The Korean government has supported informatization1 among all industries and has encouraged the establishment of an industrial structure focused on knowledge and information, in its goal to achieve the “knowledge industry of the 21st century”. It also promoted various projects based on the fundamental principles of supporting basic informatization, strengthening and expanding e-commerce, providing one-stop service for industrial information, and connecting different sectors and industries according to the development of informatization and e-business (Ministry of Commerce, Industry and Energy, 2006; KIEC, 2007). For the gradual digitalization of its domestic economy, the Korean government declared 5 core policies to develop e-commerce as the basis of industry and trade, and to increase its importance in all industries. Based on these policies, the B2B Network construction project was commenced to achieve the objectives to enhance creditability of the e-Marketplace, to establish infrastructures, to promote e-commerce in industries and to establish fundamentals of cyber trade (Ministry of Commerce, Industry and Energy, 2006; KIEC, 2007). In order to sustain continuous growth of the IT industry, the growth driver should be obtained elsewhere, such as from the manufacturing, service and trade industries. Moreover, the IT industry should be fully utilized to resolve soaring fuel prices, a fast aging population, and other socio-economic problems (Ministry of Knowledge Economy, 2008).

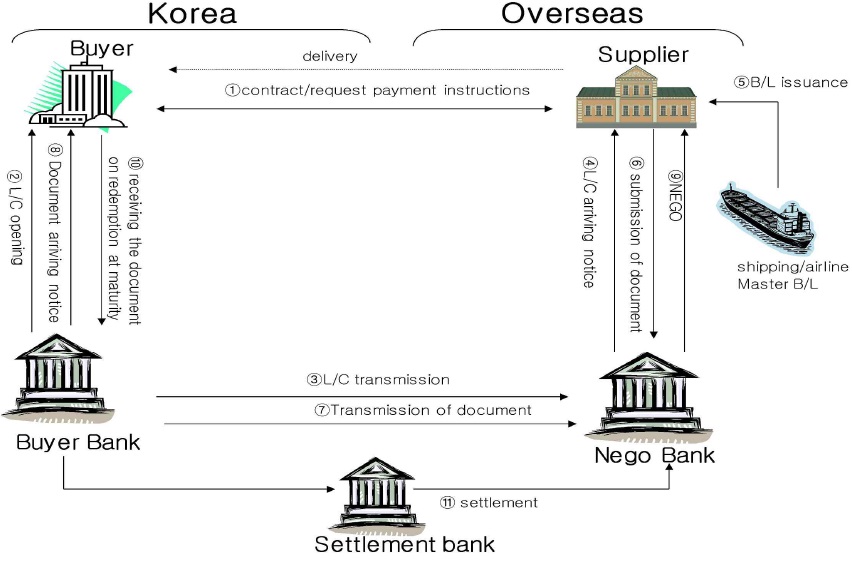

international trade transactions still pursue the traditional style, which involves intensive labor and documentation, and calls for the need to improve efficiency and speed. Verification of supporting documents of L/C (Letter of Credit), which currently plays an important role as a payment method, shows an inaccuracy rate of over 70 percent. This gave rise to the argument that electronization2 and automatization of supporting documents for trade resolves the practical problems of costly and time-taking procedures used to correct and clear the inaccuracies [Im, S. B. and Mun, H. C (2007); Heo, J. W. and Heo, H (2007); Yu, G. H (2007)].

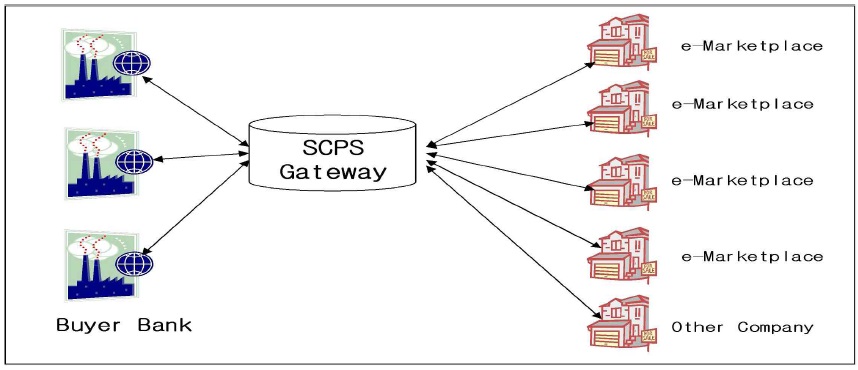

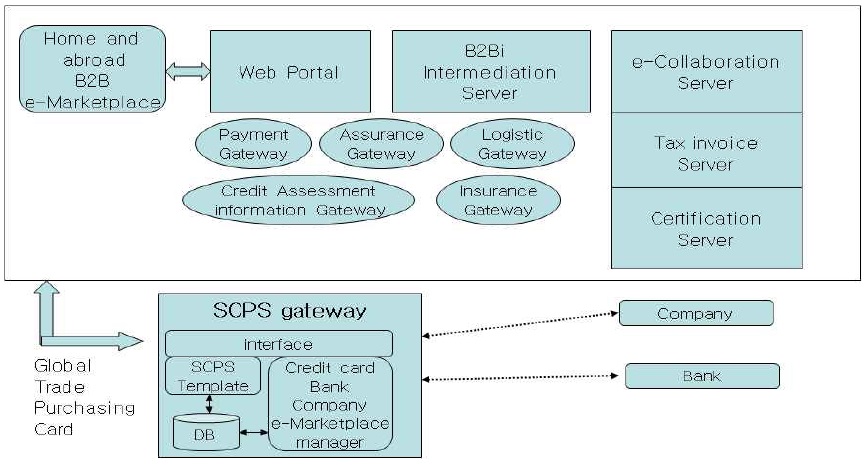

objective of electronic trade payment is to derive voluntary participation of market players in the trade industry by establishing the SCPS (Supply Chain Payment System) gateway as the hub of electronic trade payments. Considering its role as a gateway between banks and consumers, this will enable standardization of payments and also support various financial services for future expansion of the market. Although SCPS is installed in banks to provide various advantages as electronic trade payment methods, it possesses overlapping investments and limitations in the increase of usage, which calls on the need for the SCPS gateway hub system to integrate the market participants. Therefore, it is necessary to find a more convenient and efficient global purchasing system than the L/C and T/T, which have been predominantly used. The SCPS platform is suggested in order to minimize such inconveniences.

1Informatization refers to the process of making various kinds of documents or information scattered around useful for oneself. In short, it means to gather information using information and telecommunications technology including computers, express individual information in a useful way, and utilize the information after analyzing it. 2The process of making something electric consists of converting paper documents into electronic forms. Then, the storage, modification, and deletion of the electronic documents are done in a systemic way through authentication.

1. Comparison with the existing payment system

In order to complete trade in the electronic trade industry, the development of a reliable and stable global payment system is required. There are three theoretical approaches to the global payment system being visualized.

