본 연구는 벤처중소기업의 조직여유와 기업성과간의 관계에서 기업명성의 매개효과를 분석하기 위한 실증분석 연구이다. 즉 기업규모, 기업연령, 사회적 자본, 환경불확실성을 통제한 뒤, 다음의 세 가지 가설을 검증하였다. 첫 번째 가설은 벤처중소기업의 조직여유(흡수된 여유, 흡수되지 않은 여유)가 기업명성에 유의한 긍정적인 영향을 미치는 지 여부이다. 두 번째 가설은 벤처중소기업의 기업명성이 기업성과에 유의한 긍정적인 영향을 미치는 지 여부이다. 세 번째 가설은 앞에서 분석한 두 가설을 바탕으로 벤처중소기업의 조직여유(흡수된 여유, 흡수되지 않은 여유)와 기업성과간의 관계에서 기업명성이 유의한 긍정적인 매개역할을 수행하는 지 여부이다. 이와 같은 가설을 검증하기 위해 설문지 조사법을 사용하여 유효한 250개의 기업수준 데이터를 확보하여 실증분석에 활용하였다. 실증분석은 SPSS 18.0을 통해 빈도분석, 타당도분석, 신뢰도분석, 상관관계분석, 다중회귀분석을 사용하였다.

이러한 실증분석 결과, 세 가지 의미 있는 결과를 도출하였다. 첫째, 벤처중소기업의 조직여유 유형 중 현금, 유가증권 등과 같은 흡수되지 않은 여유는 기업명성에 유의한 영향을 미쳤으나, 초과인력, 초과설비 등과 같은 흡수된 여유는 기업명성에 유의한 영향을 미치지 않았다. 이는 벤처기업의 특성상 급변하는 환경변화에 유연하게 대응하는 것이 매우 중요하므로, 현금, 유가증권과 같은 흡수되지 않은 여유가 유연하게 전략적으로 활용될 수 있음을 의미한다. 둘째, 벤처중소기업에서의 기업명성은 기업성과에 유의한 영향을 미친다, 이는 벤처중소기업에서도 제품품질, 윤리경영, 사회적 책임(CSR) 등과 같은 기업명성 관리가 기업성과와 기업생존에 영향을 미칠 수 있음을 시사한다. 셋째, 벤처중소기업에서의 기업명성은 조직여유의 유형 중 유연하게 활용가능한 흡수되지 않은 여유와 기업성과간의 관계를 긍정적으로 매개하는 반면, 이미 조직에 흡수되어 버린 흡수된 여유와 기업성과간의 관계는 매개하지 못함이 나타났다. 이는 벤처중소기업에서 흡수되지 않은 여유가 기업명성 관리를 통해 기업의 성과에 영향을 미칠 수 있는 선순환 비즈니스 모델을 제시하고 있다. 마지막으로 본 연구는 제한된 표본의 통계량 분석을 통한 실증분석 연구인만큼 일반화의 한계를 가지고 있지만, 벤처중소기업의 조직여유, 기업명성, 기업성과와 관련된 학문적이며 실무적인 본 연구결과는 후속 연구의 토대를 제공해 줄 수 있기를 기대한다.

As IT(Information Technology) and FTA(Free Trade Agreement) have been widely applied in the world(Kwon et al., 2014), the global competition among companies has been more competitive. Specially, the economic power of traditionally advanced countries such as Europe and Japan has been weaker, on the other hand, the economic power of China has been stronger as the high-value strategy for G2.

As a result of the continuous economic crisis of Japan, many experts recently happened to question about usefulness of JIT(Just In Time) system by Toyota. Recently, as the high-tech industries, convergence of industries and new technological innovation are more important globally, the organizational slack which is necessary to deal with customers’needs and to get trusts of customers is begun to pay attention once again.

Although we can easily think organizational slack as the excessive organizational resources, the relationship among organizational slack, innovation and corporate performance is still arguing from the each researcher or theory.

First, prior studies don’t have same opinions related to the relationship between organizational slack and innovation. For example, Bourgeois(1981), Bromiley(1991), Damanpour(1987), Singh(1986) insist that the organizational slack is the significant positive asset for innovation, whereas Nohria & Gulati(1996), George(2005) insist that the excessive organizational slack has negative impact on innovation. Second, prior studies don’t have same opinions related to the relationship between organizational slack and corporate performance either. For example, Singh(1986), Hambrick & D’Aveni(1988), Bromiley(1991), Miller & Leiblein(1996) insist that the organizational slack is the positive effect on the corporate performance, whereas Greenley & Oktemgil(1998) insists that the relationship is not always positive.

