Negotiations for the Korea-US Free Trade Agreement began in June 2006. The agreement was signed on June 2007, thereafter ratified and passing legislation within both countries to take effect on March 15, 2012. Including the United States, Korea currently has 8 FTAs in effect covering 45 countries, with 17 additional FTAs with 29 countries under negotiation or being finalized, signifying Korea's official status as a free trade state(Ministry of Trade, Industry and Energy [MOTIE], 2013).

The Korean textile industry comprised 41% of total exports in the 1970s(Korea Federation of Textile Industries [KOFOTI], 2012), solidifying its position as a key source of exports and contributing to improvements in living standards and economic growth. Around the Asian Financial Crisis, however, exports mostly comprised of OEM manufacturing or low-cost products. In addition, the abolishment of the Textile Quotas in the U.S. after 2005 resulted in Korea losing its advantages from owning high quantities of quotas, in turn giving up its position as the leading export country to developing countries, such as China and Southeast Asia(Koh & Kim, 2009).

As of 2013, Korean textile exports has decreased 2.1% against the previous year to USD 15.6 billion, of which USD 900 million is U.S. exports, for a trade surplus of USD 510 million with imports of approximately USD 390 million. However, the trade surplus for U.S textile exports has gradually declined from USD 1.3 billion in 2007(KOFOTI, 2013).

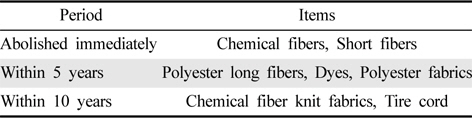

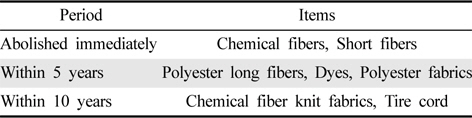

Experts predicted increased exports through improved price competitiveness following the abolition or decrease in duties through the Korea-US Free Trade Agreement finalized in 2012(Kweon, 2011). Abolishing the average duty of 13.1% characterizing the textile industry was expected to result in increased U.S. exports through improved price competitiveness against major competitors, such as Japan, Canada, Taiwan, and Mexico. Perhaps in response to such expectations, as of 2013, one year since the finalization of the Korea-US Free Trade Agreement, U.S. exports of items benefiting from the FTA has shown promising results, increasing by 14.6% against the previous year even amidst worsening export environment in Korea. Of the total textile industry, synthetic fabrics account(312.8%) for 9.1% and has been highlighted for its rapid growth against U.S. exports even before the Korea-Us Free Trade Agreement announcement(Korea International Trade Association[KITA], 2013). In the case of textiles, apparels, and shoes, however, duty level are high(average 4.3%~11.4%) and duty elimination will span across long periods spanning over 10 year, thus raising hopes for additional duty reductions and increased exports in the future. Such highlights our feeling of the effect which the Korea-US Free Trade Agreement has had on Korean exports. Increased exports create benefits, including increased productivity, new investments, development of valueadding fibers, and improved brand power while ultimately creating new jobs and employment for high-quality human resources. In addition, it creates anticipation for improvements to the textile industrial structure based on shared growth between large conglomerates and SMEs. While Korea possesses the entire textile stream, cooperation and connections between conglomerates and SMEs have been restricted, creating difficulties in creating high added value. Experts believe that through the FTA, raw materials sourced from other third party countries will be converted to Korea and increase market opportunities through high value-added products(Lee & Park, 2013).

On the other hand, some believe that it is still too early to assess the results of the Korea-US Free Trade Agreement. In the case of textiles, duties will be gradually eliminate and require examinations across the next 5-10 years. Some also feel that the effects of the Korea-US Free Trade Agreement will be minimal due to complicated certification of origin procedures and relocating of manufacturing bases (Kim, 2013a).

Within such an environment, this study aims to investigate the perceptions and appropriate response plans of the Korea-US Free Trade Agreement. Through such, the study will explore practical and realistic directions that the Korean textile industry should take in the future.

Literature related to Korea-US Free Trade Agreement and textile industry is limited, with most focusing on response plans announced before the finalization of the Korea-US Free Trade Agreement, limited to specific sectors, or measures to increase product exports. Lee and Park(2013) conducted research on utilization strategies of the Korea-US Free Trade Agreement for a specific category of new fusion/convergence new textiles while Kweon and Yoon(2011) conducted research on response plans for the entire Korean textile industry according to the Korea-US Free Trade Agreement. Chang(2012) researched the effects of Korea- US Free Trade Agreement on entrance by U.S. textiles and apparel companies into the Korean market while Koh and Kim(2009) researched U.S. textile market entrance strategies in response to the Korea-US Free Trade Agreement.

