Valorization was defined by Karl Marx as “use of resources for creating or enhancing value in Marx (Marx 1867).” In the context of Science and Technology Parks (STPs), valorization is often defined as the process creating value through transferring inventions and know-how from labs to markets using STPs as a channel.

Open Innovation was defined by Henry Chesbrough (2003) as a paradigm which assumes that firms can and should use external ideas as well as internal ideas, as well as internal and external paths to market, as the firms look to advance their technology. It is also defined to be “Innovating with partners sharing risks and rewards.”

A triple helix model that consisted of three freely overlapping spheres representing Government, Industry and Universities was advanced by Henry Etzkowitz and Loet Leydesdorff (Etkowitz et al. 2000) emphasizing the growing influence and importance of universities in a knowledge economy. Henry in a later paper written explains the rationale for listing universities and not academia in the triple helix since he felt that academic units included specialized applied research institutes that did not have the general mission of contributing to education, research and economic development as the universities did (Etzkowitz et al. 2007).

There are a number of Triple Helixes of innovation that cannot be considered to exemplars of successful valorizations. So, there must be additional actors beyond those listed in the Triple Helix that account for success of valorization process. We will examine two centers of significant successes in valorization in order to understand models of successful valorization ? Silicon Valley in the US and Bangalore in India.

The success of Silicon Valley was enabled not just by the triple helix of Government, University and Industry, especially industry in its role as a knowledge consumer. Two other significant and generally less well known phenomena defined the success of Silicon Valley ? an entrepreneurial ecosystem driven by venture capitalists and angels that benefitted from the new product development policies of large corporations and the presence of national and corporate research labs.

The first phenomenon is the flow of IP from large companies to the start up ecosystem largely due to the new product development policies of large corporations. Many large companies in Silicon Valley would require new product proposals to have the potential to generate upwards of $ 1 billion of annual revenues before they would approve their development and marketing. This enabled product innovations with an initial addressable market of $100 to $300 million of annual revenue and their inventors became rich pipeline for the venture capital community in the Valley. Such startups could easily recruit talent from the government and corporate research labs when they needed to grow. It is this potent combination of inventors without sufficient corporate support backed by venture capital and talent from the research labs that led to the boom in unparalleled and unrivalled valorization in Silicon Valley.

The emergence of Bangalore as an IT hub of India can be attributed to significant knowledge and talent flow from its high-tech labs. Bangalore housed both Defense and corporate research labs including Electronics and Radar Development Establishment (LRDE), Hindustan Aeronautics Ltd., Indian Telephone Industries Ltd., Bharat Electronics Limited, Bharat Earth Movers Limited long before IT industry took roots in that city. IT companies in Bangalore faced with post Y2k growth opportunities recruited highly trained and experienced talents from these research labs. It is interesting to note that the growth of software industry in Bangalore did not really benefit from a Science or Technology Park. On the other hand, Electronic City as an IT company hub was set up only when the government sensed there were some infrastructural challenges, especially in quality of communication infrastructure.

Science and technology parks that embrace the Triple Helix Model and are located in the proximity of large companies, high tech research labs and venture community appear to be ideal candidates to play the role of catalysts for successful valorization. A stellar example of this was the technology park adjacent to Stanford University.

2. KEY ELEMENTS OF SCIENCE AND TECHNOLOGY PARKS

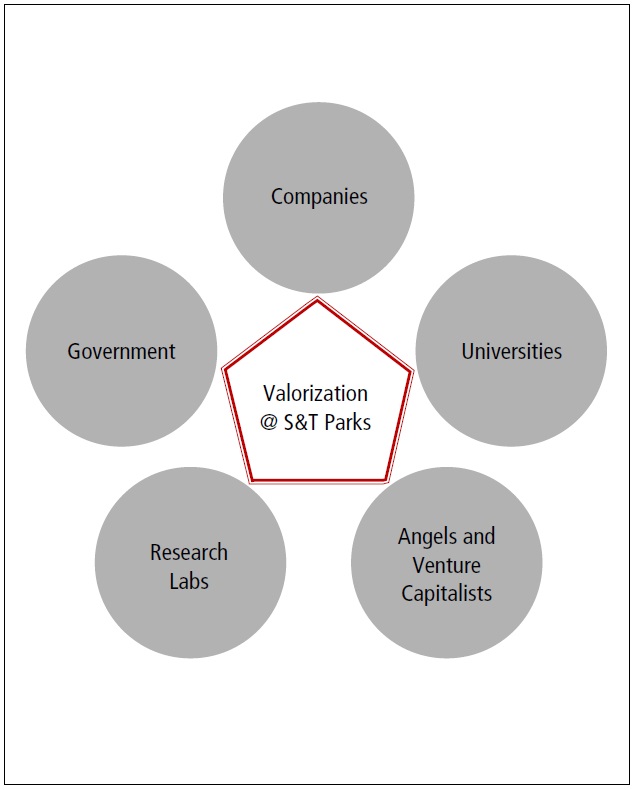

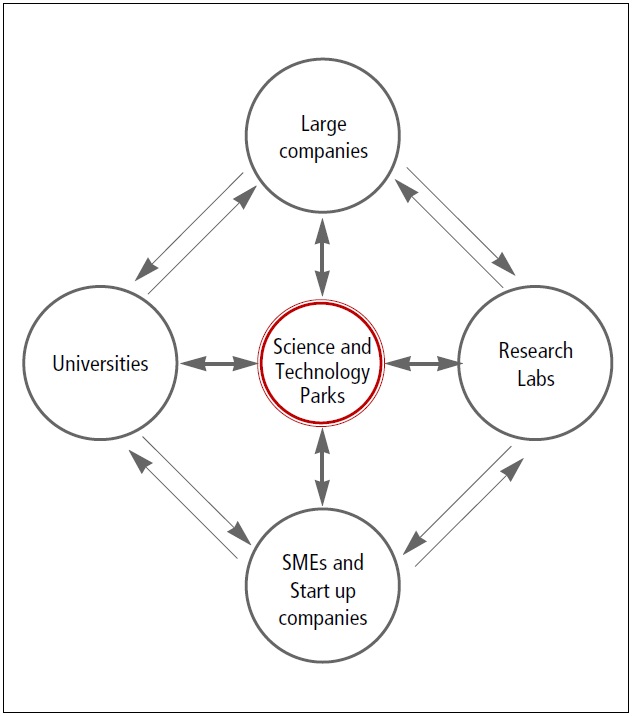

Science and Technology Parks have been studied at length (Wessner et al. 2009). While Triple Helix model certainly made the case for contribution of universities to the valorization process, time is ripe to expand this model to explicitly acknowledge the role of venture capitalists and (both corporate and national) research labs. It is imperative to include Angel investors and venture capital companies, and Research Labs as the additional and necessary stakeholders of a STP. We call this the CUGAR model ? C, representing Companies, U, representing Universities, G, representing Government, A, representing angel investors and venture capitalists and R, representing research labs. These five actors will be referred to as the core stakeholders of a STP in the rest of the paper. The CUGAR model is shown in <Fig. 1>.

