NONHEGEMONIC TO HEGEMONIC COOPERATION?

This section empirically tracks the institutional developments of the CMIM and the AIIB and compares and contrasts them through the conceptual framework of nonhegemonic and hegemonic forms of cooperation. In this article, nonhegemonic cooperation for institutional arrangement can be defined on a continuum between the levels. At its maximum, nonhegemonic arrangement indicates that there is no single hegemonic actor is either capable of setting agendas unilaterally or even predominantly or exercising veto power for major institutional decisions. In this sense, the IMF and the World Bank are two prime examples of hegemonic cooperation where the U.S. holds veto power as well as significantly determining the overall agenda (the U.S. possesses respectively 16.8 % of vote in the IMF and 15.8% in the World Bank, which exceeds the 15% level to sustain a veto in both institutions over major issues requiring a qualified majority). At a minimum, nonhegemonic arrangements indicate the decoupling of the contribution size of a given state to an institution from the voting power that state wields. Here voting power is derived through the normalized Banzhaf index, which calculates the proportion of times a state will be pivotal in a vote. Most institutional arrangements that require a qualified majority fall within this category, showing strong positive correlation between financial contribution size and voting shares/power. The procedures of the European Union Council illustrate this point well. Also, almost without exception, international lending agencies (i.e., IMF, IBRD, and five regional development banks) adopt voting arrangements in one way or another that are considerably weighted in proportion to financial contribution. The asymmetry of voting shares/power between members strongly remains.

1East Asia in this article is defined as the ASEAN plus Three (China, Japan, and Korea) countries that have collectively undertaken a substantial degree of regional economic cooperation. See Lee (2012b, 8) for the description of East Asian financial cooperation below. 2See, for example, Katada (2012) for an excellent review of works on East Asian financial cooperation. 3An empirical analysis of governance structure can generate a new theoretical puzzle for further studies. As detailed below, for example, the key institutional feature of CMIM is its nonhegemonic form of cooperation. Once that is empirically grounded, one can then ask the question of how and why such a form of cooperation came about. This interesting puzzle, which can be analyzed from various theoretical approaches, transcends the scope of this article and requires a separate work. Nevertheless, some theoretical avenues to investigate the forms of institutional cooperation are suggested in the Conclusion.

THE CHIANG MAI INITIATIVE AND ITS MULTILATERALIZATION

One of the most conspicuous phenomena in East Asian economic relations in the aftermath of the AFC is arguably the emergence and development of what Grimes (2009, 5) calls “East Asian financial regionalism,” which he defines as “[East Asian states’] attempts to reduce currency volatility, to create frameworks to contain financial crises, and to develop local financial markets.” Under the auspices of the APT, which was institutionalized in 1999 by East Asian states as a forum for regional economic cooperation, East Asian financial regionalism has been manifest and developed through three major initiatives: the Chiang Mai Initiative (CMI) (2000) as a framework to contain and manage financial crises, the Asian Bond Markets Initiative (ABMI) (2002) for development of local financial markets, and the agreement to conduct in-depth research on the feasibility of the Asian Currency Unit (ACU) (2006) for reducing currency volatility (exchange rate and currency arrangement).

In this context, on May 12, 2009 in Bali, Indonesia, the finance ministers of the APT member states entered into a unanimous agreement to multilateralize the CMI. When it was launched in 2000, it took the form of bilateral swap arrangements. The Bali decision turned the existing network of bilateral currency swaps into a multilateral currency swap scheme. Subsequently, the Chiang Mai Initiative Multilateralization (CMIM) took effect on March 24, 2010. As discussed in detail below, the emergent CMIM counts as a historic agreement, as it marks the first time that sovereign states in East Asia allowed majoritarian decisionmaking rules to govern an aspect of their interstate relations and constitutes a sharp departure in a formal sense from the so-called ASEAN Way, the norm of unanimity prevalent among ASEAN countries and between ASEAN countries and their three East Asian neighbors, China, Japan, and Korea

The idea of multilateralizing the CMI first appeared in the 2005 Annual Meetings of the APT Finance Ministers in Istanbul. It was a response to a practical, functional need. Since its inception, one of the core institutional purposes of the CMI was to ensure the

In this context, from May 2006, APT countries started to work on the details of multilateralizing the CMI by agreeing to discuss such key issues as total fund size, form of funding, legal modality, proportion of each state’s contribution, and decision- making procedures/voting shares(Chey 2009, 452). Meanwhile, the 2006 meeting produced an interim measure to accelerate the activation of the CMI. That is, the APT stipulated that all concerned parties convene within two days to make a collective decision when a member state applies for CMI funding disbursement.4 The Kyoto meeting in 2007 substantively reinforced the march toward multilateralization. On May 5, 2007, APT finance ministers concluded a basic agreement to launch a multilateral currency swap scheme through CMI multilateralization. At the Kyoto meeting, the Asian finance ministers were forthright in announcing that the envisioned multilateral institution was intended as an “Asian version of the IMF,” which was first proposed by Japan in 1997 at the Annual Meeting of the IMF and the World Bank in Hong Kong (Lee 2008).

On May 3, 2009, APT countries passed a historic milestone by announcing that the CMIM would commence in 2010, thereby translating the basic agreement of 2007 into a concrete institutional manifestation. The APT finalized the details of the new multilateral currency swap scheme and successfully addressed the five key issues (total fund size, form of funding, legal modality, proportion of each state’s contribution, and decision-making procedures/voting shares), that were put on the table at the 2006 APT meeting for multilateralization. The total size of the fund was set atUSD120 billion. The form of funding would be self-reserved reserve pooling. Its legal modality was a single, legally binding contractual agreement. The individual participating member’s contribution was set at USD 38.4 billion for China and Japan and USD 19.4 billion for Korea. The remaining USD 23.8 billion was assessed among the ASEAN countries collectively. Voting shares were finalized accordingly: China, Japan, and ASEAN countries would each have 28.4%, and Korea, 14.8%.

