There has been some literature that stresses economic policy formation through lobbying and elections. Baron (1994) lets campaign contributions influence the electoral outcome, given the candidates’ platforms. He distinguishes between informed and uninformed voters, assuming that the latter can be influenced by campaign spending. Grossman and Helpman (1996) apply Baron’s model to trade policy formation in which each party is induced to behave as if it were maximizing a weighted sum of the aggregate welfares of informed voters and members of special interests. Bennedsen (2003) extends and simplifies the earlier work by Baron (1994) and Grossman and Helpman (1996). Besley and Coate (2001) study lobbying and elections in a citizen-candidate model. Riezman and Wilson (1997) study the welfare effects of partial restrictions on political competition in a model in which two candidates receive campaigncontributions from import-competing industries in return for tariff protection. Austen-Smith (1987) has an early contribution on the interaction between lobbying and elections. Persson and Tabellini (2000) analyze the provision of public goods using a variant on the model in Bennedsen (2003).

Since most of the papers deal with government spending, the analysis of the equilibrium trade policy through lobbying and elections is rare. Furthermore, this paper is different from the work by Grossman and Helpman (1996), which focuses on the overall effectiveness of campaign contributions when some voters are fully informed and uninfluenced by campaign contributions and other voters are uninformed about economic policy platforms and respond exclusively to campaign contributions. The purpose of this paper is to consider the equilibrium trade policy through lobbying and elections in a small open economy which has a fixed factor of production. Specifically, we consider the economy in which the economic rents exist in the long run because of a fixed factor of production and each interest group has a different share of a specific factor which is used in producing a good. The reason why we assume a fixed factor of production and different share of the factor is the introduction of different economic interests among the interest groups. In fact, the basic model is the simplified version of Grossman and Helpman’s (2005) model, which has three distinct goods and a numeraire good. We build the model of one good because we want to focus on trade policy formation through lobbying and elections. We then examine the equilibrium trade policy in a probabilistic voting model, using Persson and Tabellini’s (2000) approach. We employ the assumption of a small open economy because it is the basis used to analyze equilibrium trade policies and can be easily extended to a large open economy. Also, unlike the previous models by Baron (1994) and Grossman and Helpman (1996), our model assumes that all voters can be influenced by campaign spending.

We have several findings. First, there are no lobbying activities in a probabilistic voting model when both parties announce the same trade policy before elections. Therefore, there is no campaign spending. Second, if all groups are of the same size and organized, or no groups are organized, the equilibrium trade policy is free trade. Third, the different group size and whether or not the group is organized makes the equilibrium trade policy different from free trade when the number of swing voters is the same in each group.

The organization of the paper is as follows. In the next section, we develop the model and set up a small open economy which has a fixed factor of production. We then introduce the indirect utility of an individual in the economy. In section Ⅲ, we derive the preferred policy of an individual in the economy and formulate the utilitarian benchmark to compare it with the equilibrium trade policy in the probabilistic voting model with lobbying in the following section. In section Ⅳ, we introduce the probabilistic voting model with lobbying, derive the equilibrium trade policy in that model and then compare it with the utilitarian benchmark. Section Ⅴ offers our conclusions.

Consider a small open economy populated by a large number of citizens, where the size of the population is

where

To make the arguments more clear, we adopt linear forms for the supply and demand functions. The supply function is given by

where

where

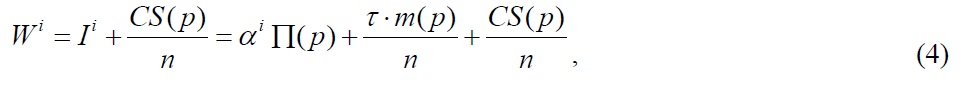

Let individual

where

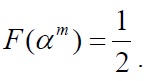

Finally, the median value of

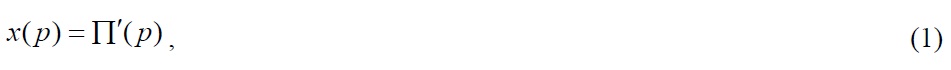

1Varian (2003) describes economic rent as those payments to a factor of production that are in excess of the minimum payment necessary to have that factor supplied. One of the examples he suggests is oil. The reason why oil sells for more than its cost of production and firms don’t enter this industry is the limited supply. Since only a certain amount of oil is available, there are a fixed number of firms in the market though they try to enter. 2The number of firms in the industry is fixed because there is a factor of production that is available in fixed supply. In this case, the equilibrium rent in competitive market will be whatever it takes to drive profits to zero; pe xe - z (xe) -∏ = 0 or ∏(pe ) = peㆍ x (pe) - z (x ( pe )) , where z is the variable cost of producing the good and the e superscript represents the equilibrium levels. Furthermore, ∏’( pe ) = x ( pe ) + peㆍ x’( pe ) - z’(x ( pe ))ㆍ x’( pe ) = x (pe) + ( pe - z’(x ( pe )))ㆍ x’( pe ) = x ( pe ) , since pe = z’(x ( pe )) in competitive market. Grossman and Helpman (2005) use this kind of setup with four goods, a numeraire good and three distinct goods. 3If τ > 0 , we call it an import tariff; if τ < 0 , we call it an import subsidy. 4Since rises as γ increases in both cases of p - p* > 0 and p - p* < 0 . 5Since rises as β increases in the case of p - p* > 0 and rises as β increases in the case of p - p* < 0 . 6policymaker sets τ , taking into account the market-determined value of p and some further constraints, such as a balanced government budget constraint or a resource constraint. Typically, the constraints will be binding; that is, the market outcomes depend on policy variables and parameters.

