Two competing and possibly complementary phenomena contribute to explaining the observed rising inequality between skilled and unskilled workers within a nation’s boundaries. Both the increasing presence of developing and transition countries in the international production networks and the fast advances in Information and Communication Technology (ICT) have radically modified the production systems. There are several consequences of such changes in production, and the increase in wage inequality in developed countries has been well investigated, in particular with reference to the US economy.

Technological change has been indicated as the driving force explaining the pattern of wages in developed countries. Gathering some stylized facts for the US economy, Acemoglu (2002) develops a unifying theoretical framework in which the behavior of technological change can be understood recognizing that the development of new technologies is, in part, a response to profit incentives. Greater availability of skilled workers in the 20th century has made it more profitable to develop skill-biased technological change (SBTC), while, reviously, the great availability of unskilled labor made the development of skill-replacing technological change more profitable . Hence, recent technological developments have affected the organization of firms, of labor markets and of labor market institutions, resulting in large effects on wages.1

Nevertheless, the increasing fragmentation of production with the bursting of trade in intermediates can be an alternative explanation forwage inequality (Feenstra, 1998). Feenstra and Hanson (1996, 1999) initially focused on international outsourcing as the main cause for the rising relative demand for non-production workers2 and only later extended the analysis including the role of technological progress. The empirical results from this extension ended in a positive and significant role for outsourcing in explaining the wage gap (almost 40% of the observed wage gap) between the skilled and unskilled, although, in some specifications, the role for technological change turns out to be more important (about 75% of the observed wage gap).3 This factor bias effect of international outsourcing hinges on the hypothesis of a single good and two factors of production, skilled and unskilled labor. Arndt (1997) challenges this conclusion and shows how the factor bias of international outsourcing can turn into a sector bias if a twosectors two-factors Heckscher-Ohlin framework is considered. The expansion of production in the outsourcing sector allows for an increase in the demand and, subsequently, in the relative wage for low skilled workers in low skill-intensive industries. Then, inequality between skilled and unskilled is reduced and what matters for the increased wage inequality outcome is the skill intensity of the sector engaged in outsourcing.4

From the above discussion, the effect of international outsourcing and technological change on the wage gap is an empirical matter.5 As concerns the European experience, a number of papers focus on the relation between the relative demand for skilled labor and international outsourcing at the sector level (Hijzen

Similarly to the approach adopted in this paper, Geishecker and Gorg (2008a) investigate the link between outsourcing and wages using a large household panel and combine it with industry level data. They point out that industry level studies are actually affected by an endogeneity bias that can be overcome using individual wages. For this reason, they estimate a wage equation introducing the sectoral outsourcing of materials and R&D intensity as additional regressors showing that outsourcing negatively affects low-skilled workers’ real wage and produces some gains for skilled workers.

Falzoni

In order to contribute to the empirical literature on the effects of international outsourcing and technological change on wage inequality, this work focuses on the case of Italy between 1985 and 1999. Although disparity in real wages among skilled and unskilled workers in Italy has increased moderately with respect to other developed economies, the process of delocalization of manufacturing production towards cheaper labor locations has been relevant, especially for more traditional sectors. By the same token, the ICT capital deepening has represented an important, although slower, transformation for Italian manufacturing. Then, despite the rather rigid institutional framework, we believe that these two phenomena have played a determinant role in affecting individual wages and the yet little change in inequality across workers’ categories. These issues are particularly relevant to guide future industrial and labor policies and what remains to establish is which of the two ‘revolutions’ prevailed, taking care to disentangle possible heterogeneous responses across sectors.

We follow Hijzen (2007), focusing on outsourcing and technological change as simultaneous sources of wage inequality, while we build on Geishecker and Gorg (2008a), using a large panel of individuals to avoid the endogeneity bias of sectoral studies.6 Differently from previous studies, we drop the use of R&D and we measure technological change by means of ICT capital per worker and, relying on information from Italian input–output tables, we directly use the data on imported intermediate inputs with no need to attribute a share of total imports to imports of intermediates. We focus on outsourcing instead of overall trade and we do not limit the analysis of outsourcing in Italy to Outward Processing Trade (OPT), as we include all imported intermediate inputs and not only reimports.7 For the first time, to our knowledge,we also consider the outsourcing of business and financial services.8 To obtain robust results,we control for other sectoral time varying factors (sectoral productivity and skill intensity) and for other unobserved effects that might drive the wage gap (e.g. changes in labor market institutions). A last refinement consists of considering heterogeneous inequality effects of international outsourcing and ICT capital deepening across sectors.

Our results, in general, confirm that both material and service outsourcing widen the skilled/unskilled wage gap while ICT capital deepening positively affects real wages regardless of the worker’s status. Important differences emerge when the overall sample is split between traditional and innovative sectors. Material outsourcing plays a major role in explaining the wage gap in traditional sectors, while the outsourcing of business and financial services dramatically affects it in innovative sectors. ICT capital deepening only matters for inequality in innovative sectors. Finally, and differently from the the general findings in the literature (Feenstra & Hanson, 1999; Hijzen, 2007), the size of the effect of technological change is lower than the size of the effect of international outsourcing.

The paper is organized as follows: section 2 presents the data sets and the variables; sections 3 and 4 discuss the empirical model and its results, and section 5 reviews the main findings.