Multilateralization of the CMI involved three additional meaningful institutional changes. The first was the increase in membership. The APT under the CMI included only five ASEAN countries (Philippines, Malaysia, Singapore, Thailand, and Indonesia). The CMIM added to the list the five remaining ASEAN countries: Vietnam, Cambodia, Laos, Brunei, and Myanmar, thus now including all ASEAN countries. Membership extension enabled the CMIM to claim with confidence that it had become a truly comprehensive regional cooperation mechanism in East Asia. The second was to make the CMIM a dollar-based multilateral liquidity support mechanism while foregoing the existing local currency-based bilateral swap arrangements under the CMI. The APT made this move in recognition that the US dollar would likely be both the cause of and solution to liquidity problems. Last but not least, the APT stipulated that the decision whether to lend short-term liquidity support, which requires a qualified majority vote (two-third of votes), should take place within a week of any application by a member state and emergency funding released upon approval. This stipulation is a strong indication of the APT’s commitment to offer timely financial support through the CMIM for a crisis-affected member state.

The CMIM was officially launched on March 24, 2010 but two remaining issues required resolution before it became a fully functioning multilateral institution. One was, and remains, the setting of lending conditionalities for the release of funds. The other was finalization of the surveillance mechanism. The two issues are interrelated in the sense that the effective and appropriate construction of lending conditionalities could not function without an adequate surveillance system. Accordingly, the AMRO (ASEAN+3 Macroeconomic Research Organization) was officially launched in Singapore for surveillance purposes on May 26, 2011. Detailed, protracted discussions on lending conditionalities are currently under way. The issue here is how to align them with “Asian” characteristics, transcending or even competing with the IMF’s one-size-fits-all program. Were it not for the establishment of different lending procedures and conditionalities, that reflects the unique socio-economic conditions in East Asia, there would be no sufficient rationale for the existence of the CMIM. In other words, it would likely just function as a regional office of the IMF. Flexibility (in terms of local economic needs and conditions), accessibility, speed of disbursement, and prevention of moral hazards are key words surrounding the design of CMIM conditionalities.

As such, what started out as a simple mechanism for addressing short-term liquidity difficulties in the region has become an institutionalized framework for region-wide dialogue and cooperation. The CMIM now reflects not only self-help and support mechanisms but also capital flow monitoring, policy reviews, coordination, and collective decision-making. In the process of institutionalizing the CMIM, the most salient outcome is the nonhegemonic characteristic of its decision- making mechanism.

The term nonhegemonic institutional arrangement is defined as the absence of a single hegemonic actor with the power to set agendas and exercise veto power for institutional decisions. At a minimum, the nonhegemonic arrangement refers to the decoupling of the contribution size of a given state to an institution from the voting power that state wields. As discussed more in detail below, veto power over such a major institutional decision as the release of CMIM funding requires one third (33.3%) of voting shares under the CMIM, which no single country has under the current arrangement. Agenda setting power is not a privilege any particular member has, either. The CMIM is managed through each annual APT finance ministers’ meeting (Board of Governors). The annual meeting is co-hosted by two countries, one from ASEAN countries and the other from China, Japan and Korea. Agendas are set by these two co-hosts as chairs of the particular annual meeting. As such, equal distribution of agenda-setting power is built in the CMIM management system. This nonhegemonic cooperation diverges from the prevailing practice of a positive correlation between financial contribution size and voting share/power favored by other multilateral institutions. The equality of agenda-setting power adds to this feature.