Recently, the studies about the moderating variables are largely expended because the debates between organizational slack and corporate reputation still exist and the developed moderating variables are only a few until now. For example, environmental risk, ownership structure, HRM and firm age are founded as the moderating variables(George, 2005; Kim & Lee, 2008; Bae, Rhee & Kim, 2014).

With regards to the moderating effect between organizational slack and corporate performance, the corporate reputation is recently introduced by a big issue. The corporate reputation is defined as overall estimation of company for the public through the CSR(Corporate Social Responsibility), quality of products, ethic management and corporate image. Especially the relationship between corporate reputation and corporate performance is actively researched now, whereas the relationship between corporate reputation and organizational slack is few researched until now. And the relationship between corporate reputation and corporate image, structural elements of corporate reputation are also actively analyzed by many researchers.

Although the prior studies related to the relationship between organizational slack and corporate reputation were few, we can guess that slack will facilitate CSR or ethic management of company, and slack will be finally connected with the corporate reputation. So we want to focus on the mediating effect of corporate reputation between the organizational slack and corporate performance, and want to find the useful meanings in respect of academic and practical venture studies.

Ⅱ. Literature Review and Hypothesis

2.1 Organizational Slack and Corporate Reputation

2.1.1 Organizational Slack

The issue related to the organizational slack was begun from the study of Cyert & March(1963). They suggested that excessive resources of organization could help to adapt to the environmental uncertainty.

Bourgeois(1981) defined the organizational slack as the cushion of actual or potential resources which allow an organization to adapt successfully to internal pressure for adjustment or to external pressures for change in policy, as well as to initiate changes in strategy with respect to the external environment. And Nohria & Gulati (1996) defined the organizational slack as more resources than available resources needed to produce the proper levels of output.

Moreover, Tan & Peng(2003) defined the organizational slack as the buffer against the unexpected changes in the environment. From what many researchers related to the organizational slack, the organizational slack can be defined as the excessive resources over necessary resources to manage the company in this paper(Bae, Rhee & Kim, 2014).

In the prior studies the organizational slack has been classified as the different types according the different researchers. First, the organizational slack frequently could be distinguished between absorbed slack and unabsorbed slack. Absorbed slack is resources that are set within the firm’s procedures and are difficult to be redeployed elsewhere, on the other hand, unabsorbed slack is resources that are deliberately uncommitted and can be redistributed easily elsewhere within the organization (Bourgeois, 1981; Singh, 1986; Tan & Peng, 2003). So unabsorbed slack is more flexible in practical use than absorbed slack. For example, excessive employees or facilities of companies are absorbed slack, but excessive cash or securities of companies are unabsorbed slack. Because this classification is the most typical classification to measure the organizational slack specially for venture SMEs, we also apply this classification in this paper.

Second, the organizational slack could be distinguished among recoverable slack, available slack, and potential slack. In definition, recoverable slack is the resource which has been already absorbed into the organization but sufficiently recovered out of the organization through the organizational innovation, so recoverable slack is similar with absorbed slack. Available slack is the flexible slack which is not set within the particular organization (e.g. money, securities), so available slack is similar with unabsorbed slack. Potential slack is the future resources by funding the money from outside of company (Geiger & Cashen, 2002; Bromiley, 1991).

2.1.2 Corporate Reputation

The issue related to the corporate reputation has been arguing until now, because the researchers do not agree with the definition and structural element of corporate reputation.

The corporate reputation was issued by Fombrun(1996), and he defines corporate reputation as the total attraction for customers, employee, investors, and other public. Bromley(2000) defines corporate reputation as the ways of making concepts related to the organization from the public. And Gotsi and Wilson(2001) defines corporate reputation as the evaluation of the public for the organization in the long period.

Recently, related to the corporate reputation, the studies about structural elements of reputation have been activated. In detail, Fombrun(1996) suggests that the corporate reputation consist of quality of product, employment environment, company philosophy, social responsibility, emotional method, and financial performance. Lewis(2001) suggests that the corporate reputation consist of quality of product, customer service, staff, financial performance, management, environmental responsibility, and social responsibility.

Joo(2008) suggests that the corporate reputation consist of corporate responsibility, quality of product, ethics management, and corporate image. Because this structural element is regarded as proper and more efficient measurement way of corporate reputation for venture SMEs, we also apply this structural element in this paper.

2.1.3 Organizational Slack and Corporate Reputation (Hypothesis 1)

Although the prior study of direct relationship between organizational slack and corporate reputation does not exit, the venture firms which have more excessive slack, such as more employees, money, securities, or facilities, tend to provide the psychological stability of employees, the adaptation ability against the change of outside environment(Tan & Peng, 2003), and the royalty of employees(Cyert & March, 1963).

Accordingly, according to these logic grounds, the employees who work in enough slacking venture firm have more possibilities of considering about long-term performance, product innovation, and corporate social responsibility. On the other hand, the employees who work in lacking venture firm have a tendency to do short-term actions. So we can expect the positive relationship between organizational slack and corporate reputation, This reasoning leads to the first hypothesis.

