한국의 벤처캐피탈은 투자규모가 세계적인 수준이나 창업초기단계 벤처기업에 대한 투자가 미흡하고 첨단기술 분야 및 수도권에 투자가 집중된 데다 신규상장 및 M&A 시장의 높은 진입장벽 등으로 벤처캐피탈의 투자자금 회수 등이 어려운 상황이다. 첨단기술 벤처기업의 경우 투자자와 벤처기업간 정보의 비대칭성으로 투자자금 조달에 어려움을 겪을 수 있으나 벤처금융 선진국은 정부 자금지원시 시장과 민간투자자와의 연계, 해외 저명 벤처캐피탈사와의 공동투자 유도 등 다양한 유인설계(incentive mechanism design)를 통해 동 문제를 해결하고 있다. 이러한 점들을 감안하여 우리 정부 및 지자체는 민간부문과의 공동펀드 확대, 지역별로 특화된 매칭펀드 조성, M&A 등 벤처캐피탈사의 출구경로 다양화 등을 통해 창업벤처생태계를 개선하는 데 주력할 필요가 있으며, 벤처캐피탈사도 외국 벤처캐피탈사와의 공동투자 등을 통해 투자대상 기업선정 및 가치증대 활동에 노력을 경주할 필요가 있다.

Although many scholars investigated activities of the venture capital (VC) firms and financing of high-tech ventures across countries over time, hardly any of them sheds light on the countries that have not been successful in developing a vibrant VC industry despite numerous efforts. On this backdrop, this paper reviews the patterns and problems of Korean VC industry as an unsuccessful case. We felt interested in investigating the Korean VC industry because Korea is found to receive relatively larger amount of VC investment in the world, but it has not been so successful in consideration of the amount of early stage investment made in the high-tech ventures and their associated returns thus far. We extend our analysis taking the examples of the VC industry of the US, Singapore, Japan, Israel, and the European countries for better policy making. Finally, we believe that comparison of the patterns of VC financing of an unsuccessful country with that of successful countries would certainly add value to the existing VC literature. The remainder of the paper is organized as follows. Section 2 discusses the eco-system of financing the high-tech ventures in line with different stages of financing followed by the “growth cycle approach to financing” popularized by Berger and Udell in 1998. Section 3 examines the pre-VC financing phase of the high-tech ventures in Korea with a particular reference to the concept fund and the business angel investments and compares those with the US, Singapore, Japan, Israel, and the European countries. Section 4 provides a general overview of the Korean VC industry until date and compares those with the countries referred to in Section 3. Section 5 examines the post-VC investment phase of Korean VC industry. Finally, Section 6 concludes with some policy remarks.

Ⅱ. Eco-system of Financing the

High-tech Ventures High-tech ventures face difficulties in raising money from the outside investors due to the presence of higher degree of uncertainties about the venture’s prospects for growth besides the problems of information asymmetry. The “Pecking Order Theory” – one of the most prominent theories in corporate finance that defines the capital structure of a company – postulates that firms with higher information asymmetry tend to use internal financing first, as it is readily available. Thereafter, they prefer debt financing to equity financing, when external financing is required, as debt provides less costly financing option for the firms over the equity financing. In addition, debt financing gives a signal to the boards and the potential investors that the investment is profitable.

Notably, as Aernoudt (2005) explains in the “Reversed Pecking Order Theory”, high-tech ventures need substantial amount of cash in their early stage of development to ensure required finance for the R&D activities which cannot be funded alone by the entrepreneur’s own money. At this early stage of development, banks, however, do not supply required finance to the high-tech ventures because either the high-tech ventures fail to supply collaterals required by the banks or it becomes difficult for the banks to forecast how high-tech ventures will repay borrowings with their unstable and uncertain cash flows. This implies that new risky ventures fail to receive bank loans under the condition of uncertain cash inflows. From the liquidity management and growth perspectives, it is also not logical to use bank loan at the early stage of a business because it shrinks funds needed for the investment and growth. These phenomena create the necessity of using sophisticated equity providers such as the business angels and the VC firms for financing the high-tech ventures. It is worth to note that the problems of financing the high-tech ventures are not limited with the early stage of the venture alone rather they are equally prevalent at the later stages of financing because of the inherent business and technological risks associated with high-tech ventures.

Thus, for financing the high-tech ventures we need to consider the whole eco-system of finance corresponding to each growth stage of a venture. The eco-system of high-tech venture financing as per different growth stages (seed, startup/early, growth/expansion, and exit). These growth stages can also be roughly categorized into three investment phases: pre-VC investments, VC-investments, and post-VC investments.

3.1 Concept Fund Investment in Korea : An Overview

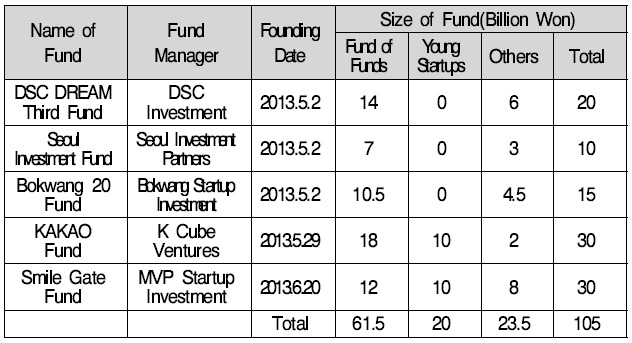

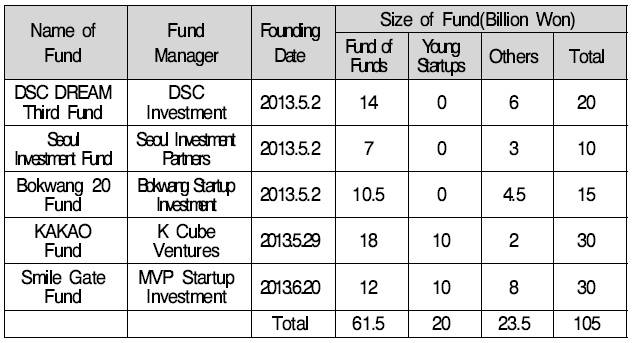

In Korea, the system to provide financial capital to the quite new startups is not strong. Recognizing this problem the Small and Medium Business Administration (SMBA) in Korea has taken some remarkable initiatives recently to improve the situation by collaborating with private companies. For instance, three funds with a total size of ₩45 billion were established in May 2, 2013 to provide different financial supports to the young startups. However, none of these funds were allocated to provide finance to the startups directly. In order to provide funds directly to the startups, a new fund was set up on March 29, 2013 partnering with Kakao, an IT company that provides free messaging service named Kakao Talk. The name of the fund was “Kakao Startup Fund for Young People” with a size of ₩30 billion in total. In this fund, SMBA invested ₩18 billion, Kakao invested ₩10 billion and other private sectors invested ₩2 billion. The fund was aimed at investing in the young and emerging entrepreneurs especially in the IT industries in Korea that were facing financial constraints. Besides, the fund was expected to provide managerial supports based on Kakao’s previous positive experience in the IT industry. Soon after this initiative, on June 20, 2013 SMBA launched another fund partnering with SmileGate, an online game company. The size of the fund was also ₩30 billion. In this fund, the SMBA, SmileGate and other private sectors provided ₩12, ₩10 and ₩8 billion, respectively. Concept Fund in Korea Clearly, we need more time to evaluate the performances of these initiatives. However, from the fund designing point of view, it seems that these initiatives were well designed as they considered human capital and experience of the private sector. These initiatives are similar to the SMBA that the US has and can be considered as a starting step in building a steadier Korean eco-system of financing new startups. But, the size of the financial supports for the new startups is still limited in Korea. Thus, more funds are needed to develop the eco-system of financing in Korea. It is worth to note that some private VC funds provide capital to the young startups in Korea although they are limited in numbers. One of them is the K Cube Ventures, a quite new VC firm founded in April 2012. K Cube Ventures specializes in undertaking investments in companies that provide services based on information technologies. It believes that a new startup really needs transfer of experience and knowledge to get success. In fact, K Cube has excellent members who can provide such a support based on their experience in frontiers of high-tech industries in Korea. These are noticed in its website that highlights the willingness of the firm to invest in prominent entrepreneurs even before the establishment of their companies(i.e.,embryonic stage). The encouraging fact is that K Cube has invested in 12 startups as of September 20, 2013 within its short span of life. Thus, we argue that establishment of more private VC firms such as the K Cube Ventures is needed to bring other VCs in the race and to improve the eco-system of financing new ventures in Korea.

