Under Rho, Mu-hyeon administration, main welfare discourses were syphoned to social investment state.1) Back then, the discourse on social investment took strong footholds from the perspectives of both theories and policy cases, and it was a terminology used in common internationally(Kim, 2007: Yang, 2007). As a matter of fact, the concept of social investment was utilized as a core ground to support major agendas of the administration: virtuous-circle of growth and distribution, and preparation for low-birth and aging society.

As a presidential candidate, Park Geun-hye made her pledge for 'the social investment-based life-cycle security state', which helped her win. Underscoring 'welfare tailored to life cycle', she promised 'the social investment-based life security state' including 'universal basic pension funds', 'universal care service', 'supply of more public housing' and 'expansion of health insurance coverage'. They significantly coincided with' 'social investment state' buoyed by the participatory government (as known as Rho, Mu-hyeon administration). The concept of 'welfare tailored to life cycle' was also suggested by 'Vision 2030' proclaimed at the end of Rho Mu-hyeon administration(Joo, 2014).

In addition, the Park Geun-hye administration pledged policies for older people or people at 50+ because they were her key supporters. From the perspective of 'welfare tailored to life cycle', she emphasizes a) to promote the employment of older people in an aged society and b) to build the basic livelihood security system with high financial efficiency, especially for those who face the last phase of their life cycle. Her pledges as a presidential candidate brings us to the interpretation that she accentuates 'elderly-friendly social investment strategies'.

To begin with, she decided to provide 200,000 won as basic pension to the all aged. Second, she expanded LTC (long-term care) service in terms of care. In addition, under the conjunction with some local governments, home-care services were given to them as a part of investment projects for community services even though the home-care service was at low level. Finally, she tried to create more jobs by invigorating social services, which required unskilled workers. Therefore, it is expected that employment opportunities would increase for unskilled elderlies. However, she passed the bill to introduce 'selective welfare-type basic fund'. The key of her policies to increase the income of older people is interpreted as that she wants to curtail the total expenditure of public fund, which ignited the expansion of policies into the private pension sector (Joo, 2014). Moreover, in case of investment projects for better community service, the older people take trifling portions, compared to future generation. However, employment rate of older people at 65 and over is 28.9%, second highest among OECD states(OECD, 2014b). This reflects that older workers have a craving for participating in labor market due to their dire social-economic situations. The replacement rate of public pension is 36.3%, which is considerably low(OECD, 2014c).

More and more older workers participate in labor market to get jobs, but they can't find decent jobs, and are driven into irregular workers or self-employees. Given that baby boomers (born from 1955 to 1963) will become 60s, jobs for elderlies will be increasing concerns to Korea. The welfare system for older people is as poor as employment. The Bank of Korea said that actual pension beneficiaries were just 45.7% of total people subject to pension (aged from 55 to 79) in 2014. To make matters worse, 60.6% of pension recipients took less than 250,000 won/month from the government. 'The poverty rate of the aged' ranks first among OECD states, showing the rate (poverty line here is less than 50% of middle income bracket) was 48.5% in 2012. It's the highest in 34 OECD states, 4 times higher than the OECD average (12.3%). In this context, it's time for Koreans to make overall review of welfare policies for older people, regardless that they are for prevention or investment(OECD, 2014c).

Meanwhile, U.K. under the New Labor Party regime, pursued social investment policies as a national agenda. U.K. is a relatively vulnerable welfare state, but it's assessed to have quite good conditions to devise new policies. In addition, U.K. is evaluated as the state moving toward the post-industrial society faster than any other major European state. In this respect, U.K and Korea have something in common. That's why social investment strategies (created in this socio-economic vein of western countries) were in the spotlight as a valid paradigm in Korea showing the attributes of post-industrial society(Giddens, 2000). Prior to exploring the aging-related problems, I want to re-examine social investment strategies of U.K. focusing on aging population. In particular, the incumbent administration implements welfare policies by significantly clinging to social investment policies of Rho, Mu-hyeon administration. Therefore, the review about U.K is meaningful in this study. First, a focus is put on the historical and theoretical background of social investment policies. Second, reviews are made to understand social issues related to aging population among new social risks. As a main part, social investment policies sought by the New Labor Party are analyzed from three aspects: income, labour, and care for older people. Finally, conclusions are made by connecting them with Korean society under the conservative party.

1)If a state and a policy (or a strategy) are distinguished to be used, the terminologies can imply both merits and demerits(Kim, 2007). However, in this study, a social investment state and a social investment policy (or a strategy) are not strictly discerned.

Ⅱ. Literature review: theory and background

1. The background and characteristic of Social investment

Until 1970s after the end of the second world war most of western countries could achieve both economic growth and social integration by establishing ‘classic welfare state’ though continuing economic growth. There are several economic, social, demographic fundamentals on which social policies from 1960s to mid 1970s in western lied.

Large-scale manufacturing industry was the major part to produce wealth and economic growth rate was very high. High economic growth could be financial base of social policy, of which social integration was on the basis. In labor market structure there was men oriented large-scale of standardized labor called ‘fordism-labor market structure’, it provided relatively high income and employment rate. Population family structure has sustainable birth rate and relatively low elderly population on which family does look after the elder and children and vulnerable household member. Taking care of family which was the job mainly given to woman is understood in other countries with subtle differences, but the traditional concept; outdoor work for men and housework for women, namely ‘male-breadwinner model’ is dominantly accepted.

Classic welfare state could be sustained with high economic growth, Fordism labor market structure, relatively stable population family structure. The main role of welfare countries in ideological aspect was to organize social services to fulfill desires of both market and family (Taylor-Gooby, 2004:2) by using Keynesian economy management.

