본 연구는 신기술기반 벤처기업이 국내 벤처캐피탈의 투자를 유치하기 위한 인적 자본과 전략적 제휴의 보증효과 관계를 규명하였다. 벤처기업의 인적 자본과 외부 전략적 제휴가 벤처캐피탈에게 투자에 관한 긍정적인 신호 효과를 유발하는가와 함께 벤처캐피탈의 투자가 벤처기업의 성장에 미치는 영향을 살펴 보았다. 연구를 위하여 신호이론을 기반으로 두 가지 접근방법을 적용하였다 먼저, 신기술기반 벤처기업의 내재가치와 국내 벤처캐피탈에게 보증효과를 주는 조직 신호가 무엇인지 탐구하였다. 그리고 성장하고 있는 신기술기반 벤처기업에 벤처캐피탈의 투자가 중추적인 역할을 하는 지 분석하였다. 이러한 가정을 아시아 개발도상국의 대표적인 사례에 해당하는 국내 신기술기반 벤처기업들에 적용하여 검증하였다. 인적 자본 변수에서 기업가의 관련 산업분야 경험, 대기업의 비즈니스그룹과 협업 및 보증효과 변수에서 벤처기업의 인증은 벤처캐피탈의 투자를 유인하는 결과를 나타냈다. 반면에 창업자의 교육 수준은 벤처캐피탈의 투자유치 효과와 기업의 성장에 유의한 영향을 미치지 않는다는 결론을 도출하였다.

Developing countries need to strengthen their research capabilities in order to catch up with advanced countries. For this, a country’s activities to develop, adapt and harness its innovative capacity are critical for its economic performance in the long run(Ernst, 2005; Ernst & Naughton, 2008). As new technology-based ventures(NTBVs), which are an important means for the commercialization of new technological discoveries and introduce disruptive technologies and perform the role of Schumpeterian entrepreneurship, or“creative destruction,” in the economy, they are an especially important source of new jobs and provide a crucial stimulus to national economies(Audretsch, 1995; Timmons & Bygrave, 1986). So the factors that drive their performances have increasingly attracted the attention of entrepreneurship scholars as well as policy makers in developing countries. NTBVs need a greater amount and variety of resources for research and development(R&D) and marketing to differentiate and commercialize new technologies compared to traditional businesses. So, it is very important for NTBVs to obtain the requisite resources from external resource holders. However, NTBVs involve not only uncertainty that general ventures possess but also additional uncertainty, for new technology is by its nature highly uncertain(Tushman & Rosenkopf, 1992). For these reasons, NTBVs are extremely risky. Such uncertainty makes resource holders hesitant to provide resources to NTBVs, so they have difficulty in obtaining the requisite resources in the markets(Colombo & Grilli, 2007; Peneder, 2008). Resource-holders therefore assess value by estimating the conditional probability that NTBVs will succeed, given a set of observable characteristics of the organization. First, important constituencies such as potential investors make quality judgments through careful consideration of internal value. In industries in which innovation is one of the pivotal bases of competition, firms with many patents signal their ability to create future advances and to capitalize on scientific developments that may be relevant to the firm's commercial interests(Cohen & Levinthal, 1990; Henderson & Cockburn, 1994; Kogut & Zander, 1996). The second category of information evaluators can use to estimate the worth of NTBVs is external endorsement. Therefore, the identity of endorsing organization becomes a primary consideration when potential investors decide whether to commit their resources to NTBVs.

It is obvious that venture capitals(VCs) typically provide resources to NTBVs(Kim & Kutsuna, 2014). VCs are risk-taking capitals and mainly invest in new companies with professional capabilities(Lerner, 1999). In developed countries, relatively efficient markets for capital and labour, easy access to complementary business services, and consistent enforcement of property right, as well as relatively corruption-free government and independent judiciary, all permit VCs to provide their resources by the rules of the game. However, in developing countries where many of these institutions exist in relatively weak form, the investment pattern of VCs in developing countries may differ from one of VCs in developed countries such as USA. Given this situation, very few studies have paid their attention to the pattern of investment decision of VCs in the developing countries and there is research gap in the field of entrepreneurship and venture capital. Therefore, the research question of this study is “How do venture capitals invest NTBVs in developing countries?” To address the research question, the present study employs insight from signalling theory which is a body of theoretical work examining communication between individuals and of which central question is when organisms with conflicting interests should be expected to communicate honestly(no presumption being made of conscious intention) rather than cheating(Podolny, 1993; 2001; Spence & Michael, 1974; Spence, 1973). Applying signaling theory, researchers have proposed that signaling can act to reduce the information asymmetry for outside investors(Deeds et al., 1997a). Like most signaling models, this study is interested here in examining signaling as a means to communicate the inherent quality of the firm. Furthermore, this study is interested in examining signals as a way of overcoming unfavorable information concerning a venture.

This study is different from other studies. Most of other studies have been interested in the investment pattern of VCs in the general context. But, we paid our attention to it in the context of developing region and our research purpose is to show the difference of it according to different contexts. We examine two ways. First, what are the internal value of NTBVs and the identity of endorsing organization signalling to VCs’ investment in developing countries? Second, do VCs play a pivotal role for the growth of NTBVs in developing countries? This study then tests these hypotheses using the NTBVs in Korea which is regarded as an example of developing countries in South East Asia. The empirical findings from this study confirm these hypotheses and have important implications for both academia and practitioners.

