Monetary policy is a key tool to influence the economic growth of a country. Therefore, it is important to understand the channels through which a monetary policy action influences the real economy as well as the time it takes for the policy action to affect economic activities. The New Open Economy Macroeconomics (NOEM) literature, pioneered by Obstfeld and Rogoff (1995), suggests that monetary policy affects the real economy through the interest rate and exchange rate channels. The NOEM literature, with stickiness in prices and wages, predicts that the effects of a policy shock on interest rates and exchange rates are realized immediately, while the effects on output are realized with a lag and on the price level with a further lag.

Although researchers in advanced economies conducted a great deal of research to test empirically the predictions of theNOEMmodels, there are only a fewstudies that investigate the effects of monetary policy shocks in Bangladesh. However, monetary policy in Bangladesh is equally important as in developed countries. Maroney

Researchers, who estimated dynamic responses of macroeconomic variables due to monetary policy shocks in Bangladesh, mainly used recursive VAR models that cannot capture simultaneous interactions among the variables. For example, Chowdhury (1986) and Chowdhury

In order to identify monetary policy shocks more precisely, this paper formulates a monetary policy function for Bangladesh by using a structural VAR model that allows simultaneous interactions among the monetary policy variable and other macroeconomic variables in the model. Although Bangladesh is not a standard small open economy, a number of external variables, such as remittances, exports, oil price, and non-fuel commodity price, influence monetary policy decisions as well as the real economy of Bangladesh.1 Therefore, I identify the monetary policy function in a small-open-economy context by allowing some country-specific features of Bangladesh in the structural VAR model.

In order to develop the structural VAR model for Bangladesh this paper follows the general procedure of Cushman and Zha (1997) and Kim and Roubini (2000), but changes it in a number of respects to incorporate the country-specific characteristics of Bangladesh. First, since exports and remittances play a key role to influence the economic growth of Bangladesh, and the central bank continuously observes these variables to make policy decisions, we include these variables in the monetary policy reaction function. On the other hand, since a key objective of Bangladesh Bank is to maintain price stability, and oil price and non-fuel commodity price feed through the domestic price level, we also include these variables in the monetary policy function.2 Second, in order to increase the precision of the model identification, I allow more simultaneous interactions among the variables of the model within the month. Finally, since the over-identified structural VAR model developed in this paper entails simultaneous interactions, in order to obtain accurate statistical inference I employ a Bayesian Gibbs sampling method to estimate the posterior distribution of the model parameters.

I assume that Bangladesh Bank contemporaneously responds to remittances, oil price, and non-fuel commodity price, in addition to domestic financial variables, such as the stock of money and the exchange rate. Since, as argued by Noman and Ahmed (2008), the foreign-exchange market of Bangladesh is not fully efficient, unlike Cushman and Zha (1997) who studies the Canadian economy, I do not allow the exchange rate to react to all variables in the model. On the other hand, I allow the interest rate, the exchange rate, and the supply of money to interact with each other contemporaneously. The use of the structural VAR approach, as opposed to the recursive VAR approach, enables me to capture these economically meaningful cross-directional relationships among variables. Following Zha (1999), I treat the foreign variables as exogenous in the model.

This identification approach involves a great deal of simultaneity among the contemporaneous variables. Therefore, the shape of the posterior density of the model parameters tends to be non-Gaussian, and hence the widely used importance sampling technique of obtaining finite-sample inferences from the posterior distribution becomes inefficient. In order to obtain accurate statistical inferences from the parameter estimates and subsequent forecasts, I estimate the model employing Waggoner and Zha’s (2003) Bayesian Gibbs sampling method that incorporates prior information into the VAR following Sims and Zha (1998). The other advantage of this method is that it can be efficiently used for the overidentified structural VAR model developed in this paper that has a restricted covariance matrix of the reduced-form residuals as well as restrictions on the lagged coefficients.

When I apply this model to Bangladeshi data, I find that the monetary policy shock transmits to real output through both the interest rate and exchange rate channels. I also find that due to a contractionary policy shock the interest rate rises and the home currency appreciates almost immediately. However, the policy shock lowers the level of industrial production with a lag of about half a year and the inflation rate with a lag of more than one year. These results are consistent with the predictions of the NOEM literature. I believe this consistency is due to a more accurate identification of the monetary policy shock in the structural VAR model.