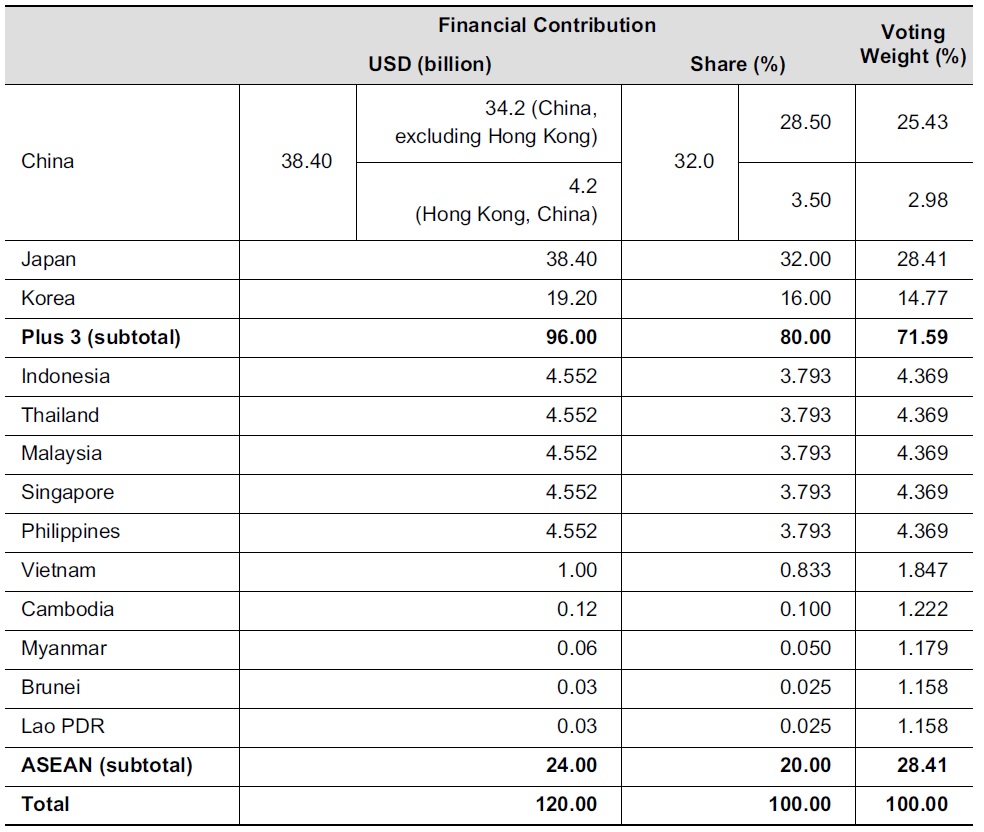

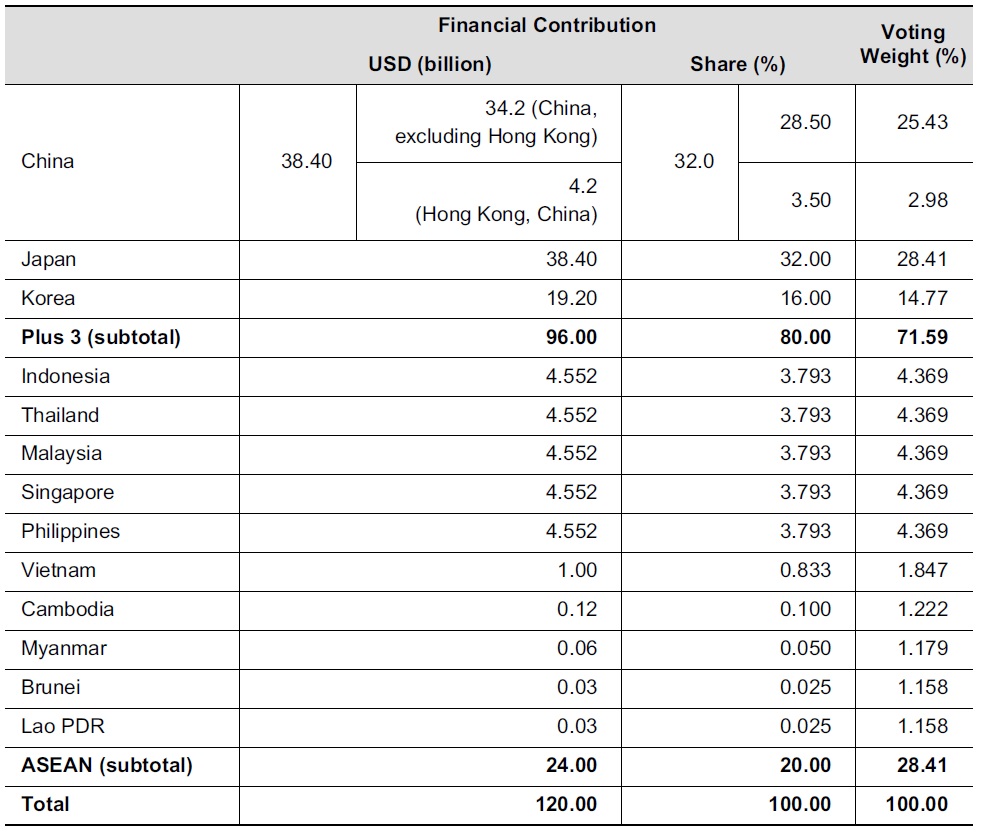

At first glance, however, the CMIM appears to be a hegemonic, weighted-voting arrangement corresponding roughly to financial contribution size (see Table 1 below). For example, China and Japan, which contribute most to the multilateral scheme (USD 38.4 billion each out of USD120 billion), each receive 28.4% of voting shares. Korea is entitled to only 14.8% voting share as it provides the smallest financial contribution (USD 19.4 billion). In the case of ASEAN, there is a fair degree of misalignment. Although its collective contribution (USD 23.8 billion) is less than the contribution of either China or Japan, ASEAN co-equals with China and Japan with the same voting share (28.4%).5

Representation under the Chiang Mai Initiative Multilateralization (CMIM Contributions and Voting-Power Distribution)

Despite this appearance, a closer examination of how major issues are to be decided with respect to veto power and how agendas are expected to be set clearly demonstrates the nature of nonhegemonic cooperation under the CMIM. The most optimal way to examine this nonhegemonic cooperation is to illustrate how Korea, the member with the smallest voting share, is not at a disadvantage in any meaningful sense along the two dimensions noted above. Korea is arguably the country that most benefits from such an arrangement. Korea, for example,

The first dimension is veto power. New members requires consensus among all members. In this regard, every member has veto power. Financial assistance and extension require a two-thirds vote by all members. However, China, Japan, and ASEAN each have only 28.4%, which is less than the 33% required for exercising veto power. As such, no one has veto power on this issue, and thus Korea again is not at a disadvantage. Taken together, Korea’s veto power is not qualitatively different from that of China, Japan or ASEAN.

The second dimension is agenda-setting power. In a collective decision-making body, agenda-setting power is typically held by the chair. Accordingly, the issue is how to select or allocate the chair. The CMIM’s agenda-setting power works on rotation basis. As noted above, the annual meeting of the CMIM is co-hosted by two members: one from China, Japan, or Korea and the other from an ASEAN country. Therefore, like China and Japan, Korea is expected to host the annual meeting every three years along with its ASEAN co-host partner. This means that these three countries would have an equal degree of agenda-setting power regardless of the difference in the size of their financial contribution. Therefore, in terms of both veto and agenda-setting power, Korea is as well positioned as its three bigger counterparts.

4For further details, see the “Joint Ministerial Statement of the ASEAN+3 Finance Ministers’ Meeting,” May 4, 2006; accessed at

ASIAN INFRASTRUCTURE INVESTMENT BANK AND CHINESE HEGEMONY?