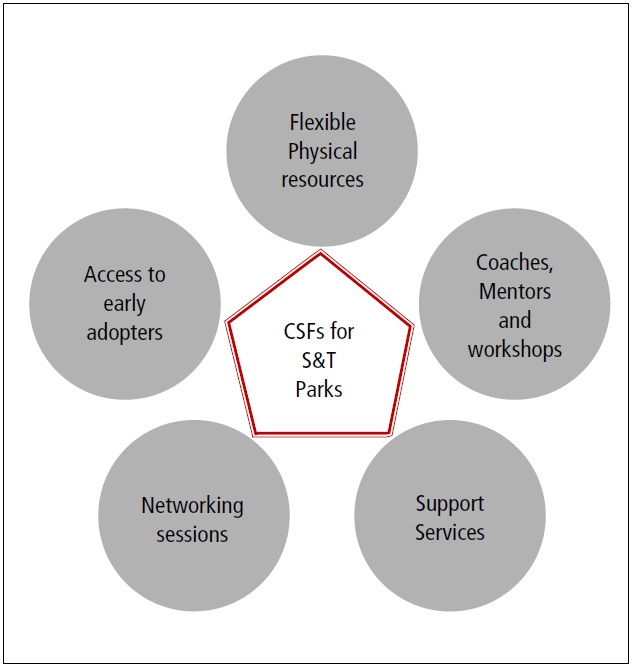

The best run STPs will have an enlightened management that establishes a very conducive environment for catalyzing the valorization process. For example, a STP that consciously facilitates regular and intense networking across its five key stakeholders is destined for success. A study of successful large scale STPs such as Sophia Antipolis in Nice, France or St John’s Innovation center in Cambridge, UK helps us to extract and enumerate the critical success factors of STPs. This collection of critical success factors for STPs is shown in <Fig. 2>.

Let us discuss the above critical success factors in some detail.

2.1 Flexible Physical Resources

STPs that provide for colocation of large companies, small and medium enterprises (SMEs) and startups provide a natural setting for nexus among the three categories of companies. Some enlightened groups such as St. John’s Innovation center in Cambridge, UK provide flexible use of physical resources along two dimensions.

Firstly they allow its tenants to leave or relocate their offices at a very short notice, in their case one-month.

Secondly, they provide different configurations of space that will allow a company to begin its life as a startup, grow into a SME and perhaps even emerge as a reasonable sized large company, all within the same campus. Such flexibility is very useful for companies since it assures some degree of permanency.

2.2 Coaches, Mentors and Workshops

While large companies may not need coaches and mentors, SMEs and startups located in a STP will certainly benefit from coaches, mentors and workshops managed by an STP. Ideally such coaches and mentors should have been successful business leaders or successful serial entrepreneurs who can earn the trust of the companies seeking their advice. In addition, coaches and mentors should come from industrial backgrounds that match the industries in which companies operate.

Well-designed workshops can be useful to all categories of tenants of an STP. Such workshops could include topics such as market research, go-to market strategy, innovation development, sales and marketing planning, CEO coaching, recruiting and tax planning.

We will elaborate a bit more on the wants and needs of the core stakeholders of an STP.

2.2.1 Large companies

Large companies in a STP will be almost self-sufficient. They may gain from sending their employees to some of the workshops. They may occasionally need some consultancy services that are covered under support services listed in section 2.3.

2.2.2 SMEs

SMEs on the other hand will need a number of service providers at the right price point. They will also need help from universities and research institutes for technical knowhow required to develop their next generation of product or service offerings and trained human capital. They will also require help in institutionalizing innovation management process within their organizations in order to fire up all their employees to be innovation oriented and to generate a pipeline of innovation opportunities that can help architect the growth of their company, both in terms of revenues and profits.

2.2.3 Startups

Startups need the most support from STPs. They need help with almost all services listed in

