The world of orthodox economists is typically made up of tradeoffs where one person wins and the other loses. Nowhere is this way of seeing development and society more evident than in the analysis of natural resources. Since the seminal paper by Corden and Neary (1982), orthodox economists (e.g., James and Aadland 2011; Beine, Bos, and Coulombe 2012) have persistently used the notion of a resource curse, the binary framework in which resource-rich countries are either entirely blessed or entirely cursed by natural resources.

This paper shows that blessings, curses, and uncertainties co-exist, co-evolve, and co-mingle in practice, and grand narratives about a “blessing” or a “curse” are not only simple but also misleading. What is a blessing to one social class may be a curse to another. Thus, contrary to a narrative of one monolithic scenario of curses or a monolithic scenario of blessings, the situation is more complex. To make this argument, the case of Ghana, a country in West Africa, is used as a case study in this paper.

Relative to other African countries, Ghana has strong institutions. The state has three arms, namely, the central state, the local state, and the traditional state. The central state has strong judiciary and legislative branches, and a democratic executive branch that is regularly changed through generally free and fair electoral means (Gyimah-Boadi 2009). According to the Electoral Commission of Ghana,1 as many as 17 political parties are registered to take part in Ghana’s multi-party democracy. In practice, it is the ruling National Democratic Congress and its opposition, New Patriotic Party, that are the largest and most vibrant parties (Bob-Milliar 2011). While Ghana is one of the few countries in Africa where ideology is explicitly stated as part of its political discourse (Elischer 2011) with the ruling government claiming to be social democratic and the largest opposition claiming to be liberal or an exponent of property-owning democracy, in practice, political parties in the country are quite similar in terms of their policies (Obeng-Odoom 2010; Bob-Milliar 2011). Ghana also has a strong and vibrant media which ranks 41st in the world and 6th in Africa, according to Reporters Without Borders (2012).

The local state in Ghana has been around for over two decades and operates in decentralised units totalling 170 spread out all over the country. In Africa, the local government system in Ghana is one of the most mature (Crawford 2010). Ghana has a third state, which is a traditional set up consisting of the chieftaincy institution. It receives considerable respect among the population and is fully recognized in the current Constitution of Ghana. While the traditional state has no direct power over the central and local states and is, in fact, barred from taking part in party politics (see Article 276, clause 1 of the 1992/93 Constitution of Ghana), chieftaincy institution has great power in terms of land management (see Article 267, clauses 1 and 6 of the Constitution of Ghana). Over 70 per cent of land in Ghana is held by the traditional authority constituted by chiefs, traditional priests, and families (Abdulai 2010, p. 138). Generally, these states co-exist peacefully, and each tends to support the process of economic development.

In those economic terms, too, Ghana has an enviable position in Africa. Its economy is booming. Its real GDP grew by 7.7 per cent in 2010, and, according to provisional figures, grew further to 13.6 per cent in 2011. Yearon-year inflation fell from 20.7 per cent in June 2009 to 8.4 per cent in December 2011 (Ministry of Finance and Economic Planning 2012). The unemployment rate dropped from 8.2 per cent in 1999-2000 to 3.6 per cent in 2006-2008 (Ghana Statistical Service 2000, 2008); and during the years for which statistical information is available (1991-92, 1998-99, and 2005-2006), the incidence of poverty dramatically reduced from 36.5 per cent to 26.8 per cent, and then to 18.2 per cent, respectively (Ghana Statistical Service 2007, p. 9). For all these political-economic reasons, Ghana has been regarded in the literature as one of the big four in Africa (Naudé 2011). While the other three countries in Africa—namely, Botswana, Mauritius, and South Africa—may possess some of the enviable record of Ghana, what makes Ghana a particularly interesting case for study is that it has only recently discovered oil and its bureaucrats, academics, and civil society groups all tend to frame their thoughts around the resource curse thesis (Gyampo 2011). Oil was discovered in commercially viable quantities in Ghana in 2007, the first lifting took place in 2010, and the first export happened in 2011. Studying such a new oil economy presents a major challenge, namely, the difficulty in obtaining sufficient data for analysis. One way to mitigate this problem is to use a data triangulation approach (Oppermann 2000) by drawing on multiple sources of evidence and stylized facts.

The rest of the paper places Ghana’s young oil industry in a global perspective, problematises the dominant framework used for analysing the industry, and considers suggestions for effective public policy.