As described above, while there are insufficient existing literature on the textile section of the Korea-US Free Trade Agreement, studies on the Korea-US Free Trade Agreement overall are being conducted in a variety of directions. Topics mainly relate to forecasts on the effects of the Korea-US Free Trade Agreement on exports, domestic investments and product manufacturing(Baik, 2008; Lee, 2009; Lee & Heo, 2012), while analysis of agreement provisions(Kim, 2013b) has already been conducted sufficiently. Studies on the relationship between the Korea-US Free Trade Agreement with the dye industry, with high relation to the textile industry, have also been conducted(Park et al., 2012). In all, it can be argued that sufficient research on the Korea-US Free Trade Agreement as a whole have been conducted. As mentioned before, however, studies on the Korea-US Free Trade Agreement within the textiles sector are yet scarce, with investigatory studies on practical company officials almost nonexistent, which adds a level of scarcity for this study and its purpose and research methodologies.

2.1. FTA (Free Trade Agreement)

FTA is the abbreviation of Free Trade Agreement, which is an agreement between countries to free up the movement of goods for mutually increased trade. In other words, it is a special trade agreement formed between countries or amongst regions to realize free trade by relaxing or eliminating trade walls(KOFOTI, 2012).

As of 2013, Korea has formed eight free trade agreements involving 45 countries, such as Chile, Singapore, EFTA(4 countries), ASEAN(10 countries), India, EU, Peru and the United States. Currently, separate agreements with Turkey and Columbia are in the process of being formed while negotiations for eight agreements involving 13 countries, such as Canada, Mexico, GCC(6 countries), New Zealand, Indonesia, China, Vietnam and Australia are under negotiations. In addition, preparations for FTA negotiations or joint research is being conducted with 14 other countries, signifying our official start to a free trade era(MOFA, 2013).

2.2. Textile Section of the Korea-US Free Trade Agreement

Chapter 4 of the Korea-US Free Trade Agreement regulates special safeguard regulations, certification of origin for the textile sector, and duties cooperation for the textile industry. In order to receive preferential duties according to the FTA, general principles and country of origin standards regulated by the FTA must be satisfied. Within the Korea-US Free Trade Agreement, a separate chapter is created on the textiles and apparel sectors to regulate matters related to country of origin all at once. Within the agreement text(Article 4.2), general principles related to textiles, apparel product countries of origin are regulated while Annex 4 describes specific rules of origin by individual textile and apparel product types.

In principle, the country of origin for the textile sector within the Korea-US Free Trade Agreement recognizes domestic origination when thread(yarn) is used to make(weave) textiles and textiles and fabrics are cut and sewn to make apparel end products, a rule referred to as the Yarn Forward rule. Korea, with shortages in raw materials, applies exceptions in the Yarn Forward Rule for linen fabrics, synthetic fiber women jacket, and synthetic fiber men shirts with consideration for the special characteristics of the Korean textile industry. In addition, Annex 4-B was newly established so that future Yarn Forward exceptions can become recognized when procuring materials with domestic shortages. Regulations on customs cooperations between both countries are also included to prevent circumvention of the agreement for textiles or apparel goods. Article 4.3 of the Agreement regulates measures on cooperation between both countries on verifying the accuracy of claims of origin as well as measures that can be enforced according to verification results. There are also regulations on obligations to protect trade secrets of companies within the process of verifying claims of origin.

[Table 1.] Duty elimination period by items

Duty elimination period by items

According to the Korea-US Free Trade Agreement 1-year report published in 2013 KITA, 2013), exports to the United States for 1 year from March 2013 after the Korea-US Free Trade Agreement took effect increased by 1.8% against the previous year while imports decreased by 9.4%. In comparison to decreased global exports of 2.0% due to worsened commerce and trade environment, exports to the U.S. have been relatively stable. Exports of items benefiting from the FTA, such as textiles, apparel, and shoes, have increased 4.3% over the previous year while textile items benefiting from the FTA have increased 9.1%. However, as U.S. customs standards(average 4.3%~11.4%) for textiles, apparel and shoes are quite high and duties will gradually be eliminated over a long period at least 10 years, additional duties reductions and increase exports can be expected in the future.