2.1 Internal value of NTBVs and VC investment in developing country

The human capital perspective suggests that human capital is an important variable that has an influence on entrepreneurial opportunity(Dimov & Shepherd, 2005). Human capital includes an entrepreneur’s knowledge which has been acquired through education and experience. The knowledge set plays a critical role in intellectual performance, which may help business development. It also assists in cumulating and integrating new knowledge as well as in adapting to new situations(Weick, 1996). In developing countries, human capital is more heterogeneous and scarcer than in highly developed countries. Therefore, human capital is more likely to create competitive advantage in the developing world. Especially, new technology industries involve the use of sophisticated and complex technologies, and they typically require extensive knowledge and research in dynamic and uncertain environments(Khandwalla, 1976; Utterback & O’Neill, 1994). Human capital should help particularly in such knowledge-intensive industries because knowledge and valid information reduce uncertainty associated with innovation and dynamic environments(Kirzner, 1997; McMullen & Shepherd, 2006). And high human capital assists such owners to learn new tasks and roles and to adapt to new situations(Weick, 1996). In contrast, owners of mature businesses have a “track record,” routines and established practices they can refer to. Over the years, variables other than the owners' human capital may become more important. Therefore, in developing countries, human capital is a critical internal value for success in NTBVs, which can be a positive signal to VCs. Relevant studies show that an entrepreneur’ human capital is an important determinant of venture capitals’ investment decision making. For example, venture capitalists depend largely upon the expected abilities of an entrepreneur for decision making(MacMillan et al., 1985). Burton et al.(2002) maintain that if an entrepreneur of venture firm possesses fame through previous founding, or he/she has more human capital, the possibility of obtaining venture capital investment would increase. And Colombo & Grilli(2010) suggest that entrepreneur’s human capital in NTBVs will lead venture capitals’ investment, because entrepreneur’s capital is positively related to firm performance.

Human capital theory maintains that knowledge provides individuals with increases in their cognitive abilities, leading to more productive and efficient potential activity(Schultz, 1959; Becker, 1964; Mincer, 1974). Two key demographic characteristics such as education and experience underlie the concept of human capital(Becker, 1964). First, formal education is one component of human capital that may assist in the accumulation of explicit knowledge that may provide skills useful to entrepreneurs. However, there is no consistent correlation between the educational level of founders and the performance of ventures. Roberts(1991) suggested an inverted-U shaped relationship between new venture performance and educational level, with performance(whether measured by survival or growth) increasing to Master’s degree level then dropping at the PhD level since highly academic people are mainly oriented toward research. Stuart & Abetti(1988) also found that entrepreneurs with PhD degrees performed less well than those with Master degrees. However, Roberts(1991) noted an industry-specific exception to his finding: In bio-science, an emergent industry at the time, founders with a PhD appeared to be more successful(Podolny, 2001). As the effect of educational level on the performance of a venture can vary depending on the characteristics of the business environment, it is necessary to consider the situation in any empirical study(Bates, 1995; Honig, 1998). It requires an innovative strategy in order to make high performance in highly uncertain environments like a new technology sector(Ford, 1988; Khan & Manopichetwattana, 1989; Scherer & Ross, 1990; Zahra & Bogner, 2000). Therefore, NTBVs possessing entrepreneurs with high educational background are more likely to succeed, which is an important determinant of venture capitals’ investment decision making. Second, human capital is not only the result of formal education, but includes experience and practical learning that takes place on the job, as well as nonformal education, such as specific training courses that are not a part of traditional formal educational structures(Davidsson & Honig, 2003). Especially, prior experience of the entrepreneurs relevant to their industry is very important for the success of new ventures(Colombo & Grilli, 2005). The relevant industry experience of top managers facilitates not only the obtaining of information and knowledge about suppliers, customers, opportunities, threats, competition, and regulations, but also the networking that they need for their survival(Kor, 2003). It is difficult to obtain these skills and knowledge in the field of information technology because the sector itself is at the initial stage of distribution of relevant information and knowledge. Also, there are very few top managers with relevant industry experience, so relevant industry experience of top managers can be a competitive asset that competitors cannot imitate, for they cannot be obtained easily in the market(Castanias & Helfat, 1991; Kor, 2003). Because NTBVs lack legitimacy and their businesses have a lot of uncertainty, they have difficulty in establishing relationships with suppliers or customers in their industries. Given this situation, the relevant industry experience of founders can facilitate the establishing of relationships with suppliers or customers, which, in turn, decrease the hazard of failure(Cooper et al., 1994; Stinchcombe, 1965). Studies maintain that founders without relevant industry experience increase the risk of failure, especially in the new technology sectors, and conversely, relevant industry experience of the founders positively influences the growth of ventures(Bruderl et al., 1992; Colombo & Grilli, 2005; Cooper et al., 1994). Therefore, NTBVs possessing entrepreneurs with relevant industry experience are more likely to succeed, which is an important determinant of venture capitals’ investment decision making.