2.2 Corporate Reputation and Coporate Performance

2.2.1 Corporate Performance

The corporate performance can be defined as the effectiveness of goal(Robbins, 1984), and Dyer & Reeves(1995) defines the corporate performance as human resource performance, organizational performance, financial performance, and market-based performance. And Koh(2011) defines the corporate performance as the recent improvement of ROS(Return On Sales), ROA(Return On Assets), market share and the numbers of employee. The corporate performance is usually used by the dependent variable, but each researcher defines the corporate performance respectively for the research purpose and model.

After we consider both the prior studies and the purpose of this research, we define the corporate performance as market share, profitability, productivity, customer satisfaction, and overall competence.

2.2.2 Corporate Reputation and Corporate Performance (Hypothesis 2)

Although the relationship between corporate reputation and corporate performance has been arguing yet, the positive relationship is a more common result than the negative relationship(Robert & Dowling, 2002; Shapiro, 1982; Graham & Bansal, 2007). They suggest that corporate reputation affect the purchasing intention and favorable attitude for the product. Consequently, corporate reputation has an positive effect on corporate performance in the end. This reasoning leads to the second hypothesis.

2.3 Mediating Effect of Corporate Reputation (Hypothesis 3)

Based on the 2.1.3, more slack, more corporate reputation after controlling the firm size, firm age, social capital and environmental uncertainty. Because the employees who work in slacking venture firm tend to be more considerate about long-term performance, product innovation and corporate social responsibility.

Based on the 2.2.2, more corporate reputation, more corporate performance after controlling the firm size, firm age, social capital and environmental uncertainty. Because corporate reputation affects favorable purchasing intention and attitude for the product, and affects positive corporate performance in the long-term.

Overall, we can expect that organizational slack will be connected with corporate performance through the corporate reputation. This reasoning leads to the third hypothesis.

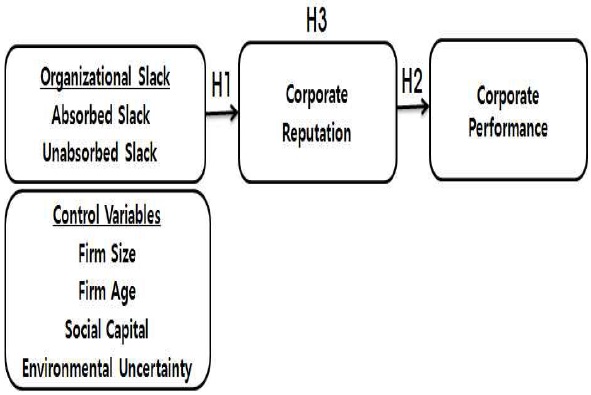

The hypothesized relationships are illustrated in this research model, as shown in

3.2 Sample and Data Collection

This empirical research model was designed to analyze the mediating effect of corporate reputation between organizational slack and corporate performance in venture SMEs. For this purpose, questionnaire surveys were administered to target venture korean SMEs in 2013. And we gathered the effective 250 samples(venture companies) from top managers and CEO. After gathering samples, we analyzed the data by the reliabilities, EFA, correlations and multiple regression analysis in SPSS 18.0.

3.3.1 Organizational Slack (Independent Variable)

Based on the Luca & Atuahene-Gima(2007), the variable for organizational slack, separately absorbed slack and unabsorbed slack, is measured with respective 8 items, using a five point Likert scale. The measures are "enough resources to achieve the vision", "enough resources to achieve the strategy", "available resources promptly for the new strategy", "available resources supported for unscheduled strategy", "available resources at the CEO’s discretion", "enough resources to apply new products by comparing with competitors", "enough resources to apply new process by comparing with competitors", "enough resources to apply new management system by comparing with competitors".

3.3.2 Corporate Reputation (Dependent Variable)

Based on Joo(2008), the variable for corporate reputation is measured with respective 7 items, using a five point Likert scale. The measures are “product or service quality", "communication with customers", "improvement of product or service", "fair business activity", "running operation within the law by CEO", "customer-driven company", "company close with the customer".

3.3.3 Corporate Performance (Mediating Variable)

We define the corporate performance as market share, profitability, productivity, customer satisfaction, and overall competence. So the variable for corporate performance is measured with respective 5 items, using a five point Likert scale. The measures are "more market share than competitors for last 3 years", "more profitability than competitors for last 3 years", "more productivity than competitors for last 3 years", "more customer satisfaction than competitors for last 3 years", "more overall competence than competitors for last 3 years".

