The field of high technology start-ups has received much importance within the entrepreneurship literature over the past two decades. Gries and Naude (2008) observe that these new, small firms are more likely to grow (Johnson et al. 2000; Lingelbach et al. 2005), create new jobs (McMillan and Woodruff 2002; Audretsch et al. 2006), and promote new and flexible organizational forms (Kim et al. 2006). In particular, small high technology start-ups have been recognized as being the major drivers of job creation and innovation and thus economic growth (Birch, 1979; Baumol, 2002; Kirchhoff and Spencer, 2008).

In the USA, the decades of 1970s and 1980s witnessed the most significant impact from high technology start-ups in terms of both employment and economic growth. At its peak, these entrepreneurial companies contributed to almost 20% of the U.S. employment. Even during the US recession of 2009-2010, 394,000 new businesses were formed, creating 2.3 million jobs (Center for Economic Studies and Kauffman Foundation, USA, 2012). Over the period of time, emerging economies too have realized their importance. In Taiwan, the contribution made by the high technology sectors to the total domestic output increased from 9.7% in 1980 to 28.5% in 2003. South Korea’s high tech manufacturing contributions to the total domestic manufacturing output jumped from 9.6% in 1980 to 21.5% in 2003 (Commission on Strategic Development, Hong Kong, 2007). In India an average of 400 new technology start-ups were created annually during 2009-2012 (Microsoft Accelerator India Report, 2012).

However, it must be understood here that although the impact of the high technology start-ups on the economy is considerable, they have a flip side as well (Bala Subrahmanya, 2014). These firms often encounter a very high failure rate. This can be attributed to several factors. The most important among these is the liability of newness – i.e. since they are trying to create a unique offering that has no precedence (Stinchcombe, 1965; Baum, 1996; Certo, 2003), there exists a considerable degree of uncertainty regarding the future. Moreover, these firms are created on a small scale with scarce resources and often face large and experienced competitors in the open market. Therefore, their ability to withstand sustained losses is usually very limited.

Despite these formidable challenges, start-ups have come up with disruptive innovations and successfully taken on the giants in their respective domains. Some of the leading companies in the technology arena today such as Apple, Cisco, eBay, Qualcomm, Intel were once incubated as tiny start-ups during their formative years (Barringer et al, 2005; Paulraj, 2012). Given the above perspectives, it is important to clearly understand the set of factors that aid the development of high technology start-ups and also identify the ones that seem to be the major deterrents.

The ecosystem for start-ups in India has been getting stronger by the day (Bala Subrahmanya, 2014). Currently, there are more than 4000 high-tech product start-ups operating in India (Microsoft Accelerator, 2012). India has emerged as one of the top destinations among emerging economies for the deployment of venture capital (VC) funds (Bain Consulting, 2012). More than 180 incubators have been set up within the academic set-ups alone (Venture Center, 2014). These have been supplemented by the efforts of other multinational corporates in terms of setting up their own business accelerators E.g. Microsoft, Google, Amazon and so on. Today, Bangalore is identified among the top nine international start-up hubs outside of USA (Pullen, 2013). Consequently Indian policy makers too seem to have realized the growing importance of start-ups. In this regard, the Inter-Ministerial Committee for MSMEs has come out with a comprehensive list of recommendations for the promotion of start-ups in Indian economy (Ministry of MSMEs, 2013). However, despite these bullish trends, there have not been any empirical studies so far that have intensely examined the start-up ecosystem in India. The aim of this paper is to fill this gap. Accordingly, the objective of this paper is to identify the key ecosystem related factors that have been critical in the emergence of a vibrant high technology start-up environment in India.

This paper is organized as follows: The next section reviews the existing literature on the core micro-level and ecosystem factors that influence the emergence and growth of high-technology start-ups. This is followed by the identification of the research gaps that enables us to substantiate the need for the study. After this, we present the conceptual framework, followed by a description of the data sources and methods of analysis. Finally we present the results from the study and discuss the policy implications emerging from the same.

This section presents a detailed review of literature about the key dimensions that influence the emergence and growth of high-tech start-ups. In particular, we discuss in detail the ecosystem related factors that are likely to have a critical influence on the high-tech start-up lifecycle.

1. Emergence and Growth of High-Tech Start-ups

Research examining the key dimensions influencing the emergence and growth of high-tech start-ups has been broadly classified under three different approaches. The first approach proposes phase based models to understand the phenomenon of high-tech start-up emergence and growth. The second approach focuses on identifying the vital independent factors that impact the emergence and growth of high-tech start-ups. The third approach can be viewed as a theory aimed at bridging both the above approaches. Key contributions from these approaches are discussed below.

Greiner’s (1972) work is considered the basic foundation for the theory on lifecycle of firm development. He introduced a phase based model, where in each phase would transit to the other based on a management crisis prior to a relatively calm phase. From a small business perspective, Churchill and Lewis (1983) applied changes to the Greiner model to incorporate unique characteristics of small firms. Other notable contributions in this area are that of Aldrich’s (1999) four-stage process (conception, gestation, infancy, adolescence), Bhide’s (2000) conceptualization of start-up lifecycles in terms of varying degrees of investment-uncertainty-profit trilogy, Hanks et al. (1993) four stage model (start-up, expansion, maturity, early diversification) in the high technology sector and Pavia’s (1990) two stage evolutionary model for high tech start-ups.

While the above contributions helped gain an understanding of the high-tech start-up lifecycle from a firm or organization perspective, they failed to represent or incorporate the influence of the entrepreneurial and external ecosystem related factors. Hence, a second approach was attempted almost in parallel to the former one in order fill the above gaps.

Vesper (1980) was one of the first researchers to propose a model to understand the dynamics of new firm creation, focused on identification of key factors that influenced new venture creation. He argued that knowledge, idea, connections, resources and implementation as being the fundamental constructs that impact new firm creation. Gartner (1985) aggregated the previous works and identified that personality of the entrepreneur, environment, the firm (organization) and implementation as being the primary tenets contributing to new firm creation.

However, the above literature fails to take into consideration the temporal dimension in the context of growth and emergence of start-ups. This gap was bridged by the further studies in this domain. Scott and Bruce (1987) reviewed the different phases (inception, survival, growth, expansion, maturity) of the small firm lifecycle against parameters such as top management role, organization structure, sources of finance and analyze the changing dimensions of these factors. Later, Wiklund et al. (2009) presented an integrative model of small business growth, wherein they unified five theoretical perspectives in an attempt to explain the complex and dynamic nature of small business growth. Their model identified- entrepreneurial orientation of the firm, the external environment, resources of the firm, and growth attitudes of entrepreneurs to be the key dimensions that explain the growth of small businesses.