2.2 External endorsement of NTBVs and VC investment in developing country

In developed countries, market-based transactions provide access to most needed elements of resources such as finances, human resources, technology etc. Relatively efficient markets for capital and labor, easy access to complementary business services and consistent enforcement of property rights as well as relatively corruption-free government permit individual entrepreneurs to raise capital, hire human resources, learn about customer demands, and play by the rules of the game. In developing countries, by contrast, where many of these institutions exist in relatively weak form, NTBVs need to act strategically to gain legitimacy is to get endorsed by respectable organizations. NTBVs involve considerable uncertainty. Entrepreneurs try to reduce this uncertainty by gaining legitimacy from well-regarded individuals and organizations. Zimmerman & Zeitz(2002) argued that legitimacy, which connotes a social judgment of acceptance, appropriateness, and desirability, is a resource by itself that enables startups to access other resources needed for survival and growth and helps startups overcome the liability of newness. Although startups can gain legitimacy by conforming passively to the demands and expectations of the existing social structure(DiMaggio & Powell, 1983; Suchman, 1995), they can also do so by acting strategically(Zimmerman & Zeitz, 2002). For instance, startups can choose more favorable environments(Porter, 1980), manipulate their environment by teaming with other successful organizations(Oliver, 1991), and create environments with new norms, values, and models(Aldrich & Fiol, 1994). Several studies have found great variance in startups’ ability to gain access to resources and stable relationships, which in turn leads to differences in these startups’ early performances(Baum, 1996; Fichman & Levinthal, 1991).

Therefore, in developing countries, external endorsement is a critical for success in NTBVs and can be a positive signal to VCs. Two key respectable organizations, business group(BG) and government, can play a pivotal role to endorse NTBVs which would be a positive signal to VCs. First, strategic alliances with BGs would provide endorsement for NTBVs. BGs dominate private sector activites in many emerging markets, arising in response to market failure and policy inducements(Ghemawat & Khanna, 1998). Although precise definitions vary across countries such as groups economies, business houses, chaebols, etc., common point is that BGs are conglomerations of nominally independent firms that operate under common administrative and financial management and often controlled by families(Chang & Hong, 2000). BGs control a substantial fraction of a country’s productive assets and account for the largest and most visible of the country’s firms. So they can contribute to innovation through intangible assets such as business reputation and government tie by substituting for functions that stand-alone institutions provide in developed countries(Teece, 1996). BGs are respectable organizations that can provide various resources including human resources, technology, or markets as well as finance. Therefore, in developing countries, NTBVs can obtain their requisite resources by collaborating with BGs. And, by establishing a strategic alliance with a highly reputable partner, venture companies can receive the benefit of the reputation and induce resources from the possessors. Stuart et al.(1999) and Stuart(2000) argue that the reputation of strategically allied partners provide the endorsement. Stuart et al.(1999) argue that as the uncertainty of ventures increases, the endorsement effect which strategic alliances provides increases. Furthermore, Chang(2004) shows that in the internet industry, the reputation of the alliance partner of the ventures provides the role of endorsement. Especially, Podolny & Stuart(1995) argue that if BGs adopt some new technology, it can be widely used by achieving social recognition. BGs often control a substantial fraction of a country’s productive assets and account for the largest and most visible of the country’s firms(Granovetter, 1995; Khanna & Palepu, 1997). In particular, unlike in developed countries, because BGs fill the gap left by market failure, they can provide resources for the innovation of ventures and thus influence the survival and growth of ventures. Therefore, due to high uncertainty of NTBVs, VCs have difficulties in evaluating the value of NTBVs directly and thus are reluctant to provide their resources. Given this situation, collaborations with BGs play the role of endorsement to make VCs positively evaluate the potential of NTBVs. This endorsement induces VCs to provide their resources to NTBVs and consequently perform well. Second, a variety of supports from governments would provide endorsement for NTBVs. Governments of developing countries trying to catch up with technological advancement have a legitimate incentive to seriously consider socioeconomic externalities of sponsoring NTBVs. Thus they often intervene in the market for corporate creation and development. Studies in financial economics argue that due to capital market imperfections, it is difficult for NTBVs to obtain the external financing they need; in turn lack of adequate funds hinders firms’ growth and even threatens survival(Carpenter & Petersen, 2002a and Carpenter & Petersen, 2002b). Under the situation of capital market imperfections, the government provides R&D fund directly to early-staged NTBVs, in which VCs are reluctant to invest, to maximize socioeconomic externalities of them(Griliches, 1998; Lach, 2000). For example, Tan & Tay(1994) investigated the factors that influence the growth of small firms and suggested that financial support from the government was major a factor. Therefore, in developing countries, NTBVs can obtain their requisite resources through supports of governments. And by obtaining supports from governments, venture companies can receive the benefit of the reputation and induce resources from the possessors. Lerner(1999) suggests the government support plays the role of endorsement. He found that the firms that receive SBIR obtain more investment of VCs than other firms. More interesting thing is that the amount of support is not important but the support itself provides the positive signal of endorsement. Unfortunately, there are not more researches than Lerner(1999)’s study that suggest the role of endorsement of the government’s support. In particular, unlike in developed countries, because governments fill the gap left by capital market imperfections, they can provide resources for the innovation of ventures and thus influence the survival and growth of ventures. Therefore, due to high uncertainty of NTBVs, VCs have difficulties in evaluating the value of NTBVs directly and thus are reluctant to provide their resources. Given this situation, supports from governments play the role of endorsement to make VCs positively evaluate the potential of NTBVs. This endorsement induces VCs to provide their resources to NTBVs and consequently perform well.