Yet, in mid 1970s, capitalism economy social structure which was supporting traditional welfare state had its fundamental change and was forced to change heavily. These changes called implementation of Post-industrial society were driven by many different factors (Pierson, 2001:82-99; Esping-Andersen, 1999; Chap 9), they can be simplified as below.

First of all, big industry transfer from manufacturing field to service field got productivity rate lower and less economic growth. While knowledge based economic system emerging, certain groups which have lack of human resource experienced chronic poverty and social isolation. Second, changes appeared in labor market that employment was not secure anymore due to high competition in getting jobs caused by globalization, the expansion of female labor in service industry. (systematization of social exclusion) Third, family no more worked as a protection for individuals as it did before because of emerging problems such as aging population, low birthrate, increasing number of single parent family. This economy system, change of labor market and family demographic structure change stretched to a topic so-called ‘Encountering new social danger’.

2. the features of the ‘social investment state’

What is the features of the ‘social investment state’? Accoding to Lister(2004; 160), it can be summarized by following order. 1. A discourse of social investment in place of ‘tax and sped’ 2. Investment in human and social capital: children and community as emblems 3. Children prioritized as citizen-workers of the future; adult social citizenship defined by work obligations 4. Future-focused 5. Redistribution of opportunity to promote social inclusion rather than of income to promote equality 6. Adaptation of individuals and society to enhance global competitiveness and to prosper in the knowledge economy 7. Integration of social and economic policy, but with the former still the ‘handmaiden’ of the latter 8. A preference for targeted, often means-tested, programmes.

Perkins has defined three kinds of categories as a meaning of ‘social investment policy’ or ‘social investment strategy’, but not absolutely meaning (Perkins, et.al., 2004:2-4). 1. Main concern of social investment strategy is combination in addition to approval between social and of economic policy 2. Social investment policy emphasis on redistribution of opportunity in order to accommodate to social risk rather than of income connected to classic welfare state 3. Social investment strategy is focused on participation of economic activity.2)

3. Emergence of new social risks

Traditional welfare countries in stable economic social structure focused on unemployment, aging and industrial disaster which might cause no income, disease that required exceptional expense. These were to deal with old social risks and they focused income maintenance program. However, change of economic social structure created new social risks which was not involved in classic welfare state (Esping-Andersen, 1999:Chap 8). Talyor Gooby who discussed new social risks and the change of social policy defined these risks as ‘The risks resulted from implementing post industrial society related economic and social changes, which people face in their life time’ (Talyor-Gooby,2004:2) and talked about the way to start these risks in 4 different aspects.

First, as the number of two-career couples is increasing, new social risks are appeared in inexperienced woman group in which work and family are hard to be compatible. Second, expense in senior care is rapidly growing due to the increasing number aging people. Most parts of senior care job are given to woman so they can’t work therefore their expense relies on only husband’s hand means that there is high potential to struggle with poverty in long term.

Third, technology change which don’t require as many unskillful employees as they hired before, change of labor market based on competitions between nations by low salary can cause a danger that people who have less education excluded from society. Thus, people who have the less education people who can be unemployed the more easily and be in long poverty. Forth, if consumers make a wrong choice in medical insurance and public pension which already became privatized, or in case regulation in private insurance didn’t work well, new risks can happen. Taylor Gooby(2004:5) who studied four root of new social risks indicated that social weak stratification has high possibility to be exposed by new social risks in three aspects.

First aspect is regarding changes in division of gender, in this case people who are responsible for work and taking care family and being asked to take care senior and being rely on other’s help but no household member to help them. Second aspect is regarding changes in labor market, in this case people have not enough skill to get a job, or training which is no more useful and no way to further the skill. Third aspect is regarding welfare state change, in this case people who use private social service which provides unsatisfactory service and improper pension. About history of social investment state, in can be summarized by following table 1.