1The official website of the Electoral Commission of Ghana contains details of the registered parties. The details of the Progressive People’s Party, registered in 2012, are yet to be included. http://www.ec.gov.gh/page.php?.page=376§ion=45typ=1. Accessed May 21, 2012.

Tom McCaskie (2008) was the first to raise the issue of global interest in Ghana’s oil industry. In particular, he showed how the United States, using the discourse of promoting USA-Ghana security relations, is keenly interested in securing its share of Ghana’s oil under the auspices of a military command for Africa (AFRICOM). Although the influence of rising global powers such as China has not been as much felt as the USA in Ghana’s oil industry, by financing infrastructural projects such as energy-producing dams (e.g., the Bui Dam), China is also a potentially interested party in Ghana’s oil. However, it is not only China and the USA that are interested in oil in Africa: all industrialised countries are seeking to move away from the Middle East-centric focus in their pursuit of oil supplies (Mohan and Power 2009). Since 2007, there have been at least 41 companies, from different countries, that have applied for prospecting licenses to operate in Ghana. The approach adopted by the Government of Ghana in dealing with these applications is to negotiate with individual companies rather than using a competitive tendering process (Akli, 2010).

The companies prospecting in the Jubilee Field and their respective shares are Tullow Oil (34.7 per cent), Anardako Petroleum (23.49 per cent), KOSMOS Energy (23.49 per cent), Ghana National Petroleum Corporation (13.75 per cent), Sabre Oil and Gas (2.81 per cent), and the EO Group (1.75 per cent) (Akli 2010), which sold off its shares to Tullow in May 2011. Therefore, as of the time of writing this paper (June 2012), the share of Tullow Oil Plc in the Jubilee field is 36.45 per cent (Public Interest and Accountability Committee 2012).

In the events leading up to the sale of the shares of the EO Group, a company owned by George Owusu and Kwame Bawuah-Edusei, there were attempts to marginalise the EO Group because of its close connections to the former government formed by the New Patriotic Party. The present government believes that the EO Group obtained its interest in the oil industry without following due process (Alliance for Responsible Opposition, 2010). However, “independent investigations” by

The present government had bigger problems with other agreements entered into by the former government. For example, on June 28, 2010, KOSMOS Energy sought the consent of the government to finalise a sale and purchase agreement with Exxon Mobil (Oteng-Adjei 2010), but the government (represented by the Ghana National Petroleum Corporation) claimed that KOSMOS Energy leaked confidential information to Exxon Mobil, which made the agreement to sell KOSMOS’ interest to Exxon Mobil inappropriate. Furthermore, the government claimed that, being a partner to the consortium that discovered the oil, it reserved the right to be given the first option to buy KOSMOS’ stake (

At the time of writing this paper (June 2012), the explicitly political issues related to prospecting companies seem to have settled. It is the resulting socio-economic issues framed around the resource curse thesis that require further political-economic analysis.

Looking behind, ahead, and beside the Resource Curse Thesis

As a concept in economics, the notion of a “resource curse” connotes the inverse relationship between resource wealth and the health of an economy (Corden and Neary 1982). Hence, the resource curse is sometimes called “the paradox of plenty” (Auty 1993). Indeed, the economies of resource-poor countries such as Switzerland and Japan have usually outperformed those of resource-rich countries such as Russia. Economic growth in the Newly Industrialising Countries (NICs) of East Asia, such as Korea and Singapore, has consistently surged ahead of resource-rich countries such as Venezuela (Sachs and Warner 1995). Such is the paradox that led Sheik Ahmed Yamani, in his capacity as Oil Minister of Saudi Arabia, to contend, “All in all, I wish we [Saudi Arabia] had discovered water” (cited in Goodman and Worth [2008], p. 201).

The curse can plague any continent. However, Africa has become the focal point of considerable research and interest (Obi 2009) perhaps because of the increasing amount of hydrocarbons which have been discovered on the continent in recent times (Lesourne and Ramsay 2009). Africa is a continent with a significant amount of oil, particularly in the Gulf of Guinea. As of 2007, Nigeria, Angola, Cameroon, Chad, Congo-Brazzaville, Equatorial Guinea, and Gabon were producing an estimated 5,120 million barrels per day. The Gulf of Guinea alone produces 7.1 per cent of total world production of oil (Lesourne and Ramsay 2009, p. 8).