1Machin and Van Reenen (1998) confirm the SBTC hypothesis studying a panel of 7 countries (Denmark, France, Germany, Japan, Sweden, UK, US) over various time intervals (within the period 1973–1989) with 15 manufacturing sectors. More recently, Bratti and Matteucci (2005) point out that the evidence in favor of SBTC for European countries is less straightforward. For further refinements on the relation between technological change and wage inequality see, among others, Aghion et al. (2002) and Borghans and ter Weel (2004). 2They found that the change in outsourcing can account for 30 to 50% of the increase in the non-production workers’ relative wage in the USA manufacturing sectors in the period 1979–1990. 3The result, though, is sensitive to the measure of ICT capital adopted and sometimes bears a smaller effect of the latter variable with respect to the effect of international outsourcing. 4Egger and Falkinger (2003) develop a complete characterization of the distributional effects of international outsourcing in the Heckscher-Ohlin framework where the factor and sector bias are reconciled according to a final equilibrium with specialization or diversification. Kohler (2001), instead, proposes a specific factor model allowing for the possibility of a welfare reducing effect of outsourcing for the domestic economy, even without any market distortion. 5Another stream of literature addresses the role of outsourcing in enhancing productivity. Amiti and Wei (2009) find a positive effect of outsourcing of materials and services for the US. For Italy, Lo Turco (2007) and Daveri and Jona-Lasinio (2008) confirm the positive role of outsourcing of materials on productivity, while services outsourcing seems to reduce productivity. 6Recently, the combination of micro data with sector level offshoring intensities has also been used to investigate the relationship between the latter and workers’ post displacement wages (Crinò, 2010). 7Helg and Tajoli (2005) use this very narrow definition of outsourcing, which only conveys information on manufacturing re-imports. 8To be more precise, only recently – and subsequent to the publication of the working paper version of this work (Broccolini et al., 2007) – do Geishecker and Gorg (2008b) deal with the wage effects of the outsourcing of services for the UK economy.

To analyze the impact of outsourcing and ICT on individual wages and wage inequality, we build a database for more than 120,000 workers observed from 1985 and 1999, merging three different data sets that contain information on individual wages, sectoral ICT, productivity and outsourcing.

The Italian Institute for National Social Security (INPS thereafter) collects data on all Italian workers employed in the private sector (except agriculture) through an administrative procedure based on firms’ declarations. Because of the administrative nature of the data, only fewindividual variables are collected onworkers. In particular, yearly grosswages,9 weeks and days ofwork, gender, age, qualification, region of the workplace, firms’ sector and size are available but, unfortunately, tenure, educational levels, daily working hours, family composition and family background are missing.

In thiswork,we employ a sample of thewhole data set, rearranged by ISFOL,10 which collects information on every workers born on the 10th of March, June, September and December of each year. Thus, one worker out of about 91 is included in the sample and the whole data set comprises more than 2,100,000 observations.11 We calculate the daily individual real wages (

Furthermore, we only consider primary workers, i.e. male workers aged between 30 and 55: the increasing presence of female and young workers in the original data set might produce a distortion due to these workers’ preference for part-time work. Finally, we drop observations referring to individuals working in the service sectors in order to focus the analysis on manufacturing.

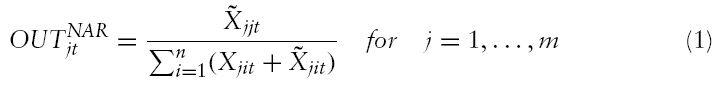

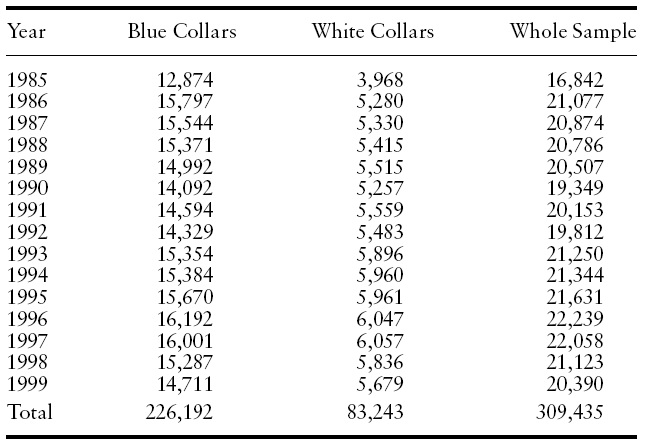

Table 1 shows the number of observations in our (unbalanced) panel, by year and skills defined as Blue Collar (

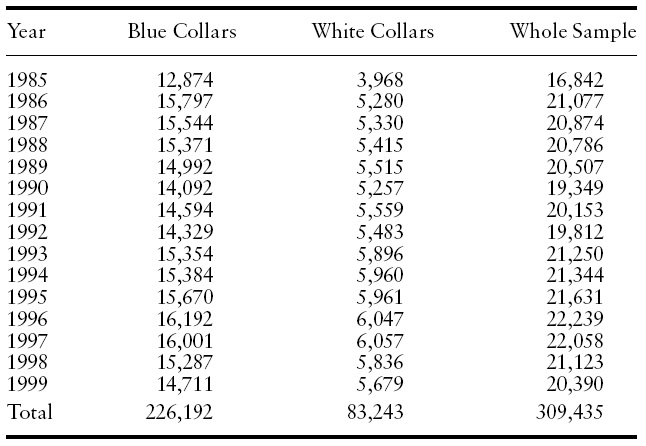

We measure the intensity of outsourcing calculating two alternative sector level indicators for material outsourcing and a third one for services outsourcing, using data drawn from the Italian input–output tables elaborated by Giorgio Rampa.13 To calculate the degree of material outsourcing, we employ a ‘narrow’ indicator, defined, in accordance to the previous literature (see Feenstra & Hanson, 1999), as:

where

for each sector

[Table 1.] Workers presences in the data set, by year and skill

Workers presences in the data set, by year and skill

To measure the overall intra- and inter-industry substitution process brought about by outsourcing,we also calculate a ‘broad’ measure of material outsourcing for sector

