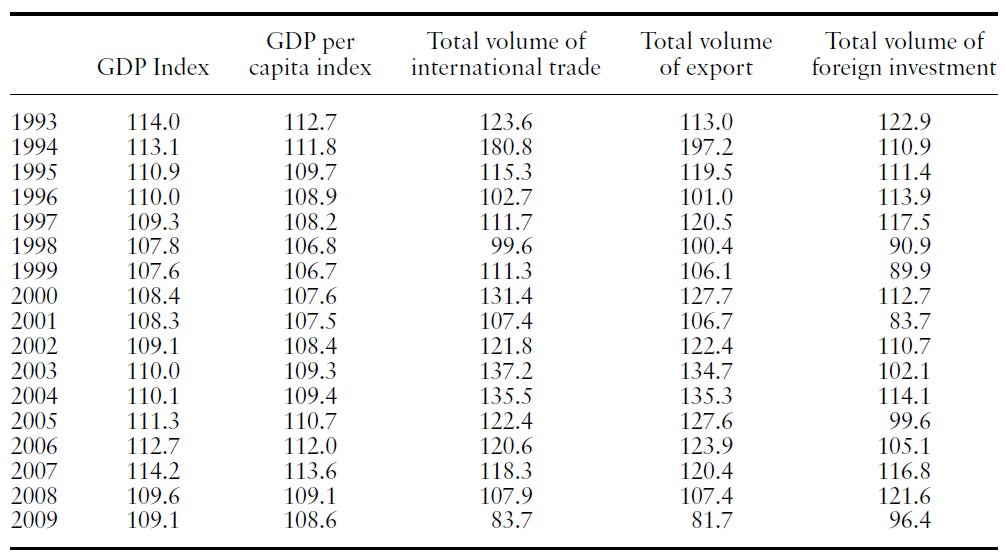

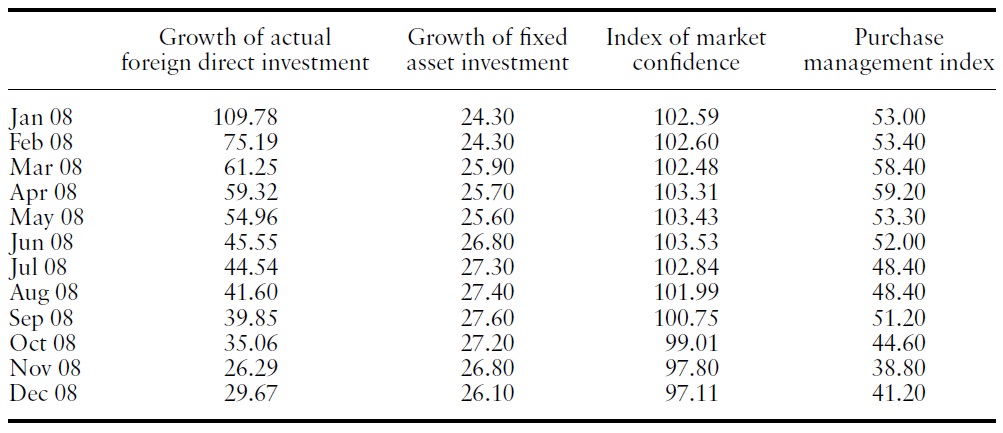

[Table 1.] Economic growth, international trade and foreign investment

Economic growth, international trade and foreign investment

Now, China is an open economy. As a major factor of openness, international trade has made an increasingly significant contribution to economic growth. Chinese international trade has experienced rapid expansion together with its dramatic economic growth, which has led the country to target the world as its market. In fact, China’s foreign trade has grown, on average, faster than its GDP for the past 25 years and it became the second largest trading nation in the world, and the largest exporter and second largest importer of goods in 2009 (seeTable 1). As its role in world trade has steadily grown, international trade plays a significant role in China’s economic growth. China’s exports of goods and services as a share of GDP rose from 9.1% in 1985 to 37.8% in 2008 and its net exports contributed to one-third of its GDP growth in 2008. The Chinese government estimates that the foreign trade sector employs more than 80 million people, of which 28 million work in foreign-invested enterprises. The consequence of this deep linkage to the foreign economies is that any large external shock would inevitably have a tremendous negative impact on China’s economic growth.

