The financial and currency turmoils of the 1990s in many European, Latin-American and Asian countries have called into question the viability of fixed exchange-rate regimes and led to the development of new models on the causes of currency collapses. We can now identify at least two main theoretical explanations of crises, one based on the view that a collapse is the inevitable outcome of inconsistent macroeconomic policies and the other based on the view that a collapse results from self-fulfilling expectations. According to the so-called ‘firstgeneration’ models of currency crises, if a government finances its fiscal deficits by printing money in excess of money demand growth, while following a fixed exchange-rate policy, a gradual loss of reserves will occur, leading to a speculative attack against the currency that forces the abandonment of the fixed-rate regime eventually (see, for example, Krugman, 1979; Flood & Garber, 1984; Obstfeld, 1986; Calvo, 1987; van Wijnbergen, 1991; Calvo & Végh, 1999).

The ‘second-generation’ models of currency crises, on the other hand, show that the government’s decision to give up a fixed exchange rate depends on the net benefits of pegging; hence, the fixed rate is likely to be maintained as long as the benefits of devaluing are smaller than the costs. However, changes in market beliefs about the currency sustainability can force the government to go out of the peg. For example, if agents expect a devaluation, a speculative attack will start, forcing the government to abandon the peg, since the costs of keeping the exchange rate fixed outweigh the benefits. On the other hand, if agents expect no change in the currency rate the fixed peg will be preserved. Private expectations are self-fulfilling and multiple equilibria can occur, for given fundamentals (see, for example, Obstfeld, 1996; Velasco, 1996; Cole & Kehoe, 1996; Jeanne, 1997; Jeanne & Masson, 2000).1

More recently, the debate about the role played by fundamentals and/or selffulfilling expectations in triggering a speculative attack has been enriched by a new set of models analyzing currency crises in the context of a change in the expectations of future policy (see, for example, Burnside

This literature typically uses static models, or models with extrinsic dynamics; that is, models where the dynamics of the system come exclusively from current or anticipated future changes in exogenous variables. Such systems are, in fact, always in steady-state equilibrium in the absence of external shocks. This is in contrast to the so-called intrinsic dynamics of the system, where the economy evolves from some initial stationary state due to, for example, the accumulation of capital stock or foreign assets.2 Models with intrinsic dynamics are useful to understand currency crises and to predict the exact time of an attack. They enable us to study the dynamics of relevant macroeconomic variables.

The purpose of this paper is to deal with this kind of dynamics using a modified version of the Yaari (1965)–Blanchard (1985) model. Our approach has three main advantages. First, it allows a ‘nondegenerate’ dynamic adjustment in the basic monetary model of exchange rate determination. Second, it shows that the macroeconomic equilibrium is dependent on the timing of fiscal policies. Third, the current account is allowed to play a crucial role in transmitting fiscal disturbances to the rest of the economy.

Acentral finding of the paper is that a collapse may occur even as a consequence of a temporary tax cut fully financed by future taxes. In particular, following a fiscal expansion, current account imbalances and the expected depletion of foreign assets will lead to a currency crisis, forcing the monetary authorities to adopt a floating exchange-rate regime. This result is in sharp contrast with the existing literature, where monetary or fiscal policies are inconsistent or expected to be inconsistent with the exchange-rate policy. On the other hand, our theoretical results are consistent with the evidence that Asian countries that came under attack in 1997 were those that had experienced larger current account deficits on the eve of the crisis.3

The main conclusion that emerges from our analysis is that crises can occur in a flexible-price, fully optimizing framework, even when both monetary and fiscal policies are correctly designed; that is, when the intertemporal budget constraint of the government is always respected and monetary policy obeys the rules of the game. The crisis, however, is not driven by self-fulfilling expectations, as the collapse results from well-defined dynamics in the fundamentals. From this point of view, the crisis is basically real and is triggered by the macroeconomic adjustment path associated with a consistent and flexible policy rule that, nonetheless, gives rise to the conditions for a run on the central bank’s foreign reserves. The main implication of our model is that the sustainability of a fixed exchange-rate system may require not only giving up monetary sovereignty, but also strongly restraining the conduct of fiscal policy.4

The paper is organized as follows. Section 2 presents the theoretical model. Section 3 describes the dynamics of the model and the time of the speculative attack. Section 4 concludes.