Yet there are many problems on the continent, ranging from resourcerelated conflicts to poor socio-economic development. Between 1965 and 2000, the per capita GDP of Nigeria, the largest exporter of oil in Africa since the mid-1960s, remained around $325, although it spent over $350 billion in oil rents (Same 2009, p. 7). Oil exploration-related conflicts are common in Nigeria, leading to frequent attacks on oil installations. Between 2005 and 2008 alone, it is estimated that 500,000 barrels of oil were lost due to such attacks and their disruptive effects (Obi 2010).

In Chad, oil from the Chad-Cameroon Pipeline alone stood at 140,000 barrels per day in 2004, and by the first half of 2005, it had increased to 180,000 barrels per day. Yet, in terms of social effects at the household level, the oil seems to have had limited impact. A substantial part of the revenue goes into military spending, leaving little for social spending to benefit the 80 per cent of the population who lives in poverty (Pegg 2006).

African countries are not the only ones caught in this paradox of plenty, of course Nauru, a small island in the central pacific, is another such case. In 1900, phosphate—a mineral for producing fertilizer—was discovered in commercial quantities (Anghie 1993). It is said that, although Nauru became wealthy because of the resource, 80 per cent of the island was “totally devastated” by environmental damage as of 1999 (Gowdy and McDaniel 1999). In 2006, an environmental journalist reported that 90 per cent of the land in Nauru was “unusable, impassable, and barren.” Beyond the environmental damage, the people are said to be poor, fresh food is scarce, and the life expectancy of Nauruans is the shortest in the region (Patel 2006, p. 151). Other resource-rich countries that have not been particularly fortunate after the discovery of oil are Iran and Kuwait. Although they have explored and exported oil for over 30 years, their economies have grown by an annual average of only 1 and 3 per cent, respectively (Larsen 2005).

In spite of this international evidence of the pervasiveness of the resource curse, care must be taken in not drawing a deterministic correlation between resource rent and socio-economic and political problems. Norway, a resource-rich country, is widely acknowledged to have avoided the curse. Discovering oil in 1969, it has successfully turned its resource into a blessing. Instead of a curse, its economy expanded (in terms of GDP per capita), catching up with, and eventually overtaking, the economies of Denmark and Sweden, its immediate neighbours. Although a slight reduction in the rate of economic growth occurred eventually, it is widely believed that Norway has avoided the oil curse and turned it into a blessing (Larsen 2005) that has improved the socio-economic conditions of the population. Underpinning this story of a resource blessing is the effectiveness of its regulatory institutions and the effects of corporate social responsibility mechanisms in oil companies, as well as a flexible labour market and the presence of an alert populace that is ready to hold the oil companies to account. Other reasons include the use of a floating exchange rate model which absorbs the volatility in oil prices, as it provides greater scope for the central bank in national economic planning (Mikkelsen et al. 2005; Larsen 2006; Al-mulali 2010).

Because Norway is a more developed country than most of the countries in Africa, it may be argued that the Norwegian example is inappropriate in discussing the resource curse in Africa. Even in Africa, however, Botswana is widely believed to have avoided the curse, too (Auty 2001; African Development Bank and African Union 2009). Between 1966 and 1999, the Botswanan economy grew at an average of 9 per cent per annum, making it the fastest growing economy in the world at the time. Also, relative to other resource-rich countries in Africa, it has succeeded in investing resource rents in social development, particularly in areas such as education and health (Pegg 2010). Regarded as a “poor country dependent on livestock, remittances, and foreign aid” in 1966, the discovery of diamonds in the 1970s transformed the Botswanan economy and society (Poteete 2007, p. 2). Gaborone, its capital city, has recently been described as “extraordinary in African terms…lacking in mass poverty, extensive squatter settlements or civil strife” (Kent and Ikgopoleng 2011, p. 478). Indeed, the 2010 Human Development Report (UNDP 2010, p. 30) describes Botswana as one of the few countries in Africa to have made “substantial progress in human development.”

These success stories show that context is important in discussing the resource curse thesis. In that sense, it is useful to consider the particular case of Ghana, and this paper does so by showing evidence of (a) blessings, (b) uncertainties, and (c) curses. Although the analysis is tentative because information on the oil industry is still sparse, evidence suggests that, in the “real world,” blessings, uncertainties, and curses co-exist, intermingle, and co-evolve, albeit not uniformly on different social groups and classes. It follows that the resource curse thesis must be problematised rather than uncritically accepted.

