The accelerated pace of globalization has created a new set of strategic opportunities and threats for firms in developing economies. In India with the advent of pro-market reforms, firms operating in hitherto protected environment are now exposed to competitive pressures both from within and outside the country. With markets getting integrated across the world, winning competitive advantage over rivals with possession of scarce resources alone might not sustain, compelling firms to search for alternatives through knowledge creation and improving innovation capability. The new forms of competition has thus led to a situation where firms should innovate continuously or else die (Freeman and Soete, 1997), Hence competition among firms is the competition on the ability to innovate. As survival is dependent on the ability to innovate, firms are looking beyond their boundaries to acquire two important resources, i.e., knowledge and financial resources for innovation. Given the limited internal resources firms have recognized the importance of integrating internal and external resources in order to improve their innovation capability. This has resulted in the coexistence of open, collaborative networks with dependence and cooperation along with the rise of tacit knowledge shielding strategies of the firms.

Success or failure of innovation is influenced by many factors such as the scarcity of innovation resources like market information and new knowledge to innovate. As innovation information (such as technological and market information) is scarce more firms have recognized the fact that a firm cannot innovate and operate independently for a long time under the circumstance of network competition. In fact, the process of innovation is also a process of removing uncertaint information and overcoming ignoring information (Daghfous and White, 1994). Competitive advantage thus depends to a large extent on the knowledge possessed by firms. Making use of extant knowledge and effectively acquiring and absorbing outside knowledge becomes a key ingredient to enhance innovation performance.

Since the economic reforms of 1991, firms in the Indian auto components industry started adopting various long term coalition strategies like joint ventures, licensing agreement, supply agreement, marketing agreement, technical collaboration etc. Among them, one of the most common and prominent tools used is an international joint venture (IJV) between domestic companies and foreign companies. In an IJV, local partners bring knowledge of the domestic market, familiarity with Government policies and regulations, understanding of local labor markets, and existing manufacturing facilities and the foreign partners offer advanced process and product technologies, management know-how, and access to export markets.

In this study an attempt has been made to understand the ways and methods used by Indian auto components manufacturing firms for enhancing their innovation capability. We examine auto components for two reasons; (a) it offers the case of an industry in which firms have constantly faced the pressures of being part of a global value chain and (b) it provides the evidence of an industry which has grown in India since the initiation of economic reforms by integrating with the rest of the world. Some previous studies have analysed the determinants of innovation activity in the Indian automobile industry (Reddy, 2011; Narayanan, 1998; Narayana, 1989).

Kathuria (1995) notes that the time-bound indigenization programme for commercial vehicles in the 1980s facilitated the upgradation of vendor skills and modifying vehicles to suit local conditions, which demand functional efficiency, overloading capabilities, fuel economy, frequent changes in speed and easy repair and maintenance. Kathuria (1995) also mentions that the choice between vertical integration and subcontracting crucially depends on the policy regime: In a liberal regime, vertical integration may not work. Narayanan (1998) analyses the effects of deregulation policy on technology acquisition and competitiveness in the Indian automobile industry during the 1980s and finds that competitiveness has depended on the ability to build technological advantages, even in an era of capacity-licensing. Narayanan (2004) analyses the determinants of growth of Indian automobile firms during three different policy regimes, namely, licensing (1980-81 to 1984-85), deregulation (1985-86 to 1990-91) and liberalisation (1991-92 to 1995-96). Unlike the prediction by Narayanan (1998), this study finds that vertical integration is detrimental for growth in a liberalised regime as it potentially limits diversification. Narayanan (2006) also finds that vertical integration plays a positive role in a regulated regime, while it is not conducive for export competitiveness in a liberal regime.

Our study further contributes to this body of knowledge pertaining to the Indian automobile sector. The essential objective of this study is to identify the motives for forming IJVs in the auto component sector as it has attracted large foreign direct investment (FDI) since liberalization and mostly through IJV. The second aim of this study is to explore how companies select their venture partner in line with their motives. Addressing these two aspects essentially forms the basis for promoting innovation in the sector. The study also tries to bring out the relationship between motives, partner selection criteria and performance of the IJVs.

II. Auto Industry: Global Chain, Local Firms and Joint Ventures

While analyzing the corporate behaviors and competitiveness edges, Porter (1985) put forth the renowned value chain theory. The theory included three key points: (i) various activities of the enterprises are an organic whole, and each activity contributes to value creation, while a kind of mutual connection lies between them, i.e. the system of “value chain.” (ii) different enterprises have different value chains, and the difference in value chain is embodied in the differences in the efficiency of various business activities, as well as in the differences in the organizational structure and business process of the enterprises. (iii) certain strategic links of higher value always exist in the multiple “value activities” of an enterprise. The advantages of the enterprise in competition, especially those that may be maintained for the long term, are the advantages of the enterprises in such strategic value links. Therefore, the enterprises shall intensively construct their own core capacities in such key links. Based on the value chain theory of Porter (1985), Gereffi (1999) contends that the global value chain is formed through the externalization of the internal value chain of enterprises. Moreover, such a system may promote the flow of knowledge in the form of techniques and management experience between the client and trustee, to transform OEM enterprises into entities capable of undertaking more valuable links in the global value chain. Humphrey and Schmitz (2002) put forward four modes of transformation at various levels centered on enterprises: process upgrading, product upgrading, functional upgrading and inter-sector upgrading.

The global auto component industry went in for consolidation in 1990s. Large number of mergers and acquisition took place to deliver more extensive component systems or to develop new products. The assemblers collaborated to reduce cost and to achieve economies of scale in fragmented markets. Alliances also accelerated the diffusion of innovation, thus, contributing to the industrial learning of the host country (Abrenica, 1998). The competition shifted from styling and number of models towards price and thus, cost competition (Mariti and Smiley, 1983). Many auto companies adopted a ‘common platform’ strategy for their various models. Common platform helped in significantly reducing the cost, which is further reduced by maximizing the number of common components between models.

