Confucian culture has always been an important part of Chinese traditional culture. Confucian culture advocates that "be disciplined when poor and be generous to the people in the world when rich". Therefore, since ancient times, there has been the saying of "Confucian businessmen". For high gain and profitable firms, they have more disposable resources to engage in public welfare and meet the needs of stakeholders. The public has a high expectation of their social responsibility performance. Thus, successful firms are more motivated to undertake social responsibility initiatives and to disclose social responsibility information (Jackson & Nelson, 2004; Hahn & Kim, 2016).

Then, is "the poor" only "good for itself"? "Poor" companies are companies with fewer resources and lower profitability. Due to limited resources, "poor" companies may be reluctant to fulfill social responsibility and disclose social responsibility information as that may bring them additional burden, and even cause short-term financial performance decline (Brammer & Millington, 2008).

This research focuses on firms with historical loss, which are relatively "poor" and investigates their voluntary disclosure. The so-called historical loss firms refer to those whose profits are not enough to make up for the losses of previous years, resulting in large amounts of negative undistributed profits. The reason for choosing historical loss firms as research objects is that this kind of firms bear heavy historical burden, face restrictions on dividend distribution and equity financing, and have a stronger desire to get the recognition of stakeholders. Therefore, it can effectively test the resource motivation hypothesis of corporate social responsibility disclosure.

The resource motivation hypothesis of corporate social responsibility disclosure is based on the stakeholder theory. Stakeholder theory holds that an enterprise is a set of interest groups, such as shareholders, creditors, employees, suppliers and so on, based on contracts. Stakeholders provide the necessary human resources, material resources and financial resources to enterprises, and demand the returns of the input resources from enterprises (Cornell & ShaPiro, 1987). In order to avoid adverse selection and moral hazard caused by information asymmetry, enterprises will voluntarily disclose information to attract investors, creditors and other stakeholders. Stakeholders can use the information disclosed as a basis to distinguish "good" enterprises from "bad" ones to reduce risks (Slater & Gilbert, 2004). Social responsibility information is an important part of non-financial information. Enterprises that actively undertake social responsibilities are often regarded as responsible citizens. They have a distinct appeal to consumers, which lead to more sales, better financial performance (Cornwell and Coote, 2005; Lev, Petrovits, & Radhakrishnan, 2010; Lins et al., 2017), and high stock returns (Ryu, Ryu, & Hwang, 2016). Socially responsible enterprises have higher reputation (Brammer & Pavelin, 2004) and are often faced with lower cost of equity capital (Dhaliwal, Li, Tsang, & Yang, 2014). Firms with historical loss are always faced with resource constraint. In order to obtain the resources controlled by stakeholders, these firms may be more inclined to disclose social information to gain the recognition of stakeholders.

Taking Chinese A-share listed firms which issued standalone social responsibility reports during the period of 2009-2017 as a sample, this paper empirically investigates the relationship between historical loss and CSRD. Findings indicate that firms with historical loss disclose significantly more social information than firms without historical loss, which means that "poor" firms are no longer confined to "being alone", but also "help the world" and timely disclose such information to stakeholders. Further research shows that the positive relationship between historical loss and CSRD are more pronounced in enterprises with less financing constraint and fiercer industry competition.

The main contributions of this study are as follows: First, this study focuses on a unique type of firms and studies the impact of historical loss on corporate voluntary disclosure, enriching the literature in the field of corporate voluntary disclosure. Second, this research studies the consequence of historical loss from the perspective of information disclosure, enriching the literature in the impact of historical loss on corporate micro behavior. Third, the findings of this research provide empirical evidence for the policy-making of the so-called classified enterprise reform in China. Resource-based motivation is one of the main motivations for Chinese enterprises to disclose social responsibility information. In order to improve their reputation and image, firms with historical loss are active in disclosing social information. But the level of corporate social performance and disclosures are adversely affected by the degree of financial constraints. In order to help firms get rid of historical loss, policy-makers should formulate policies to ease financial constraints of historical loss firms.