In contrast to the institutional development of the CMIM, the AIIB has the potential to assume the hegemonic form of Chinese-led cooperation. Although it is true that the final form of AIIB’s institutional arrangement has yet to be concluded by the participating states (and some observers such as Korea), China, which proposed the AIIB, seems intent on having it work under China’s firm control. As discussed below, China’s proposed form of the AIIB’s institutional arrangement arguably goes beyond U.S.-led hegemonic cooperation, an example of which is the IMF. Interestingly, China’s institutional vision for the AIIB appears to betray its own longstanding stance of constructing nonhegemonic multilateral cooperation. China, for example, circulated the idea of developing a norm-based, post- Cold War multilateral cooperation when it spearheaded institutionalizing the decision-making rules of the Shanghai Cooperation Organization (the SCO). As a result, the SCO assumed the form of consensus-based decision-making (expressed as “agreement without vote” in Article 16 of the SCO Charter). This decision-making rule enables all members to exercise virtual veto power in spite of the fact that China and Russia contribute most, 24% each, to the SCO’s budget (Wang 2011, 116-118).6

In China’s proposed form for the AIIB, China will exercise not only veto and agenda setting power, which are two crucial dimensions for determining the type of institutional cooperation. China also shows an interest in directly controlling the processes of the AIIB’s major investment decisions and policies. One case in point is that China proposed the creation of the AIIB without a permanent member- based board of directors. As in the case of the IMF, CMIM, and elsewhere, the board of directors usually operates on permanent member basis and has authority for planning, approving, and overhauling an institution’s major projects. Although the authority rests with the board of directors to which members are appointed based on agreement among the member states, an institutionalized board of directors is regarded as the most important apparatus designed to ensure the institution’s autonomy from major donor states. As such, China’s AIIB proposal has invited speculation from pundits and experts that China finally has finally revealed its hegemonic intention to mold world politics in a Chinese direction.

The idea of the AIIB was first presented in October 2013 when China’s President Xi Jinping announced the creation of the AIIB just before the APEC meeting in Bali, Indonesia. Premier Li Keqiang, following Xi’s lead, rearticulated China’s AIIB proposal at the Boao Forum for Asia in April 2014 by unveiling details of the AIIB’s launch. Li proposed that the AIIB be established in October 2014 through an intergovernmental memorandum of understanding among participating states. Subsequently, the first general meeting of the AIIB was held in Beijing on October 24 this year. Initially, 21 states (in addition to China) approved MOU for the AIIB, including Mongolia, Uzbekistan, Kazakhstan, Sri Lanka, Pakistan, Nepal, Bangladesh, Oman, Kuwait, and 12 ASEAN countries excluding Indonesia. Indonesia announced its intent to join the AIIB on November 3. At the time of this writing, Great Britain, France, Germany, and Italy just signed up to join the AIIB. Korea, Australia and New Zealand are seriously considering China’s invitation to become members of the new institution. Worthy of note is China’s initial exclusion of the U.S. and Japan. The exclusion of the U.S. may not be so surprising, given that the CMI has developed over the last 15 years without the U.S. (Lee 2012a) but China’s exclusion of Japan attests to the AIIB’s uneasy relationship with Japan-led Asian Development Bank (the ADB).

As its name implies, a set goal of the AIIB is to galvanize emerging Asian economies by financing large-scale economic infrastructure investment. The AIIB is a tool for addressing the vast unmet demand for productive economic infrastructure in Asia. The method for doing so is to steer the massive accumulation of savings in China and elsewhere toward large scale, long-term infrastructure developments in Asia, which private investment often cannot address due to risks and uncertainties about future rates of return. Furthermore, both the World Bank and the ADB, the two well-established existing multilateral development banks, failed to finance and do not have the capacity to finance much needed infrastructure developments in Asia. The World Bank has USD 223 billion of subscribed capital (paid in capital plus callable capital) and can loan about USD 50 billion per year. According to one estimate, USD 50 billion barely covers the annual financing gap between 2015 and 2019 for Indonesia’s infrastructure requirements alone (Economic Watch October 22, 2014).

The ADB’s subscribed capital is a comparatively small USD 78 billion (estimated). Although the ADB, unlike other regional development banks, allocates the majority of its investment to infrastructure, the annualUSD800 billion required for Asian infrastructure developments dwarfs the ADB. The ADB itself estimated in its 2011 report that developing Asian economies should invest USD 8 trillion from 2010 to 2020, just to keep pace with expected infrastructure needs. In this regard, China, the largest creditor in the world with USD 4 trillion in foreign reserve, is finding infrastructure financing a niche market for China’s international role and prestige and its massive savings can be effectively used for diplomatic purposes. Arguably, the AIIB is a sequel to the New Development Bank (the NDB) that the BRICS agreed to launch in July 2014. As discussed below, China played a major role in initiating and institutionalizing the shapes of the NDB.

In institutionalizing the AIIB, China proposed three interrelated ideas to boost China’s influence in the new institution. The first one concerns funding size. China proposed that the AIIB start with an initial authorized capital of USD 100 billion (subscribed capital is likely to be around USD 50 billion). China will contribute USD 50 billion, half of the initial capital, to the AIIB, the other half to be funded by the remaining participating members. China suggested that the amount of funding each member state would be responsible for would depend on the size of its GDP. The second is the composition of the Executive Committee and its functions. China suggested that China would exercise full discretion over the selection and appointment of Executive Committee members. This, of course, does not necessarily mean that all Executive Committee members would be Chinese nationals. Additionally, China proposed that it be the nucleus of AIIB functions. In China’s scheme, the Executive Committee would take charge of feasibility analysis of AIIB projects, investment planning, project implementation and investment overhaul, functions normally assigned to the board of directors in other international financial institutions (IFIs).