1The partition between first and second generation models is consistent with the classification scheme of currency crises proposed by Flood and Marion (1999), and Jeanne (2000). From this point of view, the so-called ‘third-generation’ models, elaborated to explain the more recent financial turmoils in Asia, Latin America and Russia, are considered extensions of the existing setups that explicitly include the financial side of the economy 2This distinction may be found, for example, in Turnovsky (1977, 1997) and Obstfeld and Stockman (1985). 3For an exhaustive overviewof the economic fundamentals in Asian countries in the years preceding the financial and currency crisis, see Corsetti et al. (1999) and World Bank (1999). 4Similar implications are also found in Cook and Devereux (2006).

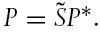

Consider a small open economy described as follows.Agents have perfect foresight and consume a single tradeable good. Domestic supply of the good is exogenous. Household’s financial wealth is divided between domestic money (which is not held abroad) and internationally traded bonds. There are no barriers to trade, so that purchasing power parity (PPP) holds at all times, that is

where

is the rate of exchange depreciation. In the absence of foreign inflation the external nominal interest rate is equal to the real rate.

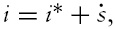

The demand side of the economy is described by an extended version of the Yaari–Blanchard perpetual youth model with money in the utility function.5 There is no bequest motive, and financialwealth for newly born agents is assumed to be zero. The birth and death rates are the same, so that population is constant. Let

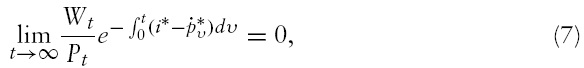

Each individual of the generation born at time s at each time period

subject to the individual consumer’s flow budget constraint

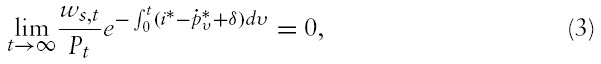

and to the transversality condition

where

6

is the external inflation rate, while

7 Each individual is assumed to receive for every period of her life an actuarial fair premium equal to a fraction

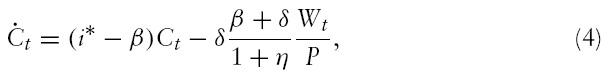

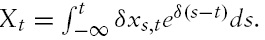

The representative consumer of generation

where,

Letting

where we have used the PPP condition.

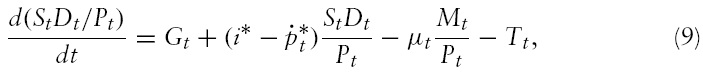

The public sector is viewed as a composite entity consisting of a government and a central bank. Let

where

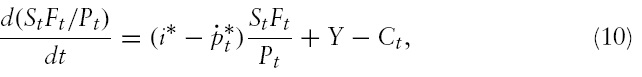

Subtracting equation (9) from equation (6) yields the current account balance:

where

2.1 Fiscal and Monetary Regimes

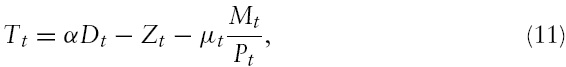

In order to close the modelwe need to specify the fiscal and the monetary regimes. The government is assumed to adopt a tax rule of the form:

where

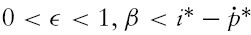

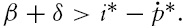

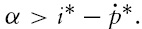

Taxes are an increasing function of net government debt adjusted for seigniorage.8 The parameter restriction on

The monetary regime is described by a fixed exchange-rate system. The central bank pegs on each date

standing ready to accommodate any change in money demand in order to keep the relative price of the currency fixed; that is, to accommodate any change in money demand by selling or buying foreign currency bonds. Thus, money supply is endogenously determined according to equation (5) for a given

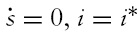

Under a permanently fixed exchange rate,

and the domestic price level is

The foreign price

that

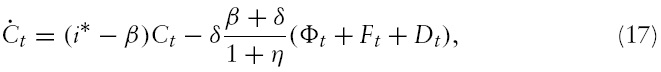

By combining equations (4) and (5) with equations (8)–(11), under the fixed exchange-rate regime, the macroeconomic equilibrium of the model is described by the following set of equations:

given the initial conditions on net public debt, on official foreign reserves, on the stock of foreign assets and on nominal money balances:

The dynamic system described by equations (12)–(14) consists of one jump variable (

