It is well known that inter-firm cooperations are becoming a pervasive mode of R&D activities, as well as a general modality for conducting business. An emerging body of recent literature on the firm’s performance demonstrates an increasing reliance on inter-firm alliances to develop new products (e.g., Ettlie & Pavlou, 2006).

The advantages of inter-firm arrangements include cost sharing, technology transfer, and information sharing (Barnir and Smith, 2002). Researchers have concluded that firms participating in inter-firm cooperation benefit from complementary resources, new markets, technology transfer, and learning (Contractor & Lorane, 1988; Hagedoorn, 1995; Das & Teng, 2004). Additional advantages of inter-firm cooperations which are especially relevant to small and medium sized enterprises (SMEs) include improved ability to outmatch a stronger competitor, easier entry into new markets, and access to resources.

However, SMEs have resource constraints, and are therefore motivated to enter into cooperation (Gomes-Casseres, 1996, 1997). In fact, they are vulnerable in partnerships, particularly with larger firms (Teece, 1986). Despite the recent trends of alliance formation for the development of new products, however, many of these new product alliances fail.

In Korea, government has taken a variety of measures to promote win-win partnerships between large enterprises and SMEs, and to promote technical cooperation between them. One of these programs is "the Purchase-Conditioned New Product Development Project," which has been active since 2002. Thanks to pre-agreements regarding the purchase of the newly developed products by large enterprises or public institutions, SMEs can carry out new product development with far less risk, including market uncertainty.

However, according to a recent study, the real purchasing rate by the preappointed large enterprises was 74.4% as of 2010 (Large, Small, and Medium-sized Enterprises Cooperation Foundation, 2010). Although this level of performance is higher than the average of inter-firm cooperations, considering that all the R&D products were predetermined to be purchased, it does not yet appear to be very successful. In this context, this study was conducted to identify the major determinants of performance of the R&D alliances, with an aim toward raising the success rate in cooperative relationships. In particular, this study assesses whether the success factors identified in the literature apply equally to SMEs in Korea.

2. Theoretical Framework and Hypotheses

2.1. Relational Network Theory

Relational network theory views economic activity as being nested in a network of inter-firm relationships (Granovetter, 1985). In particular, it highlights how firms prefer to work with partners with whom they have an embedded relationship to reduce risk and uncertainty associated with inter-organizational exchange (Chung et al., 2000; Gulati and Gargiulo, 1999; Podolny, 2001). Relational network theory highlights the role of embeddedness in mitigating the agency costs in a relationship (Granovetter, 1992). Organizational decision makers, by focusing on embedded relationships, may mitigate risk and uncertainty when selecting collaborative partners (Chung et al., 2000; Gulati and Gargiulo, 1999; Li and Rowley, 2002; Uzzi, 1996).

Strategic alliances require a different approach to managing buyer-supplier relationships. The importance of relationship management is apparent in the extant literature, which focuses largely on a) commitment; b) trust and coordination; c) interdependence as important attributes of the relationship (Anderson & Narus, 1990; Dyer, 1994; Frazier, Gill, & Kale, 1989; Handy, 1995; Nishiguchi, 1994; Ring & Van de Ven, 1994).

a) Commitment: Commitment refers to the willingness of buyers and suppliers to exert effort on behalf of the relationship. Commitment to a relationship is most frequently demonstrated by committing resources to the relationship, which may occur in the form of an organization’s time, money, facilities, etc. Only recently have theorists begun to describe how the commitment of assets can influence the nature of interorganizational relationships. A variety of studies have found a relationship between resource commitment and the joint action or continuity between parties within interorganizational relationships (Friedmen, 1991; Heide & John, 1990; Yoshino & Rangan, 1995). These results indicate that successful alliances result when both buyers and suppliers demonstrate willingness to commit a variety of assets to a set of future transactions.

b) Trust and Coordination: McAllister (McAllister, 1995) concluded that trust occurs in two forms. One of these has its roots in reliable role performance, cultural-ethnic similarity, and professional credentials; the other has its roots in “"citizenship” behavior and interaction frequency. Both forms have been found to enhance coordination by lowering administrative costs. Trust has also emerged as an important component of alliances, and several studies have corroborated the importance of trust and coordination in cooperative relationships (Pilling & Zhang, 1992; Smith & Aldrich, 1991; Smith et al., 1995).

c) Interdependence: Interdependence exists when one actor does not entirely control all of the conditions necessary for the achievement of an action or a desired outcome. Resource dependence theory (Emerson, 1962; Pfeffer & Salancik, 1978) specifies the conditions under which one social unit is able to obtain compliance with its demands when interdependence is present. These relationships have been explored in empirical studies, which investigate the relationship between dependence and control in buyer-supplier relationships (Handfield, 1993a). For instance, the relevant literature suggests that successful strategic alliances are expected to be characterized by higher levels of commitment, trust and coordination, and interdependence. On the contrary, Suh (1994) and Mohr (2010) argue that the potential loss of independence and damage of confidentiality may result in a failure of R&D alliances.

In the case of the alliance in developing new products between the SMEs and large enterprises, inter-firm cooperation carried out in the presence of openness of relationship, trust, informal communication, etc. will create stronger relationships and directly influence the outcome.

Based on the above discussions, the relationship between the level of inter-firm cooperation and the performance of R&D cooperation is hypothesized as follows.

H1: The level of inter-firm cooperation will have a positive effect on the percentage of purchase.