2.3 The mediating role of venture capitals’ investment

As resource providers, VCs are helpful for ventures. Gompers & Lerner(1997; 2001) argue that VCs provide financial resources needed for ventures and their portfolios can grow faster, for they can get additional investment from VCs and they are not in financial trouble. And, Davila et al.(2003) argue that ventures that receive more funding are able to hire, retain, and pay talented employees, who are critical to ventures’ growth and help them list their stocks in the stock market, which means an initial public offering(IPO) more quickly. Baum & Silverman(2004) suggest that VCs are not only investors but also allegedly perform an important “coach” function. They provide their portfolios with constantly services in fields such as: strategic planning, marketing, finance, accounting and human resource management, where these firms typically lack internal capabilities. Simultaneously, other resource holders can view VCs’ investment as a strong signal of ventures’ quality and future prospects(Spence & Michael, 1974; Freeman, 1999; Podolny, 2001; Stuart et al., 1999). VCs are evaluated on their ability to generate high returns for their investors. Since they take a fraction of the proceeds, they are motivated to generate high performance. Moreover, VCs that have a history of delivering extraordinary returns find it easier to raise funds from investors. Thus, VCs are unlikely to invest in ventures that have poor future prospects. In addition, since VCs often help ventures by performing “coach” function, they increase the chance that ventures become successful. Thus, endorsement by respectable VCs not only signals the quality of a venture but also serves as a vote of confidence in the venture. By doing so, the endorsing organizations’ legitimacy carries over to the recipient, providing it credibility, contact, and support for the entrepreneurs, building a venture’s image, which in turn, other resource holders will provide their resources actively(Spence, 1973; Freeman, 1999; Podolny, 2001). Megginson & Weiss(1991) maintain that VC-backed ventures go public faster than the non-VC-backed one. Chang(2004) argues that the higher the reputation of ventures, the more money internet ventures raise from VCs, the faster they have an IPO. As this study reviews the relevant literatures, the human capitals of entrepreneurs and the endorsement of respectable organizations would influence the growth of NTBVs(Khandwalla, 1976; Utterback & O’Neill, 1994; Kirzner, 1997; McMullen & Shepherd, 2006; Weick, 1996; Stuart et al., 1999; Stuart, 2000; Chang, 2004; Podolny & Stuart, 1995; Tan & Tay, 1994; Lerner, 1999). This study suggests that they lure investment of VCs in developing countries. And relevant studies maintain that VCs provide their tangible and intangible resources to NTBVs and induce passive resource holders to provide their resources, and so in turn NTBVs can acquire the necessary resources they need to perform well. Therefore, this study raises the possibility of mediating role of VCs between the human capitals of entrepreneurs/the endorsement of respectable organizations and the growth of the NTBV.

The original target research sample consists of 1,253 KOSDAQ(Korea Securities Dealers Automated Quotation) stock market listed firms from July 1, 1996 to December 31, 2005. Data were collected from DART(Data Analysis, Retrieval and Transfer System), which is an electronic disclosure system that allows companies to submit disclosures online(www.dart.fss.or.kr). This study supplemented the database with diverse approaches such as newspaper articles, publications, corporate homepages and phone calls to the firms. To define our final sample for analysis, this study had to consider changes in economic conditions at the turn of the century. This study first limited samples to information technology(IT) firms founded after 1990, because business ventures in Korea have developed as the IT industry has expanded quickly during 1990s(Chung & Choi, 2008). The Korean government had consistently loosened the listing requirements for the KOSDAQ market to encourage the provision of listed firms from July 1996 when the KOSDAQ stock market opened. But, by the early 2000s, the KOSDAQ market had collapsed(Nam & Kim, 2006; Lee, et al., 2013). With rapid market readjustment, IT firms faced a dramatic drop in stock prices. Internet companies were hit hardest elsewhere. Moreover, market factors were aggravated due to insufficient restructuring, misdeeds of venture managers and unfair trading in the KOSDAQ market. With the overall venture industry experiencing a dramatic shakeout, the government raised the registration standards for the KOSDAQ market(Lee, 2002). The KOSDAQ market was under-valued from July 1, 1996 to late 1998 due to the so called “IMF financial crisis” and the bursting of the dot-com stock market bubble from early 1999 to the first half of 2000. Thus, we also limited samples to the firms which went public after July 1, 2000 to eliminate the unusual bias caused by these dramatic changes in market conditions. After eliminating firms of which the CEO is not a founder or a major shareholder, this study came up with the final sample of 170 KOSDAQ-listed firms for analysis.

3.2.1 Independent variables

3.2.1.1 Human capital

Educational level

A founder’s level of formal education is calculated based on a classification of the founder’s information according to two levels. The higher level is a master’s or doctorate degree. The lower level is an undergraduate degree or lower.

Industry experience

The previous work experience takes on the value 1 if a founder has worked in a related industry before and 0 otherwise. The functional background takes on the value 1 if a founder’s undergraduate major or career experience is in output functions and 0 otherwise.

3.2.1.2 Endorsement

Collaboration with a BG

Korean commercial law defines about 900 firms with assets of over 2 trillion Won as a business group. More generally, they regard the 30 largest firms ranked by assets as so called ‘Chaebols’, announced by the Fair Trade Commission from 1995 to 2005. Collaboration with a BG includes supply agreements, joint R&D, share participation, and joint ventures. We define large companies as the 30 largest firms ranked by assets. This research defines a BG as an enterprise among the 30 largest firms as declared by the Fair Trade Commission. This study uses a binary variable to measure a strategic alliance with a BG that takes on the value of 1 if allied with BGs(strategic alliance with BG = 1) and 0 otherwise(no strategic alliance with BG = 0).

Government Support

In the research context, Korean government provided some support program of venture company certification. Under the venture company certification program enacted in 1998, the Small and Medium Business Administration designates qualified venture companies as ‘official venture company’ based on the stipulated regulations. This certification system is based on the ‘Special Law for the Promotion of Venture Businesses.’ This is quite a unique institution because there is no similar legislation case in the other countries. Korean government provides certified venture companies with various benefits such as tax benefits, generous stock option issues, extended guarantee by government owned financial institution, preferred supplier status for government purchase, alleviated public stock offering requirements, and so forth. This study uses binary variable to measure the firm obtained venture company certification that takes on the value of 1 if received venture company certification(venture company certification = 1) and 0 otherwise(non-venture company certification = 0).

