When financial markets are unconstrained, redundant (financial) assets do not play a role in risk-sharing and thus they are useless. Therefore, without loss of generality, we can assume that there is no redundant asset. In reality, however, redundant assets such as futures and options exist because financial markets are subject to portfolio constraints. In financial markets, agents usually face portfolio constraints when they trade financial assets. Portfolio constraints capture market frictions such as short-selling constraints, credit limits, bid-ask spreads, margin requirements, and proportional transaction costs. It is noted that many of portfolio constraints (e.g., margin requirements) depend on asset prices. It is important to investigate how redundant assets and endogenous portfolio constraints affect equilibrium asset prices in financial markets.

The purpose of this paper is to show that there exists a competitive equilibrium in an exchange economy with incomplete financial markets, where agents are subject to portfolio constraints depending on asset prices. Aouani and Cornet (2011) and Hahn and Won (2014) among others demonstrate the existence of a competitive general equilibrium in an exchange economy with incomplete markets, where each agent’s asset trading is subject to exogenous portfolio constraints, which do not depend on endogenous variables. However, when agents participate in financial markets, they are often faced with endogenous portfolio constraints such as margin requirements, which depend on asset prices.

Several recent papers have studied this problem, including Carosi et al. (2009) and Cea-Echenique and Torres-Martinez (2014), among others. Carosi et al. (2009) describe portfolio constraints by restriction functions, which depend on first-period consumption and commodity prices, as well as financial asset prices. They assume that portfolio restriction functions are continuously differentible in order to characterize the generic regularity of equilibrium. Thus such approach cannot cover cases in which portfolio constraints are represented by convex cones (e.g., margin requirements). Moreover, by assuming that the payoff matrix has a column full rank, they exclude redundant assets such as financial derivatives, whose raison d'être is portfolio constraints.

Cea-Echenique and Torres-Martinez (2014) employ endogenous trading constraints represented by correspondences that depend on both commodity and asset prices. Restrictions on consumption and portfolio choices are incorporated into a single trading constraint set. Trading constraints are so general and can therefore cover collateralized borrowing constraints and income-based portfolio constraints. In particular, attainable allocations are price-dependent. However, they impose a restrictive assumption that the set of price-dependent attainable allocations is bounded. This assumption may not be fulfilled in constrained incomplete markets with redundant assets, in which asset demand correspondences are unbounded. Therefore, they de facto exclude financial derivatives from incomplete financial markets.

The rest of the paper is organized as follows: in Section II, we present the model of an exchange economy with incomplete markets where each agent is faced with endogenous portfolio constraints. In Section III, we define constrained arbitrage and provide additional assumptions for endogenous portfolio constraints. Section IV contains examples of endogenous portfolio constraints. In Section V, we show that a competitive equilibrium exists in the economy and present a numerical example of a competitive equilibrium. Section VI contains the concluding remarks.

The paper considers an exchange economy with financial asset markets, extending over two periods. There are I agents and J financial assets. The uncertainty of the second period is described by a finite set S :={1, ..., S} of states of nature. In the first period, no agent knows which state will be realized in the second period. The payoffs of asset j∈J :={1, 2, ..., J } are realized depending on the state in the second period. There are L commodities in each state s=S0 :=S◡{0} where the first period is regarded as state s=0. Therefore, the commodity space is equal to Rℓ where ℓ:=L(S+1).

In the first period, agent i∈I :={1, 2, ..., I} makes consumption xi(0) and invests portfolio θi with his endowments. In the second period, agent i makes consumptions (xi(s))s∈S with his endowments and payoffs of his portfolio. Hence, agent i chooses consumption bundle xi:=(xi(0), xi(1), ..., xi(S)) in his consumption set Xi⊂Rℓ, which contains his initial endowment ei of commodities. Preferences over Xi are represented by a preference relation ≻i on Xi, which is irreflexive, complete, and transitive. The preference relation ≻i defines the preference correspondence Pi:Xi →. by Pi(xi) :={ ∈Xi :≻ixi}, which is the set of consumption bundles that agent i prefers to xi. Agent i is subject to portfolio constraints, as represented by correspondence Θi : RJ → 2RJ of asset price q∈RJ. To finance his consumption in the second period, agent i chooses portfolio θi∈Θi(q) in the first period.

