In terms of its impact on the country’s economy and the living standards of the people, the North Korean state is quite clearly a failed state. However, its egregious failures are not of the usual kind.

The state has evolved to serve the interests of the Korean Workers Party and the large military machine, with available resource flows being preferentially allocated in these two directions. Ordinary people in North Korea share in what remains of the national production, including food supplies. Nevertheless, the country suffered a terrible famine in the early to mid-1990s, estimated to have resulted in at least one million deaths (Haggard & Noland, 2007). In recent years, too, observers estimate that famine, or near-famine conditions have again obtained in parts of the country. At various times, food aid has been provided by China, South Korea, the United States and elsewhere, in amounts that depend both on the urgency of North Korea’s food balance at any given moment, as well as on political factors linked to North Korea’s nuclear programme, its missile programme, and the state of relations between North and South Korea.

Although the state is capable of maintaining its power by controlling the media and by using the security forces to suppress dissent, it has proved incapable of managing the economy. As a result, living standards in North and South Korea have diverged dramatically since the early 1950s, from near parity at the start to a factor of around 18–19 now (roughly $1090 per head in the North, about $19,278 per head in the South; 2010 nominal data reported by Bank of Korea; in PPP terms, the CIA Factbook estimates 2011 GDP per head at $1800). The failure of the North Korean state, therefore, is principally an economic failure. The state makes no pretence at being democratically accountable to the ‘will of the people’ in any sense, and it is not.

Accordingly, this paper examines the nature of the economic failure that has brought North Korea such miserably low living standards, and considers ways in which the economic system might be reformed to facilitate a return to overall growth in both aggregate income (GDP) and general living standards. My focus will be on institutional aspects of the needed reforms, emphasising the importance of building on existing institutions and practices wherever possible, rather than starting from scratch from a

Unfortunately, given the prevailing political system in North Korea, with the ruling Workers Party led by successive members of the Kim dynasty, we are not likely to see much economic reform in the near future. However, even within the existing system one can envisage a shift to a more technocratic leadership increasingly seeing its survival in terms of delivering improved economic performance. This is the sort of political configuration I have in mind when examining possible institutional models and reforms in what follows.

1This quote refers to a training course for senior North Korean officials to which I contributed a few years ago. When the relevant North Korean embassy saw an outline of our training material they insisted that the word ‘reform’ must be removed, but the funders of the course insisted that we must talk about reform. We avoided a diplomatic incident by replacing the word ‘reform’ with ‘change’, amending nothing else. The course proved remarkably successful.

After the Korean War, North Korea adopted the Soviet model for running its economy, with highly centralised state planning that focused on heavy industry and production for the military; agriculture largely based on state and collective farms; foreign trade that was managed as part of the annual planning process, with the Soviet Union quickly emerging as the principal trade partner; and virtually all private economic activity prohibited or severely restricted. Likewise, private ownership of land, housing, and productive assets was also prohibited.

Just as in the Soviet Union, this centralised model of economic management did deliver respectable growth rates from the 1950s to the 1970s, after which growth slowed. The economy was already stagnating by the 1980s, for similar reasons to the Soviet Union, namely: lack of innovation (exacerbated by an embargo on high-technology imports from developed countries); inefficient investment allocation; inadequate incentives to produce quality products in either industry or agriculture; inefficient and poorly directed foreign trade; and a politically repressed labour force lacking modern skills (such as IT, finance, marketing, and so on) and strongly discouraged from exhibiting entrepreneurial tendencies. Taken together, these factors sufficed to stifle growth and gradually put the economy into reverse.

The ending of the Soviet Union in late 1991, to be replaced by 15 independent states (the Russian Federation being by far the largest), was a massive economic shock for North Korea, to which – over 20 years later – it has never adequately adjusted. Trade deals under which the former Soviet Union had regularly purchased large volumes of poor quality North Korean industrial output in exchange for supplies of machinery and diverse other investment goods, as well as oil, more or less immediately came to an end. Neither Russia nor the other post-Soviet states had any interest in North Korean goods, and the country was unable to find alternative markets. Although China did provide limited relief by purchasing some North Korean goods, as does South Korea, the result was that North Korean industrial output – as well as exports and GDP as a whole – simply collapsed during the 1990s, with only modest recovery taking place since the year 2000.2 During the 1990s the country defaulted on its debts to former socialist countries, and has had no access to world capital markets since then. However, recent trade deficits have been largely funded by aid flows from South Korea and by modest commercial lending from China.

In terms of the economic structure, agriculture accounts for over 20% of GDP (as against 2.6% of GDP in the South), services account for just 31% of GDP in the North against 58.2% in the South.Within services, 22.8% of GDP is publicly provided compared with just 10.2% publicly provided in the South (2010 data, Bank of Korea). The CIA Factbook and other US official sources (e.g. Department of State) estimate that defence spending in North Korea might account for asmuch as 20–25% of the country’s entire GDP, a much higher share than anywhere else in the world; in contrast, South Korea spends about 2.8% of its GDP on defence (according to the SIPRI Yearbook 2011).

Clearly, the North Korean economy is operating at a very low average level of productivity, and its structure is heavily distorted towards defence and away from net exports. Reportedly, the country is littered with empty and abandoned factories that used to supply goods to the Soviet Union, electricity shortages are chronic and widespread due to lack of investment in basic infrastructure (although a new power station to supply the capital, Pyongyang, has just been brought on line this year), much of the central planning system is functioning very poorly if at all, and the country faces continuing difficulties over the maintenance of basic food supplies. Despite this, the government commonly treats private or informal economic activity as economic ‘crimes’ (Haggard & Noland, 2010).