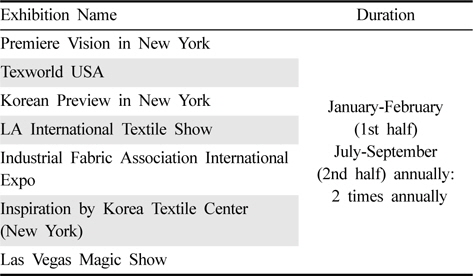

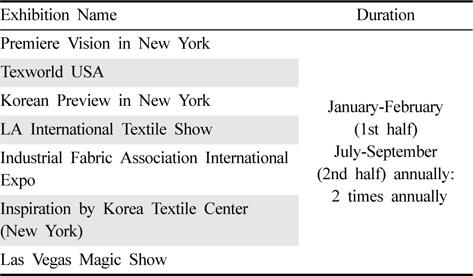

In addition, maybe as a reflection of the positive and encouraging effects of the Korea-US Free Trade Agreement, the increasing number of textile related shows and venues for buyer orders which increase new sales opportunities in the U.S. serve to add possibilities for increased exports in the future.

2.3. Textile Industry of Korea

The Korean textile industry is one of the major high-employment industries of Korea as well as a core traditional industry with high proportions of manufacturing, employment and number of companies. The textile industry comprises 10.2% of all companies, 7.0% of employment and 3.3% of shipment amounts of Korea(KITA, 2010).

In 2010, exports to the U.S. by the Korean textile industry was USD 1.22 billion, exports were USD 360 million for a trade surplus of US 850 million, yet the figure has gradually decreased since 2007(KOFOTI, 2012). On top of this, following the elimination of the 2005 textile quota system, U.S. market share has gradually decreased due to intensified competition with China(19.8%), Turkey(6.4%), India (3.9%), etc(U.S. Census Bureau, 2010).

[Table 2.] Textile related shows, venues to collect orders within U.S.

Textile related shows, venues to collect orders within U.S.

3. Research Methodology and Procedures

Through the study, perceptions and awareness on changes to the Korean textile industry environment following the Korea-US Free Trade Agreement were investigated in order to develop response measures for the changing textile industry.

For the study, fundamental investigation was conducted through a survey aimed at collecting primary data with consideration for the lack of practical company investigations on the Korea-US Free Trade Agreement. As for study subjects, a survey was conducted to 50 Korea textile companies that participated in the TEXWORLD Show held during February 2013 in Paris, France that are currently or planning exports to the United States, excluding companies dealing in specialized sectors, including supplementary materials, apparel and accessories. Korean textile companies subject to survey were designated from a pool of companies currently exporting or scheduled to export to the United States. Industries were limited to textile manufacturing, converters and agents.

For statistical analysis of collected data, data entry and conversion(Datastep) conducted and SPSS 18.0 statistical package was used for analysis. As for analysis methods, frequency analysis was conducted to investigate the general characteristics of respondents.

4. Research Results and Discussion

4.1. Questions of Survey Questionnaire

Questions within the Survey totaled 24 questions in 5 categories. The first category was the general characteristics and business conditions of respondents, second was on perceptions and necessities for the Korea-US Free Trade Agreement, third was on preparations for market changes according to the Korea-US Free Trade Agreement, fourth was on entrance to U.S. market after the Korea-US Free Trade Agreement, and the fifth was on government education and assistance. Prior to conducting the official survey, a preliminary survey was conducted for certain textile officials to investigate the level of understanding for the questionnaire and accuracy of terminologies. Through such, inappropriate questions or terminologies were deleted or corrected. In addition, for the 7 questions on preception, level of agreement was measured using 5-point Likert scales(1 point = ‘Disagree completely’, 5 point = ‘Agree completely’).

For data collection, 50 surveys were distributed and all 50 surveys were collected with researchers have stayed within survey sites. Among them, some surveys with insincere responses were corrected by requesting respondents to redo them.