China’s economy is heavily dependent both on global trade and on investment flows. Foreign investment flows to China have been a major factor behind its productivity gains and rapid economic growth. As can be seen in Table 1, the growth of foreign investment is generally faster than GDP growth. FDI flows to China in 2007 totaled $75 billion, making it the largest FDI recipient among developing countries and the third largest overall, after the EU and the United States.

The 1997 Asia Financial Crisis and the 2008 American Financial Stormresulted in regional and global economic slowdown, respectively, and the export of China and foreign investment in China has plummeted sharply. In 1998, the growth rate of exportwas 0.4%, compared with 20.5% in 1997; and the growth rate of foreign investment was negative (−9.1%), compared with 17.5% in 1997. GDP growth was 10% in 1996, 9.3% in 1997 and 7.8% in 1998. The aftermath of the 2008 American Financial Stormwas more significant with export growth changed from 7.4% in 2008 to −18.3% in 2009 and with growth of foreign investment falling from 21.6% to −3.6%.2 The shocks for the reduction of exports and foreign investment are significant, but China’s GDP growth is 14.2% in 2007, 9.6% in 2008 and 9.1% in 2009.

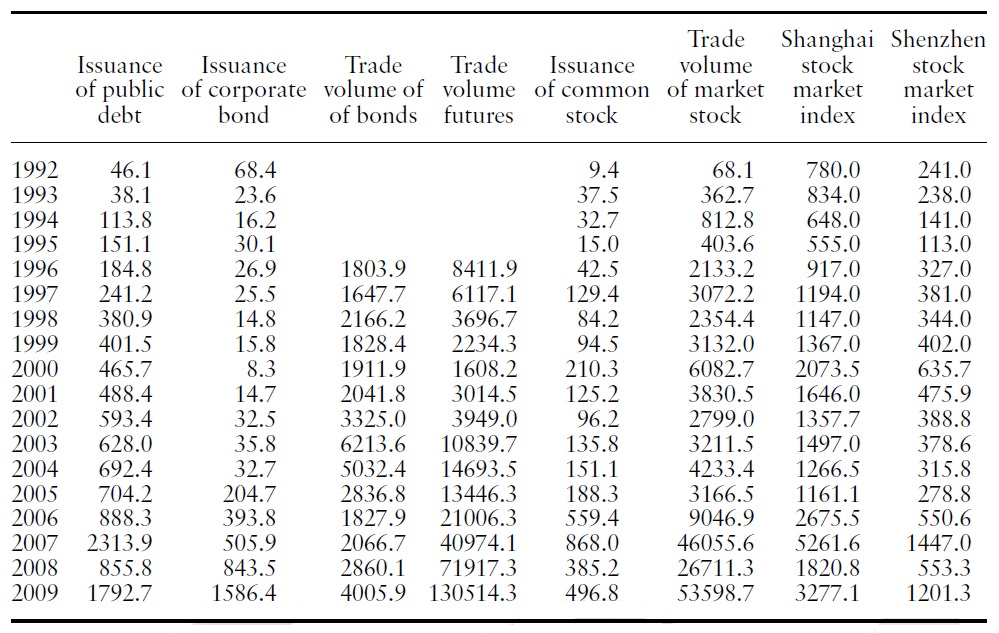

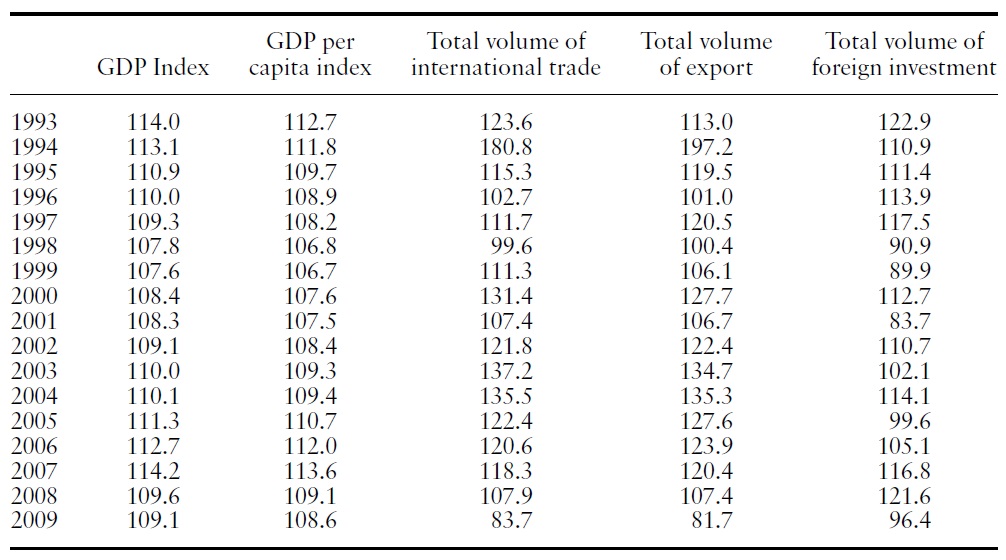

In recent years, China’s capital markets developed fast, particularly its stock market (see Table 2). The number of publicly listed firms grew from 53 in 1992 to 1718 at the end of 2009 and the number of share trading accounts grew from 2.3 million in 1992 to 17.2 million in 2009. The market capitalization was 3.9% of total GDP in 1992, 22.2% in 1997, 123.1% in 2007 and 71.6% at the end of 2009. The stock market plays an important role in China’s economy and external financial crises can have an effect on China through stock market contagion. In fact, the market index of the Shanghai Stock Exchange decreased by 3.9% year on year in 1998 and by 65.4% in 2008.