Ⅲ. Individual’s Preferred Policy and Utilitarian Benchmark

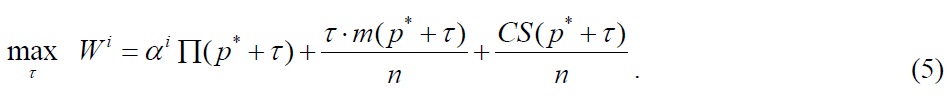

In this section, we compute individual

Individual

Using expression (5), it is straightforward to obtain the first-order condition, which becomes his preferred policy or his bliss point by Assumption 1 below (see Appendix A);

Assumption 1

This implies that everyone’s demand responds to the change in

is positive. It means that in dividual

likes an import tariff. On the other hand, if

is negative. It means that individual

likes an import subsidy. If, of course, individual

prefers free trade.

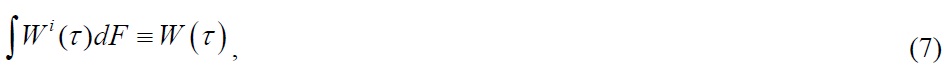

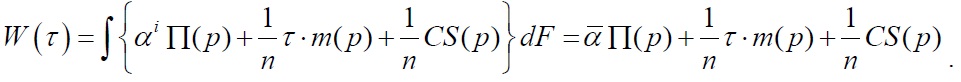

Next, let us formulate a normative benchmark to compare it to the trade policy level in the voting equilibrium. Consider a utilitarian social welfare function that simply integrates over the welfare of all individual citizens:

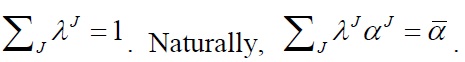

where the last term is the utility of the individual with the average share of the specific factor. This equality follows from the definition of

Namely,

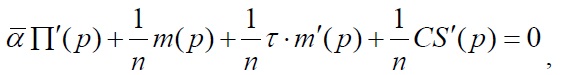

The first order condition is

which gives

where the

7

Ⅳ. Probabilistic Voting Model with Lobbying

In this section, we introduce the probabilistic voting model encompassing campaign contributions by interest groups, adapting a formulation suggested by Baron (1994).8 We postulate two candidates or parties indexed by

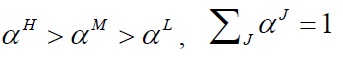

We assume that the population consists of three distinct groups,

and everyone in group

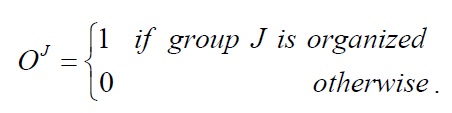

We assume that groups may or may not be organized in a lobby; the indicator variable

Organized groups have the capacity to contribute to the campaign of either of the two candidates: let

At the time of elections, voters base their voting decisions both on eco-nomic policy announcements and on the two candidates’ ideologies. Specifically, voter

where

We also assume that candidates exploit the contributions in their campaign and that campaign spending affects their popularity. Specifically, the average relative popularity of party

where

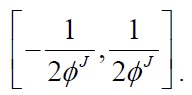

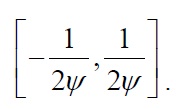

is distributed uniformly on

According to the second term, a candidate who outspends the other becomes more popular, where the parameter h measures the effectiveness of campaign spending.

The timing of events is as follows. At stage one, the two candidates, simultaneously and noncooperatively, announce their electoral platforms:

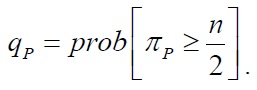

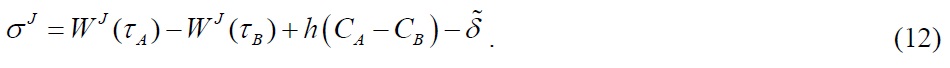

To formally study the candidates’ decisions at stage two, let us identify the swing voter in group

All voters

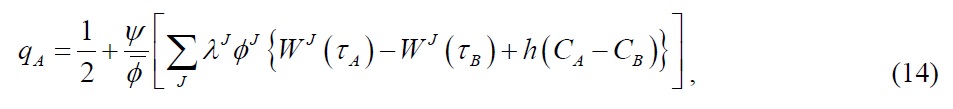

Specifically, candidate A’s probability of winning, given (12), becomes

where

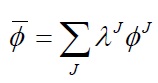

is the average density across groups (see Appendix B).