4.1.1. General Characteristics and Business Conditions of Respondents

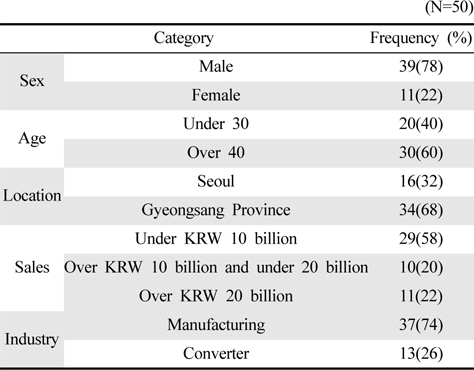

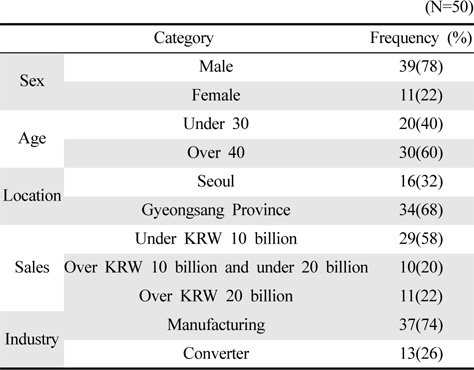

The general characteristics of the respondents are as follows(Table 3). 39 respondents(78.0%) were male while 11 respondents( 22.0%) were female. 20 respondents(40.0%) were under 40 years of age while 30 respondents(60.0%) were over 40 years of age. As for business location, 16 respondents(32.0%) were in Seoul while 34 respondents(68.0%) were in Gyeongsang province. For business sales, 29 respondents(58.%) were in companies with annual sales under KRW 10 billion, 10 respondents(20.0%) were in companies with annual sales over KRW 10 billion and under 20 billion, while 11 respondents(22.0%) were in companies with annual sales over KRW 20 billion. As for industry, 37 respondents( 74.0%) were in manufacturing while 13 respondents(26.0%) were in converters. In addition, average number of employees of companies was 37.82 employees.

[Table 3.] General Characteristics

General Characteristics

Of the respondents, 75% were focused on exports from among domestic sales, exports and imports, approximately 90% were manufacturing textiles while 10% were manufacturing knitting. In addition, responses on business sales compared to the previous year, 56% responded sales had decreased while 44% responded sales had increased. Major export regions were EU and United States while major import regions were China and Japan.

4.1.2. Awareness and Necessities of Korea-US Free Trade Agreement

All respondents were aware of the fact that the Korea-US Free Trade Agreement had taken effect.

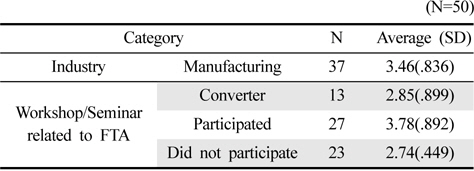

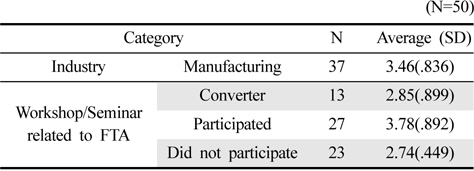

Among them, responses for the question “Are you aware of the major contents of the Korea-US Free Trade Agreement?” showed a response of 3.30 points(Likert scale), indicating above-average awareness. Results on differences in awareness according to industry and workshop/seminar for FTA, manufacturing showed higher awareness levels compared to converters and those received workshop/ seminar related to FTA showed higher awareness compared to those that had not received.

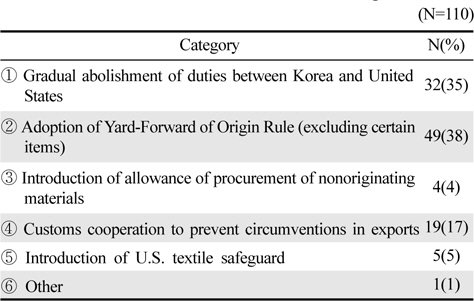

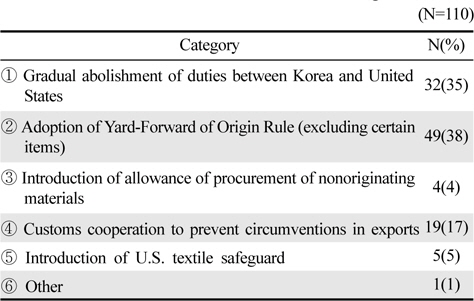

Responses to the question “Among the main contents of the Korea-US Free Trade Agreement, please check all items you are aware of. (multiple responses allowed)” showed that “Adoption of Yard-Forward of Origin Rule” and “Gradual Abolishment of duties between Korea and United States) had highest levels of awareness within respondents.