3.3.4 Firm Size, Firm Age, Social Capital, Environmental Uncertanity (Control Variables)

Because the firm size, firm age, social capital, and environmental uncertainty are potential variables to affect the corporate reputation and corporate performance. But we control these variables because we intend to focus on the mediating effect between organizational slack and corporate performance.

First, if the venture firms are bigger, the possibility of corporate reputation and corporate performance is bigger generally. So we measure the firm size by “numbers of employee".

Second, if the venture firms are more older, the possibility of corporate reputation and corporate performance is bigger generally. So we measure the firm age by questioning the “year of establishment” and use“2014-year of establishment".

Third, the social capital is defined as sum of practical and potential resources due to the relationship networks from other person or society(Nahapiet & Ghoshal, 1998). That is, if the venture firms have more networks outside, the opportunity of corporate reputation and corporate performance is bigger generally. So the variable for social capital is measured with respective 10 items, using a five point Likert scale. The measures are "cooperation with our staffs", "cooperation with colleagues", "cooperation with superiors", "sharing the information with other staffs", "sincerity of colleagues", "credibility for colleagues", "reputation of other staffs", "sharing business philosophy", "sharing vision", "sharing goal".

Fourth, the environmental uncertainty is defined as the unexpected changes of customers, suppliers, competitors and technology(Ettlie & Resa, 1992). So the variable for environmental uncertainty is measured with 4 items, using the five point Likert scale. The measures are "intensity of changing customers’ needs for last 3 years", "intensity of changing suppliers’ design, quality, and delivery for last 3 years", "to be more difficulty of expecting the competitors for last 3 years", "intensity of technological changes for last 3 years".

We surveyed to focus on the venture SMEs in Korea, and we did frequency analysis. As a result of the effective 250 samples(venture firms), the firm size consisted of 10~300 employees(177 responses, 70.8%) and under 10 employees(73 responses, 29.2%). And the firm age was from 1 year to 67 years. specially average age was 16 years.