Assumption 2

This implies that all groups have the same density,

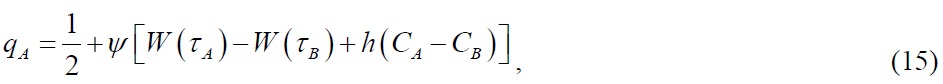

where

is the utilitarian social welfare function (see Appendix B). The last term reflects how campaign spending has an influence on the expected vote share.

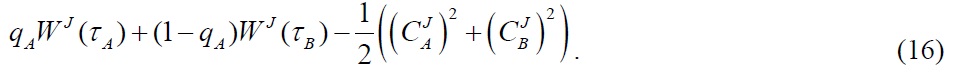

Consider how lobbies choose their campaign contributions at stage two. If organized, group

The first two terms in the expression are the expected utility group

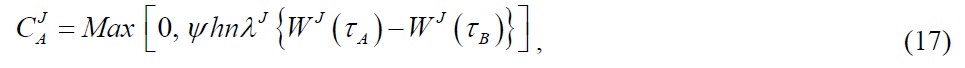

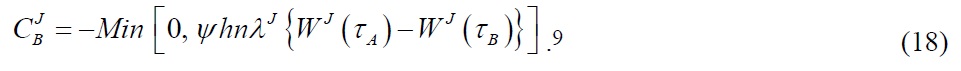

Maximization of (16) with respect to

Thus each group contributes only to the candidate whose platform gives the group the highest utility, and does not campaign at all if the two parties announce the same platforms.

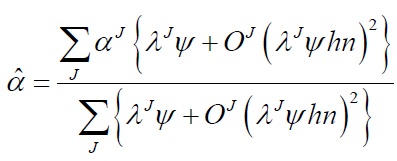

We now return to the candidates and their optimal platform choice at stage one. When making this choice, the candidates anticipate that organized groups will make contributions according to (17) and (18). But the symmetry of (17) and (18) preserves the symmetry of the two candidates’ problems. Thus, they converge on the same equilibrium policy. To characterize this policy, we substitute (17) and (18) into (15) and simplify. Candidate

By the same logic, party

However, out of equilibrium, they do spend on the party that pleases them most, and this induces both parties to tilt trade policy in their favor. To see when only a subset of the groups is organized, we take the first-order condition of (19) with respect to

where

and the

Proposition 1 can be explained as follows. The intuition that the equilibrium is socially optimal when all groups are organized is that the groups are all prepared to contribute in proportion to the marginal benefits and costs of

Except in the conditions specified in Proposition 1, the organized groups receive greater weights and the equilibrium is tilted in their favor. Furthermore, even though the number of swing voters is the same in each group, the group size (

implying an import tariff that is in the equilibrium. For the given

implying an import subsidy that is in the equilibrium.

Proposition 2 can be explained as follows. If the group with the high share of the specific factor has the largest size and is organized, it has the highest stake in the policy. Thus, both candidates announce a platform with a trade policy which is favorable to them.

8Yang (2008) examines the voting and elections without lobbying. 9The first-order condition of the lobby J with respect to CJA is The first-order condition of the lobby J with respect to CJB is 10Note that big groups are favored if they are organized. The reason is that the marginal cost of lobbying is increasing, and lobbying is a public good for the group. Big groups can spread the same amount of contributions over more members, who thus face a smaller marginal cost and are willing to lobby more.

We have considered the equilibrium trade policy through lobbying and elections in a small open economy which has a fixed factor of production. Rents exist in this economy because the factor of production has a fixed supply even in the long run. Individuals have different endowments of the factor of production and rents from each individual’s share of the factor are a part of his income.

We have shown that there are no lobbying activities in the probabilistic voting model when both parties announce the same trade policy before elections. In the game specified in the model, neither group has an incentive to lobby the candidates when they announce the same trade policy before elections. We have also found that if all groups are of the same size and are organized, or no groups are organized, the equilibrium trade policy is free trade. Since the groups contribute in proportion to the marginal benefits and costs of trade policy for their members, the candidates internalize all groups with the appropriate social weight. Finally, we have found that even though the number of swing voters is the same in each group, the different group sizes and whether or not the group is organized can make the equilibrium trade policy an import tariff or an import subsidy.

A further extension of this paper is a model that considers different inter actions between two different types of political activities, such as elections and legislative bargaining, lobbying and legislative bargaining.11 It will be interesting to see how the equilibrium trade policy changes as we introduce different interactions in political activity. By introducing those, we can gain a better understanding of how the policy is formed in different economic circumstances.

11Yang (2010) analyzes the legislative bargaining over trade policy without lobbying after elections.