2.2 Organizational Learning Theory

According to organizational learning theory, Park & Russo (1996) and Gulati (1995) concluded that the experience of cooperation creates trust and commitment Powell et al. (1996) have demonstrated that the more the experience of cooperation increases, the more profoundly the performance of cooperation will improve. In the same manner, Kale & Singh (1999) have also demonstrated that the greater the experience of cooperation is the more likely cooperation will succeed. Based on the argument above, this study proposes the following hypothesis:

H2: The experience of cooperation will have a positive effect on the purchase rate of new products

The resource-based view of strategy views inter-organizational relationships as resource linkages that provide synergies by sharing and transferring resources (Eisenhardt and Schoonhoven, 1996). Hagedoorn (1993) found that larger firms seek small partners that can provide complementary cutting-edge technologies, thereby reducing their innovation time and costs. From a resource-based perspective, firms that are able to accumulate resources and capabilities that are rare, valuable, non-substitutable, and difficult to imitate will achieve a competitive advantage over other competing firms (Barney 1991). The characteristics regarded as important and attractive by a partner in an alliance are financial and technological resources, market position, reputation, etc. Accordingly, this study formulates the following hypothesis;

H3: resources and competences of the SMEs will have a positive effect on the purchase rate of new products.

On the basis of resource-based theory, Barney (1991) suggested seriously that R&D competency is one of the company's resources. Schoenecker & Swanson (2002) employed R&D expenditure, R&D intensity (expenditure/ sales), patents, and new products as performance metrics. Lopez (2008) identified R&D intensity as an important variable that represents the resource and competencies of enterprise. The results of the study conducted by Roller et al. (2002) and Colombo & Gerrone (1996) demonstrate that R&D intensity has a positive impact on R&D cooperation. On the contrary, Lee and Kang (2006)’s research demonstrates that R&D ability does not influence the performance of an alliance. We believe that the R&D intensity of the SMEs is crucial for the large companies to fulfill their pre-agreement regarding the purchase of newly developed products. Based on this idea, this study formulates the following hypothesis:

H4: R&D intensity of the SMEs will have a positive effect on the purchase rate of new products

2.4. Efficiency of Government Support

Government efforts to promote inter-firm R&D cooperations include both direct funding supports and indirect supports. Considering the large amount of supports recently provided by government, questions should be raised as to whether they are meeting expectations. Carpon & Cincera (2007) confirm the importance of government support as a significant driver for R&D cooperation. Folster analyzed a sample of 540 R&D projects of Swedish firms and their research competitors. His findings indicated that R&D subsidy programs that allow firms to select the form of cooperation do not increase the probability of cooperation, but do increase the incentive to invest in R&D. Anrique Un et al. (2009) also determined that in the process of innovation, governmental financial support positively affects cooperation performance.

The Korean government has provided a variety of supports to stimulate the cooperative R&D activities among the industries to increase competitiveness and to encourage new product development. Whatever the size and type of support, the initiatives of the government to promote the alliances must be efficient. If it is efficient, such assistance should exert a positive effect on alliance performance. Accordingly, this study proposes the following hypothesis:

H5: Efficiency of government support will exert a positive effect on the purchase rate of new products

2.5 Moderating Effect of Market Attractiveness

It goes without saying that every company is affected by the environment. Among the complex environmental factors, market attractiveness is a key element of marketability. Generally, market attractiveness consists of market size, market growth, and profitability. The dynamics of the environment provide new opportunities to the enterprises (Chandler & Jasen, 1994; Covin & Slevin, 1989). In the literature, the market attractiveness is considered to be a factor influencing directly the R&D performance as well as a moderating variable between the independent variables and the performance of inter-firm cooperation. If collaborative relationships are not appropriate for market conditions, these relationships will fail (Powell, 1990). Market attractiveness appeals to the purchasers’ requirements for products. It means new market opportunities. If the opportunities of market expand, inter-firm collaboration would be increased in order to use the partner's resources and exploit the opportunities. In other words, market attractiveness may induce a higher degree of participation by partners into that market. According to Lee (2005), market condition is one of the determinants of performance of R&D collaboration sponsored by the government. According to changes in market conditions, the buyers will be hesitant to purchase. There is a recent study which shows that market dynamics moderates the relationship between the cooperation activities and R&D performance (Kim J.H. & J.H. Park, 2011). Market attractiveness is supposed to moderate the relationship between the independent variables mentioned above and the performance of inter-firm cooperation. Based on the above discussions, this study proposes the following hypothesis:

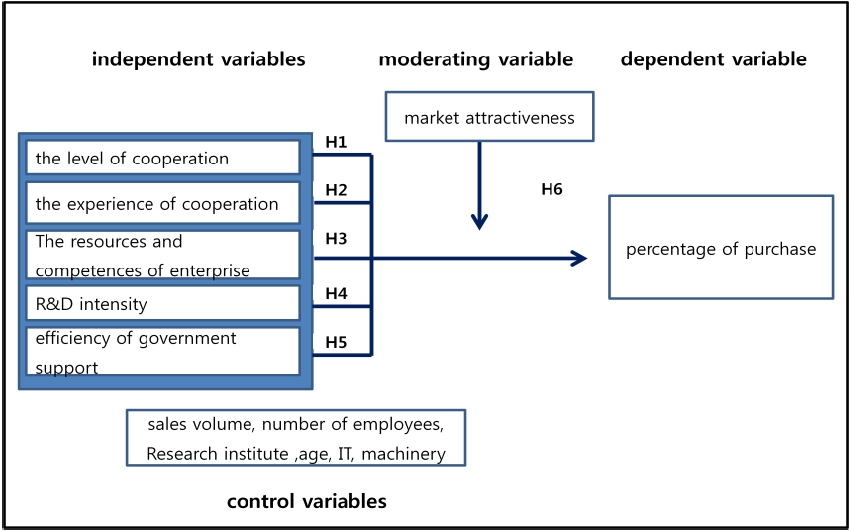

H6: The market attractiveness will moderate the impact of the level of inter-firm cooperation, the experience of cooperation, the resources and competencies of enterprise, R&D intensity, and adequacy of government assistance on the purchase rate of new products.