The remainder of the paper is organized as follows: Section 2 provides the data sources, Section 3 describes the structural VAR model that identifies the exogenous monetary policy shock, Section 4 presents the results, and Section 5 draws conclusions.

1A number of features make Bangladesh a non-standard open economy. For example, restrictions in capital transactions as well as interventions in the foreign-exchange market preclude the exchange rate to adjust freely. In this regard, Noman and Ahmed (2008) found that the foreign exchange market in Bangladesh is at best a weak-formefficient market. See Ahmed and Islam (2006) for other non-standard characteristics of the Bangladesh economy 2I am grateful to an anonymous referee for suggestions about the country-specific features of Bangladesh.

The data run monthly from 1994 to 2009. I collect the data from the International Monetary Fund’s

3Thanks goes to an anonymous referee for raising this issue about the industrial production index. 4I thank M. Moniruzzaman and Mazbah Uddin of Bangladesh Bank for providing me with the data set.

3. A Structural VAR Model with Block Exogeneity

I develop the structural VAR model to identify the monetary policy function of Bangladesh Bank in the next subsection, and I describe a Bayesian Gibbs sampling method to estimate the model in the subsequent subsection.

3.1 Identification of Monetary Policy

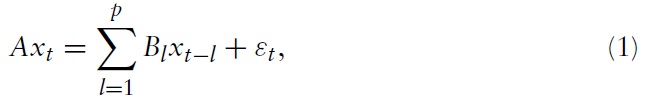

The standard structural VAR system, omitting constant terms, can be written in the following linear and stochastic dynamic form:

where

In the structural VAR model (1), the variable x comprises two blocks of variables— the domestic block of variables,

While most of these variables are commonly used in structural VAR models to identify monetary policy function, remittances, exports, non-fuel commodity price, and oil price are particularly important in the context of Bangladesh.5 Since ensuring an adequate credit supply to export-oriented industries in order to boost export growth and thereby achieve economic growth is a key objective of Bangladesh Bank, it must observe exports to make monetary policy decisions. Similarly, the flowof remittance is another important component of money supply and a key force to drive aggregate demand and hence the demand for money in Bangladesh. On the other hand, among foreign variables, both oil price and nonfuel commodity price affect the domestic price level of Bangladesh. Therefore, I include these variables in the structural VAR model.

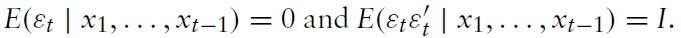

For the sake of clarity, I rewrite the structural system (1) in the following matrix notation:

where

Following Zha (1999), I treat the non-Bangladeshi block of variables as exogenous in the model. Incorporating the exogeneity assumption, the structural model (2) can be rewritten as follows:

The restriction that

where

I perform the likelihood ratio test to examine if the foreign block is Granger causally prior to the Bangladeshi block. With a lag length of eight, which is determined on the basis of the likelihood ratio test and the Akaike information criterion, the Chi-squared statistic is

Let Σ be the variance–covariance matrix of the reduced-form residuals,

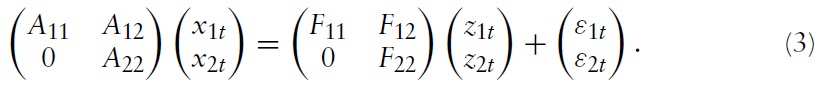

In equation (5),

The first equation of the system of equations (5) is the contemporaneous money supply equation, which is the reaction function of the monetary authority of Bangladesh. In this equation I assume that the central bank sets the interest rate by observing the current value of money, the exchange rate, remittances, oil price, and non-fuel commodity price. Since the depreciation of the Bangladeshi taka causes an inflationary pressure, and a key objective of Bangladesh Bank is to maintain a stable price level, I assume that the central bank contemporaneously responds to the exchange rate.6 I also assume that Bangladesh Bank responds to remittances and exports within the month, since both variables play important roles in achieving the policy objectives of Bangladesh Bank, namely price stability, generation of employment, and sustained economic growth.7 On the other hand, since higher oil prices and non-fuel commodity prices ultimately feed through the domestic price level, I assume that Bangladesh Bank observes these variableswhen it makes monetary policy decisions. As we see from the system of equations (5), Bangladesh Bank would be unable to observe data on industrial production and the general price level within the month due to the lag in their publication.