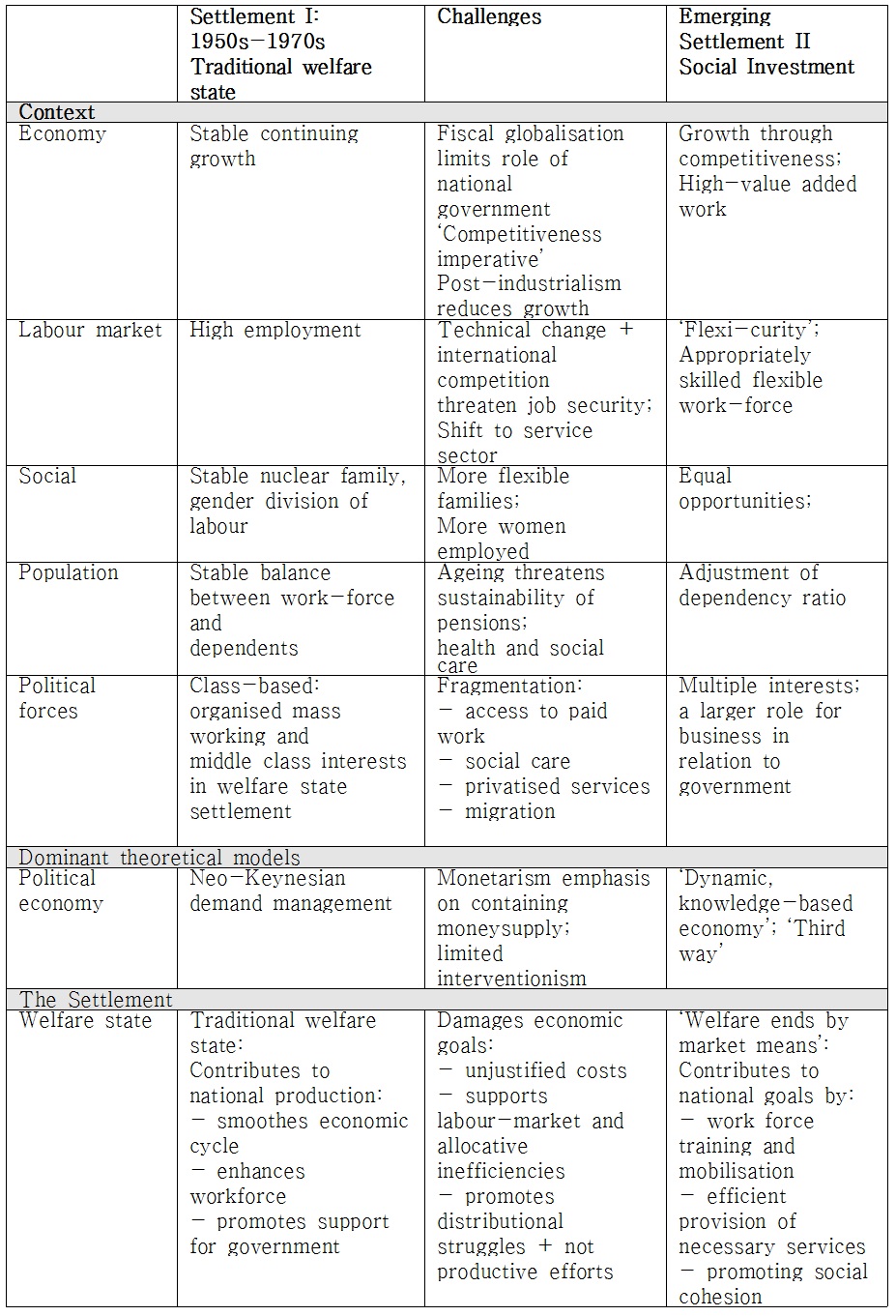

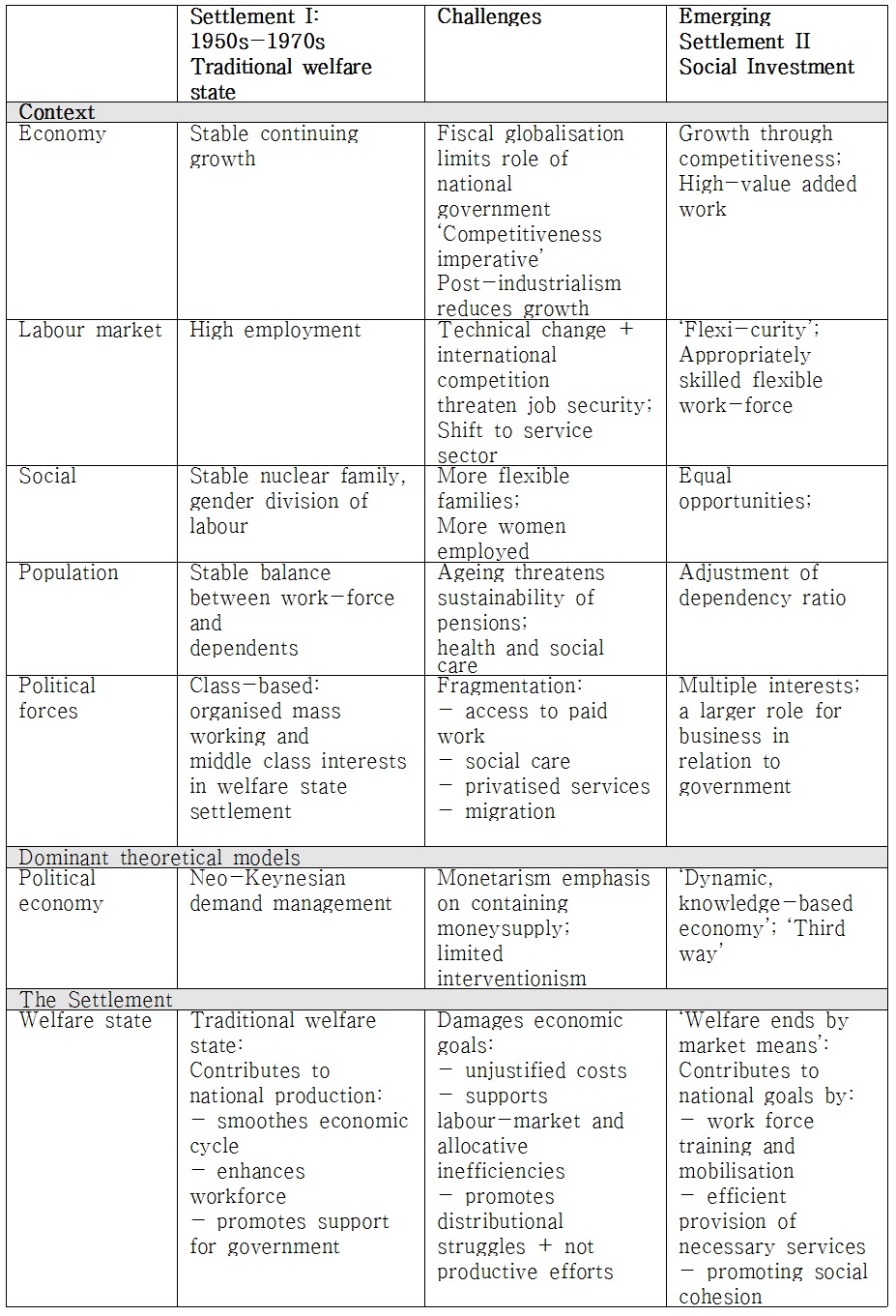

[Table 1.] The Development of the Welfare State

The Development of the Welfare State

4. New social risk and ageing population

Given the above discussions, the welfare societies taking the risk of aging populations create the following issues: aged workers excluded from changing labor markets; support for elderly people not taken care of by their families; and social security programs for older people who can't engage in labor markets. Such problems are closely related to the policies involving 'pension', 'elderly care programs' and 'employment of the aged' respectively.