So what could be done to get this malfunctioning economy back on track to deliver economic growth and improve living standards to the North Korean people? To think about this it is helpful to start by trying to understand why this economy has performed so badly. Lots of factors could be listed here, but it seems to me sufficient to focus on just three. As we shall see, they are inter-related, and link to our subsequent discussion of possible institutional reforms.

>

(i) Poor Performance of Agriculture

In a country that trades successfully, agricultural performance ought to be a second order issue since food can always be imported. But with North Korea unable to export enough to import food (except in the form of food aid), the functioning of agriculture is critical for population well being. The terrible famine of the 1990s did lead to some relaxation in state production quotas, a breakdown in the state distribution system, and a significant revival of informal and private production and trade in foodstuffs, including widespread farmers’ markets. All this was tolerated during the worst years, but as famine conditions receded, the government returned to policies of economic repression, restoring the official distribution system, restricting and banning private markets, and so on. It appeared that the private activity that had emerged – seen by some observers as the start of a more hopeful period of market-friendly reforms – was viewed by the government and Party as a threat to their control. Nevertheless, in parts of the country some quasi-private farming (

What does agriculture need to performbetter? It seems to the author that a mix of technical, organisational and institutional factors could make an enormous difference, and probably quite rapidly (in under five years, and certainly within a decade). On the technical side, modern inputs of fertilisers and pesticides, together with improved seeds and livestock (better breeds, improved veterinary standards); substantial mechanisation of agriculture; and better knowledge about what crops/animals are best farmed where, are all required. The problems in implementing such a programme are twofold. First, what, if anything, could North Korean industry currently deliver given its current decrepit state? This is an issue of investment and modernisation, where a process of change could be initiated using imported goods and equipment, but where it could only be sustained by the domestic economy. Second, who makes the decisions about what to produce where, what new knowledge to acquire and how best to use it? At present, this is the Party and government, who have already shown themselves to be seriously bad farmers!These key decisions need to be decentralised downto the level of local farms, something that would be facilitated if the farmers themselves had incentives to perform well – and not merely the existing negative incentives for failing to obey official orders or plans, such as a spell in a labour camp.

As regards organisation and institutions, agriculture needs an operating framework that stimulates innovation and improvements in productivity, and which provides farmers with the security to invest in their farms, market their produce, and so on. Politically, there is no chance of the North Korean government suddenly abolishing the collective farms and introducing private farming, but they could do it quietly and cautiously ‘by the back door’, perhaps along Chinese lines. This idea is taken up and developed in Section 4.

>

(ii) Too Much Defence Spending

To grow successfully it is generally found that economies need to achieve a decent rate of fixed capital formation (preferably over 25% of GDP, according to the recommendations of CGD, 2008), and the bulk of this investment should be devoted to productive projects, i.e. projects that increase the productive capacity of the economy, and produce something for which there is a real demand – this raises important practical questions as to how investment projects are selected. Building presidential palaces, or indeed military facilities, usually contributes nothing to future economic output (although the actual construction does, of course, provide a short-term Keynesian stimulus to current incomes and aggregate output). As experience around the world demonstrates, it is rare for a country to grow for long with a low rate of capital formation (e.g. 10% of GDP or even less), but it is perfectly feasible to have a respectable investment rate and still not grow much, as with the former Soviet Union during the 1980s. This is why the question of selecting good projects in which to invest is so important.

In this context of investment and growth, North Korea’s high rate of military spending, as noted above, is a serious concern, both economically and politically. Part of military spending, such as feeding the army, might be counted as consumption and hence as a contribution towards current living standards, especially as the military both produce some of their own food and are privileged ‘customers’ in the food distribution system. Part, such as building airfields and other military facilities, might be counted as investment, but largely of the unproductive type that adds nothing to future productive capacity. Mostly, though, spending over 20% of the GDP on defence is seriously wasteful, making it difficult to invest enough out of the remaining 80% of GDP to sustain more than a very modest economic growth rate. In this sense, North Korea’s defence spending represents a serious burden on the economy.

Politically, however, one can more easily see a rationale for high defence spending. Historically, it arose in the wake of the Korean War, but by now it is hard to see how anyone can seriously believe that South Korea – perhaps egged on by an allegedly belligerent United States – might one day attack the North; the idea is simply absurd. Hence, it makes little sense to justify North Korea’s military stance in defensive terms. Instead, one has to think of it as a fundamentally offensive stance, creating insecurity across the entire region of North East Asia. This also makes the North’s continuing efforts to develop ballistic missiles and to pursue its nuclear programme both understandable and alarming. Unfortunately, these efforts divert highly skilled people and valuable investment resources away from more ‘normal’ productive sectors, contributing further to the North’s poor economic performance. In itself, the hostile military stance is thus not especially conducive to successful development, but the symbiotic relationship between the top leaders of the Workers Party and the military elite provides the ‘glue’ that binds the whole system together.