To summarize, based on these studies, it may be inferred that the factors influencing high technology start-ups can be studied under three broad categories: (i) entrepreneur based characteristics, (ii) start-up (organization / firm) related characteristics and (iii) ecosystem related characteristics. In this paper, we attempt to view the emergence and growth of high-tech start-ups as the interplay of macro and micro factors. Among these, the entrepreneur and the firm constitute the micro factors while the ecosystem constitutes the macro factors influencing the phenomenon under study.

The following subsections provide a detailed overview of the micro and macro factors that have been studied in prior literature as being influencers of high-tech start-up emergence and growth.

1.1 Micro Factors

Entrepreneurial and the firm level characteristics are the micro-level factors influencing the emergence and growth of high-tech start-ups. Each of these micro aspects can be further sub-divided into two categories – latent and tangible. While tangible aspects refer to the characteristics that are directly observable and measurable (such as entrepreneurial background, firm size and so on), latent aspects are the more covert factors such as the entrepreneur’s personality and behavioral attributes and the firm’s adaptability in particular.

Entrepreneurial characteristics: It is now well established that the latent entrepreneur related factors such as the need for achievement (McClelland, 1961), risk-taking propensity (Brockhaus, 1980), locus of control (Brockhaus, 1982), tolerance of ambiguity (Schere, 1982), and the desire for personal control (Greenberger and Sexton, 1988) as being the key factors influencing the high technology start-up lifecycle. Further, Mazzarol et al (1999) indicate that many other tangible entrepreneur related factors, such as previous employment (Storey, 1982; Ronstadt, 1988), family background (Scott and Twomey, 1988; Matthews and Moser, 1995), gender (Buttner and Rosen, 1989; Kolvereid et al. 1993), education (Storey, 1982), ethnic membership (Aldrich, 1980) and religion (Weber, 1930) have been examined for their impact on the creation of high technology start-ups.

Firm level / organizational characteristics: Among the organizational charac- teristics, the latent factors such as the adaptability of the start-ups (Andries and Debackere, 2007), learning ability of the firm (Geroski, 1995), the firm’s strategy (Sandberg, 1986) and its management processes (Ensley et al. 2003) are some of the most discussed aspects. As far as the tangible organizational characteristics are concerned, factors such as external partnerships (Barringer et al., 2005), firm size (Dunne et al., 1989), endorsements and legitimacy establishments (Higgins and Gulati, 2006) emerge to be the dominant influencers of success of high technology start-ups. Faster time to revenue, partnerships with established brand names, a high profile company or influential celebrity as its reference customers are all different ways to build endorsements and signal the market about the legitimacy of a start-up’s product or service.

While the above two aspects summarize the micro-level core dimensions that influence the high technology start-ups, there is a need to review the macro aspects that influence this phenomenon in more detail. This is because, the ecosystem or the environment related factors seem to exert a significant influence on the growth of high-tech start-ups and more importantly they can be influenced by making conducive policy changes. Hence, the next section presents an overview of the macro factors that affect high-tech start-ups.

1.2 Macro Factors

Macro (environmental or ecosystem) parameters influencing high-tech start-up lifecycle can be categorized into four broad dimensions (i) Macro-economic indicators (including infrastructure related factors), (ii) Regional start-up ecosystem factors, (iii) Characteristics of the industrial environment and (iv) Government policies.

Several studies have explored the influence of macro-economic parameters on the high-tech start-up emergence and growth. In general, factors such as real GNP growth, expenditure on equipment (investment), unemployment rate, real interest rates, inflation, aggregate demand and costs of production influence the start-up rates (Highfield and Smiley, 1987; Wang, 2006; Hiroyuki and Nobuo, 2006). While some of these have a positive impact on the emergence of start-ups (GNP, investment, demand) others are seen to have a negative influence (interest rates and costs of production). However, the overall effect of these macro influences is not consistent and seems to vary widely across economies. As a result, many researchers find it more appropriate to examine the role of region specific factors on the emergence and growth of start-ups.

Among others, Reynolds (1993), and Reynolds and Storey (1993) identify urbanization (agglomeration) and domain specialization (resulting in an accumulation of relevant skills e.g. Bio-tech cluster, IT cluster) as the broad determinants of entrepreneurial start-ups in a region. In the context of hightech start-ups, Cooper and Folta (2000) show that a region that facilitates the absorption of external knowledge is a positive influence on the growth of high technology start-ups. This is vital for the survival of a high-tech start-up, since external developments such as rapid technological changes and new whitespace market creation can either propel the start-up to hyper growth or to closure, based on how the start-up can assimilate the changes from its surrounding environment. For instance, in the case of a radical technological breakthrough such as DNA sequencing or affordable Solar Photo Voltaic cell technology, the presence and access to creators of these inventions will spawn a new spate of start-ups trying to leverage this technological breakthrough to provide solutions in many areas that previously were not economically feasible.

Jaffe et al. (1993) establish that when the product / service knowledge tends to be localized, it generates significant positive externalities in the form of ‘knowledge spillovers’. The Silicon Valley, Route 128, and the Cambridge Region in the United Kingdom are well known clusters of high-tech start-ups. These clusters allow employees of various start-ups to network with one another and make it easier for the firms to gain access to specialized suppliers, scientific knowledge, and technological expertise indigenous to the area. Wennberg and Lindquist (2010) observe that while a number of studies has found that clusters enhance the probability of entry, survival, and growth of new firms (Beaudry and Swann 2001; Dumais et al. 2002; Pe’er and Vertinsky 2006; Rosenthal and Strange 2005; Stough et al. 1998), other studies indicate that location in a cluster decreases the survival chances of new firms, since the diseconomies of agglomeration play an increasingly important role as clusters evolve (Folta et al, 2006).

There is a third stream of literature that builds on the economic theory of industry structure and applies the same in the context of high-tech start-up emergence and growth. Researchers such as Dean and Meyer (1996) and Porter (1998) have illustrated that industry environment play a key role in influencing high technology firm’s growth. Audretsch (1991, 1995) used factors such as intensity of innovation, the concentration ratio, the minimum efficient scale, profit rate and industry growth to underline the importance of the industry specific factors on start-up survival. For example, take the case of DNA sequencing and the affordable solar Photo Voltaic cell technology. In these areas, the intensity of innovation is expected to be quite high – thus providing many economic opportunities for start-ups to leverage the new technological development. However, each of these inventions will have different capital investment requirements and minimum number of users/households to serve (minimum efficient scale) for these inventions to be used economically. The ability of the firms to meet these requirements will directly impact their survival.

Complementing the above work, researchers have studied the influence of key economic resources - labor and capital on the high-tech start-up industry. Audretsch and Lehmann (2004) establish venture capital involvement as being a key facet in influencing the high technology start-up survival. Gompers and Lerner (1999) show that existence of venture capital provides a signal to the labor market and thus a VC funded firm can potentially attract a better quality of human capital. Kim et al. (2006) identified human capital as one of the key determinants of high technology start-up creation. They note that benefits of human capital enable the firms to overcome many challenges and frictions related to finance (educated entrepreneurs may find it easier to obtain credit), marketing (skilled entrepreneurs can better identify their market niche), network forming (educated entrepreneurs may have higher social standing and so better networks).