In terms of pensions, the previously-used scheme to manage funds through low contribution and imposition methods can't work politically as a safe tool any more(World Bank, 1994). In addition, health-care and LTC (long-term care) exacerbate the problems. For example, medical costs for the people at 85 and over are 20 times higher than those for the young (Glennerster, 1999). Financial resources are fundamentally appropriated from public assistance, but many local governments can hardly take the burden of required costs. Like Japan, when pensions are managed based on a social insurance way, uncertainty increases through a relatively-high wage structure and cumulative management of funds. Furthermore, transformation of family institution weakens the responsibility to support the elderly, depriving relatively younger elderlies of opportunity to work (OECD, 2006: 140-142).

5. Ageing and social investment strategy

Like this, a lot of forces have come together to question classic welfare state due to ageing of the population. Therefore, if there is no intervention of government, it will be big social problem in the future.

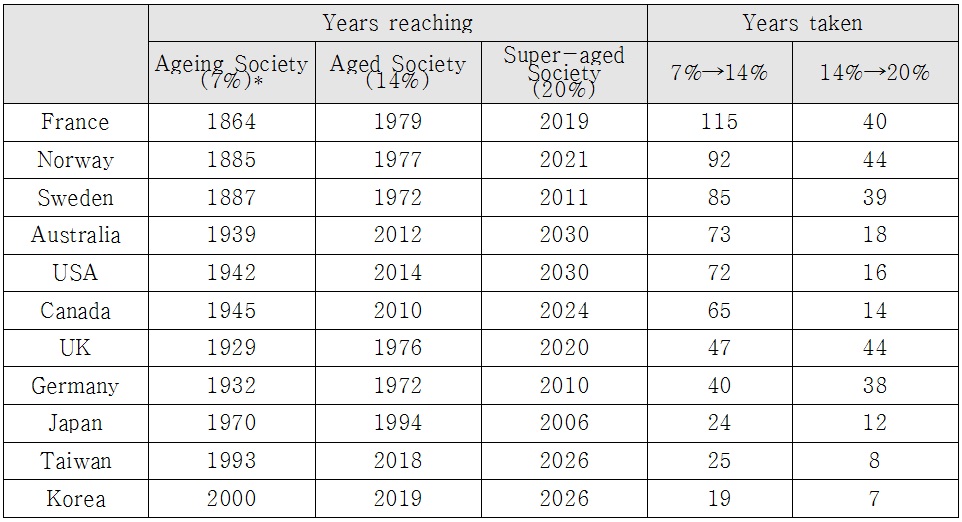

It can be seen from the table 2, Percentage of the old(<65) and Old-age Dependency Ratio have been increasing dramatically for last years, from now on, both will have grown up sharply, while Youth Dependency Ratio have fallen dramatically over the last fifty years and is continuing to decrease. Especially, these speeds of East Asian NICs is also faster than those of other countries.

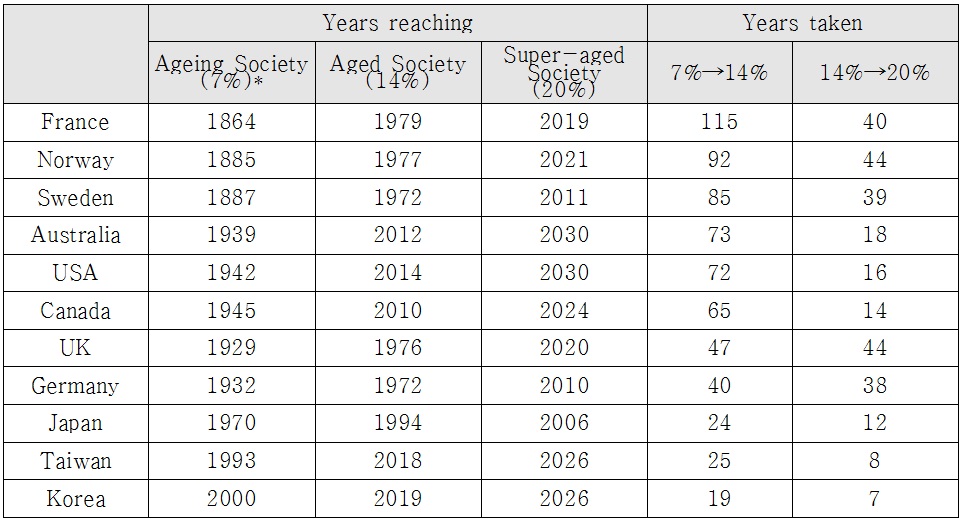

[Table 2.] International Comparison of the Tempo of Population Ageing

International Comparison of the Tempo of Population Ageing

This Ageing population will decrease growth rate of potentiality. The demographic problems are without strong economic development, severe financial tension. In order to reduce social burden, it is necessary to enhance formation of human resource. Ageing people are no exception. Anthony Giddens(1990) says, “we should move towards abolishing the fixed age of retirement, and we should regard older people as a resource rather than a problem.” This is core of social investment strategy.

Therefore, social investment strategy is support of labour power. It is that to promote adaptability and employability of labour market thoughout old age employment. The trends of employment and retirement in European countries show that employment rate of people aged from 60 to 64 (30.4%) is less than half of people from 50-54 (75%). Meanwhile, the average retirement age of EU states is 61.4 for men and 60.4 for women. They are trying to identify a new approach to retirement models in preparation for super-aged societypreparation for super-aged (OECD, 2014b). In the midst of financial crisis recently emerged, most Europeans are likely to delay their retirement and to continue to work for money. Aging of working population serves as an opportunity to provide more skilled and productive labor force than young people in one way, while it's expected to trigger inter-generational conflicts and accrue additional costs such as medical costs in other way.