Responses to the question “Do you feel that the Korea-US Free Trade Agreement is absolutely necessary to revitalize the Korean textile market and increase sales?” showed a response of 2.62 points(5 point scale), indicating less than average perceptions on necessity.

In all, while somewhat positive results were acquired on awareness level for the Korea-US Free Trade Agreement having taken effect and their major contents, somewhat negative results were shown for perceptions on the necessity of the agreement. While more in-depth research will be conducted through the qualitative study, the above data suggests that textile companies view the Korea-US Free Trade Agreement negatively, yet the above average awareness levels suggest that interest in the agreement is relatively high.

Awareness of Major Contents according to Industry, Participating in Workshop/Seminar related to FTA

[Table 5.] Awareness level of Korea-US Free Trade Agreement

Awareness level of Korea-US Free Trade Agreement

4.1.3. Preparedness for Market Changes according to Korea-US Free Trade Agreement

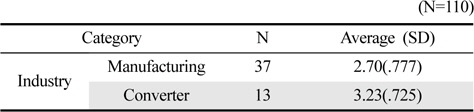

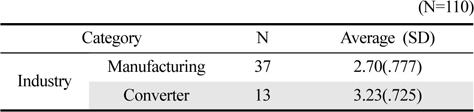

Responses to the question “Have you prepared in advance for changes to the market that will occur after the Korea-US Free Trade Agreement takes effect?” showed an average of 2.80 points, indicating less than average preparedness. Results of verifying differences in market preparedness according to industry showed that Converters were higher in preparedness compared to Manufacturing, suggesting more specialized preparations in thanks to more opportunities for direct contact with the U.S. market compared to manufacturing.

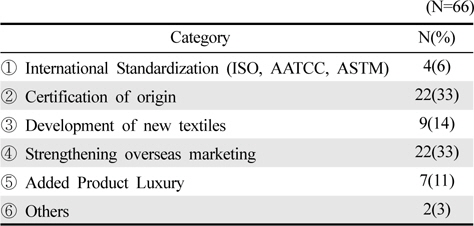

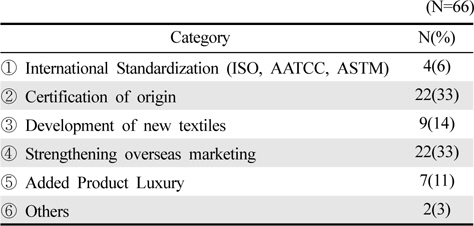

For the question “What type of preparations have you focused on? (respond only to cases in preparation for the Korea-US Free Trade Agreement /multiple checks allowed)”, responses of Certification of Origin and Strengthening overseas marketing comprised 66%.

In all, market preparedness for the Korea-US Free Trade Agreement were below average, with most preparations focusing on certification of origin and strengthening overseas marketing. Certification of origin was the first issue discussed during discussions on the Korea-US Free Trade Agreement, and preparations against this could be seen as an obvious result. In the case of strengthened overseas marketing, it was seen to have been prepared with utmost priority as it is possible to prepare quickly in short periods of time compared to adding product luxury or international standardization.

4.1.4. The Access to U.S. Market after Korea-US Free Trade Agreement

For the question “Do you feel that the Korean textile market has become more vitalized following the Korea-US Free Trade Agreement than before the agreement?”, results showed an average score of 3.06, indicating an above-average level of perception.

[Table 6.] Differences in market preparedness according to Industry

Differences in market preparedness according to Industry

[Table 7.] Contents of preparation for the Korea-US Free Trade Agreement

Contents of preparation for the Korea-US Free Trade Agreement

Response to the question “Is access to the U.S. market being conducted smoothly following the Korea-US Free Trade Agreement?” also showed an average result of 3.24, indicating aboveaverage perceptions on entrance in the U.S market.