The final strand of literature related to high-tech start-up emergence and growth is related to government policies particularly those regarding taxation. The actions of the government, in terms of its policies, legislation, programs and initiatives relevant to entrepreneurship are seen to play a key role in determining the survival and growth of the high technology start-ups. Millan et al. (2012) note that government actions should ensure that they do not distort the occupational choice of the workforce by encouraging the entry into self-employment. The results from these studies are however fairly contradictory. While Bruce (2002) concludes that higher self-employment tax rates do not significantly affect the incidence of entrepreneurship, Gurley-Calvez and Bruce (2008) find that cutting marginal tax rates faced by entrepreneurs can potentially lengthen their entrepreneurial spells.

Having discussed the literature on the role played by Micro and Macro factors separately, it might be interesting to consider the interactions among the two. However, such studies are rare to find in the existing literature. Audretsch (1995) points out that the specific industry that any startup belongs to (and the industry structure therein) plays an intermediating role on the influence of macro factors on the startups. Since, the impact of macroeconomic develop-ments varies from industry to industry, the role of played by this inte-rmediating variable becomes particularly important. Since, so far the number of new-firm start-ups have not been measured systematically at an industry level, but mostly at the macro-level (Audretsch, 1995) this influence is difficult to capture.

The literature discussed so far provides a detailed overview of the macro ecosystem parameters that influence high technology start-ups. However, it must be noted that most of it is based on the start-up phenomenon in the more developed economies. There are a few studies pertaining to the emerging economies as well. De Soto (2000) and Djankov and McLiesh (2005) show that starting and running a business is extremely difficult in emerging economies. Taking this argument further, Djankov and McLiesh (2005) argue that a reform of the business environment could have a positive impact on the growth of some of the poorest countries. It is with this background, that we explore the growth of entrepreneurship, and within it the contributions of high technology start-ups in India.

As indicated earlier, the ecosystem for start-ups in India has been getting stronger by the day (Bala Subrahmanya, 2014). Policy makers too have taken cognizance of this and recommended several policy measures to strengthen the same (Ministry of MSMEs, 2013). However, there has not been any systematic empirical analysis so far that analyzes the influence of these ecosystem related parameters on the overall start-up environment. Such an analysis is clearly warranted as given the limited resources available, it is important to prioritize and direct them towards augmenting the infrastructure that matters the most for the start-up ecosystem.

Another phenomenon worth noting in this regard is that, world over the evolution of start-ups across any economy is not uniform. Rather start-ups tend to evolve as clusters e.g. the Silicon Valley and Route 128 in the United States and the Cambridge Region in the United Kingdom. In India, too start-ups have followed the same trend and have essentially evolved as geographic clusters – with certain regions clearly dominating over others. We feel it is important to study this phenomenon and identify the factors that drive certain cities to emerge as front-runners as far as the start-up evolution is concerned.

Thus, the main objective of this paper is to study the key ecosystem parameters that have been responsible for the emergence and growth of high technology start-up clusters in India. Based on the literature review and with the motivation to obtain a deeper insight on the above phenomenon, a conceptual framework is presented and discussed in the next section.

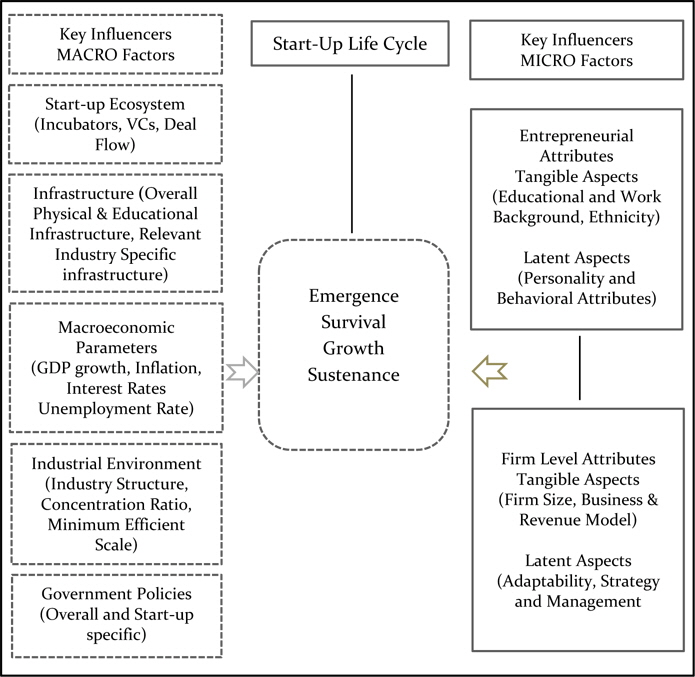

Figure 1 illustrates the conceptual framework that has been derived based on the literature review

The evolution of high-tech start-ups is believed to be influenced by a set of micro and macro factors. Micro factors primarily constitute the entrepreneurial and firm level attributes. Each of these can be further broken down into tangible and latent aspects. While tangible aspects refer to the characteristics that are directly observable and measurable (such as entrepreneurial background, firm size and so on), latent aspects are the more covert factors such as the entrepreneur’s personality and behavioral attributes and the firm’s adaptability in particular.

The macro factors on the other hand can be further divided into five broad sub-categories. Those related to the regional start-up ecosystem factors in particular (VC firms, business incubators/accelerators and other entities that enhance the deal-flow), macro-economic indicators (GDP, interest rates, inflation, unemployment, etc.) and availability of infrastructure (the overall physical, financial, educational infrastructure and also the relevant infrastructural set-up required for the high technology start-ups per se), the characteristics of the industrial environment (industry structure, concentration ratio, minimum efficient scale and profit rate) and lastly government policies (overall and start-up specific).

The scope of this study is to understand the influence of macro factors in the emergence and growth of modern technology start-ups in India. In particular, we probe the underlying reasons that cause certain geographies to emerge as vibrant start-up hubs as compared to the others. Specifically, we analyze in detail the role played by factors such as infrastructure, overall macro-economy, government policies and the start-up ecosystem in the emergence of six major start-up clusters in India. It must be noted here that we do not specifically analyze the role played by the Industrial Environment related factors in this study. The reason for this is - the data used for this study was aggregated at the level of each geography and not further broken down by industry within that geography.

Based on the framework proposed above and given the scope of this study, the following hypotheses have been proposed:

H1 Ceteris Paribus better start-up ecosystem parameters positively impact the emergence of start-ups.

H2 Ceteris Paribus better quality of physical and educational infrastructure positively impacts the emergence of start-ups.