The suppliers turned into “mega suppliers” and increased their reach to emerging markets through acquisition and IJVs (Humphery, 2003a, b). OEMs established long-term relationships with few ‘mega suppliers’ (Humphery, 2003a, b; Tewari, 2003). These suppliers either make the part under license from the globally preferred supplier or provide their own design. The least preferred option was a local company to produce the part, either under license or using their own design. The alternative is a ‘transnational’ firm or a joint venture between a transnational producer and a local company (Humphery, 2003a). In the case of technically demanding components, the local suppliers might require links with a developing country component manufacturer in order to acquire process technology (Humphery, 2003a). Hence, a ‘follow sourcing’ strategy combined with a Phased Manufacturing Program (PMP) emerged, which set localization targets for automobile manufacturers. Wherever these suppliers were not able to support diverse activities, they took the route of either joint venture or licensed their technology to the local component manufacturer (Barnesand Kaplinsky, 2000).

Localization of the product is necessary because of the differences in infrastructure conditions, road and driving conditions, standards, regulations, income level of the customers, consumer preference and taxation (Humphery, 1998, 2003a, b). Hence, to design the locally required/adapted product, the parent suppliers need local firms with good engineering capabilities who can help in localizing the product. IJVs can have the technology spillover effect on the domestic partner (Humphery, 2003a). Hence, an IJV is a win-win strategy for both the partners. Joint ventures provided international companies with partners who understood local markets, Government regulations and the supplier industry better, and also reduced initial risks (Mukherjee and Sastry, 1996). Grassmann, Zeschky, Wolff and Stahl (2010) observed that an automobile manufacturer can mitigate its dependence on its established suppliers by engaging in a cross-industry alliance with a ‘non-supplier’ to successfully develop a breakthrough innovation.

Until recently the demand for automobiles was growing in India but volumes were low which makes adaptation of the automobile part costly (Tewari, 2003; Humphery, 1998, 2003b). Small volumes hinder investment in R&D and thus, slow down improvement in productivity and quality (Abrenica, 1998). Imports are costly and small numbers have also meant that ‘follow sourcing’ and ‘follow design’ strategies are less viable and cost-effective strategies in India as compared to other countries where the market size is larger (Humphrey, 1998, 2000, 2003b). As a result, the assemblers who came to India along with their primary suppliers seek collaborations with Indian companies. Requirement of high degree of localization by Government of India (GoI) forced the leading OEMs to rely on domestic suppliers, and this coupled with increasing quality competitiveness, made upgradation of the component manufacturers important.

III. Evolution of Auto and Auto Component Sector in India

India’s automotive industry evolved through roughly three policy regimes. The three regimes are: (i) the protectionist, import substitution phase from the late 1940s to 1981; (ii) the “early reform era” which constitutes early episodes of modernization of the industry from 1982 through early 1990s; and (iii) the “reform phase” from 1991 when the Indian auto-industry was deregulated and significant amounts of equity and foreign direct investment flowed into the sector (Tewari, 2003).

The Government policy started changing in early 1990s, with liberalization in 1991. In June 1993, the first automobile policy was announced by GoI. It abolished the requirement of the license to set up an auto manufacturing plant in India, which was the first step to allow foreign investment in automobile industry with 100% equity. This marked the entry of many global car manufacturers like Honda, Hyundai, Toyota, Skoda, Ford and General Motors. Advanced technology was introduced to meet competitive pressures and environmental and safety imperatives. Automobile companies started investing in service network to support maintenance of on-road vehicles.

Currently Indian auto component industry is quite comprehensive with around 700 (ACMA, 2014) firms in the organized sector catering to 85% of the demand. There are more than 15,000 firms in the unorganized sector, in tiered formats, which meet the remaining demand. The Auto Component industry in India has a strong positive multiplier effect as a key driver of economic growth. Despite a very turbulent year, the industry clocked a turnover of Rs. 211,765 crore (USD 35.13 billion) in FY 2013-14, with an impressive CAGR of 14 percent over the last six years. Indian auto components are exported to more than 160 countries and have been growing at 15 percent per annum over the past six years. Components exports stood at Rs 61,487 crore (USD 10.2 billion) in FY 2013-14, accounting for 29 percent of overall industry turnover.

It was also observed by Kumarswamy, Mudambi, Saranga and Tripathy (2012) that firms may adapt and continue to perform, as market liberalization progresses, through catch-up strategies aimed at integrating with the industry's global value chain. For continued performance, domestic supplier firms adapt their strategies from catching up initially through technology licensing/collaborations and joint ventures with multinational enterprises (MNEs) to also developing strong customer relationships with downstream firms (especially MNEs).

Many global OEMs are setting up facilities in India, both to take advantage of the fast-growing domestic passenger car market, the strong ancillary network, low cost and high manufacturing quality in the domestic sector. Sourcing auto components from India leads to an average cost reduction of nearly 25-30%.

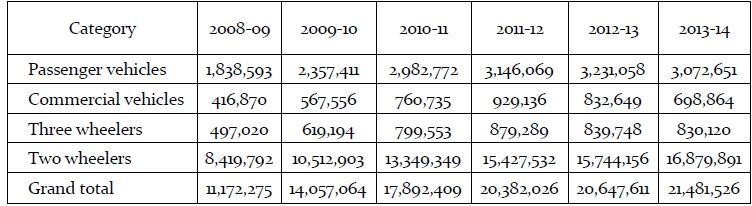

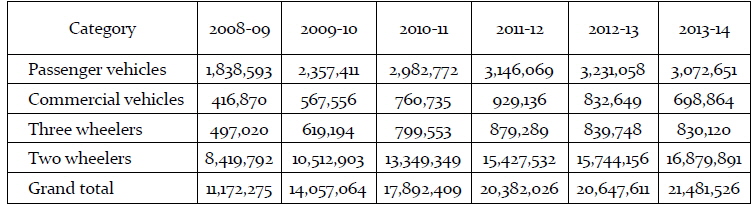

Recently India’s process-engineering skills, applied to re-designing of production processes, are being recognized by the global suppliers. The production trends are presented in table 1. They have also found that the Indian capabilities have enabled reduction in manufacturing costs of components.

[Table 1] Automobile production trends in Nos

Automobile production trends in Nos

Recent data provided by the Society of Indian Automobile Manufacturers (SIAM) show a steady overall growth in turn over and volume of production in most segments. For example two wheeler productions have almost doubled between 2008-09 and 2013-14. As on 2013-14, two wheelers constitute 80% of the market share followed by passenger vehicles 14%.