3.1 Sample and Data Collection

The population of this study is comprised of 807 medium and small enterprises which participated as a principal organization in the Purchase-Conditioned New Product Development Project. Data was collected from all 807 of the SMEs for three weeks from August 16, 2010 to October 5, 2010 with structured self-administered questionnaires conducted via an Internet web survey. A total of 136 questionnaires were completed, at a response rate of 15.3%. The sample for this study is comprised of 136 SMEs. SMEs in the IT (47.5%) and machinery (35.3%) sector account for 47.5% and 35.3% of the sample, respectively. A total of 86.3% of sample SMEs have their own research institutes. SMEs whose R&D intensity is equal to or greater than 5% constitute 48.1% of the sample. The mean levels of their organizational age, sales volume, and number of employees are 29.7 years, 182.2 billion KRW, and 180 people, respectively.

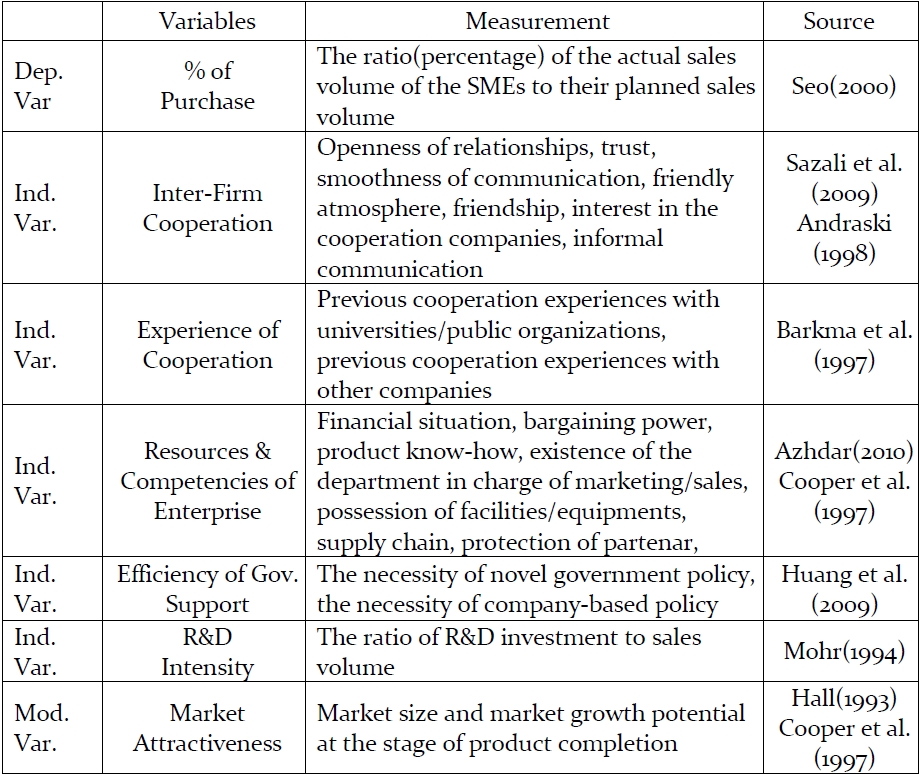

With regard to the independent variables, inter-firm cooperation was assessed by seven items assessing openness of relationships, trust, smoothness of communication, friendly atmosphere, friendship, interest in the cooperation companies, and informal communication (Andraski, 1998). Experience of cooperation was measured using two items assessing previous cooperation experiences with universities/public organizations and previous cooperation experiences with other companies (Barkma et al., 1997). Resources and competencies of enterprise were assessed by seven items assessing financial situation, bargaining power, product know-how, existence of a department in charge of marketing/sales, and possession of facilities/equipments (Cooper et al., 1997). Efficiency of government support was measured using two items assessing the necessity of novel government policy and the necessity of company-based policy (Huang et al., 2009). Finally, R&D intensity as a proxy variable of technological capacity was measured by the ratio of R&D investment to sales volume. Market attractiveness, the moderating variable of this study, was assessed by two items assessing market size and market growth potential at the product completion stage (Copper et al., 1997). For each of the multi-item measures, responses were made on the five-point scales with verbal anchors (ex: strongly disagree (1) to strongly agree (5)), and the sum of the scores divided by the number of items was used as a scale value for each respondent.

Exploratory factor analysis was used to assess the validity of the measures employed in this study. Five multi-item measures (inter-firm cooperation, experience of cooperation, resources and competencies of enterprise, efficiency of government support, and market attractiveness) were subjected to factor analysis. R&D intensity was excluded from factor analysis because it was measured using a single-item measure. In conducting factor analysis, the principal axis factoring method of extraction was employed and Varimax rotation was utilized to determine the factor structure. Five factors were extracted from the input data and 68.84% of the variance was explained by the five factors. Additionally, items from each of the five measures factored together respectively with factor loadings greater than 0.50. These results demonstrated that the multi-item measures used in this study evidence satisfactory convergent and discriminant validity.