2. Literature Review and Theoretical Analysis

Corporate losses are heterogeneous, including permanent loss, temporary loss, and historical loss (Joos & Plesko, 2005). Historic loss firms refer to those who have turned losses into profits in the current period but the profits are not enough to make up for the losses of previous years. Historical loss firms usually have "large share capital, large capital reserve, small surplus reserve and large negative undistributed profits". According to the Company Law of China, corporations cannot distribute dividends to shareholders when the previous years’ losses have not been made up. Therefore, historical loss is often a "bad news" for investors, which means that shareholders can not share the company's operating results through dividend. And shareholders' wealth will be damaged. In order to meet their personal self-interest, shareholders may tunnel listed companies through related party transactions and other means, further harming the interests of other stakeholders (Shleifer & Vishny, 1997; Johnson, La Porta, Silanes, & Shleifer, 2000; Rahman & Khatun, 2017). In addition, according to the current corporate refinancing policy in China, firms with historical loss are not qualified for equity refinancing due to being unable to distribute dividends. Thus, firms with historical loss rely more on debt financing.

Resource-based theory holds that a firm is “a pool of resources” (Hodgson, 1998).The differentials in corporate performance are primarily due to the resources firms own or control (Branco & Rodrigues, 2006). Reputation is an important intangible resource, which can bring firms competitive advantage (Roberts & Dowling, 2002). Thus, firms are willing to carry out social activities to fulfill stakeholders’ needs on the one hand and to gain reputation on the other (Fombrun & Shanley, 1990; Orlitzky, Schmidt, & Rynes, 2003; Lee, 2014; Yoon, 2014). For example, after the Wenchuan earthquake in 2008, Rockcheck Group successively donated 100 million yuan, making it the focus of media attention. Prior research posits that the disclosure of high-quality social responsibility information helps to alleviate information asymmetry (Yoon, 2019). For firms with historical loss, due to the dividend constraints and equity refinancing constraints, they urgently need to obtain more resources to help them bail out of historical loss. In order to regain legitimacy, firms with historical loss may take initiatives to increase social responsibility disclosure. Accordingly, the following hypothesis is proposed:

H1: Whether a firm has historical loss or not is positively correlated with the level of corporate social responsibility disclosure.

Whether and how an enterprise discloses social responsibility information depends not only on information demands, but also on the cost and benefit of disclosure (Cormier & Magnan, 2003). The collection, processing and reporting of social information need a lot of inputs. For firms to disclose social responsibility information, willingness and abilities are indispensible. Only those who can bear the disclosure cost are willing to disclose higher quality social information (Grossman & Hart, 2012; Zhang & Yin, 2019).

Firms with historical loss cannot raise funds through equity refinancing. If they are faced with severe debt financing constraints, it will be even worse. Investing in social responsibility will inevitably aggravate the situation for firms with historical loss and debt financing constraints. Moreover, the fulfillment of social responsibility and disclosure can't bring about immediate improvement of financial performance, and even lead to the decline of short-term performance (Brammer & Millington, 2008). Therefore, it is expected that when historical loss firms are faced with serious financial constraints, their willingness to disclose social responsibility information declines. Therefore, compared with historical loss firms with less severe financial constraints, historical loss firms with severe financial constraints are inclined to disclose more social information. Accordingly, this paper proposes the following hypothesis:

H2: Ceteris paribus, for firms with historical loss, the level of social responsibility disclosure of firms without financing constraints is significantly higher than that of firms with financing constraints.

Market structure and industry competition are important factors affecting the decision-making of the management (Leibenstein, 1966). There is certain rigidity in the demand of monopolies' products and services. Monopolies can obtain huge monopoly profits by monopoly status. So they are less motivated to win consumers by fulfilling social responsibilities. Most of the industries with high competitiveness are private ones, faced with serious homogeneity of products and great pressure to survive. In order to distinguish themselves from competitors and win customers, competitive industries are motivated to take social initiatives and disclose social information. Moreover, good social performance can help private enterprises establish political links with local governments in China, strengthen their resource acquisition capabilities, and solve their financing constraints (Yin & Zhang, 2019).