Third, China proposed that the AIIB function without a permanent memberbased board of directors. Instead, the board would be staffed by nonpermanent members who would just oversee the appropriateness of the AIIB’s organizational management. Since the Executive Committee would hold the key to major institutional decisions for the AIIB, the Board of Directors would be relegated to a discussion forum, convening once every three months. China’s rationale for a weak board of directors is to avoid the charges of inefficiency and political tug-ofwar frequently leveled against existing practices of board of directors in other IFIs. In China’s view, the board of directors as an institution is characterized by directors(often linked to donor states) jockeying for special interests rather than being objective, autonomous and impartial in planning and implementing projects (

All three ideas are not conventional in light of prevalent IFI practices. For most IFIs, the contribution of the largest donor state is usually less than 30% of the total fund. For example, the U.S. and Japan co-equal with 15.6% of total funding of the ADB. Considering that contribution size tends to go hand in hand with voting shares, China’s 50% share does seem to suggest China’s intention to put the AIIB under its firm control.

The elevation of the Executive Committee and relegation of the Board of Directors are opposite of what is normally observed at IFIs. The board of directors is responsible for major institutional decisions while the executive committee assists the board of directors in functioning effectively by providing managerial services and reporting preliminary investigations of proposed projects. Members (or directors) of boards of directors are either appointed or elected by member countries or by groups of countries. It is headed by the managing director of a given IFI and its authority derives from agreement among member states to delegate decision-making power to board of directors. Because of its professionalism and agreed-upon delegated power, the board of directors as an institution is regarded as necessary to check and balance the interests of major donor states and thus maintain institutional autonomy. Although the question of the degree to which the IFIs enjoy autonomy from the influence of major donor states has long been debated among realists, liberals, and constructivists in the field of International Relations, there is no contestation over the fact that the establishment of the institution of board of directors is a minimum condition for institutional autonomy if it to ever exists at all. As such, China’s proposal to usurp the prerogatives of the AIB Board of Directors appears to reflect China’s determination to tightly control the AIIB through a two-step process; China controls the Executive Committee, which in turn assumes the functions of the board. Will the AIIB be institutionalized in the way China has proposed, and thereby take the form of hegemonic cooperation?

6An additional feature of the SCO’s nonhegemonic cooperation is the so-called “voluntary principle.” The voluntary principle stipulates that member states have complete discretion as to whether they will take part in cooperative projects endorsed by the SCO. See Wang (2011, 118). See also Aris (2009) for a comparative analysis of ASEAN and the SCO for key institutional similarities and differences, including consensus-based decision-making. As for the China-Russia rivalry in the SCO, see Salum (2013).

FUTURE OF INSTITUTIONAL COOPERATION IN THE CMIM AND THE AIIB

This section explores the future direction East Asian financial cooperation might institutionally take with particular attention to China’s rise. As for the CMIM, this section illuminates some of the key institutional challenges ahead for the CMIM and explores whether the AIIB will be institutionalized in a hegemonic form as China is envisioning. For this investigation, China’s institutional bargaining with BRICS members for the establishment of the New Development Bank (NDB) in 2013 is exemplified. This case is illustrative in terms that the manner in which China is approaching the development of the AIIB has many parallels to China’s

>

THE CMIM AND INSTITUTIONAL CHALLENGES

From a geopolitical point of view, the next 5-10 years loom as the best chance for East Asia to attain regional financial cooperation because all major stakeholders in East Asia will strive for regional cooperation expansion in this period, albeit for differing reasons.7 China, who has been actively supportive of institutionalizing East Asian financial and monetary cooperation, is likely to continue its commitment to this end for the next decade. It is improbable that China will overtake U.S. national power by 2020. As such, for a peaceful rise, China will need to construct cooperative relations with East Asian countries both practically and symbolically (Sohn 2009, 2012a; Jiang 2010). As for Japan and ASEAN, they will endeavor to institutionally constrain China during its expansionary period, not when it is at its peak. This has become one major impetus driving their support for institutionalizing East Asian cooperation (Hayashi 2006; Grimes 2009; Katada 2009; Ba 2010). In light of both the 1997 and 2008 financial crises that shook the Korean economy and threatened to overturn it completely, the importance of financial stability through the CMIM cannot be overstated to Korean policy makers.

China has a good understanding of East Asian institutional lock-in strategies. Nevertheless, China is likely to continue its support for such institutionalization for the following mutually non-exclusive reasons. First, China can promote mutual trust within the region and create a positive local atmosphere through the institutionalization of financial and monetary cooperation. The favorable local conditions can position China better when it deals with strategic challenges within and outside of East Asia. Second, multilateral institutionalization binds China; however, it also binds other countries institutionally as well. As China’s influence in East Asia grows, the double-sided institutional constraint could work in China’s favor. Moreover, a policy derived through multilateral discussions can obtain legitimacy, which would further sustain China’s influence in East Asia in a nonhegemonic way (Ikenberry 2001). Additionally, working through a firm regional institutional foundation is much more appealing for China (as is the case for Korea) in its competition with the United States and Europe for global leadership. Last, China can entertain “the learning effect” for global leadership. China can cultivate its leadership prowess in multilateral settings through its repeated interactions with East Asian member states, which in turn can be translated into assets for China’s global leadership, if used properly. China has already begun tapping into its multilateral experiences in East Asia when pursuing multilateral diplomacy in Africa, the Middle East, and Latin America (Sohn 2012b).

Along with these favorable strategic environments, the current institutional development level of East Asian regional cooperation calls for more robust institution- building efforts from the APT. True, the APT has successfully mustered regional cooperation for the subsequent development of the CMI, CMIM, and AMRO, a remarkable achievement for a region that cannot boast of a solid track record in region-wide institution building experiences. It is also laudable, considering the diversity among the APT states in ethnicity, religion, political systems, economic development, and security arrangements. Not many pundits and scholars predicted correctly the institutional survival of the CMI when the APT got off the ground in 1999, let alone the emergence of the CMIM and AMRO.