While the Party supports the military and the military remains loyal to the Party, the current repressive system can be sustained to the benefit of these two elite groups. It would only break down if the military started to feel that it was receiving insufficient resources (one might then anticipate a military coup), or if the Party decided to make a shift towards serious economic reforms and started to see itself a ‘guardian’ of the nation’s economic progress instead of as a partner of the military. This is not unlike the path chosen by the Chinese Communist Party (and later the Vietnamese), once reforms began in the late 1970s; however, for China this was not a deliberate choice right from the start, more the result of an evolutionary process accompanied by a great deal of pragmatism. Could the Korean Workers Party achieve such a transition without provoking a coup or without completely disintegrating? Or would the attempt to do so result in the collapse of the Party and a period of political disorder?

>

(iii) Failure to Adjust to the Shock of the USSR’s Collapse

As indicated above, the disintegration of the USSR into 15 independent successor states removed the major market for North Korean exports. Although clearly a terrible economic shock at the time, what is really quite remarkable about it is the inadequacy of the North Korean government’s response. Severe trade shocks are not terribly common events, but they are not unknown either. Indeed, virtually all the former socialist countries of Central and Eastern Europe suffered such shocks at the start of their transition to the market (as the old socialist market, including the institutions of Comecon, disintegrated very rapidly), and most adapted – some better and more rapidly than others, naturally.

So howdoes, or should an economy adapt itself to this kind of shock? Normally, one thinks in terms of a mix of policy changes, typically including: (a) a devaluation of the currency; (b) the reorientation of existing exporting firms to serve new markets; (c) new firms opting to enter the export market; (d) a change in the volume and/or composition of imports, leaving room for domestic production to expand into some new areas; and possibly (e) a mildly expansionary domestic fiscal policy stance for a time to offset the fall in net aggregate demand resulting from the trade shock. In the short term, the shock unavoidably represents a fall in real income, but that need not be large and need not be sustained if the ‘normal’ economic adjustment processes are allowed to occur.

But in North Korea, they were not. The central planners thought they knew best, and one suspects they also judged that the trade disruption resulting from the loss of socialist markets might only be temporary, with demand for their ‘traditional’ exports soon recovering. Hence, it seems perfectly possible that at least for the first couple of years, major adjustment was deemed unnecessary, and by the time the planners realised that the loss of markets was permanent, a great deal of economic damage was already done. In addition, the planning system paid little attention to production costs, enterprise profitability or, in the foreign trade context, notions of comparative advantage, so that even had they wished to adjust, the planners lacked the tools, and enterprises lacked both the necessary autonomy and the incentives to enable them to do so.

Interestingly, even the Soviet Union itself, in its later years, and most of the Central and Eastern European countries, had started to work out indicators of relative export efficiency, and indicators comparing import prices with domestic costs. These were, to say the least (given the terrible quality of the centrally fixed domestic prices), rather poor measures of anything like comparative advantage, and they remained ideologically suspect; but theywere important steps in the right direction. Such steps were not taken at all in North Korea, to our knowledge.

By the early 1990s, in any case, the world market for North Korean produce – aside from arms, drugs and a variety of illegal and contraband items already allegedly playing a significant role in the country’s trade – was becoming an increasingly tough and demanding arena in which to do business. Following Japan’s early post-war economic success, Hong Kong, Taiwan, Singapore and South Korea grew rapidly on the back of manufactured exports, soon followed by China, and other South Asian countries. Moreover, while starting with relatively low technology, not very high quality items, these countries rapidly learned how to upgrade quality and produce far more sophisticated goods (e.g. electronic goods, automobiles, clothing, etc) selling them in US and EU markets that were increasingly open and very competitive. Such was the vigour of competition from new Chinese producers in particular that some African firms that had been exporting to Europe lost their market position; they proved unable or unwilling to adapt their production rapidly enough. Thus, even if North Korea had intended to adapt its production to the new market conditions in which it found itself, it would probably have faced great difficulty in doing so.

The rules-based trading framework of the GATT, and from 1995 the WTO, probably facilitated this rapid change in the structure of the world economy. China has been a WTO member since 2001, but North Korea is neither a member nor, at present, has it even chosen to be an applicant.3 Thus, North Korea is unable to benefit from the general trading rules of the WTO and must agree

2A similar story can be told for Cuba after 1991, although Cuba was always less industrialised and the main product for which it needed to find new markets was sugar. 3On the other hand, even if North Korea did apply for WTO membership there is no immediate chance that it could be accepted. This is because of the country’s stance in relation to nuclear technology (with fears that it could develop its own bomb), its experiments with missile launches (developing a potential delivery mechanism for a nuclear bomb), and its trade in illegal and contraband products. In any event, for purposes of handling trade disputes, the WTO would clearly have to regard North Korea as a state trading nation, not as a market-economy country.

3. Institutions for Raising Living Standards

Given the above problems, the low living standards, and recent very sluggish economic growth, how could North Korea undertake reforms, notably in its institutional arrangements, that might deliver better performance and improved living standards? To explore this, we start by outlining some basic ideas and concepts about institutions and their role in the economy, thenmove on to consider a number of institutional models and specific cases. The next section then applies these ideas to North Korea.

As North (1990, 2010) has argued, the institutions of an economy are the ‘rules of the game’ that agents (such as households, firms, banks, agencies of government, and the like) followwhen they operate the economy. Thought of in thisway, institutions can be formal or informal, the former often depending upon various forms of enforcement mechanism – which can be privately provided or delivered by the state – while the latter depends far more on trust, understandings, expectations and culture. Organisations are often created, or gradually evolve, to embody specific institutional arrangements and practices, such as courts to enforce business contracts according to the law. Interestingly though, such organisations serve their purpose best when they are relatively rarely used. In other words, economic agents like business partners or competitors normally settle their disputes informally, through voluntary means, while aware that the framework of law and the courts is there in the background should it be needed.