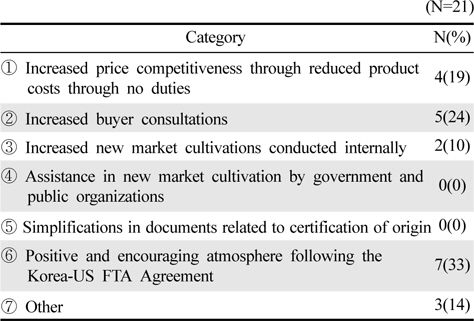

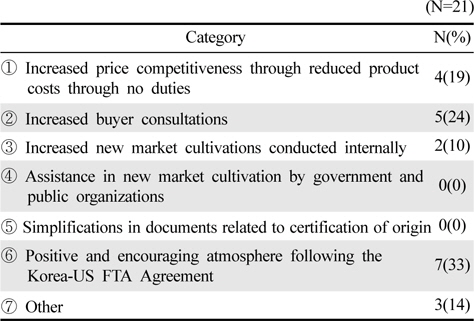

Response to the question “Has the Korea-US Free Trade Agreement actually helped sales for your company?” showed an average score of 3.62, indicating positive results. Response to the more specific question “If the Korea-US Free Trade Agreement has increased sales or revitalized trade with the U.S., what are the factors? (Multiple responses allowed)”, highest results were shown with 33% for “Positive and encouraging atmosphere following the Korea-US FTA Agreement" and 24% for “Increased buyer consultations”. In addition, approximately 50% of respondents answering “Positive and encouraging atmosphere following the Korea-US FTA Agreement” were shown to be well aware of the gradual elimination of duties between Korea and U.S. and Adoption of Yarn-forward of Origin Rule. Such results suggest that companies understanding the basic provisions of the Korea-US Free Trade Agreement experienced the positive market effects created by the FTA. Nonetheless, when considering more than half of the respondents did not respond even though multiple responses were allowed, it is difficult to conclude that increased trade with the U.S. has occurred through the effects of provisions of the Korea-US Free Trade Agreement in the short term. While the atmosphere is more encouraging than before the Korea-US Free Trade Agreement, results indicate there are no provisions directly connected to increased sales.

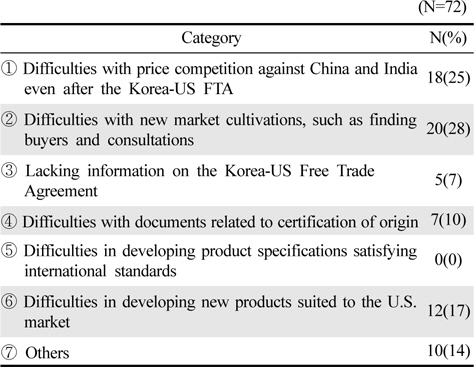

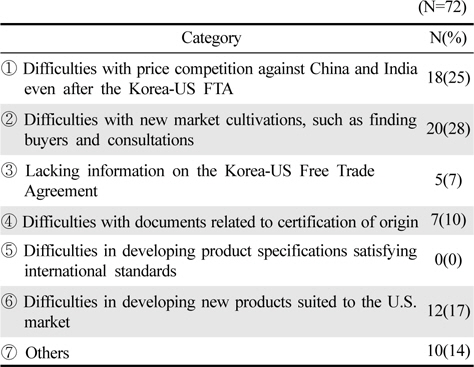

Reversely, responses to the question “if you felt difficulties in entering the U.S. market even after the Korea-US Free Trade Agreement, what are they? (multiple responses allowed)”, 28% responded “Difficulties with new market cultivations, such as finding buyers and consultations” and 26% responded “Difficulties with price competition against China and India even after the Korea-US FTA”. In addition, approximately 80% of respondents answering "Difficulties with new market cultivations, such as finding buyers and consultations” were shown to be well aware of the “gradual elimination of duties between Korea and U.S.” and “Adoption of Yard-Forward of Origin Rule”. Such results suggest a reality that even companies with relatively high levels of understanding of the Korea-US Free Trade Agreement had difficulties using the FTA to resolve their difficulties in cultivating new markets, such as discovering new buyers.

[Table 8.] Trade Revitalization with the U.S.

Trade Revitalization with the U.S.

Results to the question “what textile areas do you expect to be promising according to the Korea-US Free Trade Agreement?” showed 25 responses for industrial textiles and 18 responses for clothing and apparel. Such results are suggestive of having reflected the characteristics of the U.S. market which recognizes technological advances valued within industrial sectors and apparel and clothing exported in end-product form.