The second equation of the system of equations (5) is the money demand equation. In addition to identifying a usual money demand function — where the demand for real money balances depends on real income and the opportunity cost of holding money, that is, the nominal interest rate — I assume that money demand also depends on remittances.8 In fact, the flow of remittance is one of the major driving forces of aggregate demand and the demand for money in Bangladesh.9

The third equation is the exchange rate equation. Evidence on how exchange rate fluctuations affect other macroeconomic variables in Bangladesh is mixed. Chowdhury and Siddique (2006) found that movements in the exchange rate do not have a significant effect on the price level. On the other hand, Akhtaruzzaman (2005) found that the depreciation of the Bangladeshi taka has a significant role in explaining the inflationary process in Bangladesh. For other small open economies, such as for Canada, Cushman and Zha (1997) found that the foreign exchange market is fully efficient and is able to respond to both financial and non-financial variables within the month. However, in the context of Bangladesh, Noman and Ahmed (2008) concluded that the foreign exchange rate market is at best a weak-form efficient market. Therefore, in this structural VAR model, I define the contemporaneous exchange rate equation with the interest rate, the stock of money, remittances, exports, and non-fuel commodity price. The contemporaneous values of these variables are statistically significant in the exchange rate equation, while the other variables of the model are statistically insignificant.

The structural model identified in this way allows the monetary aggregate, the interest rate, and the exchange rate to interact simultaneously with each other and with other important home and foreign variables within the month. Since the recursive approach, with any ordering of the variables, cannot capture this simultaneity, it may produce flawed monetary policy shocks, resulting in unreliable impulse responses. Recursive identification approaches, such as those used by Eichenbaum and Evans (1995) and Kahn

Finally, I specify the production sector, which comprises three variables: exports,

3.2 A Bayesian Approach of Imposing Restrictions and Estimation

Two circumstances unfold from the identification scheme in the previous subsection. First, I allowsimultaneous interactions in the contemporaneous relationship among the interest rate, the supply of money, and the exchange rate. This higher degree of simultaneous interaction makes my structural model more realistic than any recursiveVARmodels aswell as some structuralVARmodels that have a lower degree of simultaneous interaction. Second, while a total of 36 zero restrictions on the contemporaneous-coefficient matrix,

Owing to the high degree of simultaneous interaction in this over-identified structural VAR model, the shape of the posterior density of the parameters tends to be non-Gaussian. As a result, the widely used importance sampling method of obtaining finite-sample inferences becomes inefficient, as mentioned by Leeper

To circumvent the problem incurred due to the simultaneity involved in this over-identified structural VAR model, I estimate the model following the Bayesian Gibbs sampling method of Waggoner and Zha (2003), who incorporated prior information into the VAR as suggested by Sims and Zha (1998). The advantage of this approach is that it delivers accurate statistical inferences for models with a high degree of simultaneous interactions among the contemporaneous variables, as well as for models with restricted variance-covariance matrices of the residuals and for models with restrictions on lagged coefficients.

I follow Bhuiyan (2008) to explain how the Gibbs sampling method can be applied to this structural VAR model. Let

As Waggoner and Zha (2003) mentioned, assuming that there exist nondegenerate solutions to the above problems, I can define a

The model then becomesmuch easier to handle by forming priors on the elements of

5See Bangladesh Bank’s Monetary Policy Statement (January–June 2010)) to know more about the variables Bangladesh Bank considers to make policy decisions. 6See Akhtaruzzaman (2005) to know more how exchange rate fluctuations cause inflationary pressure in Bangladesh. 7See Bangladesh Bank’s Monetary Policy Statement(January–June 2010)) to know more about the roles of remittances and exports. Although data on exports may not be officially available within the month, I assume that Bangladesh Bank is aware of this variable within the month. 8I thank an anonymous referee for pointing me to the fact that remittances influence the demand for money in Bangladesh. 9See Bangladesh Bank’s Monetary Policy Statement (January–June 2010)) to know more about the role of remittances. 10For a detailed explanation of the algebra and the algorithm, see Waggoner and Zha (2003).

