According to the neoclassical economic theory – assuming free capital markets and diminishing returns – capital should flow from capital-abundant countries (developed countries) to capital-scarce countries (developing countries) leading to the equalization of marginal returns to capital. In reality, this theoretical prediction is not observed, leading to an important paradox in international macroeconomics: the ‘Lucas paradox’. Private capital flows are important in financing development, especially in the context of insufficient and unstable aid, which makes it crucial to understand why the neoclassical theory is not observed. Why does capital not flow to developing countries where their marginal return is higher? Answering this question requires the study of the determinants of private capital flows. For foreign private capital, we consider net flows of FDI, portfolio investments and debts.

Following the Asian crisis, a number of studies on the determinants of private capital flows emerged. These studies were generally based on an approach that distinguishes between external determinants (exogenous to the economy receiving capital, or ‘push factors’) and internal determinants1 (under the recipient economy’s control, or ‘pull factors’). The analysis of external factors explains how the economic conditions of capital-exporting countries (developed countries) influences capital inflows in developing countries. These external factors reflect the opportunity cost of investment in these countries. The international interest rate and world growth rates, generally approximated by those of the United States, are the most influential factors. Low profit in developed countries is a significant cause of capital flows to developing countries where profits’ prospects can be more promising. One of the first investigations of private capital flows determinants was made by Calvo

All of these studies lead to different conclusions about the factors which significantly influence private capital inflows to a country. Another crucial element to attracting FDI is building industrial capacity. This includes developing infrastructure and human capital; strengthening institutional capabilities and economic openness; and promoting sound macroeconomic policies (low inflation, strong and sustainable economic growth). The purpose of this study is to extend the ‘Lucas paradox’ approach (which considers only the economic fundamentals3 and capital market imperfections), by integrating external factors from the traditional approach (‘push-pull factors’). Emphasis will be given to physical infrastructure and financial development that have received insufficient attention in the literature (especially for financial development) given the importance of their contribution for countries attractiveness to private capital flows. In addition, the paper controls for non-traditional variables such as capital control and banking crises. We will analyze aggregated private capital flows and their components. Breaking-up aggregate private capital flows allows the differentiation between short-term and long-term flows, which can have some common determinants while other factors are specific to certain flows. Contrary to past studies, this paper takes into account the relationship between different components of private capital and non-linear effects of financial development.

The rest of the paper is organized into two main sections: the first section analyzes the theoretical relation between private capital flows, infrastructure, and financial development and describes a simple framework based on the ‘Lucas paradox’ approach. The second part of the paper is devoted to the empirical analysis of the determinants of private capital flows followed by robustness checks. The last part concludes.

1Studies also focus on contagion during episodes of surges in private capital flows between large countries and their smaller neighbors who benefit from externalities resulting from the high attractiveness of the large countries (Calvo et al., 1996; Hernandez et al., 2001). Competition between countries of the same area for better attractiveness to private capital flows could also happen (Kang et al., 2003). 2A very recent approach, applied to emerging countries, consists of the estimation of a model of supply and demand of capital flows. Then, using the maximum likelihood method, this approach estimates the probability of disequilibrium between supply and demand of capital (Mody & Taylor, 2004). 3The economic fundamentals include industrial capacity main determinants.

2. Infrastructure and Private Capital Flows

Infrastructure availability is one of the key elements needed to run efficient business. A large number of studies (The World Bank, 1994; Temple, 1999; Demurger, 2001; Willoughby, 2003) highlight the role of infrastructure (telecommunications, electricity, etc) for economic growth and development. Beyond its direct effect on economic growth, infrastructure also affects growth by increasing private investment.4 A better availability of infrastructure increases the output of private investment by reducing transactions costs and enabling firms to get closer to their customers and suppliers, making it possible for the firms to increase their potential markets and thus their opportunities for profit. Well-developed telecommunications infrastructure, for example, can help firms to access financial resources through financial markets. Firms that do not have access to modern telecommunication services, reliable provision of electricity, or developed road systems invest less and have fewer productive investments (regardless of whether they are local or foreign).When the provision of well-functioning infrastructure fails, firms are sometimes forced to pay the costs of providing infrastructure themselves, such as electricity through power generating units, in order to continue their activities. This type of provision is generally more costly than traditional infrastructure provision. In addition to these high costs of provision, firms also support other costs due to damages caused by power outages.

The determinants of FDI may vary according to their type. FDI in manufacturing, services or in oil, gas and mineral extraction may have different determinants. Moreover, variables such as infrastructure, education or inflation may have different effects depending on the destination of FDI.

In previous studies, the importance of physical infrastructure in determining the attractiveness of foreign private capital essentially focused on FDI. Loree and Guisinger (1995) find that countries with developed infrastructure (measured by a multidimensional index of infrastructure) receive more FDI from the United States. Wheeler and Mody (1992) and Mody and Srinivasan (1998) find similar results. Kumar (2002), with a sample of 66 countries over 1982–1994, finds that the development of infrastructure, measured by a composite index, has a positive effect on FDI inflows. Ngowi (2001), Asiedu (2002) using a sample of African countries, and Jenkins and Thomas (2002) using a sample of Southern African countries, obtain similar results. The limited resources of the public sector in developing countries, coupled with profitable opportunities in some infrastructure projects (electricity, telecommunications, etc), lead to the provision of infrastructure by the private sector. Given the high cost of infrastructure investments, private corporations carrying out this type of investment are generally foreign. Sader (2000) finds that between 1990 and 1998, 17% of FDI flows received by developing countries were directed to infrastructure projects. According to Ramamurti and Doh (2004), FDI financing infrastructure represents one third of capital inflows to developing countries in the beginning of the 1990s.

4See Blejer and Khan (1984), Greene and Villanueva (1991), Serven and Solimano (1993).