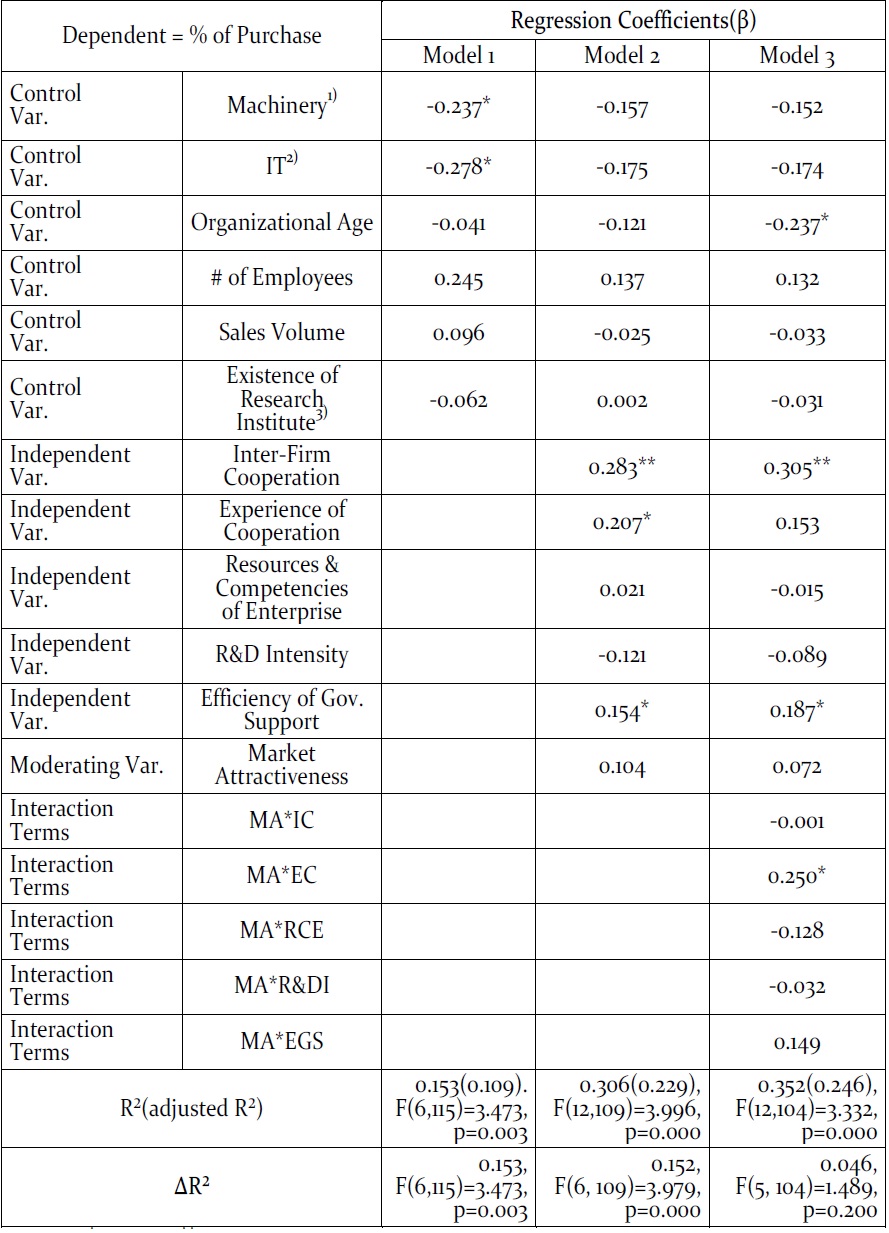

[Table 1] Measurement of Variables

Measurement of Variables

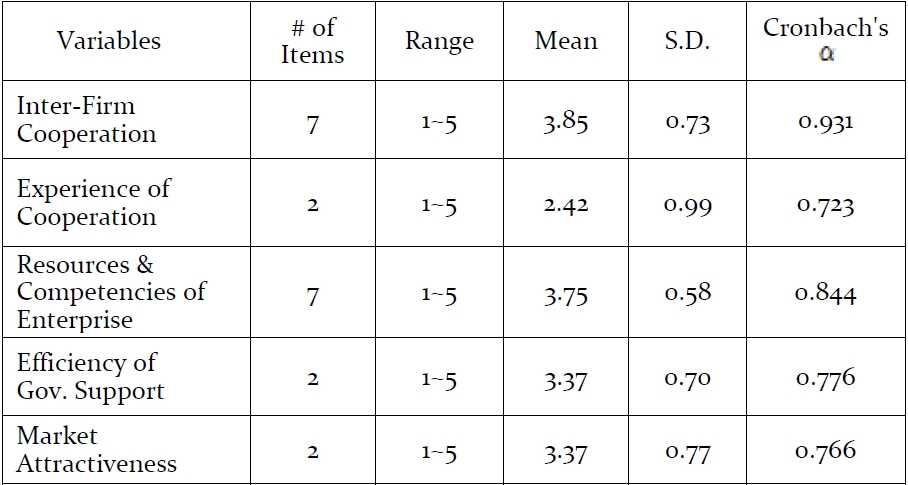

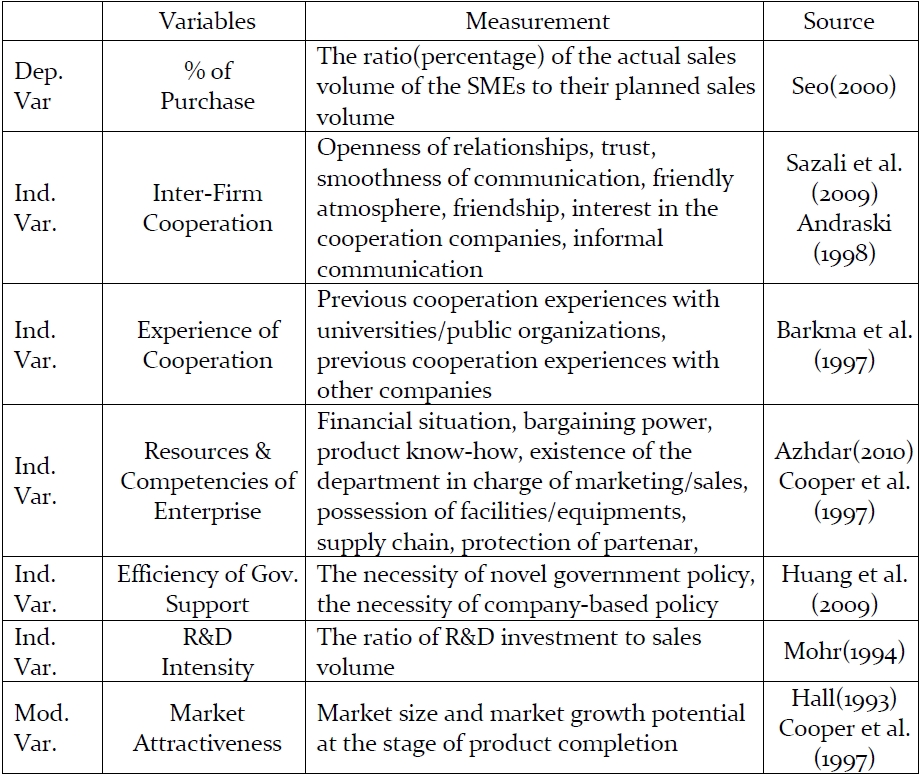

[Table 2] Descriptive Statistics and Reliabilities of Measures

Descriptive Statistics and Reliabilities of Measures

The reliabilities of the five multi-item measures were also assessed on the basis of Cronbach's alpha coefficients. Descriptive statistics and Cronbach's alpha coefficients are presented in Table 2. As shown in Table 2, Cronbach's alphas for the multi-item measures used in this study are all above 0.70, which indicates that all the multi-item measures employed herein have a satisfactory level of reliability.

Hierarchical regression technique was used to analyze data. Five demographic variables (industry, number of employees, sales volume, organi-zational age and existence of research institute) were used as controls in conducting hierarchical regression analysis. Industry was converted into two dummy variables, IT (IT=1, others=0) and machinery (machinery=1, others= 0). Existence of research institute was also converted into a dummy variable so that possession of research institute had a value of one, and no possession of a research institute was assigned a value of zero.

Hierarchical regression analysis was conducted through three stages. In stage 1, percentage of purchase, the dependent variable of this study, was regressed on six control variables--IT, machinery, and number of employees, sales volume, organizational age, and existence of a research institute. At stage 2, in addition to the six control variables, five independent variables (inter-firm cooperation, experience of cooperation, resources and competencies of enterprise, R&D intensity, and efficiency of government support) and one moderating variable (market attractiveness) were entered into the regression equation. In stage 3, five interaction terms between the five independent variables and market attractiveness were added to the regression equation in order to test the moderating effects of market attractiveness. In order to avoid the multicollinearity problem, as suggested by Jaccard et al. (1990), all the theoretical variables were standardized so that they had means of zero and a standard deviation of one, and then five interaction terms were created using those standardized variables.

Regression analysis assumes linearity and the absence of high multicollinearity. The linearity assumption was assessed for the dependent variable with each of the independent variables using the SPSS MEANS procedure. For those relationships which were found to evidence significant deviations from linearity, R2s were compared with Eta2s, along with a graphical examination of the relationships. These test results indicated that deviations from linearity were either nonsignificant or sufficiently minor that no transformations were required for the variables included in this study.