The payoff of asset j in state s∈S is denoted by rj(s), and the payoff vector of asset j over S states by an S dimensional column vector rj=(rj(s))s∈S. Payoff vector in state s is denoted by a J dimensional row vector r(s)=(rj(s))j∈J. We denote the asset payoffs by an (S×J) payoff matrix R=[(rj)j∈J]. An asset is called redundant if its payoffs can be replicated by those of the other assets. We allow redundant assets, i.e., V⊥≠{0} where V⊥={θ ∈RJ: R⋅θ =0}. We note that redundant assets do not play a risk-sharing role without portfolio constraints because their payoffs can be replicated by those of the other assets. In contrast, redundant assets participate in risk-sharing under portfolio constraints, which may prevent the replication of redundant assets. We represent this economy by E=<(Xi, ≻i, ei, Θi)i∈I; R>.

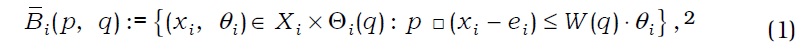

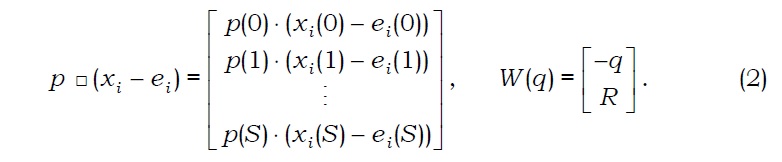

In the first period, agent i is subject to budget constraint p(0)⋅xi(0)+q⋅θi≤p(0)⋅ei(0), where (p(0), q)∈RL×RJ is a vector of commodity and asset prices in the first period. In the second period, he is subject to budget constraint p(s)⋅xi(s)≤p(s)⋅ei(s)+r(s)⋅θi, ∀s∈S, where p(s)∈RL is a vector of commodity prices at state s∈S. Therefore, given price vector (p, q)∈Rℓ× RJ, agent i maximizes his preference ≻i by choosing a pair (xi, θi) of consumption and portfolio in his budget set:1

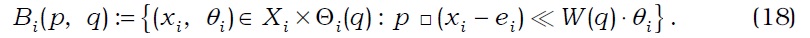

where

A pair (xi, θi)∈B̅i(p, q) is optimal for agent i if [Pi(xi)×Θi(q)]⌒B̅i(p, q)=∅.

Definition 2.1: A competitive equilibrium of economy E is a profile (p*, q*, x*, θ*)∈Rℓ×RJ×(Rℓ)×(RJ)I, such that

We now provide the list of basic assumptions for every agent i∈I, which are necessary for our main results.

Note that Assumptions (A1)-(A5) are standard assumptions. Assumption (A6) states that the portfolio constraint of agent i is represented by a convex-valued correspondence that has a closed graph. Moreover, Assumption A6 requires that portfolio constraints ‘nicely’ depend on asset prices. This assumption can cover market frictions such as short-selling constraints, bid-ask spreads, margin requirements, and proportional transaction costs.8 Moreover, Assumption (A6) states that portfolio choice sets depend solely on the relative price of assets.

1Let v and v’ be vectors in a Euclidean space. Then v≥v’ implies that v-v’∈ Rℓ+; v>v’ implies that v≥v’ and v≠v’; and v≫v’ implies that v-v’∈Rℓ++. 2Note that B̅i is a correspondence from Rℓ×RJ to Rℓ×RJ. 3The preference relation ≻i is continuous if Pi(xi) and Pi-1(xi) :={xi’∈Xi : xi≻ixi’} are open for every xi∈Xi, and is convex if Pi(xi) is convex for every xi∈Xi. 4For each xi∈Xi and for each s∈S there exists xi’(s)∈Xi(s) such that (xi’(s), xi(-s))≻ixi, where xi(−s) = (xi(0),…, xi(s − 1), xi(s + 1),…, xi(S)). 5Let A be a non-empty subset of a Euclidean space. The closure of A is denoted by cl(A) and the interior of A is denoted by int(A). 6Let X and Y be subsets of Euclidean space. A correspondence ϕ : X→2Y is lower hemicontinuous if {x∈X: ϕ(x)⌒V≠∅} is open for every open set V⊂Y and has a closed graph if Gϕ:={(x, y)∈X×Y: y∈ϕ(x)} is closed. 7The homogeneity of degree zero for constrained choice sets can be also found in and Page and Wooders (1999) and et al Carosi et al. (2009). 8See Heath and Jarrow (1987), Luttmer (1996), and Elsinger and Summer (2001).