As previously discussed, various governmental programs towards the seed stage financing are implemented around the world, and presumably, the most famous one is the SBIR program implemented by the US government. In this section, we investigate the Singapore Technology Incubation Scheme (STIS), a successful case, and the Okinawa Shinsangyo Soshutsu Fund, an unsuccessful case, to add recent experience.

3.2.1 Successful Case: Singapore Technology Incubation Scheme (STIS)

Singapore is renowned for encouraging entrepreneurial activities through comprehensive policies that include not only providing financial or managerial supports for new or potential startups but also generating entrepreneurship-friendly environments (Lerner, 2009), although it is not easy to clearly specify the degree of its contribution on Singapore’s striking economic growth separating from other factors. Since Singapore has various programs for the seed-stage ventures, we do not explain all of them in detail. Also, we do not investigate Singapore’s programs specific to startups of academic entrepreneurs who belong to universities or research institutions. There are two main public agencies which provide financial supports in the seed stage of a startup. The first is the National Research Foundation (NRF), which was founded in 2006 with the objective of enhancing Singapore’s high-tech knowledge accumulation and high-tech enterprises. NRF was set under the Prime Minister’s Office, and at the moment, the Deputy Prime Minister, Mr. Teo Chee Hean, serves as its board Chairman. The board members include presidents of four universities in Singapore. NRF took a new initiative in 2008 in the name of National Framework for Innovation & Enterprise(NFIE) to support R&D activities which accelerated entrepreneurial activities in high-tech industries. NFIF allocated a total of S$360 million from 2008 to 2012 to support R&D activities. STIS is one of the eleven initiatives of NFIE. It supports new ventures in seed stage or potential entrepreneurs who have valuable high-tech intellectual properties in Singapore. In this program, firstly, seven “technology incubators” were selected based on their past experience and incubation abilities in 2009. Eight more technology incubators were selected out of the nineteen applicants in the subsequent selection in 2012. When the selected technology incubators invested and provided incubation services in startups in Singapore, NRF co-invested up to 85% or up to S$500,000 per company with them. NRF obtained equity proportional to the amount of its investment, however, selected technology incubators had the option to buy out equity of NRF within three years of investment (at a price of 1.1 times of NRF’s amount of the investment in the first 2 years, and at a price of 1.15 times of NRF’s amount of the investment in the third year). As the option is exercised by technology incubators only when startups turn out to be successful in order to enhance their gains from the successful investments, this option enhances their potential upside gains and does not provide protection for the failed investments (i.e., does not reduce downside risk). Notably, this program was designed following the Yozma program – a very successful program to assist the growth of VC industry in Israel. Yozma program has been discussed in details in Section 4.4. The STIS just started in 2009 and its comprehensive evaluation is still difficult. However, the fact is that Singapore government expanded the size of the program than the original one which indicates the fund’s success. NFIE also includes other initiatives in order to support founding of financial institutions for startups. Early-Stage Venture Funding Scheme (EVFS) is one of them. The scheme directly provided money to funds managed by approved six private VC firms with professional experience. This design is more similar to the design of Yozma program in Israel than STIS. Another main public agency which provides financial assistance for startups is SPRING, an agency under the Ministry of Trade and Industry. Its mission is to support growth of enterprises in Singapore and to enhance trust of their service or products. Business Angel Scheme(BAS) and SPRING Startup Enterprise Development Scheme(SPRINGSEEDS) are conducted by them. BAS is similar to STIS interms of collaborating with experienced private investors. BAS provides option of co-investment by them in prospective startups to the approved private business angel investors, and SPRING SEEDS provides the same option to private investors who have managerial skill and able to support growth of startups. Their co-investment schemes are identical to STIS. The important aspect which is common in the financial support programs in Singapore is that they are heavily designed to incorporate market or private fund managers in the decision of financing projects. This feature is also noted by Gilson (2003) who argues that the selection of portfolio companies by highly incentivized fund managers and investors improves firm’s performance. In addition, the government receives knowledge and commitment from reputable investors and successful incubators or venture capitalists by providing them with enhanced potential upside gains. To sum up, Singaporean government has been successful in placing right people with proper incentives to produce rapidly-growing entrepreneurial companies. We argue that these are important issues in designing governmental supports for the entrepreneurial finance.

3.2.2 Unsuccessful Case: Okinawa Shinsangyo Soshutsu Fund (Okinawa New Industry Creation Fund)

Okinawa Shinsangyo Soshutsu Fund (Okinawa New Industry Creation Fund) was initiated in 2010. The purpose of the fund was to discover and bring up innovative startups in Okinawa in order to facilitate its local economy. Its aim was to invest up to ¥200 million in a startup in biotechnology industry, and up to ¥100 million in a startup in IT or environmental technology industry within the fund’s time limit of 10 years. The fund was jointly founded by government and private investors. Japanese government and Okinawa prefectural government invested in the fund through a governmental entity, Okinawa Industry Promotion Public Corporation. The private investors of the fund were mainly individuals or companies located in Okinawa. The general partners of the fund were private venture capitalists in Okinawa. According to the article of The Tokyo Shimbun on June 15, 20131), the fund had three dubious transactions, although they were just scrutinized by Japanese government and are not verified yet. The first dubious transaction that the article mentioned is a potential moral hazard by aprivate investor(i.e.,limited partner). The fund invested ¥66 million in to acompany which was founded by one of the private investors of the fund. This investment raised a concern that the private investor used its power as one of the limited partners to benefit itself not considering other private investors and government’s interests. Secondly, another moral hazard happened resulting from the behavior of the private general partner of this fund. The fund had a contract with a tax account office where the private general manager charged ¥600 thousand per month as payments for the tax accountant office to government. But, the wife of the private general manager has got kick back of ¥300 thousand from the tax accountant office per month. The third dubious transaction created another moral hazard for the private general manager regarding investment decision of the fund. One of the investees of the fund provided loan more than ¥10 million from the money invested by the fund to acompany which gave ¥100 million loan to the private general partner. This relationship made a belief that the private general manager intentionally selected investee and did not perform proper monitoring for the limited partners. In order to finance high-tech ventures, investors need to deal with enormous future risk and uncertainties. Thus, skills of experienced general partners are necessary to book success. At the same time, proper monitoring system for the general partners is needed to prevent moral hazard behaviors. Thus, in addition to the experienced general partners, the presence of reputable investors who have ability to monitor the behaviors of general partners is highly desirable for limited partnership business. Singapore attracted such experienced capitalists and reputed investors by providing chance of enhanced potential upside gain. On the contrary, it seems that the fund in Okinawa did not try to do so. The fund in Okinawa was aimed at providing capital for startups with cutting edge technologies. At the same time, it tried to incorporate mainly stakeholders in Okinawa and to contribute Okinawa’s local economy. Presumably, these contradictory features of the fund damaged its capacity of monitoring.

Regarding investment made by business angels, Korea started business angel activity in 1997. Since then the number of business angels has drastically increased from about 100 in 1997 to about 28,800 in 2000.

While comparing the business angel activity in Korea with other countries, it is found that the number of business angel networks in the US has grown gradually in the past decades which reached to 340 in 2009. This number is large comparing to that of other OECD countries (OECD, 2011). The amount of investment by the US business angels is more than $450 million which is obviously higher than that of other countries. Similarly, the total number of deals made by the business angles in the US is more than 2000 (as of 2009) which are much higher than that of other countries. In the UK, Business Angel Networks (BANs), which connects high-tech new ventures and business angels, has rapidly increased after the 1990s to solve the communication problem between new venture and business angels. Since Local Investment Networking Company (LINC) was founded in 1987, a lot of private angel network systems have been emerged after 1990s. This change in investment environment for business angels leads to better record of business angel investments. For instance, according to the Report on Business Angel Network Investment Activity, the number of registered business angels in the UK$$ increased from 247 in 1993/94 to 346 in 2000/01. The number of deals also increased from 99 to 217 during the same period. Further, the amount of investment also increased from ₤6.9 million in 1993/94 to ₤30 million in 2000/01. Regarding the size of business angel investment, small investment with less than ₤50 thousand is found to hold 59% of all investment as of 2000/01. In addition, seed stage investment occupies 2%, startups stage investment occupies 28%, and other early stage investment occupies 37% of all investment made by business angels. This result indicates that business angels play an important role in supplying finance to the startups and the early stage of a firm as well. However, the gap in the amount of investments by business angels and private VC firms has been widened. Presumably, this gap arises because the private VC investment largely takes place at the later stage of the firms as compared to the business angles who are usually more active in the startup finance. Murray (1994) calls this gap as a “second equity gap” and suggests that formation of a business angel syndication, which is composed of 20-70 people, is important to promote investment from business angles. On the other hand, Jose, Roure, and Aernouldt (2005) points out that many angle investors do not have adequate knowledge on the investment process. Hence they fail to take advantage of the investment opportunities that may arise in the startups. Thus, they suggest that BANs should focus on the education of informal venture market to foster investment in startups. For instance, Scotland is found to be an active place for the business angels as compared to other areas of the UK. However, few BANs invest into startups in Scotland. In this context, the role of Archangel Informal Investments Ltd. can be referred. The Archangel Informal Investments Ltd was established at Edinburgh in 1992. The investment criteria of Archangel Informal Investments Ltd were as follows. First, investees should be located at Scotland. Second, the business has to have high growth opportunities with the potential of internationalization. Third, investment will be made by equity, but if necessary debt financing will take place simultaneously. Fourth, the business belongs to the industry should qualify for the Enterprise Investment Scheme. Fifth, there would be no investment into the retail, amusement, and the real estate sectors, in general. Sixth, investment would take place not only in the early stage but also in the later stage such as management buy-outs. Finally, the desired volume of investment would be in the rage of ₤250-500 thousand with an available opportunity from 50 thousand to ₤2 million. 1)The title of the article is “Okinawa No Toshikumiai Kanmin Fand Hutekisetsu Un-you Un-ei Kankeisaki Ni Shikin (Investment Limited Partnership in Okinawa, Inappropriate Management of Public-Private Fund, Providing Capital to Parties Related to Its Fund Manager).” 2)We calculate the volume as the exchange rate of 1,154 Won/$.

