This paper presents a new approach to risk comparison in uncertain environment. Based on the uncertainty theory, some uncertain risk measures and risk comparison rules are proposed. Afterward the bridges are built between uncertain risk measures and risk comparison rules. Finally, several comparable examples are given.

As we all know, risk is an important factor in making decisions. In many areas, decision makers must often choose a course of action in the face of risks. In order to monitor risks timely and minimize the loss caused by risk, it is necessary to analyze and compare a great variety of risks.

There exist many ways to depict and measure risk because every decision maker has its own perception of risk. Variance and standard deviation were the traditional risk measures and first applied in the selection of portfolios by Markowitz (1952). After about 40 years, value at risk (VaR) was introduced in financial risk management by Guldimann (1995). Now, it is adopted by many financial institutions to control the risk of loss. Unfortunately, value at risk does not possess subadditivity. Therefore, tail value at risk (TVaR) as a natural remedy for the shortcoming of VaR was proposed by Artzner

In fuzzy environment, many researchers regarded risk as a fuzzy variable and adopted fuzzy theory and methodology as an approach to risk analysis (Zmeskal, 2005; Lee and Chen, 2008). From the beginning of the development of fuzzy set theory (Zadeh, 1965), the problem of fuzzy variable dominance was studied. Lee and Li (1988) proposed comparison of fuzzy numbers based on the probability measure of fuzzy events. Tran and Duckstein (2002) compared fuzzy numbers using a fuzzy distance measure. Nojavan and Ghazanfari (2006) presented fuzzy ranking method by desirability index. Peng

However, many surveys showed that some imprecise phenomena behave neither like randomness nor like fuzziness. In order to deal with this uncertainty different from randomness and fuzziness, Liu (2007) founded uncertainty theory based on normality, self-duality, coun-table subadditivity, and product measure axioms in 2007, and it was refined by Liu (2010a). As a new tool to study the uncertainty in human systems, uncertainty theory motivates a new area of risk analysis called uncertain risk analysis. Here the risk is defined as the accidental loss plus uncertain measure of such loss (Liu, 2010b). The fact that risk is usually not a known constant shows that it is reasonable to represent risk by uncertain variable. Up to now, many significant risk measures have been proposed from different angles in uncertain risk analysis. Peng (2009a) suggested the VaR and TVaR based on uncertainty theory. Liu (2010b) provided the risk index to measure some risk loss. Peng and Li (2010, 2011) studied the distortion risk measure and spectral measure of uncertain risk, respectively. These uncertain measures can be widely used as tools of risk analysis in uncertain environment. In this paper, we aim to define some comparison rules of risks within the framework of uncertainty theory and discuss the relationship between these comparison rules and uncertain risk measures. The risk comparison approach is different from those in stochastic and fuzzy environment. It is worthwhile to compare risks on the basis of these uncertain measures.

The remainder of this paper is organized as follows. Section 2 presents preliminaries in the uncertainty theory. The concepts of some risk measures based on the uncertainty theory are given in section 3. Section 4 introduces three types of comparison rules of risks. In section 5, we build the bridges between uncertain risk measures and comparison rules of risks. Section 6 gives some comparable illustrations. The last section contains some concluding remarks.

Let Γ be a nonempty set. A collection

(1) (Normality) M { Γ } =1;

(2) (Self-duality) M{Λ} M{Λc} =1 for any Λ ∈ L ;

(3) (Subadditivity) For every countable sequence of events { Λ i }, we have

The triplet

(4) (Product axiom) Let (Γ k, Lk, Mk) be uncertain space for k = 1, 2, … , n. Then the product uncertain measure M is an uncertain measure on the product σ - algebra Π Lk satisfying

An uncertain variable is defined as a measurable function from an uncertain space (Γ ,

and the inverse function Φ-1 is called the inverse uncertainty distribution of ξ .

Expected value is the average value of uncertain variable in the sense of uncertain measure, and represents the size of uncertain variable. The expected value of uncertain variable ξ is defined by Liu (2007) as

provided that at least one of the two integrals is finite. Liu (2010a) has proved that

if the expected value of uncertain variable ξ exists.