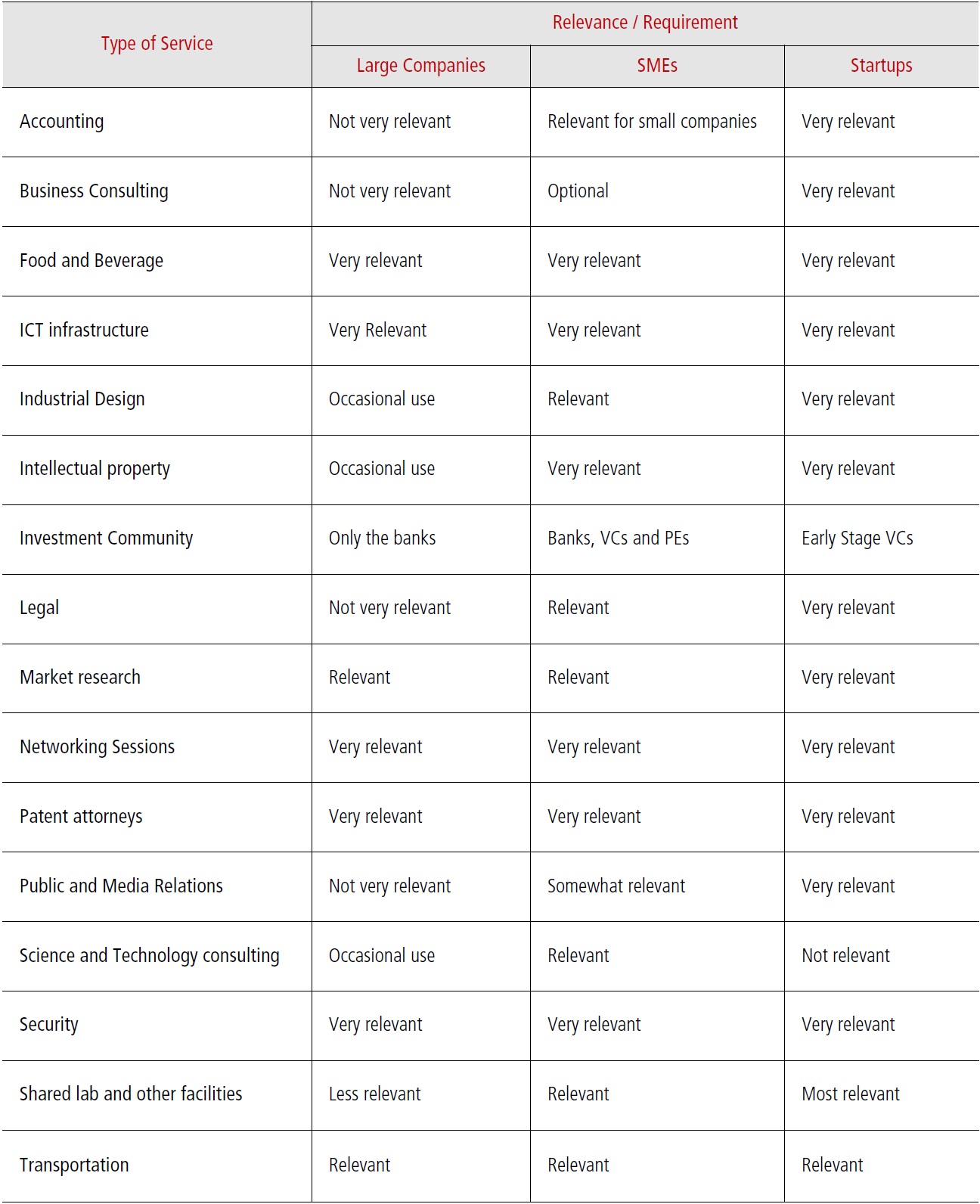

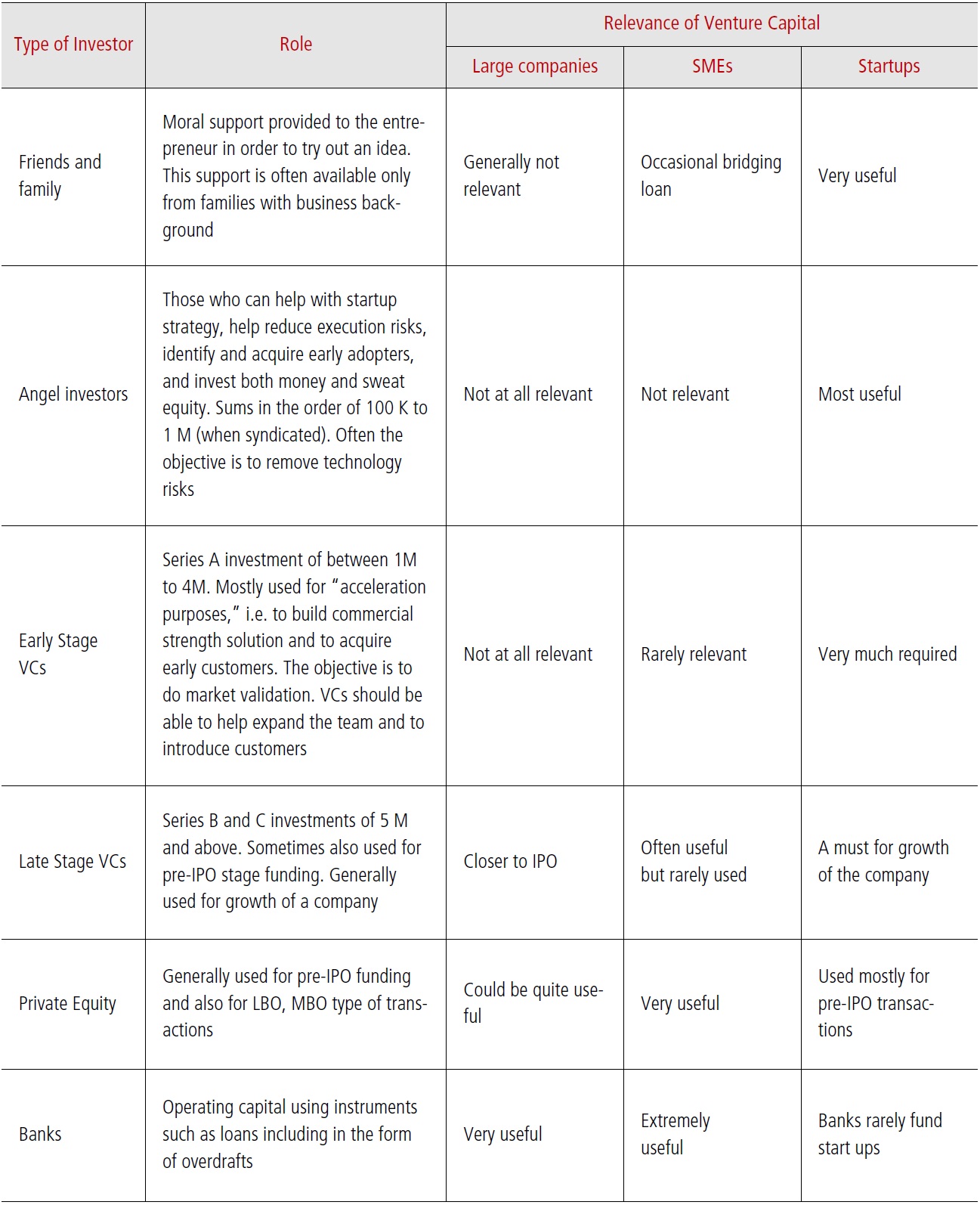

The following support services will provide a catalytic environment for the tenants of STPs. <Table 1> lists the relevance of services offered by a STP to its tenants.

i. Accounting

ii. Business Consulting (including coaches and mentors)

iii. Food and Beverage

iv. ICT infrastructure

[Table 1.] Relationship between Services and Companies in a Science and Technology Park