2)In the end, major objective of social investment policy is to improve individual human resource so that they can get a job easily and though this way to enhance county’s economic growth potential. New liberalism paradigm take social policy as nonproductive expense and understand the relation between economic growth and welfare as collision, however social policy doesn’t give negative effect to their economy. Well organized social policy is precondition for knowledge based society to be run, as OECD pointed out recently, ‘Well organized social policy’ is very beneficial to country’s economy (OECD, 2005).

Ⅲ. Social investment policy by welfare regime

A social investment state or a social investment policy is a new strategy to operate the country, which was presented to the public against neo-liberalistic rightists exercising overwhelming influences after 1980s(Yang & Jo, 2007).

Unable to resolve the problems of stagflation and high-unemployment in 1970s, the leftist parties (who had led the way to build western welfare states) lost their political impacts, finally allowing neoliberal-rightists gain power in 1980s. There is a discrepancy among countries, but rightists took power in European states. To name a few: the Conservative administration with Thatcherism (1979~1997 in U.K.), the Republic governments after Reagan (1981~1993 in U.S.A.), Helmut Kohl-led CDU (Christian Democratic Union) government (1982~1999 in Germany). Besides, rightists governed Nordic countries traditionally under the high hegemony of leftists: the Bildt-led conservative party (1991~1994 in Sweden), the conservative coalition government (1982~1993 in Denmark), and the conservative party-led government (1981~1986 in Norway).

Leftists parties in Europe were forced to step down from the power, because they couldn't resolve economic issues during 1970~1980(Perkins et al, 2004). Against backdrops that traditional workers (who are united centering on organized trade unions of public/private sectors) decreased and middle-class workers got more and more conservative, the leftists parties faced a new mission to create new political bases. Ultimately, to gain the minds of political centralists who take lion's share of ideological spectrums. they had no choice but to accept the philosophies of neoliberalism significantly, to devise strategies to administer welfare states based on new perceptions encompassing leftism and neoliberalism. However, the strategies were implemented in accordance with regime attributes.

In this section, based on the regimes of welfare states advocated by 'Esping-Andersen'(1990: 1996), aspects of social investment strategies were reviewed, depending on each regime. First, conservatism and social democracy were studied, followed by liberalism to analyze the situations of U.K.

1. Conservative welfare countries social investment strategies

Necessity to restructure conservative welfare countries related to family female policy is based on debilitated one male living family. A representative conservative welfare country, Germany in which division of labor by gender strongly remained shows change in gender based divisions, which is considered as the most significant challenge (Aust and Bönker, 2004). Although to maintain sufficient living for family woman’s work is essential due to man’s decreasing employment rate (Cancian and Reed, 2001), women are still considered as secondary works(Taylor-Gooby, 2004).

Namely, having older people need to be looked after for women means that they have to take economic difficulties at the same time give up their participation to labor market. This change says that social security system based on regular works supporting families is no more being able to accommodate these national economic and social changes. Apart from Germany, France is known as a family and woman-friendly country which can be compared with others in northern Europe considering family policy.

However, the increase of unemployment rate started from 1980s in France was a signal for French government to change their policy line. Family policy for example parents- vacation in France is not a policy to ensure women’s right to work rather a policy to control unemployment (Morgarn & Zippel, 2003).

Therefore, women in the middle class in France continue their work by hiring AFEAMA (official caregiver) to take care their children in contrast women with low income remain unemployed taking care their children with APE (breed allowance) (Morgarn & Zippel, 2003). To work or not was regarded a total freedom for women in labor market as those in Sweden and Demark in 1970s, but it changed to be more rational free option. By this change family policy seems to be categorized according to their stratums. In this prospective the answer for the outcome of social investment countries in conservative countries doesn’t sound clear to evaluate their achievement at the moment (Aust & Bönker, 2004).

In conclusion, social investment strategies in conservative countries make woman having children and older people whose role is significant in social investment countries low income worker because expanding Care service is delayed and failure of building new jobs which can enable people support their family and take job trainings.

In case of conservative states, social investment policies for aged population brought about a lot of financial expenditures. Income Transfer Payments including pensions and LTC in Germany and France are higher than other European states. Policies to vitalize jobs for older people are also high in two countries.

2. Social investment strategies in social democratic welfare countries

Accoding to Esping-Andersen(1992, 1996), social democratic welfare countries, the scandinivian states have been associated with social investment state. Esping-Andersen(1996: 38) expalained "all four countries were characterized by very low unemployment, high labour force participation among women, and comparatively high level of public health, education, and welfare employmen.". Also Activation policy (public employment services, moving allowance, job training, temporary public employment, and subsidized employment in the public or private sectors) has been regarded as a good example of social investment state. But, In spite of this resemblance between social democratic welfare states and investment state, high tax rates and cost of public service are important problem.

Nordic countries are already implementing policies of social investment states argued by Giddens(2000) as well. They increase the participation rate of women in economic activities through universal child-care, women, education, and welfare policies. By improving women's engagement in economic activities, they increase wage-earners to alleviate poverty, and at the same time secure financial sources of pensions continuously to mitigate the pension crisis triggered by aging population. In addition, the poverty rate of Sweden in 2010 showed 6.3% (total), 3.9% (children), and 6.8% (elderlies) -Korea was 49.1%(OECD, 2014b).

3. Social investment strategies in Liberalistic social welfare countries

The fundamental matter in Liberalistic social welfare countries is not because of no participation of people in their labor market rather how they participate in their labor market. In spite of relatively high women’s employment rate and high rate of two persons- livelihood- supporter- household, the number of women and children in poverty is still high in liberal countries. Thus, the output of liberalistic social welfare countries’ social investment strategies is controversial. Reducing welfare allowance, Increasing work and privation of social services in liberal countries might be helpful for government’s fiscal prudential

As Esping-Anderson(2002) pointed out, however, liberalistic social welfare countries seem to be in their trap due to lack of providing social services such as elderly care. Considering high poverty in family with older people despite of their highly participating effort to the labor market and rapidly growing gap between social stratifications due to lack of social service and market, social investment strategies’ outcome in liberalistic countries can not help being hierarchical.