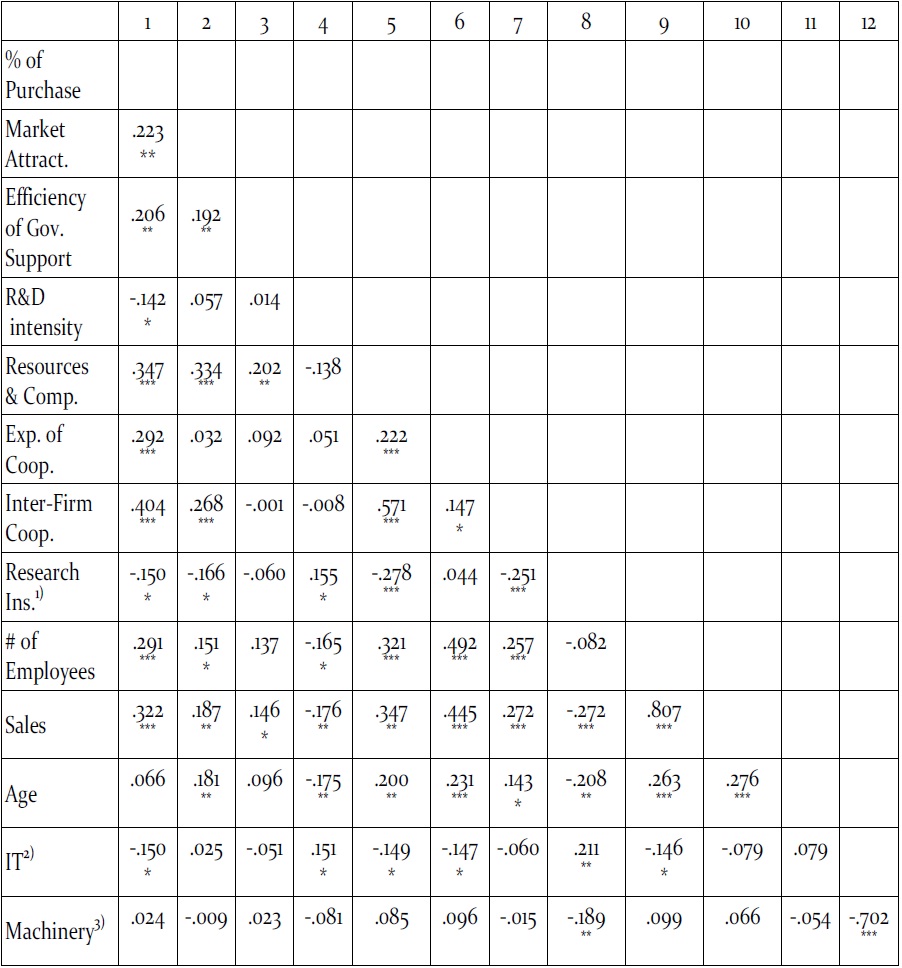

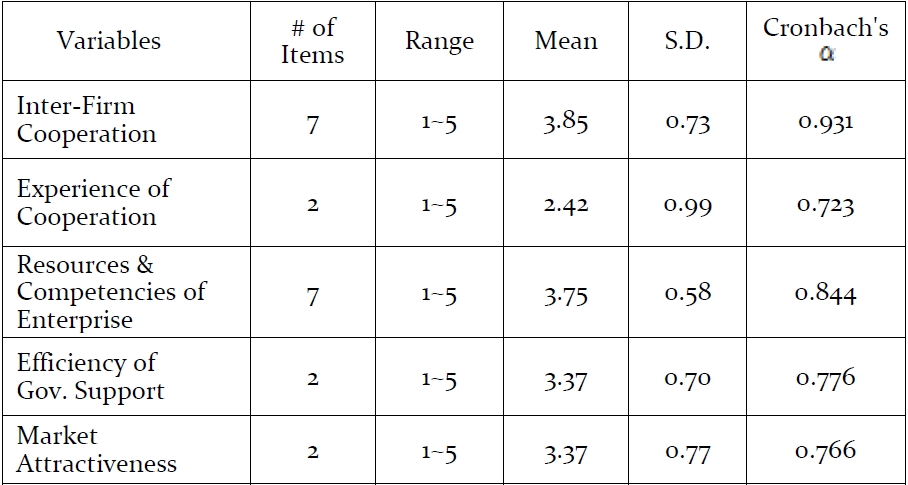

The multicollinearity problem was also checked via two methods. Correlations among variables were assessed to detect the multicollinearity problem. Correlations exceeding 0.80 were considered as indicative of the existence of a serious multicollinearity problem. As shown in Table 5, none of the correlations exceed 0.80. The eigenvalues of the independent variable correlation matrix were decomposed and examined to further check the multicollinearity. Generally, eigenvalues of less than 0.05 are considered indicative of high multicollinearity. None of the decomposed eigenvalues were found to be less than 0.05 in this analysis. These results demonstrate the absence of any serious multicollinearity problem in this study.

4.1 Correlation Analysis Results

Correlations among the variables included in this study are presented in Table 3. As shown in the table, all five of the independent variables exhibit significant relationships with percentage of purchase; inter-firm cooperation, experience of cooperation, R&D intensity, and efficiency of government support are positively associated with percentage of purchase, whereas R&D intensity is associated negatively with percentage of purchase. Additionally, market attractiveness, the moderating variable of this study, has a significantly positive correlation with percentage of purchase.

With regard to control variables, four of them were found to be significantly correlated with percentage of purchase; sales volume and number of employees were positively associated with percentage of purchase, whereas IT and the existence of a research institute were negatively related to percentage of purchase.