The discovery of oil in commercial quantities in Ghana was made in June 2007. Ghana’s oil fields are mainly offshore, although LukOil has invested $100 million to support on-shore oil exploration which is said to cover about 40 per cent of the landmass of Ghana, specifically in the Volta, Brong Ahafo, and the Northern Regions (Ghana News Agency 2008). Figure 1 is a map of “Jubilee,” which is the country’s first operating oil field. It is so called because it was discovered around the same time Ghana celebrated 50 years of independence from British colonial rule.

According to McCaskie (2008), when it was first reported that oil had been struck in commercial quantities in Ghana, John Kufour, then the president of Ghana, gave an impromptu speech about how the economic destiny of Ghana would significantly change because of the benefits of the oil industry. Also, the Minister of Energy at the time ceremoniously carried a small quantity of the oil to the Parliament of Ghana to provide “physical proof” to the parliamentarians that Ghana was on its way to joining the “club of oil producers.”

According to the Public Interest and Accountability Committee (PIAC), which was established in 2012

In the last three days of November 2010, production in the Jubilee Field averaged 24,395 barrels per day, but production picked up in December, averaging 37,932 barrels per day and has nearly doubled to 64,000 per day since then. Overall, the total oil lifting by the end of 2011 was 24,451,452 barrels (PIAC 2012). The total revenue from oil calculated based on market price totalled $444,439,138.80 in 2011 (PIAC 2012); the Government of Ghana estimates that the total revenue in 2012 will be about $826,546,666.672 (Ministry of Finance and Economic Planning 2012). If this upward trend is sustained, Ghana may become the seventh largest oil producer in Africa (Staff Writers 2008).

Estimates of “local content” in the supply of goods to the oil sector and job creation seem positive. For instance, 40–60 per cent of the jobs to be created directly from the Jubilee 1 phase are predicted to go to Ghanaians (World Bank 2009, p. 22). The impact of oil on the macro economy of Ghana is likely to be substantial too. Projected real GDP growth rate for 2011 was only 7.5 per cent without oil, but

It is expected that the country will produce gas from its oil at a rate of one thousand cubic feet of gas per barrel of oil. Assuming a peak phase 1 production from the Jubilee Field alone, Ghana could produce 120 million cubic feet of gas per day. Further assuming current world market price for natural gas liquids (NGL) of $2 per thousand cubic feet, the country is expected to obtain gross revenues of approximately $260 million per year in addition to oil revenues. From these figures, a 50 per cent equity ownership in the gas infrastructure by the Ghana National Petroleum Corporation (GNPC), Ghana’s power production company, could lead to corporation tax revenues of about $120 million per year for the Government of Ghana (World Bank 2009, pp. 2-3).

There are many potentially positive multiplier effects of oil. The World Bank has approved a $38 million credit to the Government of Ghana to be used to implement an Oil and Gas Capacity Building Project which is intended to strengthen the technical expertise of the staff of key state institutions, such as the Ministry of Energy, Ghana National Petroleum Corporation (GNPC), and the Environmental Protection Agency (EPA) as well as the Ghana Revenue Authority, the Extractive Industries Transparency Initiative Secretariat, the Attorney General’s Department, and the Economic and Organised Crime Office (EOCO). Also, the World Bank has offered $2 million in grant to empower grassroots and community participation under its Governance Partnership Facility (GPF). The declared intention is to finance the activities of civil society and community-based organisations (

Direct employment is likely to be, however, low. For instance, the Floating Production, Storage and Offloading (FPSO) vessel on the Jubilee Field (called FPSO Kwame Nkrumah) employs only one hundred people (Ekuful 2010). The oil-job creation nexus is expected to be indirect. The revenue from oil can help the state to invest in sectors such as manufacturing, which may, in turn, create more jobs (Allum 2010), mainly through derived demand. The World Bank’s (2009, p. 3 footnote) calculations show that twenty to thirty thousand jobs may be created in 2012 and another twentyfive to thirty-five thousand jobs in 2015.