3. Financial Development and Private Capital Flows

Financial development may increase private investments due to better access of firms to capital.5 With the emergence of financial intermediaries, financial development reduces transactions costs through lower informational asymmetry and better risk management and coverage.The reduction of informational asymmetry through financial intermediaries has a considerable effect on foreign capital and investments. In fact, in addition to the informational asymmetry supported by the local entrepreneurs, the distance between foreign investors and local markets generally increases this already existing information asymmetry. Foreign investors know neither the opportunities nor the risks of the local market as well as local investors do. Financial intermediaries can provide information about local market risks, providing more credibility to potential profit in the country. This stimulates the entry of new investors, in particular foreign investors, in the local market. Huang (2006), focuses only on domestic investment, but suggests an empirical model for the importance of financial development on investment. Using a sample of 43 developing countries over 1970–1998, he finds that financial development significantly and positively affects private investment. The author also concludes that private investment has a positive and significant effect on financial development. A developed financial sector also facilitates interactions between foreign and local firms and their suppliers and clients. The importance of financial intermediaries could also vary according to the type of private flows. Indeed, even if financial development significantly explains countries’ attractiveness to FDI and debts, financial intermediaries’ contribution for portfolio investments is more significant. Portfolio investments generally require a relatively developed financial sector and possibly the pre-existence of a stock market. Financial development, itself, can imply the entry of newbanks or newactors in the local market.The process of financial liberalization with bank privatization implies acquisitions in the form of FDI or portfolio investment, increasing of foreign private capital inflows. The importance of financial development for FDI could, however, be reduced with the entry of multinational banks which tend to follow their corporate clients.

As mentioned by Levine (1997), studies on financial development and investments generally do not distinguish domestic investments from foreign investments. Focusing only on foreign capital, this study enriches the scarce literature on this topic. To the best of our knowledge, very few studies deal specifically with the effect of financial development on private capital flows, precisely FDI. Hausmann and Fernandez-Arias (2000) find that countries with the least developed capital markets tend to have more FDI inflows. According to the authors, FDI can be alternative financing for the firms that do not have access to capital markets. However, using a sample of 81 foreign firms based in Southern African countries, Jenkins and Thomas (2002) show that the better financial sector development in South Africa helps the country to attract relatively more FDI than other African countries. Montiel (2006), in a theoretical analysis, argues that Africa does not attract enough foreign private capital to finance sectors with high potential profits because of Africa’s human capital weakness, lack of infrastructure, and bad institutional quality. Montiel (2006) underlines that when African countries are relativelywell endowed in these factors; financial underdevelopment explains their low attractiveness to foreign capital.

5See Levine (1997, 2003) for a review of the theoretical and empirical literature.

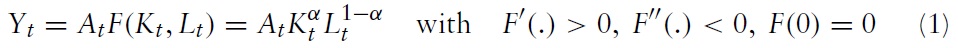

The ‘Lucas paradox’ is derived froma simple neoclassical growth model assuming a common technology to all economies. Let us consider a Cobb-Douglas production function with constant return to scales, representing a small open economy in which the production (

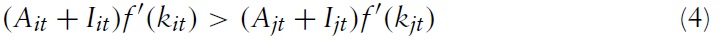

However, the prediction of interest convergence is not observed, leading to the ‘Lucas paradox’. According to Lucas, this paradox is mainly due to capital market imperfections (mostly informational asymmetry) and differences in economic fundamentals between countries, implying a difference of the technological factors (

With more detail, equation (3) can be rewritten as followed:

with

The data cover the period 1970–2003 (subdivided into five periods of five years6) and we retain for the regressions 58 developing countries.7 The variables for private capital flows are FDI, portfolio investments, debts, and private capital – defined as an aggregate of the three types of private capital.8 For the econometric analysis, we will only retain FDI and portfolio investments as variables of capital inflows for several reasons. After the debt crisis, data on debts suffer from significant measurement errors (Alfaro

We use the proportion of the subscribers of fixed and mobile phone service in the population and the electric consumption per capita as the proxies for physical infrastructure. Although these variables approximatewell the infrastructure available in a country, an addition excellent proxy for physical infrastructure would be the density of the road network in each country. The missing data problem does not allow the use of this last variable. Financial development is captured by three variables: the ratio of liquid liabilities to the GDP (M3/GDP), the ratio of bank credit to the private sector over the GDP, and the ratio of financial system deposits to the GDP. In accordance with the theoretical and empirical literature, we control for other important variables such as capital control, economic growth, and banking crisis. Appendix 1 gives the list, definitions and sources of all variables.

Although the objective of this paper is not to test the existence of the ‘Lucas paradox,’ but rather its explanation, it is interesting to investigate whether this paradox, so far established between developed and developing countries can also be observed among developing countries. In other words, are countries with higher income levels among developing countries receiving more private capital flows? The results, in Appendix 5, show that among developing countries, private capital are more directed towards countries with higher GDP per capita, confirming the existence of the ‘Lucas paradox’ among developing countries.

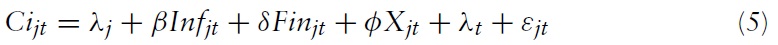

The analysis of the effects of infrastructure and financial development on private capital inflows is based on the following equation. It includes capital market imperfections and economic fundamental variables to explain the ‘Lucas paradox’ and variables specific to capital exporters’ countries in accordance with the ‘push-pull factors’ approach:

where

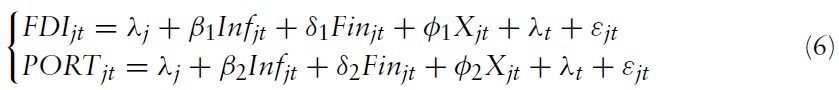

The two equations of capital inflows could be estimated with the standard fixed effect method. However, this would suppose that the amount of the FDI received by a country is independent of the amount of portfolio investments received by this country (in other words, error terms of the two equations are not correlated). This rather restrictive assumption is not verified since a high number of identical variables explain the two components of capital flows. For instance, significant inflows of FDI in a country can stimulate the inflows of portfolio investments. It is thus important to consider the correlation of error terms that can affect the significance of the coefficients. The empirical model for estimation will be a system of equations as follows:

where

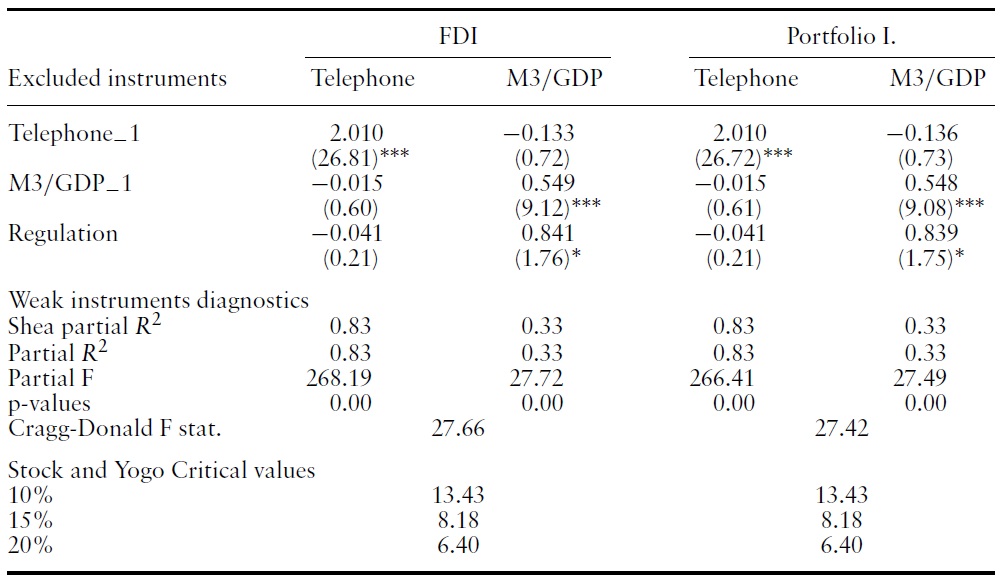

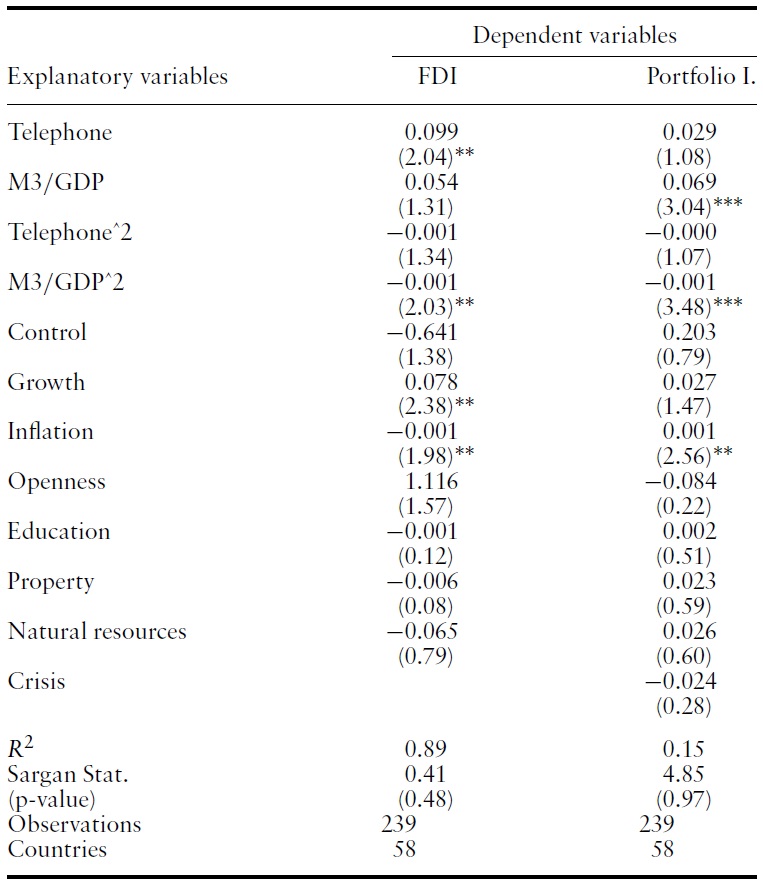

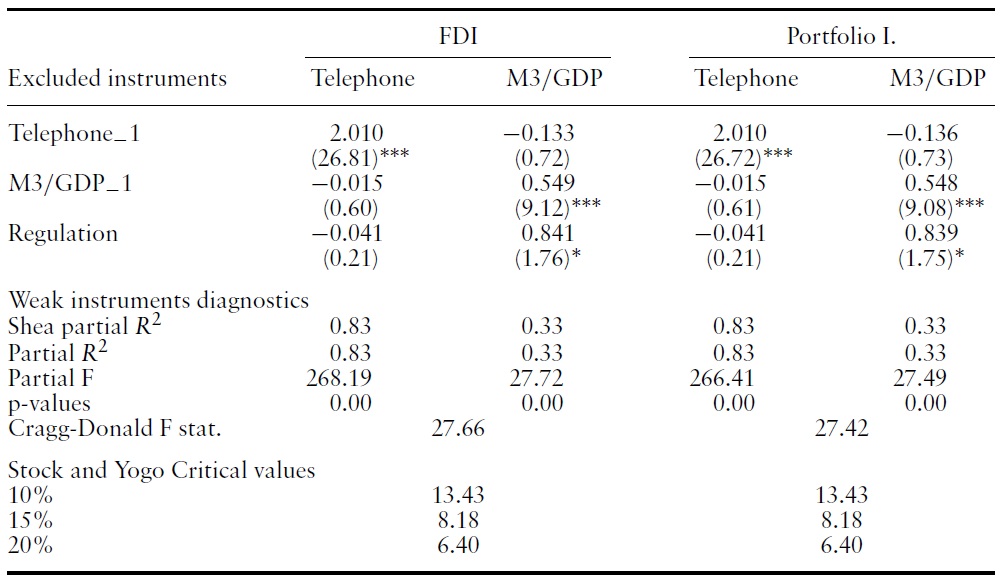

[Table 1.] First-stage equation

First-stage equation

For the estimations, we use three-stage least squares (3SLS) which, like twostage least squares (2SLS), deals with the endogeneity problem but also takes into consideration the correlation between the errors terms of the equations such as the SUR method. Under the null assumption of good specification of all equations in the model, 3SLS is more efficient since it deals with the correlation of different equations’ error terms. However, when at least one equation in the system is misspecified, this misspecification extends to all systems by the correlation of error terms, leading to biased and less consistent coefficients. In this case, the 2SLS estimator, although less efficient, is preferable since there is no correlation in error terms and it is