Let ξ be an uncertain variable with finite expected value E[ξ]. The variance of ξ is defined as

And the standard deviation of ξ is defined as

An uncertain variable ξ is called linear if it has a linear uncertainty distribution

denoted by

Φ-1 (α) = (1?α )a αb, 0 < α < 1.

The expected value and variance are

An uncertain variable ξ is called normal if it has a normal uncertainty distribution

denoted by

The expected value and variance are

3. SOME RISK MEASURES IN UNCERTAINTY ENVIRONMENT

Risk measure is the core of risk analysis. Here we introduce some uncertain risk measures quoted from Peng (2009a, 2009b).

Definition 1: (Peng, 2009a) Let ξ be an uncertain variable and α ∈(0,1) be the risk confidence level. Then the function ξVaR : (0, 1) → ? such that

From this definition, we can see that ξVaR just is the generalized inverse function of Φ-1 (α).

The VaR measures of linear uncertain variable ξ and normal uncertain variable η are

and

Definition 2: (Peng, 2009b) Let ξ be an uncertain variable and α ∈ (0,1) be the risk confidence level. Then the function ξ AVaR : (0, 1) → ? such that

The AVaR measures of linear uncertain variable ξ and normal uncertain variable η are

and

Definition 3: (Peng, 2009a) Let ξ be an uncertain variable and α ∈ (0,1) be the risk confidence level. Then the function ξTVaR : (0,1) → ? such that

The TVaR measures of linear uncertain variable ξ and normal uncertain variable η are

, and

A disadvantage of VaR is that it does not give the information about the severity of loss within and beyond the VaR level. Then, AVaR and TVaR mend this shortcoming. AVaR gives the estimation of loss within the VaR level and TVaR accounts for the severity of loss failure and not only the chance of failure. AVaR and TVaR are considered to provide the better measures of risk. Moreover, it can be verified that they all possess the properties of monotonicity, positive homogeneity, translation invariance, independence additivity.

4. COMPARISON OF UNCERTAIN RISKS

Let ξ and η be two risks treated as uncertain variables with distribution functions Φ (

Definition 4: (First comparison rule) Let ξ and η be two risks with distribution functions Φ (

First comparison rule shows the possibility of same loss is small if the distribution function of risk always lies to the lower-right of the other. We can verify that the first comparison rule is reflexive, transitive and antisymmetric. That is, this rule is a partial order. Consequently, it is essential to introduce more applicable rules.

Definition 5: (Second comparison rule) Let ξ and η be two risks with distribution functions Φ (

for all x∈? , written

Definition 6: (Third comparison rule) Let ξ and η be two risks with distribution functions Φ(

for all

It is clear that the second and third comparison rules also meet reflexivity and transitivity. In addition,

implies both

and

5. BRIDGES BETWEEN UNCERTAIN MEASURES AND UNCERTAIN RISK COMPARISONS

In this section, we will investigate the relationships between uncertain measures and risk comparison rules.

Theorem 1: Let ξ and η be two risks with continuous distribution functions Φ(

iff ξVaR (α) ≥ ηVaR (α) for all α ∈(0, 1)

Proof: Necessity: If

i.e., Φ(

for all α , which means ξ VaR (α) ≥ ηVaR (α)

Sufficiency: For any x∈?, there is α ∈(0, 1) such that ξ VaR (α) =

Theorem 2: Let ξ and η be two risks with continuous distribution functions Φ(

iff ξVaR (α) ≥ ηVaR (α) for all α ∈(0, 1)

Proof: Necessity: Assuming that

and α ∈(0, 1) , we construct the function

Next, we will prove that

always holds for a ≥ Φ-1 (α ) . Then,

i.e.,

On the other hand, for a ≤ Φ ?1 (α ), we have

i.e.,

That is to say,

Sufficiency: Assume that ξVaR (α) ≥ η VaR (α) for all α ∈ (0, 1). For a such that 0 < Φ(a) < 1, we have

By the α ≤ Ψ(a) ⇔ a ≥ Ψ -1 (α ) , it is obvious that

which implies

for a such that 0 < Φ(a) < 1. It is easy to verify this inequality holds when Φ(a) = 0 and Φ( a) =1. Hence ,

is proved.