This study follows an empirical approach using survey mode of data collection to address the two research questions given in Section 1. Our study is essentially explanatory in nature where we seek to identify motive variables and their influence on joint ventures. This study also aims to identify factors that explain the choice of joint venture partners. Our research pertain to the domain of Indian automobile industry, where research has been active for several decades (eg: Mukherjee and Sastry, 1996). According to Edmondson and McManus (2007) state of maturity of prior theory and research must determine the choice of methodology; in a field where prior research has generated a body of knowledge, quantitative research using focused questions would be appropriate. Given the purpose of our research and maturity of the domain of study, drawing on prior studies, we developed a structured questionnaire for data collection based on prior research studies.

Our population consisted of all IJVs formed by Indian companies in the automobile sector. We included IJVs having operation only in India and excluded those firms which had headquarters in India and were operating outside Indian boundaries. The study did not include the firms where there was equity participation only for the sake of investment, as the sponsoring firms would not have strategic impact on the JV (Harrigan, 1988).

We obtained a list of companies from ACMA which has 700 registered members. In addition to ACMA registered members, some information regarding a few more joint ventures was obtained during the data collection from the ventures that were a part of the our list. After screening and elimination based on accessibility and size parameters a total of 561 companies were identified for the study. It was observed that the firms were concentrated in clusters in the three regions, namely Pune, Chennai-Bangalore and NCR, also called as the three major hubs for auto component manufacturing in India. The three regions constitute 323 companies, which accounts for 57% of the population. Of this comprehensive list of 323, we found that about 124 companies had IJVs, 26 had technical collaborations and eleven were wholly owned subsidiaries (WOS) in the three regions. There were also eleven firms which had foreign collaborations but the nature of collaboration (IJV or TC) could not be known. Out of 124 joint venture firms 65 firms agreed to participate in the study, which accounted for 53% of the total IJVs in the three regions. A structured questionnaire was developed based on literature and Delphi technique (inputs from senior researches in the field) and it was administered to senior managers of the IJVs. All the 124 firms which had IJVs in the region being studied were contacted for data collection and data was collected from all the 65 firms who agreed to participate. The managers contacted were mostly of the rank of Senior Vice President, Directors, Managing Directors or Vice-presidents.

The major aspect explored was the knowledge needs. Knowledge needs refer to the knowledge pool of the partner to which a firm has access with the help of the partner. IJV appears to be common in industries undergoing significant change, and furthermore the rate of technology change is even more intense (Lyons 1991). In technology driven industries, like auto components, where R&D and product design development expenditure are high and the technical know-how is important. IJVs are formed to acquire the technology. The partnership is formed primarily to contribute their expertise in technology, R&D, product design, quality control and proprietary knowledge, which otherwise are expensive to develop internally. Some knowledge is tacit in nature and difficult to transfer through licenses or technology transfer; in such cases, exchange of technical personnel and functional managers is possible in an IJV. It can also serve as a means to acquire local managerial expertise (managerial know how) (Gomes-Casseres 1989).

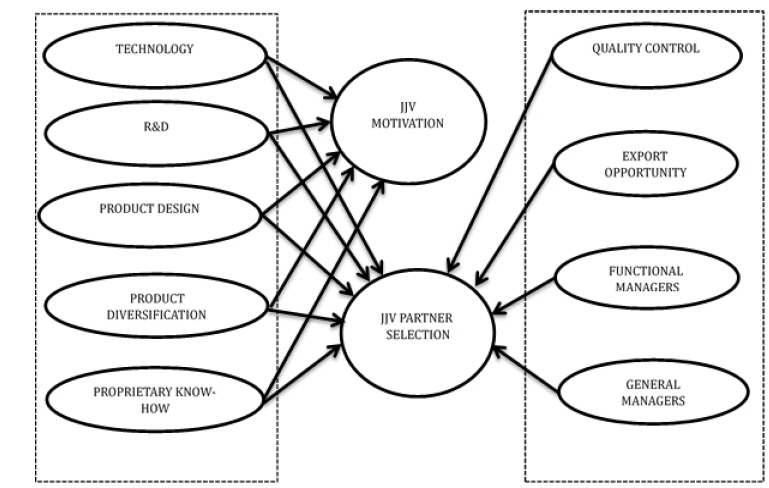

Drawing on concepts from R& D, innovation and alliances literature, we formulate our theoretical framework as depicted in Figure 1. Our study considers two important outcomes: JIV motivation and JIV partner selection. Drawing on extant literature, we posit that JIV motivation will be influenced by the dimensions of technology, R& D, product design, product diversification and proprietary know-how. In addition to these dimensions we expect that JIV partner selection will be influenced by quality control, export opportunity, functional managers and general managers. Our study further explored potential variables using a field study.

The motive variables used for this study are explained below:

Technology: IJVs provide strategic benefits from the exploitation of technology or other skill transfers (Harrigan, 1985). Contractor and Lorange (1988) pointed out that in general, alliances may be used to bring together complementary skills and talents which cover different aspects of the know-how needed in high technology industries. Technology includes transfer of both process and product know-how. The auto components sector is a technology-intensive sector and thus, access to technology is one of the drivers for forming alliances. Research & Development: As mentioned earlier, designs are now being developed by component manufacturers and they have their own in-house development centers. Economies of scale are important to break even with a large investment in R&D. Thus, firms are adopting the coalition strategy to spread the cost as well as to make use of each other’s knowledge pool. Product design: The most crucial part is design in the case of auto component sector. The IJVs are a means to have access to product design which the partner has developed over years of R&D. Firms do not want to invest in something already developed and hence, to share product designs, IJVs are formed. Product diversification: IJV allows firms to diversify into attractive but unknown business with the help of the partner who is already in the business and uses its knowledge and expertise to get into the new business. In the case of auto component industry, the suppliers have close links with the OEMs and sometimes OEMs ask the suppliers to cater to their needs of other products as well. The supplier in order to cater to the needs for the customer scouts for a partner to diversify and provide a wide range of solutions to the customer. Proprietary know-how: The auto component sector is technology driven and R&D plays an important role to sustain the competitive advantage. The technology is developed as a result of years of hard work in R&D and becomes proprietary knowledge of the supplier. The IJVs are formed to have access to rare technology and patents of the partners.