consistent, even in the case of the misspecification of one equation in the system. Although results obtained by the 2SLS do not differ significantly (Appendix 6), a Hausmann test confirms the preference for 3SLS.

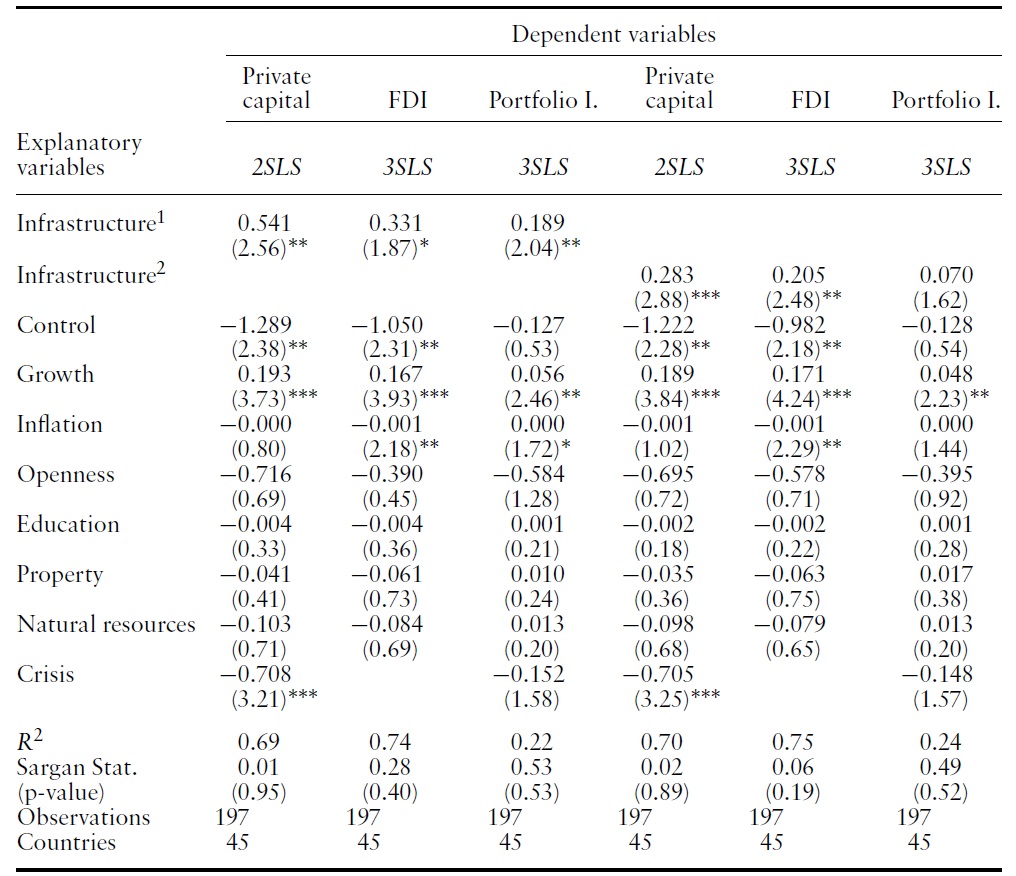

We first consider an index of physical and financial infrastructure obtained with principal components analysis that avoids colinearity problems between infrastructure variables. A second method of aggregation used is the standardization of variables. This method is similar to principal component analysis but it gives an equivalent weight to each variable in the calculation of the index. The indexes include five variables: the proportion of subscribers of fixed and mobile phone, the electric consumption per capita, the ratio M3/GDP, the credit to the private sector, and the deposits in financial institutions. The following table gives the results of estimations with aggregated indexes.