5The approach of entering money in the utility function to allowfor money holding behavior within a Yaari–Blanchard framework, is common to a number of papers including Spaventa (1987), Marini and van der Ploeg (1988), van der Ploeg (1991), and Kawai and Maccini (1990, 1995). Similar results could also be obtained by use of cash-in-advance models (see Feenstra, 1986). For aYaari–Blanchard model with cash-in-advance, see Petrucci (2003). 6Following Blanchard (1985), this condition ensures that consumers are relatively patient, in order to ensure that the steady state-level of aggregate financial wealth is positive. 7This assumption ensures that savings are decreasing in wealth and that a steady-state value of aggregate consumption exists. See Blanchard (1985) for details. 8Similar fiscal rules are frequently adopted in the literature. See Benhabib et al. (2001) among others. 9However, for δ = 0 model stability requires that β = i∗.

3. Fiscal Deficits and Currency Crises

In this section, we examine the dynamic effects of fiscal policy on the macrovariables of the model to derive the links between future budget deficits and currency crises in a pegged exchange-rate economy. The policy is centered on an unanticipated lump-sum tax cut; that is, a once and for all increase in

According to Salant–Henderson’s criterion, the peg will be abandoned when the shadow exchange rate, i.e. the exchange that would prevail in the economy in a flexible exchange rate regime, is equal to the prevailing fixed rate. The hypothesis of perfect foresight implies that traders will exchange domestic currency for foreign currency before reserves run out in order to avoid capital losses. The flexible exchange-rate regime that follows the fixed-rate regime’s collapse is assumed to be permanent. For the sake of simplicity, we assume that following the collapse the monetary authorities will adopt a monetary targeting regime characterized by a zero-growth rate of the money, that is

Since the analysis is based on the assumption of perfect foresight, the transitional dynamics of the economy depend on the expectations of the long-run steady-state relationships.

The steady state equilibrium is described by the set of equations (12)–(14) when

and the portfolio balance condition (15). Let

and

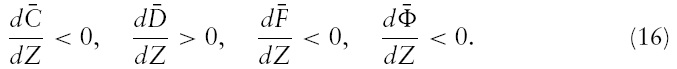

denote the long-run levels of consumption, public debt, net foreign assets and real money balances, respectively. The Appendix shows that the long-run effects of a tax cut are described by the following set of derivatives:

From the above relationships we can see that a tax cut implies that in the new steady-state equilibrium consumption, real money balances and foreign assets are below their original levels, while the government debt is higher.11 Also, notice that the tax cut would imply a jump in consumption (through the wealth effect) and hence an increase in real money balances at

the increase in real money balances is accomplished by a rise in the nominal money supply. This occurs as households accommodate any changes in money demand with portfolio shifts from foreign bonds to money (i.e., by selling foreign bonds to the central bank for domestic money). Hence, foreigncurrency assets at the central bank rise on impact, whereas the net stock of the economy external assets goes unchanged as the adjustment in

3.1 Solution Procedure and the Time of the Speculative Attack

In order to analyze the adjustment of the economy to the initial tax cut, when the public anticipate the collapse of the exchange-rate regime at some point in the future,we need to proceed backward in time. In particular,we first solve the model under the floating exchange-rate regime and find the exact time of the attack, say

Consider first the model under the floating regime, which applies for

where Φ =

From equation (5), equation (18) immediately follows. Notice that the system of equations describing the economy under the peg (12)–(14) and under the float (13), (14), (17) and (18) have the same steady-state solution, that is

and

As shown in the Appendix, the system of differential equations (13), (14), (17) and (18) is saddle path stable. The solution can be easily obtained by using the initial conditions on the predetermined variables,

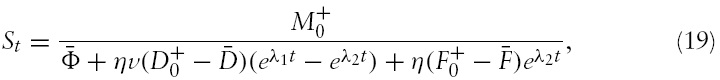

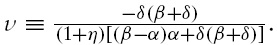

The time path of the shadow floating rate is given by (see the Appendix):

where

and

Using the above result and imposing the condition

one can compute the time of the speculative attack. Clearly, the time of the attack also depends on the size of

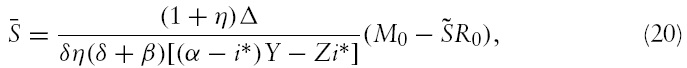

After the attack the current exchange rate will depreciate, steadily converging toward a steady state value whose level crucially depends on the initial tax cut:14

where Δ ≡ (

By contrast, the crisis will not take place if the shadow exchange rate converges towards a level below the peg, that is if