Relationship between Services and Companies in a Science and Technology Park

v. Industrial Design

vi. Intellectual property

vii. Investment community including banks

viii. Legal

ix. Market research

x. Networking Sessions ? a diverse set targeted at different outcomes

xi. Patent attorneys

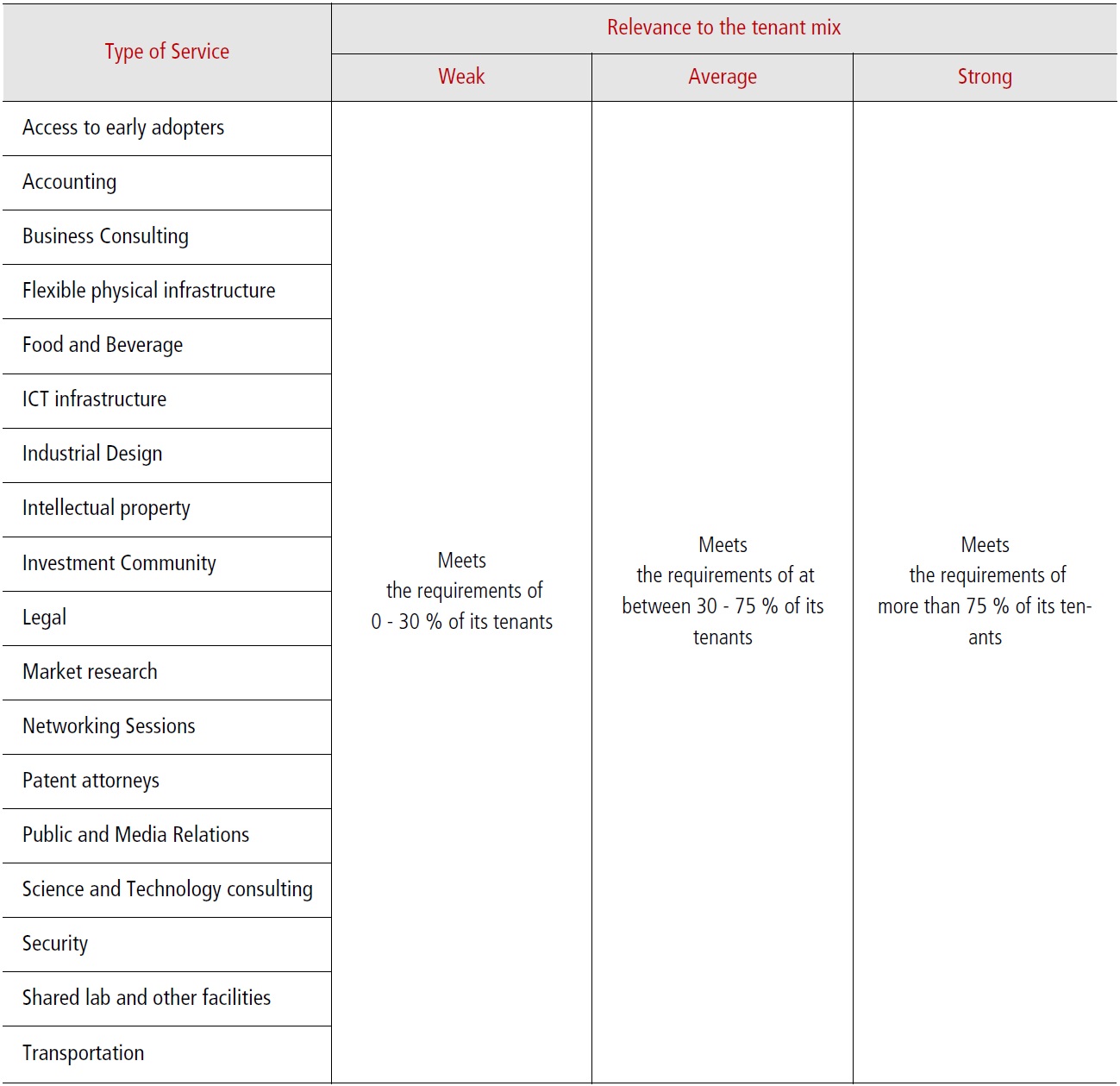

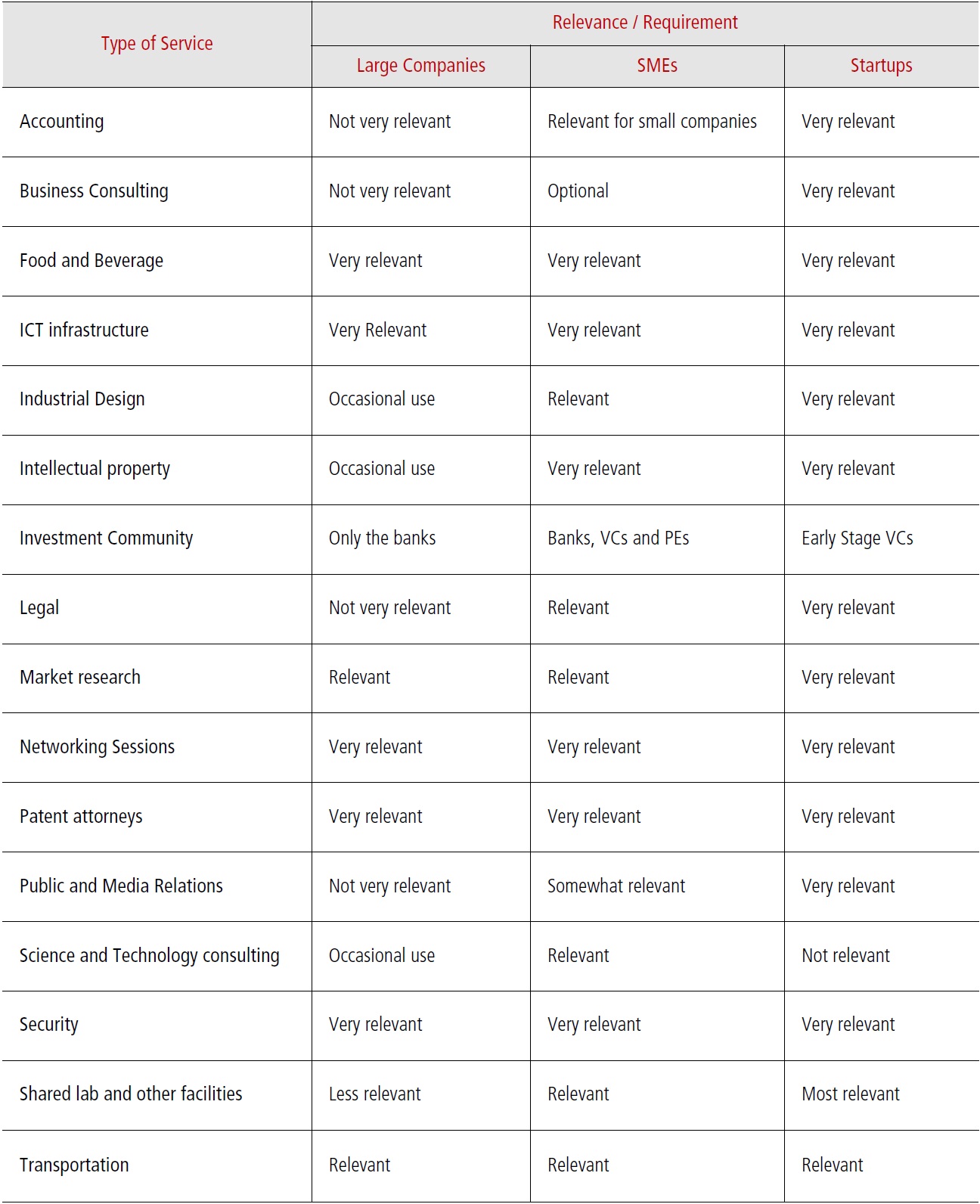

[Table 2.] A Sample Template for Measuring the Effectiveness of a STP

A Sample Template for Measuring the Effectiveness of a STP

xii. Public and Media relations

xiii. Science and Technology consulting

xiv. Security

xv. Shared lab and other facilities

xvi. Transportation

The table shown above can be a useful design instrument for the creators of STPs.

Networking sessions can be of different kinds and some examples are listed below.

i. Networking amongst tenants of a STP:

Such networking sessions will be an enabler of business partnerships across the different types of tenants.

ii. Networking between IP owners and tenants:

These networking sessions will facilitate a much easier flow of IP between the IP producers and owners such as the institutions of higher learning, corporate and national research institutes and the IP consumers who are tenants of a STP.

iii. Networking between Science and Technology Experts and the tenants:

These networking sessions will help bridge science and technology consultants in institutions of higher learning with the tenants of a STP.

iv. Networking sessions between tenants and target customers:

These sessions will allow the tenants of a STP to validate their business/innovation ideas even before they launch on development. Such sessions can also be organized for post development usability/utility assessment.

v. Networking sessions between startups and serial entrepreneurs:

This is a definite requirement in STPs that house startups. Several of the startups will benefit engaging successful serial entrepreneurs as CxOs, members of the Board of Directors or simply as Business/Technology advisors.

vi. Networking sessions between tenants and investors:

These sessions are critical. Investors will range from angels and early stage investors for startups to banks for large companies.

Access to early adopters becomes a very important function of a STP. Such access is important for all categories of its tenants, be they large companies, SMEs or startups.

The management of a STP should use a template such as the one shown in <Table 2> for monitoring, measuring and managing its value to its tenants. It is important that a benchmarking method will have to be designed to match the mix of tenants that a STP houses. Any attempt to rank STPs using a standard template would be futile since no two parks are likely to have the exact mix of tenants.

3. ROLE OF STPS IN OPEN INNOVATION

Open innovation involves two-way flow of intellectual property and perhaps accompanied by transfer of human capital between the core stakeholders of a STP. STPs are natural candidates to become multi-way connectors for Open Innovation across the Universities, Research Labs, startups, SMEs and large companies as shown in <Fig. 3>.

The different types of networking sessions organized by a STP will facilitate its tenants for in licensing and out licensing of intellectual property. These and other networking sessions could potentially lead to flow of human capital as well. Silicon Valley secret sauce to success is to encourage free flow of human capital from one company to the next thereby enriching individuals and the companies that hire them.