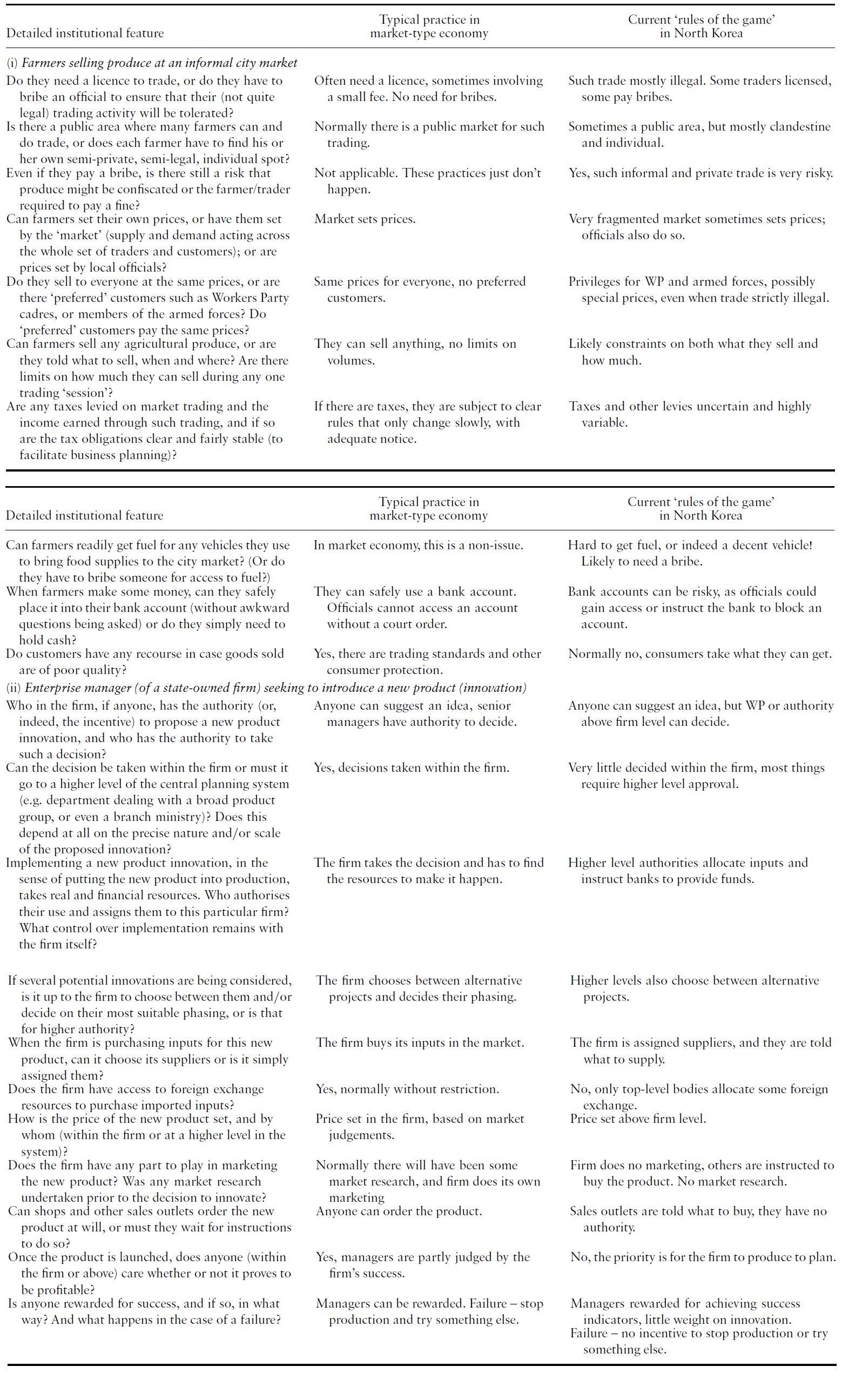

What tasks do the institutions of an economy fulfil for us? There are three main categories of economic institution, namely those: (a) protecting property rights (in relation to other private agents, and in relation to the state itself); (b) facilitating transactions; and (c) facilitating cooperation. There are many different mechanisms through which these requirements can be met, including diverse mixes of private and state provision. The sorts of transaction that turn out to be economically attractive, and the agents able to performthem, depend verymuch on specific details of the prevailing institutional arrangements. A couple of examples, both routine, everyday activities in market-type economies, as well as being especially relevant for North Korea, illustrate the issues; they are shown in Table 1.

These examples illustrate many important aspects of what North and others have termed the

Thus, in either of the above examples, starting from a highly restrictive and controlled economic environment, one could imagine liberalising two or three specific aspects of the transaction. But if the other aspects were still subject to tough regulation (or were even illegal), then most economic agents would still perceive the transaction as risky and dangerous. Hence few transactions would occur, except possibly in the farmers’ market casewhere a limited amount of business could be done informally, ‘below the radar’ of official scrutiny and control. To carry out successful business, it is not of course essential for all the ‘rules of the game’ to be embodied in formal legislation, backed up by well functioning courts and the like. This is how we tend to think of such matters in developed western countries, but this way of thinking merely reflects our history and culture. In different societies, things can be done very differently, and still work (surprisingly) well. Examining some institutional models and specific cases will help to make this clear; one of the cases also illustrates the possible limitations of institutional models.