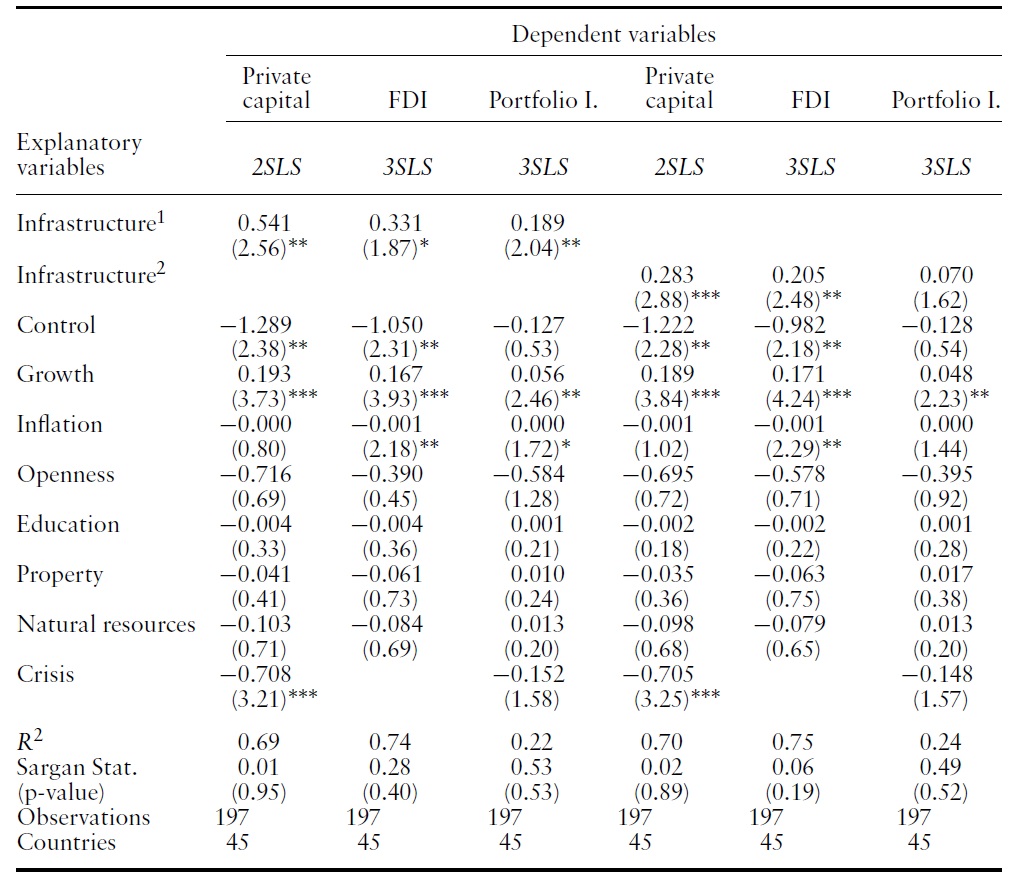

[Table 2.] Estimation with physical and financial infrastructure index

Estimation with physical and financial infrastructure index

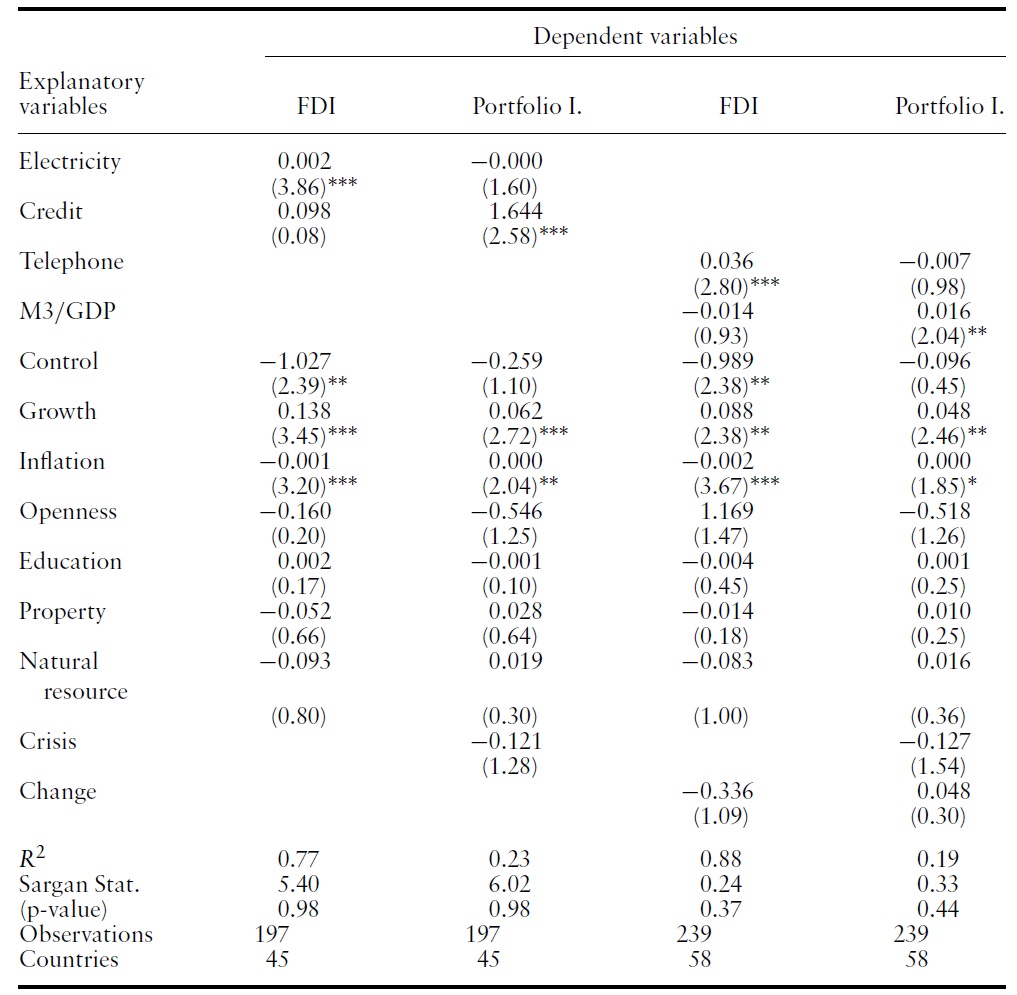

Before interpreting the results obtained with the infrastructure index, we separately estimate the equations with individual variables of infrastructure in order to address criticisms generally made to aggregate indicators that cannot distinguish the partial contribution of each variable. Table 2 gives the results of estimations considering a proxy for physical infrastructure (the proportion of fixed and mobile phone subscribers) and another one for financial development (M3/GDP) separately

Beside the instrument diagnostic tests that reject the hypothesis of weak instruments, the Sargan overidentification test does not reject the validity of the instruments. Control variables have almost identical effects when considering the index of infrastructure or individual variables of infrastructure and financial development. The macroeconomic instability, characterized by a high inflation or a banking crisis negatively affects FDI and portfolio investments respectively (Table 2). Inflation positively affects portfolio investment. This result could illustrate the fact that Latin American countries, which attract an important part of portfolio investment in the sample, have higher inflation, particularly during the Mexican crisis of 1994. Capital controls11 have a negative effect on private capital inflows, and a good economic performance characterized by a high growth rate positively influences private flows. Countries that are more open also receive more FDI.12