V. Analyzing Motives and Partner Selection Criteria

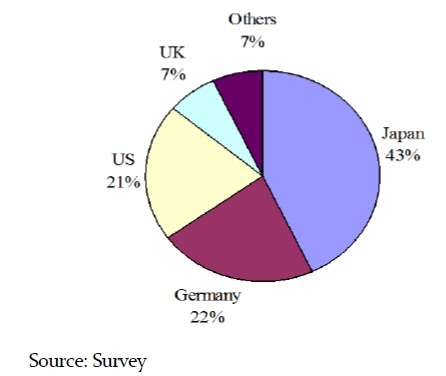

A total of 65 companies out of 124 IJVs in the three regions of study agreed to participate in the research. Out of the 65 responses (one response per company), 64 were used for the study. The data was collected only from the companies where each of the partners had at least 5% stake (as per the definition of IJV for the study). Figure 2 presents the nationalities of the 64 foreign partners in the sample. Maximum number of collaborations was found to be with the Japanese companies accounting for 47% of the sample. This could be attributed to the success of Japanese company - Suzuki in India. Next to Japan was USA with 23% collaboration, followed by Germany with 14%, UK 8% and others had 8%. Other countries include Australia, France, Korea, Thailand and Singapore.

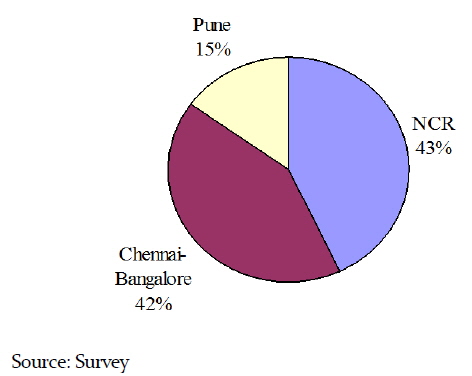

Figure 3 presents the region wise distribution of the companies in the sample. The two regions National Capital Region (NCR) and Chennai-Bangalore constituted 85% of the sample. This is due to the fact that these two regions account for approximately 47% of the total population while the Pune region accounts for 11% of the total population.

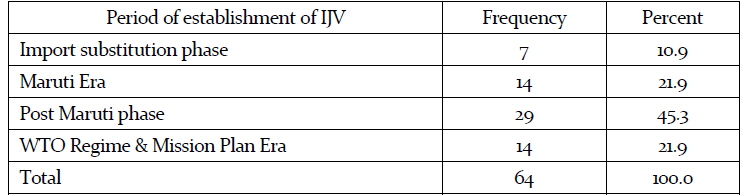

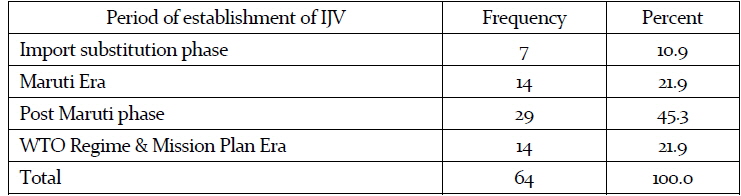

Evolution of the auto component sector can be divided into three policy regimes and two eras. The number of IJVs formed in different periods can be seen from table 2. It can also be seen that the maximum number of IJVs were formed in post Maruti phase i.e. 1991 to 2001. The entire analysis and the tables are based on the primary data collected from 65 IJV firms in the National capital region, Mumbai-Pune region and the Chennai - Bangalore region.

[Table 2] Period of establishment of IJV

Period of establishment of IJV

The liberalization policy and subsequent auto policy in 1993, gave thrust to IJV formation. As all the eras did not have equal time length, we have calculated IJVs per year to study the trend in the IJV formation. From 1947 to 1981 in the import substitution phase, only seven IJVs were formed, as compared to the Maruti era during which there were about 14 IJVs in a span of eight years (1982 - 1990). The post liberalization saw a real spurt in IJVs and this period from 1991 to 2001 witnessed about 29 IJVs. This trend continued even in the post WTO era with 14 IJVs between the years 2002-2006.

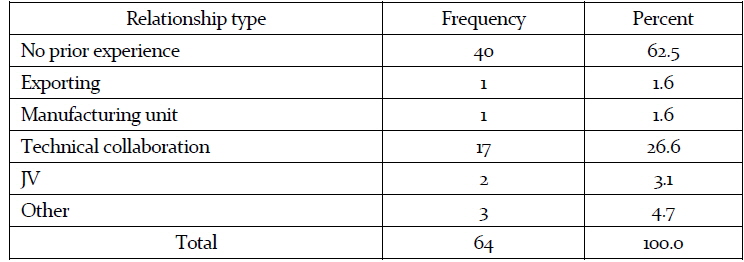

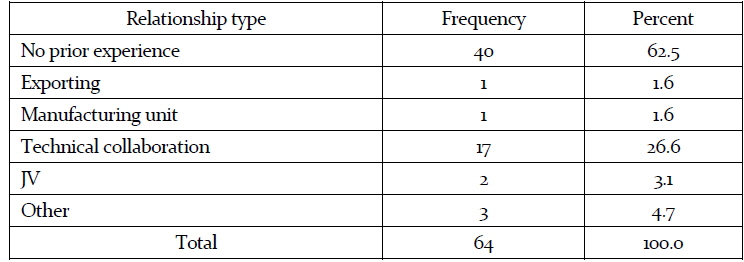

In the next stage of analysis we have attempted to understand the relationship Indian firms had prior to forming an IJV with the foreign partner. From the data, presented in table 3, it was found that in 37.5% of the cases, the Indian partner had a relationship with the foreign partner in some form or the other, prior to the joint venture in question. About 71% (17 out of 24) of companies having prior relationship with the partner had technical tie-up with the foreign partner. While in rest of the cases, IJVs were formed between the partners who were not involved in any business relationship.