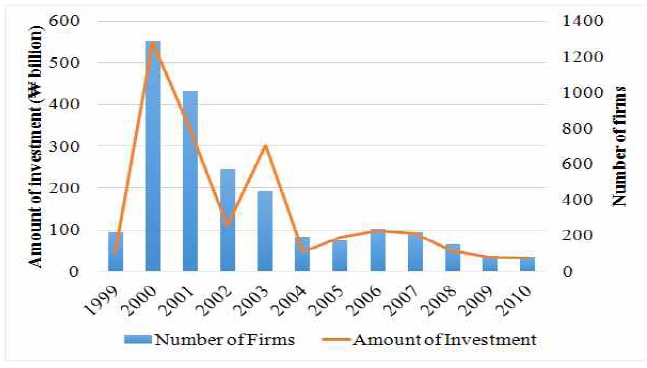

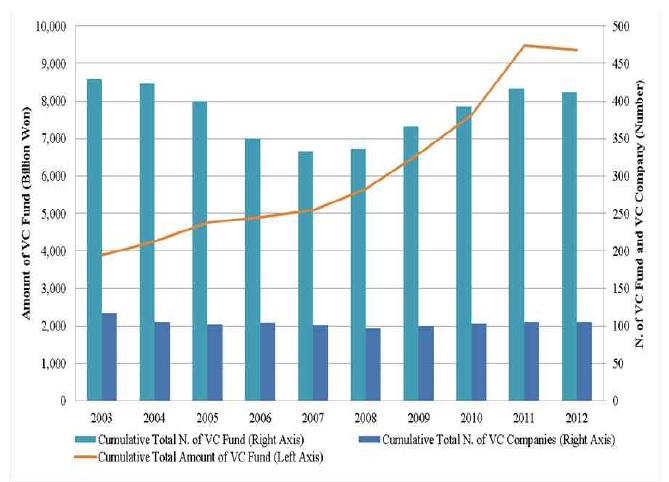

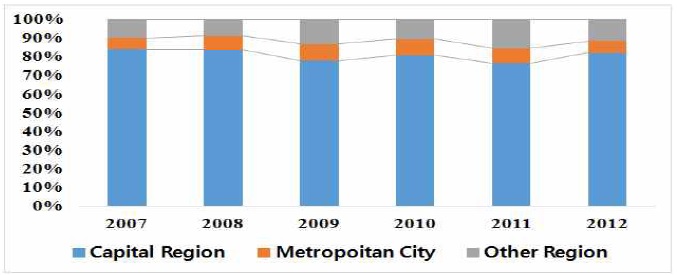

The Korean VC industry dates back to 1974 when the Korean government created Korean Technology Advancement Corporation (KTAC) – an intermediary financial institution that aimed at transferring research results from the government-supported research institutes to the technologically competent new ventures. However, the real break-through of VC took place in 1981 with the changes of the government from dictatorship to democracy that resulted in significant changes in government financial policy, inter alia, including the incorporation of KTAC under a Special Law to cater to the financing needs of industry R&D projects and their commercialization. In 1982, Korea established Korean Development Investment Corporation (KDIC) as a limited liability private VC firm to strengthening the Korean technology-oriented new ventures through equity investments. Then, in 1984, the Korea Development Bank created Korean Technology Finance Corporation – a new VC firm to finance high-tech growth firms. In 1986, the government enacted two laws simultaneously – the Small and Medium-Size Enterprise Start-up Support (SMESS) Act and the New Technology Enterprise Financial Support (NTEFS) Act – to support the small enterprises and the previous VC firms respectively. These two laws, in fact, divided the Korean VC firms into two types: (1) New Technology Enterprise Financial Companies (NTEFC) with an object to invest funds with less government oversight, and (2) SMESS companies to invest funds in startup and early stage firms with less than 5 years age. However, this division created a disadvantageous position for the SMESS Act VC firms as they were under the jurisdiction of Ministry of Finance (MOF) administration. Then, in 1992, KTDC was transferred to the control of the Ministry of Science and Technology and changed its name to Korea Technology & Banking (KTB) which resulted in further confusion and overlap. However, to increase Korea's technological capabilities, the government rapidly increased VC funds that promoted development of many new VC firms in 1990s although there were many cases of bankruptcy in previously VC financed companies. In 1993, Korea liberalized regulations for investment by extending the age limit for investment and removing the investment ceilings for investors. During the late 1990s, the government added several incentives to promote VC industry that include (1) incentives to promote innovative small firms, (2) creation of government VC funds to provide matching funds for VC limited partnerships, (3) permission of pension funds to invest up to 10 percent of their capital in VC partnerships, and (4) removal of the restrictions on foreign investment in Korean VC partnerships and an increase of tax benefits for VC projects. Those efforts remarkably increased Korean VC funds and the amount of investment as well except for the period 2006-08 due to global financial crisis. As a whole, However, despite the increase of the size of VC funds, the return on investment (in absolute term) is found to be remained somewhat constant at ₩6000 billion over years, except for the year 2008. In other words, this indicates the reduction of productivity of Korean VC funds. Perhaps, this low productivity is due to the volatility of Korean stock markets, and the inability of the Korean VC firms to add value to the investee company. Korean VC investment mainly targets the high-tech sectors such as the information technology, biotechnology, and culture and content. In 2012, the amount of VC investment in these three sectors accounted for 65% of the total VC investment. Cho and Lee (2013) argue that the reason behind such patterns of investment is to take the easier option of harvesting given by the government in the investment of high-tech firms in Korea. They also mentioned that firms listed on KOSDAQ are highly concentrated in high-tech industry. Accordingly, Korean VC investment in the early stage reached to the highest level in 2008 (40%). Then, it dropped to 29% in 2009. Afterwards, it remained somewhat constant at the same level until date. On the other hand, the later stage financing grew substantially and jumped to 41% in 2009 from a merely 9% in 2003. Even in 2012, the later stage investment is found to share approximately 40% of the VC investment in Korea. By contrast, expansion stage financing that captured largest percentage of VC investment until 2006 declined to below 25% since 2009. Overall, this implies that after the world financial crisis, Korean VC investment has shifted more to the later stage financing from the early and expansion stage financing. Figure 3 and 4 indicate the proportion of number of companies and amounts invested by the VC firms by regions in Korea, respectively. Capital Region includes Seoul, Incheon, and Gyeonggi. Metropolitan City includes Busan, Daegu, Gwangju, Ulsan, and Daejeon. Other Regions includes Gangwon-Do, Chungcheongbuk-Do, Chungcheongnam-Do, Jeollabuk-Do, Jeollanam-Do, Gyeongsangbuk-Do, Gyeongsangnam-Do, and Jeju-Do. As evidenced from the figure, both the number of companies invested by VC firms and the amount of VC investment are highly concentrated in the capital region (i.e., Seoul, Incheon and Gyeonggi), as this region constantly holds around 80% of all VC investments in Korea. The concentration of VC investment in Korea is found quite higher while comparing the same with Japan, the US, and the UK (illustrated in Section 4).