When no portfolio constraints are present in incomplete markets, no arbitrage opportunity is admitted and therefore the law of one price holds in equilibrium. However, the law of one price does not hold in incomplete markets with portfolio constraints, and it is not appropriate to apply the notion of arbitrage used for unconstrained incomplete markets to constrained incomplete markets. The notion of constrained arbitrage is employed in Jouini and Kallal (1999) and Luttmer (1996), which study incomplete markets with exogenous portfolio constraints. To introduce an appropriate notion of arbitrage for incomplete markets with endogenous portfolio constraints, let Ci(q) denote the recession cone Γ(Θi(q)) of Θi(q).9

Definition 3.1: Asset price q∈RJ is said to admit a constrained arbitrage for agent i if there is a portfolio θi∈Ci(q), such that W(q)⋅θi>0. Asset price q∈RJ is said to admit no constrained arbitrage for economy E if it admits no constrained arbitrage for every agent i∈I.

No constrained arbitrage is equivalent to no arbitrage in unconstrained incomplete markets. Let Qi denote the set of asset prices that admit no constrained arbitrage for agent i. Then, Q: ∩i∈IQi is the set of asset prices that admit no constrained arbitrage for E. Let Ni(q) be the lineality space of Θi(q).10 We define N0(q)=Σi∈I(Ni(q)⌒V⊥) and denote by N0(q)⊥ its orthogonal complement in RJ. Let us define Q*:={q∈Q: q∈N0(q)⊥}. The following results show what is appropriate for equilibrium asset prices.

Proposition 3.1: It holds that Q and Q* are non-empty.

Proof : To show Q≠∅, suppose otherwise, that is, Q=∅. Consider q=λ ⋅R with λ ∈. Since Q=∅, we see that q∉Q. Then there is some agent i with θi∈Ci(q) satisfying W(q)⋅θi>0, which makes q⋅θi=λ⋅R⋅θi≥0 necessary. If q⋅θi>0, then q∈Q, then q∈Q, which is a contradiction. If q⋅θi=λ ⋅R⋅θi=0, then R⋅θi=0. This implies that q∈Q, which is a contradiction. Hence, Q is non-empty.

To show Q*≠∅, suppose otherwise, that is, Q*=∅. Take any q∈Q, and we have q∉N0(q)⊥. Then there exists v∈N0(q) such that q⋅v<0 without loss of generality. Since there exists vi∈Ni(q)⌒V⊥, ∀i∈I such that v=Σi∈Ivi, it follow that q⋅vi<0 for some i. Noting that vi∈Ci(q) and R⋅vi=0, we see that vi is a constrained arbitrage opportunity at q. Therefore, q∉Qi and q∉Q, which is a contradiction. Hence, Q* is nonempty.

Proposition 3.2: Under Assumption (A4), an equilibrium asset price q belongs to Q*.

Proof: Let (p, q, x, θ) be an equilibrium of E. Suppose that q∈Q. Then there is some i∈I with vi∈Ci(q) satisfying W(q)⋅vi>0. This implies that θi+vi∈Θi(q) and W(q)⋅θiW(q)⋅(θi+vi). Due to Assumption (A4), there exists a consumption bundle xi’∈Xi, such that xi’≻ixi and (xi’, θi+vi)∈B̅i(p, q), which contradicts the optimality of (xi, θi ) in B̅i(p>, q). Hence, q∈Q.

We now show that q∈N0(q)⊥, that is, q⋅v=0 for all v∈N0(q). Suppose otherwise. Then there exists v∈N0(q) such that q⋅v<0 without loss of generality. Since there exists vi∈Ni(q)⌒V⊥, ∀i∈I such that v=Σi∈I vi, it follow that q⋅vi<0 for some i. Noting that vi∈Ci(q) and R⋅vi=0, we see that vi is a constrained arbitrage opportunity at q. That is, q∉Qi, and therefore q∉Q, which is a contradiction. Hence, q∈N0(q)⊥. ■

From Proposition 3.2, we see that Q* is an appropriate set of equilibrium asset prices and that Q and Q* appear as cones with vertex zero under Assumption (A6). We observe that Q* may not be convex. Therefore we consider Q̂ which is the convex hull of Q*. Then Q̂ is a nonempty convex cone.