[Table 3] Prior relation with foreign partner

Prior relation with foreign partner

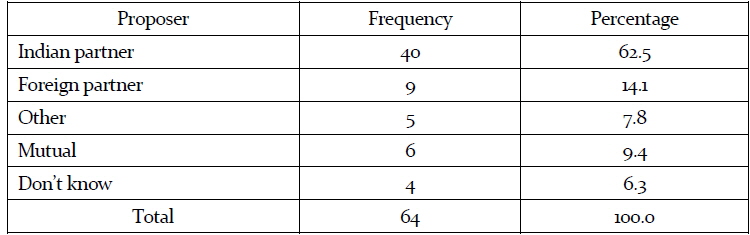

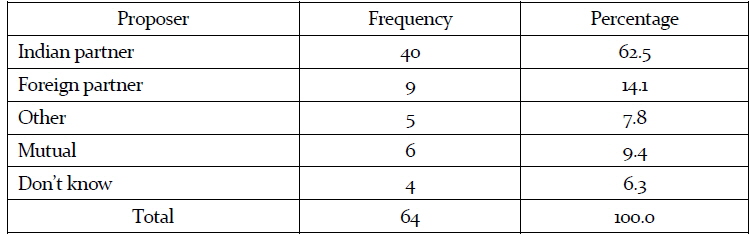

To understand the formation of the IJVs we also asked the respondents “who initiated the concept of IJV formation”. Table 4 shows that in 62.5% of the cases, Indian partners conceived the idea of forming an IJV and took the proposal to the foreign partner. In 14.1% of the cases the foreign partner proposed the IJV with the Indian partner. Only in 9.3% of the cases, both the partners took the decision mutually and felt the need for IJV; predominantly it happened after long relationship as technical collaboration or another IJV. Only in about 7.8% cases the IJV was proposed by the customer or the existing technical collaborator of the Indian partner.

IJV initiator firm

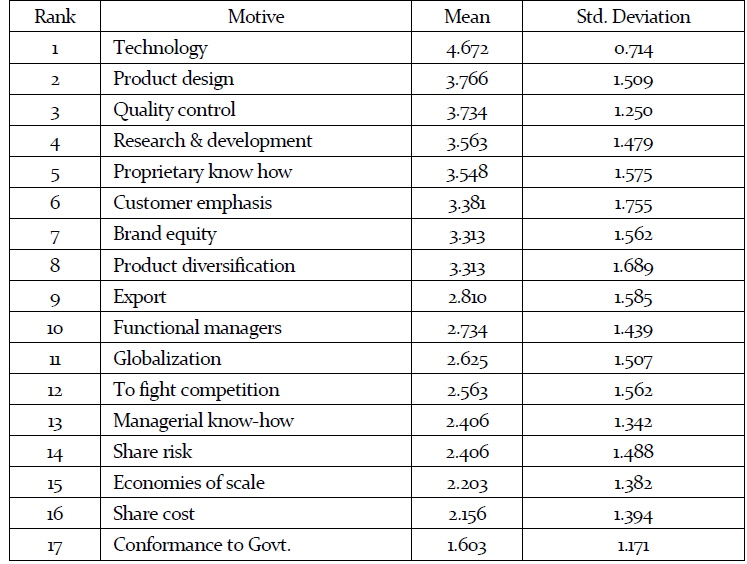

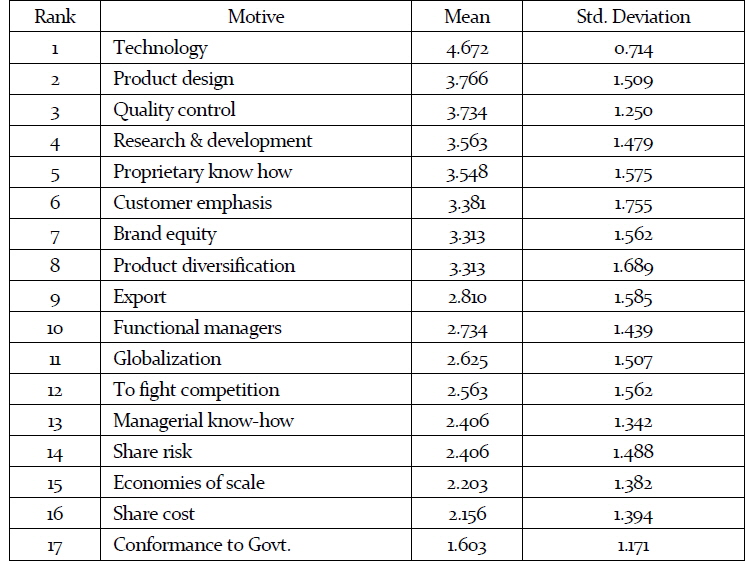

We have identified 17 motives for forming an IJV for the Indian partner, based on prior literature and personal interviews with the senior officials of the IJV firms during the pilot study. The respondents ranked the motives on a five point likert scale, where 1 = not important, 2 = slightly important, 3 = moderately important, 4 = very important and 5 = one of the most important motive for forming the IJV. Weighted average mean was calculated for the motives and they are presented in table 5 with their standard deviation.

[Table 5] Relative importance of the motives for forming an IJV with Indian partner

Relative importance of the motives for forming an IJV with Indian partner

In an IJV the main motive for an Indian partner was found to be technology with mean score 4.67 (on a five point likert scale). Design and technology lies with the global suppliers of the OEMs and to serve these global OEMs, Indian companies collaborated basically for technology (mean score 4.67), product design (mean score 3.77), and quality control measures (mean score 3.73), to produce high quality products. The small volumes in relation to the cost involved in development of the products and designs prohibited the Indian companies from setting up R&D and developing design centers. For Indian companies, the primary motives to form IJVs were to gain technology and related skills from the partner.