3.2.2 Mediating variables

Venture capital investment

Previous research suggested that the investment of VC affects the time to IPO. Gompers and Lerner(1997; 2001) argue that venture firms that have obtained VC investment go public faster than firms without VC investment. Venture firms endorsed by VC can secure additional financial resources at the proper time, thus they can grow relatively fast. In addition, venture firms endorsed by VC attain rapid growth, because VC often helps venture firms by providing non-financial resources such as marketing support, managerial advice, human resources supply, and alliance arrangements with potential customers and suppliers, all of which can increase the chance that these start-ups become successful. An endorsement by a respectable VC investor also signals the quality of a venture firm. By doing so, the endorsing organization’s legitimacy carries over to the recipient, providing it credibility, contact, and support for the founders, building a start-up’s image, and facilitating the start-up’s access to resources. Therefore, the reputation of VC helps venture firms go to IPO faster(Gompers, 1996; Yoon et al., 2010). This study uses a binary variable to measure VC support that takes on the value of 1 if it received VC(VC investment = 1) and 0 otherwise(no VC investment = 0).

3.2.3 Dependent variables

The growth of NTBVs

NTBVs exploit business opportunities with differentiated technology in areas of rapid technological change. NTBVs are under a higher level of uncertainty than existing firms, thus, they lack sufficient financial resources for R&D and marketing compared to existing firms. An IPO allows a firm to tap a wide pool of investors to provide it with capital for future growth, repayment of debt, and/or working capital. And once a firm is listed, they are able to enhance their reputation by introducing the firm’s value outside of the firm. But, IPO firms sometimes exhibit a decline in post-issue operating performance because there is potential for higher agency conflicts, lower ownership retention, and IPO expenses(Degeorge & Zeckhauser, 1993; Jain & Kini, 1994). Despite these drawbacks, NTBVs have no choice but to implement IPOs as a crucial strategy and try to reduce the time required to IPO. Researchers thus adopt the IPO event as a measure for the rate of the NTBVs’ growth(Chang, 2004; Stuart et al., 1999). The time to IPO is measured by months since the date of founding. This study takes the logarithm of this variable for the adjustment of scale.

3.2.4 Control variables

3.2.4.1 Industry sub-type characteristics

Characteristics of industry sub-types affect venture firm’s time to IPO(Chang, 2004; MacMillan et al., 1985; Stuart et al., 1999). The market stage also influences on alliance formation(Eisenhardt & Schoonhoven, 1996). We defined an IT firm as the firm assigned an IT index when listed on KOSDAQ. IT KOSDAQ index classifies communications and broadcasting, IT software, and IT hardware. Communications and broadcasting includes communications services and broadcasting services. IT software covers internet, software, computer services, and digital contents whereas IT hardware covers communications equipment, IT equipment, and semiconductor, and components.

3.2.4.2 Stock Market Conditions

Stock market conditions influence the time to IPO(Chang, 2004; Ritter, 1991; Stuart et al., 1999). Founders and financial investors tend to decide to go public because high subsequent investment returns are expected from the buoyant stock market for IPOs. The IPO process in Korea usually takes 3 months. This study thus measures the stock market condition as the composite stock exchange index of KOSDAQ from 3 months before the IPO date.

3.2.4.3 Firm Size

This study controls for firm size. Firm size is used to account for the greater resources and choices available to larger firms with a greater ability to invest in technology and innovation as well as potential scale advantages(Scherer & Ross, 1990). This study measures firm size as the log(10) of yearly sales just before the IPO.