Section 4.1 discussed the development of Korean VC industry in terms of amounts and number of VC funds, productivity of VC investments, amount of VC investment by regions, industry, and sectors, and VC firms’ age as well. This section offers a comparative picture of Korean VC investment with other successful VC countries. With regard to the concentration of VC investment, Korea tends to follow the similar patterns with other countries. For instance, VC investment in Japan is mainly concentrated in Tokyo. As shown in To sum up, the analysis made in sections 4.1 and 4.2 show that (1) the amount of VC investment in Korea is not small, (2) the amount of cumulative total amount of VC investment is increasing, (3) VC investment in early stage decreased and VC investment in later stage increased in previous ten years, and the change was especially substantial from 2008 to 2009, (4) VC investment is concentrated in high-tech sectors, and (5) the average amount of investment in early stage per deal is small compared to the US, and (6) VC investment is primarily concentrated in Seoul.

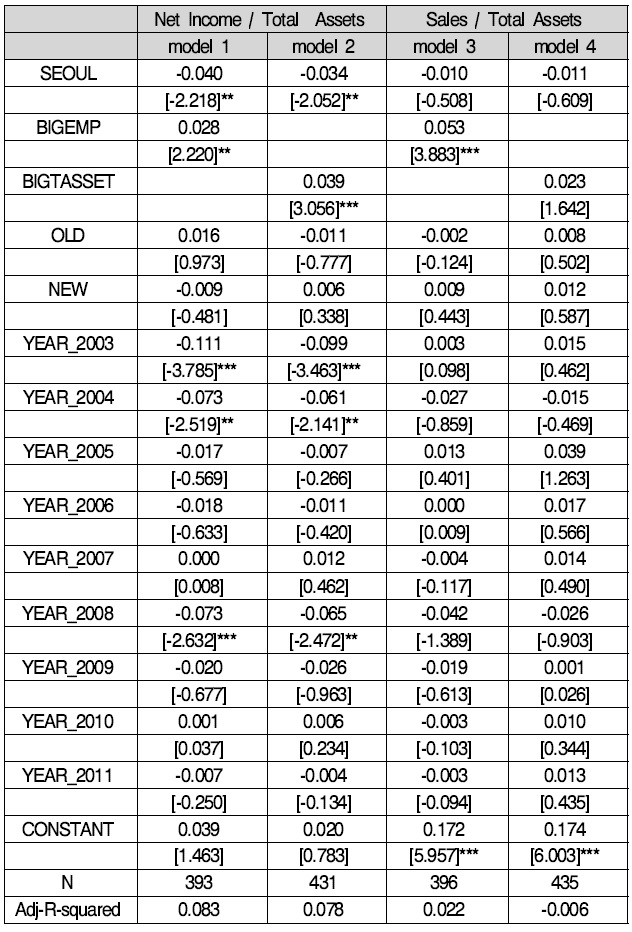

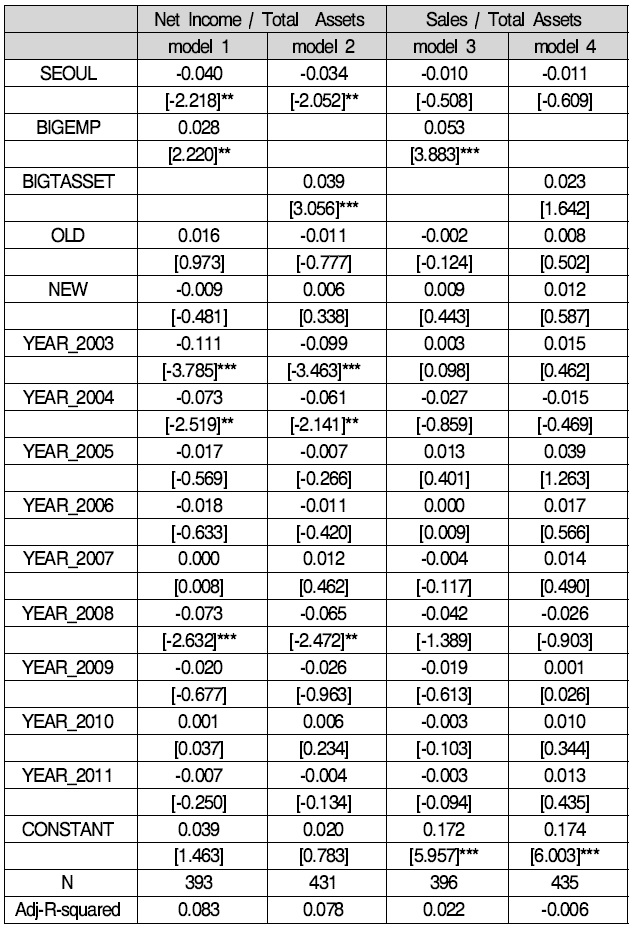

In this section, we conduct empirical analysis on the determinants of performance of VC firms in Korea employing Orbis database which is managed by Bureau van Dijk, a private information provider. Orbis database covers over 100 million companies around the world combining information from various sources. The sample period of our analysis covers the period 2003-2012(fiscal-year basis). We identified 104 VC firms in Korea in Orbis database based on the “Venture Capital Firm List” given on the website of Korean Venture Capital Association with some assistance from Bureau van Dijk. Orbis database, however, does not provide any financial information of 37 VC firms. As a result, we identified 67 VC firms in Korea that have financial information for empirical analysis. The names of the 67 VC firms are listed in the appendix. We conduct regression analysis to investigate the performance of Korean VC firms. The result is reported in Regression Results In model 1 and model 2, the coefficient of SEOUL is found to be negative and statistically significant at the 5% level. This result suggests that VC firms whose headquarter is located in Seoul have unpleasant performance. When comparing between VCs in Seoul and VCs in other areas, net income, which is scaled by total assets, of VCs in Seoul is found to be 4% lower than that of the VCs in other regions. On the other hand, the size of VC firms, measured by the number of employees and total assets, is found to be positively related with fund performance. By contrast, the age of the VC firms is found to be independent with the funds’ performance. This becomes clear as the coefficient of SEOUL becomes negative but statistically insignificant when we use sales to total assets as a measure of fund performance (Models 3 and 4). However, the coefficient of BIGEMP is found to be positively related with the fund performance, consistent with the result from model 1 and model 2. Overall, the regression results show that VC firms that are located in Seoul are negatively related to the fund performance. Besides, the size of VC firms is positively related to the fund performance, even if the coefficient of size of some models is found to be insignificant.

VC firms are regarded as the driving force for some of the dramatically growing industries in the US (Jeng and Wells, 2000). The underlying reason is that most of current globally leading companies such as Microsoft, Intel, Apple and Google all got investment supports from the VC firms when they were startups. This success attracted much attention to the policy making institution of many non-US countries. In consequence, they designed various programs aiming at developing effective VC market modeling the US VC industry (Gilson, 2003). We summarize implications obtained from the programs adopted in successful and unsuccessful countries to understand how governmental support for VC industry should be designed and enforced.