In U.K. representing the regime of liberalism, the discussions on social investment states were made against the background of neoliberalism-based welfare reforms led by Thatcher government (1979-1996). Blaming the welfare policies envisaged by the previous government of labor party, Thatcher (former prime minister) aspired to reduce national welfare. In short, the leftists party was desperate to develop a new welfare paradigm to justify its pro-welfare policies under the circumstances that the liberal ideology was strong and political supports for welfare states were weak(Lekins et al, 2004). Therefore, the analysis leads us to the conclusion that welfare perceptions were reborn with the concept of social investment.

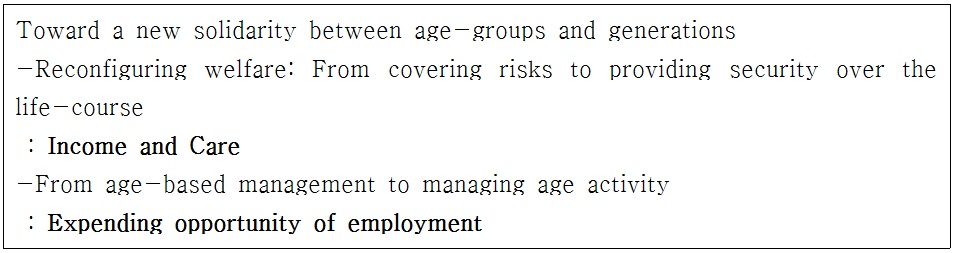

Discourses on social investment states emerging after the new labor party took power faced problems inherited by Thatcher: relatively weak budgets for welfare, and poor infrastructures, which forced U.K. government to decide social investment policies (under the regime of liberalism) which were highly effective and feasible (i.e., New Deal 50 + Elderlies). Pension and elderly-care services also demonstrate clear trends of privatization. The table 3 summarizes the core characteristics of social investment state and analytical framework for the aged by Guillemard(2011). To fathom the policies of U.K., the next chapter will address social investment policies focusing on aging.

[Table 3.] Analytical framework and characteristics of social investment for the aged

Analytical framework and characteristics of social investment for the aged

Ⅳ. Social investment policy for older people in case of UK

It is known that U.K. has developed the Beveridgean-type pension scheme arguing that the government should cover the minimum level of life. It established a unique tier structure (the government: tier 1/ the private sector: tier 2) through market-centered reforms strongly promoted by Margaret Thatcher in 1980s. Taking power in 1997, the New Labor Party led by Tony Blair inherited structural problems related to the pension scheme of conservative party, embarking on new reforms. Major reforms are as follows(Choi, 2011):

First, 'Minimum Income Guarantee' was introduced in 1999 to provide minimum wages to older people under the poverty line through asset surveys, and its amounts changed in proposition to wage. The MIG was converted to Guaranteed Credit as a part of pension credits in accordance with 'the Pension Credit Act' in 2003. Along side with 'Guaranteed Credit', 'Saving Credit' system was stipulated by law. Thanks to 'Saving Credit', £1 of income didn't decrease when £1 of income increases under the line of minimum income guarantee. Rather than this, some of personal savings to prepare for old age were deducted from income accredited by the government, allowing older people to get positive rewards.

Second, another remarkable change was made to replace SERPS with Stata Second Pension gradually in line with 'the Child Support, Pensions, and Social Security Act'. This system was designed to offer a strong incentive (exemption) to the low-income bracket and to provide higher benefits than SERPS to the bottom-income group. Especially, credits were given to carers, so the low-income bracket or care-providers were allowed to receive pensions (more than the minimum income line). Until 2007, it was operated in proportion to income, but after that, fixed amount was given(Bonoli & Shinkawa, 2006).

Third, the year of 1999 saw the introduction of 'Stakeholder Pension' in accordance with welfare reforms and the Pension Act. This pension was devised to provide the opportunity of stable personal pension to the low/middle income group, so it required relevant commission to be lower than 1% of total fund, and at least £20 of contribution. It tried to improve flexibility when a personal pension was transferred. It was controlled by the Occupational Pension Regulatory Authority, but fund investment was regulated by the Financial Services Authority newly opened in 2000.

Fourth, through the Finance Act, the government, in 2004, simplified the existing tax law which had 8 types of taxation systems. By doing so, the government made efforts to improve the public understanding, and to deregulate tax brakes to encourage people to increase their savings for their old age. In addition, employees were allowed to enjoy tax breaks who contributed less than£1.5 million to the private pension for their all life(OECD, 2014c).

Lastly, in line with the Pension Act, the Occupational Pension Regulatory Authority was converted to 'the Pension Regulator' to simplify and clarify the role of regulations. Such a change enabled the Pension Regulator to oversee the occupational pensions, to provide advice about overall management of funds, and to take supervising activities to prevent an occupational pension subscriber from receiving supports from the pension protection fund.

What's interesting was that pension reforms were conducted in the direction to enhance the importance of private pensions under the two-tier system as opposed to expectation for the Labor Party Government to strengthen the public pension. To guarantee the public income, above-mentioned schemes of basic livlihood security are critical, which raised the bar of basic level of public benefits, and provided pensions to elderlies who couldn't reach the basic level. However, under the two-tier system, the private pension was expanded rather than the public pension. Regulations on private funds were simplified and reinforced as a whole, and at the same time, 'Stakeholder Pension' was introduced to allow the public to get more trust on and insure the personal pension in 1999. It means that the government worked for expanding the private fund in a full funding way(Davis et al, 2014).