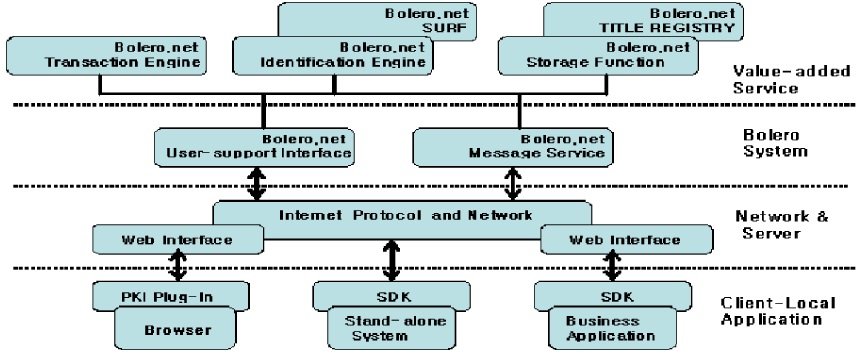

The first approach is a practical method of maintaining all the procedures and only replacing a paper document with the electronic document. A typical example is BOLERO. BOLERO originated from the BOLERO project which started as a consortium of a marine transportation company, bank, and communication companies of Hong Kong, Netherlands, Sweden, UK and USA in June 1994. It is led by the SWIFT and TT clubs. Through BOLERO, the association established by the collaboration of those companies, aims to provide world-wide commercial services by way of electronic documents.

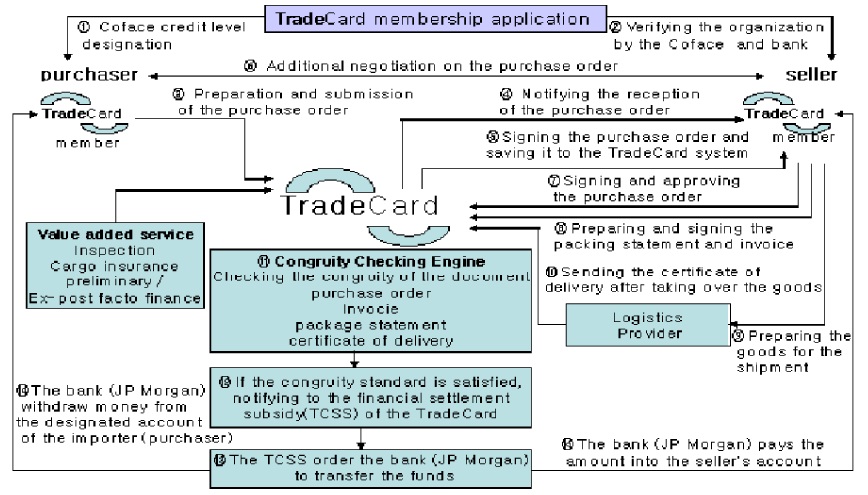

The second method consists of a functional approach to change the system in a way to produce maximum work efficiency, and also omit unnecessary or overlapping procedures caused by the use of computers. TradeCard, which is promoted by WTCA (World Trade Centers Association), GEIS and some companies in the USA, is one example. In this method, the traditional L/C is replaced by the electronic transmission of export and import documents, and electronic payment systems [Bae, J. H (2003); Shim, S. R. and Jang, K. J (2006)].

Lastly, the trade payment method is a comprehensive approach to providing a one-stop service including the party verification, trade mediation, trade information supply and trade document forwarding, etc. A typical example is the ABN/Amro service which uses the solutions of Identrus or BeXcom, both led by blue chip banks throughout the world. There are other examples too. Domestic and foreign large companies have adopted the electronic method for payment systems in cooperation with trade automation companies and banks.

However, contrary to expectations, most of the electronic payment systems remain at a test operation phase and do not sit in the complete settlement stage. There are some reasons as to why development in the trade payment sector is lagging behind. One of the crucial problems of the trade payment system is the participation of many players with different applicable laws and regulations. In addition, there are some other obstacles that make it difficult to implement payments of large amounts, such as high costs for the system, the absence of risk hedge methods, and a lack of problem solving methods in case certain problems arise, etc.

In the case of BOLERO, it is limited to the electronic transaction of the existing L/C and collection transaction. IdenTrust, which started a bit later, similarly carries out the existing functions of L/C and the collection method, but contains the added function of coping with problems that are caused by the electronic transactions. However, it remains at a stage of commercialization by a number of financial institutions (Kang, 2000).