[Table 1.] Examples of institutional arrangements

Examples of institutional arrangements

When building institutions in the process of transition from central planning (in all its variants, including some already partially reformed), the countries of Central and Eastern Europe and the former Soviet Union had several options available to them. These included the following.

(a)

(b)

(c)

(d)

(e)

In all these cases, the political context for reforms proved far more complex and problematic than most economists initially understood. Political factors constrained what could actually be accomplished in many transition economies, whatever specific approach to institutional reform they set out to follow.

To make these approaches more concrete, we now present some illustrative examples; these relate to EU enlargement in 2004 and 2007; German reunification in 1990; and reforms in Russia. The last of these is discussed most fully because some of the associated mistakes and lessons seem particularly pertinent for North Korea.

For a potential new member state, EU enlargement involves far more than merely joining a particular club, operating as a free trade area (internally) and a customs union (externally). New members are required to incorporate into their domestic legislation and institutional practices the entire

Given this complexity, the accession process itself has evolved accordingly. Once a newcountry has been accepted as a candidate for EU membership, and the negotiations have commenced, then chapters of the

For each accession country, annual progress reports are prepared by the Commission, and negotiations are complete when all chapters have been dealt with and the Commission reports favourably on the country’s overall progress and readiness for membership. A treaty of accession, and its ratification by the candidate member state and all the existing member states, completes the accession process. The whole thing is neither quick nor easy, and commonly takes at least five years.

New member states of the EU, notably the ten transition economies that joined in 2004 and 2007, not only saw themselves as joining the western system of alliances, and a large, successful, free and open trading area, but they understood that they were taking on a largely complete institutional and legal framework for managing their economy and society.4 In doing so, these countries thought that they had bought into a more or less guaranteed convergence of their living standards to EU (average) levels. In other words, they expected the EU ‘economic mechanism’ to deliver faster economic growth than the EU as a whole achieved, thus ensuring catching up at a steady rate. This expectation has turned out to be at best only partially valid. Let us briefly consider why.

There are two principal reasons. First, even when a country has fully adopted the

Turning to the German reunification of 1990, not only was the entire

Although this is slowly changing, the East Germans were used to a more leisurely pace of work than those in the West, and their educational and political system had strongly discouraged entrepreneurship. In the early post-unification years, when unemployment in the East rose rapidly, many younger and more entrepreneurial workers from the East migrated to the West – some later returning, many settling there. Moreover, it was an unfortunate and unintended side effect of extensive state engagement in renewal and reconstruction in the East, that traditional attitudes about state responsibility were reinforced for a time, rather than being replaced quickly by more individualistic and self reliantWestern attitudes. All this made for a difficult transition.

Last, we have the example of economic reform in Russia, a process that was both chaotic and highly charged politically.While we still cannot claim to understand enough about the economics of transition to enable us to adopt a rigid view regarding the ‘proper’ sequencing of reforms, there was a widely held conception that macroeconomic stabilisation and the liberalisation of prices and trade would come first, followed by enterprise restructuring and privatisation, with diverse institutional reforms (mostly legal and organisational, but also to do with expectations and responsibilities, and the role of the state) following along in their wake (Gaidar, 2003; Berglöf, 2003; Shleifer & Treisman, 2005).

For a mix of reasons, Russia’s reform path diverged considerably from this sequence. It began with extensive price liberalisation, although the government retained control over a limited range of key prices deemed politically sensitive, such as the prices charged to Russian consumers for their public utilities.Given the pent up demand (monetary overhang) resulting from years of shortage, it was not terribly surprising that freeing most prices unleashed a burst of severe inflation. This was exacerbated by the fact that all the CIS countries remained in the rouble zone where the mix of monetary indiscipline, the collapse of fiscal revenues in many of the countries, and the sheer lack of experience and understanding as regards running central banks across a monetary union,5 proved catastrophic: by 1993, most of the region had inflation at or exceeding 1000%. By the mid-1990s, Russia and all the other CIS members had introduced new currencies (Russia retained the rouble, but re-denominated it), and had brought their government budgets back under control, with macroeconomic stabilisation gradually being achieved; and inflation slowly declined. The institutional framework through which Russian macroeconomic management was conducted evolved quite slowly, and it remains highly politicised.

Although trade liberalisation commenced early in the reform process, initially it entailed little more than cancelling many of the prevailing administrative controls over trade, including the government-to-government contracts that had formed part of the annual planning process. Most enterprises were left wholly unprepared for their new trading environment, having little knowledge of potential customers, little experience of marketing, and poor access to convertible currency finance. Under such conditions, it is remarkable that trade did not collapse even further than it did – some enterprises, and not only those in the energy sector, found new partners and struck new profitable deals impressively quickly. However, the institutions that we take for granted to support foreign trade in market-type economies only developed quite slowly in Russia, and remain far from perfect even today: trade-related banking; unified exchange rates and sensible tariffs; export credit guarantees; trade support through embassies and the like; legal rules regarding business contracts, backed up by the courts; and so on.