Theorem 3: Let ξ and η be two risks with continuous distribution functions Φ(

iff ξVaR (α) ≤ ηVaR (α) for all α ∈( 0, 1).

Proof: Similarly, the necessity can be proved by constructing the function

And, we may prove the sufficiency after noticing

In the uncertainty theory, many types of uncertain variables can be used to describe risks. In this section, we concentrate on the comparison of risks with linear and normal uncertain distributions. First, according to the three risk comparison rules, we can obtain the following results for two risks with linear uncertain distributions.

Theorem 4: Let ξ ~

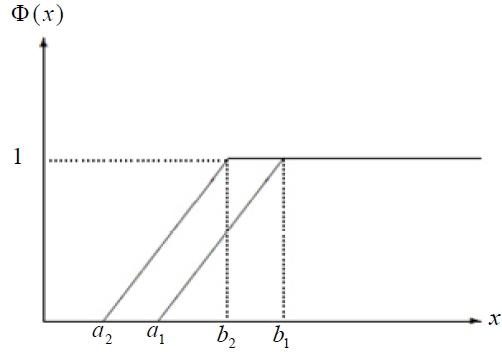

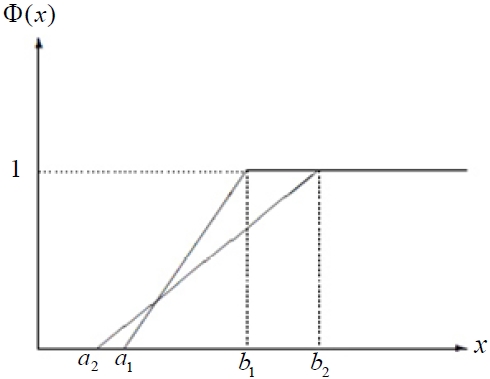

Proof: (1) It directly follows from the uncertain distribution of linear uncertain variable and definition of the first comparison rule. The result can be described in Figure 1.

(2) It follows from the second comparison rule and Theorem 2 that

Under the hypothesis b1 ? a1 < b2 ? a2 we get

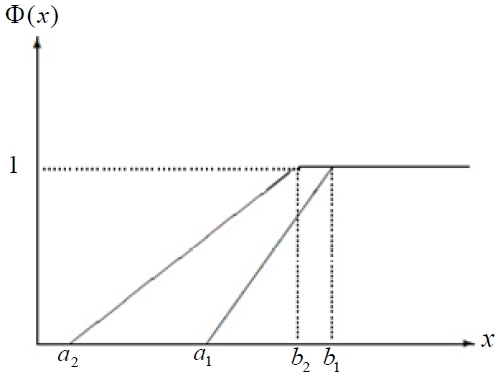

which yields b1 + a1 ≥ b2 + a2 i.e., E[ξ ] ≥ E[η ] . Then the result can be described in Figure 2 when b1 < b2 and Figure 3 when b2 < b1 .