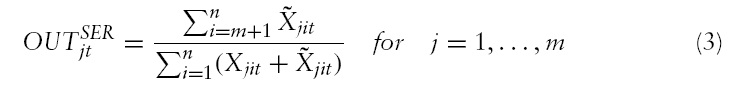

Eventually, the outsourcing of services in sector

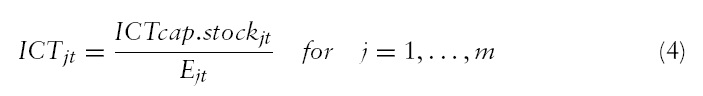

Moving to our second variable of interest, the extent of ICT capital deepening is measured as:

where

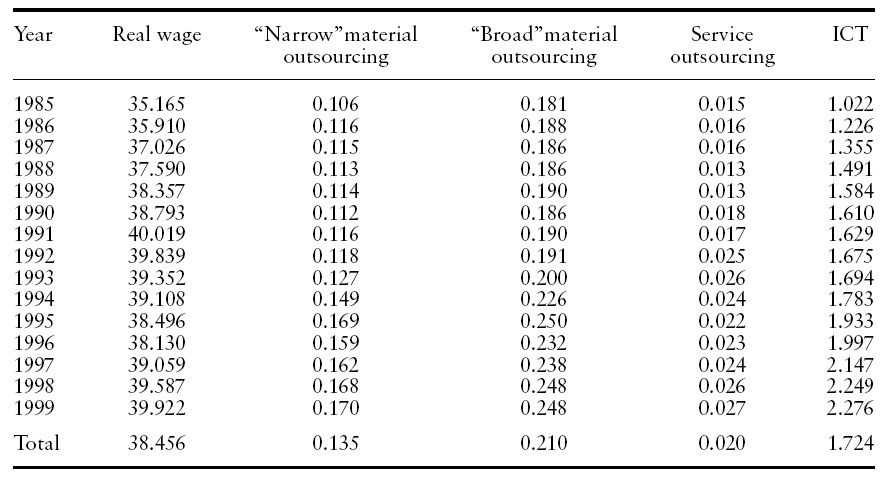

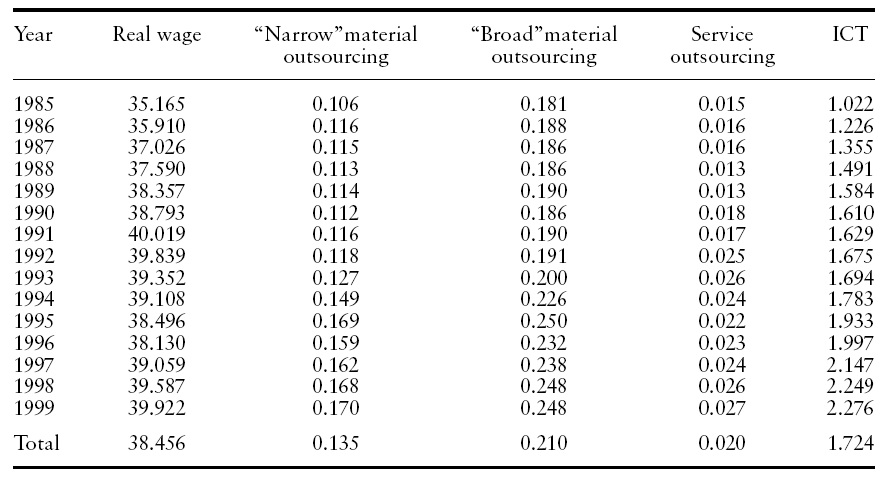

The analysis of the temporal and sectoral distribution of our key variables is showninTables 2 and 3.The average realwage grewsteadily until 1991. From1992 onwards, the effect of the lira crises and the loss of competitiveness together with the negotiation of the ‘Protocollo sulla politica dei redditi e dell’occupazione’ (signed in 1993 by the government and social partners), which introduced the method of ‘concertazione’ and the two-tier bargaining system, both at sectoral and firmlevel, probably played a role in the real wages reduction that occurred up to 1996. The ‘narrow’ measure of material outsourcing14 increases in the period under analysis, partially reflecting the trend emerging for the ‘broad’ measure of outsourcing, while the intensity of imported business and financial service inputs nearly doubled during the sample period, even if it is much smaller than the other indicators.