We now impose a portfolio survival condition, which states that there is no constraint on trading for sufficiently small amount of portfolios.

To analyze the effects of redundant assets on risk-sharing in constrained asset markets, we need to examine feasible zero-income portfolios. We call portfolios in Ci(q)⌒V⊥ scale-free feasible zero-income portfolios for agent i in that, if vi∈Ci(q)⌒V⊥, we have λ vi∈Θi(q) and R⋅(λvi)=0 for every λ≥0. Particularly, if q∈cl(Q̂)\{0}, some agent i may have a portfolio vi∈Ci(q)⌒V⊥ satisfying q⋅vi≤0. Therefore, in the presence of scale-free feasible zero-income portfolios, some agent’s portfolio choices may be unbounded with his budget constraint satisfied. To prevent such negative effect of scale-free feasible zero-income portfolios at the aggregate level, we need the following assumption:

If Assumption (A8) does not hold, there is an asset price q∈cl(Q̂)\{0}, such that some agent i has a scale-free feasible zero-income portfolio vi∈Ci(q)⌒V⊥, which is supported by the other agents because -vi∈Σj≠iCj(q)⌒V⊥. Therefore, agent i can hold an indefinite amount of portfolios in the direction of vi such that the budget constraints of all agents and the market clearing condition are not violated. This possibility is eliminated by Assumption (A8).

9Let A be a non-empty convex subset of Euclidean space X. The recession cone of A is the set Γ(A)={v∈E: A+v⊂A}. When A is closed, Γ(A) is also closed and can be expressed as Γ(A)={v∈X:∃{xn} in A and {an} in R. with an → 0 such that anxn → v} 10The lineality space L(A) is the maximal subspace in A, that is, L(A)=Γ(A)⌒[-Γ(A)].

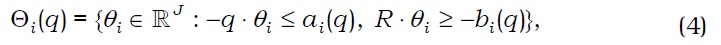

Financial intermediaries prohibit short-selling above specific limits, which can depend on asset prices. Financial regulation prohibits the purchase of some securities above given limits, which may also depend on asset prices. Let continuous functions ai: RJ→RJ and bi: RJ→RJ take the values of the short-selling limits or buying limits of agent i on securities, respectively. The portfolio constraints of agent i can therefore be described by

where 0∈(ai(q), bi(q)), ∀q∈RJ, ai: RJ→RJ, and bi: RJ→RJ are continuous functions and homogeneous of degree zero in q.

Financial intermediaries can provide credit to agents with limits that depend on asset prices. In this case, the trading strategies of agent i are restricted such that

where ai: RJ→R++ is a continuous function and homogeneous of degree one in q and bi: RJ→ is a continuous function and homogenous of degree zero in q.

Financial assets such as collateralized debt obligation (CDO) are used as debt instruments and should be backed by a pool of other financial assets. Supposing that security 1 is a risk-less bond, we can express portfolio constraints in the following form:11

where θi-=(-min{0, θij})Jj=1, θi+=(max{0, θij})Jj=1, ai∈R+, and bi∈R++. It is obvious that the portfolio correspondences of the above examples satisfy Assumptions (A6) and (A7).

As in Heath and Jarrow (1987), portfolio constraints that involve margin requirements can be described as

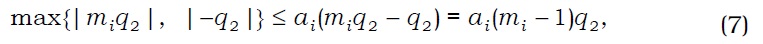

where security 1 is risk-less bond, ai≥2, and bi∈R++. For example, assume that J=2 and bi=0.12 Suppose that security 1 is risk-less bond and security 2 is a stock. Now suppose that agent i shorts one stock and maintains a margin account with mi proportion of the stock price in the bond. The portfolio constraint is therefore reduced to

which implies that mi≥ai/(ai-1). In the case where ai=3, we have mi≥3/2, that is, agent i should put the money from shorting the stock and an additional fifty percent of the stock price in his margin account.