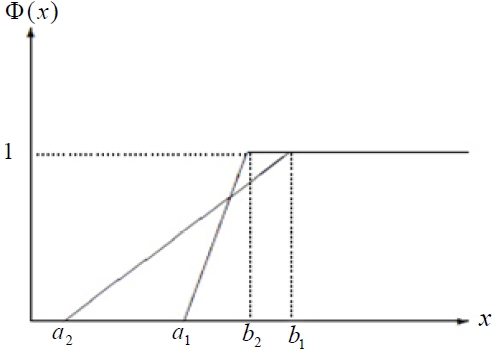

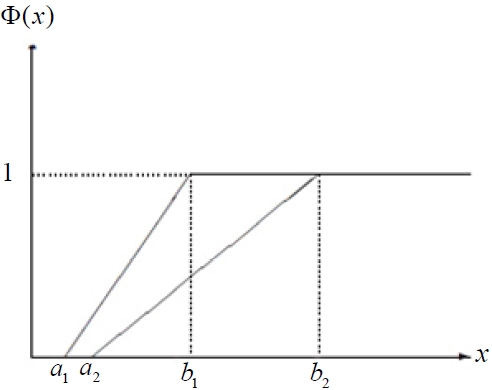

(3) By the analysis similar to (2), we have that

if and only if E[ξ ] ≤ E[η ] . We can describe the result in Figure 4 when a1 < a2 and Figure 5 when a2 < a1 .

Next, we give the comparison results for two risks with normal uncertain distributions.

Theorem 5: Let ξ ~

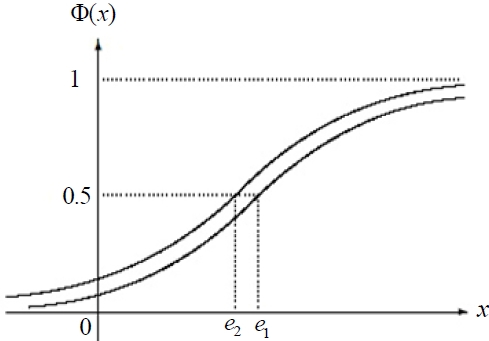

Proof: (1) It follows from the first comparison rule that

if and only if Φ(

for any

We know that the variance of an uncertain variable provides measure of the spread of the distribution around its expected value. So σ1 = σ2 implies the same spread of the distributions around theirs respective expected values. The result can be described in Figure 6.

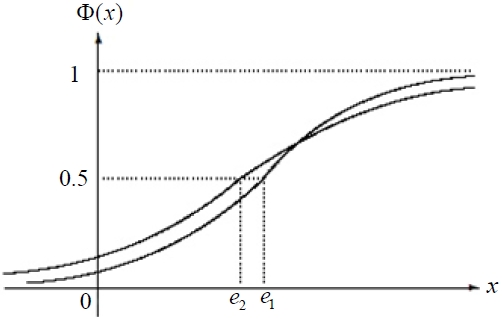

(2) It follows from the second comparison rule and Theorem 2 that for α ∈ (0, 1),

So, we can obtain that

iff e1 ≥ e2 and σ1 ≤ σ2. In addition, σ1 ≤ σ2 indicates that the distribution of risk ξ is more tightly concentrated around its expected value. The result can be described in Figure 7.

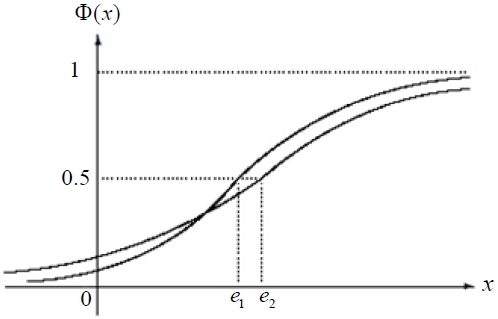

(3) It follows from the third comparison rule and Theorem 3 that for α ∈ (0, 1),

So, we can obtain the result which can be described in Figure 8.

This paper has proposed a new approach to risk comparison by means of uncertain measures. We introduced the concepts of some uncertain measures and risk comparison rules within the framework of uncertain theory. Special attention is paid to building the bridges between uncertain measures and risk comparison rules. We described the three risk comparison rules by three kinds of uncertain measures: uncertain VaR, uncertain AVaR, and uncertain TVaR, respectively. Moreover, the results are applied in the risks with linear and normal uncertain distributions. This method will be a very helpful tool for studying risks whose characteristic is neither relative to randomness nor fuzziness. It should be emphasized that there are many ways to rank risks according to different uncertain measures. In risk analysis, choosing and finding a suitable risk measure to compare the risks will be constant exploration.