In all, the positive and encouraging atmosphere following the Korea-US Free Trade Agreement have resulted in a revitalized textile market and smooth entrance into the U.S. market, in turn leading to increased sales for companies. Nonetheless, many companies express difficulties in entering the U.S. market due to difficulties in cultivating new U.S. markets, difficulties with price competition with emerging countries, etc. Particularly, even after the Korea-US Free Trade Agreement, acquiring cost superiority over China and other third states will not be possible in the short term, creating the need for continued and focused research on countermeasures.

[Table 9.] Difficulties in access to U.S. market

Difficulties in access to U.S. market

4.1.5. Workshop/Seminar and Assistance Provided by Government

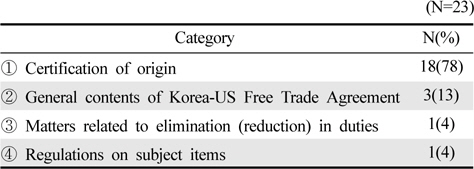

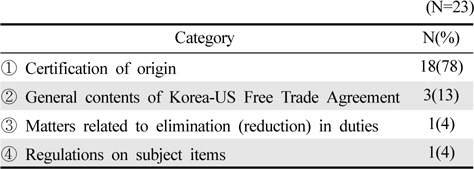

Among all respondents, those that had received education related to the Korea-US Free Trade Agreement had been slightly over half at 54%. The workshop/seminar related to Korea-US Free Trade Agreement provided by government organizations had mostly covered Certification of Origin(78%). The Certification of Origin was focused as the most critical issues.

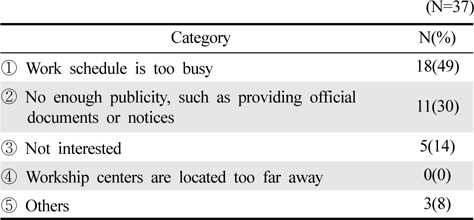

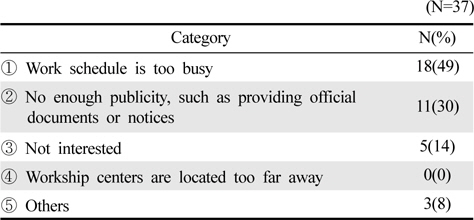

Results on reasons why non-participating respondents had not receive the workshop related to Korea-US Free Trade Agreement showed highest responses with 48.7% for “work schedule is too busy” and 29.7% for “not enough publicity, such as providing official documents or notices”.

For responses to the question “If you intend to participate the workshop related to the Korea-US Free Trade Agreement in the future, what method would be best? (multiple responses allowed)”, 17 responded Visits to companies, 15 responded Briefings, 14 responded Seminars and 1 responded Other.

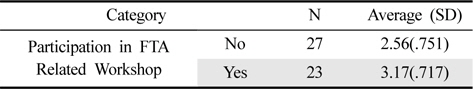

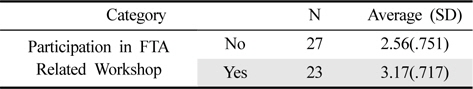

For responses to the question “When facing difficulties related to the Korea-US Free Trade Agreement, have you received systematic assistance from related organizations and government in quick and friendly ways?”, average response was 2.78 points, indicating below average results. Results of verifying whether respondents received FTA related workshop, respondents having received FTA education exhibited more positive responses compared to respondents not participating in FTA related workshop. Such suggests that training participants believed that the government education had been generally helpful.

[Table 10.] Contents of workshop/seminar on Korea-US Free Trade Agreement

Contents of workshop/seminar on Korea-US Free Trade Agreement

Reasons for not participating in the workshop related to Korea-US Free Trade Agreement (N=37)

[Table 12.] Awareness of government assistance according to participation in FTA related workshop

Awareness of government assistance according to participation in FTA related workshop

Responses to the question “What forms of government assistance to you think are necessary to effectively utilize the Korea-US Free Trade Agreement to enter the U.S. market? Please answer according to areas your company requires most.)”, 13 responded workshops and financial support, followed by PR, Marketing investments on overseas shows, Simplified operations, Quick elimination of duties, Support to discover buyers and contacts, Support in developing products suited to the U.S. market, Joint entrance by Korean companies into U.S shows, Investments, Vitalized U.S. sales opportunities and market cultivation.

5. Conclusion and Implications

Based on the results of this study, response measures to successfully enter the U.S. market are proposed as follows.