Privatisation also occurred early in the Russian reform process, mostly in the period 1992–94. And it was mostly accompanied by very little enterprise restructuring. Privatising small shops and service establishments proceeded rapidly, just as in most other transition economies, andwas largely unproblematic and uncontroversial; in most cases, existing managers found themselves becoming the new owners. Medium and larger businesses in industry, construction and other sectors proved far more challenging. There was a widely held expectation in Russia, across the political spectrum, that privatisation should be perceived as ‘fair’, not least because of the former socialist ideology according to which productive assets were (already) ‘owned by the whole people’. In any event, inflation had largely wiped out the value of most ordinary people’s savings,6 so privatisation by selling off assets to the Russian public could not have worked. Instead, for a nominal charge, all citizens were issued with privatisation vouchers to enable them to bid for shares in the companies being privatised, with the most widely used privatisation model allocating (for free, or for a modest fee) the majority of shares to managers and workers. Very large firms (including most large lossmakers in heavy industry) were retained by the state at that time, some being privatised later. But by the mid-1990s, most firms were formally in private hands (even when the state still held a shareholding). Thus was privatisation accomplished in Russia, with lots of corruption along the way – not helped by the poor legal and accounting framework within which everything was carried out (Hare & Muravyev, 2003). Moreover, few firms were restructured before privatisation, and not many afterwards as the new owners (mostly former managers) had little capital and limited access to new technology, newmarkets. Nevertheless, the exercise did get much production out of state hands, a useful step towards building a market-type economy.

The point about restructuring is that Russia’s traditional state-owned enterprises did not, by definition, produce for the market; rather, they produced to order, in line with the state plan, and their produced inputs were also supplied through the planning process. Once this framework vanished, many firms discovered thatmuch of their productionwas unprofitable so they needed to concentrate on their best productswhile also upgrading production facilities, improving quality, and so on. All this is a normal part of what happens all the time in a market economy, but in Russia it needed to happen on a very large scale all at once. In practice, partly due to fears of mass unemployment, the Russian government allowed the process to extend over a long period, and in some sectors it still continues after two decades. Politically, this was understandable, although economically costly. And an alternative approach of encouraging faster adjustment by creating very favourable conditions for many new firms to start up (replacing older firms that go out of business) is still far from being the norm for Russia, as one can see from the World Bank’s regular surveys of business conditions around the world (see World Bank, 2011).

Overall, Russia had a bad transition fromcentral planning, with enormous falls in income during the 1990s, poorly conducted privatisation, very slow macroeconomic stabilisation, and the even slower evolution of market-friendly institutions. The last decade has seen a return to growth, mostly around 4–6% per annum, improving living standards, and more stable economic conditions. But much remains to be done in terms of improving the institutional conditions for private sector development.

4The frameworkwas never quite complete, asmuch remained within the competence of the member states, and in fact the evolution of the EU has been marked by frequent debates over whether this or that issue should remain devolved or whether the centre (Brussels) should assume greater powers. 5This is no easy task, of course, under the best of conditions, as we are learning very painfully in Western Europe through the experience of the Eurozone. 6However, Russia did also experience massive capital flight during most of the 1990s, as anyone with the opportunity to do so got their money out of the country and placed it in safer locations, such as London, the US, Cyprus, and a few other places.

4. Implications for North Korea

From the above review of institutions, including commentary on EU enlargement, German reunification, and Russian reforms since 1991, what can we learn to provide guidance relevant for North Korea – assuming, as postulated earlier, that North Korea eventually decides to focus its political attention on improving the economy? If we think of possible reforms within the context of the Korean Workers Party still holding power, but shifting somewhat in a more technocratic and performance-oriented direction, then there are several avenues to be explored and developed, including some that also draw on Chinese experience since the late 1970s. We will list a few and then discuss them, without at all claiming to provide a comprehensive picture.

>

(i) Focus on the Key Issue of Securing the Food Supply

The core function of a modern state is to provide citizens with security in their everyday lives. In part this means assuring freedom from violence both domestically and internationally, in part it means ensuring that the basic necessities of life are available to all. Foremost among these, surely, is the food supply.7

Ensuring that adequate food is generally available does not, of course, imply that the production and distribution of food must be in state hands. Just as for China, however, serious reforms in North Korea must start with improvements in the food supply. The sort of political compromise that worked for China could do so in North Korea, with land leased out to families or groups of families, moderate production quotas to be supplied to the state distribution system, and complete freedom to produce and sell in the market all above-quota output. This could operate in a very decentralised way, possibly even with different approaches being pursued in different regions.

At the start, it needs no formal legal change, no top-down enforcement. But it does require a degree of trust between local farmers and farmers’ groups and local/regional political cadres. Farmers need to feel confident that income gains will not be confiscated, and that they do not risk being sent to a labour camp for producing the ‘wrong’ things. Building such trust might take a little while, and would probably evolve differently in different places. Local leaders increasingly need to see their role in terms of helping farmers to produce more – by providing access to (and perhaps some funding for) vital inputs (seed, fertiliser, pesticides and so on) and equipment (tractors, fuel, basic tools and implements) – the

As soon as this reform process gets under way, numerous practical and very concrete questions are bound to arise. For instance, can a farming family or group of families hire labour?What happens if some people on the collective farmdo not work hard or are not good farmers for some other reason – what sort of income guarantees should they get? Would the collective remain in business, operating alongside the quasi-private farmers, or would it only remain as a paper entity, an organisational form not quite abolished but no longer directly producing anything? How would services formerly provided through the collective be financed and supplied? And so on. But reforms have to start somewhere, and it would be absurd to insist on settling all these matters before anything could change.

