Foreign direct investment (FDI) deserves attention as a driving force of economic growth in recipient countries, mainly due to two factors. One factor is its macroeconomic effect of boosting the effective demand of a given host country owing to the intensive capital investment and employment activity carried out by incoming foreign firms. This aspect of inward FDI has such critical significance for developing countries and post-socialist transitional states experiencing serious capital shortages that many studies have been conducted on it. The other factor is its external effects on domestic firms – that is, FDI spillovers arising from the new entry into the production market of host countries and the subsequent business expansion ofmultinational enterprises (MNEs) that have superior management know-how and advanced production technology. Because the FDI spillover effects represent a unique social phenomenon, economists have been paying considerable attention to this characteristic of FDI from theoretical and empirical perspectives. In fact, the issues concerning the relationship between MNEs and domestic firms in the host countries, which were raised in the 1960s after witnessing the advent of the age of internationalization, by Brash (1966) and Katz (1969), are still stimulating many researchers today, as demonstrated by the fact that a number of microeconomic research works that empirically examine FDI spillover effects have been published in recent years with the remarkable enhancement of firm-level datasets worldwide (Görg & Strobl, 2001; Crespo & Fontoura, 2007; Meyer & Sinani, 2009).

Many economists agree that domestic firms in recipient countries gain positive externalities from FDI via the four main routes that follow. The first route is the imitation of the management system and production of MNEs. One transmission mechanism often reported in this regard is reverse engineering.Nowadays, industrial espionage is also considered to be an extreme form of imitation. The second route is the intermediate input of goods and services supplied by MNEs, which contributes to quality improvement and cost reductions in in-house products. The third route is the feedback of marketing information and transfer of techniques for quality control, inventory, and standardization through the provision of goods and services to MNEs. These foreign customers tend to actively encourage local suppliers in the formof sending experts to the latter, implementing joint research projects, and holding joint drills. The fourth route is the acquisition of human capital in the form of movement of experienced managers, engineers, and other skilledworkers from MNEs to domestic firms, including not only voluntary career changes but also the active recruitment and headhunting of talent by local competitors that are quite common, in particular, in countries with a poor market for skilled labor. Now that the role of intangible assets and tacit knowledge is becoming increasingly important, the latter two routes have the same degree of significance as the former two in order for FDI to make positive productivity spillovers to domestic firms.

On the other hand, many researchers unanimously assert that FDI can also have a negative impact on domestic firms in the recipient countries, namely through crowding-out effects,whichmay surpass FDI’s positive competitive effect by breaking down ineffective, monopolized domestic markets and improving the managerial discipline of indigenous companies. This is especially true when MNEs strategically attempt an all-out effort to gain a significant share in the production markets of host countries with relatively closed economies, where the level of management skills and production technology of domestic firms is significantly poorer by international standards. In thisway, FDI has pros and cons for domestic firms. Thus, substantial direct capital inflows from abroad do not necessarily guarantee positive spillover effects for domestic companies.1

It is easy to imagine that post-socialist transitional countries met almost all of the above conditions to generate negative externalities from inward FDI. There have been a wide variety of empirical studies carried out regarding FDI productivity spillover effects in transition economies, including those by Kinoshita (2001) on the Czech Republic, Dries & Swinnen (2004), Jensen (2004), and Marcin (2008) on Poland, Javorcik & Spatareanu (2008) and Altomonte & Pennings (2009) on Romania, Sinai & Meyer (2004) on Estonia, Javorcik (2004) on Lithuania, Yudaeva

The studies listed above presented different but interesting conclusions by turning their attention to such factors as the level of market orientation and the type of business of foreign companies (depending onwhether theywere foreign-owned subsidiaries or joint-venture firms), the ownership structure and the technology absorption capability of domestic firms, the geographical relationship between MNEs and domestic firms, and the market concentration, labor intensiveness, and other characteristics of each target industry in an attempt to determine why statistically significant spillover effects cannot be detected from the estimations of baseline models. On the other hand, these studies do not consider any relationship between the multi-layered structure of industrial classifications and FDI productivity spillover effects, which are the focus of this paper. To the best of our knowledge, the same can be said for the preceding studies on industrialized and developing economies.

In this paper, we present a new empirical model regarding the productivity spillover effects of horizontal FDI and an estimate of the model using large-scale panel data of Hungarian firms of the early 2000s.We argue that it is not necessary for domestic firms to treat all foreign firms that come under the same category of the 2-digit level of industrial classification in a homogeneous manner. The market relationship between a domestic firmand foreign counterparts has amulti-layered structure arising from the sectoral differences among firms according to the lower levels of the classification. In contrast to the conventional model to capture the market presence of horizontal FDI using a single variable, the empirical model proposed in this paper is designed to identify horizontal spillover effects on the productivity of domestic firms according to the industrial sector with different depths by expressing the FDI presence usingmultiple variables with a nested structure corresponding to the aggregated level of industrial classification.2 As a result of the estimation of the econometric model with the nested spillover variables in the right-hand side, which is called ‘the nested variable model’ in this paper, we confirmed the horizontal spillover effects in Hungary simultaneously taking place in sectors with a different depth that cannot be captured with the conventional model. In other words, foreign firms in Hungary have statistically significant spillover effects on the productivity of domestic firms in the same industry, but their direction and degree differ greatly depending on proximity in product and technological space (hereinafter referred to as ‘industrial-technological proximity’) between MNEs and domestic companies. Moreover,we found that, first, FDI productivity spillover effects are generated in patterns that are completely different between themanufacturing and service industries, even during the same period in the same country. Secondly, FDI exhibits different spillover effects on different productivity indicators, and thirdly, the estimation of productivity spillover effects is sensitive to the selection of business scale indices, as it is the basis for calculating the market presence of FDI. In this sense, our empirical evidence may suggest new insights for the studies of both industrial organization and transnational investment.

The remainder of this paper is structured as follows: Section 2 examines the relationship between the multi-layered structure of industrial classifications and productivity spillover effects of horizontal FDI. Section 3 specifies the objective and period of empirical analysis. Section 4 describes the data employed for this study. Section 5 discusses the empirical methodology. Section 6 presents the estimation results. Section 7 summarizes the major findings and concludes the paper.

1We do not go into the details of this issue, on which many researchers have been working for years. For more details, see excellent survey articles by Blomström & Kokko (1998) and Görg & Greenaway (2004) as well as thorough literature reviews by Javorcik (2004), Sinani&Meyer (2004), Halpern & Muraközy (2007), and Kneller & Pisu (2007). 2It is noteworthy that Ruane&Uǧur(2004) and Haskel et al. (2007) found that the differences in the aggregate level of horizontal FDI resulted in a statistically significant gap between the estimation results of individual productivity spillover effects. Differently from the approach taken in this paper, however, they do not pay attention to the nested structure of the industrial classification.

To examine the productivity spillover effects of inward FDI to Hungary, we propose a new analytical framework, the essence of which is to refine the empirical methodology for estimating the externalities of horizontal FDI on the productivity of domestic firms by taking into account the multi-layered structure of industrial classifications arising from the sectoral differences among firms within an industry at the 2-digit classification level.The fundamental concept is based on our interview surveys of company managers and other executive officers of Central and Eastern European enterprises conducted in recent years in the framework of our Hungary-Japan joint research project and others. The empirical model developed in this study is based on our finding that domestic firms tend to have a substantially different scope of management interest and attitude towards MNEs operating in the same industry according to the 2-digit industrial classification, if these foreign counterparts are distinguished at a lower classification.3

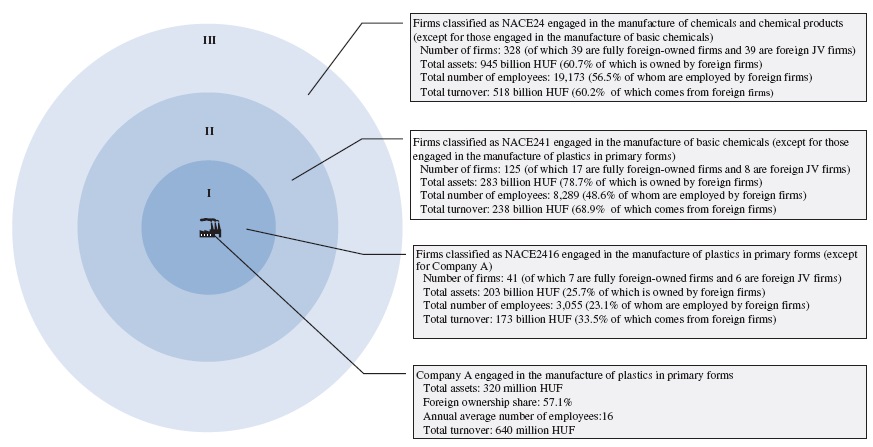

Using census-type data of Hungarian firms,4 we provide a concrete example of the multi-layered structure of industrial classifications as we assume it to be. In Figure 1,we focus on a manufacturing firm(hereinafter ‘CompanyA’) that is categorized as a manufacturer of plastics in primary forms according to Code 2416 of the General Industrial Classification of Economic Activities within the European Communities (NACE2416). Company A is a typical medium-sized Hungarian enterprise with 16 employees, a total turnover of 640 million Hungarian forints (HUF), and total assets of 3200 million HUF, and 57.1% of its equity capital came from foreign investors as of 2003.