First, Korean textile companies must invest efforts in developing high-performance, high value-adding products intended for the U.S. market. Due to the long-term economic recession, the U.S. market is changing from high-volume orders to more conservative, small-orders(Koh & Kim, 2009) while needs for new products are increasing in contrast to previous tendencies to seek basic products. Such market changes must be investigated to understand specialized products suited to the U.S. market to lead new product trends. Such items include highly promising items as knits, laces, embroideries( Kim, 2013a), highest quality wools, silk or substitute natural- feeling high-functional synthetic fibers or stretch cottons. These items mentioned by companies participating in this study and were seen to be areas requiring efforts by companies themselves separate from government assistance.

In addition, there is urgency in developing new products that break from imitations created by transforming low-cost basic fabrics or existing fabrics by adding post-processes. In other words, developments with differentiated grounds are necessary by changing thread designation methods, processing methods, and weaving methods. As low-cost fabrics manufactured in China and Indonesia are currently all developed through focuses on post-processes identical to Korean textile companies, creative methods for development are required from the initial stages of production process to create additional differentiations.

Second, active government-led efforts to create new sales channels and opportunities are required by participation in U.S. shows and order sessions. Shows in the U.S. have become more active following the Korea-US Free Trade Agreement, with a variety of exhibits being hosted. While actively participating in such shows within the U.S., there is also a need to establish an identity unique to Korean booths in order to attract visits by U.S. buyers. In addition, participating in buyer sessions conducted regularly by KOTRA and KOFOTI could be another effective measure. However, the biggest consideration when participating in shows and buyer sessions is that visible results are difficult to produce with just one or two instances, in turn requiring years of continuous participation. As overseas buyers, including U.S. buyers, exhibit conservative tendencies, continued investments for at least several years may be necessary. Consequently, it is necessary to invest continuously in overseas shows with persistence and consistency. In addition, rather than concentrating on the number of shows or amount of assistance, the government should conduct marketing on a national level by inviting high-quality buyers to raise the brand power of Korean booths so buyers will ultimately seek Korean brands on their own.

Third, self-sustainability of textile companies must be cultivated through continuous and focused government training. Up-to-date information can be acquired by actively utilizing “Textile Industry FTA Support Center” (www.ftatex.or.kr) currently operated by KOFOTI, with voluntary use by companies being recommended. In the case of companies affected by the Korea-US Free Trade Agreement, utilizing 1:1 customized consulting provided by the government is recommended. In addition, current FTA education is conducted on the textile industry as a whole, so there are difficulties in acquiring FTA strategies suited to each company. Consequently, conducting focused education by textile category and providing solutions suited to the perspectives of each company may be more effective.

Lastly, FTA effects must be maximized through gradual elimination of duties and thorough FTA response plans for agreements with countries around the world. The Korea-US Free Trade Agreement currently in effect has differences in time frames for applying special duties according to textile item. As a result, continued preparations for items scheduled for elimination of duties within the next 5, 10 years are required. In addition, friendly political relations with the U.S. must be maintained in order to add provisions favorable to Korea within the FTA.

In addition, conditions of free trade agreements around the world, not only the Korea-US Free Trade Agreement, must be examined to investigate and respond to effects to U.S. and global trade. In actuality, the Korea-Turkey FTA which took effect this past May 1st, and the FTAs with Canada, China, Indonesia and Vietnam expected to take effect within the next 2-3 years will not only have a significant effect on Korean industries, but also on trade with the United States. Consequently, investigations from various perspectives are required. According to the results of this study, many textile companies believe that future free trade agreements between Korea-Indonesia, Korea-Vietnam and United States-China will have a much bigger impact on Korean textile exports than the Korea-US Free Trade Agreement. As such, the government must pay attention to international circumstances to quickly deliver information to related industries.

This study is the first study to examine the perceptions and their counter plans of Korean textile companies for the Korea-US Free Trade Agreement. It is unique in that a survey was conducted for industry officials for practical investigations on industry conditions. There are differences in the forecasts and research results the Korea-US Free Trade Agreement 1st year report or other studies published prior to this study. Consequently, an in-depth study will be conducted in the future to examine their causes from various perspectives.

The results of this study can be used as foundational data in establishing response measures not only for the Korea-US Free Trade Agreement, but also for FTA with other countries. It is also hoped that this study will be useful in the continued growth and development of the Korean textile industry.