With the rapid growth of the Internet, the integration of social resources online has been bringing more business value than ever. Through the Internet, the integration of social resources, widely dispersed, but with huge capacity, is undoubtedly being introduced as a novel method of accessing resources for entrepreneurs. Against this background, assembling all crowdfunding-related stakeholders led to the birth of the crowdfunding platform. Crowdfunding has now become a virtual online platform for the exchange of information and resources.

Since its birth in 2009, the Kickstarter Internet funding platform has spread widely around the globe. Ahlers et al. (2012) gave four classifications of the crowdfunding model, based on the returns to backers: donation, reward-based giving, equity, and debt. Among them, donation crowdfunding means that publicly-spirited sponsors offer free financial assistance for crowdfunding originators. By contrast, reward-based crowdfunding refers to promises for after completion of the project to give investors some form of feedback or souvenirs.

In other words, reward-based crowdfunding is a crowdfunding model with attributes of pre-selling or pre-purchasing. Equity crowdfunding needs initiators to obtain funding support from investors in exchange for stake-equity or future revenue. Debt crowdfunding means that sponsors provide originators with a certain amount of money and withdraw principal and interest at the appointed time.

According to Kickstarter’s own data published in 2014, $1.27 billion has been backed on the platform within the last five years and $529 million raised in 2014. Since 2011, crowdfunding has spread throughout China. According to an October 23, 2014, report published by the Sootoo Research Institute, a data research institution in China, a total of RMB464 million were raised within the first three quarters of 2014. In all kinds of crowdfunding projects, pledges to cultural and public welfare projects account for 65 percent and 27 percent of the industry total, respectively.

Remarkably, the money raised for smart hardware products accounts for six percent of total crowdfunding. Besides, crowdfunding also brings other special significance benefits to technology entrepreneurship.

Firstly, crowdfunding eases the channels of communication between technological projects and private capital. Therefore, new tech firms with light assets can be free of the funding constraints traditionally associated with financing. Meanwhile, they still keep a strong voice in corporate governance.

Secondly, crowdfunding provides a low-price, popular, simple, and influential marketing platform for technology-based start-ups. The spirit of the Internet also endows this platform with openness, equality and interaction. So, technical teams can complete market-testing of their products. Furthermore, they can obtain product orders and capital for production by reward-based crowdfunding.

Finally, crowdfunding funders come from various sectors of social life. Therefore, they bring, not only capital, but also other resources, including mature distribution channels, professional original equipment manufacturer (OEM) production, cost-effective raw materials, excellent managerial talent, or complementary technology.

This paper, based on the elaboration likelihood model (ELM), researches the factors that impact on the success of crowdfunding, which is likely to make a great contribution to entrepreneurs, and especially to technology-based entrepreneurs. ELM has strong power to explain how crowdfunding initiators convince their followers to make investment decisions based on platform strategy and market response.

The ELM theory was put forward by psychologists Petty E. and Cacioppo, J.T. in the 1980s. This model is one of the most influential theories about customer information processing. It explains the two persuasion approaches of individuals dealing with cognitive information (Petty and Cacioppo, 1984). The first type of persuasion is that which likely result from a person’s careful and thoughtful consideration of the true merits of the information presented in support of an advocacy (central route).

The other type of persuasion is that which more likely occurs as a result of some simple cue in the persuasion context, inducing change without necessitating scrutiny of the true merits of the information presented (peripheral route) (Petty and Cacioppo, 1986). So, ELM describes two relatively distinct routes to persuasion.

The base of ELM theory is motivation and the ability to think and evaluate (O’Keefe, 2008). Many scholars have also applied ELM theory to fields such as psychotherapy (Petty, Cacioppo and Kasmer, 1985); counseling (Petty, Cacioppo and Heesacker, 1984); advertising (Cacioppo and Petty, 1983, Haugtvedt, Petty and Cacioppo, 1992); selling (Petty, Cacioppo and Schumann, 1984), mass media (Petty, Priester and Brinol, 2002); web personalization (Tam and Ho, 2005), sources of persuasion from online trust (Harmon, 2015), and even popular online peer-to-peer lending platforms (Wang and Kang, 2014).