[Table 3] Correlations among Variables

Correlations among Variables

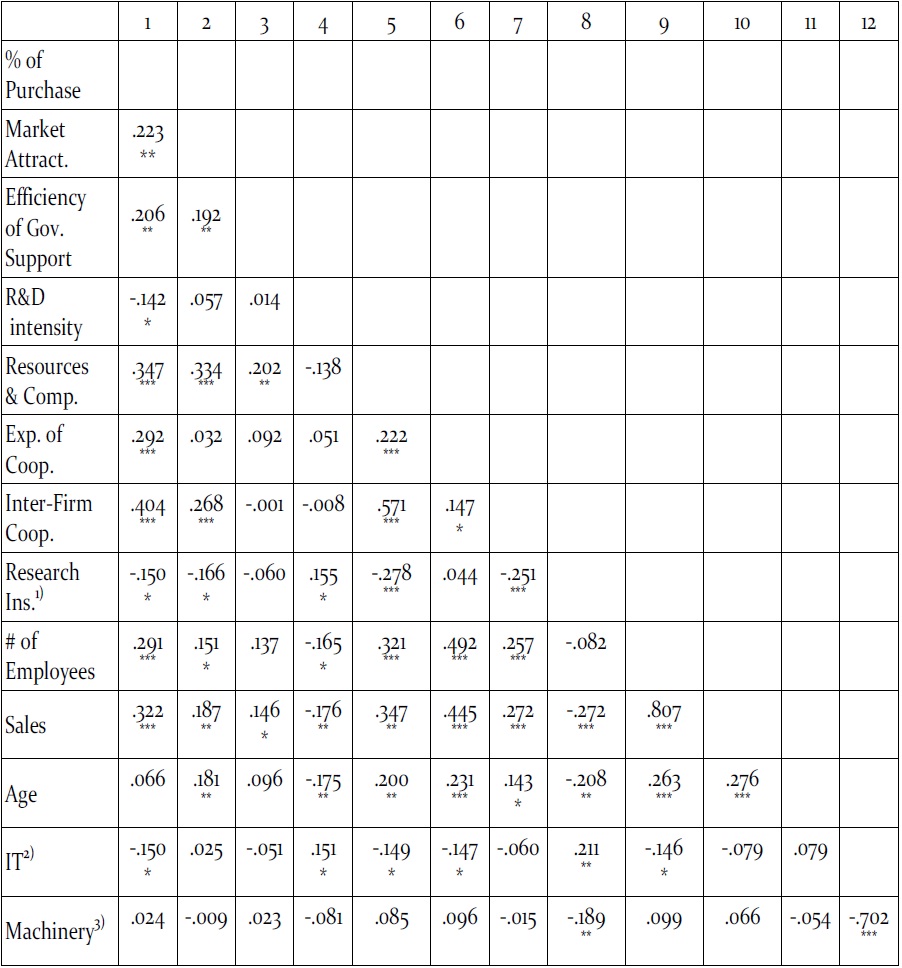

4.2 Hierarchical Regression Analysis Results

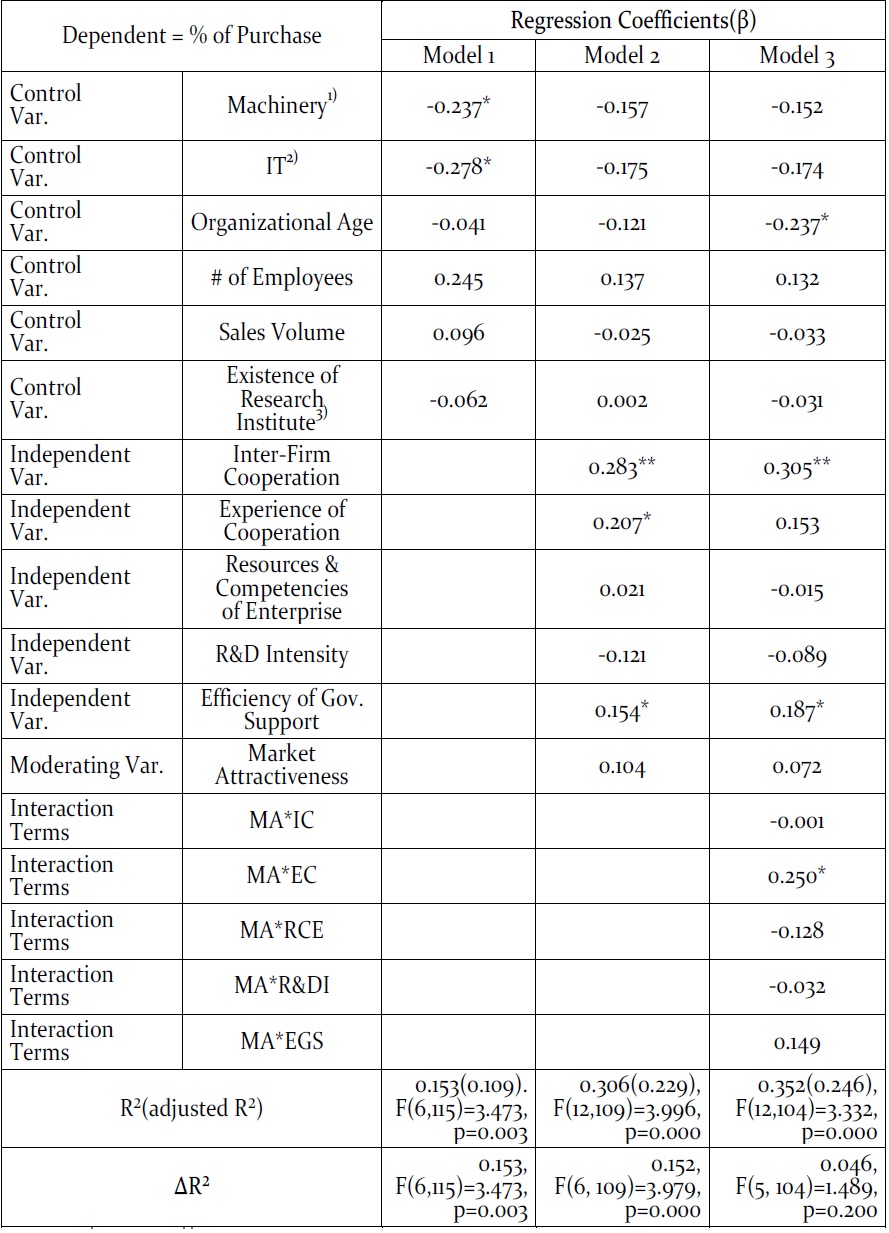

As mentioned previously, a hierarchical regression analysis technique was used to estimate the causal model of this study. Hierarchical regression analysis was conducted through 3 stages. In stage 1, percentage of purchase was regressed on six control variables; in stage 2, in addition to the six control variables, six theoretical variables were entered into the regression equation. Finally, at stage 3, five interaction terms between the five independent variables and market attractiveness were added to the regression equation to evaluate the moderating role of market attractiveness. The results are shown in Table 4. Figures presented in the table are standardized coefficients.

First, consider the results for Model 1, in which six control variables were regressed on percentage of purchase. As shown in the third column of the table, Model 1 explains 15.3% of the variation in percentage of purchase, which is significant at 0.01. Additionally, three out of the six control variables are significant; machinery and IT exert negative effects on percentage of purchase, whereas the number of employees has a positive effect on it. These results indicate that percentage of purchase is lower for SMEs in the IT and machinery sectors than those in other industries, and that as the number of employees’ increases, the percentage of purchase also increases.

Next, consider the hierarchical regression results for stage 2, where six theoretical variables were added to Model 1. As shown in the fourth column of Table 4, the six theoretical variables additionally explain the variation of percentage of purchase by 15.2%, which is significant at 0.01. As presented in Model 2 of the table, four out of the five independent variables are significant; inter-firm cooperation, experience of cooperation, and efficiency of government support exert a positive impact on percentage of purchase. On the other hand, market attractiveness, the moderating variable of this research, exerts no significant effect on percentage of purchase. These results indicate that as inter-firm cooperation, experience of cooperation, and efficiency of government support increases, percentage of purchase increases.