[Table 2.] Daily real wages and outsourcing and ICT indicators, yearly averages

Daily real wages and outsourcing and ICT indicators, yearly averages

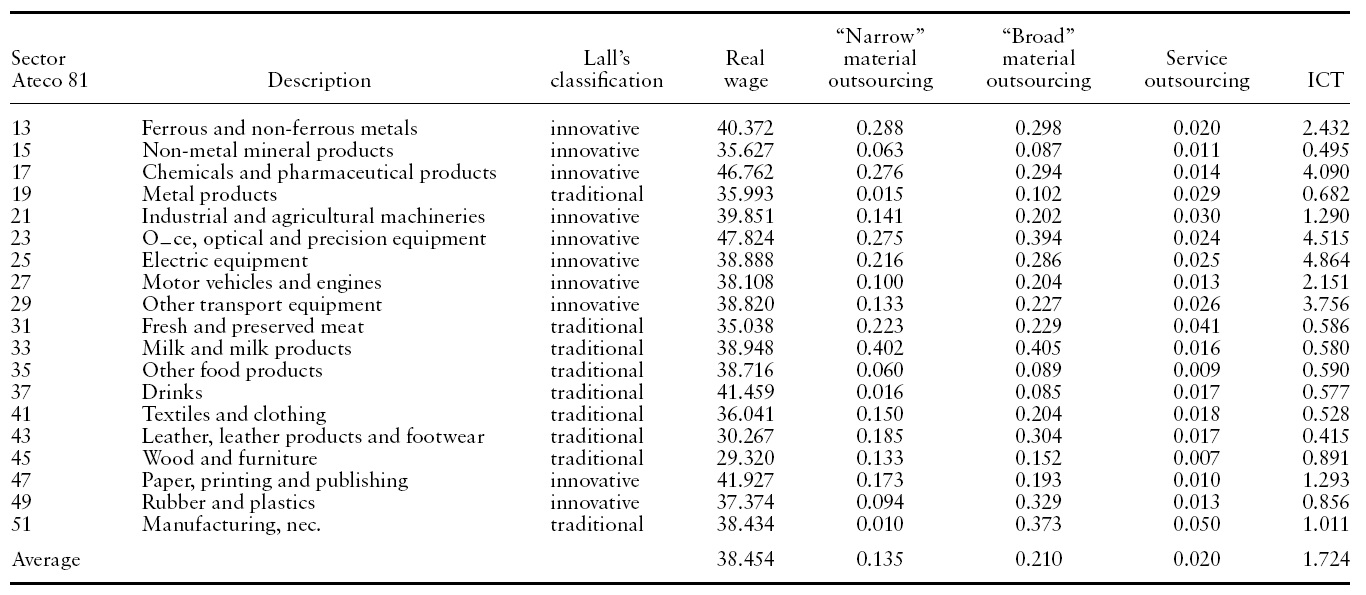

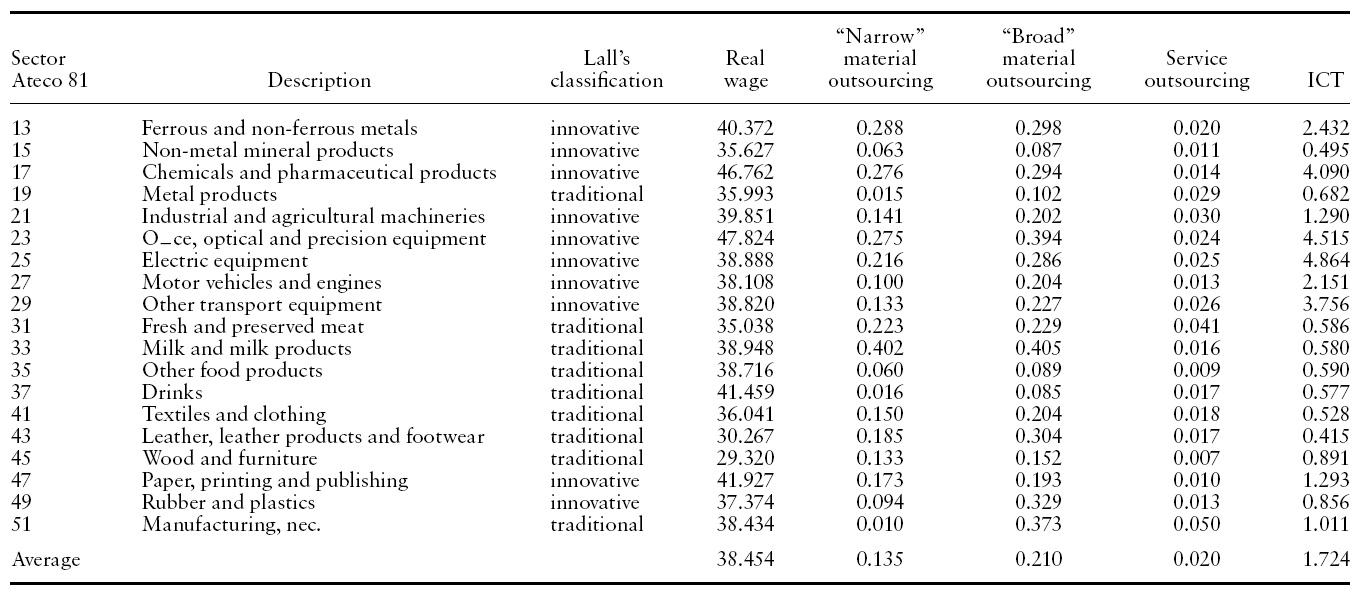

[Table 3.] Daily real wages and Outsourcing and ICT indicators, averages by sectors

Daily real wages and Outsourcing and ICT indicators, averages by sectors

Across sectors, the outsourcing of materials, both in the narrowand broad measure, is more pronounced in the Chemicals and Pharmaceutics, Office, Optical and precision Equipment, Electric Equipment, Meat, Milk Products and Leather. ICT capital per worker is higher than the average in more innovative sectors, such as the Chemicals and Pharmaceutics, Office, Optical and Precision Equipment, Electric Equipment and Motor vehicles and transport Equipment.15