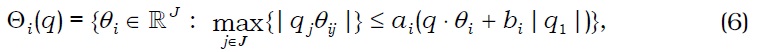

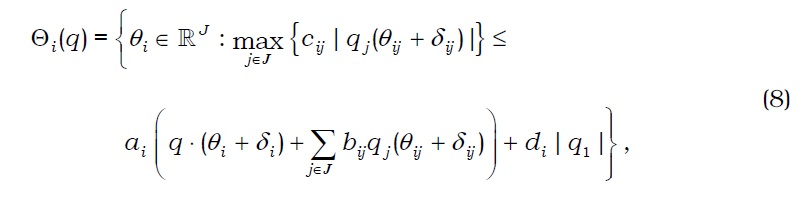

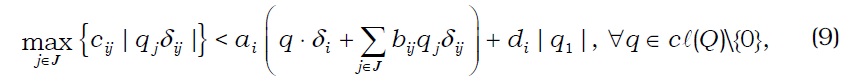

Won (2003) provides a more generalized form of the example in Heath and Jarrow (1987). Assuming that security 1 is a risk-less bond with qi=1, we modify his example to present the portfolio constraint set of agent i at q∈cl(Q)\{0} by

where ai≥1, bij≥0, cij≥0, di>0, and δij>0 are constants for every i and j and δi=(δij). It is obvious that Θi has a closed graph and satisfies the homogeneity of degree zero. If we assume that

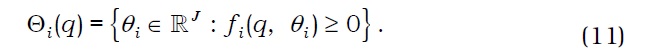

we have 0∈lnt(Θi(q)), ∀q∈cl(Q)\{0}. To see that Θi is convex-valued, we define continuous function : RJ × RJ→R by

The portfolio constraint correspondence is then given by

We can observe that maxj{⋅} is a convex function on RJ and |⋅| is a convex function on R, which implies that -maxj∈J {cij|qj(θij+δij)|} is a concave function of θi. Hence, we see that is a concave function function of θi and therefore Θi is convex-valued.

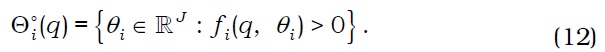

To show that Θi is lower hemicontinuous, we define correspondence Θi°: RJ →2RJ by

Suppose θi*∈Θi°(q*), that is, (q*, θi*)>0. Take a sequence {(qn, θin)} converging to (q*, θi*). Since is continuous, for sufficiently large n,

which implies that θin∈Θi°(qn). Thus we see that Θi° is lower hemicontinuous. Noting that Θi(q)=cl(Θi°(q)), we see that Θi is lower hemicontinuous. Hence, Θi satisfies Assumptions (A6) and (A7). □

11This example is adapted from Elsinger and Summer (2001). 12To be precise, bi should be sufficiently close to zero.

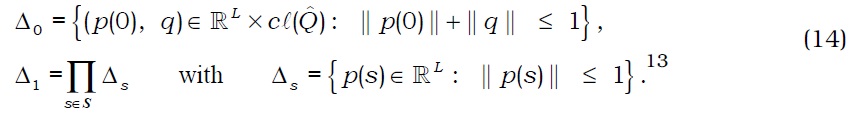

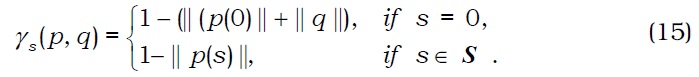

In this section, we will show that there exists a competitive equilibrium of economy E. We define the sets of normalized prices by Δ=Δ0×Δ1, where

We observe that Δ is compact and convex.

̂Let X :=Πi∈I Xi and AX :={(x1, ..., x I)∈X: Σi∈I (xi-e i)=0}. We denote by X̂i the projection of Xi onto AX and let X̂: Πi∈I X̂i. To consider a sequence of truncated economies, we take an increasing sequence {(Kn, Mn)} of compact convex cube pairs with center 0 such that Kn⊂Rℓ with X̂i⊂int(K1), and Mn⊂RJ with 0∈int(M1) which satisfy ∪nKn=Rℓ and ∪nMn=RJ. For each n and i∈I, we define Xin :=Xi⌒Kn, Θin(q) :=Θi(q)⌒Mn, Xn :=Πi∈I Xin, and Θn(q) :=Πi∈I Θin(q). Moreover, the preference correspondence Pin : Xin → 2Xin is defined by Pin (xi) :=Pi(xi)⌒Xin.