Firms with historical loss bear a heavy burden of prior loss. The key to get rid of this predicament is to enhance their competitiveness and profitability. When historical loss firms are in fierce market competition, it will be difficult for them to expand market share and increase profits. Building reputation is a good way to achieve product differentiation. Good social performance and disclosure are conducive to building reputation (Toms, 2002; Hasseldine, Salama, & Toms, 2005). Therefore, historical loss firms in highly competitive industries may be more inclined to disclose social information. Compared with monopoly industries, competitive industries tend to disclose more social information when historical losses incur. Accordingly, the following hypothesis is put forward:

H3: Ceteris paribus, for firms with historical loss, the level of social responsibility disclosure of firms in competitive industries is significantly higher than that of firms in monopoly industries.

3.1. Sample Selection and Data Sources

This paper takes Chinese A-share listed firms which issued standalone social responsibility reports from 2009 to 2017 as the initial sample. The data started in 2009 due to the fact that some listed firms in China were mandated to issue standalone social responsibility reports in 2008. The institutional environment of corporate social disclosure has changed. Provincial marketization index in 2018 has not been issued to date, so this research does not include the data in 2018.

The data screening process is as follows: (1) exclude financial industries; (2) exclude negative net profit observations; (3) exclude missing key financial data. Finally, 4450 firm-year observations remain. Considering the low proportion of historical loss firms and the possible endogenous problems, the tendency score matching (PSM) method is used to find matching samples for all historical loss firms by placing the nearest neighbor 1:1, 1:2, 1:3 matching method. Samples that do not satisfy the common support hypothesis are excluded. The paired samples satisfy the common support hypothesis and equilibrium hypothesis. To avoid the possible influence of extreme values, main variables in this paper are tailed at the level of 1%. The data of corporate social responsibility disclosure are collected from Runling Global Corporate Social Responsibility Report Rating Database, and the financial data are from CSMAR database. The statistical software used for data processing is Stata 14.0

3.2. Variable Measurement and Model Design

To test hypothesis H1, this paper constructs the following model of corporate social responsibility disclosure:

The dependent variable CSRDi,t denotes the level of CSRD. The independent variable Hislossi,t is a dummy variable of whether an enterprise has a historical loss or not. If the net profit of the sample firm is greater than or equal to 0 and the undistributed profit is less than 0, it is called historical loss firm, and Hislossi,t will take 1. If the net profit of the sample firm is greater than or equal to 0 but the undistributed profit is greater than or equal to 0, it is called non-historicalloss firm, and Hislossi,t will take 0. Drawing on previous literature (Rahman, Sobhan, & Islam, 2019), this paper controls the following variables: firm-level characteristics (size, leverage, profitability, growth), corporate governance (property rights nature, ownership concentration, board size, proportion of independent directors, CEO duality), and institutional environment. In order to control industry and year fixed effects, this paper introduces industry and year dummy variables. The definitions of all variables are shown in Table 1.

[Table 1:] Definition of Variables

Definition of Variables

In order to test hypothesis H2 and H3, this paper divides the sample into groups according to the degree of financing constraints and industry competition. Then conduct regression analysis on each subsample. If significant differences exist in the coefficients of Hislossi,t between groups, it will mean that financing constraints and industry competition have significant impacts on CSRD of historical loss firms. This paper uses SA index by Hadlock and Pierce (2010) as a proxy for the degree of financing constraints. The index only contains two variables: size and Age, and does not contain endogenous variables. The formula is SA=-0.737*Size+0.043*Size^2 -0.04*Age. If SA index of the sample firm is larger than the median of the industry, it is classified into financing constraint group. Otherwise, it is classified into non-financing constraint group.

As for industry competition, this paper uses HHI as a proxy variable. The formula is HHI= (Xi/X)^2, in which Xi denotes prime operating revenue in the current period, and X denotes the sum of prime operating revenue of all firms in the industry. If HHI of the sample firm is larger than the median of all industries in that year, it is a monopoly industry and will take 1. Otherwise, it is a competitive industry and will take 0.