H3 Ceteris Paribus better quality of relevant industry-specific infrastructure positively impacts the emergence of start-ups.

H4 Ceteris Paribus health of the overall macro-economy positively impacts the emergence of start-ups.

This section describes the research design and method of analysis adopted for the purpose of this study. A description of the data, the sample, description of variables and their definitions, modes of data collection is presented below.

1. Sample, Data and Method of Analysis

As mentioned earlier, the primary objective of our study is to analyze the most important start-up hubs in India and understand the role played by various macro factors in their emergence.

This study is based on secondary data collected from various official sources. It covers the early stage start-ups from six major Indian start-up hubs (Bangalore, Chennai, Hyderabad, Kolkata, Mumbai/Pune and New Capital Region (NCR) area) between 2005 and 2013. Due to the geographical proximity of Mumbai and Pune, they are being considered together as a hub. Similarly, due to the geographical proximity of New Delhi, Gurgaon, Noida and Ghaziabad they have been considered together in the NCR hub. We chose the above cities since about 93% of the early-stage start-ups during the period of study emerged from these start-up hubs (Venture Intelligence, 2013).

About 65% of the start-ups in our sample fall directly under the high technology domain – Information Technology (IT) and IT enabled (ITeS) sectors. Even when they belong to other sectors, IT is understood to be the major enabler. Thus, we believe that our sample provides an appropriate representation of the high technology start-ups.

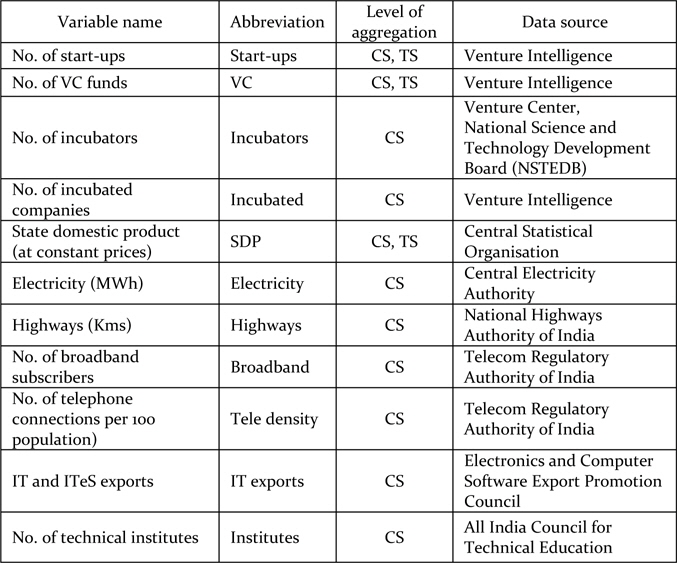

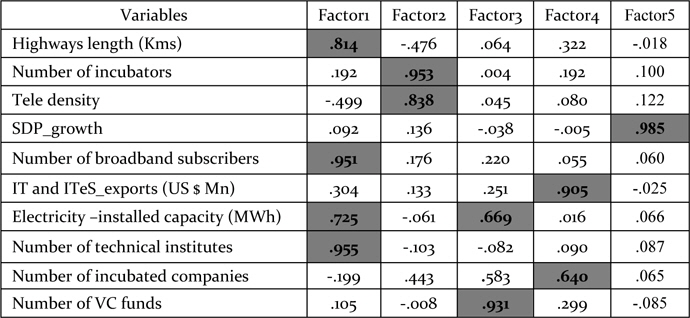

The analysis dataset for this study comprises a panel of six start-up hubs in India such that cross-sectional and time-series information (with annual frequency) on each of them is available from 2005 to 2013. This data has been compiled from several official sources as mentioned in Table 1.

[Table 1] Variable definitions and data sources

Variable definitions and data sources

As seen in Table 1, data on certain series were available at both time-series and cross-sectional levels, while those for others were available at cross-section level alone. For the latter set of variables, we have imputed the cross-section level values across all the time periods. Similarly, data on most of the series were available at the state level and not city level. The state level data have hence been imputed at the city level (based on the state that the particular city belongs to).

Dependent variable: Since the primary objective of this study is to explore the ecosystem related factors that contribute to the emergence of geographical start-up clusters – the dependent variable is the number of start-ups (varying across geography and year).

Independent variables: The independent variables can be classified into the following broad categories: those directly related to the start-up ecosystem in particular, those associated with the available infrastructure in a particular geography and finally those that are a proxy for the overall health of the macro - economy in that geography.

Prima facie, we expect most of the independent variables (described in Table 1 above) to be mutually correlated. This can potentially result in severe multi-collinearity problems if the variables are used together in the same regression model. Hence we decided to first perform factor analysis with the aim of grouping them into meaningful factors/constructs. Since, the factors / constructs thus obtained using the Principal Components procedure are mutually orthogonal to each other, the multi-collinearity problem is done away with. We then use the factor scores for these constructs (along with the other control variables) to build OLS regression models that predict the potential drivers responsible for the emergence of the start-up clusters. The analysis was performed using SPSS 21.0.0.0 software. For Factor analysis, we report the Factor Loading Matrix. For OLS regression, we report the t-values, adjusted R2, F-Statistic and the Variance Inflation Factor.

Ⅴ. Start-ups in India: A Backdrop

At the outset, we would like to present a brief overview of the start-ups in India. Although, India has had a rich entrepreneurial culture, the emergence of high-technology start-ups is viewed to be a fairly recent phenomenon. These new age firms are essentially the product of technology/knowledge based entrepreneurship (Bala Subrahmanya, 2014). They seem to have emerged in India only after the initiation of economic liberalization in 1990/91. The information and communication technology (ICT) revolution coupled with globalization have been the major driving forces in this regard (Bala Subrahmanya, 2014).

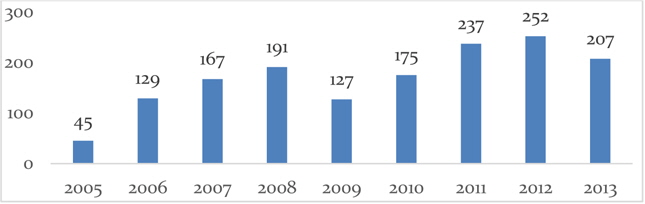

Today, India has been recognized, as one of the potential sources of high-tech start-ups in the global economy (Start-up Genome, 2012). There are about 4000 start-ups operating in India today (Microsoft Accelerator, 2012). VC has been seen to be one of the key enablers for the new economy start-ups. However, policies pertaining to VC were streamlined only as late as 2002, when SEBI was made the central regulatory authority of all VC firms operating in India (Desai, 2003). Thus any analysis pertinent to the modern start-up ecosystem in India can be made only after 2002. Accordingly in this section, we have used data from the year 2005 onwards. As can be seen in Figure 2, the number of start-ups operating in India has steadily increased since 2005.