4.4.1 Incentive Design between Governmental Program and Private VC Firms

4.4.1.1 Successful case

Governments can invest in private VC firms as a source of funds or can establish public VC firms to stimulate VC industry. When governments directly involved in the VC industry as a supplier of funds, they should be especially aware of the agency problems of private fund managers because of information asymmetry. Policymakers should design the system of governmental supports considering their potential effects on private sectors’ growth and incentives. Regarding this point, we discuss some successful and unsuccessful cases such as the Yozma program in Israel, IIF program in Australia, WIF program in Germany and the LSIF in Canada. In addition, we highlight new initiatives in Japan. Israeli government launched Yozma program in 1993 with a $100 million fund in order to accelerate the VC industry in Israel. Yozma allocated $20 million in direct investments in its portfolio companies and invested $80 million in 10 privately owned VC funds. This was Yozma’s large investment as a fund of funds intended to let private VC firms to select and monitor their portfolio companies in earnest. Actually, Yozma did not participate in the process of selections of portfolio companies but offered facilitative supports. As Gilson(2003) points out, Yozma provided monitoring and managerial supports to private VCs. On the other hand, Israeli government did not give guarantees against loss of VC funds and did not set limits on their return. Israeli government gave call options on shareholdings of Yozma to other investors of funds in order to enhance their potential upside return. This incentive scheme worked well to attract highly-competitive, private fund managers who have high opportunity costs. Yozma asked private VC firms to raise money from foreign reputable investors when they apply for Yozma. Such investors actually performed monitoring of VC firms in lieu of Israeli government. As a result of Yozma program, VC funds in Israel raised more than US$1 billion and VC industry experienced substantial growth. Looking at this success, Israel government decided to exit and privatized Yozma fund in 1997. Avnimelech and Teubal(2006) examine the evolutionary process of the VC industry and high-tech startups in Israel and find that they co-evolved affecting each other. They also mention the importance of international partnership. Although there are other factors which possibly affected the growth of Israeli VC industry, such as many skilled researchers, active equity market, cultural and institutional backgrounds, Yozma is recognized as a driver of VC industry development in Israel. For the success of VC industry, policymakers should concern about foreign VC firms and global collaboration of VC firms more and more (Lerner, 2009). A number of researchers and practitioners recognize that Israel is one of the most successful countries in the world for stimulating VC activity through the collaboration of foreign VC firms. Importantly, the actual trigger of the cumulative success of the VC activity in Israel attributed to the Yozma fund which was co-managed by a local management company and a reputable foreign VC firms. (Avnimelech, Schwartz, and Bar-EL, 2007). The success of Yozma program attracted and subsequently gathered foreign reputable investors in VC firms in Israel. Most of the investors were institutional investors with long experience in VC and private equity investments in western economy. Yozma fund invested only in private funds which could raise sufficient amount of money from foreign reputable investors. Thus, private fund managers of Yozma program have to pass the selection of foreign reputable investors. After starting funds’ operations, foreign reputable investors are also expected to monitor the work of private fund managers. These schemes prevent the governmental officers from selecting, monitoring and interfere with daily works of VC firms in order not to be suffered from “political” problems. In addition, local fund managers and entrepreneurs also received benefits from knowledge spillover of foreign reputable investors and got access to valuable networks, which further contributed to the long term growth of whole local VC industry. Thus, the system of Yozma program was designed to make the use of foreign reputable investors well. The Australian Innovation Investment Fund (IIF) Program, which was established for the purpose of stimulating the small and high-tech companies in 1997 in Australia, is another successful cases that government participated. The success elements of IIF were as follows: (1) the ratio of government to privately sourced capital must not exceed 2:1, (2) investment will generally be in the form of equity and must be in the small, new-technology firms, (3) at least 60% of each fund’s committed capital must be invested within five years, (4) subsequent investment should be shared on a 10:90 basis between the government and private investors, (5) both the government and the private investors would receive an amount equivalent to their subscribed capital and interest on that capital, and (6) the funds established under the IIF program will have a ten years term (Cumming, 2007; Cumming and MacIntosh, 2007).

4.4.1.2 Unsuccessful case

On the other hand, Deutsche Wagnisfinanzierungsgesellschaft (WFG) program, which conducted by German government are known as a failure case. WFG program was launched in 1975. German government offered private fund managers a program in which fund managers have low risk and low return on investment. Gilson (2003) suggests that investments of WFG program were passive due to the lack of incentive of active monitoring. Canadian Labour-Sponsored Investment Funds (LSIFs) is known as another unsuccessful VC case. Canadian LSIF was a mutual fund listed on the stock exchanges and did not operate like a private VC firm (Cumming and MacIntosh, 2007). The source of LSIFs was only the individual investors. The LSIFs was not founded as the limited partnership but as corporations. This structure broke down the limited life span of a partnership that is required for the fund managers to be actively involved in firm’s operation. In addition, the corporate form diminished contractual flexibility of operation due to the agency problems between entrepreneur and governmental parties. In fact, the structure of LSIFs was inferior enough to create high agency costs, and ultimately it lowered the funds’ performance against the benchmarks (Cumming and MacIntosh, 2007). In Canadian case, bad public policy leads to crowding out of private investment (Cumming, 2007). An implication of these cases is that the form of government investment is important in determining whether the investment would stimulate the VC activity and the growth of high-tech firms as well. Cumming and Johan (2008) argue that the well-designed partnership structure between governments and private VC firms plays an important role in its success.

4.4.1.3 New initiatives in Japan

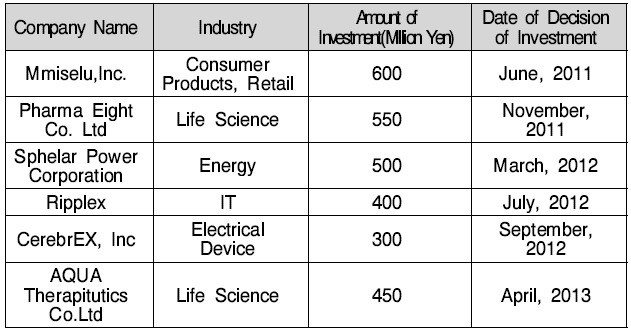

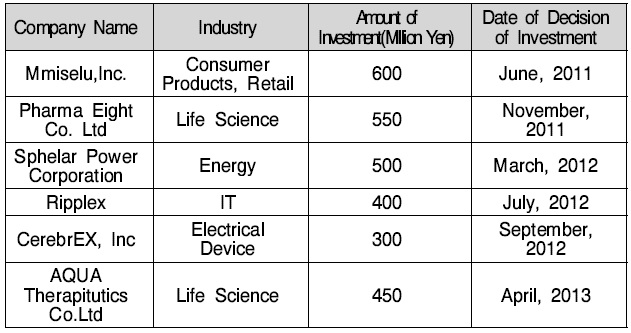

Japanese government made huge investment in Innovation Network Corporation of Japan (INCJ) which was created in July 2009. INCJ’s main aim was to give impetus to further public supports on generation of new business areas of Japanese companies with their large amount of risk capital and managerial supports. Hence, INCJ also played a role of private equity fund providing supports to big companies in Japan. INCJ started with ¥82 billion from Japanese government and ¥8.5 billion from sixteen big companies in Japan. The leading Japanese companies such as Sony, Toyota, and Panasonic agreed to invest in INCJ, and the number of companies which invested in INCJ increased over time. In addition, Japanese government originally granted ¥800 billion loan guarantee capacity to INCJ. Then, following the global financial crisis and the big earthquake in Japan, Japanese government granted even more loan capacity to INCJ. The capacity of the loan guarantee was extended to ¥1.8 trillion, and INCJ got investment of ¥280 billion in total (Japanese government invested ¥266 billion and 27 big companies invested ¥14 billion) as of March, 2013. INCJ has given the time limit of its activity for 15 years, which considered being long because INCJ was intended to support long-term growth of their portfolio companies. Lerner (2009) argues that public VC programs need longer time for their success as temporal VC programs tend to be failed. Japanese government seemingly avoided this pitfall. Early Stage Ventures Invested by INCJ (by May 2013) INCJ was further related to the national policy on intellectual properties. This was because Japanese government long had a concern on the difficulty in accelerating successful commercialization of universities’ intellectual properties despite the fact that some universities in Japan have cutting-edge technologies. For example, Japanese government tried to promote university startups since 1990’s witnessing successful university startups in the US like Genentech. The political support reached the peak in the beginning of 2000’s and the cumulative number of foundation of university startups amounted to more than 1800 in 2008, however, most of them ended in miserably fails. Contrary to the US, Japanese government could not achieve the political goal of accelerating Japanese economy with university startups. CerebrEX is a fabless semiconductor startup which designs, develops, manufactures and sells IP blocks and display controller for high-definition flat panel displays, and headquartered in Kobe, Japan. It is a startup just founded in 2012. First of all, CerebrEX has an excellent management team. Masahiro Kato, the CEO of CerebrEX, has worked in the business of semiconductor with strong technology background. Before starting CerebrEX, Mr. Kato worked for THine Electronics, Inc. as the company’s COO. THine Electronics, Inc. is also a semiconductor venture founded in 1991 and successfully experienced IPO in June, 2001. Thus, Mr. Kato has an outstanding experience in technology of semiconductor industry, management of a semiconductor company and broad network in the industry. INCJ invested ¥300 million in CerebrEX in September, 2012. This investment was just 3 months after its founding date. The amount of investment was large enough for a high-tech venture that has extraordinary high risk. INCJ also provided managerial supports for CerebrEX by sending outside directors. INCJ invested in CerebrEX because it was difficult in obtaining finance from private VC firms for high-tech startups.

4.4.2 Creation of Technology-oriented VC Firms

4.4.2.1 LSIP

In August 2010, INCJ founded Life-Science Intellectual Property Platform Fund (LSIP), the first fund of intellectual properties in Japan, together with Intellectual Property Strategy Network, Inc. (IPSN)3). INCJ initially invested ¥600 million in LSIP, and planned to invest additional amount at most ¥1 billion seeing its performance in the following three years. Takeda Pharmaceutical Company, a Japanese leading pharmaceutical company, also agreed to invest in LSIP at the time of its foundation. LSIP tried to commercialize universities and public research institutions’ patents of life science focusing on biomarker, EScell, cancer and Alzheimer's disease by gathering patents, bundling them and marketing with specialists. It is worth to note that in Japan, Technology License Organization (TLO) of each university has long tried to commercialize or license patents of a university, however, some of them are not successful because of the following two reasons. First, companies usually prefer bundles of patents of closely related technologies, however, each university tried to license only their own patents through their TLOs. Second, some patents of universities are not obtained for its commercialization (e.g. companies usually try to obtain blocking patents when they obtain a patent which can be commercialized, but patents of universities usually do not have their blocking patents), and have little value from the viewpoint of companies that tries to commercialize them. These reduced the attractiveness of patents of universities from company’s side. Although there had been no systematic evaluation of performance for LSIP, yet LSIP is expected to fill these gaps.