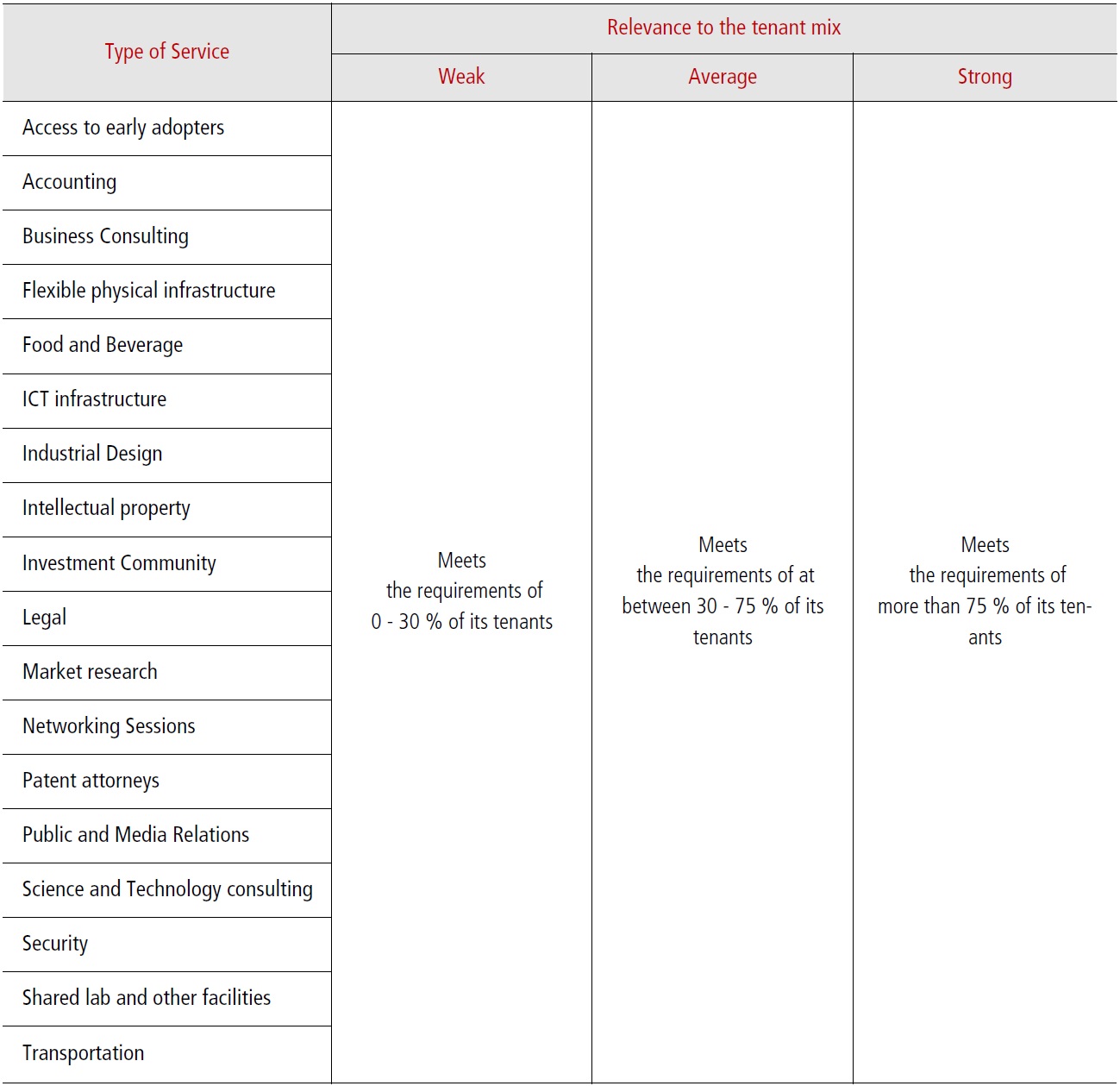

4. ROLE OF INTELLECTUAL PROPERTY IN VALORIZATION

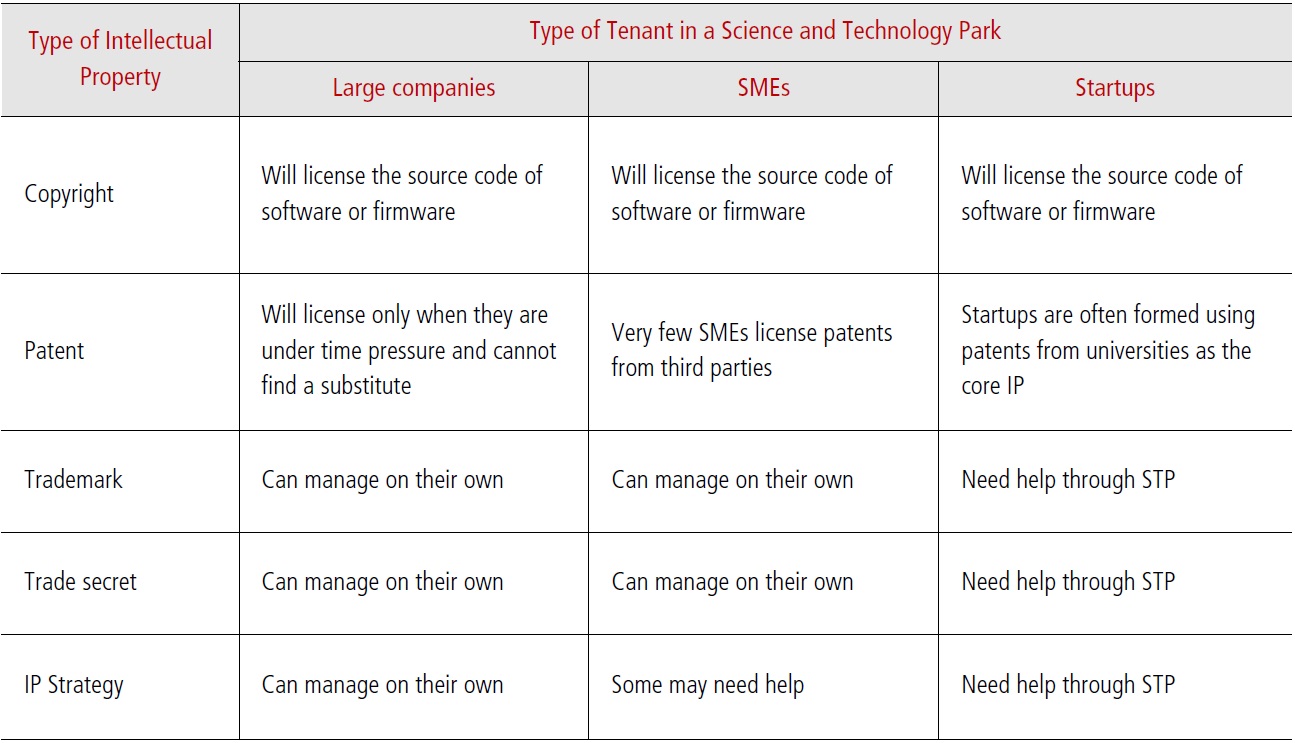

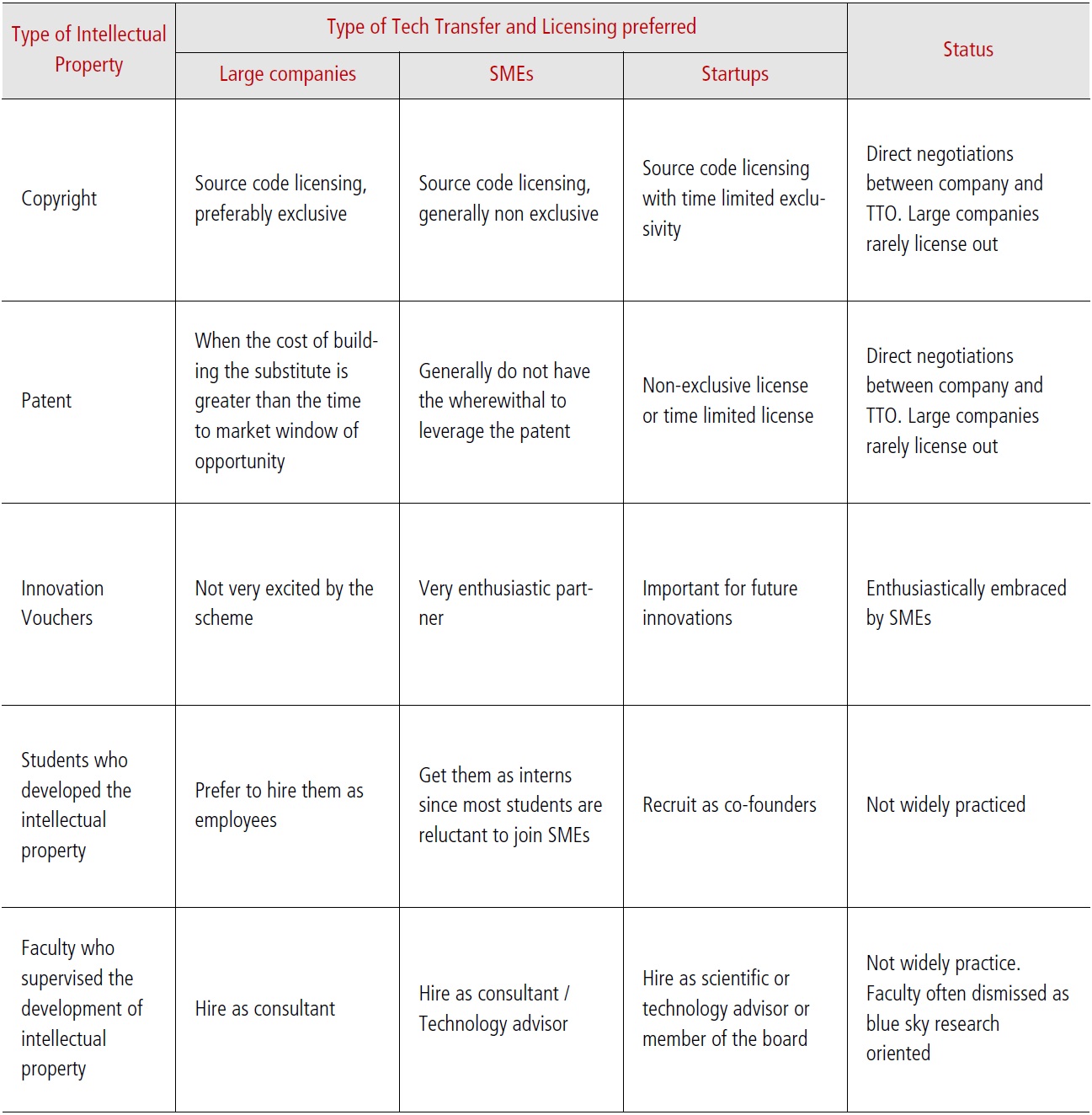

Intellectual property is important in the valorization process. <Table 3> lists the relationship and value of intellectual property to core stakeholders of a Science and Technology Park.