Despite these institutional developments, there are still many challenges for the APT to meet if it intends to turn the CMIM into an Asian Monetary Fund (AMF), a full-fledged regional institution. Two issues particularly loom large in this respect. The first challenge is to clarify the logistics of activating the CMIM in times of financial crisis. This is pertinent to the APT’s agreement on lending prescriptions and conditionalities under the CMIM. Clarifying and institutionalizing them is critically important precisely because it directly relates to the CMIM’s institutional ontology (Cho 2014). If the CMIM is to have the same lending prescriptions and conditionalities as the IMF, there would be no rationale for its institutional development, other than, say, that the CMIM is a regional office of the IMF and functioning as a cash cow.

Re-establishing the CMIM’s relationship with the IMF is also crucial. Under the current CMIM system, 70% of funds for an emergency bailout are linked to the IMF. Indeed, the portion de-linked from the IMF increased from 10% in 2000 to20% in 2005 and again to 30% in 2013. The APT plans to increase IMFdelinked funds up to 40% in the near future. Korea was a co-chair country of the APT Finance Minister’s Meeting and played a major role in increasing IMF delinked funds to 30% in 2013. IMF de-linkage is likely to increase further when the APT clarifies and institutionalizes the CMIM’s lending prescriptions and conditionalities. In this respect, AMRO’s role cannot be overemphasized. After all, AMRO is the only surveillance unit in East Asia. The contents of lending prescriptions and conditionalities are inseparable from how surveillance functions, monitors, and reports. The APT also has yet to finalize the details of AMRO’s monitoring function in terms of range, depth, and the mandate of policy recommendation (how compulsory can it be to members?). How would the APT establish the CMIM’s relationship with the IMF? Would it make the CMIM compete with the IMF institutionally? Would it have the CMIM complement the IMF? If so, in what areas would the CMIM and the IMF compete with and complement each other? All of these are important questions that must be addressed by the APT sooner or later for the future of East Asian financial and monetary cooperation.

As such, East Asian financial and monetary cooperation is at a crossroads, waiting for major decisions to be made for its future. The APT can either succeed in consolidating existing efforts toward the formation of an independent, autonomous AMF or become mired in an institutional deadlock. The CMIM may end up as a failure like the Asia-Pacific Economic Cooperation (APEC) (Beeson 1999 Ravenhill 2000; Webber 2001). The APT is by and large in agreement on the necessity of furthering the independence of the CMIM. There exists, however, areas of disagreement and differences among the APT members over the pace, scale and other details of the future of the CMIM.

In light of this article’s analysis, the most critical issue is whether nonhegemonic cooperation will continue into the future despite China’s rise. It is fair to say that it will be sustained. As the literature on institutional change and continuation suggests, an institution is hard to change once it is established. Institutional developmental inertia (stickiness) and/or path-dependent nature of institutional development will continue the present framework. This, however, does not guarantee that the CMIM will never change. As in the case of the IMF and ADB, China may try to increase its shares and voting power in the CMIM and thus become the dominant player. If unsuccessful, China may choose to bypass the CMIM, rendering it institutionally ineffective and irrelevant. In other words, China can wield the strategy of voice and exit with the possibility of creating a parallel institution in East Asia (Aggarwal 1998). What would be China’s future choice? How would the rest of East Asia respond to China’s rise?

>

THE AIIB AND CHINA-LED HEGEMONIC INSTITUTIONAL COOPERATION

Will AIIB’s institutionalization be finalized along the lines China proposed? Although it is premature to predict the future of the AIIB, ongoing discussion suggests that it may not be the case. India, which was initially hesitant to sign on as a charter member of the AIIB, decided to join it upon receiving confirmation from China that its proposed AIIB’s governance framework is subject to debate (Asian Economy, October 23, 2014). Korea also expressed the same concern. In the annual meeting of the APEC, Korean Finance Minister Choi Kyong Hwan, commenting on the possibility of Korea’s participation in the AIIB, opined that “China’s proposed ideas of AIIB’s governance seem not to live up to the levels of rationality and fairness practiced in most IFIs” (

China is apparently toning down its proposals in the face of these mounting pressures. The aforementioned confirmation that India received from China illustrates this point. Additionally, Li Shang Yang, the Director of the National Institute of International Strategy of the Chinese Academy of Social Sciences, declared that “nothing has been finalized regarding the AIIB’s governance structure. China is certainly open to further discussion with Asian counterparts on AIIB’s governance structure and voting mechanism” (

In this regard, a preliminary analysis of AIIB’s future direction can be performed comparatively via an example of China’s policies toward the NDB. China played a crucial role in establishing NDB as part of the BRICS. As is the case of AIIB, China attempted to make NDB a China-led institution by offering the largest financial contribution. By providing the largest financial contribution, China expected to gain the largest voting shares and influence. Perhaps not surprisingly, the other BRICS members (Brazil, Russia, India, China, and South Africa) checked China’s ambition and China decided to back off its original position to accommodate the other members’ concerns.