As Figure 1 shows, Company A is surrounded by 41 firms that are also categorized as manufacturers of plastics in primary forms, of which 13 are foreign firms, including seven fully foreign-owned companies. These firms are hereinafter collectively referred to as ‘Enterprise Layer I’ for brevity. The total assets, number of employees, and turnover for Enterprise Layer I, excluding Company A, are 203 billion HUF, 3055 employees, and 173 billion HUF, and firms with foreign participation account for 25.7%, 23.1%, and 33.5% of these figures, respectively. These 42 firms engaged in the manufacture of plastics in primary forms, including Company A, are encompassed by ‘Enterprise Layer II,’which consists of 125 firms involved in the manufacture of basic chemicals (NACE241). Of these 125 firms, 25 are foreign, which account for 78.7%, 48.6%, and 68.9% of the total assets, number of employees, and turnover for Enterprise Layer II, respectively. These percentages are much larger than those for firms engaged in the manufacture of plastics in primary forms. Furthermore, Enterprise Layer II is also externally surrounded by ‘Enterprise Layer III,’ consisting of 328 firms categorized as manufacturers of chemicals and chemical products (NACE 24). Of these 328 firms, 78 are foreign firms, which account for 60.7%, 56.5%, and 60.2% of the total assets, number of employees, and turnover for firms engaged in the manufacture of chemicals and chemical products, respectively, excluding those in the manufacture of basic chemicals.

As of 2003, Company A was involved in the manufacture of chemicals and chemical products in Hungary, together with 378 domestic firms and 116 companies with foreign participation. As indicated in Figure 1, however, Company A and these 494 enterprises outline clear boundaries differentiating the industrial groups by industrial-technological proximity. It is also clear that the FDI presence in Enterprise Layers I, II, and III is quite diverse.

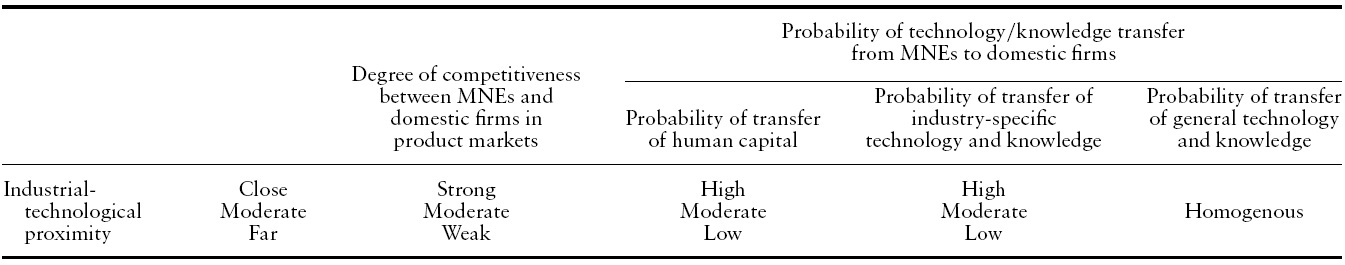

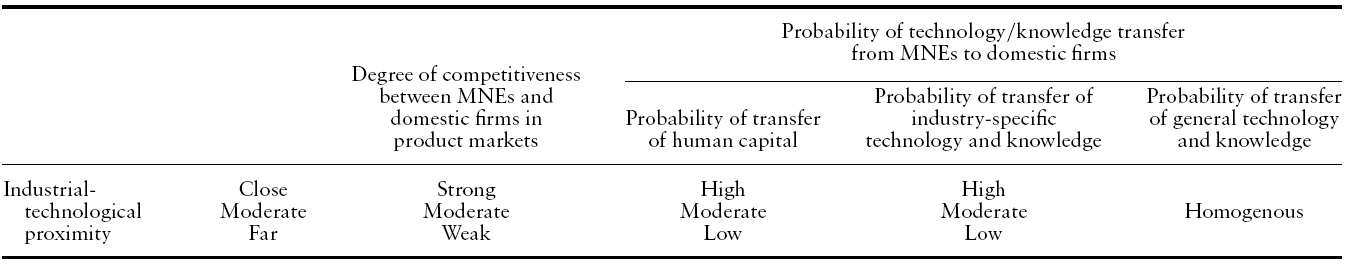

The industrial-technological proximity of MNEs and domestic firms is closely related with the degree of competitiveness between the two in the product market and with the probability of the technology and knowledge transfer from the former to the latter, even focusing solely on the relationship between the two operating in the same sector (Table 1). The closer the industrial sector of a domestic firm is to that of an MNE, the fiercer the market competition between the two will be, but, at the same time, the greater the possibility for the domestic firm to improve its productivity by acquiring good human resources through voluntary career changes and headhunting of the employees hired by the foreign firm as well as by imitating its industry-specific technology and knowledge. On the other hand, the more remote the industrial sector of a domestic firm is to that of an MNE, the more moderate the competition between the two will be, but, at the same time, the less the possibility for the domestic firm to gain industry-specific technology and knowledge and transfer of human capital from the foreign firm.5 Nevertheless, it may be possible for a domestic firm to significantly improve its productivity by imitating the general technology and knowledge of a sectorally remote MNE if its technology and knowledge are at a high level and can be utilized for wider applications to company management than those of domestic enterprises. To sum up, the spillover effects of horizontal FDI on the productivity of domestic firms emerge as the complex agglomeration effects of all of these factors.

From the theoretical point of view presented above, it is easy to predict that domestic firms may receive different productivity spillover effects from horizontal FDI with different degrees of industrial-technological proximity. For instance, if market competition withMNEsoperating in an outer circle (e.g., Enterprise Layer III) is in fact lower, but more general technology and knowledge are transferable from these foreign companies to domestic firms, it is highly likely that positive FDI spillover effects emerge from this circle in the aggregate. In contrast, if there is significant industry-specific technology and knowledge that domestic firms can absorb from MNEs operating in Enterprise Layer I, but market competition between them is so strong that this crowding-out effect offsets the benefits of technology and knowledge transfer, negative spillover effects may take place in this enterprise layer as a whole. Needless to say, the complete opposite situation is possible, and we can also anticipate a non-linear relationship between the FDI spillover effects and industrial-technological proximity between a domestic firm and MNEs.

Relationship between industrial-technological proximity and degree of competitiveness between MNEs and domestic firms in product markets and probability of technology/knowledge transfer from MNEs to domestic firms

In the real world, the market relationships and industrial linkages between MNEs and domestic firms are quite diverse and vary from country to country as well as industry to industry. Unless the research target is small enough, it is quite difficult, therefore, to theoretically predict the direction and degree of such external effects, and the issue has been the subject of empirical studies. Hungary is not an exceptional case.

3We also received relevant suggestions fromfield studies conducted by other researchers with respect to former state-owned enterprises privatized by Western MNEs and other foreign investors in transition economies. See Estrin et al. (2000) and Stephan (2006), for instance. 4We describe the details of the data in Section 4. Downloaded by [Yonsei University] at 16:19 29 December 2012 5In comparison with blue-collar workers, however, it may be easier for management and whitecollar workers to move from one company to another beyond the strictly defined boundaries of a 4-digit sector. Therefore, when we analyze an industry with a higher proportion of administrative staff in the totalworkforce, it is more likely that positive horizontal FDI spillovers from outer circles will be observed (i.e., Enterprise Layer II and III in Figure 1).

3. Objective and Period of Empirical Analysis

In this section, we specify the objective and period of our empirical analysis by overlooking inward FDI to Hungary during the transition period and reviewing the preceding studies on the FDI productivity spillovers in the country

Hungary is well known for having received a comparatively large amount of direct investment from abroad for its economic scale since the very first stage of its systemic transformation to a market economy (Iwasaki, 2007). In fact, Hungary received the largest FDI among the Central and Eastern European (CEE) countries on an accumulated total amount basis from 1990 through 1997, due to such factors as its proactive open market policy, privatization of state-owned enterprises focusing on direct sales to strategic foreign investors, and geographical proximity to Western markets. Although Hungary was overtaken by Poland as the largest FDI-recipient country in the region from 1998 onward, it received US$62.7 billion, or 17.8% of the total FDI that flowed into the ten CEE countries from 1990 to 2007, and its per-capita cumulative FDI for that 18-year period was US$9711, the second highest after the US$9923 for the Czech Republic among these ten countries.6

This vast inflow of FDI led to the emergence of a mega foreign sector within the Hungarian economy. The number of firms with foreign participation almost tripled from 9117 to 27,177, and the total amount of FDI invested in those companies jumped from 215 billion HUF to 14.810 trillion HUF from 1991 to 2007. Foreign capital actively participated not only in the manufacturing sector but also in the service sector. In 2007, the manufacturing sector had 3264 foreign firms, or 12% of the total number of foreign firms in all industries, and attracted 5.451 trillion HUF from foreign investors, or 36.8% of the total prescribed capital amount contributed by foreign investors in all industries, whereas the service sector had 21,015 foreign firms (or 77.3% of the total) and attracted 6.436 trillion HUF (or 43.4% of the total).7

As discussed above, inward FDI to Hungary has contributed to the emergence of many foreign companies in a relatively short time, especially those in the manufacturing and services industries. The investment and business mode for MNEs has also continued to evolve over the years (Kiss, 2007). This movement may have had a significant impact on the direction and degree of the external effects of FDI on the productivity of domestic firms along with the dynamic changes in the presence of foreign companies in the domestic market and their relationship with domestic counterparts.