An important issue is whether local people are likely to receive a reasonable share of these jobs or not. According to the Local Content and Local Participation in Petroleum Activities Policy Framework, the Government of Ghana expects at least 90 per cent local participation in the industry by 2020. Whether this aspiration is realistic is hard to say, as employment data are few and far between. It has been reported that 86 per cent of the staff of Tullow Ghana are Ghanaians (

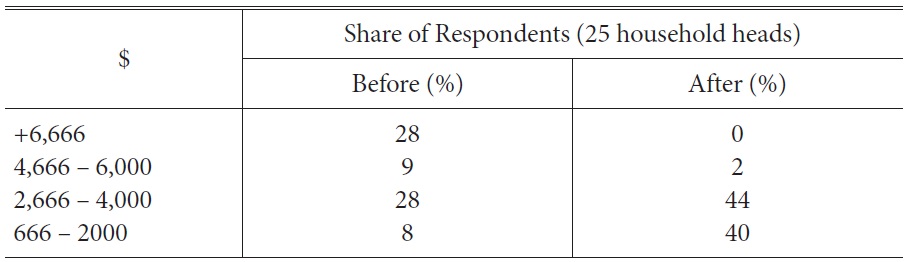

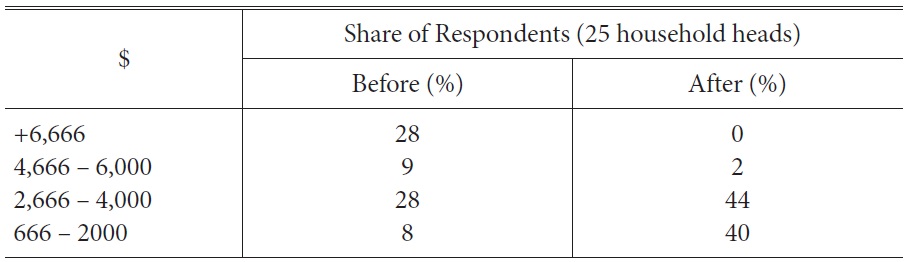

This overall picture, however, hides differential impacts of the process of job creation. For instance, fisherfolks in the oil area are likely to face worsening working conditions. The decision by the state to ban fishing in certain areas in the sea in order to protect oil installation is a case in point. It is expected that this restriction will affect fish harvest. One survey of the opinions of 204 female fishmongers conducted before production began (Boohene and Peprah 2011) found that 52 per cent of them anticipated a reduction in fish supply. Of course, the ban is likely to protect life too because the exclusion zone will become a “haven” for fish, some of which are fingerlings and so need protection. Simultaneously, however, by drawing fish from elsewhere to the safe haven, fisherfolks’ living conditions will be adversely affected. A “before and after analysis” of incomes in the Cape Three Points area (see figure 1), where the predominant occupation is fishing (Manu 2011), shows that the related activities of oil exploration, production, and development are worsening fisherfolks’ incomes, as shown in table 1.

[Table 1] Net Annual Income of Fishermen in the Cape Three Points Area

Net Annual Income of Fishermen in the Cape Three Points Area

Table 1 shows that oil exploration, production, and development has dramatically decreased the incomes of fishermen at all income levels. Those who were earning over $6,000 before the ban are no longer earning that much and may have joined the ranks of other lower income brackets, thus swelling the share of people earning between $2,666 and $4,000 and between $666 and $2,000. Amoasah (2010) predicts as well a worsening of the situation due to possible flaring, spillage, noise, air emissions, hazardous solid waste, and poisonous water discharges into the sea. This analysis shows that, even the process of job creation—normally regarded as a blessing—can simultaneously be a curse to different social classes and groups.

Aside from local content in job creation, oil is expected to be a blessing through the effects of corporate social responsibility (CSR). Tullow Oil plc has commenced a community health outreach project in partnership with the Ghana Health Service in six coastal areas, namely in Shama, Ahanta West, Nzema East, Ellembele, Sekondi-Takoradi, and Jomoro, areas which are located in the Western Region of Ghana. The programme entails specialist advice and treatment of diseases by optometrists, dentists, and ear, nose, and throat specialists as well as treatment by general practice doctors. Local people have benefitted from this programme. For instance, in just one day, about 1,120 people were screened in Shama alone. The project is valued at about $150,000 (

Collectively, it is the prospects of job creation, oil rents, and CSR—the benefits of which are different for different groups of people—that constitute a potential resource blessing. There are other effects, namely, the “Dutch disease” and volatility, which are neither blessings nor curses. Rather, they are uncertainties, at least at this stage. While some of the uncertainties (e.g., “Dutch disease” effects), a discussion of which we shall do shortly, are so classified because of the non-availability of evidence of whether they will, in fact, occur, others such as volatility are inherently #8220;uncertain” and should properly be called “uncertainties,” not “curses” as described in orthodox economics literature.