It can be easily shown that the currency crisis will occur only if the initial tax reduction

The lower the probability of death

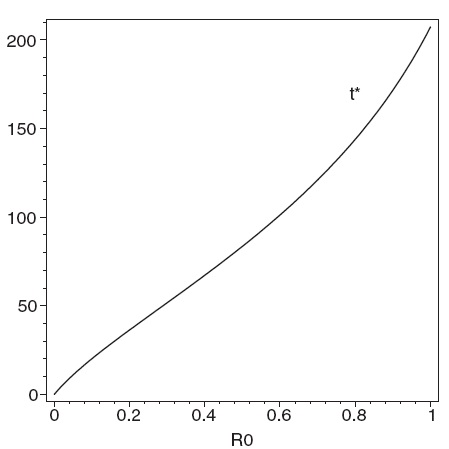

It can be shown that the critical threshold level of initial reserves is increasing in the probability of death

The adjustment process can be better described by making use of a simple numerical example.17

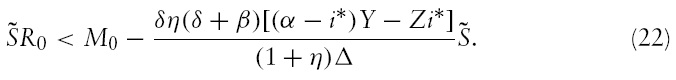

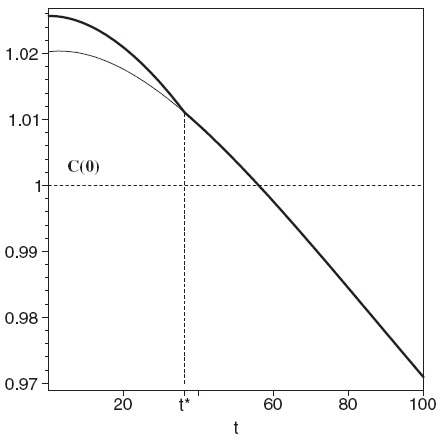

Consider Figures 1–4 and assume, for example, an unanticipated tax cut at

Current generations profit from the lump-sum tax cut, since they share the burden of future increases in taxation with yet unborn individuals.

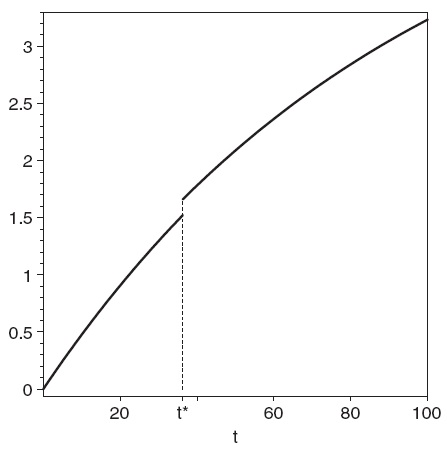

The dynamics of net foreign assets is depicted in Figure 3. Following the tax cut, the economy starts reducing its holding of foreign assets to finance the higher consumption level along the transitional path. Agents accommodate additional money needed for consumption by selling initially

Figure 4 plots the time path for net government debt, which increases gradually and at the time of the attack jumps upward because of the sudden exhaustion of official reserves, and then continues increasing converging to a new long-run equilibrium above its starting level.

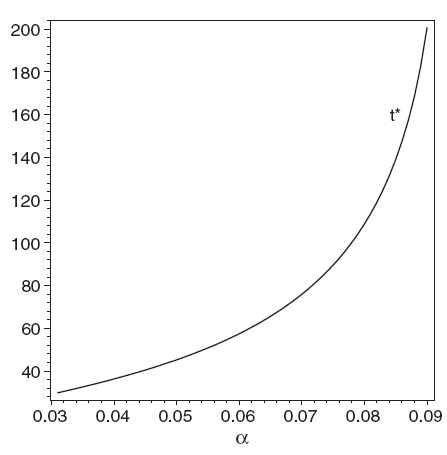

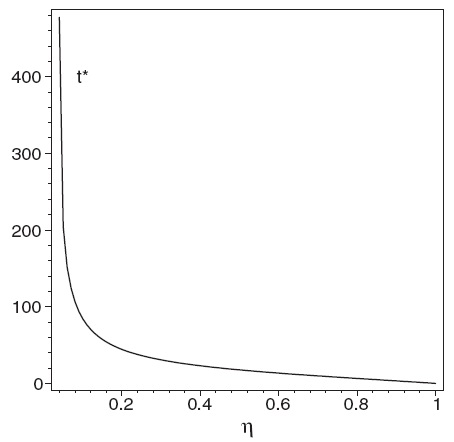

Under the baseline calibration, Figures 5–8 show how the time of the attack

Notice that in this model a crisis may occur even when the fiscal budget is showing a surplus.18 This is because, along the transitional path, a sequence of fiscal surpluses will replace the initial sequence of deficits in order to satisfy the government intertemporal budget constraint.