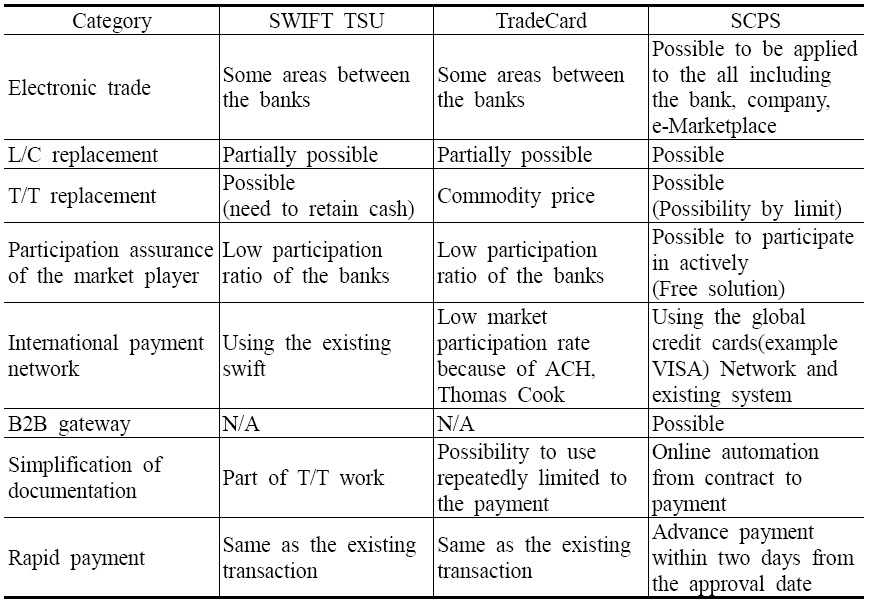

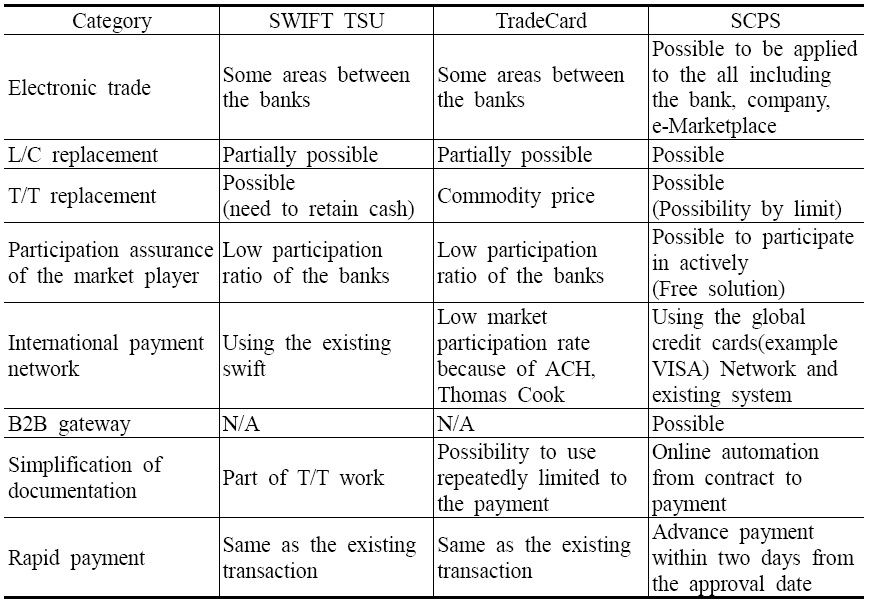

Previously, attempts to introduce international electronic trade payment methods were not successfully accepted in the market, and there are currently no electronic trade payment methods dealing with e-commerce in development. Even Alibaba.com, the largest B2B e-Marketplace in the world, fails to provide one-stop total service from the inception of the transaction until the payment because it does not have online payment functions through electronic contracts (only through catalog systems). The table below illustrates some functions of TradeCard and SWIFT TSU used abroad as electronic trade payment methods and compares them with those of the SCPS proposed by this study (Kang, 2000; Choi, 2003; Jung & Hwang, 2003).

Currently there are no electronic trade payment methods used in South Korea, but the online processing of documentation such as e-L/C is under progress. Since no electronic trade payment methods are available for B2B e-Marketplace, membership payment and sample transactions are often completed using regular credit cards despite the high charges. Although a website operated by KOTRA, Buykorea.org, offers KOPS (KOTRA Online Payment Service), it may not be considered an electronic trade payment method because the domestic exporter has to pay 2.5% of the transaction amount as commission, and the importer may not fix the maturity date.

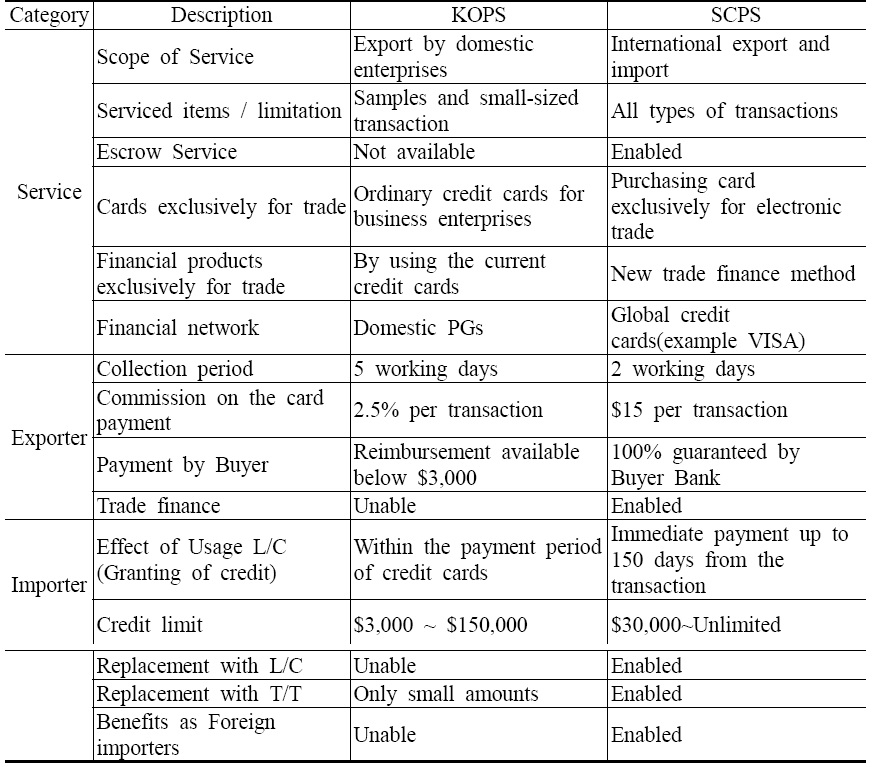

[Table 1] Comparison with other international payment systems

Comparison with other international payment systems

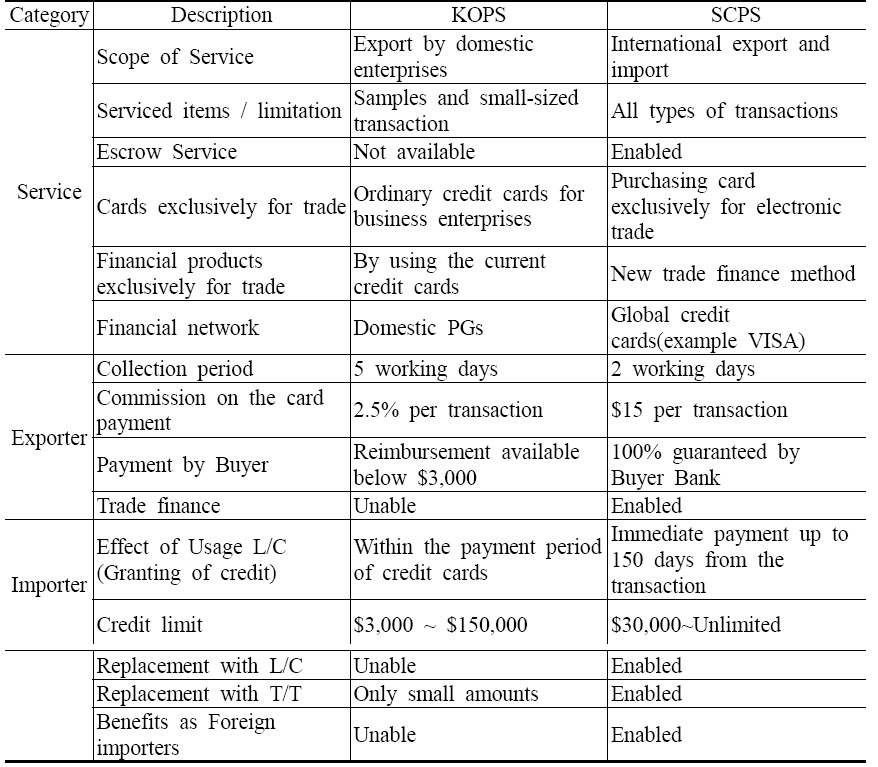

[Table 2] Comparison between KOPS and SCPS

Comparison between KOPS and SCPS

In the case of Ecplaza.com, high commission charges and impracticability raised needs for the new payment method even though it already operates sample transactions and online membership payments through Paypal. Some of the B2B e-Marketplaces are expanding their business scope to utilize cyber trade agency businesses over the nearly saturated domestic market where competition becomes more and more competitive. e-Sang Networks, a representative B2B e-Marketplace member of the steel market, sells co-purchased imported raw materials. Considering the currently described market situation, the establishment of the SCPS gateway, which will realize the electronic trade payment, will open a new paradigm and bring new profit channels and efficiencies to importers, exporters, banks and B2B e-Marketplaces.