Ultimately, the NDB was institutionalized as follows. Initial total funding size was set at USD 100 billion with a start-up capital of USD 50 billion. Each BRICS member was to contribute USD 10 billion to NDB’s start-up capital and all members to increase their financial contribution proportionately to reach USD 100 billion over the next five years. As such, equilibrium would be established and maintained among BRICS in terms of contribution size. One noticeable exception to this balance of financial contribution is China’s larger contribution and share in the “Contingent Reserve Arrangement (CRA)” within the NDB framework. The CRA, like the CMIM, is an institutional apparatus to provide emergency liquidity to member states facing financial distress or crisis. Total funding of the CRA was set at USD 100 billion.8 China’s USD 41 billion contribution leads with Brazil, Russia, and India following with USD 18 billion. South Africa’s USD 5 billion brings up the rear. Pundits and experts observe that China’s lead in CRA contributions can spill over into China’s larger influence on NDB governance in the future (

When it comes to governance structure, the NDB is no different from most IFIs. Its Board of Governors (or Executive Committee) oversees the institution’s organizational management. In the NDB, the Board of Directors functions on a permanent member basis and has the authority to make major institutional decisions for projects and investment. The presidency rotates among BRICS members every five years. Furthermore, BRICS managed to establish a fairly equal dispersion of authority. The NDB will be headquartered in Shanghai, China but the first president will be from India. The nomination is likely to be made and finalized at the next annual meeting of BRICS to be held in Russia, November 2015. Russia chairs the Board of Governors while Brazil chairs the Board of Directors. Lastly, South Africa will host the first regional center of the NDB. Although the institutional effect of China’s acquisition of the NDB headquarters remains to be seen, NDB’s institutional cooperation, on a continuum, can be interpreted as closer to CMIM style nonhegemony.

Of course, one-to-one direct comparison between the AIIB and the NDB can be misleading. With regard to the AIIB, there is no substitute for China in terms of financing. The greater diversity in AIIB membership renders the construction of a united front against China more difficult. Also, most member states are likely to be recipients of Chinese investment. Nevertheless, new members, such as Korea, Australia, Great Britain, France, Germany, Italy, and potentially Japan, can create a window of opportunity for attenuating China’s institutional ambition. As noted above, China is striving to expand AIIB’s membership to make it more meaningful and recognizable in the politics of global standard setting. The question is how many concessions China will make in balancing three goals: China’s status in world politics, the institutional efficiency of the AIIB, and the institutional democracy of the AIIB.

7This section of the article below (the CMIM and Institutional Challenges) borrows from the author’s work in Korean (Lee 2012b, 22-25) with pertinent updates and modification. 8Critics of the CRA point out that USD 100 billion is only 2.5% of total foreign reserves of the BRICS. As such, the total funding size of the CRA is far from sufficient for the designated purpose. See Trade Brief (July 18 2014, 4) by Institute for International Trade.

CONCLUSION: THEORETICAL REFLECTION AND FUTURE STUDIES

This article has so far empirically tracked the institutional developments of the CMIM and the AIIB, and, in so doing, has uncovered the salient institutional features of both institutions inductively with the aid of two mirror concepts, nonhegemonic and hegemonic institutional cooperation. With that said, can existing theories of institutional cooperation account for both forms of cooperation? This concluding section discusses one major approach, the rationalist institutional design approach, to institutional cooperation and applies it to both forms of cooperation. As discussed below, this rationalist approach is arguably a dominant school of thought specially theorized for institutional design and variation. Providing a brief review of this approach to determine whether this body of literature can account for both forms of cooperation, this article argues that while the rationalist approach is relatively well positioned to explain hegemonic cooperation, it is weak for evaluating nonhegemonic cooperation. On this basis, alternative investigative approaches for nonhegemonic cooperation are suggested. Lastly, this article touches on the relationship between regional and global financial orders as a key thematic issue for studying global financial governance.

Couched in the rationalist theorization of international institutions, Koremenos, Lipson, and Snidal (2001) provided a theoretical account of the “rational design of international institutions.” Their problematique was that the existing research on international institutions at that time did not move beyond the question of “whether institutions matter” and thus lost sight of important empirical questions of how and why major international institutions are organized along radically differently lines. As such, they clarified the purpose of their theoretical effort and theorized variations in institutional designs. These three scholars defined international institutions as “explicit arrangements, negotiated among [rational] international actors, that prescribe, proscribe, and/or authorize behavior” (Koremenos et al. 2001, 762) and attempted to show how various institutional arrangements are the product of rational institutional consideration (Koremenos et al. 763).

To formally conceptualize and then operationalize institutional variations, Koremenos et al. constructed five dimensions of institutional design: membership rules (membership); scope of issues covered (scope); centralization of tasks (centralization); rules for controlling the institution (control); and flexibility of the arrangements (in accommodating new circumstances) (Flexibility). Although all five dimensions can be analyzed with respect to the institutional design of both the CMIM and AIIB, “rules for controlling the institution” is the most salient for the purpose of the present study (i.e., accounting for nonhegemonic and hegemonic cooperation). Here, “control” is concerned with how collective decisions are made. In fact, Koremenos et al. viewed voting arrangements as the most important observable indicator of “control” (Koremenos et al. 772). The issue is whether voting and decision-making rules are weighted. Apart from the general decision rule of simple majority, qualified majority, or unanimity, this essentially has to do with whether all members have equal votes or whether one member holds veto power over major institutional decisions.

For “control,” Koremenos et al. developed three conjectures (or hypotheses). Conjecture 1 posits that “individual control decreases as number increases.” Conjecture 2, which has direct bearing on the present article’s puzzle, posits that the “asymmetry of control increases with the asymmetry of contributors.” Simply put, the more a member contributes to the institution, the more control that member is likely to have in voting arrangements. That is, “an actor’s control over an institution relates to the actor’s importance to the institution” (Koremenos et al. 792). The IMF’s weighted voting is a good case in point. Conjecture 3, which is also relevant to the present article’s puzzle over nonhegemonic and hegemonic cooperation, posits that “individual control [to block undesirable outcomes] increases with uncertainty about the state of the world.” Based on prospect theory, which posits a risk-averse behavioral pattern of states, this conjecture draws out a dominant member’s desire to hold veto power to protect itself from unforeseen circumstances.