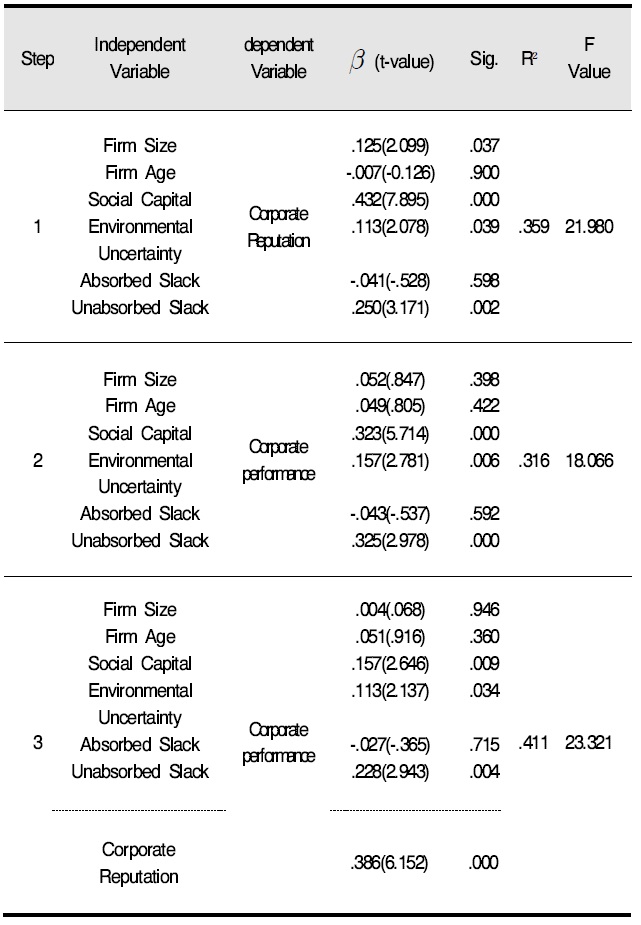

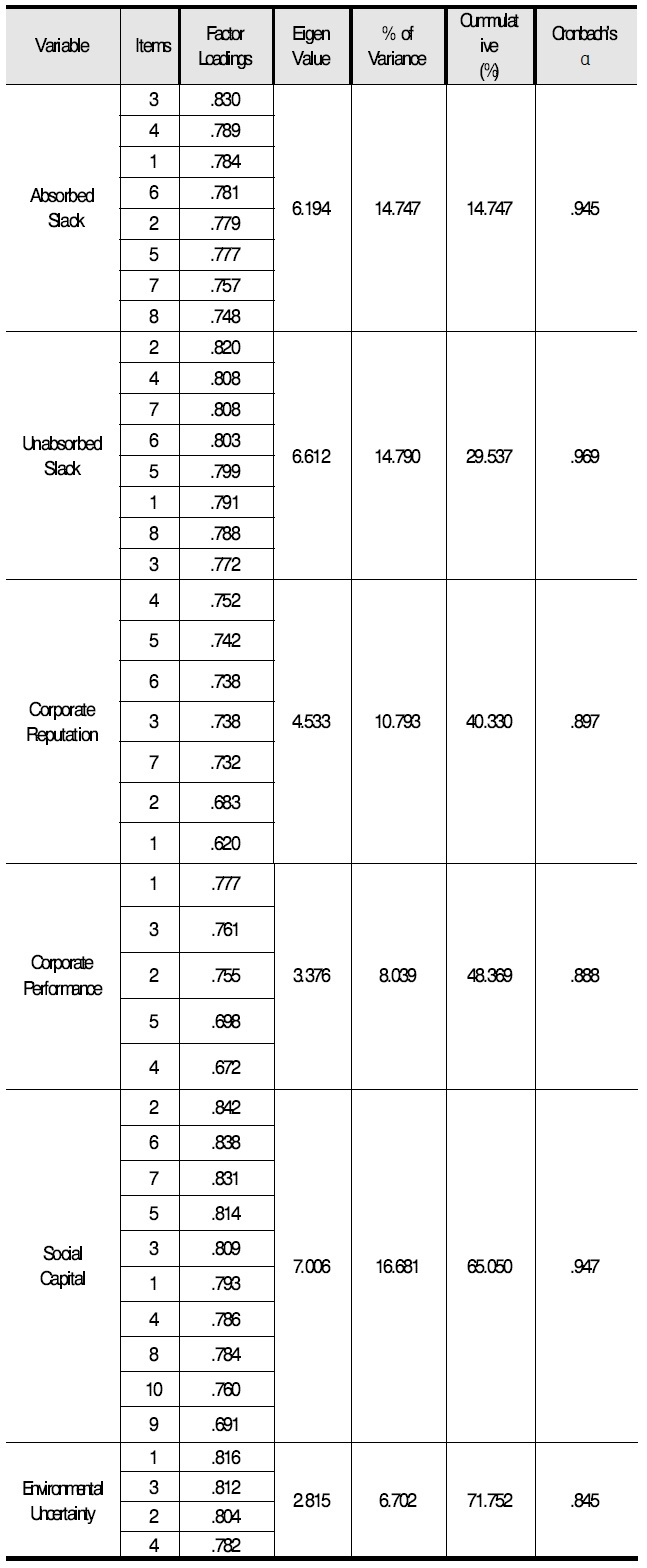

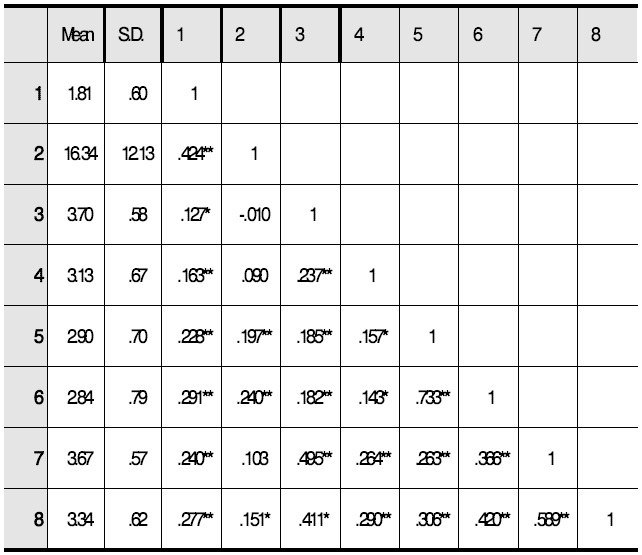

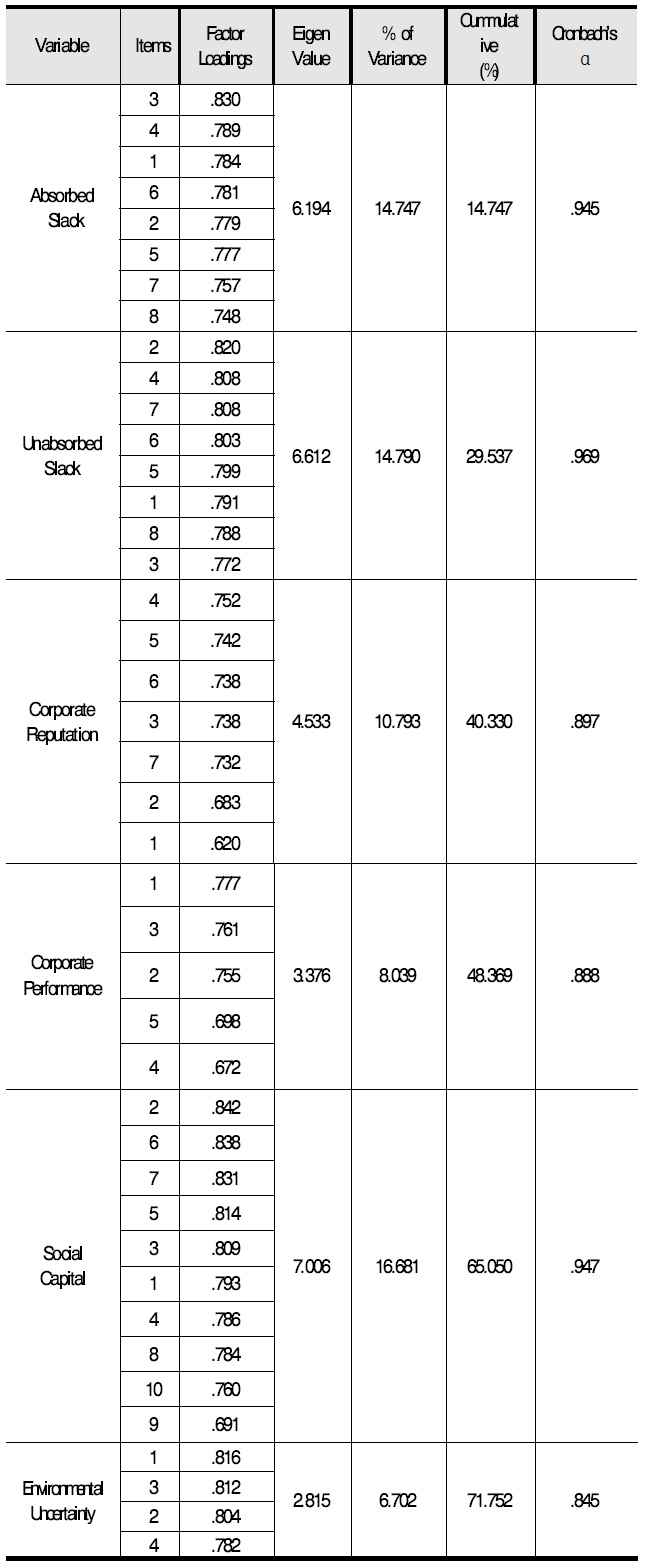

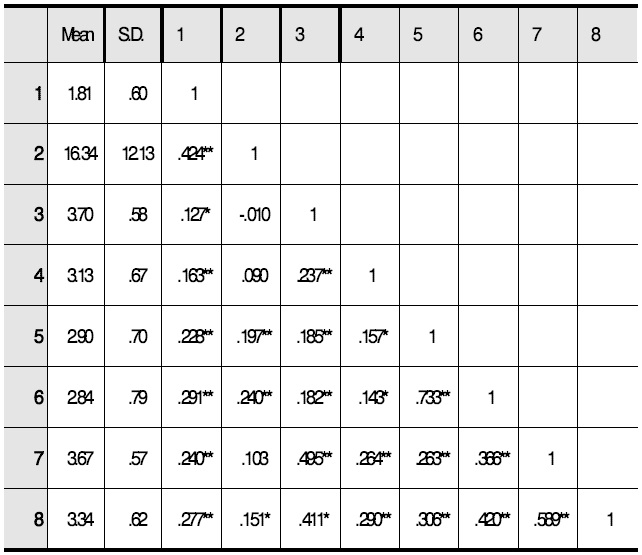

We verified the validity and reliability by using SPSS 18.0. To check the validity of variables, EFA(Exploratory Factor Analysis) was executed by the principle components analysis with the varimax rotation. If the eigenvalues were over 1.0 and factor loadings were over .4, the validity was generally acceptable. After the verification of validity, the reliability was tested by the Cronbach’s ɑ values. If the Cronbach’s ɑ values were over .6, the reliability was generally acceptable. The results of validity and reliability were shown as Validity and Reliability The descriptive statistics and correlations among the variables were shown as Descriptive Statistics and Correlations