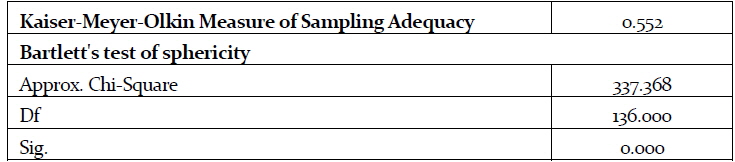

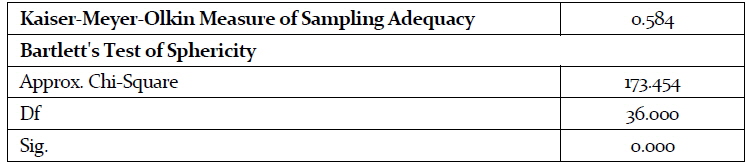

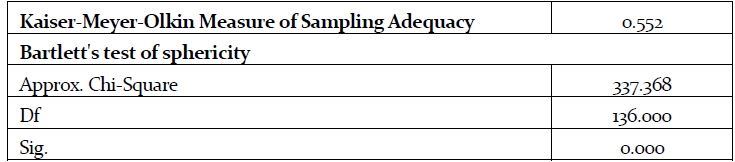

The 17 motives listed in table 5 were found to be inter-correlated as presented in table 6. Because of the potential conceptual and statistical overlap, an attempt was made to identify a small number of distinct, non-overlapping strategic motives for the sample data by means of exploratory factor analysis. The Kaiser-Meyer-Olkin (KMO) and Bartlett’s test was carried out to test the suitability of the data for factor analysis. The KMO measure of sampling adequacy indicates the proportion of variance in the variables which is common, i.e. which might be caused by underlying factors. High values (close to 1.0) generally indicate that a factor analysis may be useful with the data. If the value is less than 0.50, the results of the factor analysis probably won't be very useful. Bartlett's test of sphericity indicates whether the correlation matrix is an identity matrix, which would indicate that the variables are unrelated. The significance level gives the result of the test. Very small values (less than 0.05) indicate that there are probably significant relationships among the variables. A value higher than about 0.10 or so may indicate that the data are not suitable for factor analysis.

[Table 6] KMO and Bartlett's Test

KMO and Bartlett's Test

Table 6 presents the KMO and Bartlett’s test results for the ten motive variables. The KMO test value is 0.522, which is more than 0.50, indicating that the factor analysis is valid for the motive set of variables. The Bartlett’s test value is also significant at 0.01 level.

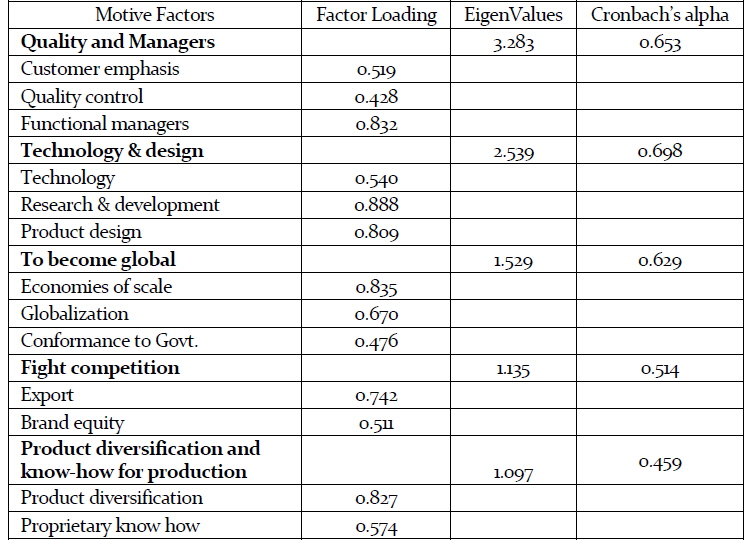

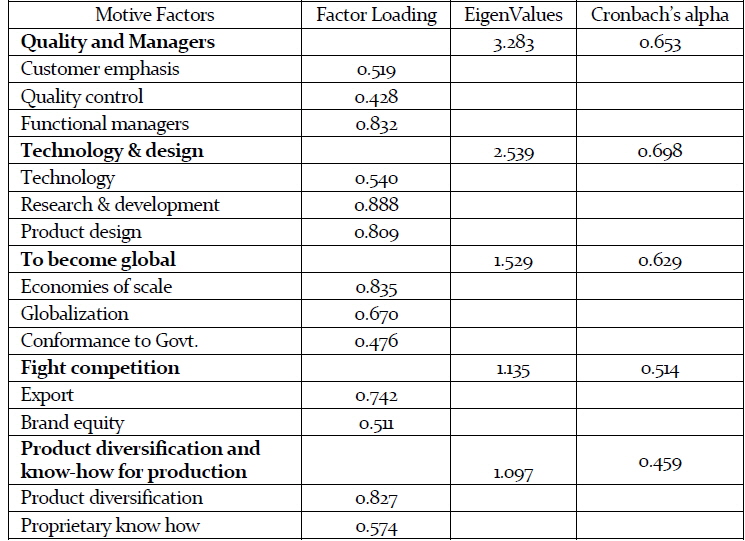

The 17 motives were factor analyzed and factors having an Eigen value more than one were used for the study. Items having a loading of more than 0.4 were considered as one factor (Hair et al., 2005). Factor analysis results are presented in table 7. Six factors thus obtained explained 68.18% of the variance. The Cronbach alpha value was also checked for reliability of the factors so formed. As the Cronbach alpha value is dependent on the number of items and the sample size, the norm of 0.70 or more (Hair et al., 2005) has not been considered for our analysis. The sample size was comparatively small and the number of items in each factor were also low (<=4). As the study is exploratory in nature Cronbach’s alpha norm cannot be strictly followed. The reliability of the set motive was checked and the Cronbach’s alpha was found to be 0.72, which is above 0.70.

[Table 7] Factor analysis result for motives of the Indian partner to form IJV

Factor analysis result for motives of the Indian partner to form IJV

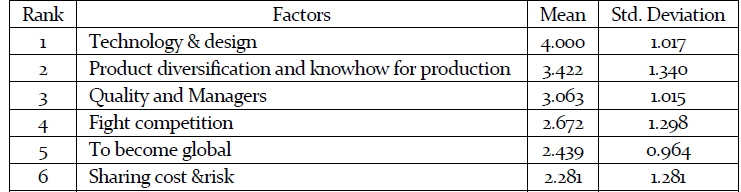

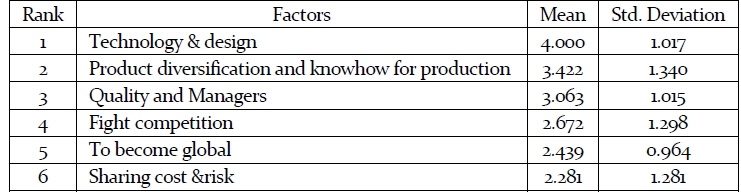

Average score of the items in a factor was calculated to get the value for an individual factor. The scores thus obtained were ranked according to the weighted average mean of all the respondents which is presented in table 8.