When introducing the Stakeholder Pension, the government adopted 'the Minimum Standard (as known as Charges-Access-Term) to minimize the side effect of the existing personal pension. The most transformative factors are as follows: it's easy to transfer the pension right; additional charge is not imposed; and the structure to charge subscribers is transparent and simple. In case of existing personal pensions, it's unclear how much charge the subscriber paid among his/her contributions, and it's reported that the imposed charge was quite high(Back, 2010).

Consequently, in U.K., gradual privatization was evaluated as a failure, which was pursued through the Defined Contribution Pension by the Thatcher administration since 1980s. The basic pension was reinforced to resolve poverty-related problems by the New Labor government, but it's policy goal was still to expand personal pensions through strict regulations. The reform (in 2007) allowed the government to promote the 'Personal Account Pension Scheme'--which is a state-led Defined Contribution Pension, quite different from the market-oriented (private) personal pension(Davis et al, 2014: Choi, 2011).

In U.K, like others, age-friendly employment polices were reckoned as necessary, as a part of social investment policies after 1990s, when aging-related problems were increasingly understood. Early retirement was an issue in mid-1970s, but the U.K. government often encouraged older people to retire even in 1980s, proving that she managed the policies of labor market by focusing on youth unemployment. Be that as it may, senior-friendly employment policies were not easily legislated․institutionalized after 1990s. At an early stage, the government touted the benefits triggered by hiring older people so as to induce employers to change their mindset. However, they were legislated․institutionalized as a part of social investment policies by the Labor Party taking power in 1997. In addition, the policy gained the momentum from other policies devised by the labor party-led government emphasizing 'Welfare-to-Work' concept. For instance, 'New Deal 50 Plus' or 'Code of Practice on Age Diversity in Employment' clearly stipulated the employment of aged people(Moon, 2004).

The labor party introduced 'New Deal Programs' in 1997 to bring various types of welfare recipients (including beneficiaries of Jobseekers Allowance), the jobless, and not-economically active population to the labor market. Among them, there was 'New Deal 50 Plus' designed to help older people (at 50 and over) to get jobs. It's operated as a pilot project in 1999, and expanded across the country in 2000 (Moon, 2004). Unlike 'Youth New Deal' or 'New Deal 25 Plus' (mandatorily applied to people subject to the program), this program allows people to choose to join, and detail contents are divided into supports to individuals and supports to companies. In case of New Deal 50 Plus, 'Income Support', 'Jobseekers Allowance', 'Disability Benefits', and others are given to the elderlies at 50+ who received the benefits for at least 26 weeks in the past or receive them now. The program participants enjoy three benefits: consultation and support for getting a job or starting a business; tax credits; and training grant(Lee, 2008:Choi, 2012).

If a program candidate applies for Jobcenter based in his/her domicile, a personal adviser is allocated to provide a broad range of supports for him/her to get a job or start his/her own business. Tax credit was introduced when the 'Employment Credit' was launched to support newly-employed older people for 52 weeks. In April, 2003, it was incorporated into 'Working Tax Credit', enabling them to enjoy tax credits for the total work period (not 52 weeks) if they are entitled to get the credit(Tregeist et al, 2006).

Training Grant is valid for 2 years starting from the date when an applicant joins 'New Deal 50 Plus'. The grant can be used for him/her to participate in training programs usually not offered by employers, or to utilize a training/education center. This benefit is not constrained to employed elderlies, because older people who start their business are also entitled to receive money required for relevant knowledge. Subsidies are provided for 6 months to the company who hire the participants in the New Deal 50 Plus program. If the company wants to get this subsidy, it must sign 'New Deal Employer Agreement with a Job centre.

The company hiring a worker through 'New Deal 50 Plus' is required to employ him/her for at least 6 months; otherwise, it should give a notice to the Job centre and obtain an approval in advance. Moreover, the company should give a wage (equivalent to the subsidy) to the older worker, and should not fire him/her on the pretext of hiring a new older person (OECD, 2004: Lee, 2008).

New Deal 50 Plus can be evaluated by comparing their employment rate and average employment rate. In 2003, 70% of older people at 50+ and those entitled to get pensions participated in labor market, which increased gradually from 64% in 1997 to 70.7% in 2005. As a result, the gap between their employment rate and average employment rate decreased from 4.6% in 2003 to 4.0% in 2005. Likewise, the employment of older people aged from 50 to 69 also increased slightly from 54.3% in 2005 to 54.8% in 2006, while simultaneously reducing the gap with average employment rate by about 1% from 20.8% to 19.9% (DWP, 2006: 50-51). In a nutshell, the growth of their employment rate implies that the New Deal policy gives rise to positive outcomes for a short time (Universal Credit at Work, 2015).

In 2009, 'New Deal 50 +' was incorporated into 'Flexible New Deal', and was changed to 'the universal credit', in 2013. Since 2013, 'the working programme' has been expanded to cover all age groups. Therefore, now U.K. is not implementing a policy for only low-income older people like the New Deal 50+. However, the U.K. government included 'Working Longer Program' to 'the working programme' to encourage more elderlies to get jobs, and has provided financial incentives to workers who participate in the labor market after they received the basic pensions. However, such policies are not fulfilled at a large scale(Choi, 2012).

3. Care: Elderly and Long term care

U.K. testifies the characteristics representing welfare states of liberalism in terms of elder-care. Basically, U.K. had developed 'state-led welfare schemes', but former Prime Minister Margret Thatcher launched 'the market mechanisms' earlier than other European states, demonstrating the possibility of marketization. In U.K., emphasis is put on the private/profitable sector, but institutional regulations have been strict while the level of marketization is high. In other words, U.K. promotes the Social Investment Strategies through market mechanisms in terms of elder-care(Lewis, 1998).