4. Empirical Evidence of the Effects of Monetary Policy Shocks

The first step of estimation is to test the over-identifying restrictions imposed on the contemporaneous and the lagged coefficients. Following Cushman and Zha (1997), I perform a joint test of the contemporaneous and the lagged identifying restrictions. As long as all restrictions are treated as a restricted subset of the complete unrestricted parameter space, the likelihood ratio test can be applied to test the overall identifying restrictions. In the model, the contemporaneouscoefficient matrix, A, has 17 over-identifying restrictions, and with a lag-length of 8, the number of lagged restrictions on the foreign block of variables is 112. Therefore, with a total of 129 restrictions, the estimated Chi-squared statistic

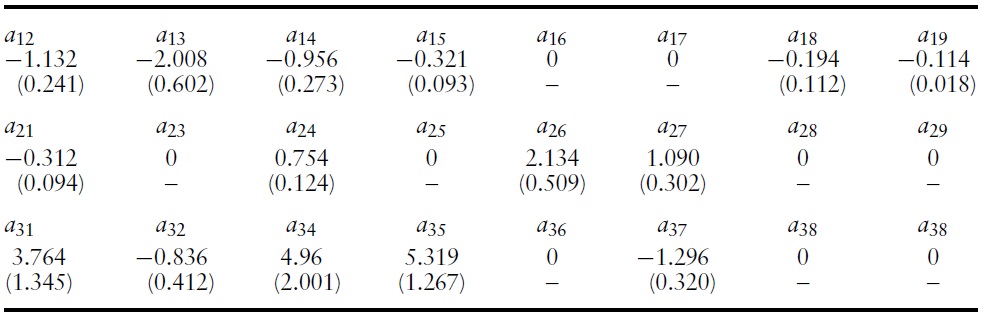

As mentioned in subsection 3.1, a greater degree of simultaneous interactions among the variables makes the structural approach developed in this paper more realistic than existing approaches in the literature. Therefore, the estimated contemporaneous coefficients will be informative about the effectiveness of this approach. The estimated contemporaneous coefficients of the first three equations of the model are reported in Table 1. Since the production sector and the foreign block of variables do not have any structural interpretation, I do not report the contemporaneous coefficients of those variables. The significance of most of the contemporaneous coefficients and, in particular, the strong significance of the simultaneously interacted coefficients indicates that both a recursive identification and a structural identification that do not allow the financial variables to interact with each other simultaneously would be erroneous.

The first row of Table 1 shows the estimated contemporaneous coefficients of the monetary policy function. In this equation, the contemporaneous coefficients of all the variables are negative and statistically significant at the 5% level. The signs of these contemporaneous coefficients will be positive if the variables are moved to the right-hand side of the monetary policy equation, and this sign changing rule is true for all the coefficients reported in Table 1. In the money supply equation, the negative and significant coefficients of the monetary aggregate and the exchange rate imply that Bangladesh Bank tightens the monetary policy by increasing the interest rate when it observes an unexpected increase in monetary aggregates and a depreciation of the currency. Since both the increase in monetary aggregates and the depreciation of the Bangladeshi taka cause inflation, tightening monetary policy upon observing these developments is consistent with Bangladesh Bank’s policy objective of price stability. Similarly, the negative and significant coefficients of remittances and exports imply that Bangladesh Bank contracts monetary policy in the face of increasing remittances and exports. Both remittances and exports drive up the aggregate demand and hence cause inflationary pressures in the economy. Finally, the negative coefficients of oil price and non-fuel commodity price suggest that the central bank contracts monetary policy upon observing higher oil and non-fuel commodity prices. Although the coefficient of oil price is not significant at the 5% level, it is not highly insignificant either.

