According to the OECD/NEA estimates, nuclear power plants (NPPs), whether with a large reactor or with small modular reactors (SMRs), are competitive with many other electricity generation technologies in a significant number of cases, one of the exceptions being natural gas in the USA with the current level of prices. However, SMRs have particular features and requirements setting conditions for their deployment. This paper presents the preliminary analysis by OECD/NEA of the economics, opportunities, and market for small nuclear reactors.

According to the OECD/NEA estimates1,2, nuclear power plants (NPPs) whether with a large reactor or with small modular reactors (SMRs), with electric output of less than 300 MWe, using light-water technology, are competitive with many other electricity generation technologies in the large majority of cases, the exceptions being natural gas in the USA with the current level of prices, and large hydro.

However, SMRs, including multi-module plants, may have higher values of levelised cost of electricity (LCOE) than NPPs with large reactors. The LCOE for an SMR should decrease with large scale serial production, which is the key element for proving the competitiveness of SMRs. However, large initial orders of SMRs are needed to launch the serial production process and it is important to know who could be the first customers, and how many SMR designs will really be deployed in the near future.

As with large reactors, the market for SMRs is difficult to estimate. However, using the commonly accepted assumption that SMRs could be competitive with many non-nuclear technologies for generating electricity, in the cases when NPPs with large reactors are, for whatever reason, unable to compete, one can try to identify the key market opportunities.

For remote areas, only Russia is currently pursuing the deployment of a floating NPP in the Arctic region. For traditional, on-grid deployment, there are many opportunities currently analysed by the vendors of SMRs, in both industrial and developing economies. In particular, countries initiating a nuclear programme might be interested in starting with an SMR instead of the previously traditional first-step of a research reactor. Korea has developed and licensed SMART - a 90 MWe SMR. In the United States there are a number of SMR projects in advanced stages of development. In January 2012, the US Department of Energy (DOE) issued a USD 452 million funding opportunity announcement to provide support to the US SMR technology development and design certification. The B&W mPower 180 MWe SMR was the first to win the DOE grant.

Some OECD/NEA member countries, and in particular the United States, perceive the development of SMRs as an opportunity to reindustrialise the domestic nuclear sector and increase exports. This paper presents the preliminary analysis by OECD/NEA of the economics, opportunities, and market for small nuclear reactors.

Generally speaking, the SMRs target two general classes of applications.

The first class is niche applications in remote or isolated areas where large generating capacities are not needed, the electrical grids are poorly developed or absent, and where the non-electrical products (heat or desalinated water) are as important as the electricity, e.g. the Arctic regions in Canada, Russia, and the United States.

The second is traditional on-grid deployment and direct competition for electricity production with large NPP and other sources of power. The typical power of SMR units perfectly fits the existing grids and infrastructure, making them a viable option for replacement of traditional fossilfueled energy sources. Besides, the relatively small upfront capital investment for one unit of an SMR provides more flexibility in staging capacity increases, offering the opportunity of financial risk reduction.

2.2 Differences between SMRs and Large Reactors

Direct competition with alternative power sources is probably the largest market for SMRs. It is important to identify and understand the fundamental differences between NPPs with SMRs and large reactors.