We denote by En the truncated economy <(Xin, Pin, ei, Θin)i∈I>. We observe that each Xin is compact and each Θin is lower hemicontinuous with non-empty compact convex values and has a closed graph. Moreover, each Pin inherits the properties of Pi. We define function γ : Δ → RS+1 by γ (p, q)=(γs(p, q))s∈S0 with S0=S◡{0}, where

Let Ψin=Mn, ∀ i∈I, and Ψn=Πi∈I, Ψi. For every i∈I and every n, we define correspondences B in: Δ → 2Xin×Ψin and B̅in: Δ → as follows:

Proposition 5.1: Under Assumptions (A1)-(A7), for each n, there is a profile (pn, qn, xnθn)∈Δ×Xn×Θn(qn) such that

where zn(s):= Σi∈I(xin(s)-ei(s)) for every s∈S0.

Proof: See Appendix. ■

Lemma 5.1: Suppose that Assumption (A6) holds. Let {(qn, θin)} be a sequence in RJ × RJ with qn → q* and θin∈Θi (qn). Suppose that {an} be a sequence in R+, such that an → 0. If sequence {an θin } converges to vi, then vi∈C>i(q*).

Proof: Apply 3.2 Lemma on p. 396 of Page (1987) to Θi. ■

From Proposition 5.1, we obtain an equilibrium existence theorem for economy E.

Theorem 5.1: Under Assumptions (A1)-(A8), economy E has a competitive equilibrium.

Proof: Take a sequence {(pn, qn, xnθn)} of profiles obtained in Propostion 5.1. Since each Xi is closed and bounded from below, X̂i is compact and so is X̂. Noting that {(pn, qn, xn )}∈Δ×X̂, without loss of generality, we may assume that {(pn, qn, xn )} converges to (p*, q*, x*)}∈Δ×X̂.

Claim 1: Σi∈I(xi*-ei)=0 and Σi∈Iθi*=0, where (xi*, θi*)∈X i × Θi(q*) for each i∈I.

Proof: From (d) of Proposition 5.1, it is immediate that Σi∈I (xi*-ei)=0. To show Σi∈Iθi*=0, we claim that sequences {θin} for each i∈I are bounded. Suppose otherwise. For each n, we set an=(1+Σi∈I ‖θin‖)-1, which converges to 0. We see that anθin∈Θi(qn) and sequence {anθin} for each i∈I are bounded. Thus, without loss of generality, it converges to vi for each i∈I. Since Σi∈I anθin=0 for all n, it holds that Σi∈I vi=0 and Σi∈I‖vi‖=1, which implies that vi≠0 for some i∈I.

Using Lemma 5.1, we see that vi∈Ci(q*). On the other hand, pn(s)⋅(xin(s)-ei(s))≤r(s)⋅θin+γs (pn, q n) for all n and s∈S. By multiplying both sides of the inequalities by an and passing to the limit, we obtain R⋅vi≥0. In view of Σi∈I vi=0, we obtain R⋅vi=0, that is, vi∈V⊥. This implies that vi∈Ci(q*)⌒V⊥. Since Σi∈I vi=0, by Assumption (A8), we obtain vi=0 for all i∈I, which leads to a contradiction.

Therefore, {θin} is bounded for each i∈I. Without loss of generality, we may assume that {θin} converges to θi*. From Assumption (A6) and (d) of Proposition 5.1, it follows that θi*∈Θi(q*) and Σi∈Iθi*=0. □

Claim 2: γ (p*, q*) = 0.

Proof: This immediately follows from (e) of Proposition 5.1. □

Claim 3: (xi*, θi*)∈B̅i(p*, q*)

Proof: This directly follows from (a) of Proposition 5.1 and Claims 1 and 2. □

Claim 4: p*(0) ≠ 0.

Proof: If p*(0)=0, agent i has xi∈Xisuch that xi≻ixi* and (xi, θi*)∈B̅i(p*, q*) in view of Assumption (A4) and Claim 3. Since p*(s)≠0, ∀s∈S due to Claim 2, by Assumption (A5), there is xi°∈int(Xi) such that p*(s)⋅xi°(s)≪p*(s)⋅ei(s), ∀s∈S. Since ‖q*‖=1 by Claim 2, Assumption (A7) ensures that there exists θi°∈int(Θi(q*)) such that q*⋅θi°<0. Then, for t∈(0, 1) sufficiently close to 1, we see that txi+(1-t) xi°≻ixi* and p*□ [txi+(1-t)xi°-ei]≪W(q*)⋅[tθi*+(1-t) θi°] with tθi*+(1-t) θi°∈Θi(q*). Since Θi is lower hemicontinuous, there exists a sequence {θ̂in} converging to t(θi*+(1-t) θi° such that θ̂in∈Θi(qn), ∀n. Therefore, for sufficiently large n, we have txi+(1-t) xi°≻ixin and pn□ [txi+(1-t)xi°-ei] ≪W(qn)⋅θ̂in with txi+(1-t)xi°∈Xin and θ̂in∈Θin(qn). This is a contradiction in view of of Proposition (b) and (e) of Proposition 5.1. Hence, it follows that p*(0)≠0. □