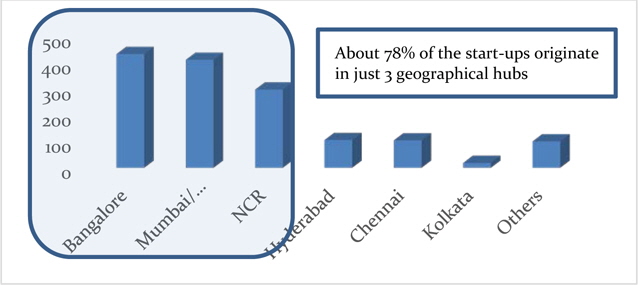

Moving on to the geographical spread of start-ups, about 78% of the start-ups in India originated from just three geographical hubs – Bangalore, Mumbai/Pune and NCR area (see Figure 3). Bangalore alone accounts for 30% of all early-stage start-ups. In fact, Bangalore is regarded as the Silicon Valley of India and considered to have one of the best ecosystems for start-ups in the world (Start-up Genome, 2012). It is also considered one of the nine “International Start-up Hubs” outside the USA (Pullen, 2013).

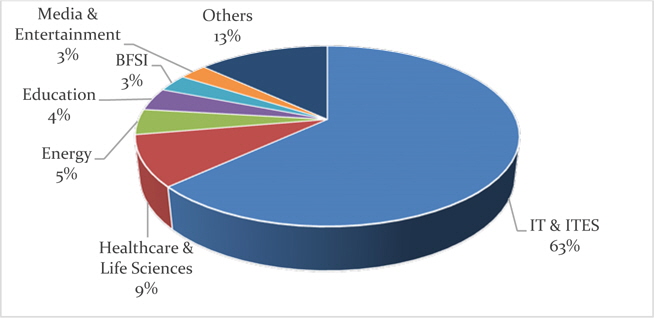

As seen in Figure 4 below, about 63% of the start-ups belong to IT and ITeS sectors followed by those in health care and life sciences, energy, media and entertainment, BFSI and other domains (see Figure 4). Among the IT and ITeS sectors an overwhelming proportion of start-ups belong to online services, mobile value added services, enterprise software and products, other BPO and related IT services. Even for those start-ups belonging to the other sectors, IT is seen to be the major enabler.

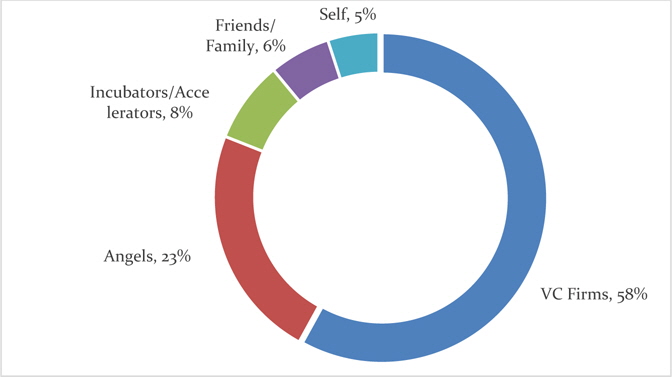

Among the funding sources of start-ups in India (Figure 5); VC funds, angel investors and incubators/accelerators make up for about 90% of the total funding. There are about 364 SEBI-registered VC funds operating in India (SEBI, 2014). If we add to this the non-SEBI registered ones, the number is as high as 480 (Venture Intelligence, 2013). About 180 business incubators have been set-up within academic set ups alone. Several angel networks are actively operating out of the major start-up hubs in India today.

It is with this background of the Indian start-up scenario, that we present our analysis and discuss the results pertaining to the macro factors that have contributed to the development of geographical start-up clusters.

Ⅵ. Factors Influencing Start-up Hubs: Discussion of Results

This section is divided into three sub-sections. The first section discusses the preliminary data analysis viz. descriptive statistics (by geographic clusters) and bi-variate correlations from the data. The second section discusses the results from Multivariate Factor analysis. The last section discusses the results from the regression models.

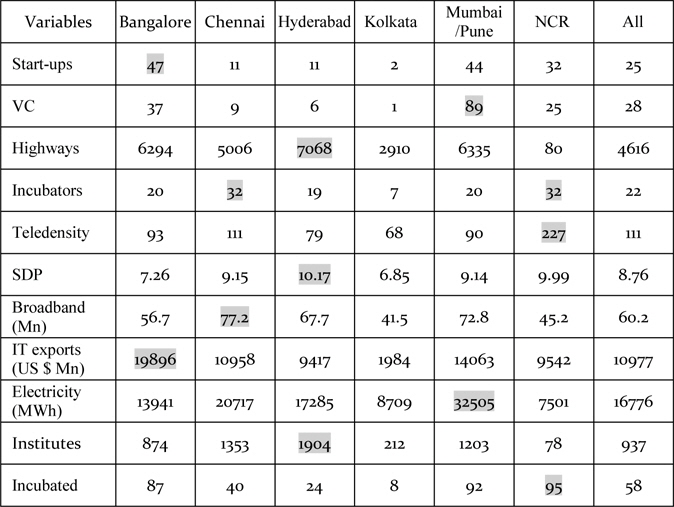

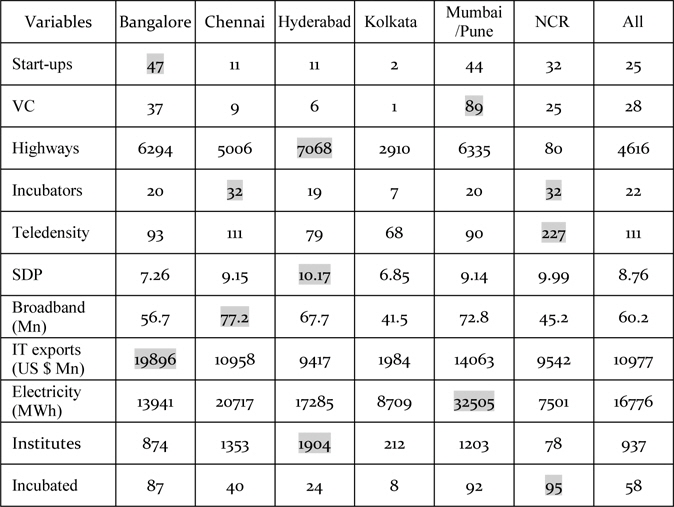

Table 2 presents the mean values (by geography) for the dependent and all independent variables. It can be seen that, on an average, Bangalore has the highest number of early-stage start-ups as compared to the other start-up hubs. Among infrastructure related variables, Andhra Pradesh (AP) ranks highest in terms of the length of highways while Maharashtra ranks highest in terms of the installed electricity capacity. Educational infrastructure is the best in AP (as measured by the number of technical institutes) and so is the SDP growth. Tamil Nadu (TN) and NCR both rank the highest in terms of the number of business accelerators and incubators however NCR alone ranks highest in terms of the number of incubated companies. TN ranks highest in terms of the number of broadband subscribers, NCR ranks highest in terms of the overall Tele density. This could be potentially because the NCR is predominantly urban in nature resulting in a high telephone penetration (as measured by teledensity). Karnataka ranks highest in terms of its value of IT and ITeS exports.