[Table 3.] Value of Intellectual Property to the Tenants of a Science and Technology Park

Value of Intellectual Property to the Tenants of a Science and Technology Park

5. ROLE OF LICENSING OFFICES IN VALORIZATION

Licensing offices need to understand the circumstances under which a third party will license intellectual property. <Table 3> is a good guideline for assessing the likelihood of getting a third party to license the IP managed by a Licensing Office.

Monetizing technology innovations and managing technology transfers have been widely examined by many including the author (Narasimhalu 2006; 2009). The best form of technology transfer is not merely licensing of intellectual properties given that there is a lot of tacit knowledge that will not generally be captured in intellectual properties. Every effort should be made to transfer the tacit knowledge as well. Networking sessions that bring together IP creators, owners and consumers is a very effective mechanism to facilitate the transfer of tacit knowledge to the licensees. Additionally, one or more IP creators can be engaged by a licensee in the form of either a consultant or intern or hired in as an employee.

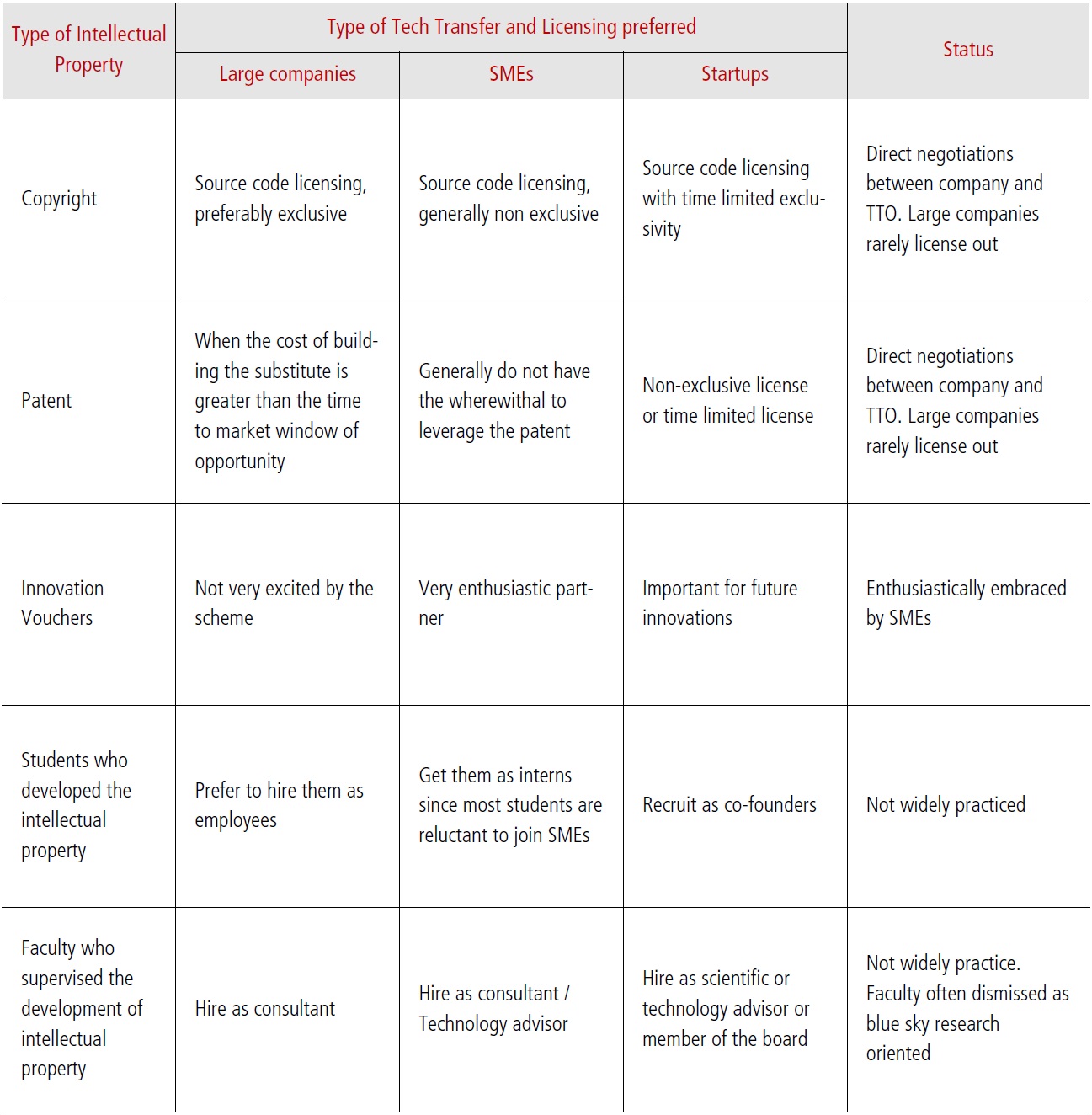

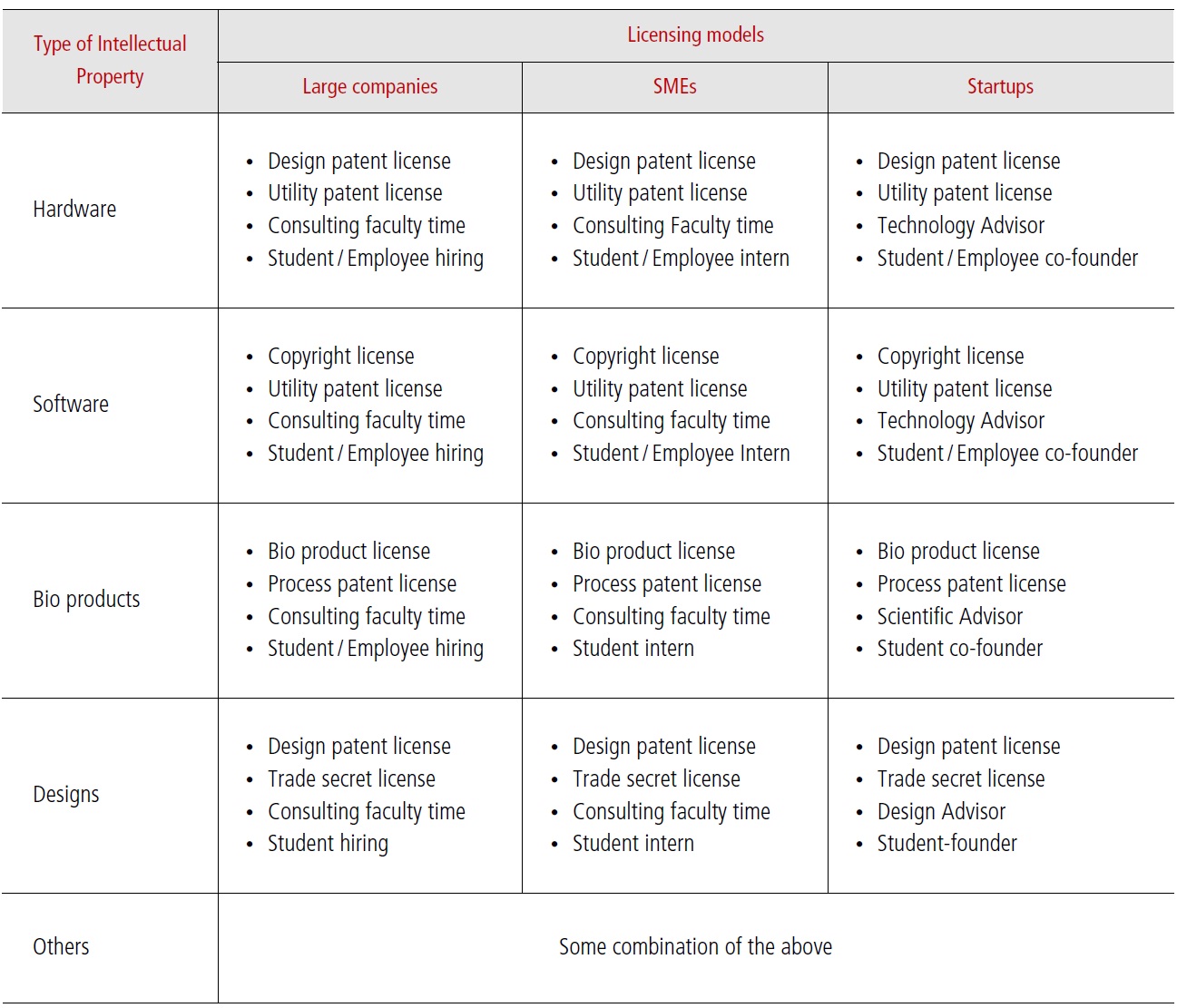

Licensing offices should realize that they should offer licensing proposals that include IP and tacit knowledge transfer rather than a proposal merely for the rights to an intellectual property. <Table 4> captures typical licensing interests of core stakeholders of a Science and Technology Park. The status reported is derived from first hand interactions with several licensing offices in the region.

Companies such as Apple and British Telecom used to pay an annual subscription of around $ 1 million to MIT’s Media lab in order to have non-exclusive access to all the IP as well as the opportunity to station one of their senior managers in the Media lab. It turns out that the companies really valued