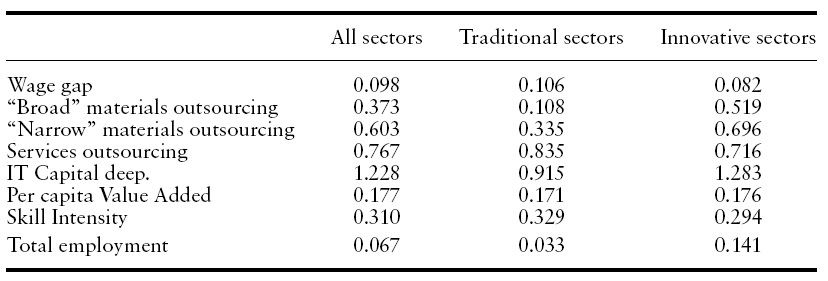

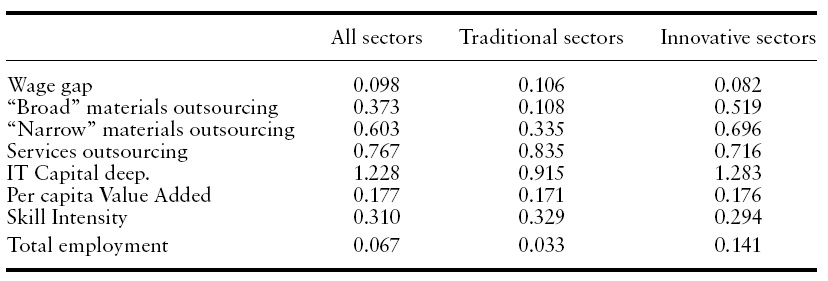

To sum up, Table 4 shows that, on average, the gap in real wages has grown by more than 9%, with a higher rate in traditional sectors. Material outsourcing increased by 60%, when measured according to the narrow definition, with an even faster pace in innovative sectors. The outsourcing of business and financial services grew by more than 75%, with many innovative sectors displaying shares above the overall manufacturing average. It is worth noticing that for both material and service outsourcing the temporal evolution shows an acceleration at the beginning of the 1990s (see Table 2). The ICT capital per worker experienced the most striking growth, more than doubling during the sample period, especially in innovative industries.

[Table 4.] Variation rate in the period 1985?1999

Variation rate in the period 1985?1999

Coming to the other possible determinants of the wage gap, sectoral productivity grew by around 17% and the skill intensity by about 30%, both almost homogeneously across traditional and innovative industries. Eventually, the evolution of total employment was highly skewed towards innovative sectors (+14% with respect to +3.3% in traditional sectors).

9Gross wages are the sum of net wages, taxes and social contributions on workers; social contributions on firms are not included in gross wages. 10Istituto per lo Sviluppo della Formazione Professionale dei Lavoratori (Institute for Training Workers). 11For a detailed description of the dataset, see Centra and Rustichelli (2005). 12This price index is calculated by the Italian Institute of Statistics (ISTAT) with respect to blue and white collar households. 13We consider 19 sectors, according to the ateco 81 classification, 2 digits. The dataset is available at http://www.giuri.unige.it/iotables/index.html 14In the descriptive analysis, the indicators of outsourcing and capital deepening are in levels and not in logarithms, in order to be more readable. 15The classification of sectors as ‘Traditional’ or ‘Innovative’ follows the one in Lall and Mengistae (2005): the 19 ateco-81 sectors are classified as Innovative according to the existence of economies of scale and to the technological content of their typical activities; the remaining sectors are classified as Traditional.

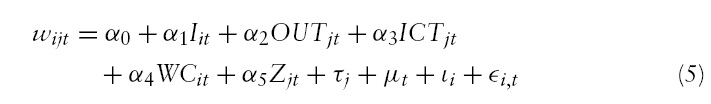

The empirical model is a standard wage equation (see, among others, the seminal contribution of Mincer, 1974), in which we add the outsourcing and the ICT variables among the right-hand side regressors. The basic specification of the wage equation for the panel data set is given by:

where,

• individual specific data: age, number of days worked per year, their squared values to account for nonlinearities;

• work specific data: firm size, measured by a categorical variable based on the number of employees and the region where the firm is located.

With respect to our key variables,

is an idiosyncratic shock affecting individual wage at time

To study the relation between outsourcing, technological change and wage inequality, we follow two strategies. First, we include in equation (5) the interaction terms between the

Secondly, to test the robustness of our findings, we estimate equation (5) for the two sub-samples of blue and white collar.

Equations (5) and (6) could be estimated with standard Fixed (FE) or Random Effects (RE). We perform the Hausman test, rejecting, in both cases, the null hypothesis.17 Thus, we will generally present the results obtained using the FE estimator.18

We test for the presence of serial correlation following a solution proposed by Wooldridge (2002) and implemented in Stata by Drukker (2003), based on the AR(1) serial correlation of the residuals obtained from the estimation of model (5) in first difference. Since the test rejects the null hypothesis, we will estimate equations (5) and (6) using the variance–covariance matrix corrected both for heteroskedasticity and serial correlation.

16We take the natural logarithm of the share of outsourcing as previously defined and of the other variables introduced below, so that we can easily interpret their estimated coefficient as elasticities. However, we will also check for the robustness of our results using the linear and the logistic transformation of these variables. 17This results is also consistent with the a priori that, in our specification, the additional hypothesis required by the RE of no correlation between the unobserved effects (i.e. education, innate ability) and the explanatory variables is likely to fail. 18The results of these tests are available from the authors, on request.