4.4.2.2 UTEC

The University of Tokyo Edge Capital (UTEC) was established in 2004 as a technology oriented VC firm partnered with The University of Tokyo, a university which has the strongest track record in Japan in terms of its technology transfer. As previously mentioned, Japan’s attempt to promote university startups ended in fail, however, the collaboration between The University of Tokyo and UTEC, and UTEC’s concentration in high-tech industries seem to show a new way of supporting high-tech ventures incubated by universities. We examine the case of UTEC’s investment in Microwave Chemical Co. Ltd (Micro Chemical), in order to understand the role of VC companies on growth of high-tech ventures. Microwave Chemical was founded by Iwao Yoshino and Yasuhara Tsukanori in 2007. It aimed at achieving efficient production of chemicals or energies using their technologies of microwave. Mr. Yoshino worked for Mitsui & Co. Ltd., a large trading company in Japan, and has experience in corporate VC and consulting business in the US. After getting his MBA from University of California, Berkeley, he tried to start his own business and found Dr. Yasuhara who was an associate professor of Graduate School of Engineering, Osaka University and a specialist of microwave. Arguably, this was a good combination for the management of high-tech venture because Mr. Yoshino’s professional management skill and Dr. Yasuhara’s cutting-edge technologies of the microwave industry were complementary to each other for the sustainable growth of the company. UTEC announced that it had invested in Microwave Chemical in January 2011. UTEC sent Naonori Kurokawa to Microwave Chemical as an outside director. He has a doctoral degree in engineering in addition to MBA. Tomataka Goji, Managing Director and representative director at UTEC also supported Microwave Chemical as its auditor. In March 2013, Microwave Chemical raised ¥400 million from two VC firms including UTEC and a bank. Subsequently, in July 2013, it also succeeded in raising additional ¥300 million from another VC firm, JAFCO. Thus, the investment in Microwave Chemical increased to ¥700 million in total which is relatively large in Japan. This case illustrates how UTEC played a key role in bringing Microwave Chemical to the next financial stage through its coaching or certification.

4.4.2.3 Bio-Sight Capital

Bio-Sight Capital is a VC firm and a business incubator of startups in bio-technology and life science industry. The company was founded by Masayuki Tani, who had about 14 years’ experience in supporting IPOs as an employee of Nomura Securities Co. Ltd., the leading securities company in Japan. He also worked for the foundation of Nasdaq Japan before establishing Bio-Sight Capital. Bio-Sight Capital manages an incubation center in Osaka, which has facilitated IPOs of many companies. In June 2013, Bio-Sight Capital opened its new research center in Okinawa, which is quite far from metropolitan areas in Japan’s main island. As previously mentioned, VC investment in Japan is concentrated on Tokyo, and thus, experienced and professional VC firms and business incubators such as Bio-Sight Capital is expected to facilitate entrepreneurial activities in regional areas. Bio-Sight Capital invested in 6 high-tech ventures and then succeeded in IPOs. 3)IPSN is a company which supports commercialization and global management of intellectual properties of universities and high-tech ventures. The presence of a variety of exit routes is a prerequisite to the effective development of the venture business eco-system. If successful, IPO is considered as the strongest exit route for the VC investment as it yields the biggest payout of any exit strategy (Jeng and Wells, 2000). However, it is very expensive to facilitate an IPO as the IPO process requires spending substantial amount on the accountant, attorneys, underwriters and IPO managers’ besides the listing requirements imposed by the regulators. In addition, there is no guarantee that the price attained through an IPO will be a profitable one because the market performance of IPOs fluctuates depending on a country’s economic and business conditions. More importantly, in the technology sector, previous experience indicates that a few technology companies successfully exit the market through an IPO. Thus, in addition to IPO, mergers and acquisitions (M&A) is considered to be a useful exit strategy for the VC firms. The underlying reason behind the M&A to be a popular exit avenue for the VC firms is that the VC funded company usually sends a positive signal of growth and productivity that attract acquirers to put extra premium on the assets of the VC funded company. In addition, the acquired firm can rapidly enlarge its business by ousting out competition and mobilizing synergic effects. Notably, mergers and acquisitions are usually clubbed together in the practical field, but they mean slightly different things in a theoretical point of view. Clearly, a merger happens when two firms decide to form a new company with their existing assets. By contrast, acquisition abolishes the name of the target firm but retains the identity of the buying firm. Most importantly, M&A may take place in different forms depending on the tax, legal and accounting considerations, but the purpose remains same, i.e., to achieve faster growth by capitalizing synergies in the products, operations, markets, technology and human resources between firms. Thus, M&A is viewed as one of the effective exit avenues for the VC firms.

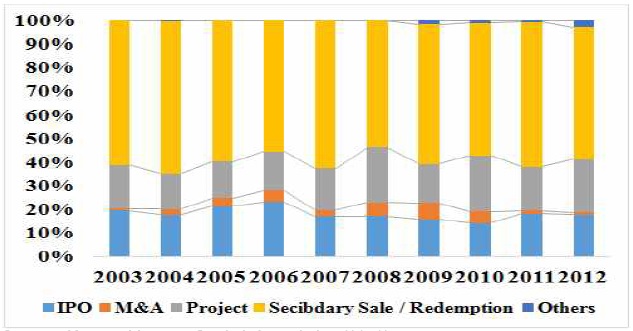

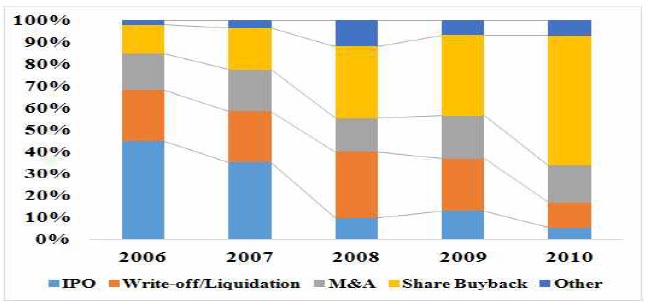

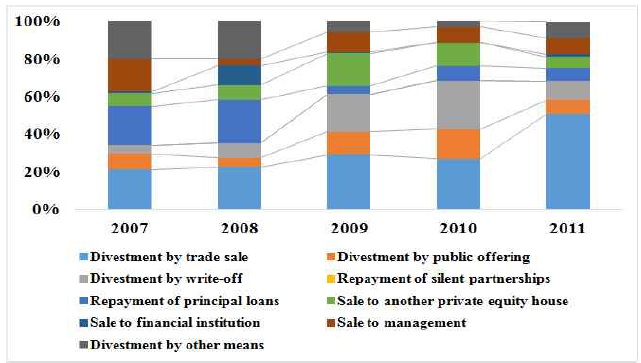

The Korea Securities Dealers Automated Quotation (KOSDAQ) was established in 1996 to offer an exit route for new ventures in Korea. One distinguishing characteristics of KOSDAQ is that more than 80% of listed companies on KOSDAQ market are high-tech companies. This number is higher than those of most stock markets around the world (Cho and Lee, 2013). The listing standards of KOSDAQ require more than three years old with positive profits (i.e., more than ₩200 million or more than ten percentage return on equity). These listing standards are stricter than that of MOTHERS, a stock exchange for startups in Japan. In 1999, Tokyo Stock Exchange established MOTHERS for startup companies. MOTHERS have no requirements for firm’s age, net assets, and profits. The number of KOSDAQ IPO firms dropped following the collapse of IT bubble from 171 in 2001 to 71 in 2003. There are only 22 IPOs in 2012. The percentage of VC-backed IPOs also shows a similar trend. It is noteworthy that the top 1 underwriter (Korea Investment & Securities) holds 22.2% of all the number of IPOs and 36.3% of total market capitalization of IPO firms at KOSDAQ. Figures 11-13 show the percentage of IPO and M&A of VC-backed firms in Japan, the US and the UK. For instance, in Japan, the percentage of IPOs is found to decrease gradually in comparison to the share buyback that increased in the period 2006-2010. On the other hand, M&A is found to be remained constant at around 10% during the same period. By contrast, the US is found to have approximately 90% exits through M&A as compared to IPOs. Likewise, in the UK, M&A is found to hold major share in exits as compared to other exit routes such as IPOs.