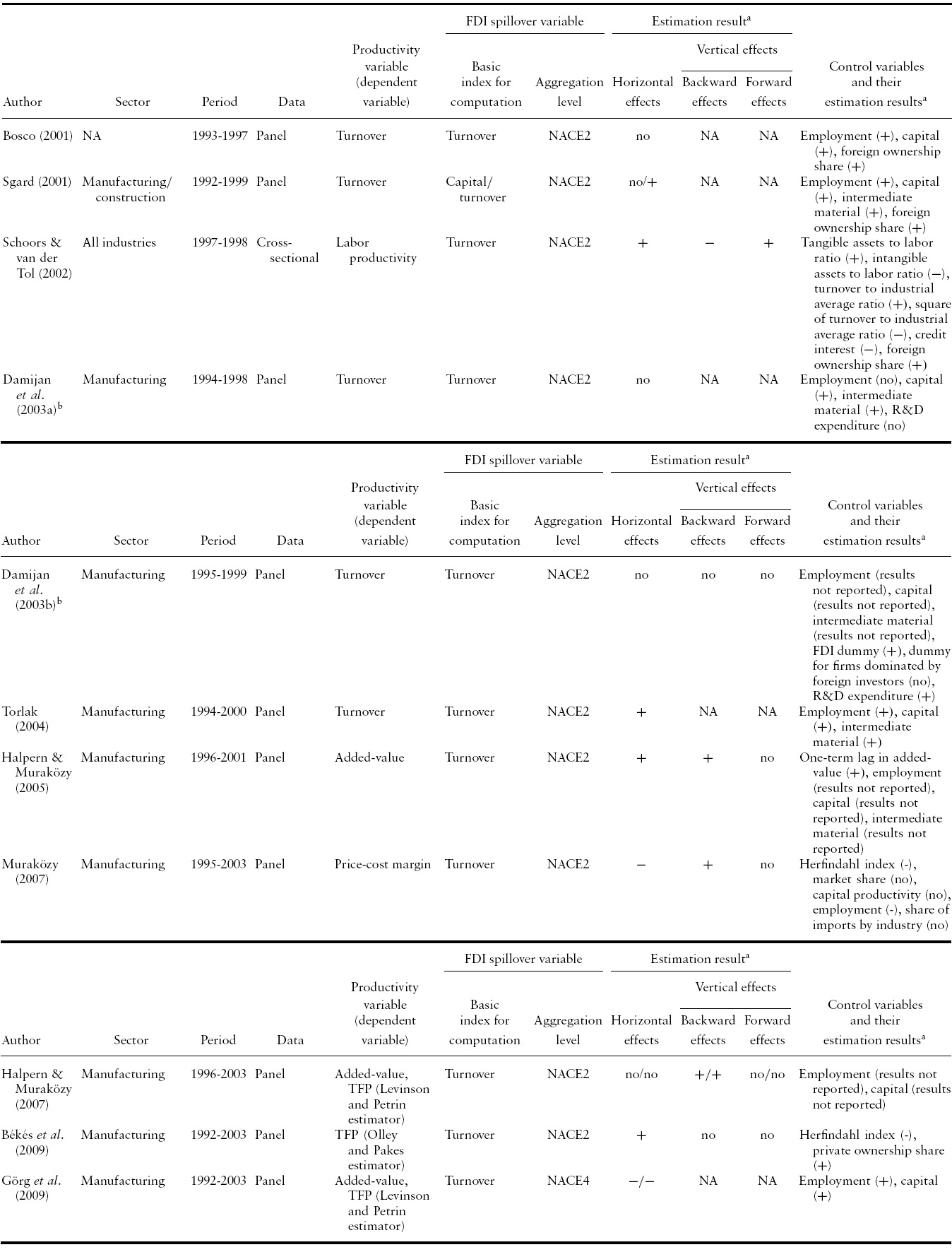

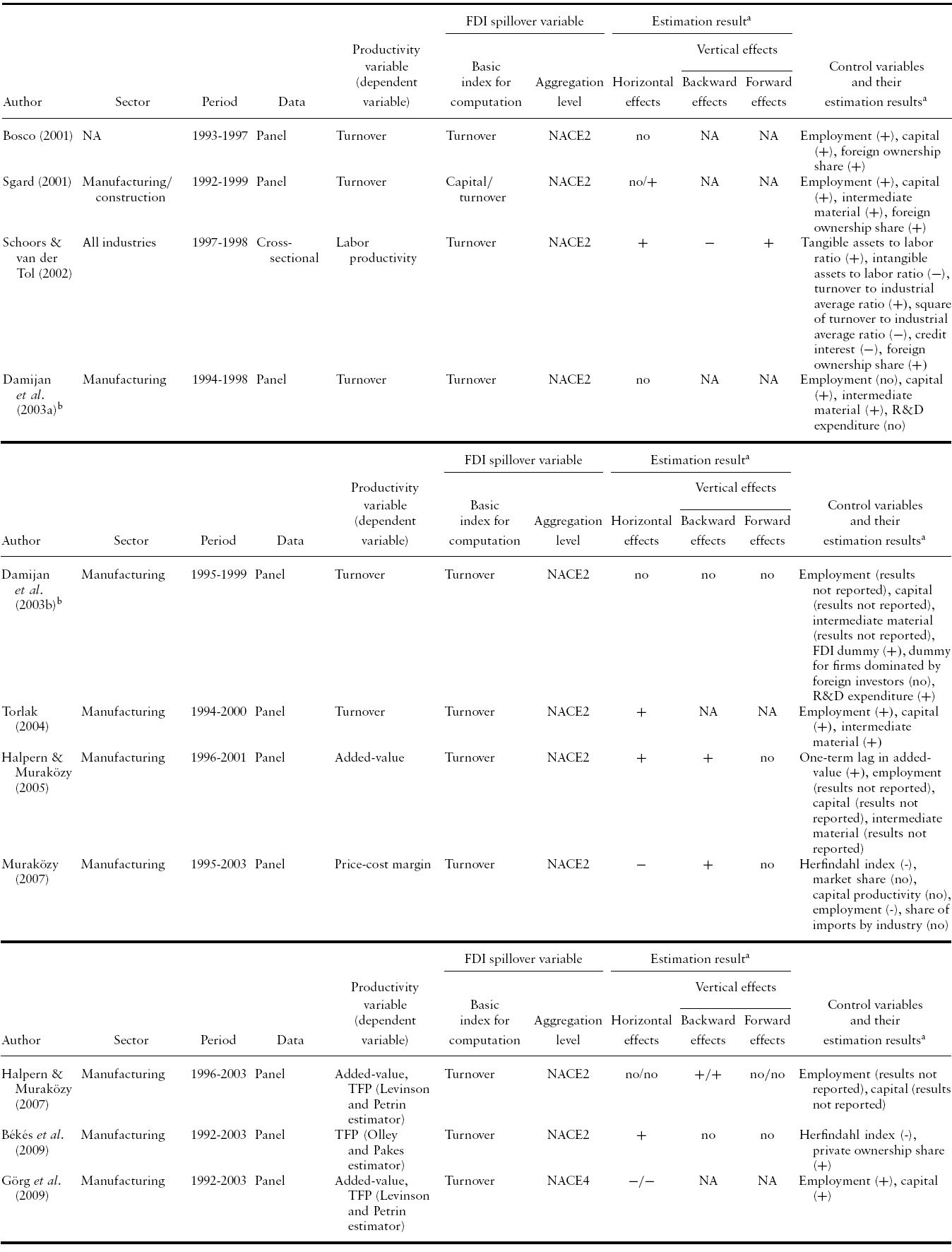

On the other hand, most researchers negatively evaluate the relationship between MNEs and domestic firms in Hungary by looking at the considerable disparities in financial standing and technological levels between the two and the low local procurement rate of entering firms.8 The results of quantitative analyses concerning FDI spillover effects are also used to back up such negative assessments. As far as we surveyed with regard to this issue, 11 papers have been published in the past, either devoted solely to the case study of Hungary or reporting empirical results limiting the scope of any estimation of Hungary as part of international comparative research. Table 2 contains a summary of empirical methods and estimation results in these research works. It is difficult to determine from this table that the preceding studies as a whole strongly suggest the positive spillover effects of inward FDI to Hungary on the productivity of domestic firms; this is because the estimation results of the proxies for the market presence of FDI – that is, the spillover variables representing the comparative business scale of foreign companies within each industrial sector they belong to – are mixed. In fact, these 11 studies report three negative and six insignificant estimates against five positive ones regarding the horizontal spillover effects. There is no denial, however, that the non-uniformity of the empirical results is largely dependent upon the differences not only in the structure of the regression models and dataset used but also in the estimation period applied because the presence of FDI and the relationship between MNEs and domestic firms in Hungary are considered to have changed dynamically at each stage of the transition to a market economy from the 1990s to the early 2000s.

With this in mind, we re-examine FDI productivity spillover effects in Hungary only for the early 2000s, duringwhich the business activity of foreign firms entered its mature, stable stage. It is highly likely that positive FDI spillover effects during this period exceed crowding-out effects for two reasons. First, the business activity of many MNEs has taken greater root in local communities, and their alliance with domestic firms has achieved larger scale and depth through parts supply and outsourcing than before. Second, many domestic firms have improved their management practices, and the weaker ones have been forced out of business through severe market competition over the past 15 years.9 We also give great attention to the service sector, which has been completely ignored in previous studies, because, as reported above, the presence of foreign companies in services is just as remarkable as it is in the manufacturing industries and, hence, we expect that a significant amount of technology and knowledge has been transferred from MNEs to domestic firms in the service industries.