Crowdfunding draws inspiration from the concepts of micro-finance and crowdsourcing. Mollick (2014) proposes a definition of crowdfunding from the perspective of entrepreneurship. Crowdfunding is a novel means of financing available to individual entrepreneurs or organizations (both non-profit and for-profit). They can raise money for their venture projects from investors through crowdfunding platforms instead of through formal financial intermediaries. Although the contribution of each online investor is relatively small, there are many of them (Mollick, 2014).

Some scholars have researched the motivation of crowdfunding participants. Gerber et al. (2012) have identified five motivations of founders: financing, building relationships, acquiring legitimacy, copying successful experiences and raising the participative awareness of sponsors through social media. Belleflamme et al. (2014) suggest that there are three factors encouraging funders to initiate crowdfunding, including financing statement, public attention and market reaction to their products or services. Summarizing previous research findings, we believe there are six motivations for entrepreneurial funders to participate in crowdfunding. These are financing, increasing the social focus on entrepreneurial projects, completing market tests of products or services, training early users, building relationships with stakeholders and attempting to obtain non-monetary entrepreneurship resources, and enhance entrepreneurial self-efficacy.

And, some scholars focus their research on the participative motivation of crowdfunding funders. Among representative conclusions, Wang and Fesenmaier (2003) consider that the participative motivation of crowdfunding funders contains usage effect, quality guarantee, funder identity and expected return.

III. Theoretical Framework and Hypothesis Development

In a crowdfunding situation, the typical central routes are detailed product specification and the setting of crowdfunding investment limits. These require careful thinking and rational analysis from the recipients of information, and thus central routes are more convincing than peripheral cues (Petty, Cacioppo and Goldman, 1981). But peripheral cues also possess unique functions with which information receivers could feel happy and make a positive evaluation (Gregg and Walczak, 2008). The representative peripheral cues include webpage design, celebrity endorsement, expert recommendation and assessment from followers.

Trust is mainly gained through two routes in the trading process. One is the direct trust that comes from individual judgment derived from the direct experience obtained from personal knowledge and interpersonal communication. The other route is the credit that derives from others’ opinions on a target object in the surrounding social environment (Kimery and McCord, 2002).

Crowdfunding projects could attract effective public attention through the tangible demonstration of products in accordance with mass reading habits, clear description of crowdfunding returns, and a series of platform strategies such as recommendations from industry experts, investors, or geeks. Funders also analyze market response indexes. For instance, the number of lovers, followers, interact topics, or backers without any material reward. Thus, funders will have trust in products and will make investment decisions accordingly.

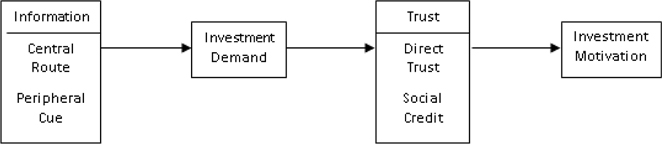

On this basis, we developed a model of investment decision-making processes in crowdfunding situations as shown in Figure 1. The investment demand of funders comes from their rational analysis (central route) and intuitive feel (peripheral cue). As funders know more about a crowdfunding project, they will increasingly have direct trust in the product. At the same time, social credit also strengthens the confidence in the product. As this trust grows to a certain level, the funders will generate strong investment motivation and invest in a crowdfunding project.

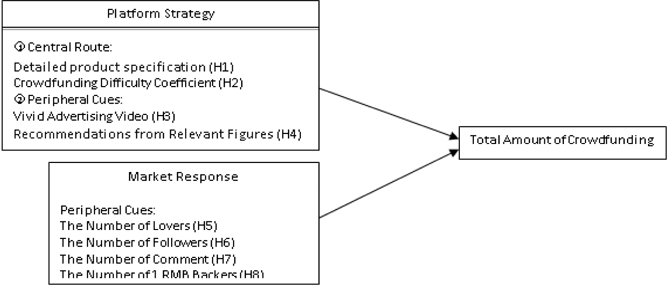

Based on the above analysis, this paper constructs a theoretical framework, as shown in Figure 2, to research the influences of platform strategy and market response on crowdfunding success via central route and peripheral cue.