2. Background of B2B Marketplace in Korea

B2B e-commerce in Korea has developed in line with the activation of purchase fund loans through electronic guarantees. Although many agencies of e-commerce have existed before, current market players are guaranteed e-Marketplaces. The electronic guarantee started by the Korea Credit Guarantee Fund (KCGF), had a low default rate which was caused by the transparency of transactions, increasing demands, and market expansion. Soon after it was first introduced, the Korea Technology Credit Guarantee Fund and Seoul Guarantee Insurance entered into the market and established their own respective gateways. Subsequently, banks also started to offer purchase fund loans based on electronic guarantees. In the early stages, e-Marketplaces with low management competency and price competitiveness had difficulties in the introductory market.

However, electronic financing services have become a key point in electronic transactions between enterprises, illustrating the inverse phenomenon of enterprises utilizing the e-Marketplace in order to enjoy the advantages of electronic finance, which is often observed in the market (Kim, 2001; Jeong, 2009).

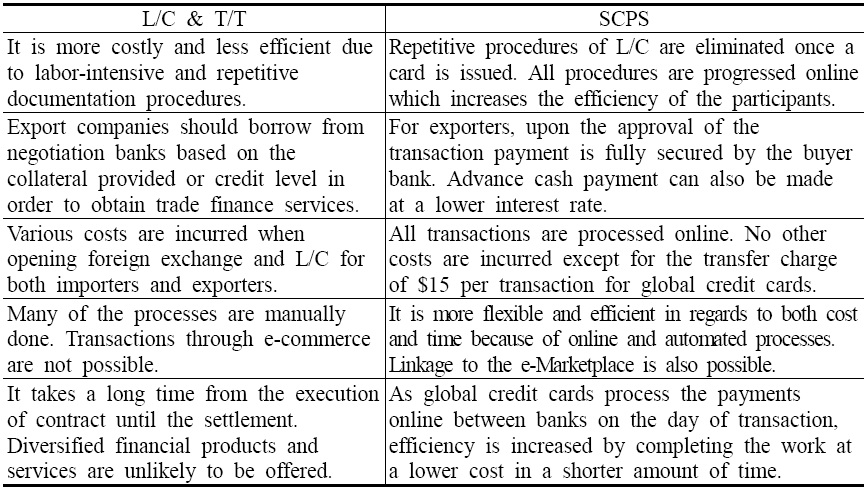

The most frequently used trade payment methods, namely L/C (Letter of Credit) and T/T(Telegraphic Transfer), have disadvantages of being costly and are inefficient due to labor-intensive labor documentation and repetitive complex procedures. Although some alternatives to make these procedures more efficient through the use of e-L/C based on XML electronic documentation were proposed to overcome the limitations, they failed to integrate the practical issues of trade payments. Moreover, the alternatives did not provide electronic trade payment solutions related to the actual B2B e-Marketplace or the services needed by enterprises. Nor did they successfully eliminate the repetitive procedures, as they are merely the same ones that L/C offered online to replace the existing off-line procedures. The U-trade hub recently launched by Korea International Trade Association (KITA) is an online service for only a part of the actual offline transactions with electronized L/C and e-negotiation functions. It does not enable alliances with e-business service providers or offer diversified financial products (Kim, & Lee, 2003).

Even if there were many global B2B e-Marketplaces in the industry, the lack of payment methods for electronic trade would pose obstacles for the facilitation of these e-Marketplaces. For example, Alibaba.com, the largest B2B e-Marketplace in the world, and ecplaza.com, the largest in Korea, have online payment functions only through catalog systems and not through electronic contracts. In particular, the important role that a gateway based on electronic guarantee has in the market shows that practical financial services that are both convenient and beneficial for enterprises are essential for the success of e-commerce. To successfully establish the fundamentals for electronic trade, realistic payment methods and payment system gateways should be provided to support the enterprises and e-Marketplaces along with the existing XML services of the Korea Customs Service and RosettaNet Services.

International electronic trade payment systems TradeCard, Bolero Surf and IdenTrust were introduced as basic platforms of electronic trade used to facilitate B2B e-commerce (Bae, 2003). However, these payment methods were refused in the market because they required a great deal of investment, and non-market players such as Thomas Cook established separate networks. As Thomas Cook is an issuer of traveler's checks (not a credit card company), this limitation was anticipated from the beginning. Furthermore, many questions were raised regarding the profitability compared to the investments.

Ⅲ. Architecture and Contents of SCPS (Supply Chain Payment System)

SCPS is a new B2B payment method that is intended to be used in international B2B transactions. It is based on the concept of the purchasing card which is already well established in the market. Its purpose is to provide the best solution for the various demands in the market. The establishment of sthe SCPS Gateway will support the actual transactions in the global purchasing card system through connecting systems, forming a new business model, and proposing alternatives of system operations and model expansions.