[Table 4.] Type of Interest in Licensing from Different Types of Companies and Summary of Status

Type of Interest in Licensing from Different Types of Companies and Summary of Status

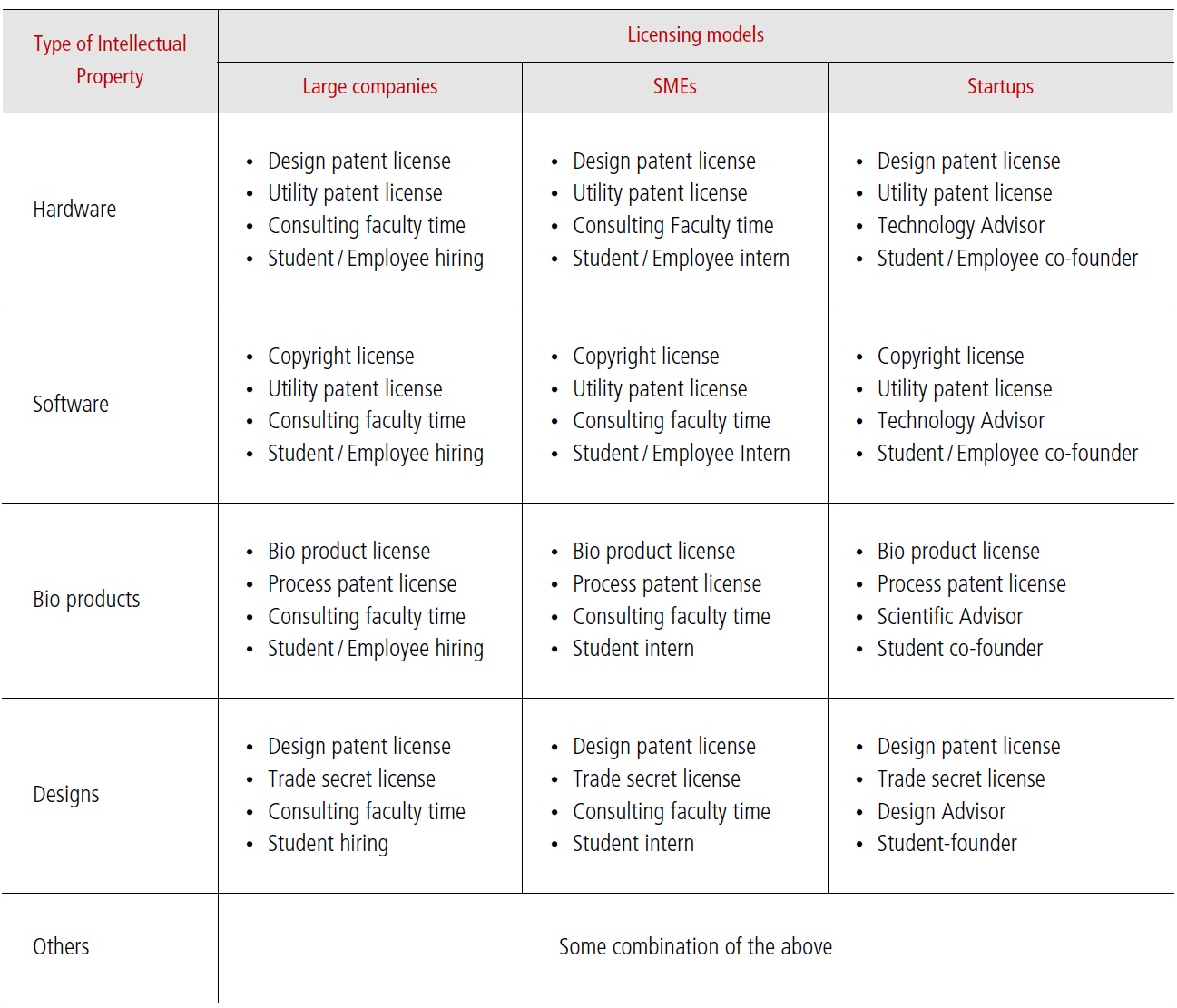

the opportunity for their senior managers stationed in the Media lab to scout top talent and hire them into their companies. These large companies understood the value of tacit knowledge and hence felt it was much more important to hire the “brain” that created the intellectual property than merely license the intellectual property. Hiring the “brain” pretty much accesses all the tacit knowledge along with the non-exclusive license. This is a much more compelling option than merely getting an exclusive license of an intellectual property with no access to the tacit knowledge residual in the “brain” that created. If we believe in this observation then licensing models need to be revisited. Some sample licensing bundles for a university licensing office are shown in <Table 4>.

Licensing offices should structure licenses that enable a comprehensive transfer of the intellectual property created in their organization. The pricing should include three components. The first component is the fee for the intellectual

[Table 5.] Sample License Bundles for University Licensing Office.

Sample License Bundles for University Licensing Office.

property. The second component in the case of a university would be the sum of the fee for the faculty consulting time during the course of the transfer and perhaps a student internship fees. In the case of a research lab the second component should be a fee for its employee’s secondment during the period of IP transfer. The third component in the case of a university should be a fee for helping recruit the student creator. The third component in the case of a research lab may be charge a “transfer fee” if they decided to allow an employee to join an IP licensee. <Table 5> suggests some IP license bundling options that can be used by licensing offices.