4.1 Descriptive statistics and correlations

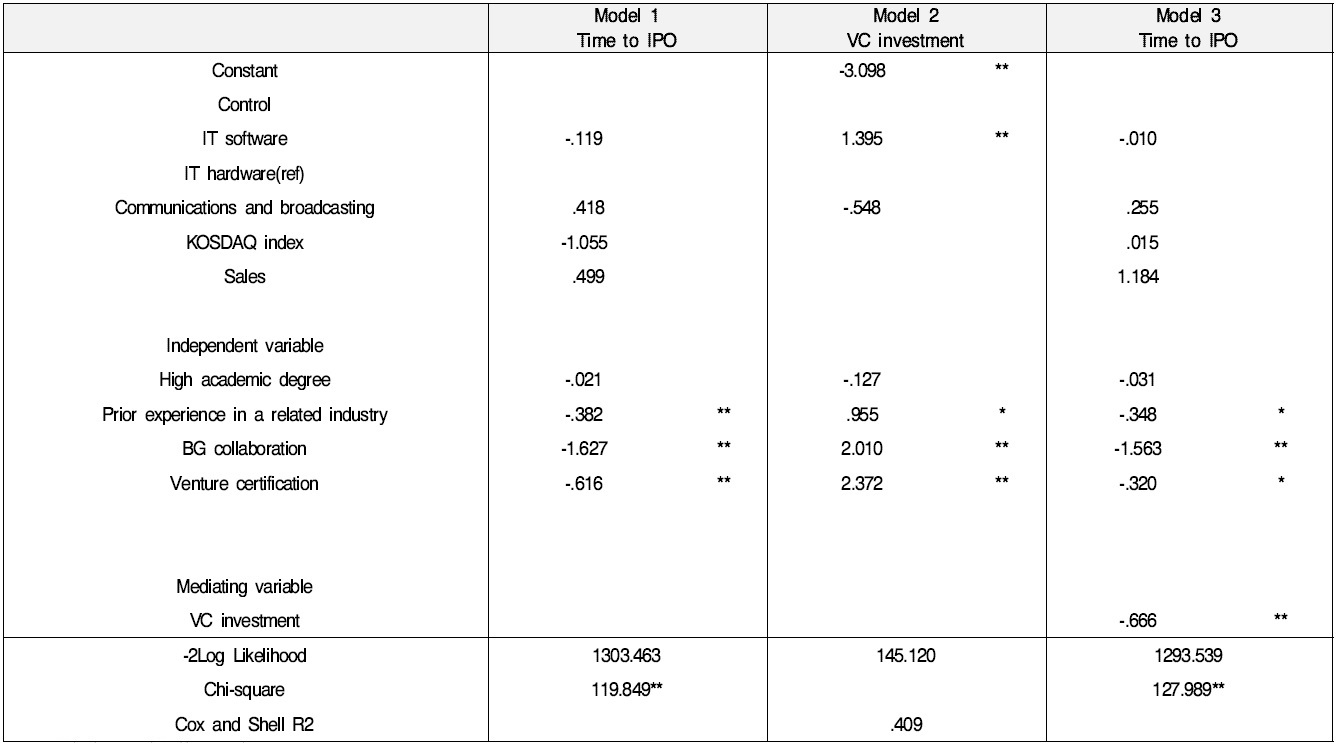

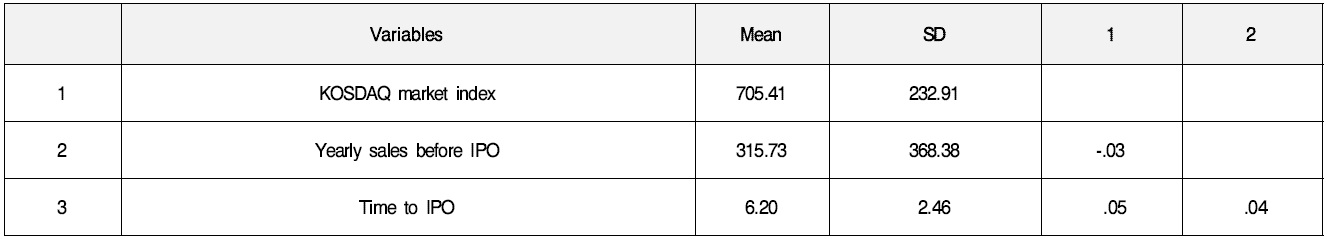

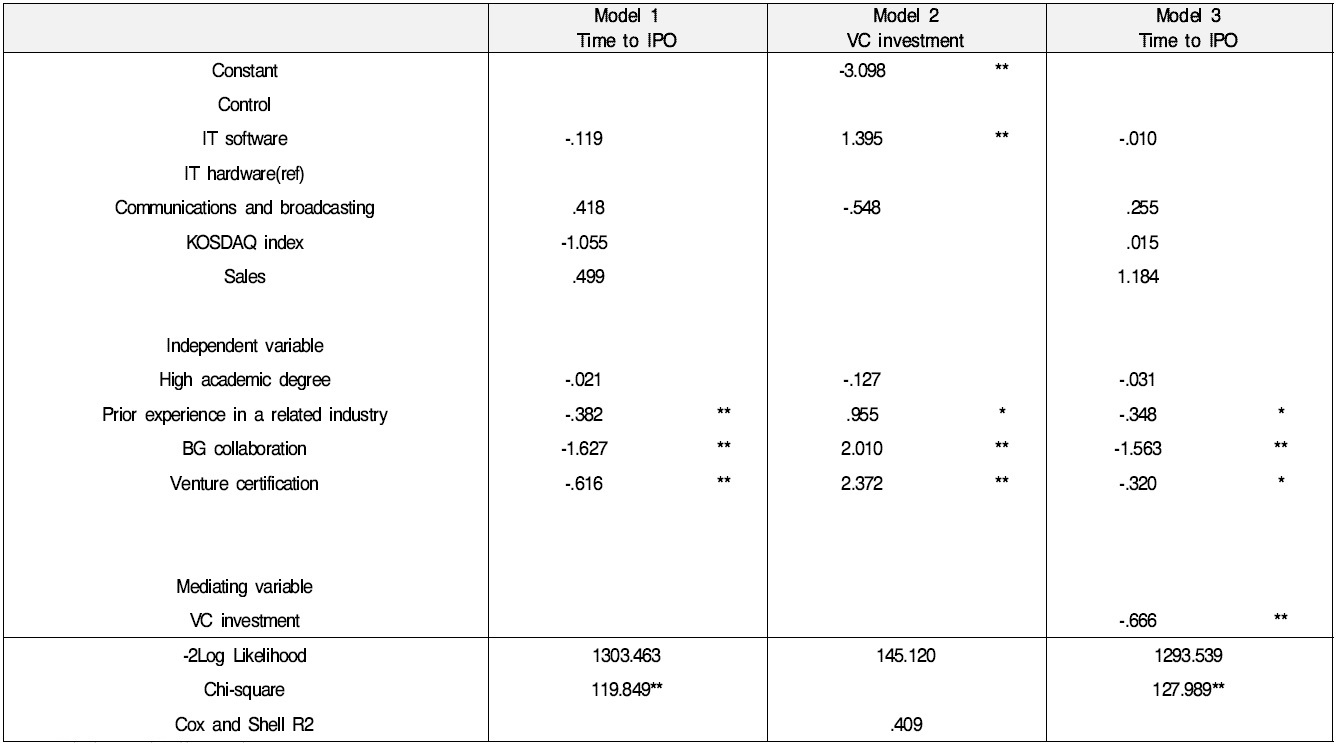

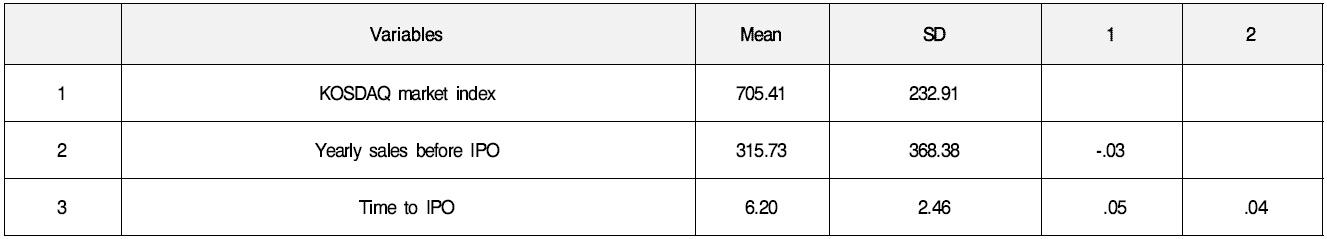

Descriptive Statistics and Correlations < Table 2 > presents the results of our study. Results of Regression Analyses

4.2.1 Logistic regression(Hypotheses 1, 2)

Logistic regression was employed to test Hypotheses 1 and 2 in the Model 2. We added the VC’s investment as a dependent variable. We conduct logistic regression because the dependent variable is measured not on a quantitative scale, but on a qualitative scale. The binary variable of VC’s investment follows binominal distribution, not normal distribution. We show the result of this test in the following section.