[Table 2.] Empirical studies on FDI productivity spillover effects in Hungary

Empirical studies on FDI productivity spillover effects in Hungary

6Authors’ calculation based on UNCTAD official data (http://stats.unctad.org/fdi/). 7Authors’ calculation based on HCSO, the Statistical Year Book of Hungary (various years), and the official statistics of the Hungarian Central Statistical Office available at: http://www.ksh.hu/. 8For instance, see Farkas (2000), Szanyi (2004), Fink (2006), Acs et al. (2007), and Rugraff (2008). 9Studies suggesting this possibility include those by Inzelt (2008), Makó et al. (2009), and Sass et al. (2009).

The data underlying our empirical analysis are annual census-type data of Hungarian incorporated enterprises offered from the National Tax Authority of Hungary for academic research purposes. The data were compiled from financial statements associated with tax reporting submitted to the tax office by legal entities performing accounting and tax procedures by double-entry bookkeeping.The observation period was from 2002 through 2005. The data cover all industries, including manufacturing and service industries,10 and contain basic information for each sample firm, including the NACE 4-digit codes, annual average number of employees, total assets, turnover, and other financial indices. In addition, the locations of the sample firms are identifiable to the extent that they are divided into the capital region, the western region, and the eastern region.11

Information about the ownership structure includes the total amount of equity capital (prescribed capital) at the end of the term and its share of state, domestic private investors, and foreign investors. Thus, the data allow us to know whether a given sample firm is a fully domestically-owned or a foreign firm and, when it is a foreign firm, whether it is a foreign joint-venture firm or a fully foreign-owned firm according to the ownership share of foreign investors in the total amount of subscribed equity.

All nominal values are deflated with the base year being 2002 to use the data.12 As Sgard (2001) and Claessens & Djankov (2002) indicate, firm-specific price deflators, which are the most desirable for deflation, are not available in Hungary. Hence, following the steps taken by these two studies, the consumer price index, the industrial producer price index, and the investment price index reported by the Hungarian Central Statistical Office are used as alternative deflators for every aspect of the empirical analysis in this paper. In addition, for using the data, samples including unrealistic and inconsistent input and missing values that pose an impediment to our empirical analysis are removed, and cleansing procedures are performed with due attention.

The data form an unbalanced panel with the new entry and exit of enterprises during the observation period. All of the effective data values concerning these newly entering and exiting firms are used for the computation of industry-level aggregated values, such as FDI spillover variables and Herfindahl indices reported later. The observations used for our empirical analysis are limited to those concerning companies with an average number of employees of five or more, and to those available in the data for at least two terms in the analysis period in order to control for a firm’s individual effects using panel data estimators and to exclude so-called ‘one-man companies’ and micro firms from our estimation. Following many previous studies, we also exclude those companies that belong to industries with fewer than five active firms at the 4-digit level from the observations used in the empirical analysis of the paper.

The original data include almost the same number of sample firms as the official statistics. As a result of data cleaning and the exclusion of small-scale companies, with respect to 2003, 8505 manufacturing firms and 17,232 service firms remain in our dataset. According to the data and official statistics, the proportions of these sample firms in the total number of incorporated enterprises and employees for 2003 account for 23.0% and 58.4% (540,146 employees) for manufacturing firms and 9.3% and 44.9% (567,078 employees) for service firms, respectively. Furthermore, the sample of manufacturing firms includes 1520 foreign firms (of which 886 are fully foreign-owned firms), and that for service firms includes 1825 foreign firms (of which 994 are fully foreign-owned firms). The proportion of these foreign firms in the total number of samples (13.0%) is almost identical to that of the official statistics if the company size is considered. The same has also been confirmed for the observations for the other years. In other words, the panel data used for our empirical analysis consist of samples representative for the manufacturing and service industries in Hungary.

10The manufacturing industries include food products and beverages through recycling (NACE 15-37). The service sector refers to wholesale and retail trade: repair of motor vehicles, motorcycles, and personal and household goods (NACE 50-52), hotels and restaurants (NACE 55), transport, storage, and communication (NACE 60-64), and real estate, renting, and business activities (NACE 71-74). 11The individual regions consist of the following city and counties: the capital region consists of Budapest and Pest County; the western region consists of the following nine counties: Gyȍr-Moson-Sopron, Komárom-Esztergom, Vas, Veszprém, Fejér, Zala, Somogy, Tolna, and Baranya; and the eastern region also consists of nine counties: Nógrád, Bács-Kiskun, Csongrád, Békés, Jász-Nagykun-Szolnok, Hajdú-Bihar, Szabolcs-Szatmár-Bereg, Borsod-Abaúj-Zemplén, and Heves. 12Unless otherwise specified, the unit used for the price data is 1000 HUF

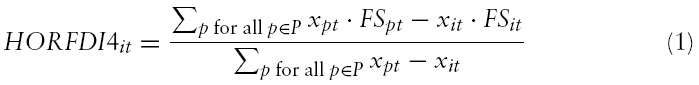

In this section, an empirical model is developed on the basis of the discussion in Section 2 regarding the relationship between the multi-layered structure of industrial classifications and the spillover effects of horizontal FDI on the productivity of domestic firms. The model is designed to estimatemultiple variables representing the market presence of horizontal FDI according to the degree of difference in industrial-technological proximity to a domestic firm to be analyzed. As in many preceding works, our sample firms include both fully domestically owned firms and foreign joint-venture companies. In the empirical analysis, the direct effects of foreign participation on productivity of a joint-venture company are controlled by the foreign ownership share in the total amount of subscribed equity of the company

As demonstrated in Figure 1, in the case of Hungary, which adopts the NACE industrial classifications, the presence of FDI in the manufacturing and service industries is calculated at three classification levels for each industry, and the productivity of the

where the subscript

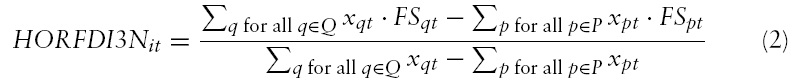

The presence of foreign firms in the 3-digit aggregated level sector

Similarly, the presence of FDI in the highest aggregated level sector

As is the case with the relationships among the three different enterprise layers drawn in Figure 1, the above horizontal spillover variables have a nested structure that varies depending on the level of aggregation. Namely, the numbers 2, 3, and 4 included in the names of the variables stand for the levels of aggregation inNACE, andNat the end denotes that the variable has a nested structure in the relationship with the lower categories. Empirical models that comprise these nested spillover variables of horizontal FDI in the right-hand side of the estimation equation are hereinafter called ‘nested variable models’ to distinguish them from the models with a single horizontal variable.13

To compare the estimation results from the two different empirical approaches, we also estimate an additional horizontal spillover variable without giving any consideration to the multi-layered structure of industrial classifications. Specifically, the productivity variable of the