Consequently, the real estate market in several Chinese cities has exhibited signs of a bubble that was bursting, including a slowdown in construction, falling prices and growing levels of unoccupied buildings. This has increased pressure on the banks to lower interest rates further to stabilize the market. In addition, the current crisis has greatly shrunk external demand, which has resulted in the closure of thousands of factories and a rise in unemployment, especially in developed coastal areas. The Chinese government in January 2009 estimated that 20 million migrant workers had lost their jobs in 2008 because of the global economic slowdown. According to an official survey on the confidence of investors and senior management of enterprises conducted in the fourth quarter of 2008, the index of business confidence was 30% lower than the previous quarter.

In summary, China did suffer from the regional and global financial crises significantly, but we argue that China managed rather well to go through the crises with a strong government. In the following section, we discuss the role of government in weathering the financial storms.

[Table 2.] China’s capital markets

China’s capital markets

1China generally implements reforms in a gradualist fashion. 2Exports in May 2009 were down 26.4% on a year-on-year basis, the biggest monthly decline ever recorded. FDI flows to China dropped by nearly a third in January 2009 (year-on-year basis).

3. Macroeconomic Management during the Crisis

Keynesian economics states that private sector decisions sometimes lead to inefficient macroeconomic outcomes, and therefore advocates active policy responses by the public sector, including monetary policy actions by the central bank and fiscal policy actions by the government, to stabilize output over the business cycle. During economic downturns, Keynes further contended that aggregate demand for goods might be insufficient. Therefore, government policies could be used to increase aggregate demand, thus increasing economic activity and reducing unemployment and deflation. Likewise, during economic overheating, government policies could be used to eliminate inflation to balance and stabilize the economy.