10The effects of government deficit in optimizing models can be found, for example, in Frenkel and Razin (1987), Obstfeld (1989), Turnovsky and Sen (1991). 11It can be easily shown that if δ = 0, the long-run effects of the fiscal expansion will simply be: That is because when the probability of death is equal to zero, the Ricardian equivalence is restored and the time profile of lump-sum taxes does not affect consumption. In such circumstances a tax cut will not give rise to any current account imbalances and to any change in demand for real money balances, that is why the currency crisis will not take place. 12Strong empirical support for a positive relationship between the current account deficit and current and expected future budget deficits is found by Piersanti (2000). See Baxter (1995) for a more general discussion on this issue. 13Clearly, since movements in fundamentals and hence the speculative attack are predictable in this model, the government could avoid the sharp loss in reserves by abandoning the peg just before the attack. However, if the government did so, then speculators would incorporate this into their strategies, so introducing strategic interactions and uncertainty into the time of collapse.We do not consider these issues here, which would terribly complicate the model and make it intractable (as there is no equilibrium in pure strategies) without adding anything newto the Pastine’s (2002) results; nor we consider the optimal exit time issue as in Rebelo and Végh (2006), which nonetheless also involves strategic interactions.We simply focus on the less intricate and narrow target of describing the macroeconomic adjustment path associated with a consistent and more flexible policy rule – in contrast to those considered in the existing literature – which gives rise to the possibility, but not the certainty, of a currency crash, i.e., on the conditions for an attack. 14Recall that under under the floating regime all the observed variations in the level of real money balances are only due to changes in the exchange rate. 15Letting Z∗ denote the critical level of the tax cut above which the peg will collapse, it can be easily shown that 16Letting R*0be the critical stock of reserves below which the crisis will occur, we have that 17Figures 1–4 illustrate a numerical example based on the following parametrization: i∗ = 0.03, η; = 0.25, δ = 0.02, α = 0.04, Y = 1,G = D0 = 0, F0 = 0.5 and R0 = 0.2. The rate of time preference, β = 0.024, and the initial stock of nominal money balances, M0 = 8.46, are implied. The fiscal expansion consists of an increase in Z of 0.05 from zero. 18This result is consistent with the evidence that in most Asian countries, during the years preceding the crisis, fiscal imbalances were either in surplus or in modest deficit. See World Bank (1999).

In this paper we have used an optimizing general equilibrium model with overlapping generations to investigate the relation between fiscal deficits and currency crises. It is shown that a rise in current and expected future budget deficits generates a depletion of foreign reserves, leading up to a currency crisis.

Crises can thus occur even when policies are ‘correctly’ designed; that is, a monetary policy fully committed to maintaining the peg and the fiscal authorities respecting the intertemporal government budget constraint. The sustainability of fixed exchange-rate systems may thus require not only giving up monetary sovereignty but also imposing a more severe degree of fiscal discipline than implied by the standard solvency conditions.

The authors are very grateful to two anonymous referees for their extremely useful suggestions. The authors also wish to thank Fabio C. Bagliano, Marianne Baxter, Leonardo Becchetti, Anna Rita Bennato, Lorenzo Bini Smaghi, Giancarlo Corsetti, Andrea Costa, Alberto Dalmazzo, Bassam Fattouh, Laurence Harris, Fabrizio Mattesini, PedroM. Oviedo, Alessandro Piergallini, Cristina M. Rossi, Pasquale Scaramozzino, Salvatore Vinci and participants at the II RIEF Conference on International Economics and Finance – University of Rome ‘Tor Vergata’ for helpful comments on previous versions of this paper. The financial support of the MIUR (Grant No. 2007P8MJ7P_003) is gratefully acknowledged. The usual disclaimer applies.