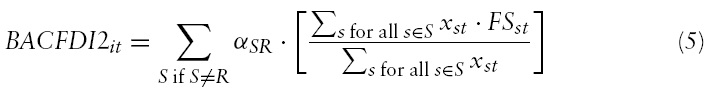

Furthermore, as Schoors & van der Tol (2002) and Damijan

where

We adopt three indices for the

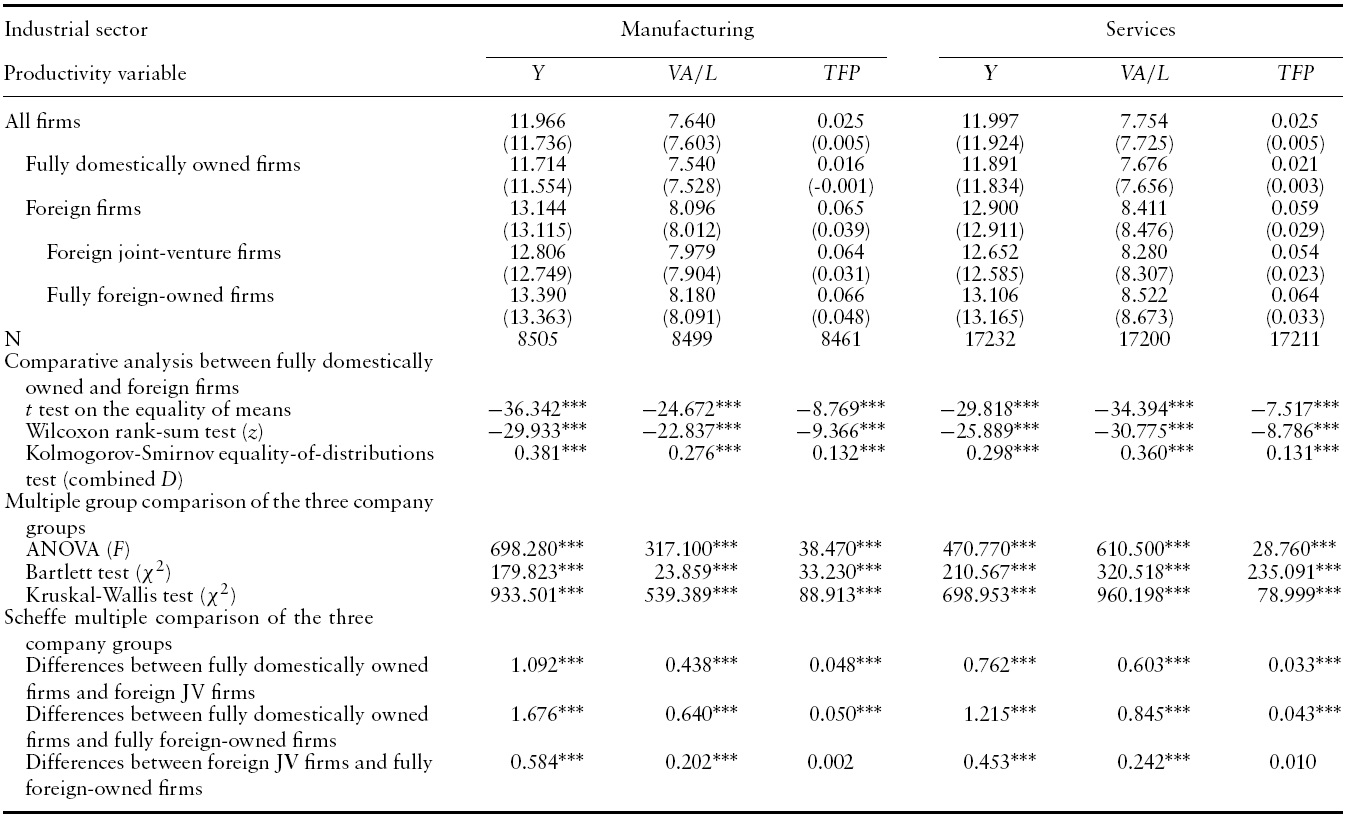

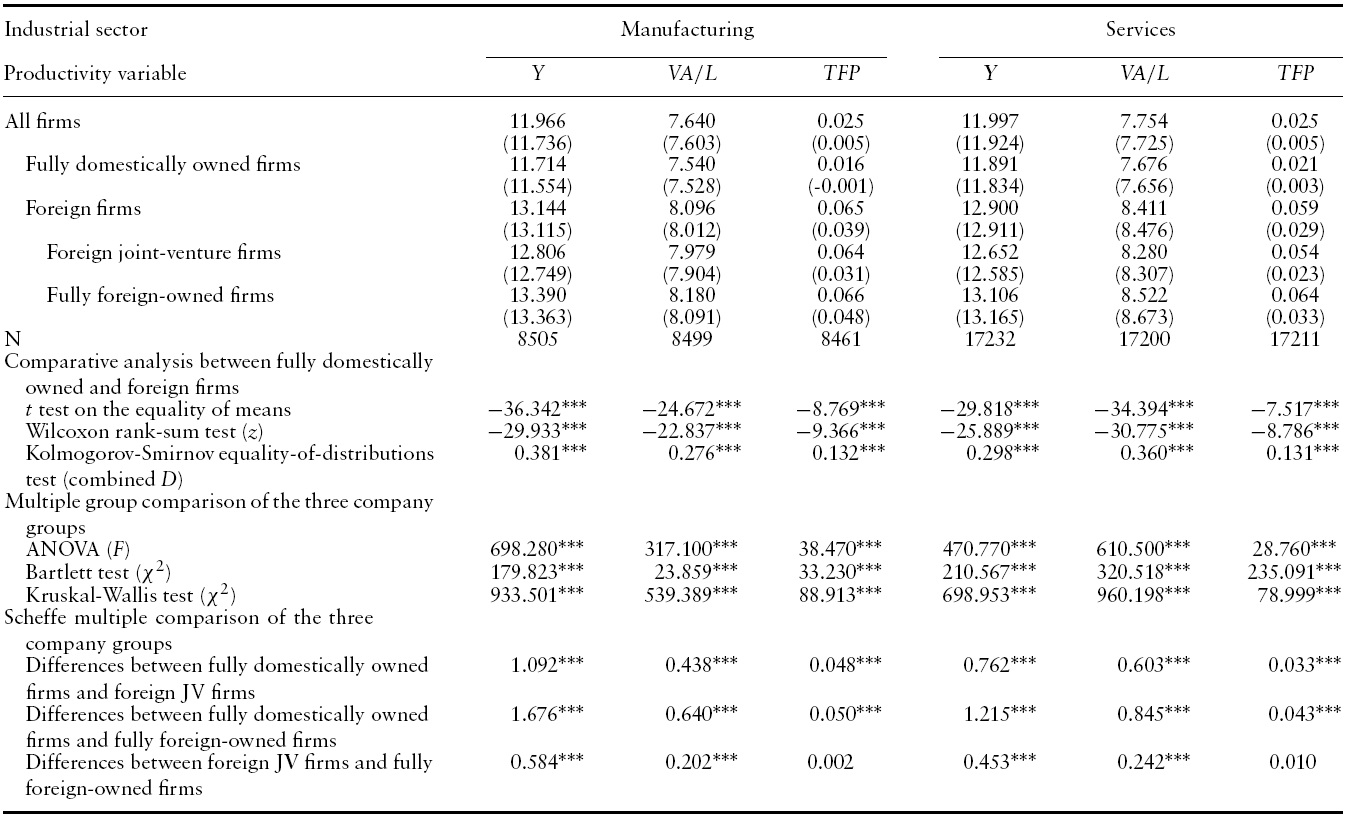

FDI spillover effects on the productivity of domestic firms are generated on the condition that MNEs have significantly better productivity than domestic firms. Table 3 shows the results of univariate analysis regarding the productivity gap between different company groups in terms of ownership structure in the manufacturing and service industries using the above three productivity variables. We confirm that, as of 2003, foreign firms are superior to fully domestically owned firms in both sectors and in all three of the productivity variables with statistical significance at the 1% level. Moreover, the results of the analysis of variance and the Scheffe multiple comparison of the three company groups indicate that fully foreign-owned firms are superior to foreign joint-venture firms in terms of productivity in general. In both industries, however, no statistically significant differences are evident between fully foreign-owned firms and foreign joint-venture firms in terms of total factor productivity. Almost the same results as those shown in Table 3 are obtained from the analysis using 2004 and 2005 observations. Hence, we predict that FDI in Hungary had considerable potential for generating positive productivity spillover effects on domestic firms in the early 2000s.

The observations in our regressions are limited to those of fully domestically owned firms and foreign joint-venture firms since we focus on FDI productivity spillover effects on firms established by domestic investment. To avoid possible endogeneity between firm-level productivity and the market presence of FDI that may cause the simultaneous bias on the estimation results, the total asset at the end of year

Along with FDI spillover variables, we introduce three independent variables representing the input of capital stock (

[Table 3.] Univariate analysis of productivity gaps among different types of firm ownership, 2003

Univariate analysis of productivity gaps among different types of firm ownership, 2003

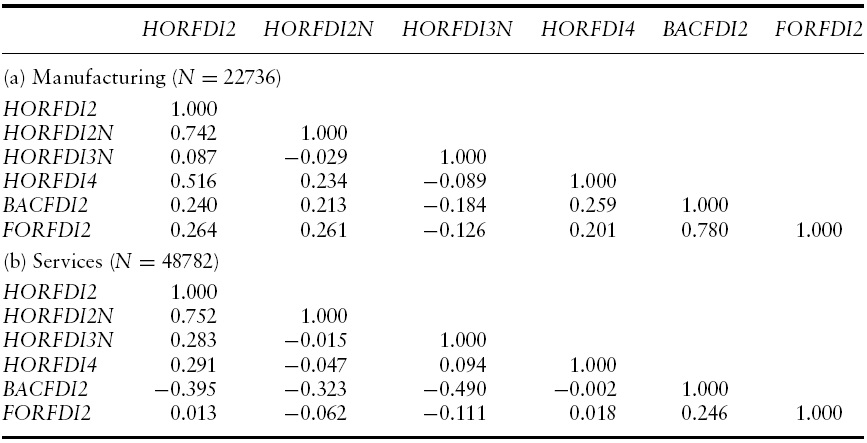

[Table 4.] Correlation matrices of FDI spillover variables

Correlation matrices of FDI spillover variables

To control the firms’ individual effects, we used three panel data estimators: pooling OLS, random-effects, and fixed-effects estimators. The selection of the estimation results reported in this paper is carried out in accordance with the results of two model specification tests. One is the Breusch-Pagan test to examine the null hypothesis that the variance of the individual effects is zero, and the other is the Hausman test to examine the random-effects assumption (Greene, 2008).

Furthermore, it is pointed out that, when aggregate variables are used to estimate firm-level outcomes, the standard errors of the coefficients of aggregate variables may be biased downwards (Moulton, 1990; Imbens & Wooldridge, 2009). Following Boschini&Olofsgård (2007),Taylor (2007), Geishecker&Görg (2008), and many others, we, therefore, compute the standard errors for all specifications using the Huber-White sandwich estimator, which allows for the errors of the within-industry clusters of observations to be correlated independently of the between-industry errors.18

13Using the same empirical methodology, Iwasaki et al. (2011) examined the information spillover effect of FDI on the export decision of domestic firms in Hungary. 14These backward and forward spillover variables are computed using the input–output table for 2005 compiled by the Hungarian Central Statistical Office (HCSO, 2009). 15Petrin et al. (2004) describe how to estimate TFP using econometric software. 16According to Ackerberg et al. (2006), however, the Levinsohn-Petrin estimator may undergo collinearity problems, and, hence, there is still room for the development of the TFP estimation technique. 17Girma et al. (2004) examine the causality between the export activity of British firms and their productivity and confirm that export is an important channel for improving the productivity of domestic firms. Iwasaki et al. (2010) verify the superiority of foreign ownership over domestic private ownership and the inferiority of government ownership compared with domestic private ownership in terms of productivity using the same data in this paper. 18As a supplementary regression analysis, we estimated the effect of each FDI spillover variable separately and computed the standard errors of its coefficient adjusted for clustering on aggregated industry and confirmed that these estimation results do not significantly differ from those reported in Section 6.