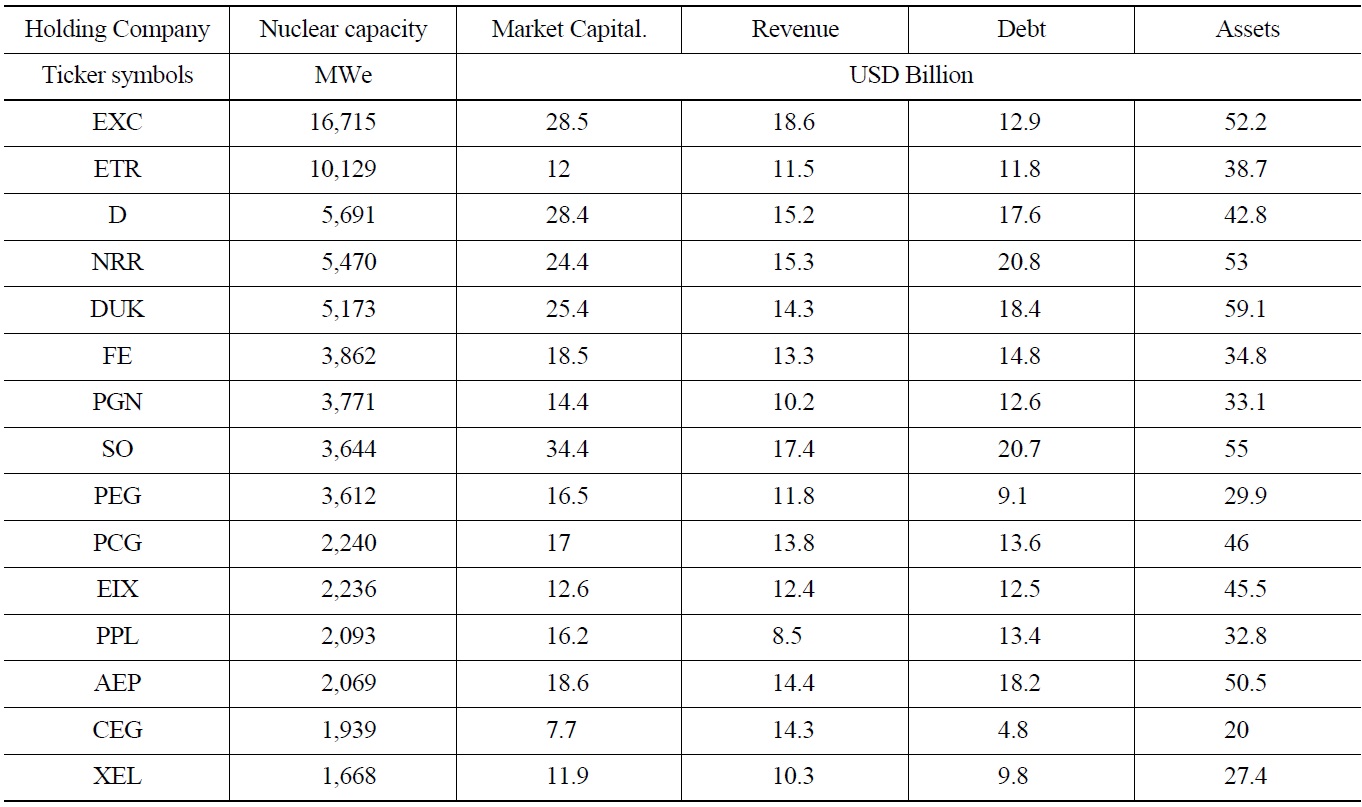

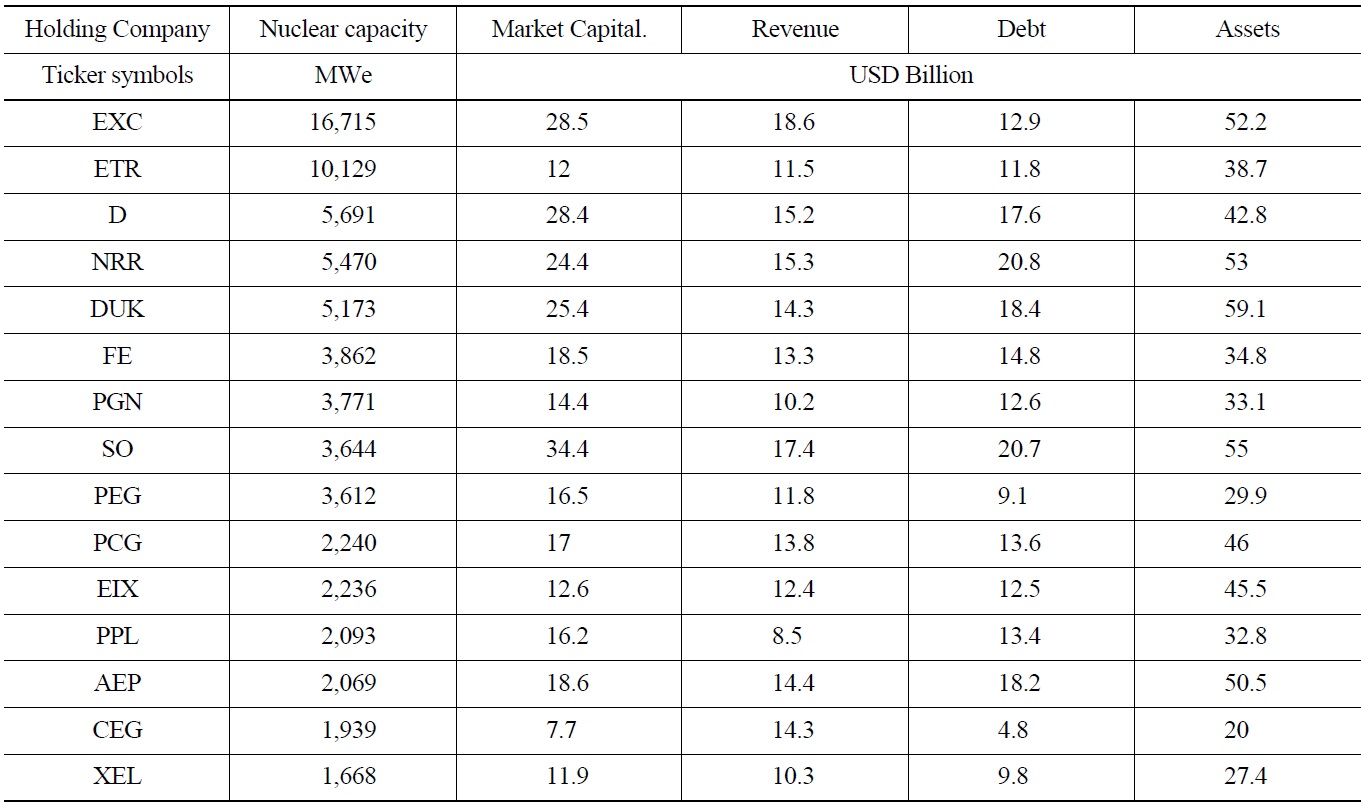

In large reactors, the economy of scale is one of the key elements for decreasing the specific investment cost leading to higher electricity output and higher NPP costs (of the order of magnitude of USD 5-10 billion per unit). On the other hand, most of the SMRs aim to compete with traditional sources of power using the economy of serial production of small units. Also, the absolute cost of one SMR unit (which could be below USD 1 billion) is significantly smaller than the cost of modern large reactors (about USD 5-10 billion). The latter figure is comparable to the annual revenue (from all sources of electricity production) of most US nuclear utilities (see Table 1).

[Table 1.] Financial Profile of Some US Nuclear Utilities in 20103

Financial Profile of Some US Nuclear Utilities in 20103

For a typical utility it is easier to finance an SMRbased modular project with incremental deployment than one large reactor. In general, modular construction implies that tasks which used to be performed in sequence are done in parallel with factory-built modules. This approach is already implemented for the construction of some modern large reactors (e.g. AP1000), but in the case of SMR the module is the

The SMRs are believed to have a potential for cogeneration (e.g. water desalination, heat production) since the power output of SMRs well suits existing heat and water distribution networks. In this case the redundancy of multiple modules enhances the reliability of continuous supply in the case of industrial usage of co-generated products.

Finally, the modularity may offer additional simplicity for decommissioning if the modules can be replaced and disassembled/decommissioned in the factory conditions.