[Table 1.] Estimated contemporaneous coefficients

Estimated contemporaneous coefficients

All the contemporaneous coefficients of the money demand equation, which is the second row of Table 1, have expected signs and are statistically significant at the 5% level of significance. We notice from Table 1 that both income and price positively affect the demand for money, while the interest rate affects negatively. On the other hand, the negative and significant coefficient of remittances in the money demand function means that the demand for money increases when there is an increase in the flow of remittances, which is a one of the major driving forces of aggregate demand and hence the demand for money in Bangladesh. The expected signs and statistical significance of the contemporaneous coefficients of the money demand function are similar to those of Ahmed and Islam (2007) and Narayan

On the other hand, all the contemporaneous coefficients of the exchange rate equation, which is the third row in Table 1, have expected signs and are also statistically significant at the 5% level of significance.When I checked the role of inflation, industrial production, and oil price, I found that the contemporaneous coefficients of these variables are not statistically significant. Therefore, these results differ fromthose of Cushman and Zha(1997) who found that exchange rate market in Canada is fully efficient and significantly responds to all the variables within the month. In contrast, the results of the exchange rate equation support the conclusion made by Noman and Ahmed (2008) who found that the foreign exchange market in Bangladesh is weak-form efficient market.

Before presenting impulse responses, it is worth discussing the theory underlying the open-economy monetary transmission mechanism. Following the pioneering work by Obstfeld and Rogoff (1995), a number of open-economy monetary transmission models, such as those by Chari

Over short periods of time, since output is determined by aggregate demand, the fall in aggregate demand causes a fall in aggregate output. With a given underlying growth rate of potential output, the reduction in actual output implies a negative output gap.While this negative output gap might continue for a while, eventually the economic slack leads to a fall in wages and prices of other inputs. Finally, this reduction in firms’ costs of production leads to a reduction in the price of output, that is, to a low inflation rate in the economy. Therefore, theoretically, while the effects of the policy shock on interest rates and exchange rates are realized immediately, this effect on the level of output is realized with a lag, and on the price level with further a lag.