[Table 2] Descriptive statistics by geography - mean values

Descriptive statistics by geography - mean values

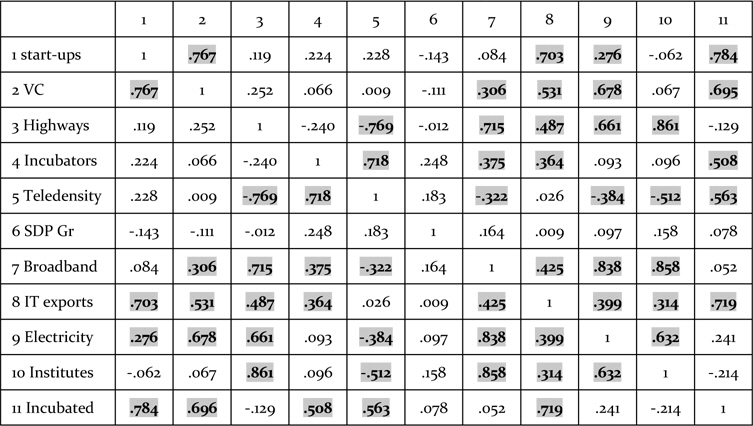

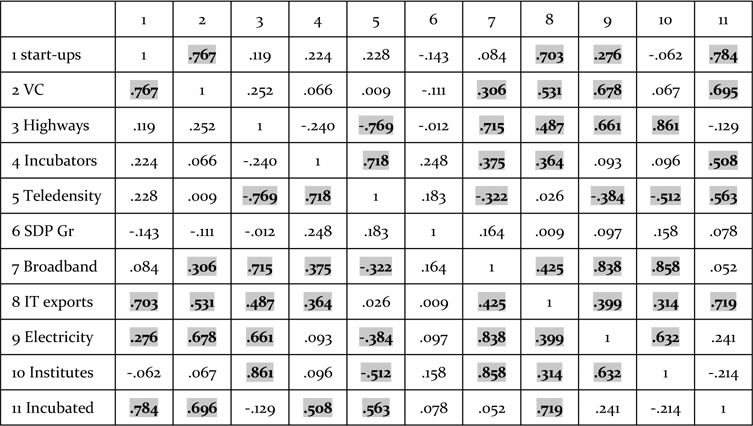

Table 3 presents the bivariate correlations among all the variables. A preliminary analysis of correlations showed that most of the independent variables were significantly mutually correlated. Thus as discussed earlier, we would have encountered severe multi-collinearity problems if the variables were used together in the same regression model. To circumvent this problem and also to arrive at a more meaningful definition and quantification of constructs, we decided to first perform Multivariate Factor Analysis and then use the factor scores thus obtained as independent variables in the regression models.

[Table 3] Pearson bi-variate correlations (All variables)

Pearson bi-variate correlations (All variables)

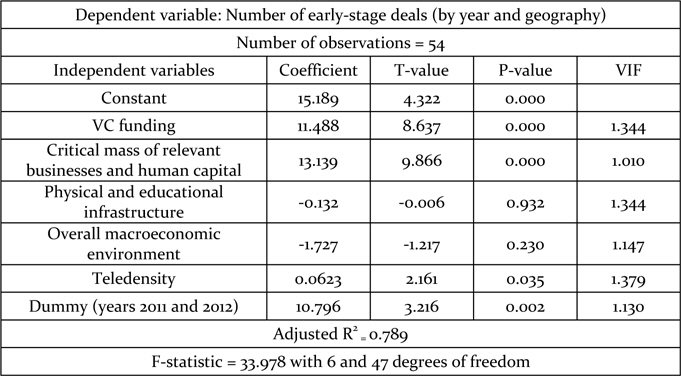

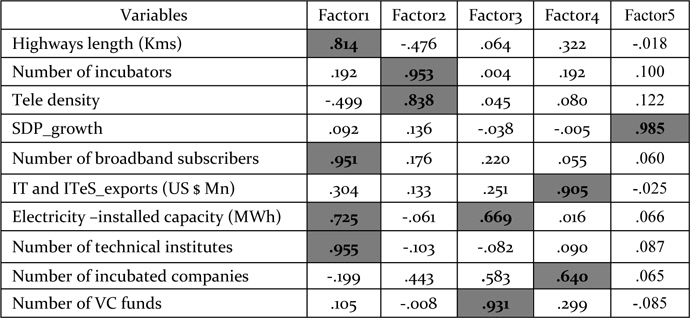

We performed multivariate factor analysis using the principal components algorithm. The factor analysis solution yielded 5 factors that explained 98% of the total variation in data. We decided on the number of factors to be considered based on both technical metrics (Scree plots and Eigen values) and intuitive logic. The matrix of factor loadings is presented in Table 4. Each of the constructs has been discussed in detail.

[Table 4] Matrix of factor loadings

Matrix of factor loadings

The first construct (Factor 1) is called physical and educational infrastructure – it comprises variables such as total electrical installed capacity, total highway length, number of educational technical institutes and also the number of broadband subscribers. It measures the quantum of ‘infrastructural endow-ment’ in a particular geography.

The second construct (Factor 2) is called desired infrastructure for high technology ventures – it has variables such as the teledensity and the number of incubators. Teledensity captures the intensity of internet penetration (telephones per 100 of population) while incubators are necessary for providing seed-stage funding and consulting services to the nascent ventures. We believe the above variables to be extremely important for early-stage ventures particularly for those in the high technology domains.

The third construct (Factor 3) is called VC Funding which we consider to be an essential attribute for a robust start-up ecosystem. This construct is measured by the number of active VC funds in a particular geography. VC has been identified as one of the most important source of funding for start-ups particularly in the Technology domains. It must be noted here that the variable total electrical installed capacity is loaded on Factor 3 with a factor loading of 0.669. However, we still prefer to call this factor VC funding as the variable on the number of VC funds has a much higher loading of 0.931.