2.3 Estimates of the Electricity Generation Cost with SMRs

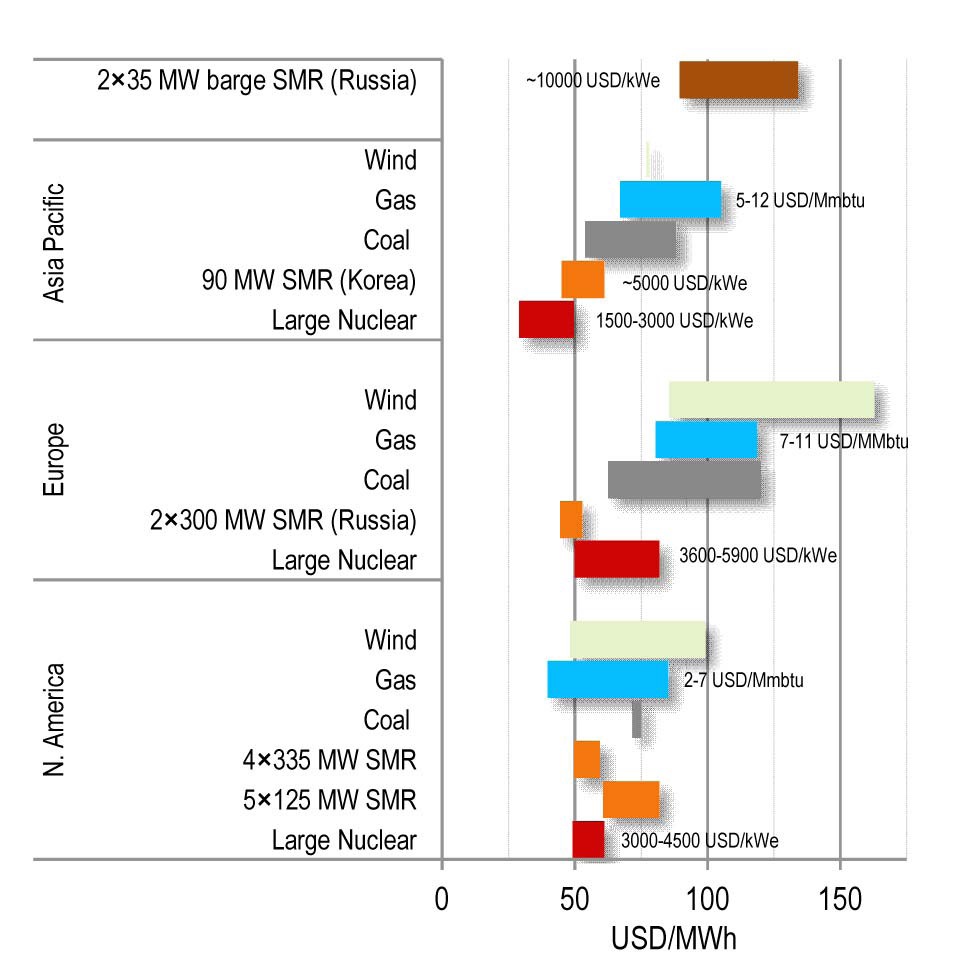

In regulated electricity markets with loan guarantees and with more or less strictly regulated prices, the key economic parameter is Levelized Cost of Electricity (LCOE). The estimates of the LCOE, obtained using the top-down scaling law methodology (described in detail in reference 1), for generic PWR SMRs and some alternative sources, for different regions, and for 5% discount rate, are provided in Fig. 1. The largest component of the LCOE for nuclear power plants is the investment cost. Below, we discuss various factors influencing the SMRs’ capital cost.

One of the main factors negatively affecting the capital cost of the SMRs is the lack of economy of scale. As a result, the specific (per MWe) capital costs of the SMR are expected to be tens to hundreds of percent higher than for large reactors. Some of the other SMR features are advocated by the designers as improving their economic competitiveness and estimates for these reductions are discussed below. These do not all apply to all SMRs, and thus cannot simply be added.

The construction duration of the SMRs could, in principle, be significantly shorter than for large reactors, especially in the case of factory-assembled reactors. This would result in important economies in the costs of financing, which are particularly significant if the discount rate is high.

Some small reactors could be fully factory-assembled, and then transported to the deployment site. Factory fabrication is also subject to learning effects which could reduce the SMR capital costs. The magnitude of this reduction is considered to be comparable or even higher to that of the effects for series build of plants constructed on site.

In particular, full factory fabrication is possible for a bargemounted plant (e.g. floating NPP with KLT-40S) According to the designers’ estimates a full factory-fabricated, bargemounted NPP could be 20% less expensive than a landbased NPP with an SMR of the same type. Further decrease of SMR capital cost can be achieved due to learning effects of factory fabrication. However, to fully utilize this effect, series of at least 5 ? 7 units are needed.

In some advanced SMRs, significant design simplifications could be achieved through broader incorporation of size-specific inherent safety features that would not be possible for large reactors. The designers estimate that these simplifications could reduce specific capital costs for near-term PWR SMRs by at least 15%.

Even if all of the above mentioned factors are taken into account where they are applicable, the investment component of the levelised cost for a SMR still appears to be higher than in the case of large reactors.

The sum of the cost for operation and maintenance (O&M) and fuel cycle components of the LCOE for advanced SMRs is expected to be close to the corresponding value for a large reactor (of similar technology). Lower O&M costs are expected for SMRs but, in contrast, the fuel costs could be higher in the case of a SMR than for large reactors (in particular, because of lower fuel utilisation).