[Table 8] Importance of the motives for forming IJV for Indian partner

Importance of the motives for forming IJV for Indian partner

From table 8 we can observe that for an Indian partner the most important motive was to get ‘technology and product design’ (mean score 4.00). The other two important motives were also related to technology that is, ‘proprietary know-how and diversification’ (mean score 3.42) and ‘quality control measures and mangers’ (mean score 3.06). These top three motives were basically to gain the technological skills of the foreign partner. For Indian firms ‘to become global’ was not found to be of high importance (mean score 2.44). ‘Sharing cost and risks’, as discussed in the literature, were not found to be important for the Indian firms. We probed into the reason with a few open ended questions. From the discussion it emerged that firms in the auto component sector did not need financial support as they were mostly self-sufficient and they did not need partnership for capital, rather their needs were mostly technology related. The risk was also thought to be less important for Indian companies as the products they manufacture were mostly well established and were being supplied by the global suppliers. They were only replicating the products leading to a lesser chance of failure, as they had products as well as customers ready for it.

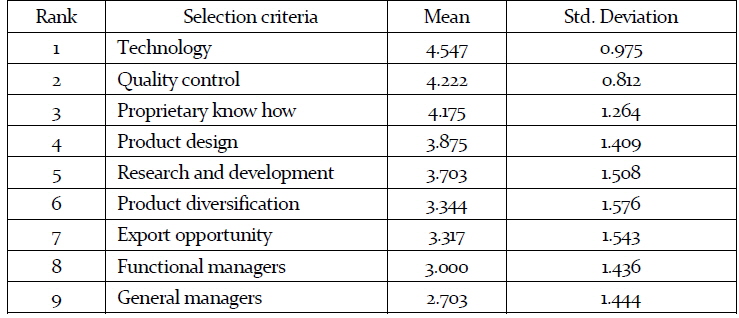

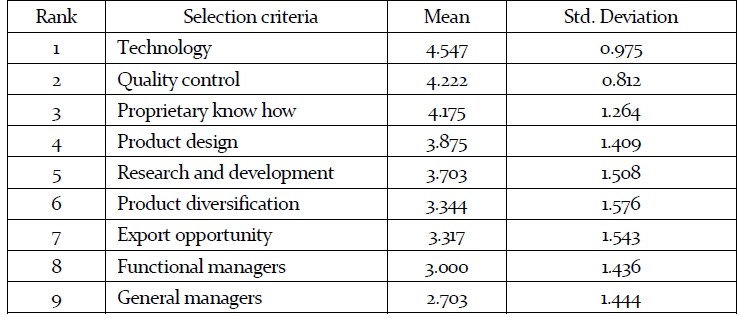

The respondents ranked the importance of skills and characteristics of the partner as perceived by the Indian partner while selecting the foreign partner. The respondents ranked the partner selection variables on a five point likert scale, where 1 = not important, 2 = slightly important, 3 = moderately important, 4 = very important and 5 = one of the most important. Table presents the ranking obtained based on the weighted average mean score of the responses.

It can be seen from table 9 that the Indian partner emphasizes on the partner’s technological capabilities while selecting a partner (mean score 4.55). Thus, the Indian partner considered the quality measures the foreign partner was following so that it could improve the quality as well as the productivity of the local venture. They considered a partner who had the access to proprietary knowledge, product design and diversification capabilities. Indian Partner did not place very high importance on the general management (mean score 2.70) as the operational management was basically from the Indian side. From the table we can also see that eight out of nine task related criteria had a score more than the mean score of three, which illustrates that all the partner selection criteria were of high importance for the Indian partners.

[Table 9] Partner selection criteria for the Indian partner in an IJV

Partner selection criteria for the Indian partner in an IJV

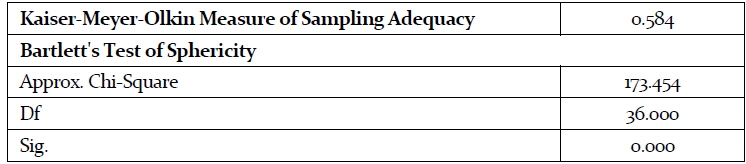

The partner selection criteria thus obtained were conceptually overlapping and were correlated. To reduce the number of variables and to obtain a set of non-overlapping parsimonious set of partner selection criteria, factor analysis was carried out. The KMO and Bartlett’s test was carried out to test the suitability of the factor analysis for variables as explained. Table 10 presents the KMO and Bartlett’s test results for the task related selection criteria variables and partner related selection criteria variable respectively. Table presents that the KMO value is 0.584 which is above the norm of 0.5 and Bartlett’s test value is also significant at 0.01 level. Hence, we conclude that factor analysis is valid for the nine task-related selection criteria Indian partners have for selecting the foreign partner for an IJV.