The fourth construct (Factor 4) is called the critical mass of relevant businesses and human capital. This is proxied by 2 variables viz. the quantum of IT and ITeS exports emerging from a particular geography and the number of incubated companies in that geography. It must be understood that certain geographies have not emerged to be top exporters of high-technology products/services over night. It has been a gradual process resulting from the cumulative accumulation of critical mass of relevant businesses and human capital skills in the high-technology domains over a period of time. It must be added that, supportive government policies too have played an important role in the emergence of certain cities as important IT hubs. We believe that the net result of all the above factors is reflected in the outcome variable viz. IT and ITeS exports. The second variable in this construct viz. the number of incubated companies constitutes the major source of deal flow for the early-stage VCs. A critical mass of incubated companies may thus be regarded as a pre-condition for a flourishing start-up scenario as most successful start-ups are expected to be incubated at some point of time in the past. Thus, the two variables viz. IT and ITeS exports and the number of incubated companies represent a pre-existing critical mass of relevant businesses and human capital skillsets.

The fifth construct (Factor 5) is overall macroeconomic environment which is measured by the growth of SDP in that particular geography.

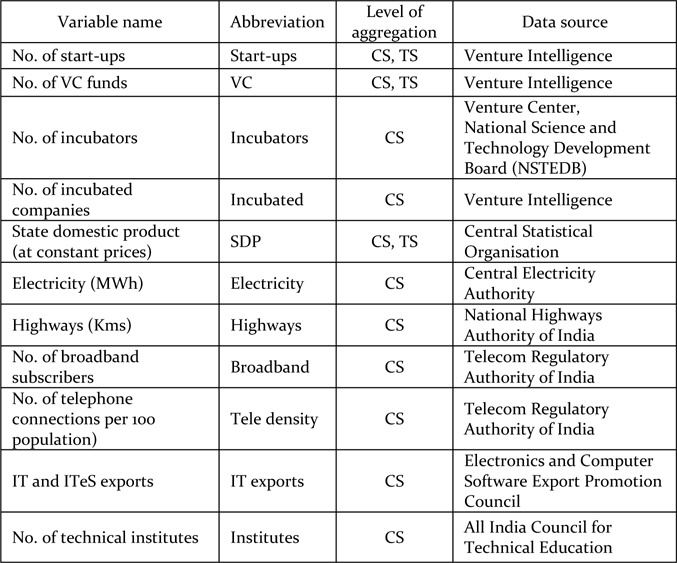

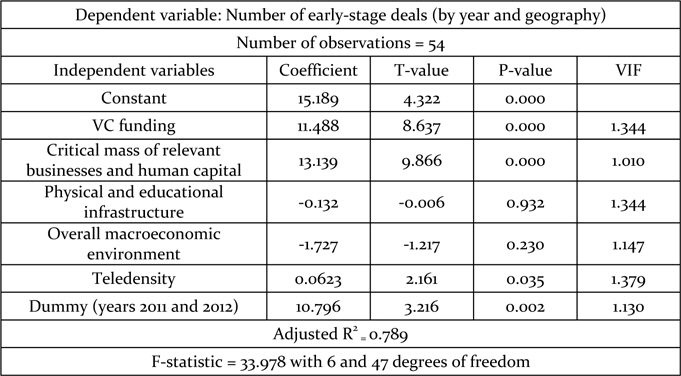

With these identified factors, we carried out regression analysis. The purpose of building regression models was to identify the set of attributes that have been instrumental in the emergence of start-up clusters in India. In addition to the factor scores we used another control variable. Figure 1 shows that there has been a spurt in the number of early-stage start-ups during the years 2011and 2012. We decided to probe this and hence created an indicator variable to capture this effect. Based on the above variables, we built a series of OLS models. The results from the best model have been consolidated in Table 5.

[Table 5] OLS regression results

OLS regression results

The dependent variable used in this regression is the number of early-stage deals by year and geography; while the independent variables are factor scores on the constructs (described in the previous section) along with a few other control variables.

The regression results enable us to identify the key factors responsible for the emergence of geographical start-up clusters in India. VC funding is one of the main drivers in the emergence of start-ups. A strong presence of VC funds in a particular geography leads to better prospects of it emerging as a start-up cluster. Another critical factor that seems to have a major influence is the pre-existence of a critical mass of relevant businesses and human capital. A relatively high proportion of start-ups belong to the high-technology domains, wherein the quality of human capital is the most critical parameter. Presence of a critical mass of high-technology businesses (including the pre-incubated companies) implies that the requisite capital and skills sets that are a pre-condition for the emergence of high-technology start-ups are available in abundance.

Coming to Infrastructure related variables – we classify them into 2 sub-groups – the traditional physical infrastructure and the modern infrastructure (in terms of the internet penetration). We found that traditional infrastructure related variables (roads, electricity and technical educational institutions) were not at all significant in driving the growth of new age start-ups. This is not to belittle the role played by traditional infrastructure, but rather that it is a minimum requirement that any city vying to become a start-up hub needs to possess. However, for a start-up hub to become truly vibrant something more relevant is called for.

Rather, what seemed to matter more in terms of differentiating the most vibrant start-up clusters from others is the quality of infrastructure directly relevant to the new age businesses (as measured by teledensity). The most potent reason for this result could be that about 65% of the modern start-ups belong to IT and ITeS domains. Even where they belong to other domains, Internet is a major enabler. Thus Internet and Telecommunications can be regarded as the backbone of such new age businesses.

Another point worth noting in this regard is that the construct on traditional infrastructure includes the educational infrastructure as well – in terms of the number of technical educational institutes present in a particular geography. However, it appears that merely having a higher number of technical institutes (resulting in higher technical manpower) does not seem to influence the start-up ecosystem much. The possible reason for the same could be that high-tech manpower is fairly mobile between cities within India. The specific geographical location of some of these technical institutes would however matter if they have vibrant business incubator set-ups therein. Thus, some of the premier technical institutes in India (IIT, Bombay; IIM, Bangalore; IISc, Bangalore; IIT, Delhi, etc.) seem to be co-located in some of the prominent start-up hubs.

We used the variable on SDP growth as a proxy for the overall macro-economic environment. Again it is interesting to note that this did not seem to influence the emergence of start-ups significantly. In fact, in our sample, the geographies with relatively higher SDP growth rates did not seem to have the most vibrant start-up ecosystems. Again, this is not to decry the role of macro factors but rather goes on to justify the fact that a strong macro economy is a minimum must-have. In fact almost all the cities in our sample (except Kolkata) had SDP growth rates above the national average for India.

The indicator variable for years 2011 and 2012 has a positive sign. These years are particularly interesting from the point of view of start-up/VC ecosystem study. Although the foreign inflow of VC and consequently the volume of growth/late stage deals significantly declined during this period, there was a spurt in the growth of VC funded early-stage start-ups (Bain Consulting, 2012 and 2013). The reasons for the above are two-fold. During these years many large sectors (within India) such as infrastructure, energy and telecom suffered owing to inadequate political momentum and regulatory bottlenecks (Bain Consulting, 2013). Simultaneously, the world economy also underwent a severe downturn – consequently drying up aggregate flow of VC funds which serves as the primary source of capital for later stage investments. However this period also coincides with the boom for the E-commerce industry as the number of VC funded early-stage E-commerce deals nearly doubled during this period as compared to the earlier years. To summarize, we can state that although the average value of VC funded deals went down, the sheer volume of deals still went up. This explains the positive sign on the indicator variable for 2011-12.