2.1 Platform Strategy

Funders design a series of platform strategies on crowdfunding websites to arouse public attention. Regarding product tangible demonstration, the detailed product specification plays an important role in helping funders to make rational and objective analyses, which could increase product confidence and the probability of crowdfunding success. Thus, we assume that:

Hypothesis 1: Detailed product specification is positively related to the total amount of crowdfunding.

Crowdfunding difficulty coefficient can be used to show how much contribution the unit price of a product makes to its final funding goal, which embodies the technique of setting crowdfunding investment limits. The unit price of a product means that funders promise to sell their products at this price level to others. The final funding goal, based on a consideration of every possible angle, not only ensures attracting enough capital for mass production, but also understanding the real market demand of a crowdfunding product. Accordingly, we define the crowdfunding difficulty coefficient by the ratio of unit price with the final funding goal and formulate the following hypothesis:

Hypothesis 2: The crowdfunding difficulty coefficient is positively related to the total amount of crowdfunding.

Vivid advertising video is the most intuitive approach to product display and user experience, which can arouse funders’ interest and investment demand quickly. Thus, we establish the following hypothesis:

Hypothesis 3: Vivid advertising video is positively related to the total amount of crowdfunding.

Social credit can be enhanced by recommendations from relevant experts, investors and geeks. This can entice funders to build product confidence and make investment decisions. So, we formulate that:

Hypothesis 4: Recommendations from relevant figures are positively related to the total amount of crowdfunding.

2.2 Market Response

On crowdfunding websites, the number of lovers, followers, interact topics, and backers without any material reward are essential market response indicators. To some extent, these data can reflect public recognition of a crowdfunding project, which influence funders to generate good feeling toward a product and make investment decisions. Therefore, the following hypotheses can be articulated:

Hypothesis 5: The number of lovers is positively related to the total amount of crowdfunding. Hypothesis 6: The number of followers is positively related to the total amount of crowdfunding. Hypothesis 7: The number of comments is positively related to the total amount of crowdfunding. Hypothesis 8: The number of RMB1 backers is positively related to the total amount of crowdfunding.

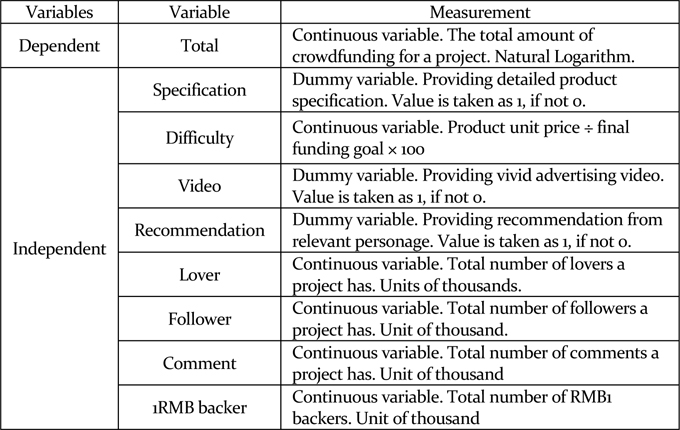

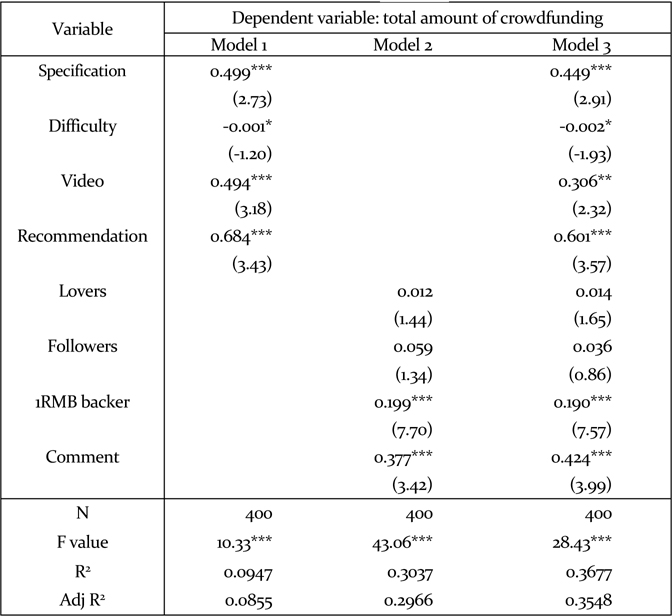

Dependent variable: the total amount of crowdfunding. Independent variable: platform strategy and market response. Variable definition and measurement are as shown in Table 1.