Table 2 reports descriptive statistics of major variables before PSM. From this table, we can see that the minimum value and maximum value of CSRD are 18.340 and 74.950 respectively, which indicates that great difference exists in the level of corporate social responsibility disclosure of the sample firms. The mean value of Hisloss is 0.039, which indicates that approximately 4% of the sample firms have historical loss. This ratio is a bit high, showing that historical loss is an urgent problem to be solved. Table 3 reports Pearson correlation coefficient matrix of main variables after PSM1:1 pairing. From this table, we can see that the correlation coefficient between Hisloss and CSRD is 0.172, significant at the level of 1%. Thus, hypothesis H1 is preliminarily confirmed. In addition, Size, Lev, SOE, Top10, Board and Market are positively correlated with CSRD, indicating that firms with larger size, higher leverage, more concentrated ownership and larger board as well as state-owned enterprises and firms in better institutional environment may have a higher level of corporate social responsibility disclosure.

[Table 2:] Descriptive Statistics

Descriptive Statistics

[Table 3:] Pearson Correlation Coefficient

Pearson Correlation Coefficient

4.1. Historical Loss and Corporate Social Responsibility Disclosure

Table 4 reports the regression results of historical loss on CSRD. Column (1) is the OLS regression result for the whole sample. Column (2) - Column (4) are OLS regression results of PSM1:1, PSM1:2 and PSM1:3, respectively. For the four regression models, signs of the coefficients of Hisloss are all positive. After matching, the significance levels of Hisloss even increase. The results support hypothesis H1, which indicates that compared with non-historical-loss firms, historical loss firms tend to disclose more social responsibility information

[Table 4:] Multivariate Regression Results

Multivariate Regression Results

4.2. Differences in the Impact of Historical Loss on CSRD between Groups

Tests for hypothesis H2 and H3 are conducted after PSM1:1 based on model (1). Table 5 reports regression results after dividing the sample firms into financing constraint group and non-financing-constraint group. From this table, we can see that the sign of the coefficient of Hisloss is positive but not significant in the financing constraint group. However, it is positive and significant at the level of 5% in the non-financing-constraint group. That is to say, the positive correlation between historical loss and corporate social responsibility disclosure mainly exists in the non-financing-constraint group. Financing constraints restrain the improvement of corporate voluntary disclosure of historical loss firms. Hypothesis H2 is verified.

[Table 5:] Historical Loss, Financing Constraint and CSRD

Historical Loss, Financing Constraint and CSRD

Table 6 reports regression results after grouping the sample firms into two groups according to industry competition. The table shows that the regression coefficient of Hisloss is significantly positive in competitive group but not significant in monopoly group. The findings indicate that industry competition has promoted the improvement of voluntary disclosure of historical loss firms, verifying Hypothesis H3.

[Table 6:] Historical Loss, Industry Competition and CSR Disclosure

Historical Loss, Industry Competition and CSR Disclosure

In order to test the reliability of the above conclusions, the following robust tests are carried out: First, the measurement of the dependent variable is changed. Divide the sample firms into two groups in accordance with whether or not the CSRD rating score of a firm exceeds the industry median. Set a dummy variable, Dummy_CSRD. If the CSRD rating score of a firm exceeds the industry median, Dummy_CSRD takes the value of 1; otherwise, it takes 0. Then run Logistic regression. Second, change the matching methods of control group and treat group. Radius matching and nuclear matching were used to screen control group. Third, change the measurement of the independent variable. Considering that the impact of historical loss on corporate social disclosure may be lagging, this study substitutes Hisloss with historical loss with one-period lag, Laghisloss. The results of all robust tests are shown in Table 7. The regression coefficients of Hisloss are all positive at a significant level of more than 10%, which shows that the conclusions of this study are robust.

Robust Test

At the Economic Working Conference of the Central Committee of the Communist Party of China held at the end of 2018, it was pointed out that the supply side structural reform should be deepened in accordance with the principle of "consolidation, enhancement, upgrading and unblocking". The primary task of supply-side structural reform is to reduce production capacity. As a result, the loss-making companies are pushed to the forefront of history. Resolving losses and alleviating the historical burdens of companies become the top priorities of reducing production capacity and realizing the upgrading of the industrial structure.