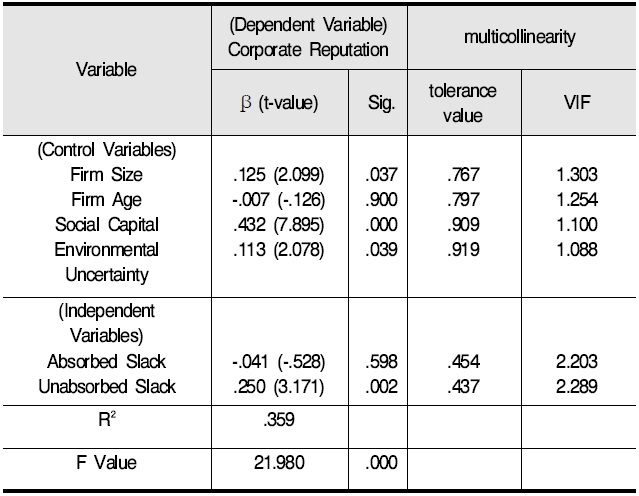

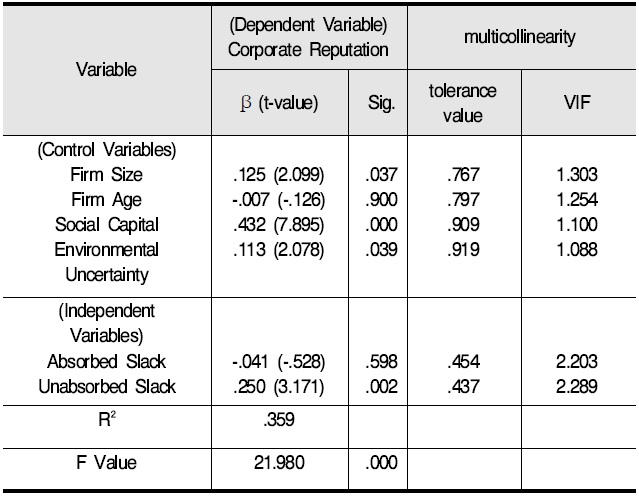

4.4.1 Impact of Organizational Slack on Corporate Reputation (Hypothesis 1)

The multiple regression analysis was used to test hypothesis 1 and the results were shown as Results of Multiple Regression Analysis on Corporate Reputation

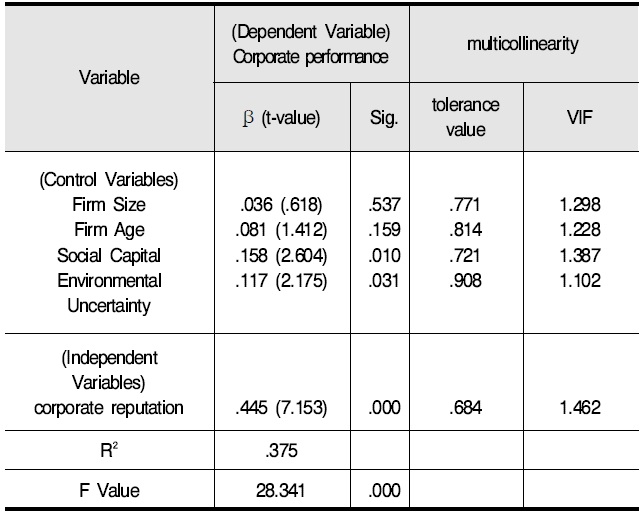

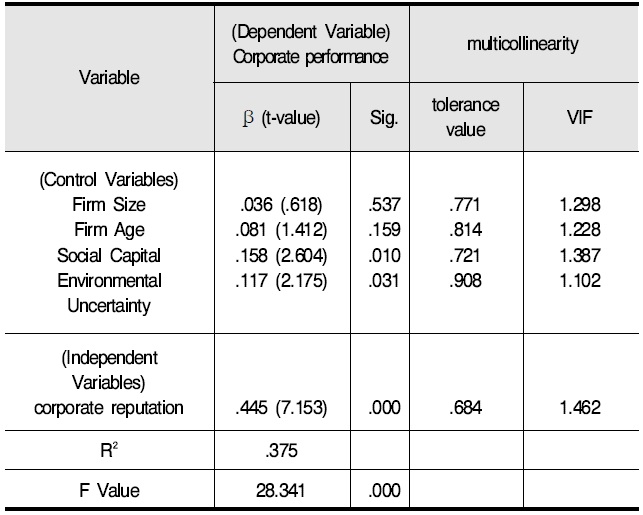

4.4.2 Impact of Corporate Reputation on Corporate Performance (Hypothesis 2)

The multiple regression analysis was used to test hypothesis 2 and the results were shown as Results of Multiple Regression Analysis on Corporate Performance