The notion of the “Dutch disease” refers to the situation in which a boom in natural resources leads to contraction in the non-booming part of the economy. It arises because of a fall in overall labour supply (as households choose more leisure) and a shift of labour from the non-booming to the booming sector. In turn, the output in the non-booming sector declines and the price of the factors of production in the booming sector drops relative to prices of factors in the non-booming sector. This aspect of the Dutch disease is called the “resource movement effect.” There is also a “spending effect” in which expenditure of oil resources impacts the value of the local currency which, in turn, may affect imports and exports. Exports of an oil country may become too expensive to the point that it may cause their demand to fall, while imports into the oil country may be cheaper than locally made goods, such that there may be a rise in demand for imported goods and a fall in demand for locally produced goods. Consequently, local or indigenous industries may fold up (Corden and Neary 1982).

The “disease” was first discovered in the Netherlands where the discovery of natural gas in the 1960s led to negative effects on the Dutch economy: the guilder, the Dutch currency, appreciated in value. As a result, Dutch exports became relatively uncompetitive. Also, much national attention was given to the development of the natural gas resource with adverse effects on manufacturing industries. In 1977,

Not many studies have been conducted about possible effects of the Dutch disease on the oil industry of the Ghanaian economy. Some optimists, such as the World Bank, believe that it is unlikely that Ghana will suffer from the Dutch disease, given the existing conditions in Ghana, namely, the fact that the size of Ghana’s industry is small—only about one-eighth of neighbouring Nigeria’s—as well as its active promotion of other commodities such as cocoa and gold. According to the Ghana Country Director of the World Bank, “It’s a bit of oil, not a whole lot, so it’s not enough to give you the Dutch disease and a curse” (

The work of Dagher, Gottschalk, and Portillo (2010) remains the only systematic analysis of a possible resource movement effect. Employing a dynamic stochastic general equilibrium (DSGE) model, it assumes large “learning-by-doing effects” and high substitutability of labour between the non-traded and traded sectors. It further assumes a direct relationship between the traded sector and overall productivity in the economy. This study found that, although there may be some output losses in the traded sector, they are small. Even if they are large, however, they are not large enough to offset the overall positive impact of the oil industry on the Ghanaian economy.

Others, such as the Centre for Policy Analysis (CEPA) in Ghana (CEPA 2010), have alluded to the possibility of a Dutch disease scenario, particularly in the form of spending effects. The CEPA study contends that, as more revenues from oil become available, the value of the local currency will increase. In turn, imported goods will be cheaper and, hence, make people switch from purchasing of goods made by local producers to imported goods. On the other hand, exported goods may become more expensive, leading to a drop in the demand of exports from Ghana. Overall, CEPA (2010) argues that there could be job losses as a result of oil exploration.

These polarised views seem to leave open the question of whether there will, in fact, be the Dutch disease effect. Breisinger et al. (2010) argue that it is an empirical question, dependent on how oil rents will be used in practice. For instance, if a “spend all” strategy is used, not only will there be pressure on the local currency, with implications for imports and exports, but also the distribution of income may become more unequal between rural and urban households, as agriculture may be adversely affected by appreciation in exchange rate. However, if a “save all and invest interest only” strategy is used, there is less likelihood of the Dutch disease effect. From this perspective, the current formula that guides how oil revenue should be used—a theme to which we return below—is likely to prevent the Dutch disease effect. However, it is still early days, so it is more appropriate to regard the Dutch disease effect as “uncertain.”

Volatility is the second uncertainty. Actual oil revenue obtained on the world market may exceed or fall below expectations. It follows that there may be some periods of “windfalls” and other periods of “losses.” Apriori, we would expect that these “ups” and “downs” would have implications for economic growth, as they can change revenue and expenditure plans in the economy. The empirical work of Van der Ploeg and Poelhekke (2007) shows that, in the long run, price volatility causes a negative relationship between natural resource rents and economic growth. The relationship is stronger when volatility is higher on the world market or when there is greater dependence on oil rents and less diversification in the economy.