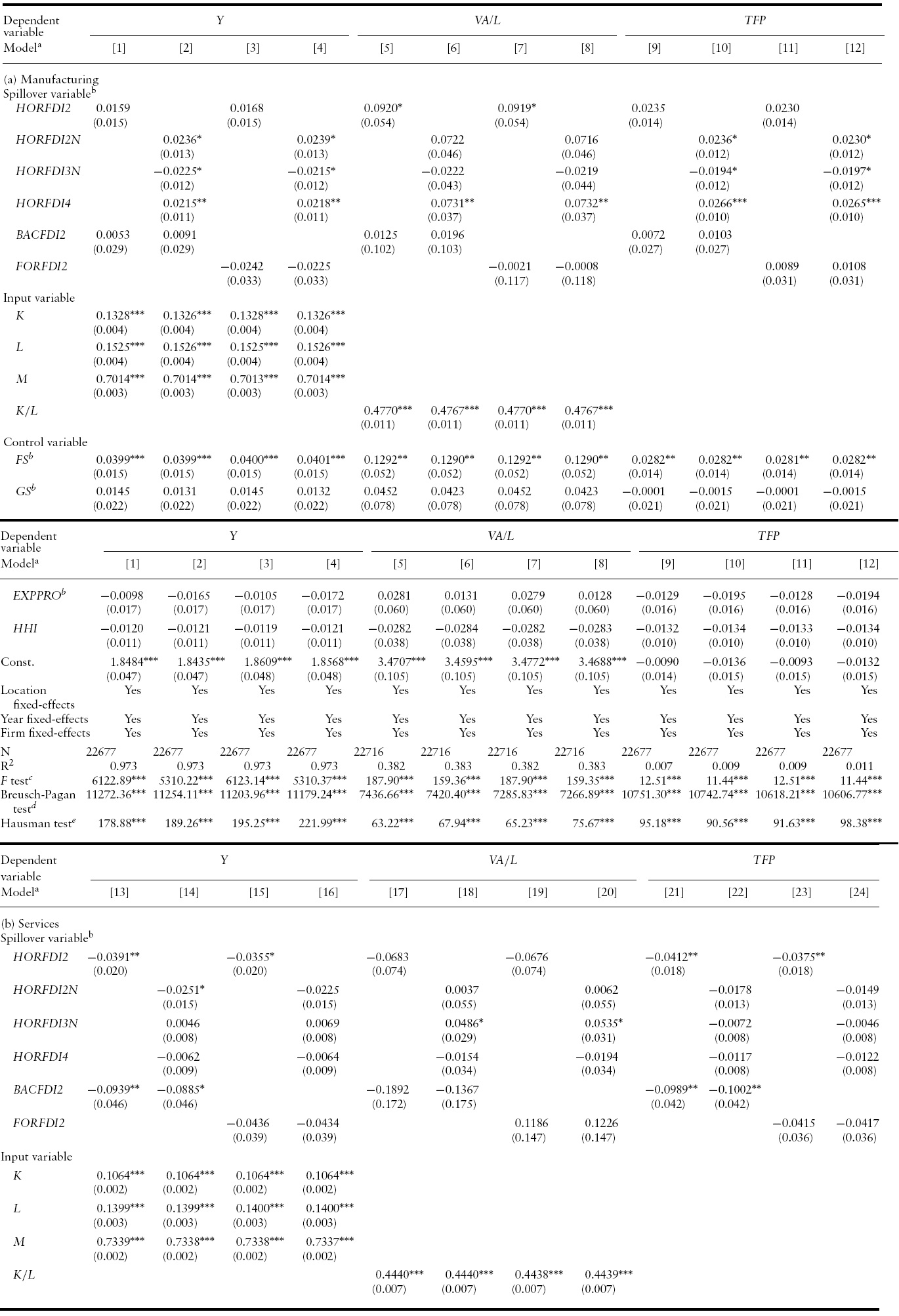

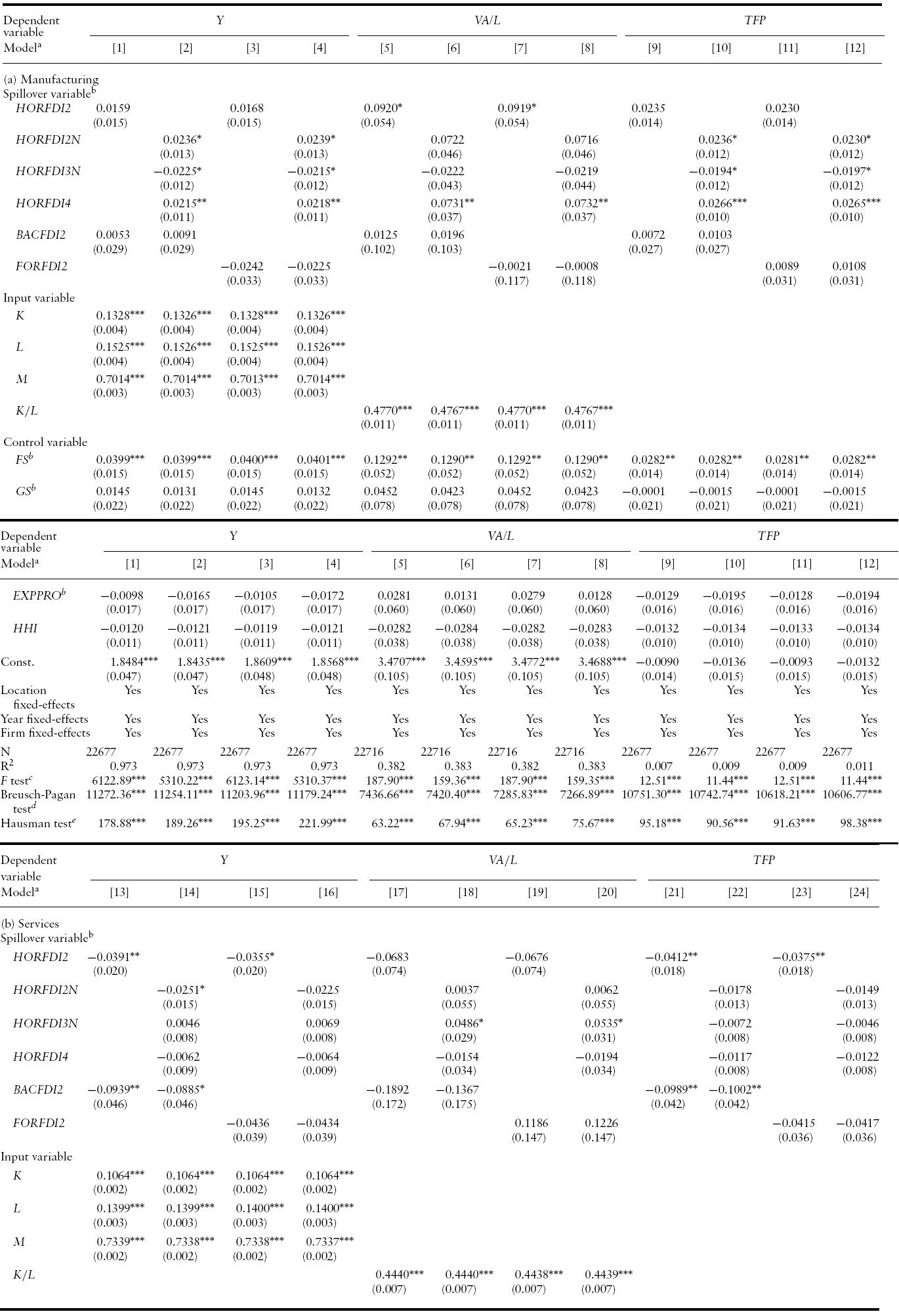

The estimation results using all observations are shown inTable 5.The definitions and the descriptive statistics of the variables used for estimation are listed in the Appendix.Table 5 contains the 24 regression models to deal with all combinations of the two industrial sectors, the three dependent variables, and the four sets of the FDI spillover variables. Both the Breusch-Pagan and the Hausman tests rejected the null hypothesis in all cases at the 1% significance level.19 Therefore, estimates of the fixed-effects models are exclusively reported in Table 5.