Once farming starts to improve, demand will grow for a variety of related services and products such as grain milling, bakeries, diverse forms of food processing and storage, meat production and meat processing, repair services and much more. Some of this will already exist, either as part of the original collective or state farm or as separate state-owned enterprises. Initially quite informally, some or all of these entities could be hived off (perhaps leased) as quasi private businesses, or individuals could be allowed to set up new businesses, perhaps in partnership with the relevant local government as was the case at the start of China’s reforms. This has two benefits. First, as agriculture improves it will also become more productive, needing fewer workers; hence new businesses, initially linked to agriculture, will quickly provide additional jobs for displaced farmworkers. Second, the new businesses should start to generate profits, a share of which can be paid to the local administration. Again, this creates a win-win situation with well aligned incentives, subject to two conditions: (a) local governmentmust resist the temptation to interfere in how businesses are run and what they do; but (b) they must insist that local businesses operate with hard budget constraints, with rapid liquidation of failing businesses.

>

(ii) Think about What the State Can and/or Should Do

The prevailing ideology in North Korea holds that all economic matters fall within the remit of the state, or specifically the Korean Workers Party, with little or no scope allowed for individual initiative. Even a modest reform, such as that sketched above, requires the state to pull back, and it must do so credibly so that its withdrawal is believed and trusted. Given North Korean history, it will not be easy to reach that point.

In any case, reform is not just about abolishing some state controls over the economy, and then letting the (new) private sector rise up to provide whatever is demanded, for in all successful market-type economies we find a strong state fulfilling many important functions. Indeed, in countries where states are weak and ineffective we generally find poverty and a very poorly functioning economy. Thus, the North Korean state not only needs to withdraw from many areas of economic control, but itwould gradually need to develop newcapabilities in areas where a growing ‘private’ sector requires a strong state. Getting this balance right is difficult, evolves over time, and is struck differently in different countries.

At a minimum, though, the state would have to develop institutions and practices to handle the following economic functions: (a) manage the macroeconomic framework to keep inflation down and overall activity close to full employment; (b) manage the social safety net, social welfare provision, labour market regulation; (c) supervise banks and the financial system; (d) handle competition policy, consumer protection and the like; (e) facilitate entry and exit of firms, regulation of the business environment; and (f) protect property rights and business contracts. As we saw above, most of these areas proved highly problematic in the Russian transition, and some are still not properly settled.

For North Korea, the last of the above functions, property rights and contract, could well prove the most contentious, since it conflicts most obviously with current official ideology. However, rather as in China progress could be gradual, starting with informal understandings, building up trust and notions of shared responsibility, and only later formalising property rights in legal form. Even then, it might prove hard to reach a point where the state not only protects property rights in disputes between two non-state parties (private, quasi private, or whatever), but also protects the rights of private agents against the state itself: in other words, the state accepts legally based limitations upon its own power. Thatwould be a major step towards the rule of law (see Dam, 2006).

>

(iii) Reduce the Scale and Costs of the Military

Spending so much of the GDP on the military and maintaining a military establishment of over 1 million men is economic lunacy anywhere, let alone in an impoverished country such as North Korea. There is quite simply no credible threat to justify such spending.However, it could not sensibly be unwound quickly, since no country wants a million (or even half a million) unemployed young men roaming the streets, and probably looking for trouble.8 Instead, bringing down the scale of the military has to be done gradually, and the following steps outline a possible approach: (a) immediately cut back (or even stop) recruitment to the military; (b) make it possible for soldiers who have served at least 20 years to retire from the army with a pension, and perhaps with a plot of land so they can feed themselves and their families (this is not unlike the practice of the Roman Legions, many centuries ago); (c) increasingly use platoons of soldiers to undertake civilian tasks such as road building and repair, some farming, other economically useful duties; (d) where feasible, expand the civilian production occurring in defence-related factories while cutting back on weapons production; (e) over time, gradually hive off specific civilian activities of the defence forces into separate companies, perhaps initially SOEs, but eventually private; (f) last but not least, update the country’s military doctrine to make clear that a much smaller military is appropriate, probably with a different structure fromthe existing establishment, and hence think of all the above steps as stages towards this new structure and scale.

>

(iv) Experimentation at the Local or Regional Level

There are many aspects of the business environment where we neither know what institutional arrangements are ‘best’ in all conditions, nor what suits the local culture. Hence, it is sensible to try a variety of local and regional experiments to test out different models of reform for North Korean production, with different mixes of newfirms – private or quasi private – reformed SOEs, types of regulation and market access, financing conditions, and so on. Some will work, and some will most likely prove ineffective. The best can be offered as models for lagging regions and districts, while failing models should be quickly abandoned – but not replaced by the former highly centralised state planning, which has already amply demonstrated its failings.

North Korea is a small country and one would expect a major element in its eventual economic success to be associated with vigorous engagement in foreign trade. To achieve this, the country needs competitive products supported by good marketing and adequate finance, none of which currently exist to a sufficient extent, so there is a long way to go. Can the government (or Party) deal with this by selecting certain SOEs and instructing them to produce goods for export? Yes it can, and it currently does. However, from an economic point of view this is a seriously bad approach for several reasons. First, how can the government conceivably have enough information about firms’ capabilities to be able to judge which firms should be actively producing for export? Second, under present institutional arrangements, what would be the incentives for a selected exporting firm to deliver high quality output reliably and on time? Third, what control would an exporting firm have over the quality and delivery schedules of its key produced inputs, and if their domestic quality were inadequate would the firm be allowed to import some major inputs? Fourth, would an exporting firm have any control over the number and quality of the workers it employed, so that it could manage labour productivity?