Consistent with the provisions of the Petroleum Revenue Management Act (Act 815) of Ghana, the government has established a “stabilisation fund” (see section 9 of this act and also Breisinger et al. [2010]; Gatsi 2010) to provide “stability” in the face of fluctuating oil prices. On the one hand, if oil prices rise above budgetary projections, “excess” rents are invested in the fund. On the other hand, if prices fall such that revenues received are lower than projected, part of the fund may be used to finance the budget (for more on stabilisation fund, see Davis et al. [2001]).

While section 17 of Act 815 stipulates a range of “not more than 70 percent” of total oil revenue as the share to be used to support the national budget (called the Annual Budget Funding Amount, see section 17), the official government position is more definite: that 70 per cent of oil revenue will be expended to support the annual budget. The remaining 30 per cent is to be regarded as 100 per cent, which will then be split into a Heritage Fund4 (30 per cent) and Stabilisation Fund (70 per cent) (Kwettey 2010). Whether a stabilisation fund is sufficient to insure against price volatility, only time will tell. Such funds do not typically anticipate permanent volatility or long periods of price volatility (Davis et al. 2001). Also, as the experience of superannuation funds in Australia shows (Frankel 2004), the effectiveness of such funds is crucially dependent on where and how they are invested as well as the calibre of the fund managers and whether they are accountable to the populace. Indeed, were the funds invested in stocks and shares, they would be subject to the same price volatility they seek to stabilise.

Meanwhile, debate continues about how to spend the revenues that will go into the Annual Budget Fund. The serious concerns of policymakers and researchers range from fiscal and monetary aspects or inflation to fear of embezzlement (Acosta and Heuty 2009). Todd Moss and Lauren Young (2009), researchers from the Center for Global Development in the USA, have recommended direct cash transfers to Ghanaians to increase their interest in how oil revenues are spent. Direct cash transfers, they argue, can make the state more accountable to the people because the state has to depend on ordinary people (with oil money) for taxation. Thus, rather than the state directly using revenue from the oil industry for the provision of public services, Moss and Young argue that placing the revenue in the hands of the citizenry—from current estimates, about $50 per adult per year— hrough direct cash transfer is the way to ensure transparent revenue management. Such recommendations deal with the social and political aspects of the concerns about oil rents.

What about the economics of managing oil rents? According to Dagher et al. (2010), the government should spend only a small amount of the rents consistently over a long period of time from the perspective of ensuring a healthy fiscal and monetary environment. In this way, benefits of the rents can be lasting and sustainable. Moreover, it can help to curb demand-push inflation arising from high short-term expenditure. In practice, the debate in Ghana has taken the form of concerns about whether to collateralize the oil rents, that is, the question of whether to borrow against the future oil rents or not. The position taken by the New Patriotic Party (NPP), which is the largest opposition party, and civil society organisations such as the Civil Society Platform on Oil and Gas is that borrowing against future oil rents is inimical to effective management of revenues: it is a good principle in life that one does not eat one’s chickens before they are hatched (

The position of the government, on the other hand, is to spend now, including spending future revenues by collateralising them (Ablakwa 2010). The Parliament of Ghana has voted to allow collateralisation of oil rents, all of which are supposed to be placed in a holding account, a temporary account, for subsequent disbursement (section 2, subsections 1 and 2) of the Petroleum Revenue Management Act, 2011, Act 815). According to PIAC (2012, p. 41), the Government of Ghana has entered into a loan arrangement totalling $3 billion which was collateralised against the Annual Budget Funding Amount.

The question about how effectively oil rents should be expended remains contentious. Economic studies about this issue are lacking, save the work of Dagher et al. (2010). Dagher and his colleagues claim that if, on the one hand, there is little expenditure in the non-traded sector, pressure on the real exchange rate arising from the realignment of factors of production from the traded to the non-traded is considerably diminished. From that perspective, the country risks less exchange rate pressure if all expenditure is in the direction of the traded sector. It follows that, if oil rents are expended on projects with high import content, the tendency for the real exchange rate to rise would be low. Similarly, less expenditure on non-tradable goods such as services is likely to exert lower pressure on wages and inflation in the services sector. On the other hand, high expenditure on traded goods in the real sector of the economy would benefit both the tradable and non-tradable sectors, following a Keynesian logic of economy-wide impact, resulting from public investment in the “real economy” in areas such as construction of roads, schools, and hospitals.