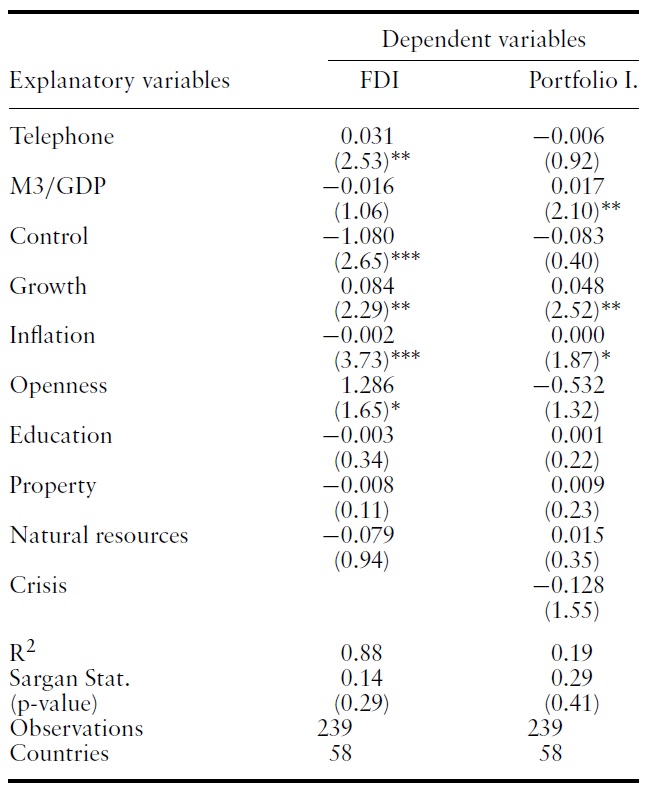

With respect to infrastructure and financial development, the index of physical and financial infrastructure, either obtained by the principal components analysis or by the standardization method, positively and significantly affects private capital flows and each of its components (FDI and portfolio investments). Physical and financial infrastructure have a stronger impact on FDI than on portfolio investments, but this result gives no indication of the respective importance of physical or financial infrastructure in the attractivity of FDI or portfolio investments. Table 3 deals with this question by underlining the fact that physical infrastructure only affects FDI inflows while financial infrastructure only has a significant effect on portfolio investments. Indeed, a rise of 1 percentage point in the number of fixed and mobile phone subscribers increases FDI inflows by 0.03 percentage point. To illustrate the results, a simple simulation shows that if Sub-Saharan African (SSA) countries were to reach, on average, the same level of infrastructure development as Latin American countries, FDI inflows directed to SSA countries would increase by 15 percentage points.13 This result highlights the existence of a minimal condition in order to guarantee prosperity of investments and thus attract FDI. A large number of economic activities (especially industrial ones) require a minimum of communication infrastructure (telephone, roads) allowing or facilitating the access to raw and intermediate materials but also the access to markets, reducing production costs. The government usually provides financing for infrastructure since firms can hardly support the cost. The existence of infrastructure thus creates a favorable business environment, encouraging investments, particularly foreign investments.

[Table 3.] Estimation (3SLS) with differentiation of physical and financial infrastructure

Estimation (3SLS) with differentiation of physical and financial infrastructure

Portfolio investments are more volatile and relatively scarce in developing countries. Of the two infrastructure variables, only financial development significantly and positively affects portfolio investment flows to developing countries. A rise of 1 percentage point of liquidity liabilities increases portfolio investments by 0.02 percentage points.14 Inflows of portfolio investments require a high level of financial development since this form of capital flow is most frequently negotiated in stock markets. By improving information sharing, developed financial markets reduces transaction costs and the potential risk taken by investors.15