The nested variable model succeeds in identifying the horizontal spillover effects originating from the different depths of the industrial sector that cannot be captured with the model having a single horizontal variable. In fact, as is shown in panel (a) of Table 5, Model [1],which adopts the conventional empirical approach, detects no statistically significant horizontal effects. The coefficient of

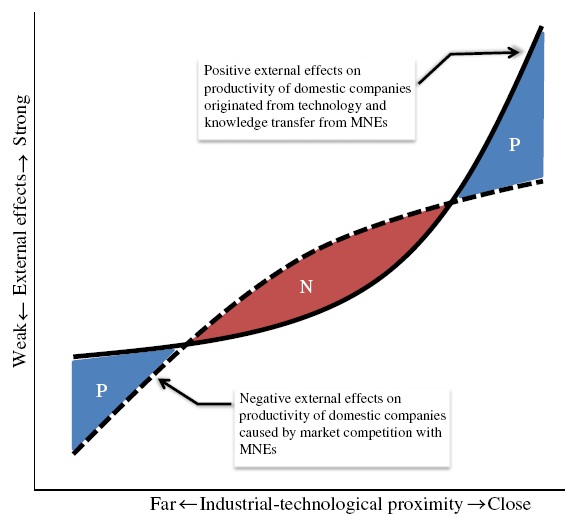

The estimation results in panel (a) of Table 5 as a whole strongly demonstrate that there is a non-linear correlation between the industrial-technological proximity between a domestic firm and MNEs and the spillover effects of horizontal FDI in the Hungarian manufacturing sector. Based on the empirical evidence that the FDI presence has a positive effect in Enterprise Layers I and III and a negative effect in Enterprise Layer II,we conjecture that there is a relationship, as illustrated in Figure 2, between the positive external effects on the productivity of domestic companies originated from technology and knowledge transfer from MNEs and the negative external effects caused by market competition with MNEs.20 As the figure shows, if both effects are an increasing function of industrial-technological proximity between a domestic firm and MNEs, on the one hand, the external effects of technology and knowledge transfer draw an upward convex curve (

Panel data analysis of FDI productivity spillover effects: comparison of the conventional model and the nested variable model

On the other hand, as indicated in panel (b) of Table 5, the horizontal FDI spillover effects on service firms are generated in a completely different pattern from those on manufacturing firms.We found that foreign competitors generally have negative impacts on the production scale and total factor productivity of domestic firms in the same sectors they belong to, whereas, in Enterprise Layer II, they have a positive spillover effect on the labor productivity of domestic firms with statistical significance at the 10% level. These estimation results are quite interesting, as they suggest that the market behavior of MNEs may have diverse impacts on the production performance of indigenous companies in recipient countries.21

With regard to the vertical FDI spillover effects, we did not detect in our regression analysis any statistically significant backward spillover effects on manufacturing firms, whereas the analysis confirms significantly negative effects on the production scale and total factor productivity of service firms, suggesting that, in the Hungarian service sector, advancement of MNEs into downstream industries tends to result in downsizing and a loss of efficiency in production of domestic firms operating in upstream industries. It is likely that intense market competition between MNEs and domestic firms negatively affects the production activities of local suppliers as a result of management deterioration and/or exit of their traditional client companies. As for forward FDI spillovers, their impacts are insignificant for both manufacturing and service firms.

Our estimations have produced positive and significant coefficients on the input variables. Among the control variables, as has been confirmed in many studies regarding FDI into Hungary,

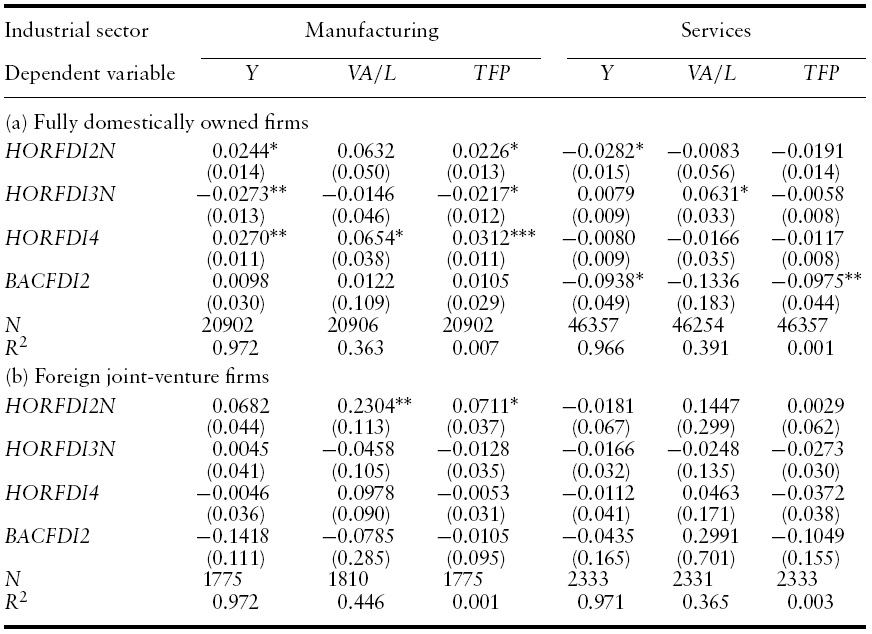

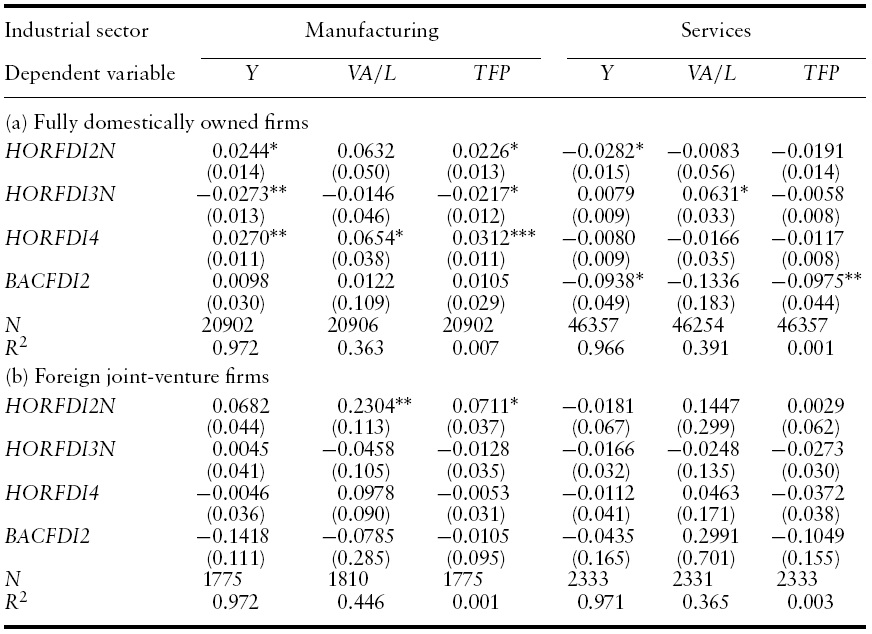

Table 6 shows the estimation results when classifying the observations into those for fully domestically owned firms and those for foreign joint-venture firms. The estimates reported in this table are those for FDI spillover variables only using regression models with the backward variable on the right-hand side. Table 6 reveals that fully domestically owned firms are the main recipients of external effects originating from inward FDI, whether they are positive or negative. We presume that, on average, the chances of a Hungarian foreign joint-venture firm acquiring the technology and knowledge fromotherMNEsare greatly diminished due to the existence of foreign ownership as a direct endogenous channel for improving its productivity and to the relatively small productivity gap with fully foreign-owned firms, as confirmed in Table 3.

Estimation results by differentiating observations between fully domestically owned firms and foreign joint-venture firms