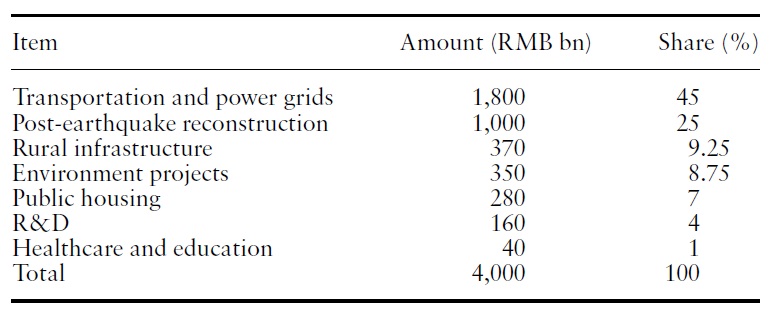

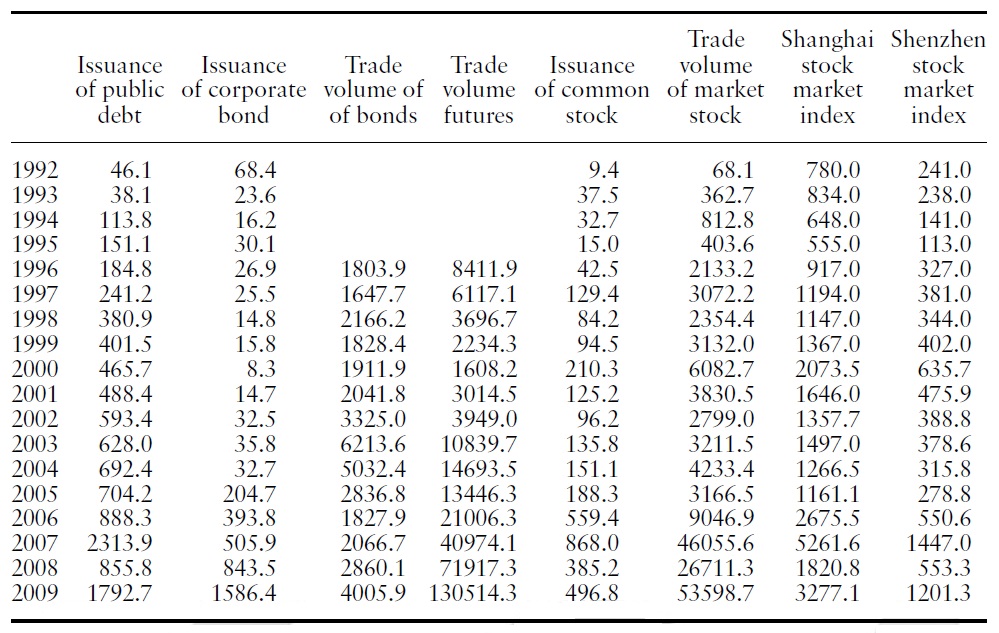

Following Keynesian recipes, China has responded to the 2008 American financial storm quickly and effectively on a number of fronts.3 On October 8, 2008, China’s central bank announced plans to cut interest rates and the reserve requirement ratio in order to help stimulate the economy. China’s State Council announced on October 21 a new economic stimulus package, which included an acceleration of construction projects, new export tax rebates, a reduction in the housing transaction tax, increased agriculture subsidies, and expanded lending to small and medium enterprises. This stimulus was confirmed as a two-year four-trillion package (about US$586 billion) on November 9. Table 3 reports the distributions of the government fund, which is mainly dedicated to infrastructure and infrastructure-related projects. The package would finance programs in 10 major areas, including affordable housing, rural infrastructure, water, electricity, transport, the environment, technological innovation and rebuilding areas hit by disasters. This is the typical approach of Keynesianism: to expand domestic demand and stimulate the domestic market by large increases in infrastructure projects.

[Table 3.] Components of the fiscal-stimulus package

Components of the fiscal-stimulus package

Keynesian economists argue that fiscal stimulus raises the market for business output, raising cash flow and profitability, and spurring business optimism. This accelerator effect means that government and business could be complements rather than substitutes in this situation. Government spending on such things as basic research, public health, education, and infrastructure could help the longtermgrowth of potential output. The US$586 billion economic stimulus spending package includes developing infrastructure projects as a means of sustaining the Chinese economy. As can be seen in Table 3, the government budget is 7.6 trillion yuan, up 22.1% from the previous year and the budget deficit is about 8.6 times the 2008 budget deficit, although it is merely 3% of GDP.