5.4.1 Alternative explanatory variables

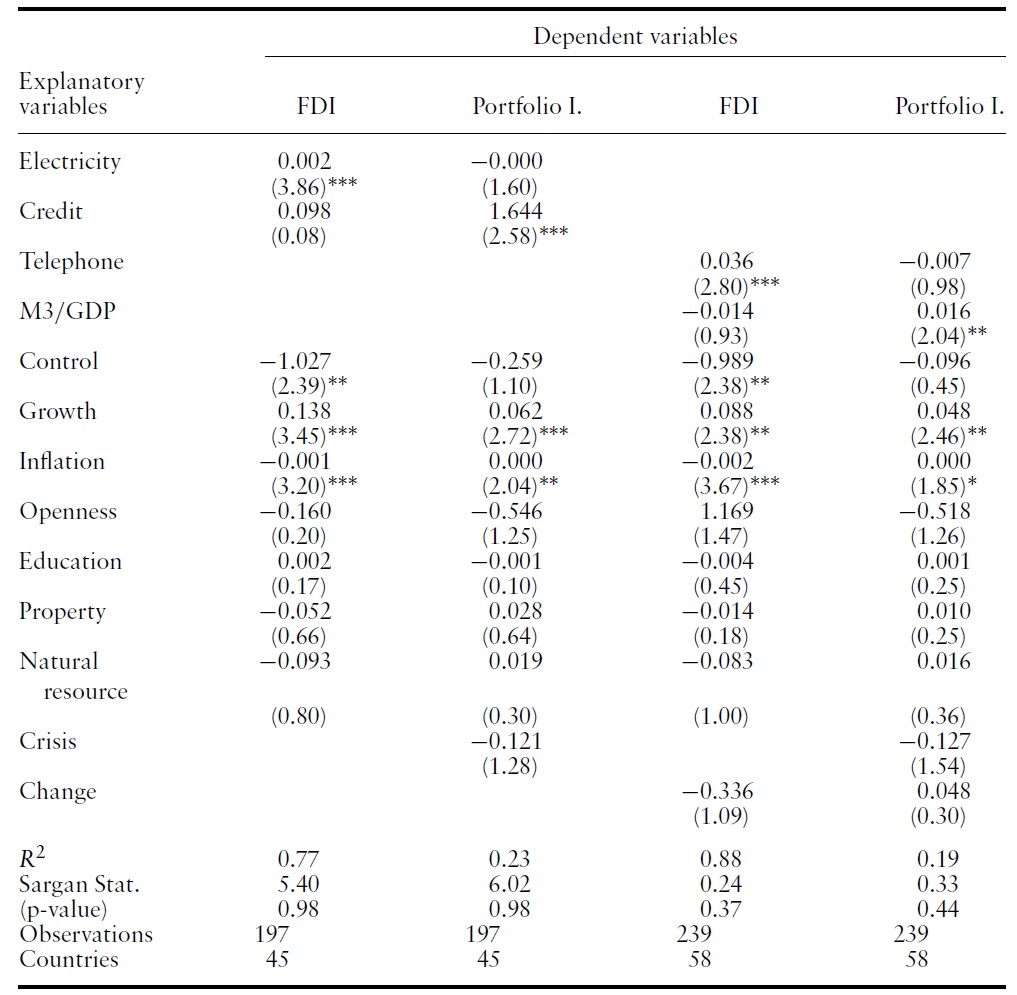

The literature suggests several variables that capture the physical infrastructure or financial development of a country. We considered the percentage of subscribers of fixed and mobile phone service in the population as a proxy for physical infrastructure and liquid liabilities (M3/GDP) as a proxy of financial development. The results can be influenced by the choice of these variables.As a robustness check, we estimate the system of equations with electric consumption per capita to reflect physical infrastructure and credit to private sector (in percentage of the GDP) as the financial development variable. The results are robust to the use of these alternative variables (Table 4).

[Table 4.] Robustness checks (3SLS)

Robustness checks (3SLS)

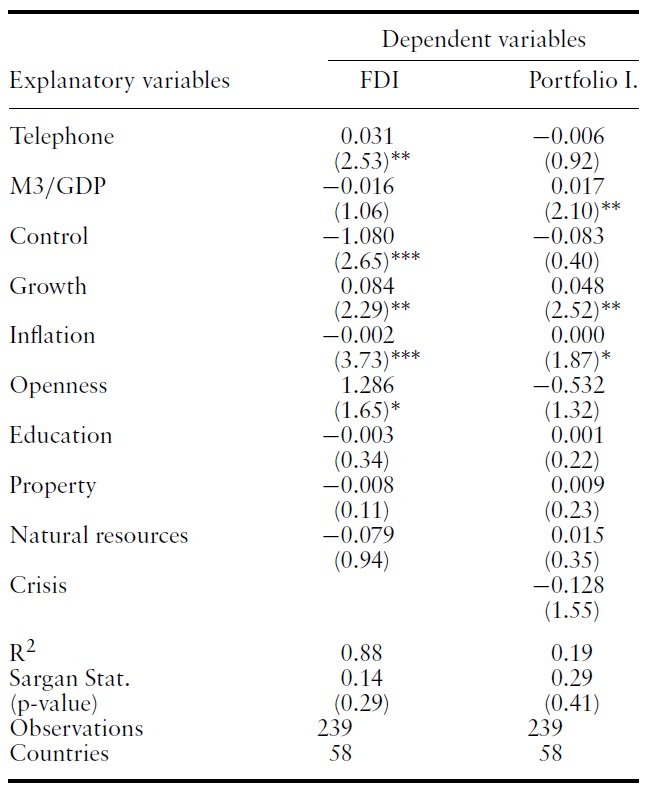

[Table 5.] Non linearity check (3SLS)

Non linearity check (3SLS)

Since portfolio investments are short-term flows, high variability in exchange rates could cause uncertainty in the return on these investments. Exchange rate variability may also negatively affect long-term flows such as FDI by increasing uncertainty in returns. Considering the exchange rate variability variable, the main results remain robust (Table 4).16