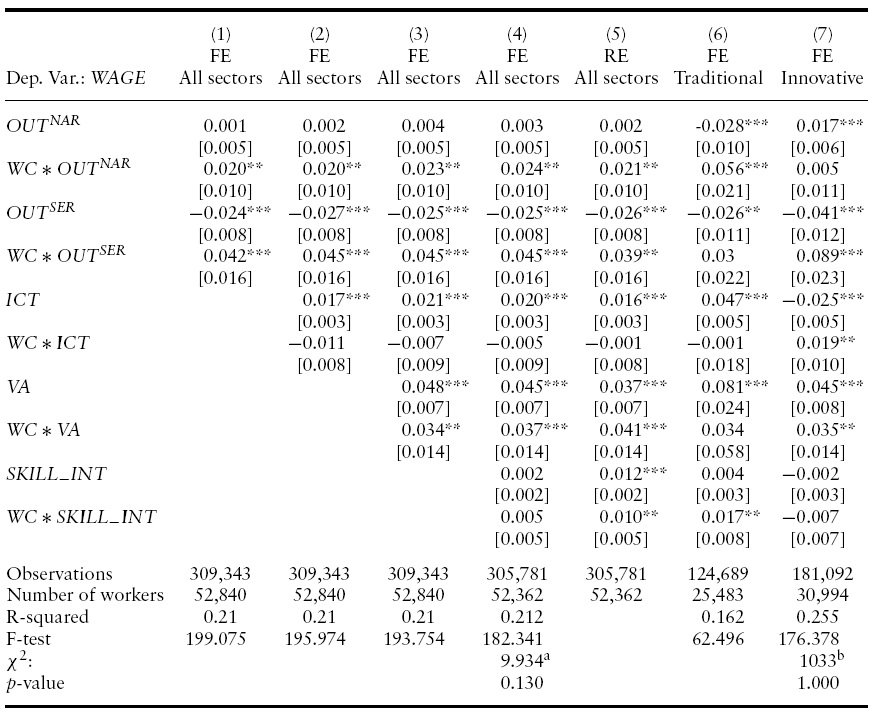

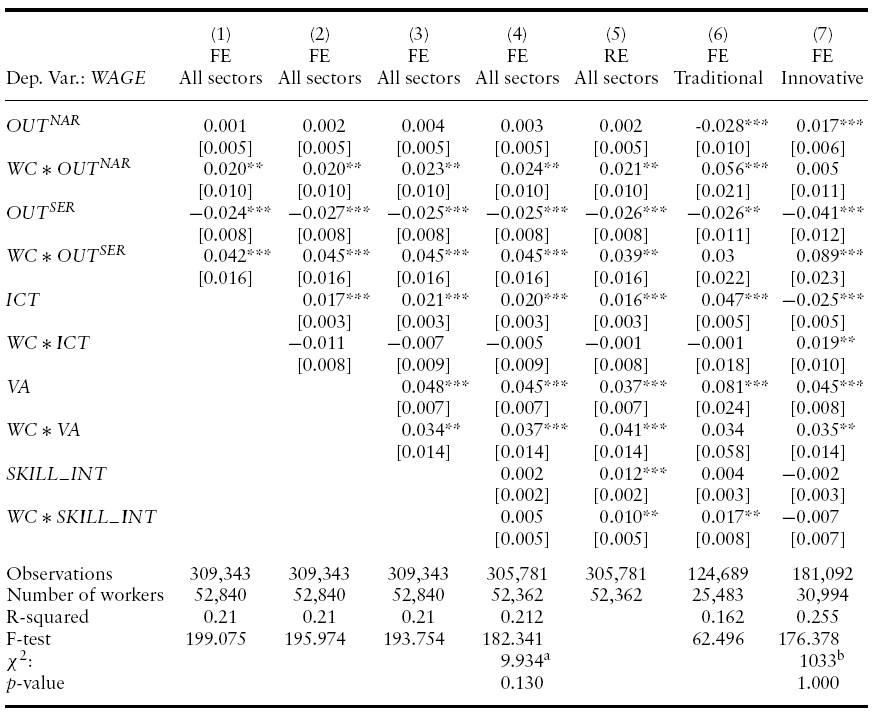

Table 5 presents the relevant coefficients of the estimation of equation (5).19 Columns (1) to (4) show the fixed effect estimates: we start including only the outsourcing variables and thenwe add

In what follows, we refer to material outsourcing considering the ‘narrow’ indicator (equation (1)), but similar results are obtained substituting this measure with the ‘broad’ one.20 Our results show that wage inequality is widened by international outsourcing, while ICT capital deepening does not have any significant effect on the wage gap. Specifically, the coefficients on material and service outsourcing are stable across different specifications (columns (1)–(4)).

In column (5) we report the Random Effects estimates: there are no relevant differences in the magnitude and significance of the coefficients of our key variables, apart from

[Table 5.] Estimation of equation (6)

Estimation of equation (6)

The main assumption in the estimation of the empirical model is that sector level outsourcing and ICT capital deepening are exogenous with respect to individual earnings. An endogeneity bias might arise if the decision of firms to relocate production abroad and/or to invest in ICT are affected by the evolution of individual wages.

In Italy, industry wages are mainly based on national contracts and this could influence firms’ decisions to relocate production abroad and to invest in ICT. Nevertheless, a relevant heterogeneity remains across individual wages because of personal and territorial features. Therefore, sector level phenomena can be considered exogenous with respect to each individual wage history. However, we perform the C-test statistic to test for the endogeneity of

The last two columns showthe results obtained separately estimating equation (5) for the two sub-samples of traditional and innovative sectors, in order to ascertain if outsourcing and technological change have heterogeneous impacts on wage dispersion in different industries, according to their degree of innovative capacity. The estimates point out interesting differences since material outsourcing only affects inequality in traditional sectors while service outsourcing does so in the innovative ones. As expected, the role of ICT capital deepening is only relevant for disparities in innovative sectors. The detailed results are as follows:22