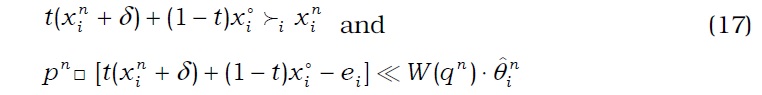

Claim 5: q*∈Q*.

Proof: First, we show that q*∈Q. Suppose otherwise. Then there is some agent i who has a portfolio θi ∈Ci(q*) satisfying W(q*)⋅θi>0. Assumption (A4) ensures that there exists δ∈Rℓ such that xi*+δ≻ixi* and p*□δ<W(q*)⋅θi. Claim 3 implies that p*□(xi*+δ-ei)<W(q*)⋅( θi*+θi) with θi*+θi∈Θi(q*). Note that Claims 2 and 4 imply that p*(s)≠0, ∀s∈S0. Assumption (A5) allows us to take xi°∈int(Xi), such that p*□ xi°≪p*□ei. Therefore, for t∈(0, 1) sufficiently close to 1, we obtain t(xi*+δ)+(1-t)xi°≻ixi* and p*□[t(xi*+δ )+(1-t)xi°-ei]≪W(q*)⋅[t(θi*+θi)]. Since t(θi*+θi)∈Θi(q*) and Θi is lower hemicontinuous, there exists a sequence {θ̂in}converging to t(θi*+θi) with θ̂in∈Θi(qn). For sufficiently large n,

with t(xin+δ)+(1-t)xi°∈Xin and θ̂in∈Θin(qn). This is a contradiction in view of (b) and (e) of Proposition 5.1. Hence, q*∈Q.

We now show that q∈N0(q*)⊥, that is, q*⋅v=0 for all v∈N0(q*). Suppose otherwise. Then we have some v∈N0(q*) such that q*⋅v<0 without loss of generality. Since there exists vi∈Ni(q*)⌒V⊥, ∀i∈I such that v∈Σi∈Ivi, it follow that q*⋅vi<0 for some i. Noting that vi∈Ci(q*) and R⋅vi=0, we know that vi is a constrained arbitrage opportunity at q*. Applying the same arguments presented in the previous paragraph, we arrive at a contradiction. Hence, q*∈N0(q*)⊥ and therefore q*∈Q⌒N0(q*)⊥, that is, q*∈Q*. □

Let us now define the open budget set of agent i by

Claim 6: [Pi(xi*)×Θi(q*)]∩Bi(p*, q*) = ∅.

Proof: Suppose that the claim does not hold. Then there is some i∈I with (x̂i, θ̂i)∈ [Pi(xi*)×Θi(q*)]⌒Bi(p*, q*). Noting that Pi-1 is open-valued by Assumption (A3), we see that Pi-1 is lower hemicontinuous. Since Pi and Θi are lower hemicontinuous and Bi has an open graph, the correspondence (p, q, xi) ↦ [Pi(xi)×Θi(q)]⌒Bi(p, q) is lower hemicontinuous. Therefore there is a sequence {(x̂in, θ̂i n)} converging to (x̂i, θ̂i) such that (x̂in, θ̂in )∈[Pi(xin)×Θi(qn)]⌒Bi(pn, qn). For each t∈(0, 1) and each n∈N, we set yin(t) :=(tx̂in+(1-t)xin, tθ̂in +(1-t) θin). Observe that, for sufficiently large n, we obtain yin(t)∈xin × Θin(qn) and thus yin(t)∈Bin(pn, qn) by aim 2. Therefore, for sufficiently large n, we have yin(t)∈[Pin(xin)×Θin(qn)]⌒Bin(pn, qn), which contradicts (b) of Proposition 5.1. Hence, [Pi(xi*)×Θi(q*)]⌒Bi(p*, q*)=∅. □

Claim 7: For every i∈I, [Pi(xi*)×Θi(q*)]∩B̅i(p*, q*) = ∅.