4.2.2 Survival analysis(Hypotheses 3, 4)?

Survival analysis was employed to test Hypotheses 3 and 4 in the Model 1 and 3. We use the time to IPO as a dependent variable. A longitudinal statistical analysis method may be used both in the analysis of qualitative and quantitative data(Tuma & Hannan, 1984). The dependent variable of this analysis method is the time to the occurrence of an event or the rate of an event occurring that a researcher is interested in. This study adopts the Cox Regression Model, which is a widely used statistical model to investigate the complex relationship between survival time and other factors. To test the mediating role of the alliance with a BG, the present study adopts the four steps of Baron & Kenny(1986). Baron & Kenny(1986) suggest four steps to establish mediation. Step 1 requires that the independent variable is significantly related to the dependent variable; step 2 requires that the independent variable is significantly related to the mediator; step 3 requires that the mediator affects the dependent variable while controlling for the effect of the independent variable. And finally, when these conditions are satisfied, step 4 requires that the effect of the independent variable on the dependent variable is insignificant when controlling for the mediator in order to indicate complete mediation; otherwise partial mediation is indicated. The effects in both steps 3 and 4 are estimated in the same regression equation. Model 1 tests the relationship between independent variables and firms’ growth which explain control variables, independent variables, and the dependent variable of time to IPO. All of the control variables are not significant. Among independent variables, related-industry experience of an entrepreneur(p < .01), BG collaboration(p < .01) and venture certification(p < .01) are negatively significant to time to IPO. However, the relationship between level of education of a founder and time to IPO is not significant. It means that the NTBVs whose entrepreneurs have prior experience in related industries or which have BG collaboration or receive venture certification are more likely to grow faster. Model 2 tests the relationships stated in Hypotheses 3, 4, explaining the dependent variable of VC’s investment. IT S/W in control variables is positively significant to VC’s investment. Related-industry experience of an entrepreneur(p < .05), BG collaboration(p < .01) and venture certification(p < .01) are positively significant to VC’s investment. However, the relationship between level of education of an entrepreneur and VC’s investment is not significant. It means that NTBVs whose entrepreneurs have prior experience in related industries or which have BG collaboration or receive venture certification are more likely to receive VCs’ investment. Therefore, Hypotheses 1-2, 2-1, and 2-2 are supported. In the final step of the mediation analysis, the growth of NTBV was regressed on independent variables, VC’s investment, and the control variables. Model 3 indicates that the negatively significant relationship( Literature often suggests that the level of education is, beyond major, positively related to the receptivity of innovation(Guthrie et al., 1991; Wiersema & Bantel 1992). This study , thus, maintain that the innovative propensity of entrepreneurs in the situation of NTBVs can provide a positive signal to VCs’ investment, which in turn facilitates the growth of NTBVs. Our statistical analysis, however, shows that entrepreneurs’ educational level has no significant effect on the VCs’ investment. Entrepreneurs’ previous work experience in a related industry, however, does have a statistically significant signalling effect in VCs’ investment. Some of research findings are consistent with those statistical results. Gimmon & Levie(2009) argue that a founder’s advanced academic background has no significance on the survival of NTBVs. While, Colombo & Grilli(2005) suggests that an education in economics/management or science/engineering influences positively the growth of NTBVs. These arguments imply that founders’ related industry knowledge and skill from are more significant factors in NTBV performance than the academic background. These empirical results suggest that an entrepreneur’s specific knowledge and skill through relevant industry experience have a critical impact on the growth of NTBVs, but that educational level does not. However, Gimmon & Levie(2009) argue that an entrepreneur’s advanced level academic background lures venture capital’s investment. Such conflicting results can be explained by considering the developing country. Dahlstrand(2001) compared entrepreneurs from corporate with ones from university. Entrepreneurs from university have advantage of technology development, while ones from corporate have strengths in creating profitability and sales growth. In developed countries, relatively efficient markets for capital and labour, easy access to complementary business services, and consistent enforcement of property right, as well as relatively corruption-free government and independent judiciary, all permit VCs to provide their resources by the rules of the game. However, in developing countries where many of these institutions exist in relatively weak form, VCs consider these market failures as an important factor in investment decision making and are interested more in realization of financial performance than in ability of technology development. Therefore, Korean venture capitals consider industry experience as being more important than educational level when they evaluate entrepreneur’s human capital. This study provides some contributions. First, it contributes to theory and literature on entrepreneurship and strategy in developing countries by developing and testing a mediating model that provides an explanation of the NTBV performance relationship. From a signalling theory perspective, it is important to understand the resource providers which lure VC’s investment as a linkage between internal value and external endorsement and the NTBV growth in a developing country. Second, in the practical aspect, this study found that because there is market failure in developing countries, VCs entrepreneurs’ concrete and specific knowledge background and the endorsement by BGs and government are important factors for their investment decision making and also investigates the mediating role of VCs for the growth of NTBVs in a developing country. Therefore, NTBVs in a developing country should consider these factors to receive the investment from VCs. Some limitations of this study, along with directions for future research, are also worth noting. First, this study adopts time to IPO as a measure for venture performance. Related research measures the time to IPO as the indicator of NTBV’s growth(Chang, 2004; Deeds et al., 1997a; 1997b; Stuart et al., 1999). This study believes this event is a meaningful interim measure of a NTBV performance because plenty of financial resources are required to maintain venture firm consistency. This measure is not perfect since not all the ventures decide to go public. Thus, this study acknowledges the limitation in using time to IPO as a performance indicator. Second, this study believes that further examination regarding the NTBV entrepreneurs’ social capital is warranted to better understand the implications of the signalling mechanism. Prior research shows that the social capital of start-ups within the framework of the governmental incubator program seems to be weak, as indicated by the non-significant effect of social capital for attracting outside resources(Green et al., 1999; Honig et al., 2006). However, from a differentiated perspective on social capital, it is required to investigate the signalling effect of other variables such as reputation and prestige(Harrison & Freeman, 1999). This suggests that an examination of the moderating role of school prestige on the signalling mechanism of the educational level of founders. A further limitation regards limited variables explaining entrepreneurs’ human capital. The various types of human capital, such as entrepreneurial mind-set, and learning ability can be understood as firm resources applying signalling theory. Baumol et al.(2009) cast doubt on the proposition that a higher level of technical education will bring more entrepreneurial thinking and learning abilities. Future studies would benefit from considering those variables in order to assess if links to the various types of human capital affect performance as a firm develops. Finally, using diverse dependent variables would significantly improve our understanding on the signalling mechanism of entrepreneurs’ human capital. This study adopts time to IPO as a dependent variable to investigate the signalling effect of founder’s human capital. Prior research measuring NTBV performance with market value in the course of IPO as well as time to IPO(Stuart et al., 1999) has shown that the influence of resource holders signalling mechanism on time to IPO and firm value evaluation are differentiated. Time to IPO is a firm performance indicator and this suggests that for resource holders who provide resources for firm growth it may serve an important role as a signal of promising performance in the growth stage of ventures, while market value at IPO can be used to measure how the ventures are valued in the IPO process. Prior studies argue that underwriters, institutional investors and individual investors act as a signal and so influence market value at IPO(Megginson & Weiss, 1991; Podolny 1993). These signalling effects may be helpful to new ventures that have not yet proven to be viable. Further study is thus necessary in order for us to understand the exact nature and extent of these relationships. Specifically, further investigation is needed to test the signalling effect of entrepreneurs’ human capital and the endorsement by respectable organization such as BGs and government on the evaluation of NTBVs at IPO. presents means, standard deviations, and correlations for the measures. VIFs(variance inflation factors) for all the regression models are less than 2, which are well below the guideline of 10 recommended(Chatterjee et al., 2000). The features of the sample firms are described as follows. The yearly sales just before the IPO are 315 billion won on average and we can tell those firms are SMEs. In the IT industry, less than 1% of firms are in communications and broadcasting, 47 % of the firms are in the IT software(internet, software, computer services, and digital contents), and 49 % of the firms are in IT hardware(communications equipment, IT equipment, semiconductors, and components). The founders with a master’s or doctoral degree are 29 %, and with related industry experience are 45 %. 51 % of the firms had alliances with BGs and 56% of the firms are certified as venture companies. 75% of the firms obtained VCs investment. The dependent variable, the time to IPO, it is 6.2 years on average.

] Descriptive Statistics and Correlations

] Results of Regression Analyses

참고문헌

참고문헌

80.

Stuart R., Abetti P. A.

(1988)

The field study of technical ventures part III: The impact of entrepreneurial and management experience on early performance, In Frontiers of Entrepreneurship Research, ed. Bruce A. Kirchhoff, Wayne A.. Long, W. ED McMullan, Karl H. Vesper and William E. Wetzel, Jr., 177-193.

이미지 / 테이블

이미지 / 테이블

[

<Table 1>

]

Descriptive Statistics and Correlations

[

<Table 2>

]

Results of Regression Analyses

[

<Table 2>

]

Results of Regression Analyses