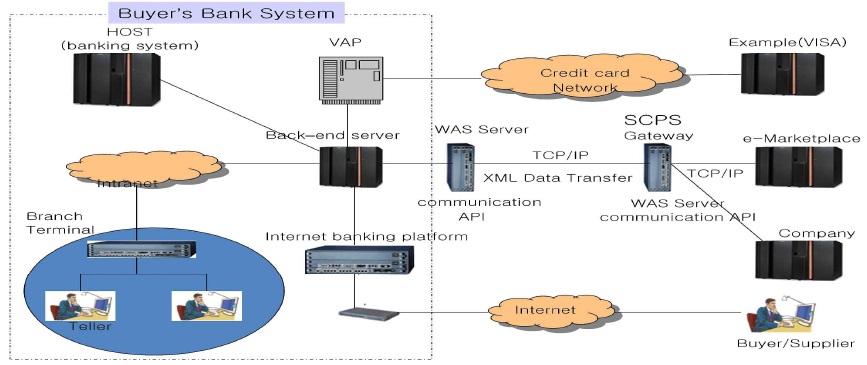

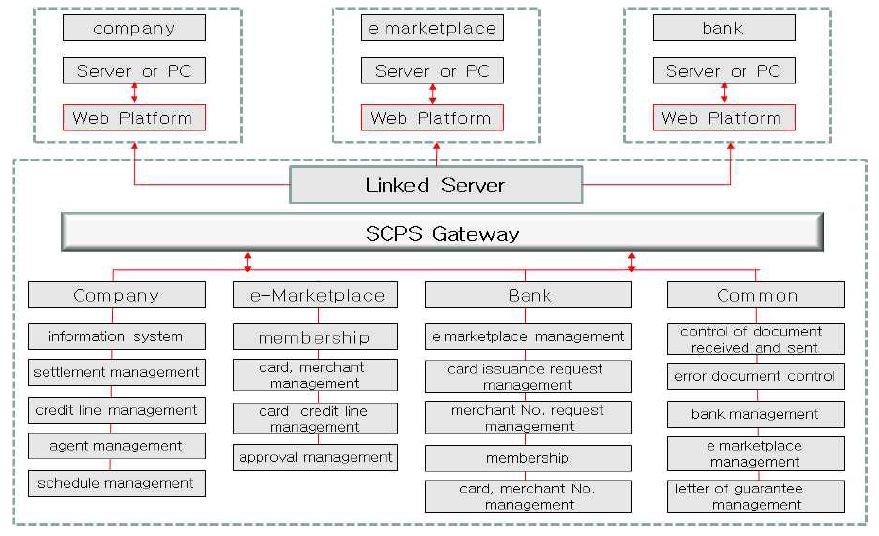

The intention of the project to support the SCPS Gateway is to develop a mutual interface for the enterprises that install the system and provide XML communication appropriate for financial institutions and global credit cards by fully utilizing the existing platform. The overall structure according to the system connection amongst importers/exporters, e-Marketplaces and banks are provided below. Furthermore, strategic usage and expansion in the future is proposed by establishing the SCPS Gateway in various platforms to enable the market participants to use the global purchasing card system.

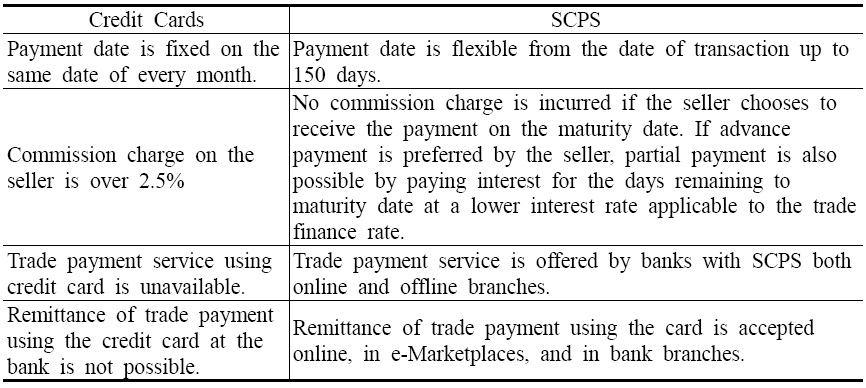

Global credit cards (e.g. VISA), with approximately 22,000 banks as members all over the world, provide credit card systems and standardized work processes, and support payment procedures by processing payment between banks on the day of transaction through its network over VAP (global credit cards Access Point). While SWIFT involves numerous on-hand processing because it only sends notices for payment and leaves the related banks to verify and confirm, while global credit cards automatically process the payments between members around the world at a higher efficiency and lower cost. Global credit cards are part of major credit card companies, and possess the largest market share in the world, as well as in Korea with 80%. There have been numerous attempts to enter the B2B market, especially the trade payment market as most of the business is B2B business, but due to market conditions and unverified solutions each attempt was discontinued. To provide solutions to the issues faced, the differences between the current credit card system and SCPS are compared and explained as follows.

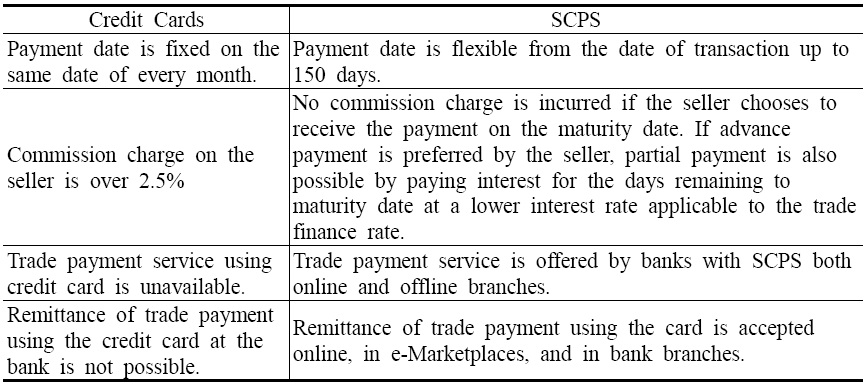

[Table 3] Differences between the current Credit Card and SCPS

Differences between the current Credit Card and SCPS

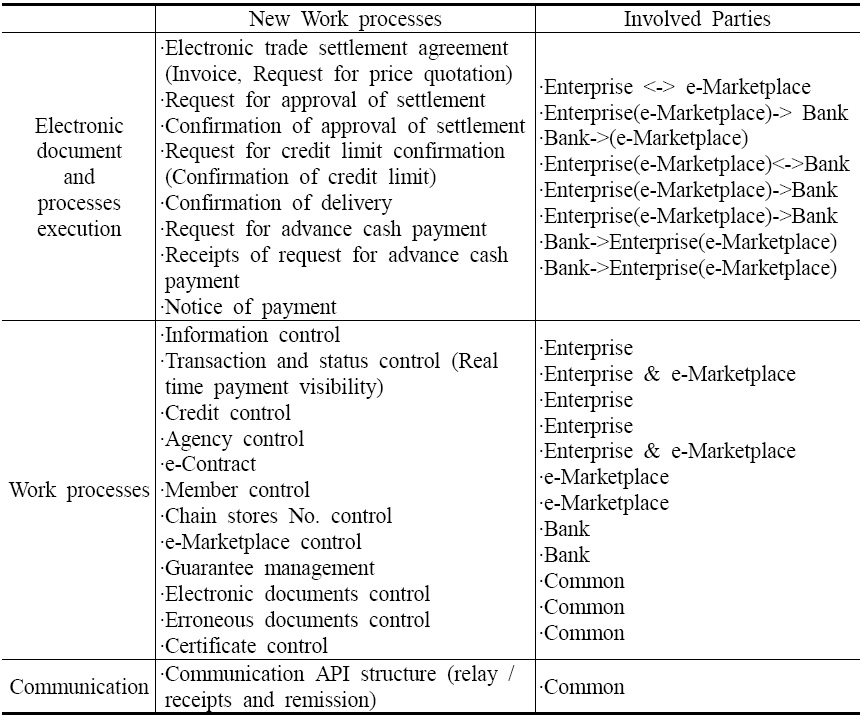

Some SCPS processes and new work processes are to be installed in the related platforms such as web portals, B2Bi in Korea, and in other countries, as a basis to provide comprehensive support and induce participation of related companies for the enterprises, financial institutions and e-Marketplaces who wish to participate in e-cooperative services for electronic trade payments. By connecting the global B2B e-Marketplace EC Plaza and the SCPS installed in financial institutions, a gateway will be constructed to enable electronic trade payment. The system structure and work process is illustrated below.