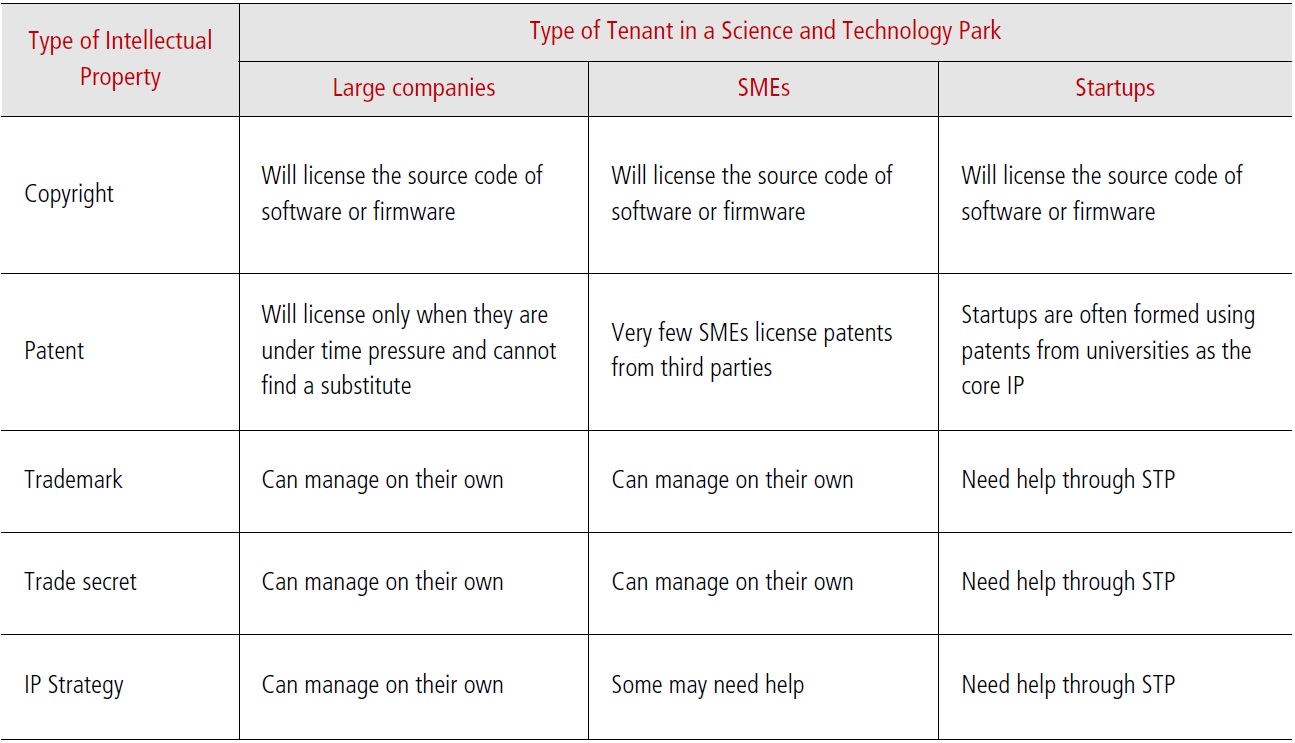

Role and Status of Investment Community in the Valorization Process through Science and Technology Parks.

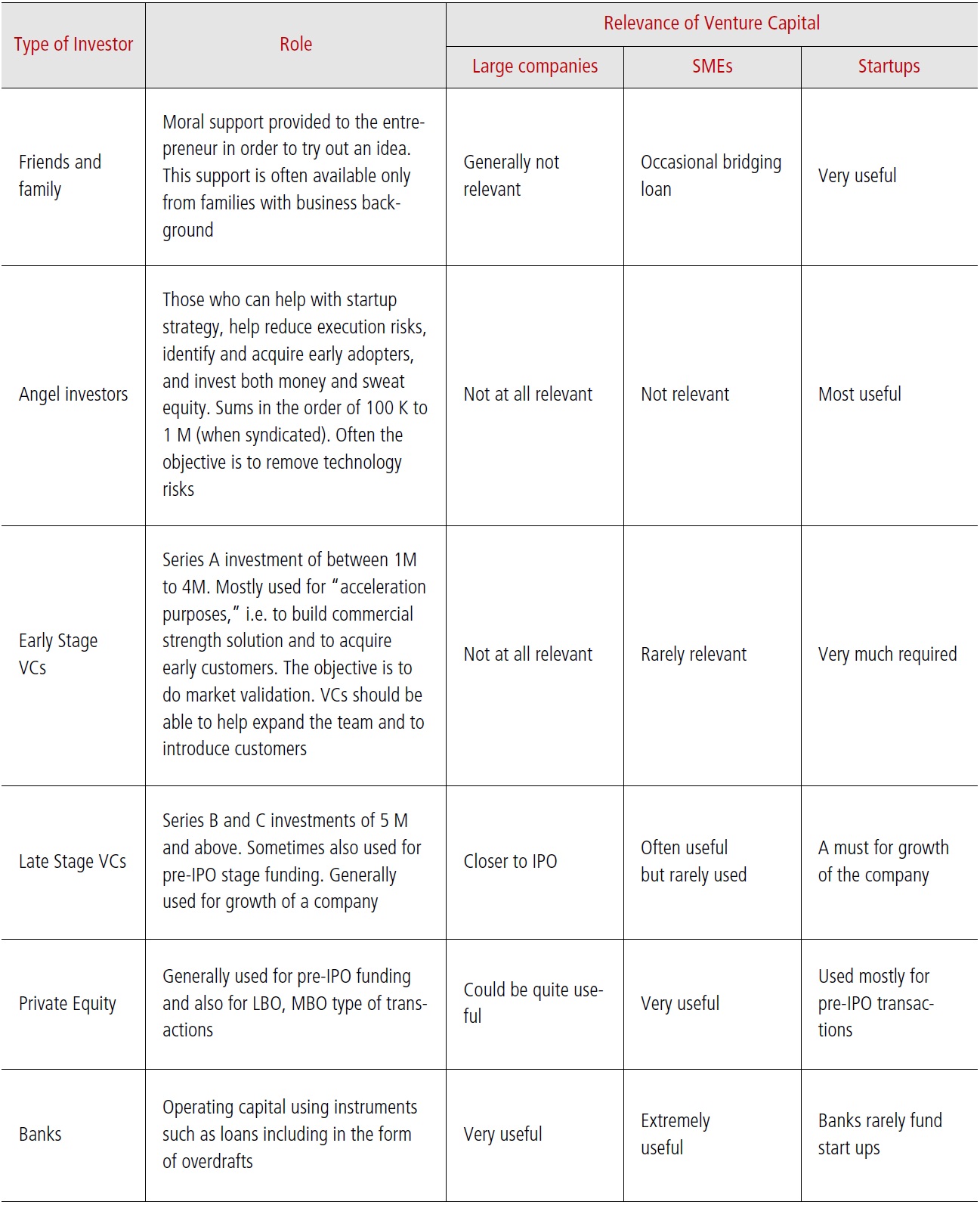

6. ROLE OF INVESTORS IN VALORIZATION

While discussing the role of investors in valorization, it is important to include Angel investors as well since they are likely to do much of the “heavy lifting” before the Venture Capitalists enter the investment scenario. The role of investors in the valorization process is captured in <Table 6>. The table also presents a summary of status for the countries reported in this paper.

This paper introduces motivations for extending triple helix model into CUGAR that can help improve the valorization process in Science and Technology parks. This model has been used to describe Critical Success Factors of Science and Technology Parks. Role of Science and Technology Parks as a catalyst for Open Innovation was then briefly discussed. The key role of Intellectual Property, Licensing offices and Venture Capitalists in the valorization process was also discussed with some suggested approaches. We trust that the contents of the paper will be useful to the designers of Science and Technology Parks.