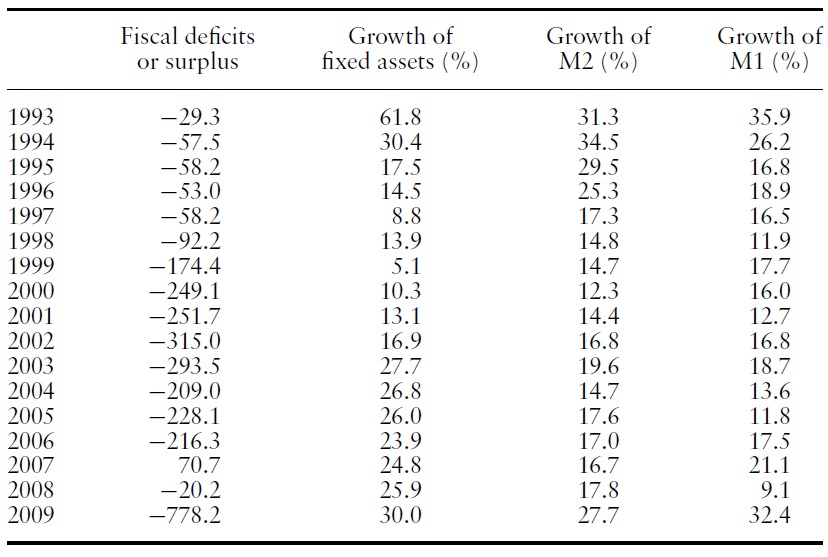

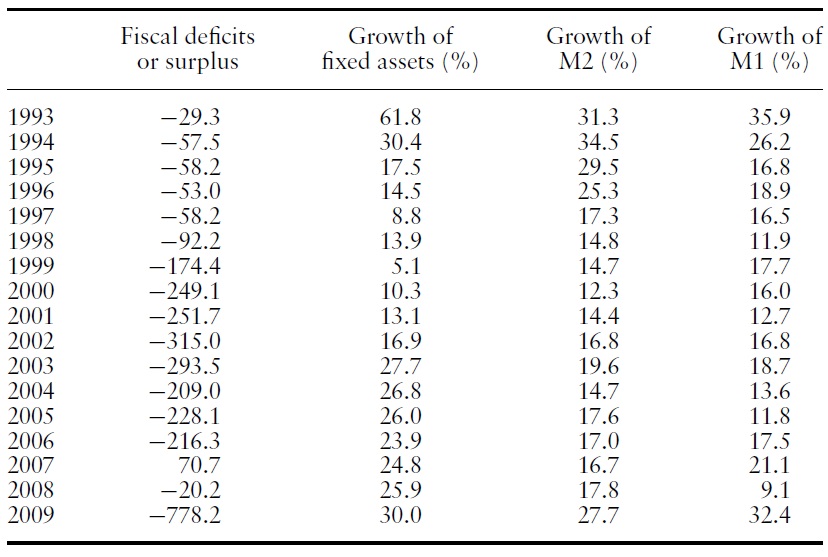

China also made important adjustments to loosen its monetary conditions. Some of these measures include cutting interest rates and lifting lending limits on commercial banks.The lending rateswere adjusted quite significantly downwards in recent months from 7.2% to 5.6% from August 2008 to November 2008. Lending rates were further revised downward to 5.3% in December 2008. Similarly, the central bank also cut half a percentage point on the reserve requirement ratio for banks from an all-time high of 16.5% to 16% in December 2008. As can be seen in Table 4, money supply is increased quickly. In December 2008 and January 2009 China’s money supply registered its highest year-on-year percentage change since May 2008: 17.9% and 18.8% respectively. In addition, the massive foreign reserves and favorable trade surplus also allow China to maintain the stability of its currency, both of which are important monetary factors for China to maintain the competitiveness of its economy and its attractiveness to FDI inflow.

[Table 4.] Government deficits, investment of fixed assets and monetary supplies

Government deficits, investment of fixed assets and monetary supplies

China made use of the macro economic tools aggressively and reinforced the domestic market as a way to fend off the global reverberations from the economic downturn under Keynesianism.

3On September 27, 2008, Chinese PremierWen Jiabao reportedly stated in a speech that ‘What we can do now is to maintain the steady and fast growth of the national economy and ensure that no major fluctuations will happen. That will be our greatest contribution to the world economy under the current circumstances.’

4. Government Ownership of Banks and Firms

Indeed, besides opening of foreign trade and investment in China, the rapid growth of the non-state sector and the foundation of a diversified banking system benefited China’s reform a lot. However, the government still owns a large chunk of banks and firms,which allows China’s government to intervene with the economic activities at the micro level.

Meanwhile, the government is also the controlling shareholder of Chinese banks, which makes government monetary policies very effective. At a time when other economies remain pinched by the global credit crunch, China is quickly awash in liquidity. As the government pushed banks to free up credit to hard-hit sectors of the economy, Chinese bank lending more than doubled in January 2009. New loans rose in January to a record amount of 1.62 trillion yuan (US$237 billion) from December’s 771.8 billion yuan, which also represented a year-on-year increase of over 800 billion yuan or 104%, given bank lending of 814.1 billion yuan in January 2008. It means that banks lined up to provide funds to developers for the stimulus-package projects, which largely benefited cash-strapped domestic enterprises trying to stay afloat amid shrinking overseas demand and waning consumer confidence.