[Table 10] KMO and Bratlett’s test for task related selection criteria

KMO and Bratlett’s test for task related selection criteria

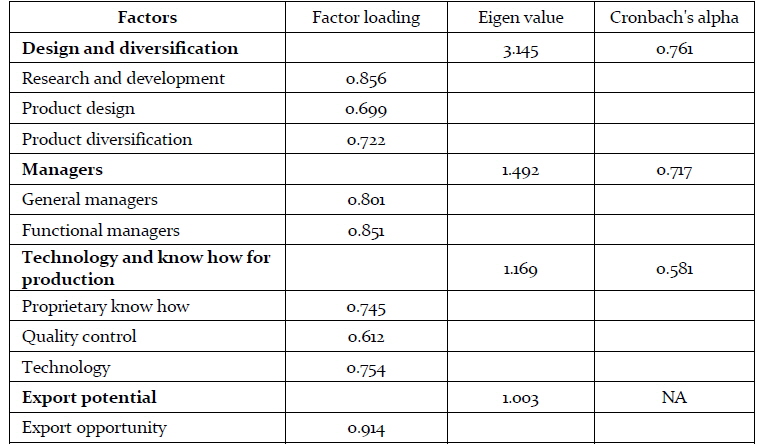

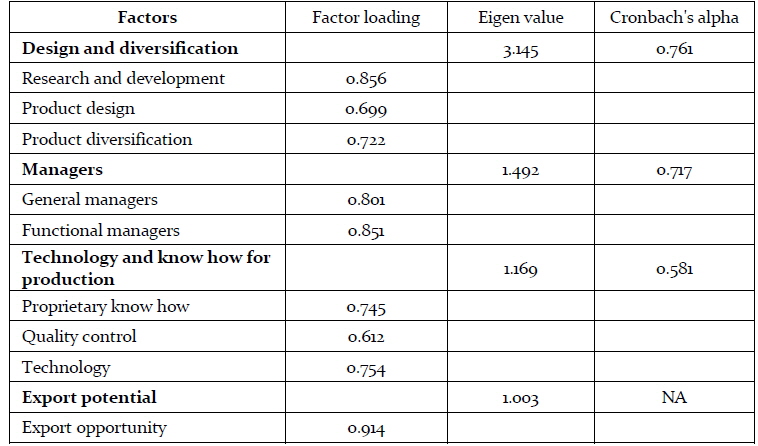

The nine task-related partner selection criteria were factor analyzed. After factor analysis four factors were obtained which explained about 75.67% of the variance. The four factors thus obtained were named on the conceptual understanding of the factors. Table 11 presents the factors obtained as the result of the factor analysis. The table presents factor loading of each variable on factor, Eigen values and the Cronbach’s alpha values of the variables.

[Table 11] Factors for task-related selection criteria for selecting foreign partner

Factors for task-related selection criteria for selecting foreign partner

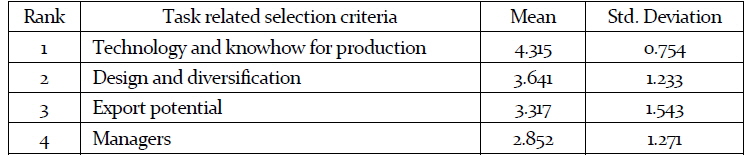

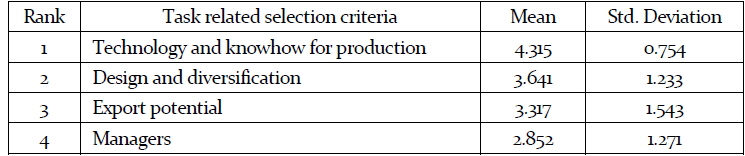

The factors thus obtained were ranked based on the average score calculated for the factor. Table 12 presents the average score of the variables calculated for a factor and their standard deviation.

[Table 12] Relative importance of the task-related selection criteria factors

Relative importance of the task-related selection criteria factors

Table 12 presents that the Indian firms placed high importance to technology and design capabilities (mean score 4.32). Export opportunity (mean score 3.32) was also of high importance for the Indian partner; however they did not place high importance on the managerial capabilities of the partner (mean score 2.85) as the Indian partners were mostly responsible for the management of the IJV as explained earlier. The purpose of partner selection stems from the fulfillment of strategic motives. As the task-related selection criteria emphasize resources and capabilities that the firms currently lack, in order to compete effectively, we expect task related selection criteria to be driven by the motives for forming the IJV.

It emerges from this study on motives and partner selection criteria in joint ventures that the automotive industry is volume driven in India. This forces a certain critical mass as a pre-requisite for attracting the much-needed investment in research and development (R&D), new product design and development. In a globally competitive environment, where the instruments of competition have changed, innovations and upgradation of technology assumes importance for gaining and sustaining competitive advantage. Investments in R&D is essential for this. As Indian firms possess limited capabilities in this regard, there is a dependence on foreign partners for technology transfer, R&D and product design, which was aptly observed rakings of motives in our anaysis. This also assumes importance as the auto sector, especially the auto components segment. In India, has large numbers of suppliers which are medium sized and with limited capabilities as well as the volume to invest in developing their own designs and technology. We find that the Indian partners only carry out localization of the products and engineering part in the product development. The predominant reliance of the Indian auto component sector is limited to adaptive technology. IJV is the most favored route for the companies to garner global technology, design and quality. Indian companies prefer IJV over technical collaboration to gain more commitment and continued technology transfer from the partner. Further, collaboration with a foreign partner also helps them get customers and at times Indian firms regard the IJV partner as a medium to enter export markets. The advantage IJVs offer to the foreign parent is that they can exercise control on the technology related issues and need not involve in issues related to day to day management and dealing with the Government regulations. Another advantage the parent firm gets with an IJV is investment in the emerging market. Foreign players consider this as a potential of expanding their sourcing from the Indian base.

Access to the knowledge pool of a partner to which the other firm has the access can only be with the help of a joint venture for e.g. technology knowhow, product design knowledge, local market knowledge etc. In our analysis the highest ranked strategic motives of the Indian firms were to get access to technology of the foreign partner, product design, quality control measures, research & development support, proprietary know-how and the emphasis of the OEM in India to collaborate with their global supplier. Indian firms gave maximum importance to technological skills, quality control measures and proprietary knowledge of the partner. There is a conceptual understanding that the motives will affect the partner selection criteria in terms of skill and resources needed from the partner (knowledge needs and resource needs). The task related selection criteria refer to the skill set of the partner and this study has attempted to establish that relationship empirically.

It emerges from our findings that developing economies, such as India, could use the joint ventures route to push industrialization further. This assumes importance from a policy perspective as the current policy goal is to enhance the pace of industrial growth through a policy of “Make in India”. In this scenario attracting investments through JV route has the potential to achieve the twin objectives of increasing investments and accessing frontier technologies. However, for more JV and investments creation, a favorable investment climate and technology fostering ecosystem should be the targets of policy instruments.