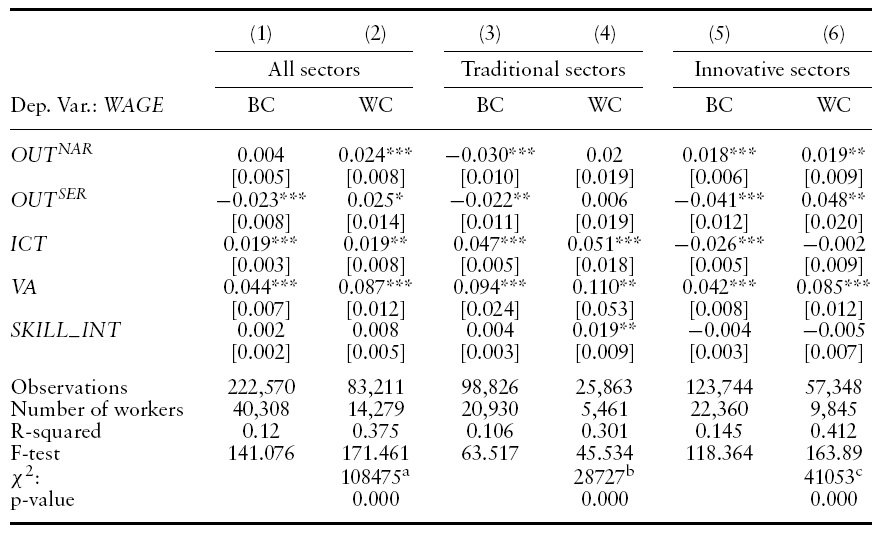

• material outsourcing has amuch larger impact onwage inequality in traditional sectors than on average, since it lowers the blue collar wages and raises the white collar wages by almost the same amount. In innovative sectors, instead,

• service outsourcing has a strong effect on wage inequality in innovative sectors, since the elasticities are twice as large as average both for white collar (+0.048) and blue collar (−0.041) wages. In traditional sectors, on the other hand, an increase in

• ICT capital deepening, which does not affect the average level of inequality (columns (2)–(4)), turns out to increase wage dispersion in innovative industries, where it lowers the BC wages, leaving roughly unaffected theWC wages. In traditional sectors,

The last rows of column (6) in Table 5 display the Wald test and P-value for equality of coefficients across the two subgroups of sectors: the null is strongly rejected providing evidence of heterogeneity of the effects of outsourcing and ICT according to the typical content of the activities performed.

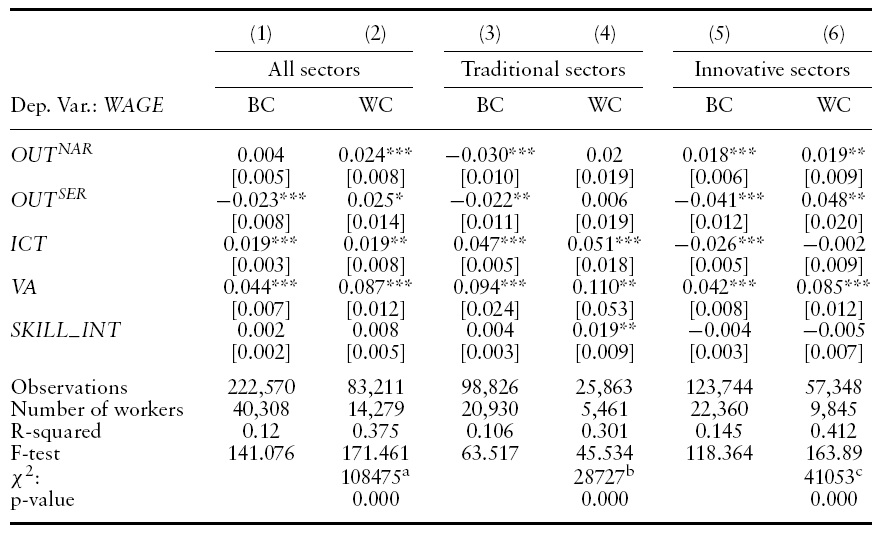

Table 6 reports the results of the fixed effects estimation of equation (6) separately for white and blue collar workers. The first two columns refer to the overall sample, while the other columns make a distinction between traditional and innovative sectors. The results generally confirm the ones obtained by the general model (5), in which we model heterogeneity including interaction terms between our key variables and

Our results are robust to a number of modifications of the empirical model and to different definitions of outsourcing and ICT.23 As regards model specification, the one-by-one exclusion of some of the sectoral controls does not change the size and significance of the effects of ICT and outsourcing. Furthermore, results are consistent even taking either the linear or the logistic transformation of the shares of material and service outsourcing and of the share of non-production workers in total workforce. With respect to alternative indicators of outsourcing and capital deepening, we replace the ‘narrow’ indicator with the ‘broad’ one (

[Table 6.] Estimation of equation (5), by worker’s status

Estimation of equation (5), by worker’s status

19The complete estimation includes a set of control variables available in the data set, namely workers’ ages (linear and squared), days worked (linear and squared), regional, yearly, firm size and sectoral dummies. 20Results are not reported for the sake of brevity, but they are available from the authors upon request. 21In doing this procedure, we follow Geishecker and Gorg (2008a). Nonetheless, we are fully aware that possible issues of simultaneity and reverse causation would need a deeper inspection and might represent a potential problem for our estimates. 22As regards industry level controls, sectoral productivity in general is related to an increase in wages, although it is associated with an increase in the wage gap in the innovative sectors. The degree of skill intensity has a limited effect only on wage inequality in traditional sectors, where it raises the daily real wage of skilled workers. 23Results are not reported for the sake of brevity, but they are available from the authors upon request.

The focus of thiswork has been on the relative impact of international outsourcing of materials and services and ICT capital deepening on the skilled/ unskilledwage inequality in Italy.

The case of Italy can be considered an interesting one since relevant changes have occurred in manufacturing due to the delocalization of production towards lowwage cost locations. ICT capital deepening has also reshaped the organization of firms in Italian manufacturing, and the gap in real wages between skilled and unskilled has increased during recent years. A large panel of workers has been combined with sector level data on international outsourcing and ICT capital stock, producing a unique and wide data set where the wage disparity evolution has been observed between 1985 and 1999, a relevant period for the changes undergone in the Italian manufacturing. Besides, a measure of sectoral productivity and one capturing the degree of skill intensity, together with interactions of both time and industry dummies with worker’s status are meant to control for further observables and unobservables driving the inequality outcome.