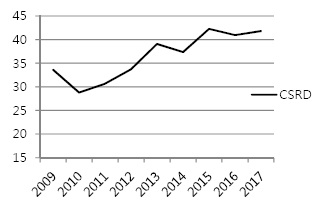

Historical loss firms generally have high capital reserves and low surplus reserves. Although historical loss firms have the normal hematopoietic function, they bear heavy historical burdens. They are faced with serious financing constraints. In order to alleviate financing constraints, historical loss firms actively perform social responsibility and disclose social responsibility information. As is shown in Figure 1, the average social responsibility disclosure index of historical loss firms was 33.63 in the year 2009. However, in the year 2017 it was 41.79. The average index rose by 24.26%. COSCO Shipping is one of the typical examples of historical loss firms. It is a logistics company listed in Shanghai in 2007. The firm suffered losses for two consecutive years in 2011 and 2012. In 2013 it declared a profit of 2.88 billion yuan. Its undistributed profit in 2013 was -10.11 billion. So it satisfied the definition of historical loss firm. The CSRD index of this firm was 77.59 in 2011, increasing to 79.89 in 2013, ranking AA. It far outstrips the other listed firms of the same period, which has an average of 38.98 in 2013.

It is worth noting that most historical loss firms have high capital reserves and high negative undistributed profits. According to Company Law of China, capital reserves can be transferred to paid-in capital but cannot make up losses. The negative undistributed profits of historical loss firms cannot be compensated by capital reserves. As loss prevents historical loss firms from paying dividends, the absolute value of shareholders' wealth is reduced. Furthermore, large capital reserves are mandated to save, resulting in resources idle and wasted. Therefore, the higher the proportion of capital reserves in net assets, the greater the possibility of idle resources and waste. In view of this, regulators should relax the ban on capital reserves of historical loss firms to make up for loss, which ultimately helps to improve the protection of stakeholders’ rights.

This paper investigates the impact of historical loss on corporate voluntary disclosure and the moderating role of financing constraints and industry competition. Using a sample of Chinese A-share listed firms which issued standalone social responsibility reports over the period 2009-2017, this research finds that the level of corporate social disclosure is positively correlated with historical loss. Firms with historical loss disclose significantly more social information than firms without historical loss. Financing constraints deteriorate the situation of firms with historical loss, leading to the low level of social disclosure. Market competition impels firms with historical loss to be more socially responsible and disclose more social information.

The findings indicate that resource-based theory can effectively explain the motivation of corporate social disclosure. Although firms with historical loss have certain profitability, due to the huge negative undistributed profits, they have no access to dividend distribution and equity refinancing. In order to improve the relationship with stakeholders, firms with historical loss may increase voluntary disclosure to alleviate the information asymmetry. Being socially responsible could signal to the outside a responsible corporate image, helping to win the support of stakeholders and the resources they control. However, it is worth noting that financing constraints and industry monopoly are hindrances to the improvement of corporate social disclosure. In order to help firms get rid of historical loss and protect the legitimate rights and interests of stakeholders as well, policy-makers should formulate relevant policies to solve the financing constraints of firms with historical loss, allow firms with historical loss to make up for historical loss with capital reserve and improve the efficiency of capital reserve. In addition, the government should reduce intervention and create a fair and orderly market competition environment. As market competition can promote corporate awareness of social responsibility and impel corporations to improve social disclosure.

This study has its limitations. First, this study uses Runling Global Corporate Social Responsibility Rating Data to measure the level of CSRD, without considering the continuity of information disclosure. Future research can use the first-order difference method to study the incremental impact of historical loss on corporate social disclosure. Second, social disclosure of a firm may not inform of its social performance. The object of this study is corporate social disclosure of firms with historical loss. The potential differences between CSRD and corporate social performance are not taken into consideration, which may have some adverse impacts in understanding the conclusions of this research. Future research can explore social performance of firms with historical loss and investigate whether differences exist between CSRD and corporate social performance.