5.2.1 Diversity of Underwriters

In the UK, the Alternative Investment Market (AIM) was established in 1995 as an alternative stock exchange of Unlisted Securities Market (USM, from 1990 to 1995). The AIM does not require the listing standards in terms of firm age, market value, profits, net assets, and so on. Because of having no listing standard of the AIM, many young firms, not only matured firms, went into public through the AIM. As a result, the number of firms listed on the AIM grew substantially and reached at 1233 firms as of 2008. The AIM also works on attracting foreign companies diligently, and the number of foreign companies reached at 317 firms as of 2008. One of the characteristics of AIM is the introduction of nominated advisors and brokers systems. The system contributed to the emergence of various types of intermediaries for SMEs. The top 10 advisors at AIM are: Seymour Pierce Ltd, Collins Stewart Europe Ltd, Grant Thornton UK LLP, Arbuthnot Securities Ltd, W. H. Ireland Ltd, Canaccord Adams Ltd, KBC Peel Hunt Ltd, BlueOar Securities Plc, Evolution Securities Ltd, Panmure Gordon (UK) Ltd. These advisors are small and medium-sized securities companies, not big securities companies or merchant banks. It is noteworthy that the top 1 nominated advisor holds only 5.8% of all the number of IPOs at AIM, whereas the top 10 nominated advisors hold 38.5%. Further, the total shares of top 10 nominated brokers are found to have only 35.6% in the UK. On the other hand, in Japan’s case, IPO underwriting market is found to be dominated by the top three securities companies (i.e., Nomura Securities, Daiwa Securities, and Nikko Securities). When comparing exit routes between the UK and Japan, it is evident that besides the stock exchange with lower listing standards for new ventures, the diversity of underwriters plays an important role in driving the ventures to go to public.

5.2.2 Exit in Foreign Markets

Israeli has a domestic stock market, Tel Aviv Stock Exchange (TASE). However, Israeli companies conduct their IPOs not only on TASE but also on NASDAQ in the US (Jeng and Wells, 2000). They also argue that trade sales to the foreign companies are popular exit route for the Israeli VC firms. Importantly, while many Israeli startups go public on NASDAQ, there are few Korean startups that went on NASDAQ (Chung, 2007). It is evident that more than half of the companies listed on AIM originated from the UK. Then, Africa is ranked second with 5.9% stake. Firms of other countries also hold large stake in AIM. This implies that AIM tends to focus mainly on the promotion of foreign companies. The US companies hold the largest shares (87.9%) in NASDAQ. Although firms from various countries are found to exist in NASDAQ, as in AIM, however, they capture small shares as compared to that of AIM. For instance, China holds only 3.7% followed by Israel that holds 2.2%.

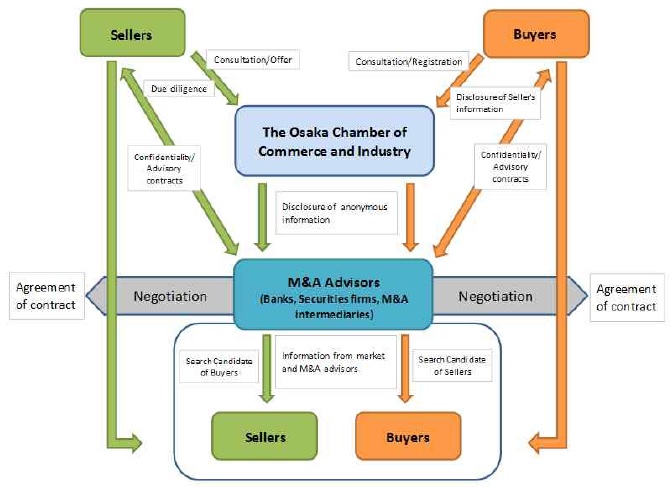

5.2.3 M&A Market for SMEs

The attempts to improve M&A market for SMEs have been made by both public and private sectors in Japan. The first support of M&A for SMEs by public institutions is made by The Osaka Chamber of Commerce and Industry (OCCI), a chamber of commerce supporting business activities in Osaka and Kansai region, in April 1997. At that time, many people had bad impression towards M&A because of sensational news about hostile take overs. OCCI tried to provide a market where buyers and sellers as well as M&A advisers can interact together to create fairdeals, as illustrated in It is worth to note that besides a developed M&A market for SMEs, professional advisers for M&A and some private firms can play an important role in supporting M&A deals. For example, Nihon M&A Center Inc., a private firm supports roughly 200 deals of M&A for SMEs every year. Another good example is Riverside Company, which is aprivate equity firm established in the US in 1988, and now operates globally with $3.5 billion assets. A distinguish characteristic of Riverside Company is its strong focus on investment in SMEs. The company usually invests in firms that have less than $250 million assets. Another feature of the company is that it does not only try to cut costs of investees, but also tries to increase investees’ revenues using its global networks.

In this paper, we reviewed the VC activities and financing of high-tech ventures in Korea taking the examples of the VC industry of the US, Japan,Singapore, Israel, and European countries. Based on our discussion and findings, we offer the following suggestions to enhance the VC activities in Korea. High-tech ventures always face difficulties in raising money from the outside investors due to the presence of high degree of uncertainties about the venture’s prospects for growth. Thus, we argue that to promote high-tech financing government should play an active role at the seed stage of the startups in terms of creating funds for the startups, developing prudential rules and regulations, and ensuring of necessary non-financial supports. However, we caution that government should not interfere with the incentives and monitoring mechanisms of VC contracting because it reduces efficiency of the VC market by limiting private ordering – the contracting structure that developed to manage the information asymmetry and agency costs that inevitably prevailed in the seed stage high-tech financing. At the seed stage, high-tech ventures are found to be relied on public funds (i.e., Proof of Concept Funds) rather than the public investors as a source of outside financing. However, creation of public funds only in the government sector seems not to be very effective because of bureaucratic hassles’ and other bottlenecks. Thus, we suggest that Korean government should develop more concept funds such as the Small and Medium Business Administration Program in collaboration with the private sector such as Kakao to foster innovation financing. In other words, a well-designed partnership structure between government and private VC firms or private firms is indeed essential in financing the startups. Business angels’ tend to play an active role in financing the startups. Although business angels’ investment activity is said to be related to the stock market condition as well as incentives offered by the government, this has not been proved in the case of Korea. So, we recommend that government should create Business Angles Networks (BANs) or syndication resembled to that of UK to ensure financing from the business angels. Simultaneously, we suggest undertaking programs to educating the business angels’ with the investment process to secure investment from them. As regards to the volume of investment, Korean VC industry is found to be the second largest in the world after the US. This is of course an encouraging factor. However, in terms of creating value for the investee company, Korean VC industry seems to be inefficient. This indicates that Korean VCs are either incapable in selecting the appropriate candidates (ex-ante) or they cannot undertake activities which can add value to the investee company (ex-post). Thus, we argue that Korean VCs should put more emphasis on the screening and value adding functions of the investee company. These could be done in several ways. For instance, Korean VCs may focus on specializing investment in a particular sector or can collaborate with the academic spin-offs or can form close relationship with the foreign VC firms as is seen in the case of Singapore and Israel. Korean VC industry is found to be more involved in financing the high-tech sector. This is of course not a bad phenomenon. But we are afraid that concentration on a single sector is likely to increase vulnerability of the Korean VC industry if the market conditions turns bad. We note that the success of VC industry depends on the robustness of the exit markets, and it becomes risky when there is a single sector concentration. Thus, we recommend that Korean VCs should diversify their portfolios to increase the shock absorbing capacity. There is also a regional equity gap as most of the VC activities is found to be concentrated in the Seoul area. This could be due to the Confucian mind set of the Korean people where starting a company is not seen as a sign of daring, but of failure. Unlike the US, average Koreans are still risk averse and getting a job in the government sector or any of the chaebols such as the Huyndai, Samsung, and LG groups are treated with an explicit social respect. Thus, a shift in the mindset is needed to appreciate pro-entrepreneurship thinking in all regions and in all sectors from both the bottom up and top down. Notably, our analysis confirms that firms located in other regions tend to perform well or at least not bad as compared to Seoul. This implies that Korean VC firms should extend VC activities in other regions too in order to increase their size of business and efficiency in operations as well. Most importantly, expansion of business in other regions expects to reduce gradually the cultural barrier to innovation and change and for that matter the Confucian attitude of the Korean people, in particular. As regards to the exit routes of Korean VC firms, it is found that strong exit routes such as the IPO and M&A only share 20% of the VC exits whereas secondary sale and write-off hold over 50%. Furthermore, M&A plays a minor role as an exit route as compared to the IPO. Given the volatile conditions of the Korean stock market, we suggest that the government should create environment for mergers and acquisitions, and encourage private ordering which are indeed important for the promotion of the VC industry, in particular. Last, but not the least, the VC system should be viewed as an interdependent organic system where the incentive and monitoring structure, the explicit and implicit contracts, and the VC market players relationships will be interrelated, and the role of the government should be to nurture the eco-system. The government should not interfere with the incentive and monitoring mechanisms among the market participants for the spontaneous development of the VC industry. In addition, the policy goal of the Korean VC development plan should include expansion of infrastructure for private sector leading venture investment in order to establish a market based venture business eco-system. shows the recent concept fund investment in Korea.