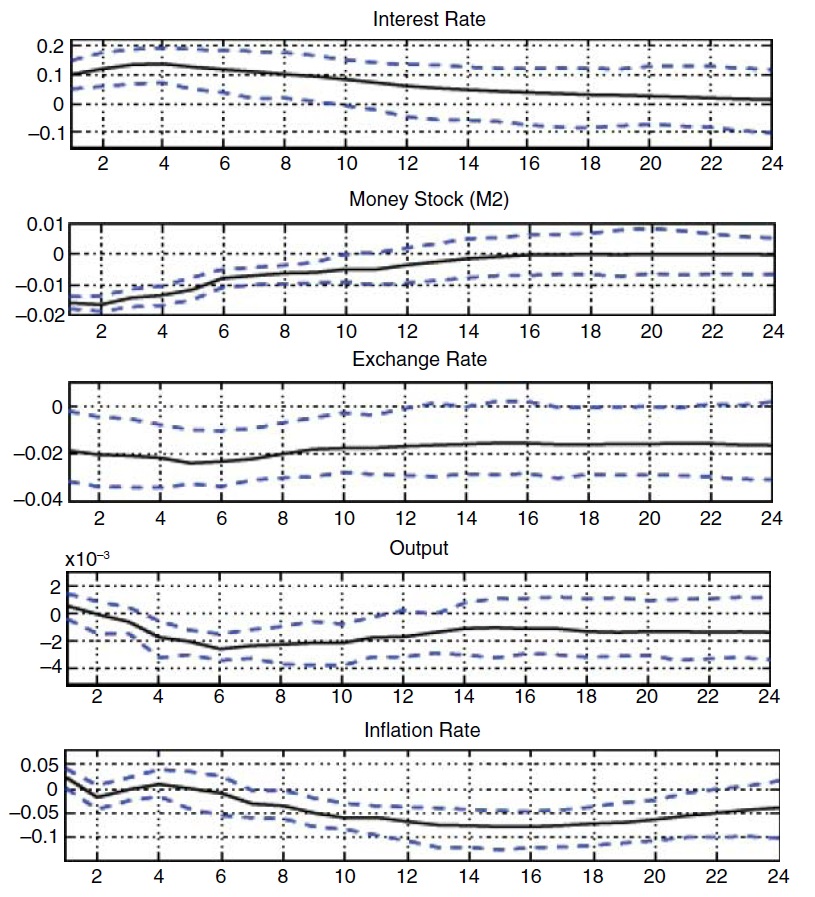

The estimated impulse responses of the macroeconomic variables due to a onestandard-deviation disturbance in the money supply equation, interpreted as a contractionary monetary policy shock, are displayed in Figure 1. The response horizon, in months, is given on the horizontal axis. The solid lines are the impulse responses estimated using the Bayesian Gibbs sampling method of Waggoner and Zha (2003) discussed in subsection 3.2.12 On the other hand, the upper and lower dashed lines contain the 95% confidence interval.13

We observe from the figure that in response to a contractionary monetary policy shock, the interest rate increases and the stock of money decreases instantaneously. We also notice that the impulse responses of both the interest rate and the stock of money remain significant for about ten months. Following the same shock, the Bangladeshi currency appreciates on impact and gradually depreciates to its terminal value. Therefore, this response of the exchange rate is consistent with Dornbusch’s (1976) prediction that following a policy shock the exchange rate overshoots its long-run level on impact, followed by a gradual adjustment to the initial value.

We also observe from Figure 1 that due to the contractionary policy shock industrial production falls with a lag of about half a year. Finally, this policy shock lowers the inflation rate, the highest impact of which is realized with a lag of more than one year and remains significant up to about two years after the shock was introduced. Therefore, while the interest rate and the exchange rate respond to the policy shock immediately, industrial production responds with a lag and the response of the inflation rate is further delayed.

These results are consistent with the predictions of the NOEM literature regarding the dynamic responses of a contractionary monetary policy shock, both in terms of the direction and the timing of the responses. I believe this consistency is due to a more accurate identification of the monetary policy feedback rule of Bangladesh Bank in the structural VAR model. Apart from the identification of the policy function, the Bayesian Gibbs sampling method of estimation employed in this paper also provides us with more accurate parameter estimates and subsequent forecasts of macroeconomic variables.

At this point it is interesting to compare the findings of this paper with other findings in the literature. The impulse responses of this paper match more closely with the impulse responses of structural VAR studies than those of recursive VAR studies in the literature. For example, both Cushman and Zha (1997) and Kim and Roubini (2000) found that a contractionary monetary policy shock increases the interest rate and depreciates the home currency almost immediately, while the same shock lowers industrial production with a lag and the inflation rate with a further lag. However, Cushman and Zha (1997) reported that the response of the interest rate remains significant for a short period of time and concluded that the monetary policy transmission mechanism operates through the exchange rate in a small open economy.

In contrast, the findings of this paper differ significantly from those of recursive VAR studies. For example, Bhuiyan and Lucas (2007), employing a recursive VAR model, found an appreciation of the home currency due to a contractionary monetary policy shock, which is inconsistent with what we expect from a contractionary monetary policy shock. It is difficult to compare our results with those of Chowdhury

We check the robustness of the results of this paper by estimating the model employing some other alternative identifications. We find that the recursive approach with various orderings of the variables generates puzzling results similar to those found in previous studies. For example, a recursive identification that does not allow monetary policy to contemporaneously respond to the exchange rate and remittances causes an initial depreciation of the Bangladeshi taka after a contractionary policy shock. I have also estimated the structural VAR model by including the world interest rate. However, the qualitative results remain unchanged due to the inclusion of the world interest rate in the model. Finally, when I estimate the model using