[Table 1] Variables and measurements

Variables and measurements

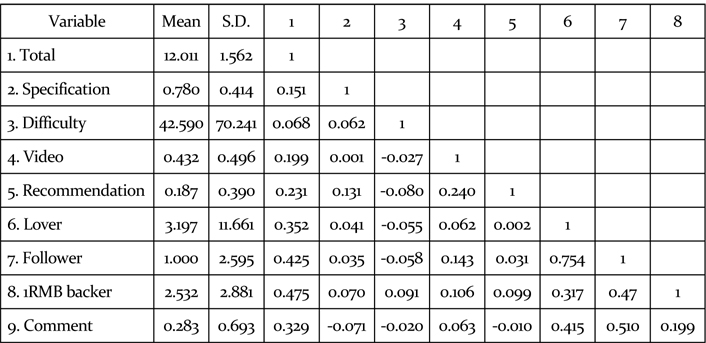

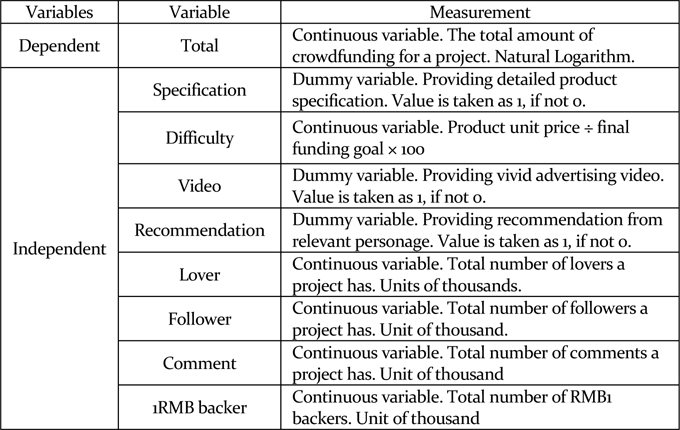

The JD e-commerce platform has increasingly gained brand value and drawn customer resources in the field of three ‘c’ products - computer, communication and consumer electronics - during the last ten years. This led JD Crowdfunding to quickly become the highest-quality crowdfunding platform for technology products in China since it launched in July 2014. Research data were collected from 400 technological crowdfunding projects using JD Crowdfunding. This avoided invalid conclusions resulting from differences among various crowdfunding platforms and it enhanced the ability to compare different sample data. The descriptive statistics of the sample are shown in Table 2.

[Table 2] Descriptive statistic and correlation coefficient analysis

Descriptive statistic and correlation coefficient analysis

Among the 400 samples, 78 percent of the projects provide detailed product specifications, while 43 percent provide vivid advertising video. Some 18.7 percent of the projects have recommendations from the sustained response of people. The mean value of crowdfunding difficulty coefficient is 42.59, while its standard deviation is 70.24, which clearly shows that there are many differences in the setting of crowdfunding investment limits. On average, each project has attracted 3,197 lovers, but there still exist differences among projects with the standard deviation11.66.

From the results of correlation analysis among variables, the three independent variables used to descript platform strategy - detailed product specification, vivid advertising video and recommendations from relevant people - have a significant positive correlation with the total amount of crowdfunding. However, the crowdfunding difficulty coefficient is negatively correlated with the total amount of funds. The result also shows that the four independent variables about market response; the number of lovers, the number of followers, the number of comments, and the number of 1 RMB backers. All the variables display a remarkably positive correlations with the total funding pledged.