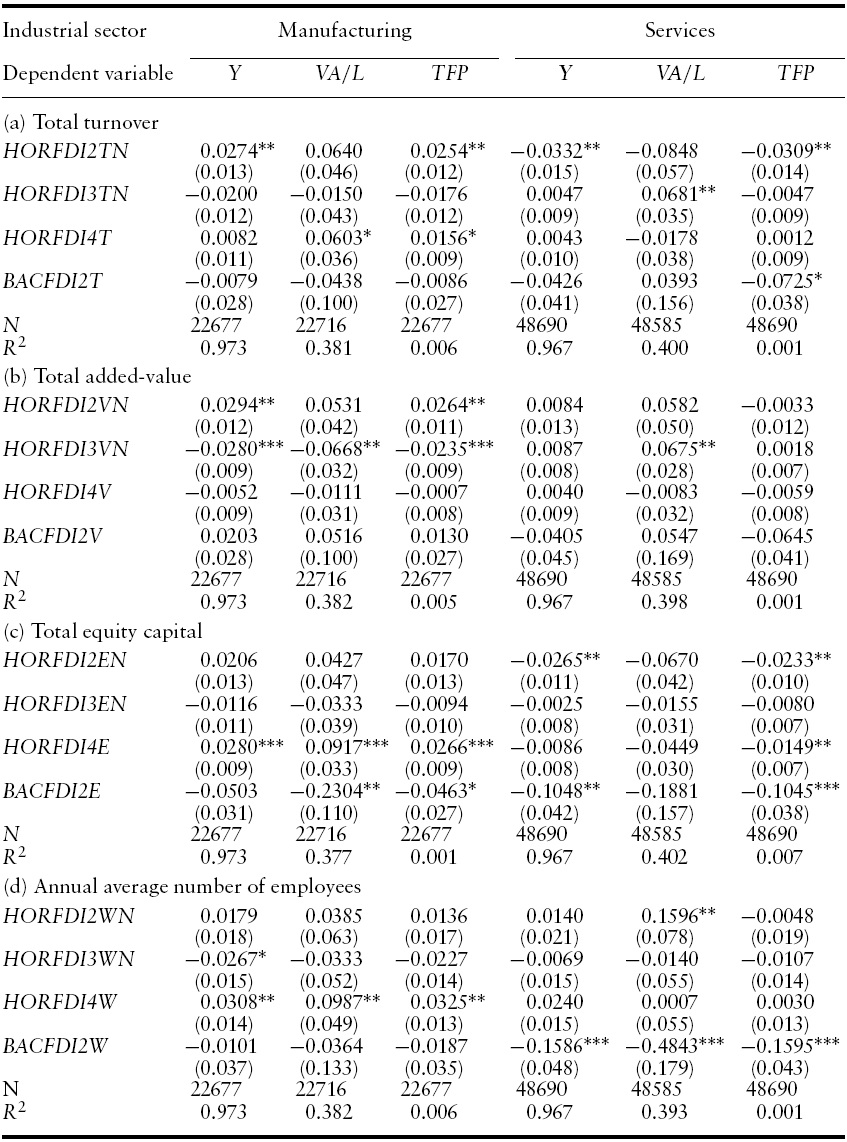

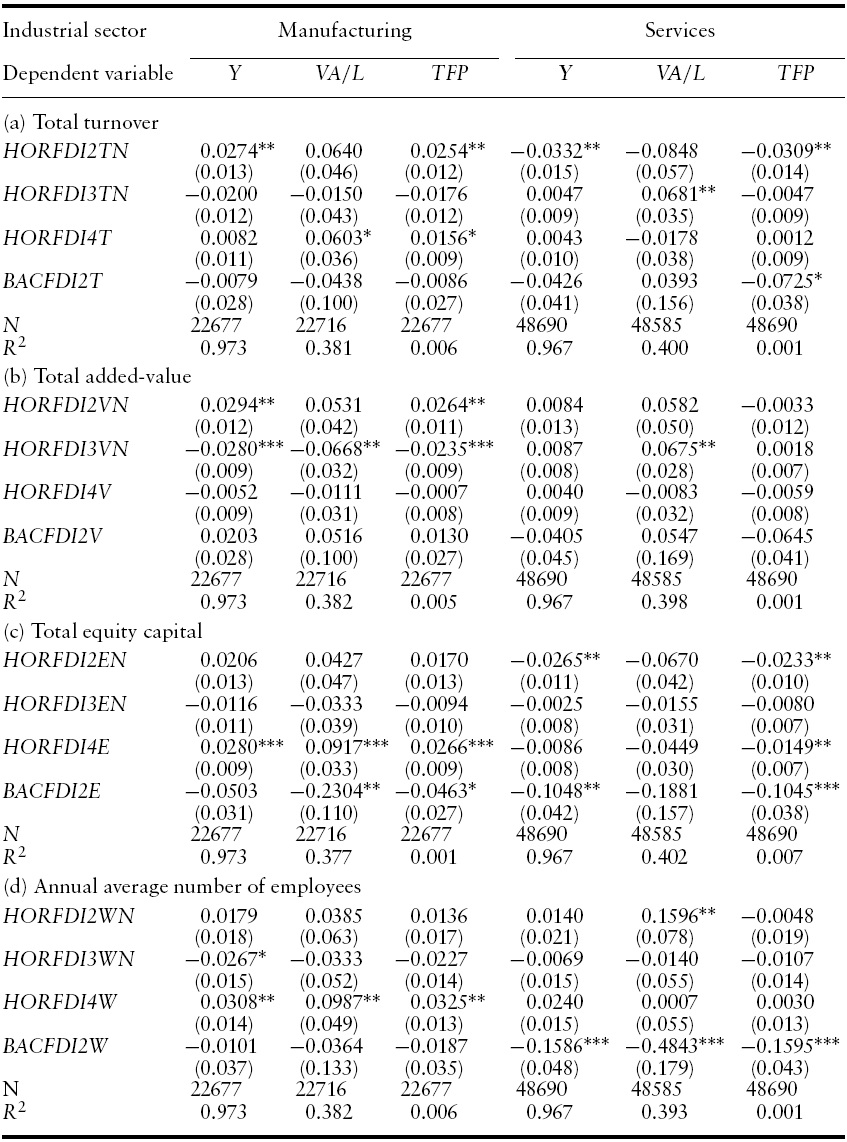

As explained in the preceding section, the FDI spillover variables estimated in Table 5 are calculated on the basis of total assets. In most previous studies, however, the market presence of FDI is expressed using an index other than assets. With this in mind, we also estimate the FDI spillover variables using the next four indices: (a) total turnover, (b) total added-value, (c) total equity capital, and (d) annual average number of employees. Table 7 shows the results. The table reveals that there are certain differences among individual estimation results in terms of how FDI spillover effects are generated. For instance, according to the estimation results for manufacturing firms, the productivity spillover effects of horizontal FDI are stronger within the external enterprise layers (i.e., at the Enterprise Layers II and III) than within the sector of the firms to be analyzed when turnover and added-value are used as the basic indices for the computation of FDI spillover variables. On the other hand, when equity capital and the number of employees are used as the basis to calculate the market presence of FDI, the horizontal effects generated closer (i.e., at Enterprise Layer I) to the firms to be analyzed are emphasized. As for the service industry, there are significant differences in the statistical evaluation of the spillover effects on labor productivity between cases inwhich turnover and added-value are used as the basic indices and those inwhich the number of employees is used. Different management indices capture different aspects of firmactivity. The regression results reported in Table 7 indicate that the empirical evaluation of FDI spillover effects on the productivity of domestic firms greatly differs depending on what aspect of the activity of MNEs the researcher focuses on most, suggesting that careful attention should be given to the selection of the proxy variable for the marker presence of FDI in the recipient country as well as to the productivity indices of domestic firms.22

Estimation results of FDI spillover variables computed using total turnover, total added-value, total equity capital, and annual average number of employees

As discussed above, our estimation results are sensitive to the selection of indices as the basis for computation of FDI spillover variables. Yet the signs of the FDI spillover variables estimated at the 10% or less significance level are exactly the same among the different estimation results reported in Tables 5 and 7. Therefore, we can safely say that the FDI spillover effects repeatedly detected in different model specifications with 10% or less significance level are highly robust estimates.

19These specification test results apply to all the other estimation results reported in this paper. Downloaded by [Yonsei University] at 16:19 29 December 2012 20Positive external effects on the productivity of domestic firms can also be anticipated from market competition with MNEs through the managerial discipline of local companies and other channels. Therefore, here, we refer to the negative effects of market competition in net terms. As presented in the Introduction, in former socialist economies, market competition with foreign companies tends to bear heavily on domestic counterparts. Hungary is not an exception. Thus, in Figure 2, we assume that competition with MNEs has a net negative effect on the productivity of domestic firms. 21In some cases, such as Models [21] through [24] in panel (b) of Table 5, insignificant estimation results can be obtained if the horizontal effects are dissolved for each enterprise layer. Thus, it would be desirable to estimate conventional models as well and compare the results with the estimation results of nested variable models. 22In particular, the estimation results when added-value is used to compute productivity or the market presence of horizontal FDI are entirely different from other results. This may relate to the transfer pricing operation by MNEs with the aim of reducing the tax burden. The strong influence of this factor possibly leads to over- or underestimation of the activity level of foreign companies based on added-value, and this type of measurement error may result in biased estimations.

It is not necessary for domestic firms to treat all foreign companies that come under the same category of industrial classification in a homogeneous fashion. In fact, local company managers are looking at the structure of their industries in a more multi-layered manner and paying strong attention to how close or far their firms are to and from foreign counterparts in the context of industrialtechnological proximity. This is our conviction, acquired through several field surveys, and it provides the basic concept for this study.

Based on the above notion, in this paper we made several contributions into the study of the spillover effects of inward FDI both from methodological and empirical aspects.

First, previous empirical works have given significant attention to the differences between horizontal and vertical FDI, whereas they have not given sufficient consideration to the internal structure of horizontal FDI itself. In this paper, a newempirical framework is presented by looking at themulti-layered structure of industrial classifications arising from the sectoral differences among firms. The essence is that the market presence of horizontal FDI, which has been traditionally treated using a single variable, is expressed as multiple variables with the nested structure corresponding to the depth of industrial classification in order to identify the horizontal spillover effects on domestic firms by the enterprise layer illustrated in Figure 1. As explained in Section 5, our empirical methodology is simple and can be used for a wide range of applications.

Second, we estimated the new empirical model using large-scale panel data of Hungarian manufacturing and service firms for the early 2000s and succeeded in detecting FDI horizontal effects that could not be captured with the conventional model. The estimation results of the nested variable model proposed in this paper strongly suggest that foreign firms in Hungary have statistically significant spillover effects on production scale and labor productivity as well as total factor productivity of domestic firms in the same industry, but their direction and degree differ greatly between individual enterprise layers. It is impossible for the single spillover variable, which is aggregated at a certain industrial classification level, to capture such complex effects of horizontal FDI.23 Furthermore, based on the estimation results of the new empirical model, we found the non-linear correlation between the industrial-technological proximity between a domestic firm and MNEs and the spillover effects of horizontal FDI in the Hungarian manufacturing sector and discussed a possible form of its function. In this sense, our paper sheds light on a blind spot in the empirical study regarding the external effects of horizontal FDI and proposes a solution to overcome this problem.

And thirdly, this paper presents the following suggestive empirical results: (a) FDI productivity spillover effects are generated in patterns that are completely different in different industries, that is, the manufacturing and service industries, even during the same period in the same country. (b) FDI exhibits different spillover effects on different productivity indicators. (c) The estimation of productivity spillover effects is sensitive to the selection of business scale indices as the basis for calculating the market presence of FDI. We conclude, on the basis of the above empirical results, that the transfer of technology and knowledge from MNEs to domestic firms in a recipient country occurs on the basis of a very complex economic mechanism. Therefore, careful attention should be given to the selection of variables and the model specifications so that they fit well into the scope of a micro-economic empirical examination of FDI spillover effects.

23As in almost all preceding studies, which divide FDI into the horizontal type and the vertical type by simply using the industry classification code, the empirical analysis in this paper cannot strictly distinguish between the spillover effects of the two types of FDI either. Reconsideration of the empirical strategy is a topic reserved for future research.