Taken together, all these three conjectures imply a strongly correlation between contribution size and voting power (including the existence of veto power). This line of analysis suggests that the only basis for nonhegemonic cooperation would be equality of contribution, which makes each member equally important to the institution. These insights would fit with the AIIB if it is to be institutionalized in the manner China initially proposed. China, the largest shareholder, would exercise the largest voting power with the institutional support of a China-led Executive Committee that would deny the board of directors a major role. Although China’s possession of veto power at the AIIB has not yet been proffered, one can expect from rationalist insight that China will attempt to bestow veto power on itself sooner or later. Furthermore, as long as China firmly controls the Executive Committee, agenda-setting power will also be under China’s belt.

However, this rational design approach is not useful for explaining the CMIM’s nonhegemonic institutional design, in which contribution size is not reflected in the weight of voting rights of each member in terms of the absence of veto power and equality of agenda-setting power.9 In essence, this rational design approach is ill-equipped to identify the “rationality” behind the CMIM’s institutional design. This theoretical blind spot cannot be separated from the research program’s assumption (not problematization) of rationality. The assumption of rationality does not provide researchers with a tool for exploring the underlying structures that make certain choices

An alternative to the rationalist approach for the analysis of nonhegemonic cooperation can be found in the constructivist theorization of international politics. Analytically, constructivism is a collection of theoretical positions that problematizes the sources of interests and rationality. Constructivists pay particular attention to collectively-held ideas, norms, and identities in shaping the ways in which states define what they want and pursue. As such, the variation in hegemonic and nonhegemonic institutional cooperation can be analyzed in terms of how collective preference among member states for institutional rules, norms, and decision-making procedures is the outcome of their collective visions (ideas), collective understanding of appropriateness (norms), and shared identities.

Although constructivism has yet to offer specific accounts of nonhegemonic institutional cooperation, there is indeed a long tradition in the constructivist literature of how these collectively-held ideas mitigate power anxiety and asymmetry in institutionalizing multilateralism (Ruggie 1992; Alker 1996; Barnett and Duvall 2005; Rathbun 2012). This literature can be a good starting point from which testable hypotheses on nonhegemonic cooperation can be derived for specific analyses.10 A major challenge to constructivist theorization then becomes more of an issue of empirical analysis. Empirically, an appropriate account of nonhegemonic cooperation has to connect the importance of collectively-held ideas and values to a full range of evidence of the actual bargaining and negotiation processes through which nonhegemonic cooperation is discussed, negotiated, and finally institutionalized. In this regard, the key to success is to design research that ties theory to empirics with fuller attention paid to context-sensitive empirical data gathering and non-arbitrary interpretation of the data. The basis of context-sensitive analysis is the full use of reflexive epistemology aimed at historicizing (institutional) reason and reasoning (Douglas 1986; Adler-Nissen 2013).

Given the recent proliferation of regional institution building around the world, the analytical frameworks that can account for both hegemonic and nonhegemonic cooperation are needed and should be further refined for comparative analyses of institutional buildings. The dialectical interaction between hegemonic and nonhegemonic forms of institutional cooperation has until now been insufficiently analyzed. In particular, analyses of nonhegemonic cooperation can specify more divergent ways of mitigating “democracy deficit” in multilateral cooperation as conditions of possibility for mutual coexistence of states.11

Last, but not least, a key thematic dimension to the changing international financial and monetary order(s) is arguably the relationship between regional and global levels. There are three layers that would structure the interactions of both levels in shaping the future directions of global financial governance (i.e., Lee 2012b, 8). The first layer relates to the depth, degree, and direction of the change in the existing neoliberal institutional framework, such as IMF reform. The second is the extent of the emergence and solidification of the increasing number of regional financial and monetary systems (Powers and Goertz 2011). The last layer connects to the relational characteristics of the financial and monetary order developing at the global and regional level. Will they develop along mutually complementary lines? If not, will they develop exclusively and be institutionalized in a competitive form, not only globally and regionally but also interregionally?

The extant literature on the development and transformation of international economic order supports the link between regional and global orders. Since the European global expansion in the early 19th century, international economic order tended to take the form of an expanded regional order (Watson 1992; Gamble and Payne 1996). The latest argument that Europe spearheaded neoliberal financial liberalization over the last 30 years exemplifies this insight (Abdelal 2007). This sheds light on the critical importance of regional order for global rulesetting. The post-Cold war development of various regional order-making efforts can be also understood as regional competition to ensure a bridgehead in the changing international economic order (Jabko 2005; Acharya and Johnston 2007; Fawn 2009). These examples strongly suggest the foundation of international economic order through regions. If so, will an emerging East Asian regional financial order (i.e., CMIM-style nonhegemonic cooperation) be a platform for global financial governance?

9One way to look at the formation of nonhegemonic cooperation in rationalist framework can be an examination of whether institutional cooperation yields private/club or public goods. In this line of reasoning, the provision of private goods (rather than public goods) is more likely to encourage the emergence of nonhegemonic cooperation, as members of an institution would have more incentives to financially contribute to as well as to govern the institution with equal voice. But this insight is still insufficient in addressing the question of why a larger financial contributor ever accepts a nonhegemonic institutional design. I thank an anonymous reviewer for pointing out an alternative possibility of rationalist explanation of nonhegemonic cooperation. 10Once the question of what constitutes “institutional rationality” in a given context of multilateral cooperation is addressed, there should be much ground for cross-fertilization of rationalist and constructivist insights for solving specific analytical problems inherent in empirically studying institutional evolution and change. See Dobbin (1994) and Campbell (2004) for exploring the notion of institutional rationality with the possible synthesis of rationalism and constructivism. I thank Dr. Kang Sun Joo for pointing out this analytical possibility. 11As Onuf (1989) argues, a rule almost always accompanies a ruler and the ruled (Onuf 1989). In this context, analyses of nonhegemonic cooperation help explore the possibilities of different kinds of rules that in turn help constitute different kinds of collective identities within an institution.