Proof: Suppose that the claim does not hold. Then there is some i∈I with (x i, θi)∈[Pi(xi*)×Θi(q*)]⌒B̅i(p*, q*). Since Claims 2 and 4 imply that p*(s)≠0, ∀s∈S0, by Assumption (A5), we can take (x i’, θi’)∈Bi(p*, q*)≠∅. Assumption (A3) implies that for t∈(0, 1) sufficiently close to 1, t(x i, θi)+(1-t)(x i’, θi’)∈[Pi(xi*)×Θi(q*)]⌒Bi(p*, q*), which contradicts Claim 6. Hence, [Pi(xi*)×Θi(q*)]⌒B̅i(p*, q*)=∅. □

By Claims 1, 3, and 7, we prove that (p*, q*, x*, θ*) is a competitive equilibrium for economy E. ■

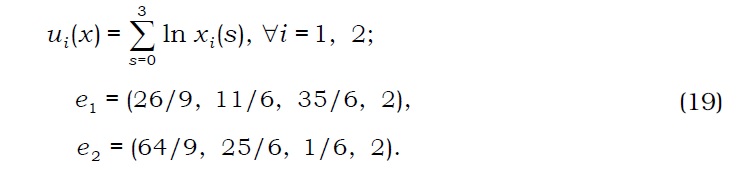

Example 5.1: We consider an exchange economy with I=2, L=1, J=3, and S=3. The utility functions and initial endowments of agents are provided as follows:

Let Xt=R4+, ∀i=1, 2 and consider the commodity as a numéraire. Payoff matrix is given by

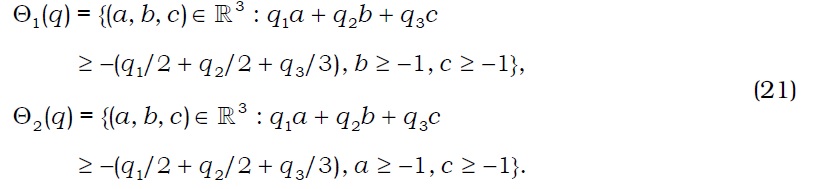

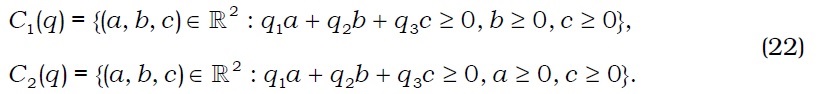

This allows us to restrict no-arbitrage asset prices to R3++. Note that V⊥={v∈R3: v=λ(1, 1, -1),λ∈R}. Portfolio constraints for agents are described by:

The recession cones of these constraints are:

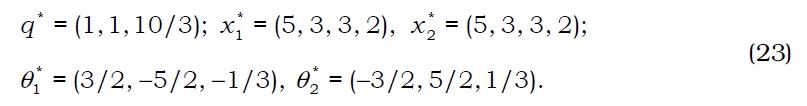

Define R+ :={θ∈R3: R⋅θ>0}. Since Ci(q)⌒R+=R3+ for all i and q∈R3++, we find that Q=R3++, which is a nonempty open convex cone. We denote a competitive equilibrium of the economy by (q*, (x1*, x2*), (θ1*, θ3*))∈R2+×(R4)2 × (R3)2. Then it follows that

Since Ci(q*)⌒V⊥={0} for all i=1, 2, we see that Assumption (A8) is trivially holds. Note that the law of one price does not hold and that thefirst inequality constraint of agent 1 is binding at the equilibrium. □

13‖⋅‖ is the Euclidean norm.

It is shown that there exists a competitive equilibrium in a two-period exchange economy with incomplete markets where redundant assets are present and portfolio constraints are represented by a lower hemicontinuous correspondence of asset prices. Most of general equilibrium models, which study incomplete markets with endogenous portfolio constraints, either express portfolio constraints in terms of differentiable restriction functions that describe the boundary of constraints, or de facto exclude redundant assets. The present paper not only models endogenous portfolio constraints via correspondences of asset prices, but also considers the risk-sharing role of redundant assets in incomplete markets. Assumption (A8) plays a key role of excluding the unboundedness of scale-free zero-income portfolios, which arises due to redundant assets. Future possible directions of research include weakening Assumption (A8) for more general results and extending the results of this paper to economies with multiperiod incomplete markets.