] Concept Fund in Korea

3.2 Lessons from Foreign Experience

3.3 Business Angel Investment in Korea : An Overview

3.4 Lessons from Foreign Experience

4.1 Korean VC Industry : An Overview

4.2. Patterns of VC Investment in Korea ? A Comparative Picture

4.3 Empirical Analysis on VC performance

. The dependent variable of model 1 and model 2 is net income divided by total assets, and the dependent variable of model 3 and model 4 is sales divided by total assets. The independent variable, SEOUL takes the value of 1 if a VC firm is located in Korea, 0 otherwise. BIGEMP takes the value of 1 if a VC firm’s average number of employees from 2003 to 2012 is equal to median of all VC firms in our sample or more, 0 otherwise. BIGTASSET takes the value of 1 if a VC firm’s average amount of total assets from 2003 to 2012 is equal to median of all VC firms in our sample or more, 0 otherwise. These two variables capture effects of size. OLD takes the value of 1 if a VC firm’s age at the time of 1st of January 2013 is more than 21 years, 0 otherwise. Also, NEW takes the value of 1 if a VC firm’s age at the time of 1st of January 2013 is less than 9 years, 0 otherwise. Year dummies are also incorporated into the models.

] Regression Results

4.4 Lessons from Foreign Experience

indicates the list of early stage ventures which got approval of investments from INCJ as of June, 2013. We did not include investments in funds, or in companies which had not been established yet when the investment decision of INCJ was made in order to analyze only usual VC investments of INCJ. INCJ usually invests from ¥300 million to ¥600 million in early stage ventures per deal. This investment is fairly large in early stage ventures in comparison to the average amount of private VC fund invested in an early stage venture per deal.

] Early Stage Ventures Invested by INCJ (by May 2013)

5.1 Korean IPO and M&A Activities as Exit Routes

5.2 Lessons from Foreign Experiences

Ⅵ. Conclusion and Policy Recommendations

참고문헌

이미지 / 테이블

[

<Table 1>

]

Concept Fund in Korea

[

<Figure 1>

]

Business Angel Investments in Korea

[

<Figure 1>

]

Business Angel Investments in Korea

[

<Figure 2>

]

Number and Amount of VC Fund in Korea

[

<Figure 2>

]

Number and Amount of VC Fund in Korea

[

<Figure 3>

]

Proportion of Number of Companies Invested by VC Firms by Region in Korea

[

<Figure 3>

]

Proportion of Number of Companies Invested by VC Firms by Region in Korea

[

<Figure 4>

]

Proportion of Amounts Invested by VC Firms by Region in Korea

[

<Figure 4>

]

Proportion of Amounts Invested by VC Firms by Region in Korea

[

<Figure 5>

]

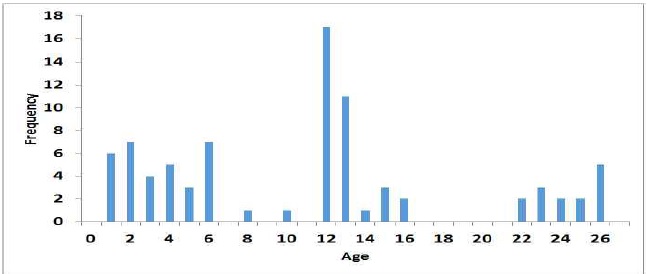

Distribution of VC Firms by Age

[

<Figure 5>

]

Distribution of VC Firms by Age

[

<Figure 6>

]

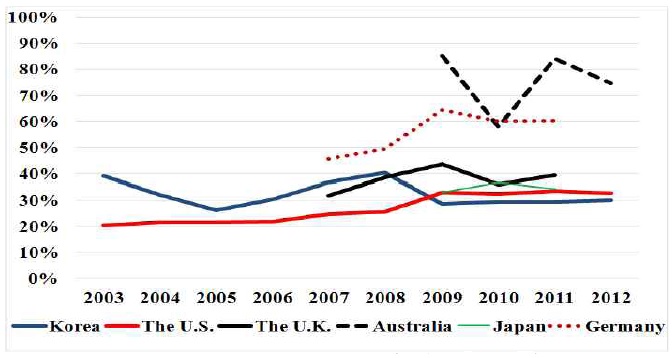

VC Investment as a share of GDP

[

<Figure 6>

]

VC Investment as a share of GDP

[

<Figure 7>

]

Ratio of Amount of Investment in Early Stage Ventures to Total VC Investments

[

<Figure 7>

]

Ratio of Amount of Investment in Early Stage Ventures to Total VC Investments

[

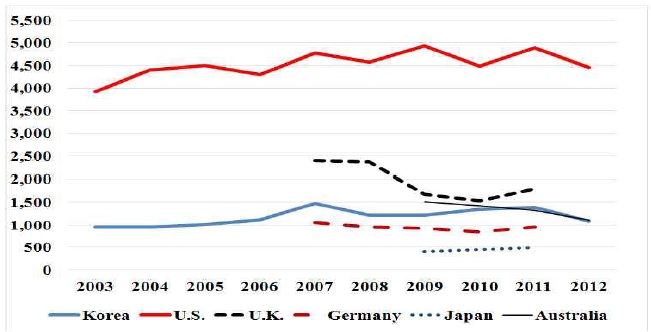

<Figure 8>

]

Average Amount of VC Investment in Early Stage Ventures per Deal (in $ thousand)

[

<Figure 8>

]

Average Amount of VC Investment in Early Stage Ventures per Deal (in $ thousand)

[

<Figure 9>

]

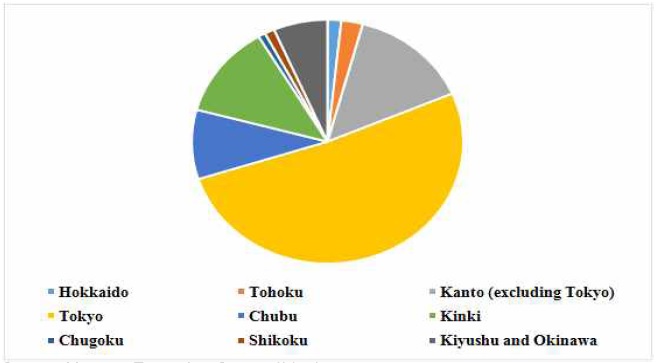

Proportion of Amount of Outstanding Balance of Investment and Loans by Region in Japan as of March 2011

[

<Figure 9>

]

Proportion of Amount of Outstanding Balance of Investment and Loans by Region in Japan as of March 2011

[

<Table 2>

]

Regression Results

[

<Table 2>

]

Regression Results

[

<Table 3>

]

Early Stage Ventures Invested by INCJ (by May 2013)

[

<Table 3>

]

Early Stage Ventures Invested by INCJ (by May 2013)

[

<Figure 10>

]

Exit Routes of VC Firms in Korea (Percentage)

[

<Figure 10>

]

Exit Routes of VC Firms in Korea (Percentage)

[

<Figure 11>

]

Exit Routes of VC Investments in Japan (Percentage)

[

<Figure 11>

]

Exit Routes of VC Investments in Japan (Percentage)

[

<Figure 12>

]

IPO and M&A of VC-backed Companies in the US (Percentage)

[

<Figure 12>

]

IPO and M&A of VC-backed Companies in the US (Percentage)

[

<Figure 13>

]

Exit Routes of VC Investment in the UK (Percentage)

[

<Figure 13>

]

Exit Routes of VC Investment in the UK (Percentage)

[

<Figure 14>

]

Number of IPOs Underwritten by Top Three and Other Underwriters in Japan

[

<Figure 14>

]

Number of IPOs Underwritten by Top Three and Other Underwriters in Japan

[

<Figure 15>

]

Structure of M&A Market for SMEs by OCCI

[

<Figure 15>

]

Structure of M&A Market for SMEs by OCCI