According to the data available today, SMRs are projected to have higher values of LCOE than NPPs with large reactors. However, the cost of electricity generation with SMRs might decrease for large scale serial production, which is very important for proving the competitiveness of SMRs. A large initial order of SMRs would be needed to launch the process and improve the economic competitiveness. On the other hand, to obtain a large order, one would already need to demonstrate the economic attractiveness of the SMR technology.

3. CHALLENGES OF SMR DEPLOYMENT

Regulatory issues and delays regarding SMR licensing may occur due to their innovative nature, in particular their strong reliance on passive safety systems, and modularity4. Some SMRs advertised by the vendors incorporate novel technical features and components targeting reduced design, operation, and maintenance complexity which will need to be justified by the designers and accepted by the regulators.

There are currently only two licensed SMR designs: the Russian floating power plant using ice-breaker-type reactors KLT-40S and the Korean SMART reactor (integraltype PWR).

Non-water-cooled SMRs may face additional licensing challenges in those countries where national regulations are not technology neutral, e.g. they may be based on established water-cooled reactor practice. A lack of regulatory staff familiar with non-water-cooled reactor technologies may also pose a problem. The first non-water cooled SMR to be licensed may be the Russian SVBR-100 Pb-Bi-cooled reactor.

Some of the advanced SMR design concepts provide for a long-life reactor core operation in a “no on-site refuelling mode” or remotely operated. The regulatory norms providing for justification of safety in such operation modes may be not readily available in national regulations.

The licensing of the SMRs is affected by the Fukushima accident in a similar way as for large reactors. The issue of multiple units on one site is particularly challenging for SMRs since the modularity of deployment is one of their promoted economic advantages.

Financing aspects of the licensing4 and nuclear regulation of SMRs are also important. The amount of the licensing fee and nuclear insurance may become significant cost factors if they do not take into account the power output of the reactor.

One of the motivations for the OECD countries to develop SMRs is their potential for export. In some countries, the SMRs are perceived as an opportunity to reindustrialise the domestic nuclear sector.

However, there may be significant limitations to exporting the fully assembled reactors since this would imply significant costs for obtaining the licenses and authorisations from the organisations ensuring the export control, primarily in the United States.

For on-grid deployment in industrial countries, the SMR competitiveness must be demonstrated and seen to constitute an economic advantage. To achieve economic competitiveness, and benefit from learning effects and factory fabrication, serial production is needed. If this is the case, one of the applications for the SMRs would be the development of new nuclear capacity by private investors or utilities for whom small upfront capital investments, short on-site construction time (with the accordingly reduced cost of financing), and flexibility in plant configuration and applications are particularly important.

SMRs are considered a potential replacement for decommissioned small and medium sized fossil fuel plants, as well as an alternative to newly planned plants, in the cases when certain siting restrictions exist, such as limited free capacity of the grid, limited spinning reserve, and/or limited supply of water for cooling towers of a power plant.

In the United States, SMRs are considered to present an interesting alternative for replacement of old coal power plants5 that will become uneconomical in the coming years due to stricter environmental regulations. The implementation of the EPA regulations for emissions by 2020 would make small and old coal-fired plants uneconomical, resulting5 in the loss of about 27 GWe. This capacity will be replaced with gas-fired, nuclear, and renewable power sources, and could lead to several tens or even hundreds of SMR units.