According to the correlation analysis of all variables, the relation coefficients are all below the multi-contribution threshold value of 0.5 as per the empirical literature. Although, the relation coefficient between the number of followers and lovers is 0.754, and the relation coefficient between the number of followers and comments is 0.51, we run an analysis of variance inflation factor (VIF) on all variables. All the VIF values are below 2, which is below the empirical analysis threshold value of 10. We can conclude therefore that there is no serious co-linearity problem among all variables.

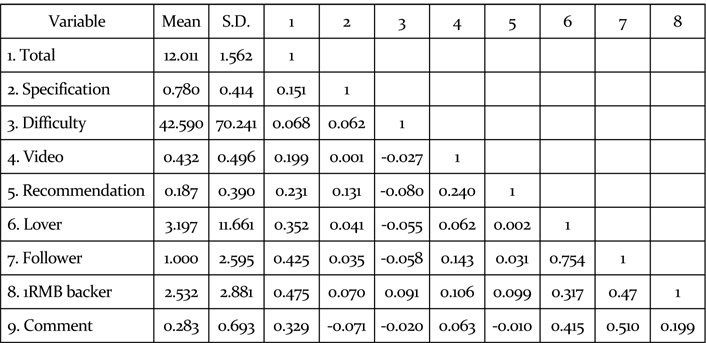

The dependent variable, total funds pledged, is a continuous data set whose observed value is above zero. The data is suitable for using the multi-linear regression under the rule of ordinary least square (Advanced Econometric and Stata Application, 2010). Table 3 shows the result of the regression analysis between the total funds pledged and platform strategy and market response.

[Table 3] OLS regression analysis

OLS regression analysis

Based on the findings, the overall model reaches a statistically significant level. From the result of the regression coefficient, the platform strategy factors - detailed product specification, vivid advertising video, and recommendation from relevant people - accelerate significantly the growth of total funding pledged.

Consequently, hypotheses 1, hypothesis 3, and hypothesis 4 are all supported. At the same time, the crowdfunding difficulty coefficient has a significant negative correlation with the total fund pledged (β= −0.002, p< 0.1). Thus, hypothesis 2 is supported as well. The result also revealed that the market response factors - the number of 1 RMB backers and the number of comments - have a significant positive correlation with total funding pledged. Thus, hypothesis 7 and hypothesis 8 are also supported.

Interestingly, the number of lovers and followers produce an insignificant positive correlation with the total amount of funding. This clearly shows that hypothesis 5 and hypothesis 6 are not supported by the data.

This paper explores the influences of platform strategy and market response on crowdfunding success, based on the ELM theory, and designs theoretical hypotheses using the empirical method. We can draw the following conclusions:

Firstly, detailed product specification, as one of the central routes, is an objective description of product features on the basis of which crowdfunding funders can make a rational analysis and promote investment to a significant degree.

Secondly, vivid advertising video and recommendations from relevant people are two peripheral cues that have a positive effect on investment decisions. Vivid advertising video is a tool to build up a good impression of a product, while using recommendations from relevant people to establish trust in the product quality.

Thirdly, the crowdfunding difficulty coefficient has a negative impact on the total amount of crowdfunding. When a product’s unit price is low while the funding goal is high, funders predict a low level of success in crowdfunding. Consequently, they become reluctant to make funding decisions or may even give up investing.

Fourthly, the number of comments and 1 RMB backers are two important peripheral cues that lead to a positive correlation with the total funding pledged. The number of comments reflects the concerns of crowdfunding followers, the more thoughtful the consideration, the greater the number of comments. The number of 1 RMB backers apparently represents the number of supporters who are willing to own a product. Although the currency value of RMB is very small, the behavior of 1 RMB investors shows a commitment by crowdfunding followers to support a project with practical action. So, these two factors enhance the possibility of crowdfunding success.

Lastly, the positive impact of the number of lovers and followers on total funding pledged turns out not to be significant. The rationale for these conclusions is, first, that funders who make investments do not click “like” or “follow” and, second, those who do show some interest in a product, but have no demand for it at this stage.

Crowdfunding research is still in its infancy in China. At present, it is a relatively small academic field. On the basis of collected data, this paper offers an analysis of crowdfunding in China that could be compared with similar studies carried out in Western countries. This will further accelerate Chinese studies by coming up with universal patterns or principles of successful crowdfunding for business.