Thus, based on the regression results just discussed, it can be said that out of the hypotheses proposed in section 3, H1 and H3 can be validated whereas H2 and H4 could not be supported.

Ⅶ. Summary and Policy Implications

In this paper, an attempt has been made to empirically establish the role played by the ecosystem related components in the emergence of high technology start-up clusters in India. For this, we analyze six main geographic start-up clusters viz. Bangalore, NCR, Mumbai/Pune, Kolkata, Chennai and Hyderabad. Among these, the first three clusters are seen to be the most vibrant ones accounting for about 80% of the total early-stage deals in India.

Our study throws up several interesting findings that enable us to empirically justify some of the recent initiatives proposed by the government of India in the context of promoting technology start-ups. To start with, our results indicate that traditional physical infrastructure related factors are not quite important in the development of geographical clusters. Rather what seems to matter in this regard are the specific start-up ecosystem related factors – such as the volume of deal flow (arising from the previously incubated companies), availability of VC funding and also the presence of a pre-existing critical mass of relevant high technology businesses and skillsets. Interestingly, the presence of educational infrastructure (high number of technical institutes) did not seem to matter much but the extent of internet penetration certainly did. Lastly, a high rate of economic growth (as measured by SDP) too was not significant in the emergence of a robust start-up ecosystem.

Based on this study we can draw several important policy implications. First of all, the policy makers need to focus on augmenting the deal volume arising from the pre-incubated companies. Setting up of more incubators and accelerators within the existing university and corporate setups with the view of either commercializing the academic research or identifying strategically important start-ups can be an important step in this direction. Allowing companies to invest in technology incubators (of academic institutions approved by the Central Government) as a part of their Corporate Social Responsibility (CSR) initiatives under the Companies Act, 2013 is certainly another important step in this regard. The recent policy recommendations of the Inter-Ministerial Committee for MSMEs (Ministry of MSMEs, 2013) further support this argument.

While these trends are certainly quite encouraging, it must be pointed out here that merely setting up more incubators will not address the problem. For them to really augment the deal volume, they need to be functional. While there are about 180 incubators operating in India today, a very few of them is really functional in the true sense (Maital et al., 2008). In fact most incubators within the academic set-ups focus on providing merely physical infrastructure (Maital et al., 2008). Unless they can provide other critical services such as mentoring, access to financial institutions, investors and other vital networks or key stakeholders, they will not be very effective in augmenting the flow of viable deals in the start-up ecosystem (Ministry of MSMEs, 2013). Another point worth noting in this regard is that so far India has focused on the incubation of ideas alone. Technology Business Incubators (TBIs), that provide a technical entrepreneur access to required machines and equipment to test and manufacture products on a pilot scale, are almost missing from the Indian scene. Such TBIs have played a major role in the start-up ecosystem in Israel and the US (Ministry of MSMEs, 2013).

Further, our findings show that VC finance is one of the critical sources of funding for early-stage companies. The policy makers seem to have realized the importance of the same as can be seen from the announcement of the SIDBI India Opportunities Venture Fund and India Inclusive Innovation Fund (together amounting to INR 10,000 crore) and an additional fund of INR 10,000 crore for funding early-stage start-ups (Ministry of MSMEs, 2013; Union Budget, Ministry of Finance, 2014). While it is quite heartening to know that the current policy initiatives are very much in tandem with what empirical results would suggest, these efforts are clearly not sufficient. Some of the key problems faced by the Indian VC industry have been highlighted time and again by the various industry reports (Bain Consulting 2011, 2012, 2013). E.g. while the equity investments in listed companies are exempt from long term capital gains tax, this provision does not apply to unlisted companies. Since the early-stage VC investments are primarily made in unlisted companies, this is a major cause for concern. On the exit front, there are severe bottlenecks. India does not have too many stock exchanges that permit the listing of start-ups. Only recently, SME platforms have been introduced on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). However, these are yet to gain traction. Since, exit is the only way for VCs to get their Return on Investment, exit related logjams can severely hamper VC investments in the future.

Another cause of concern regarding private sector VCs is that they have migrated “upstream” and now focus on funding the scale-up stages of the new businesses rather than providing seed capital to the nascent ones (Grail Research, 2012). Thus, in the true sense, they do not address the financial needs of these early stage ventures. This void needs to be met by the public financial institutions on the lines of Small Business Investment Companies in the US (Ministry of MSMEs, 2013). So far, the government supported VC funds in India have not been very successful in garnering large funds. One of the key reasons for this could be that currently pension funds, insurance companies and provident funds are not allowed to contribute to the VC fund corpus. Unless these problems are addressed head-on, they can potentially prove to be major deterrents to the emergence of a robust VC – start-up ecosystem.

Above all, our study points out that a high economic growth alone will not be sufficient in establishing a vibrant start-up ecosystem. In fact, our data show that cities with the most vibrant ecosystems do not necessarily have the highest growth rates. Moreover, there seems to be a strong network effect at play here whereby the geographic location of start-ups will tend to naturally gravitate towards cities with a pre-established critical mass of high technology businesses. Thus, a critical mass of bigger businesses and start-ups would in turn tend to mutually reinforce each other. Disrupting this chain with the intention of creating completely new start-up hubs is going to be clearly difficult. Thus it appears that, rather than directing resources to creating completely new start-up clusters, it might be more realistic (at least during the short-term) for the policy makers to focus on specific factors pertaining to the start-up ecosystem that are directly under their control.

Thus, this study has made two significant contributions to the body of existing academic literature. To start with, we develop a framework that explains the influence of the principal micro and macro parameters on the high technology start-up lifecycle in an emerging economy context. We further analyze the possible ecosystem related macro parameters responsible for the emergence of geographic start-up clusters in India. We go one step further and empirically establish the role played by specific macro components in this regard.

Ⅷ. Limitations of the Study and Scope for Future Research

This study has focused on primarily examining the impact of macro factors on the high-tech start-up ecosystem. A parallel study that focuses on the impact of micro factors will complete the understanding of the phenomenon in entirety and extend the knowledge in this area. There is further scope to enhance the macro analysis as well by adding an additional level of granularity in the form of industry level data. This is particularly important given the fact that industry type and structure are known to be key mediators between macro level factors and startup ecosystem parameters. Another interesting area of research would be to analyze the impact of the interaction between the macro and micro factors. Usually, any macro level policy change will tend to impact the micro level parameters over time. How these transitions pan out and impact the start-up ecosystem would be a potential area of further research.