Apart from the focus on both international outsourcing and ICT, which allows for conveying information on their relative importance in affecting the wage gap, the present paper adds to the existing empirical literature providing evidence on their heterogeneous effects across workers and sectors. In this respect, although international competition and technological progress have strongly stimulated the general reorganization of production in Italian manufacturing, the responses of traditional and innovative sectors have been different, with the former looking for cost saving and the latter for technology improvements.

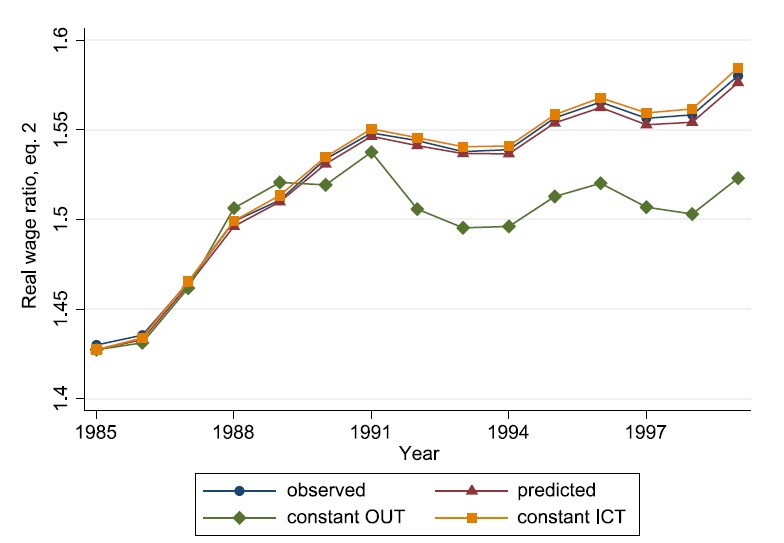

In general, our results are consistent with the idea that international outsourcing was one of the determinants of the broadening wage gap between skilled and unskilled Italian workers in the period 1985–1999. The real wage ratio, in fact, increased from about 1.43 to around 1.58 during the sample period. To have an idea of the economic contribution of outsourcing and ICT capital deepening on the evolution of the wage ratio, we present its observed path, the one predicted by the model (5), and the ones calculated with outsourcing and

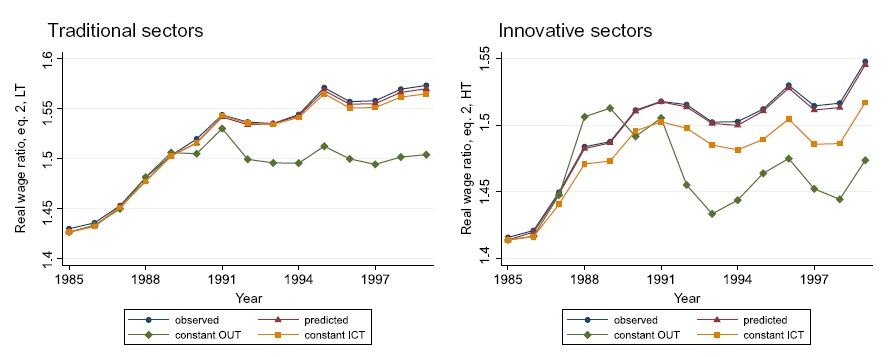

Figure 2, built in the same way as Figure 1, investigates the possibility that technological change and international outsourcing have different effects on the wage gap in traditional (left panel) and innovative (right panel) sectors. As one could see, the evolution in traditional sectors mimics the one for the entire manufacturing industry, while the picture is somewhat different for innovative sectors, as results from the estimation of the wage equation. More specifically, the wage ratio increases from 1.41 to 1.55: in this case both technological change and international outsourcing contributed to the wage gap, even if the latter is the predominant force. On the one hand, the effect of ICT capital deepening accounts for around 0.03 points out of the 0.14 point increase in the wage ratio and its contribution is pretty stable and increasing through time. On the other hand, the impact of outsourcing seems to start in the 1990s and it accounts for 0.08 points. Hence, international outsourcing and ICT capital deepening together explain a large part of the widening wage dispersion in innovative sectors, with the former being the most relevant factor. Despite the fact that this result is somewhat reversed with respect to the existing empirical evidence concerning other economies (Feenstra&Hansen, 1999, for the US, and Hijzen, 2007, for the UK) it can be related to the slower pace of the ICT ‘revolution’ compared with the increasing importance of vertical disintegration in the organization of firms in Italy.

Cost saving, together with a reduction in the weight in total employment, is consistent with our result on increased inequality in traditional sectors, mainly driven by the outsourcing of materials. The factor bias effect of international outsourcing of material has resulted in the upgrading of jobs within the sector and to a decline in the relative real wage of the unskilled. Technological change increases the average wage, but is neutral with respect to the workers’ status in the Italian traditional sectors.

For the innovative sectors, the search for productivity improvements together with the increase in the relative weight in manufacturing employment is in line with the observed increased inequality related more to business and financial services and ICT capital deepening.

Whether high or low skill intensive, the dramatic increase in the outsourcing of business and financial services together with the growth in the relative weight of innovative sectors in total manufacturing employment could reproduce the inequality result studied by Arndt (1997). If it is the high skill intensive sector to send abroad part of production, the relative wage of skilled workers increases.

The results fromthis research naturally lead to some future developments in the study of the consequence of international outsourcing and ICT on the stability of wages and employment across sectors, and workers’ status.