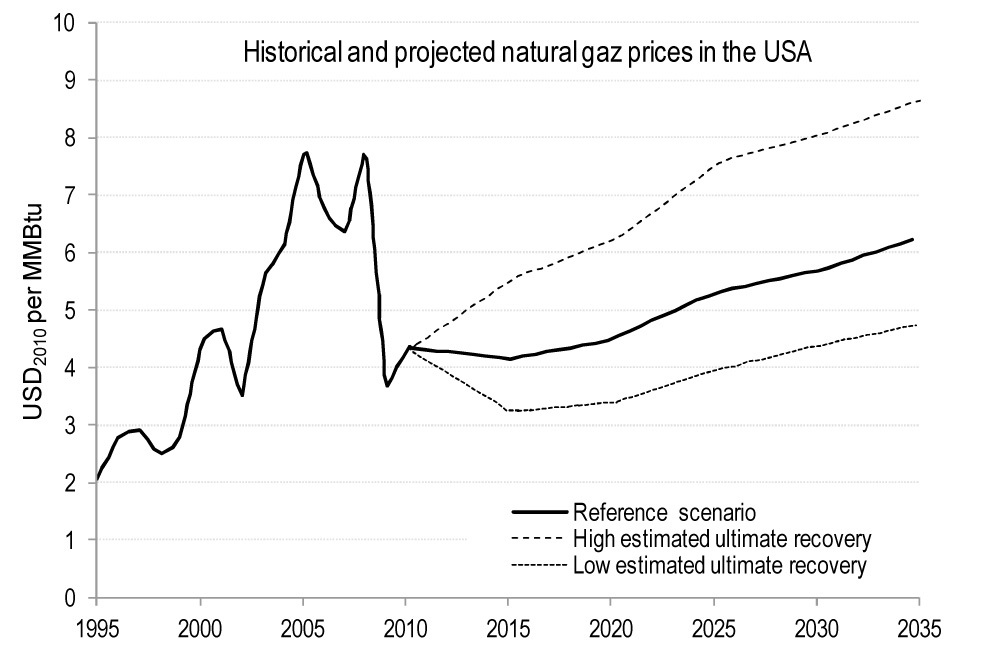

According to Fig. 1, nuclear in general (NPP with a large reactor or with SMR) is competitive with many other technologies, except with natural gas in the USA at the current level of prices. However, according to projections6 (see Fig. 2), the expected increase of exports of US shale gas and rising extraction costs will lead to the growth of the price of natural gas in the USA to about 5 USD2010/Mmbtu after 2020 ? the level at which the SMRs will become competitive (see Fig. 1).

Countries initiating new nuclear programmes might be interested in starting with an SMR instead of the previously traditional first-step of a research reactor. According to the World Nuclear Association, nuclear power is under serious consideration in about 45 countries which do not currently have it, and the IAEA stated that 65 countries without nuclear power plants “are expressing interest in, considering, or actively planning for nuclear power”. 31 are not currently planning to build reactors, and 17 of those 31 have grids of less than 5 GW i.e. in which large reactors cannot be easily introduced. It should be noted, however, that the financial, political, and industrial conditions in the countries planning to develop nuclear power may

not be sufficient for a near-term deployment of SMRs.

However, the market size could be potentially tens to hundreds of units in the most optimistic scenario. The necessary conditions are licensing and demonstration of the economic competitiveness. For the latter, large initial orders of SMRs would be needed to launch the serial production process and allow cost reductions.

4.2 SMR Deployment in Remote Areas

To date, the only country envisaging SMR deployment in remote areas is Russia. Up to 7 floating NPPs are projected in the coming decade, with the first deployment of a 70 MWe twin-unit barge-mounted power plant in 2016. If this deployment is technically and economically successful, further applications might be envisaged. However, although the only SMR under construction is designed for remote applications, the size of the corresponding segment of the market is probably not the primary driver for this technology.

The economics of the SMR strongly rely on large scale serial production in factory conditions, which is the key element for proving the competitiveness of SMRs. However, large initial orders of SMRs are needed to launch the serial production process and it is important to know who could be the first customers, and how many SMR designs will really be deployed in the near future.

The market size for SMRs is potentially tens to hundreds of units. If only a few SMRs are constructed in the coming decade, one should not exclude consolidation of SMR vendors to increase the market share.

The principal challenge for the SMRs is licensing, because of innovative and passive design features, and the difficulties of modifying the existing regulatory and legal frameworks.

Other important challenges are siting, multiple units/modules on the same site, the number of reactors required to meet energy needs (and to be competitive), and the general public acceptability of new nuclear development.

If advanced SMRs are successfully licensed and their economic competitiveness is demonstrated, this technology may lead to a new nuclear renaissance of the nuclear industry.

DOE ? US Department of Energy

EPA ? US Environmental Protection Agency

IAEA ? International Atomic Energy Agency

LCOE ? Levelised Cost of Electricity

NEA ? OECD Nuclear Energy Agency

NPP ? Nuclear Power Plant

OECD ? Organisation for Economic Cooperation and Development

PWR ? pressurised water reactor

SMR ? Small Modular Reactors or Small and Medium size Reactors