In U.K., the private service providers of elder-care increased drastically owing to neoliberalism strategies including privatization sought since 1980s. Especially, in case of institutional (center) care, profit/private centers account for 65.4%, followed by public sector (19.2%) and non-profit sector (15.5%). In contrast, the private sector (including non-profit/profit) covers 67.6% of home-care services while public sector takes 32.4%. The U.K. government doesn't control the operators of service-providing organizations, but institutional care is largely dominated by the profit/private sector while non-profit/private covers the majority of home care. It's after 2000 (when the New Labor Party took power) that the basic criteria on service provision was developed and recommended to manage the service quality as the quality of institutional service was required(Lewis, 1998). The government tries to inspire the existing centers (providers) to satisfy requirements and qualification step by step. In the meantime, the government doesn't control the quantity of elder-care services, so many providers are competing according to market principles. Among them, many centers (service facilities) are closed because of management crisis. In particular, small-sized facilities face a series of bankruptcy. In U.K. the central government can effectively manage the service participants supported through the central government funds, but the trust in market mechanisms make it difficult to make any attempt for controlling the service types(Berry, 2015: Chon, 2012).

Besides, the government introduced 'Direct Payment' system in 2000 to improve service users' right to choose, but unlike Germany, it imposes quite strong regulations on where the money is appropriated. Therefore, it's safe to say that 'Direct Payment' of U.K. is not used at a large scale now, but if it grows, the money is likely to be used for the public service market. Futhermore, the possibility is high that the money will be used to hire personal assistants directly.

Accordingly, U.K. is the country with high possibility of marketization of care service when it comes to market formation and market operation. The service prices are various depending on providers, and differentiation of service is possible, depending on various service qualities. In addition, the social protection for service workers is also poorly regulated. They allow service providers to implement management strategies to reduce labor cost by using cheap labor force(Naylor, 2012).

To recap what's been said until now, first, care-service providers are diversified by marketization and market has scaled up. However, the Cameron administration operated its budgets in a conservative way, reducing or slightly increasing the coverage of care service. Second, the Direct Payment' system was expanded to improve the objective conditions in terms of people's right to select, but lack of information and supportive systems restrained people from exerting their rights to choose actually. Third, marketization, in particular, created various problems in the market of LTC: increasing pressure for cost reduction, fierce competition, illegal utilization of workers, insufficient regulations, and others.

The existing studies on social investment policies focally dealt with future generation such as children and or their education/job activation programs(Esping-Andersen: 2002b: Kim, 2007: Yang et al, 2007: Moon, 2004). However, this study put focus on a new social risk, so-called 'Aging', and reviewed the social investment policies for older people based on the case of U.K. This study analyzed the aspects and changing directions of senior-friendly social investment policies, and examined how U.K. had promoted social investment policies for elderlies in a multifaceted way. This study underscores 'independent individual schemes' such as pensions, elder-care, and elder employment, or micro policies for the aged, going beyond the existing welfare policies for older people toward the more comprehensive approachers to address aging issues from a social investment angle. In short, this study gives the grounds to enhance the understanding about the connectivity of welfare sector, for example the relations of income guarantee-health-social service-employment for the old, and to accentuate that issues related to older people can be approached through a social investment perspective.

As shown by above-analyses, the evaluations on such policies are limited. Taylor-Gooby(2004) explained as privatization and means-test characteristics of pension fulfilled by the New Labor Party, and said the party tried to achieve welfare goals by using the market tools. He also noted that the party's policies worked effectively to create jobs for youth, single parent, and women (who are not addressed in this study) and to make some contributions to poverty reduction. However, in terms of elderlies issues, the government couldn't make big accomplishments in pension and care sector, except job creation for older people. New Deal 50+ which made contribution to job creation was abolished. The limits of social policies led by the New Labor Party are derived from the gap between the goal and tools which were used to achieve its welfare goals. In other words, the welfare system of liberalism (U.K.) should pursue the harmony between central leftists' goals and market-friendly tools, so the structural gap was a determining factor about the policy success. Korea society needs to consider such actual problems, going beyond ideological conflicts.

Meanwhile such social investment policies for older people are no more attractive to conservative parties in Korea and U.K. As a matter of fact, social investment policies (facilitated by the labor party in U.K. or by the Rho Mu-hyeon administration in Korea) were downsized or abolished in both countries. In Korea, it seemed that Park Geun-hye administration followed the social investment policies of Rho administration at first, but the existing pledges were abandoned or compromised when the incumbent president, Park faced the second year of her term.

Gordon Brown, former PM of U.K. carried out policies of fiscal expansion to stimulate economy, when global financial crisis began, increasing welfare expenditures. However, the coalition between Conservatives and Liberal Democrats (hereinafter, Coalition) evaluated the welfare policies of the New Labor Party as a failure from a cost-effectiveness aspect, deciding to implement fiscal contraction at full swing. In case of various welfare allowances, the universal payment has been changed to the selective payment in line with income level. In addition, the range of opportunities for recipients to choose is widening as a whole(Painter, 2013). The Coalition performed 'Spending Review' in 2010, announcing its plan of fiscal contraction as much as £80 billion. The Coalition planed to secure £18 billion by reducing welfare expenditures until 2014~2015 (when is the end of its term). However, to avoid backlashes, the Coalition promoted to change the formula (which has long-term influences) of calculating the welfare benefits rather than immediate reduction of welfare expenditures(Painter, 2013). Based on the policies of Coalition, some benefits were cut: Child Tax Credit (for working households), Earned Income Tax Credit (EITC), Housing Benefit, Livelihood Benefit for the Disabled, and Employment-Supportive Benefit. The Coalition argued it could reduce its spending by £5.8 billion until 2014~2015. Such measures curtailed actual values of welfare benefits through asset survey. Actual values of benefits for children as well as pension recipients showed downward trend. For example, in case of benefits for working age people, their actual values reduced to the level of 1980.