These are critical issues for export success, and the current business environment in North Korea does not offer effective solutions for any of them. Moreover, instructing firms to export runs the risk that the goods they deliver will be exported at huge losses, since poor quality output might only be saleable at prices well below their production costs; this is clearly not a sustainable position. The issue of input quality is also more important than often thought, and one of the interesting lessons from case studies of enterprise reform in Eastern Europe is exactly that point: many firms could not restructure properly until they had gained control over the supply chain and enforced higher quality standards from start to finish.

Hence export success, in the sense of profitably exporting competitive products, will come about in North Korea through one or more of three routes: (a) entirely new firms will initially supply the domestic market, develop their capabilities, and eventually move into the export market – these firms will not be constrained by the old rules of the central planning system; (b) a major liberalising and decentralising reform of North Korea’s SOEs takes place, giving firms powers to choose what to produce and where to sell it, control over their inputs (both produced, and labour), and the ability to import inputs if necessary; or (c) engagement with already successful foreign firms through FDI and the like.

I regard route (a) as very likely, because it can begin with quite low-level institutional reforms that leave much of the central planning system intact. Route (b) is highly desirable but less likely since it entails dismantling the core of North Korea’s economic system, and that might be perceived as too threatening for the country’s political leaders. Route (c) is also very likely as it can be done on a piecemeal basis, deal-by-deal, and where it involves partnership with existing firms it can bring in improved management, innovation, access to markets, and other crucial expertise. However North Korea reforms to improve its trade (especially export) performance, it will need to review how its exchange rate is set, the structure of its tariffs and any non-tariff trade barriers, trade finance, and a variety of other related matters.

>

(vi) Infrastructure and Investment

For most countries, the key to development lies in the rate and quality of investment. As we noted above, according to CGD (2008), investment should ideally exceed 25% of GDP to enable a poor country to grow rapidly, improve living standards and catch up with more developed countries at a decent rate. For North Korea, it is clear that much public infrastructure – power supplies, transport facilities, telecommunications services, etc – has been neglected for decades now, so a lot more investment will be needed in these sectors. However, it should be directed towards activities that support private or quasi-private sector development, not towards the military, nor towards the pet projects of Party leaders. In other sectors, most investment should be guided by prospective demand – domestic or exports – and by the prospects for earning decent profits. For firms undertaking such investment, budget constraints must be hard, so that economic failure is penalised by quick exit from the market. All these conditions can be met most easily for small projects undertaken by new firms that can easily be allowed to fail when things don’t go well, since there is less at stake politically. For larger projects, possibly involving established SOEs as partners or even as principal actors, getting the right conditions in place for productive investment, given North Korea’s history and political background, will be an order of magnitude more difficult. The institutional desiderata clash rather seriously with the current political realities.

7Something so basic that in rich, western societies, we hardly think of it any longer as a basic necessity, as we simply take it for granted. As a result, we are more likely to think of a mobile phone as a basic necessity! 8To see this, one only needs to think of the terrible example of Iraq, immediately after the ouster of Saddam Hussein. The army was foolishly disbanded and mayhem, quite predictably, ensued.

In the above discussion, I have suggested several areas for reform in North Korea that ought to result in improved living standards quite rapidly. Where relevant I have highlighted what I see as critical political constraints that might slow down or prevent certain desirable economic changes from taking place, and in all cases I have tried to sketch the institutional conditions that appeared to be needed for economic success. My emphasis was on partial or sectoral measures, local measures, and a good deal of decentralisation, both because this facilitates experimentation, and because it might prove less immediately threatening to the existing political structures and ruling hierarchy. The result, though, is that my proposed approach might appear somewhat messy – this is perfectly true, but I would also argue that my approach has the merit of workability.

However, there is a strand of literature on North Korea that either advocates, or explores the implications of, a complete political and economic merger between North and South Korea (Noland, 2000; Noland et al., 1999; Funke & Strulik, 2005). It seems to me that this could only come about in the event of a catastrophic political collapse in the North, with both the Workers Party disintegrating and the military proving unable or unwilling to reimpose control, rather like the situations in Germany in 1989 (when the East German security forces were no longer willing to shoot their own people) and the Soviet Union in 1991 (when the August coup against Gorbachev failed, but he was then unable to reimpose effective control over the country).

Drawing on the arguments advanced above, my own view is that an early merger between North and South would be a huge mistake, both economically and politically. I think the way forward should be via an interim administration in the North, some years of reform in the North to improve living standards (especially by reforming agriculture), and the gradual introduction of markettype reforms, giving people time to get used to living in a market-type economy without the panoply of centralised control that has dominated everyone’s lives for several decades. In some ways, reunification of Korea ought to be analogous to the process of EU enlargement, with reforms going on in all sorts of areas (including diverse features of the institutional framework), over an extended period, until the North was agreed to be ready to operate under the economic ‘rules of the game’ that prevail in the South. This would offer the North a clear end-state to work for, but would avoid the costly German mistake – albeit perhaps politically inescapable – of throwing them into the deep end with no preparation.