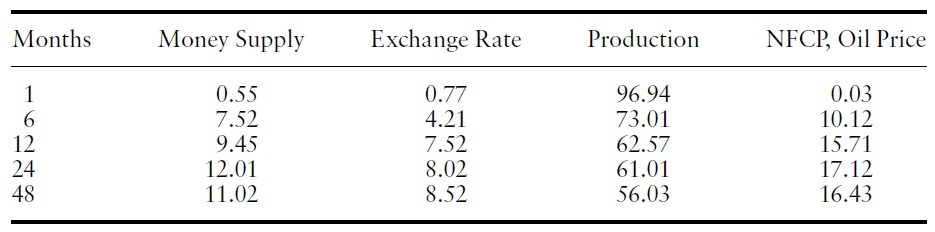

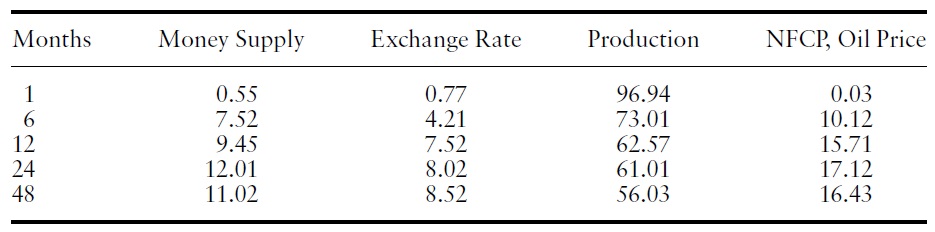

Lastly, I report the sources of industrial production fluctuations in Bangladesh. Table 2 presents the variance decomposition of industrial production due to shocks in various macroeconomic variables over different horizons. We see from the table that the monetary policy shock is not the dominant source of the fluctuations of industrial production in Bangladesh at any horizon. This result is similar to the findings of most recursive as well as structural VAR studies in the literature. We also notice from the table that shocks in the production section, which are shocks in industrial production, exports, and inflation, are the primary source of industrial production fluctuations, although non-fuel commodity price shocks, oil price shocks, and monetary policy shocks also become important sources of industrial production fluctuations in the medium to long run.

[Table 2.] Forecast error variance decomposition of industrial production

Forecast error variance decomposition of industrial production

11I refer interested readers to Ahmed and Islam (2007) and Narayan et al. (2009) to know more about the stability of the money demand function, which is a precondition for the success of the monetary targeting approach of monetary policy in Bangladesh. 12An alternative method to compute the impulse response functions would be Jordà’s (2005) local projections method. Although Jordà’s method is relatively new, the principal advantage of this method over other existing methods in the literature is its robustness to misspecifications of the VAR model. 13While there are a number of methods available to compute error bands, Sims and Zha (1999)showed that the so-called other-percentile bootstrap method amplifies any bias in the estimation procedure, resulting in a downward skewness in the error bands relative to the error bands computed using the Bayesian method. On the other hand, the classical method produces skewness in the error bands towards the upward direction. Although Kilian (1998) proposed bias correction in the other-percentile bootstrap method, Sims and Zha (1999) showed that this procedure causes even more skewness in the error bands for a over-identified structural VAR model with simultaneous interactions in the contemporaneous coefficient matrix.

This paper develops an open-economy Bayesian structural VAR model for Bangladesh in order to estimate the effects of a monetary policy shock. The structural model developed here allows the financial variables of the model to interact contemporaneously with each other and with a number of other home and foreign variables. Since the identification approach involves simultaneous interactions in the contemporaneous relationships of the variables in the model, in order to increase the precision of the parameter estimates, I use a Bayesian Gibbs sampling method to estimate the model. This paper finds that the liquidity effect and the exchange-rate effect of the policy shock are realized immediately, while industrial production responds with a lag of about half a year, and the inflation rate responds with a lag of about one year.

I believe the consistency of the impulse responses generated in this paper with the predictions of theNOEMmodels is due to a more accurate identification of the structural VAR model, which estimates a more precise measure of the exogenous monetary policy shock. In order to make the model more realistic, I incorporate some country-specific characteristics of Bangladesh in the structural VAR model. I also realistically allow the nominal interest rate, the stock of money, and the exchange rate to respond to each other and to a number of other home and foreign variables within the month, which increases the precision of the model identification. In addition, the Bayesian Gibbs sampling method of estimation employed in this paper also provides us with more accurate parameter estimates and subsequent forecasts of macroeconomic variables due the monetary policy shock.