Finally, consider the results for Model 3, where five interaction terms between the five independent variables and market attractiveness were entered into the regression equation. As presented in the fifth column of the table, those five interaction terms additionally explain the variance of percentage of purchase, but not significantly so, at 0.10. This indicates that the addition of the five interaction terms does not significantly contribute to the explanation of percentage of purchase. In other words, this result means that market attractiveness does not moderate the relationships between the five independent variables and percentage of purchase. However, the results for Model 3 show that the interaction term between market attractiveness and experience of cooperation (MA*EC) exerts a significantly positive impact on percentage of purchase. The significance of the term, MA*EC, appears to be a statistical artifact, as the variation additionally explained by the addition of the five interaction terms is not significant. In summary, the results for Model 3 indicate that market attractiveness does not perform a moderating function in the relationships between the five independent variables and percentage of purchase.

[Table 4] Hierarchical Regression Analysis Results

Hierarchical Regression Analysis Results

The results of this study indicate that inter-firm cooperation, experienced cooperation, and efficiency of government support have positive impacts on the purchase rate of new products. On the other hand, R&D intensity and resources of competencies of the firm do not influence it. Additionally, market attractiveness does not moderate the effects of the five independent variables on the purchase rate of new products.

The most important action to be taken to facilitate the purchase of new products and to improve the performance of the SMEs is to strengthen inter-firm cooperation. These findings are consistent with much of the social embeddedness literature. Bilateral open communication may perform a significant function in determining the success of inter-firm alliances. Active information sharing behaviors between large enterprises and SMEs appear to be important in managing the relationship and result in conflict resolution orientation, which is an important predictor of success. It is important, as well, to nurture and strengthen a sense of trust with the buyer. Additionally, formal as well as informal commitments of time and energy appear to be significant predictors of the performance of inter-firm alliance.

This study makes a significant contribution to the literature on inter-firm cooperation in that the results of this study showed that the relationship with the present partner is more important than the past experience of cooperation with other partners. The beta coefficients of the two variables in the regression model are .283 and .207, respectively. Appropriate cooperative procedures and structures ensure that the right individuals contribute to the external cooperation at the right moment, and they also encourage more attractive inter-firm cooperation. Moreover, in the SMEs, internal cooperation needs to be encouraged during new product development.

The results of this study partly demonstrate the necessity of government support for private R&D activities. Government support can not only guarantee the commercial success of sponsored projects but can also promote the purchase decision by customers. C. Anrique Un, et al. (2009) demonstrated that process innovations that enjoyed public fund support exhibited superior performance. This finding has important implications for Korean policy makers. The government needs to make efforts to facilitate a strong and continual inter-firm relationship in the process of selection and determination of public R&D support activities.

In contrast with the predominant literature that assesses the success factors of inter-firm alliances in new product development, the results of this study demonstrate that neither resources nor competencies of enterprise nor R&D intensity affect the alliance performance. Prior studies have demonstrated that, in particular, in advanced economies, decisions to enter into research partnerships, as well as the effects of different types of R&D alliances, are determined primarily by the external R&D resources that a firm can obtain from its partners. The findings of this study also contrast with the relevant literature that emphasizes the importance of assets in determining inter-firm alliance success (Nishiguchi, 1994). These findings, along with the other results of this study, could be interpreted to indicate that it is not so much the R&D competencies that lead to successful inter-firm performance, but rather the management relationship with the customer company.

Market attractiveness is one of the major characteristics of the marketplace in which a newly developed product competes. A firm must analyze the situations and trends of a potential market for a newly developed product. Additionally, for the success of the venture company at various stages, market factors have proven to be very critical. Prior to beginning a new product development initiative, a firm should know that it will fit the target market. Considering that market attractiveness is employed to determine whether or not a market might be a profitable one for investment, this research has resulted in unexpected findings. However, the reason for these findings appears to be that market attractiveness had been already assessed by the customer company when it predetermined to purchase a new product that would be provided afterward by an SME. This indicates that market attractiveness will not make a great deal of difference among the respondents, which might lead to a statistically insignificant moderating effect of market attractiveness.

In summary, the findings of this study imply that factors related to inputs necessary for inter-firm cooperation require more attention in Korea. CEOs of Korean SMEs need to commit themselves to trustworthy relationships and open communication with their partners. The findings also have implications for Korean policy makers. They need to pay special attention to the facilitation of strong relationships which will be achieved, for instance, by strict evaluations and incentives in the process of selection and determination of SMEs for the provision of government support.

Our study focuses the degree of cooperation during the development of new products, the experiences of cooperation, R&D resources, R& D intensity and adequacy of government support. The technical completeness including quality, cost, matching with the market trend should have strong effect on the dependent variable in our research. If we included such variables in our research model, the R2 could have risen considerably.

This study has several limitations, which in turn provide opportunities for future research. One critical issue is related to the definition and measurement of the dependent variable - alliance performance. Aside from the general performance of R&D activities, this study attempted to measure one observable consequence of a firm’s purchase behavior of the product developed by an SME with which it was preassigned to buy in accordance with the agreement made in advance.

Second, as data were collected from SMEs participating in a government sponsored program, there might also exist a limitation involving the generalization of the findings of this study to all the SMEs. Future research will be necessary to determine whether the results observed herein hold in other settings.

Finally, this study was conducted in Korea and applied to a specific governmental support program. Therefore, the results of this study should not be considered generalizable to other countries. Further research is expected to provide a deeper understanding of the issues explored herein.

A more concrete study is necessary considering the actual situations the SMEs have faced in real alliance activities. Some case studies can also be applied to the super SMEs having made successful achievements of inter-firm alliance together with the reasonable purchase rate. There still exist the other factors, such as technical completeness including quality, cost, and matching with market trend. This maybe is the next step of the research.