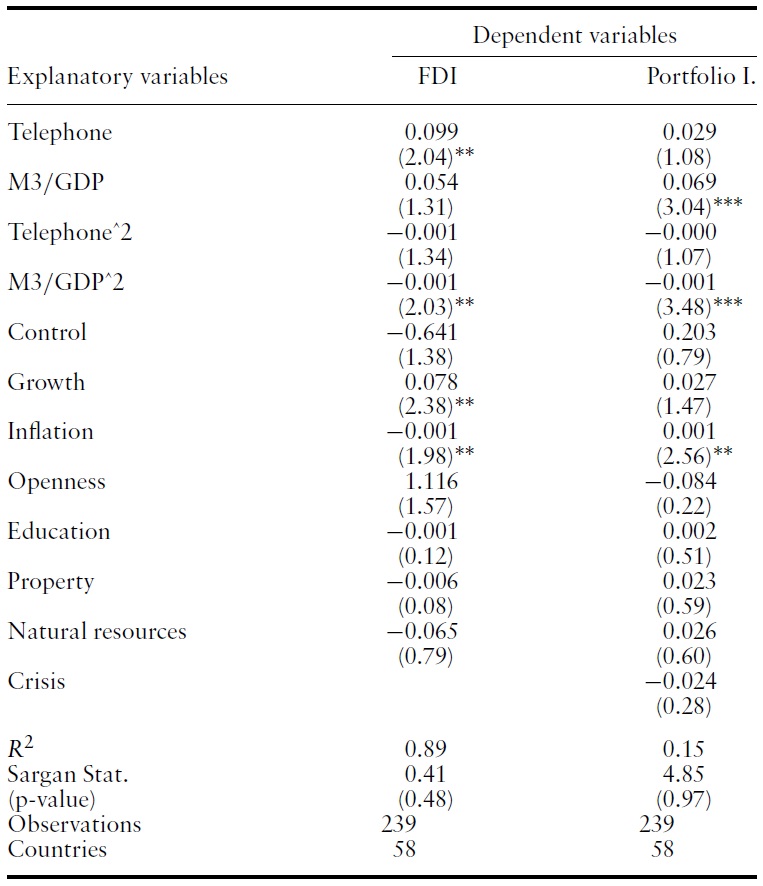

5.4.2 Non-linear relationship

The analysis has focused on testing linear relationships so far.However, the impact of infrastructure and particularly of financial development on private capital flows could be non-linear. An increase in credit or liquid liabilities can be a signal of a financial development but an excessive supply of money or private credit could also indicate a bad management of the monetary policy that could weaken the financial system and reduce portfolio investment. A weakening of the financial system could also contribute to a banking crisis, with devastating impact on private flows, particularly on portfolio investment. Table 5 shows the results considering possible thresholds for the impact of infrastructure and financial development.17

The main results are confirmed and the effects of physical and financial infrastructure on FDI and portfolio investment inflows become higher. Once we have allowed for non-linearity, the results show a significant threshold effect for financial development. The threshold level is on average around 70% (liquid liabilities in percent of GDP) in low-income countries. This highlights the importance of good management of the monetary policy and the potential negative impact of excessive money supply.

6The five year periods are: 1970–1974, 1975–1979, 1980–1984, 1985–1989, 1990–1994, 1995–1999, and 2000–2003. This subdivision helps to address non-stationarity issues that could arise with annual series. 7Central and Eastern European Countries (CEEC) are not taken into account in the regressions since the majority of these countries were part of the Soviet Union before 1990, whereas one of our objectives is to evaluate a differentiated effect before and after the 1990’s financial crises. 8Foreign direct investment is net inflows of investment to acquire a lasting management interest (10% or more of voting stock) in an enterprise operating in an economy other than that of the investor. It is the sum of equity capital, reinvestment of earnings, other long-termcapital, and shortterm capital as shown in the balance of payments. Portfolio investment flows are net and include non-debt-creating portfolio equity flows (the sum of country funds, depository receipts, and direct purchases of shares by foreign investors). Bank and trade-related lending covers commercial bank lending and other private credits (World Bank, 2005). 9We checked the specificity of debt compared to FDI and portfolio investments by adding to our system of two equations an equation of debt.The results (available upon request) showthat physical and financial infrastructure does not increase debt inflows. 10This variable of credit market regulation indicates governments’ constraints or incentives in terms of control of interest rates on deposits and bank loans. An instrument for financial development, commonly used in the literature is the legal origin. This instrument cannot be used in our case since it is already included in the country fixed effects. 11The measure of capital control is the average of proxies of government restrictions that affect capital mobility (capital account restrictions, current account restrictions, presence of multiple exchange rates and repatriation requirements for export proceeds). There is a structural break in capital account data series in 1996 when the IMF started to report more details on capital account – permitting a measure of the intensity of capital account restriction – instead of the dichotomous variable. That makes the data before and after 1996 not entirely comparable. Quinn (1997) and Mody and Murshid (2005) have constructed single data series using the IMF publications. Chinn (2004) finds also that Quinn index explains 71% of the four variables we used to construct our index before 1996. As in Mody and Murshid (2005), a robustness check using a truncated sample (before 1996) does not change our results. 12Education does not affect significantly private capital flows to developing countries. According to the type of FDI (vertical FDI or horizontal FDI), multinational firms will look for unskilled cheap labor or skilled more expensive labor force. Urata and Kawai (2000) find that skilled labor availability discourages Japanese FDI. After a breakdown analysis, the authors show that skilled labor positively affects FDI in developed countries but the effect is not significant for developing countries. 13Onaverage, over the period 1970–2003, only2%of the population in SSA countrieswere telephone subscribers compared with 5% for Asian countries and 12% for Latin America countries. 14Liquid liabilities increased by 18% between 1990 and 2003 in the sample countries. 15The analysis shows that FDI and portfolio investments are mostly explained by identical determinants. It is important to pinpoint that some specific determinants of portfolio investments relate to the international economic situation, mainly the international interest rate and growth rate, approximated by those of the developed countries. As mentioned above, these important variables in the determination of portfolio investments are captured by time fixed-effects. 16Private capital inflows, particularly FDI to developing countries, have risen exponentially since 1990 with a peak prior to the Asian crisis. Important reforms in the liberalization of current and capital accounts were undertaken by developing countries at the beginning of the 1990s within the framework of the Washington Consensus in order to attract more private capital. A temporal Chow test before and after 1990 enables us to show stability of the coefficients during the two periods. There is no differentiated effect on the determinants of private capital due to the reforms, and no specificity before and after the 1990s crises. Data availability does not allowthe test of other dates of potential ruptures or an Andrews-Quandt test that would enable us to determine the break point. The choice of the break period, although imposed to us by the data is also justified theoretically. 17The Ramsey-Reset test confirms the non-linearity suspected for the variables of physical and financial infrastructure.

This paper has analyzed the determinants of FDI and portfolio investments in a sample of low-income and emerging countries. Based on two theoretical approaches (Lucas paradox and push-pull factors) and after controlling for interaction between components of capital flows (with 3SLS), this study finds that physical infrastructure only fosters FDI inflows while financial development has a positive effect on portfolio investments. The results highlight the importance of non-linearity – particularly for financial development – in analyzing the determinants of foreign private capital. This indicates the importance of sound monetary policy and stronger oversight in the financial system. Indeed, lax monetary policy and excessive credit provision could weaken the financial system and significantly reduce portfolio investment inflows. It is thus important that policies aiming to attract more private capital consider also the possible negative effects, such as sudden stops or a reversal of short-term capital flows by maintaining an adequate monetary policy and improving the supervision and the regulation of the financial system.