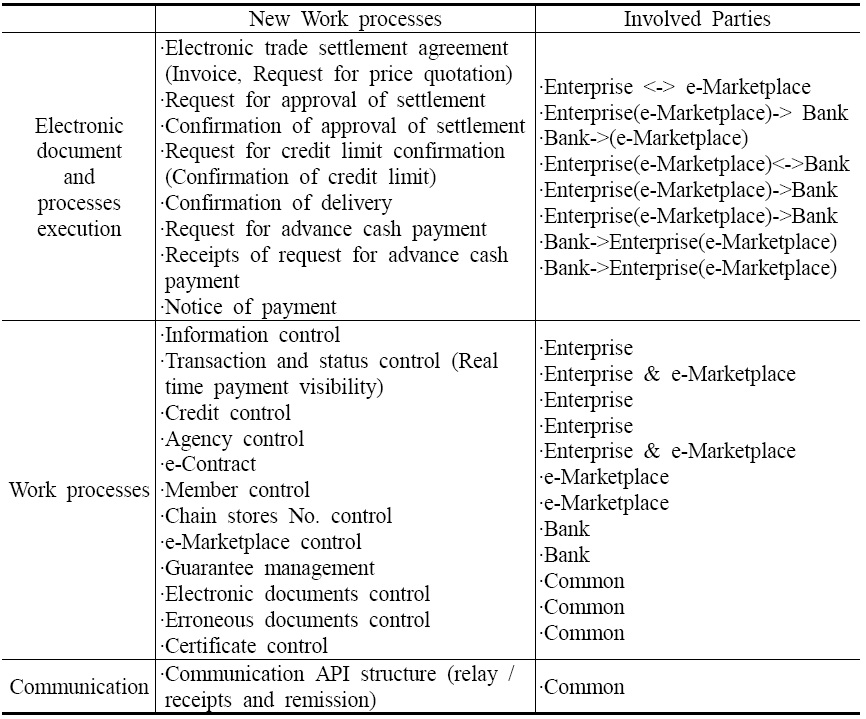

[Table 4] Global gateway development and link business

Global gateway development and link business

The project aims to perform real-time transactions related to SCPS through structuring of the functions of the related parties and realizing interface and communication API (Application Programming Interface). It also aspires to receive and transfer electronic documents. For this to be successful, the communication among banks, e-Marketplace, and enterprises is critical. Considering the characteristics of gateway, structuring the API communication module based on PKI (Public Key Infrastructure) for security purposes is also imperative.

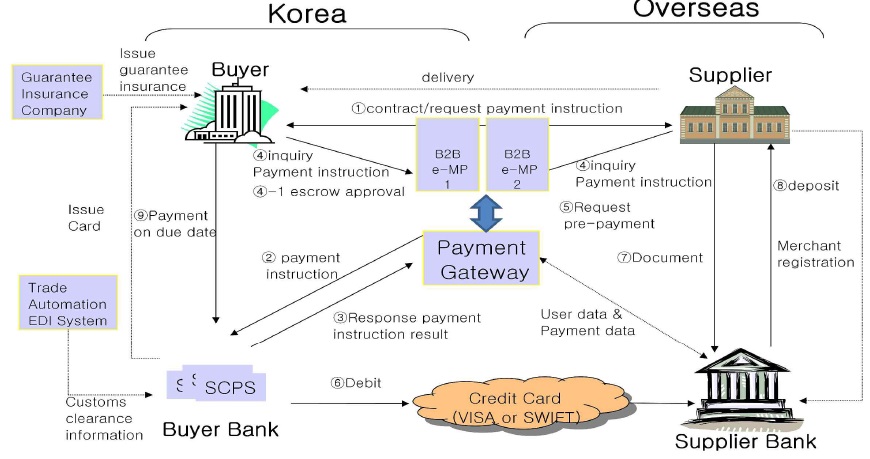

A flow chart of the general work process used to introduce the global purchasing card system for the promotion of a global e-Marketplace between the suppliers and buyers is provided below. Buyer receives trade settlement cards issued by a bank with SCPS. Supplier registers with a supplier bank which is in alliance with global credit card companies.

Basically, SCPS is necessary for buyer banks because the cards are issued to the buyers, and the obligation and responsibility to pay the transaction proceeds to the supplier which are imposed upon the buyer bank after the buyer's request for approval. All financial services for providing trade payment are focused on the buyer bank while the supplier bank takes a role as receiving the payment. Therefore, in the introductory stage, SCPS may be installed in Korean banks where electronic finance applications are more advanced. International transactions can be made possible by establishing SCPS in banks of other countries.

3. Characteristics of the SCPS

Through the SCPS gateway, enterprises and e-Marketplaces can utilize the electronic trade settlement method, which is based on the purchase card, in their relationships with banks that already have SCPS installed. SCPS is a model of a purchase card system used in electronic commerce and expanded for trade in alliance with global credit cards (e.g. VISA) and the global purchasing card system, which facilitates understanding and utilization of the market participants and provides various financial services.

Credit cards have certain limitations that are generally accepted in the trade transactions between enterprises, despite the fact that they are internationally standardized and easily used, because they are based on B2B transactions with fixed maturity dates and high commissions. To use credit cards as an international electronic trade payment method, it is required to electronically process all documents between banks of different countries through electronic trade and to acquire the participation of global credit card companies that have already established networks amongst the banks globally. SCPS is a solution that can be installed in a bank to enable international trade payments through the network of global credit cards (e.g. VISA) including services of electronic documents for B2B, online banking, and linkage with the mainframe. It also provides new functions such as flexible maturity dates at the disposition of the enterprise, low interest rates, low banks charges compared to T/T transfers, and advance cash payments when required by the supplier. Since the process of the global credit cards network is already internationally standardized, when SCPS is installed in a bank and linked with the credit card account system, electronic trade payment services can be readily offered.

As a new electronic payment solution based on the purchase card, SCPS is the expanded format of the advanced purchase card solution in Korea. All documentation procedures can be done online because it has eliminated the inconvenience of opening L/C and payment of bank charges once a card is issued, and provides direct trade payment methods in line with e-Marketplaces. There is no separate offline process required for participating banks because with the global credit cards network, the settlement can be processed on the day requested. All transactions can be settled successfully within two working days. In addition, the SCPS gateway provides real-time payment visibility to show market participants the current status of the transaction for all phases of transactions.

The SCPS gateway does not just provide existing settlement services online, but also offers a new trade payment method. As a result, banks are able to secure a new profit channel and enterprises can reduce expenses and improve efficiency and liquidity, while e-Marketplaces may maximize profits through the expansion of their roles as online trade agencies all over the world. The goal of the SCPS Gateway is to connect enterprises, e-Marketplaces, and banks and to provide them with transaction and trade payment functions through electronic documents so that they can develop into a total trading hub for cyber trade.