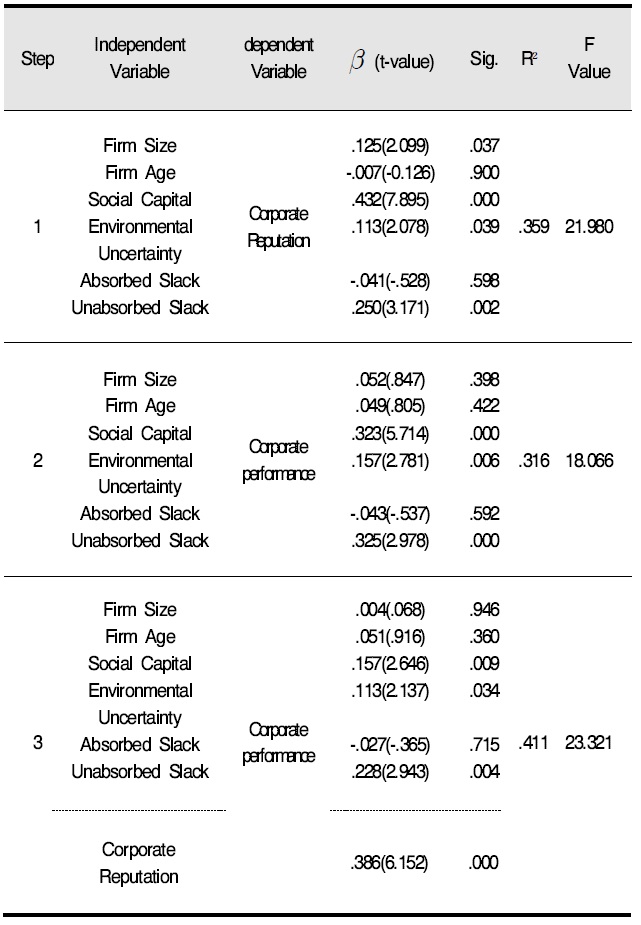

4.4.3 Mediating Effect of Corporate Reputation (Hypothesis 3)

The three step mediated regression analysis was used to test hypothesis 3(Baron & Kenny, 1986; Van Dyne, Graham & Dienesch, 1994). First, we verify if organization slack has a effective impact on corporate reputation in step 1. Second, we verify if organization slack has a effective impact on corporate performance in step 2. Third, we verify if organizational slack and corporate reputation have a effective impact on corporate performance in step 3. Then, if The results were shown as <Table 5>. In step 1, unabsorbed slack has a positive effect on the corporate reputation( Results of Three Step Mediated Regression Analysis The findings indicate that flexible unabsorbed slack such as money and securities can be connected with corporate reputation, and then corporate reputation such as quality of product, ethics management, corporate social responsibility can be connected with corporate performance in venture SMEs. But there is no mediating effect of corporate reputation between absorbed slack and corporate performance.

The research model of this empirical research is to verify the mediating role of corporate reputation between organizational slack and corporate performance in venture SMEs. To test these hypothesis, the 250 venture firms in Korea were analyzed by questionnaire surveys and SPSS 18.0. We can find some important findings. In detail, unabsorbed slack such as money and securities can be connected with corporate reputation. And corporate reputation such as quality of product, ethics management, corporate social responsibility also can be connected with corporate performance in venture SMEs. But there is no mediating effect of corporate reputation between absorbed slack and corporate performance. These results suggest the new business model of slack, reputation and performance in venture academic and business field. Furthermore, we can find the important roles of unabsorbed slack and corporate reputation. Overall, the management of slack and corporate reputation is essential for corporate performance.

This research has also the limitation of generalization. Especially, as this research was analyzed by limited number and region of samples, more numbers of sample are needed for further researches. Also, in the future the comparative studies between venture firms and non-venture firms are recommended.. The validity was generally acceptable because the eigenvalues of all variables were exceeded 2.81 and all factor loadings were exceeded .62. The reliability was also generally acceptable because the Cronbach’s ɑ values of all variables were exceeded .84.

] Validity and Reliability

. According to the correlation analysis, most correlations were significant and supported for this research model. But the correlation between absorbed slack and unabsorbed slack was exceeded .73, so the multicollinearity test was executed. As a result, the correlations were generally acceptable and there was no multicollinearity problem of this research model because the tolerance value was over .1 and VIF(Variance Inflation Factor) was under 10.0.

] Descriptive Statistics and Correlations

. As a result,

] Results of Multiple Regression Analysis on Corporate Reputation

. As a result,

] Results of Multiple Regression Analysis on Corporate Performance

] Results of Three Step Mediated Regression Analysis

5.1 Contributions and Implications

5.2 Limitations and Future Research Directions

참고문헌

이미지 / 테이블

[

<Figure 1>

]

Research Model

[

<Table 1>

]

Validity and Reliability

[

<Table 1>

]

Validity and Reliability

[

<Table 2>

]

Descriptive Statistics and Correlations

[

<Table 2>

]

Descriptive Statistics and Correlations

[

<Table 3>

]

Results of Multiple Regression Analysis on Corporate Reputation

[

<Table 3>

]

Results of Multiple Regression Analysis on Corporate Reputation

[

<Table 4>

]

Results of Multiple Regression Analysis on Corporate Performance

[

<Table 4>

]

Results of Multiple Regression Analysis on Corporate Performance

[

<Table 5>

]

Results of Three Step Mediated Regression Analysis

[

<Table 5>

]

Results of Three Step Mediated Regression Analysis