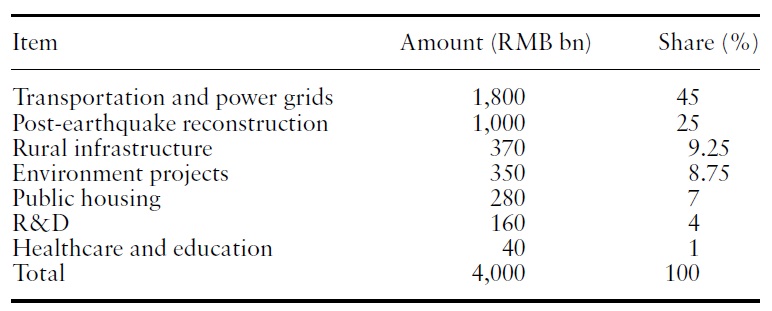

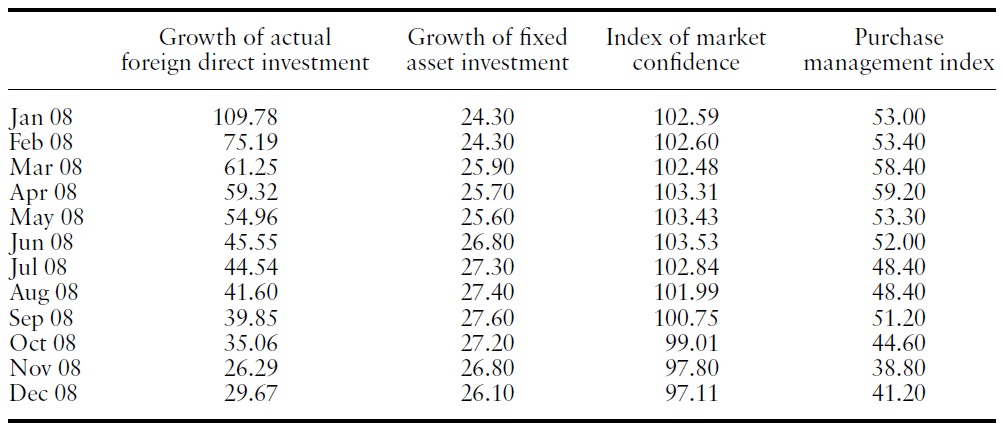

[Table 5.] FDI, investment and confidence in 2008

FDI, investment and confidence in 2008

Although thousands of private companies closed down in 2008, the government responded with plans to expand the public sector to take up the slack caused by the global financial crisis. Due to career concerns, the managers of the statecontrolled enterprises closely followed the instruction of the government (Tian& Estrin, 2008). For instance, the central government tightly controls 159 large SOEs, provides key inputs from utilities, heavy industries, and energy resources that facilitate private sector growth and drive investment, the foundation of national growth. These firms actively expanded their corporate operation and assisted other firms, even at the cost of profitability. They even use retained earnings to purchase land in order to boost the market of real estate, even if their major operation has nothing to do with real estate development. Therefore, China’s corporate sector turns out to be bullish in the very short run, which is illustrated by an increase of 41% of China’s Purchasing Management Index in December 2008 (seeTable 5).4 This has put to a stop the slide of the country’s PMI index for the first time since May 2008. It consequently resulted in boosting market confidence and in raising aggregate demand.

4Purchasing Management Index (PMI) measures new orders made by the manufacturing sector.

Going through the 1997 Asia Financial Crisis and the 2008 American financial storm, China has developed rather well during the past two decades. Indeed, these two crises have hit China quite hard, but China handled them better than other economies with the active role of its government. China’s government is reasonably rich, strong and powerful and it keeps intervening into economic activities in China, which gives ammunition to those who oppose the doctrine of the Washington Consensus and neoliberal economics.

China’s economic growth in the last 30 years is the result of more market oriented economic policies. The rapidly growing private sector and its role as a major player in the global economy could not have been possible with its centrally planned system. However, we argue that the Chinese government significantly contributed to dealing with the external shocks from world financial markets, particularly with the stabilization of domestic stock markets, the policies of real estate and the promotion of confidence of producers and consumers.The evidence from China during market failures supports the theories of developmentalists on the active role of governments in economic development. Given that the legal institutions are not sound and distrust still prevails, we need government intervention to promote economic development even if the government tends to be corrupt, particularly during financial crises created by market failures (Aghion