The advantages of SCPS are as follows:

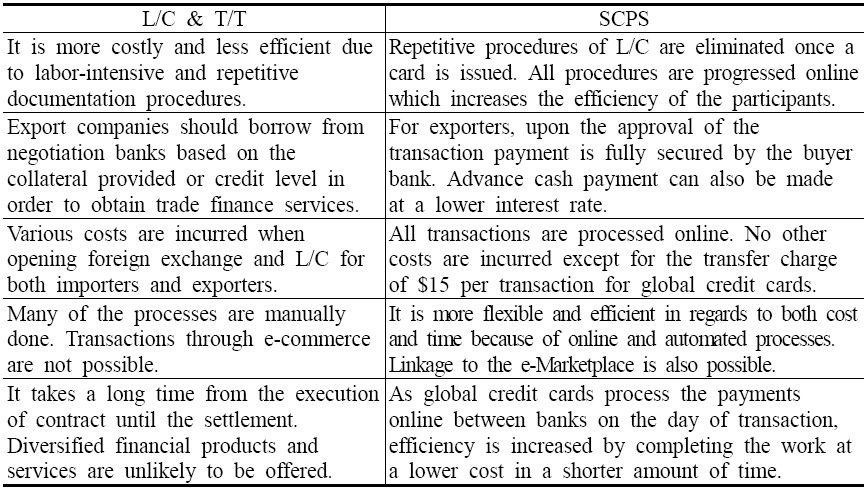

[Table 5] Strengths of SCPS compared to the current L/C and T/T

Strengths of SCPS compared to the current L/C and T/T

Ⅳ. Structure of work system database

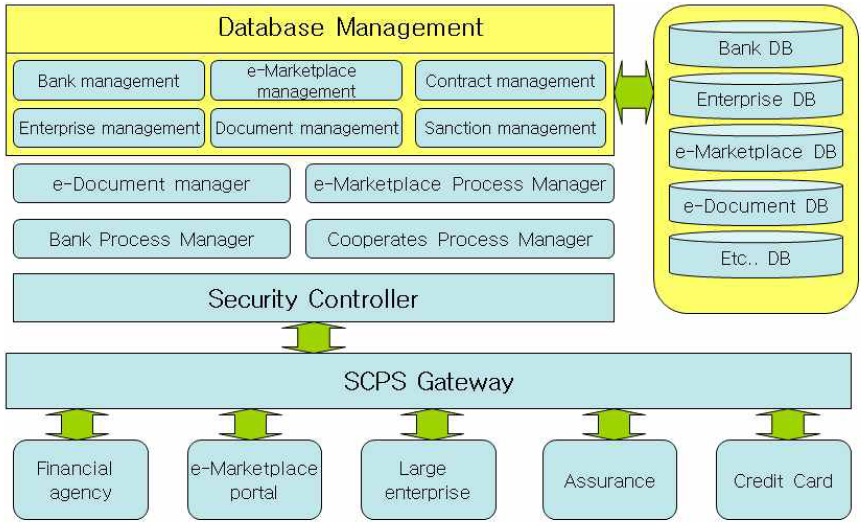

The structure of the general work system database used to promote the global B2B e-Marketplace and establish the fundamentals for the global purchasing card system is as follows:

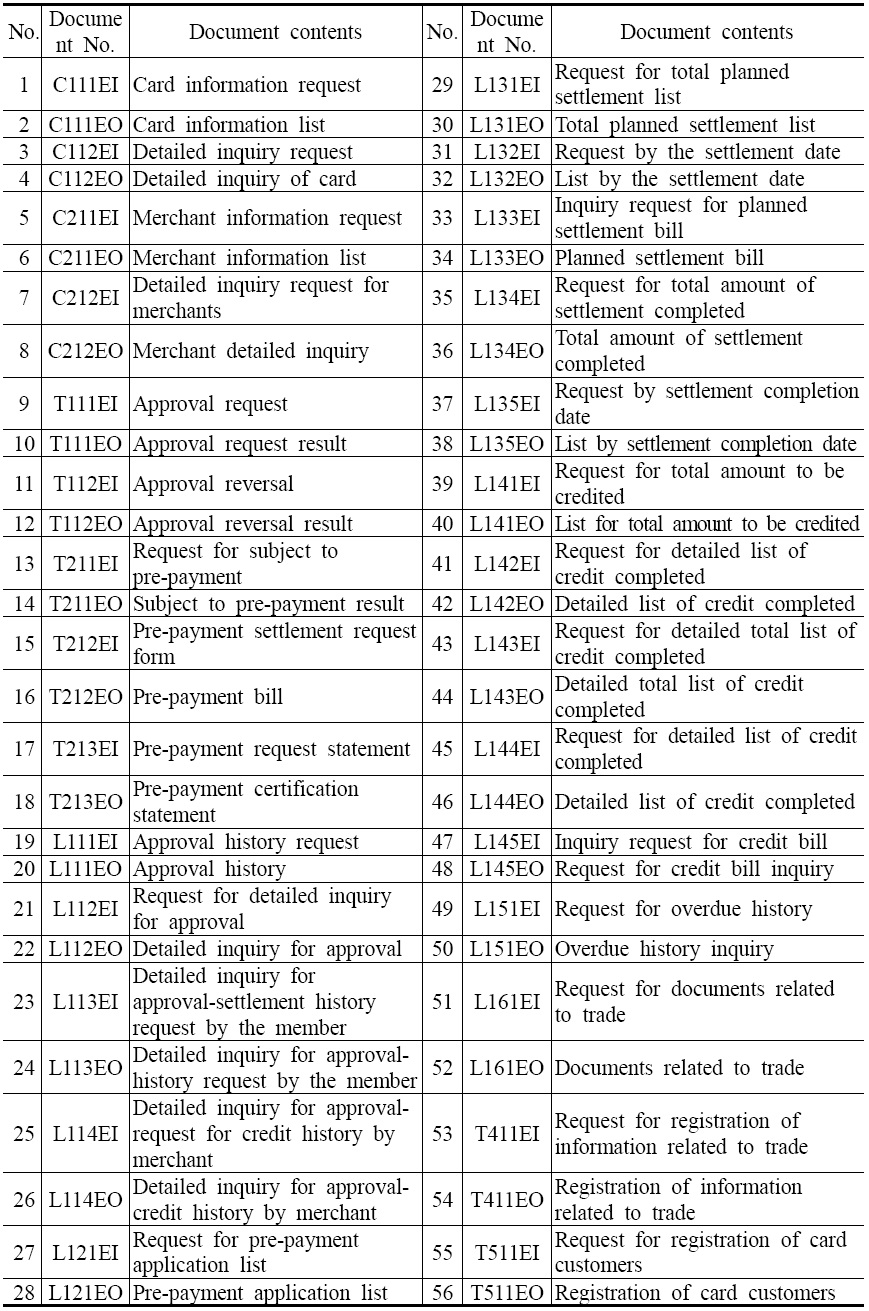

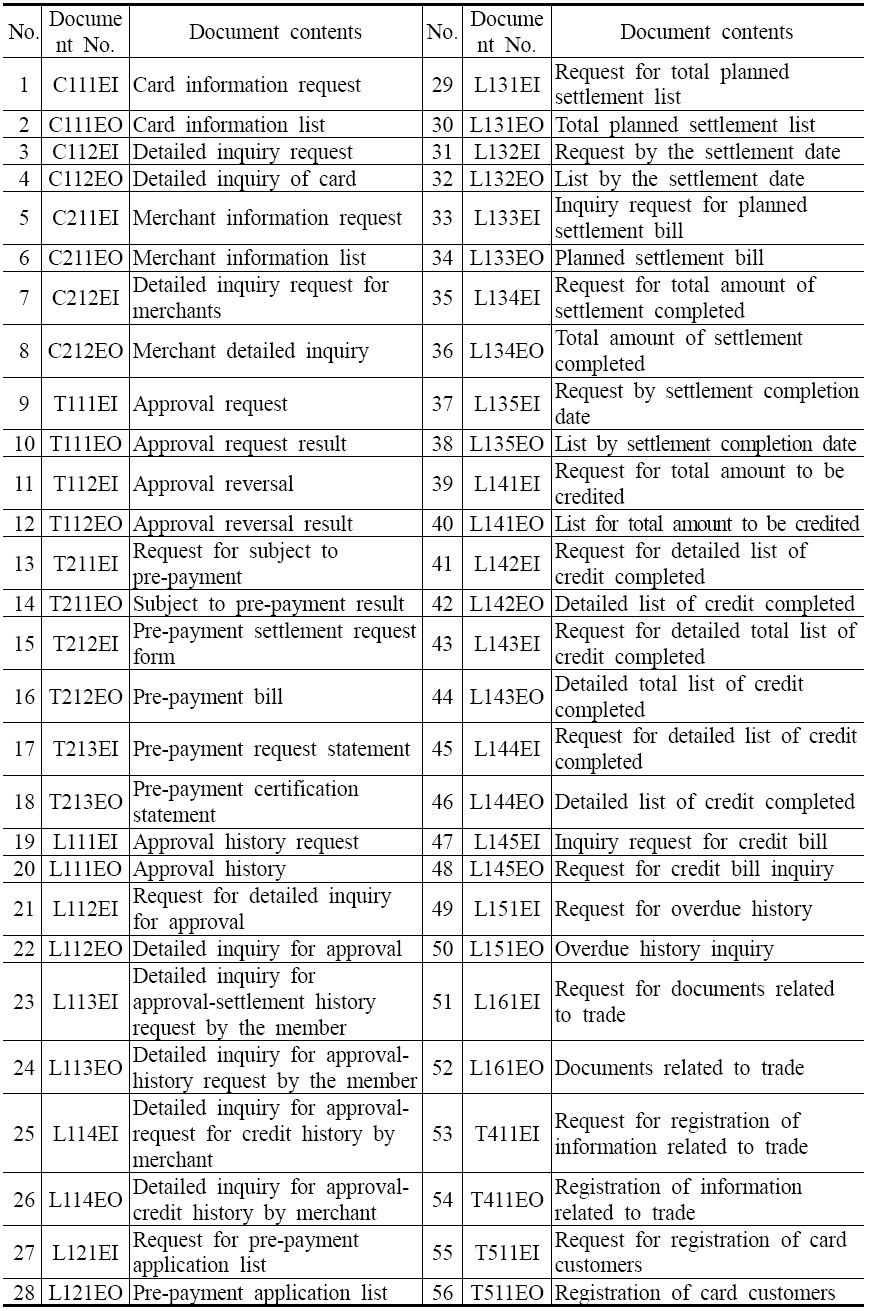

[Table 6] Electronic document of SCPS Gateway in global purchasing card

Electronic document of SCPS Gateway in global purchasing card

The development of the system has been completed, and currently it has been applied to the Suhyup Bank in Korea as an exemplary case. In order to make the system quickly spread to many corporations through the B2B e-Marketplace, identifying corporations, finding ways to link the system to those companies, and winning trust through global purchasing cards is very important. To this end, the commission of the settlement gateway is set lower than that of other gateways. The Payment Gateway (PG), operator of SCPS, should be managed as a contractor with banks home and abroad, e-Marketplaces home and abroad, and corporations. In principle, the commission rate of the B2B e-Marketplace will vary by company to company and the commission will range from $3 per transaction to 0.05% of the transaction amount. In addition, the commission of the global settlement gateway is set at a maximum of 0.0025% of the transaction amount, which is cheaper than that of other Payment Gateway (PG) companies which cause price competitiveness in the global settlement gateway.

The number of institutions that deal with the global purchasing card, which is the basic financial instrument for global settlement gateway, will be increased so that the purchasing card is actively linked to a gateway.

Due to a lack of appropriate solutions for B2B transactions, there are currently no payment methods that provide various financial functions. In this regard, international payment methods are required to integrate international logistics, document control, and payment methods. The new payment methods that support international B2B transactions are required to have functions to easily pay and safely receive the transaction proceeds. The SCPS proposed by this study calls for the global purchasing card system for the global e-Marketplace to apply the ideas of the purchasing card, which is already widely accepted in the market for international B2B transactions.

Since SCPS processes the payment between banks and transfers the data using the global credit card (e.g. VISA) network, it is not required for the supplier banks to institute a solution. Accordingly, when SCPS is installed in banks, the system can be used as an electronic payment method for international trade where a global credit card network exists. The global credit card network is often selected because it has a comparative advantage over other payment systems in terms of global competitive edge and influence. Since the network process of global credit cards is internationally standardized, it is possible to provide the global purchasing card system if the SCPS is installed and connected to the card account system.

Through the linkage of the integrated platform infrastructures of electronic trade payment, a practical payment method that is appropriate for the new e-business market is provided. SCPS offers an online-based trade payment system at a lower cost with more convenience to business enterprises; to e-Marketplace and banks it provides new profit drivers, and also expands the consumer base and electronization of work processes. Based on these advantages of SCPS, the system is expected to establish a practical model for actual transactions in the market and to further promote global electronic trades. Moreover, it will also be utilized to establish a model that can serve as the international standard of the SCPS platform gateway if the construction of an SCPS Gateway is requested by other countries. Establishment of the nationally authorized Hub and standardization of the B2B trade payment makes it possible to form a network with an overseas e-Marketplace and M2M such as Alibaba.com. This in turn enables SCPS to become the cornerstone in carving out the global B2B market based on a practical international payment system for the first time in the world.