Dagher and his colleagues (2010) argue that inflation may rise if the latter scenario is realised, suggesting the need for prudent monetary policies. Further, they suggest that, if the Bank of Ghana saves up a significant share of the rents from oil in foreign currency with the aim of controlling real appreciation in the exchange rate, it may have long-term problematic consequences for inflation. They contend that, while whichever policy is adopted has costs and benefits, overall, a combination of public investment and spending more on items with high import content may be useful to reduce the extent of the fiscal and monetary issues related to oil rents.

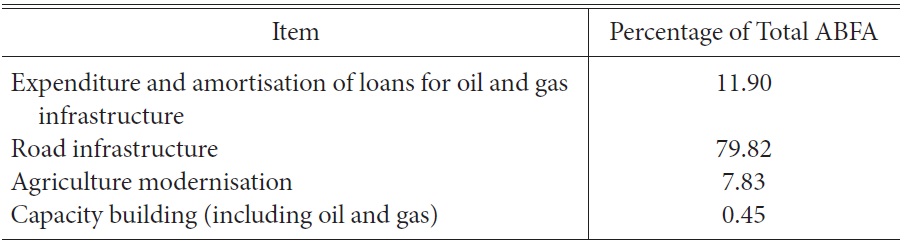

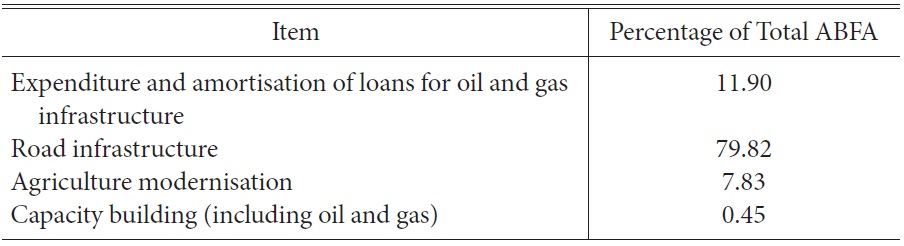

[Table 2] Allocation of Annual Budget Funding Amount (ABFA)

Allocation of Annual Budget Funding Amount (ABFA)

The Annual Budget Funding Amount as of September 30, 2011 was $112 million (Ministry of Finance and Economic Planning 2012). Details on how this amount was spent are contained in table 2 below.

Road construction dominated the expenditure pattern, suggesting possible employment generation potential. Also, expenditure on “oil and gas infrastructure” mainly went to the establishment of the Ghana Gas Company—again an avenue for job creation. The budget statement clearly discloses details of various expenditure heads and each of the expenditure items is informed by the Ghana Shared Growth and Development Agenda, one of the roadmaps for Ghana’s economic development (PIAC 2012). Although it is telling that capacity building receives very little attention and hence can lead to a situation where there are oil jobs but insufficient local expertise to fill them, it seems the only downside with respect to revenue expenditure as noted by PIAC is that the budget does not capture expenditure for the fourth quarter of 2011. Even then, PIAC suggests that this setback is understandable because data were not available at the time of preparing the budget, and the Ministry of Finance and Economic Planning seems to have started taking steps towards rectifying the problem (PIAC 2012). Thus, there is no evidence of “mismanagement” or inefficient management. Indeed, the Petroleum Transparency Index published by the Institute of Economic Affairs, one of Ghana’s leading independent think tanks, gave Ghana’s Minister of Finance and Economic Planning a perfect score for making information on oil and gas revenues and expenditure readily accessible (Ghana News Agency 2012). Not all is well, however; there are curses, too, and, as with blessings, their incidence on different social groups is not uniform.

Little attention has been given to the environmental aspect of oil windfall. The official position, as read by Minister for Environment, Science, and Technology Sherry Ayittey (2010), is that government is “ready and willing” to meet the potentially negative effects of oil exploration on the environment. What exactly is meant by this claim is not clear.

According to the minister, four state institutions have been given the mandate to ensure sustainable exploration. These institutions are the Environmental Protection Agency (EPA), Ghana National Petroleum Corporation (GNPC), Ghana Maritime Authority (GMA), and the Ministry of Environment, Science, and Technology. She draws attention to plans by EPA to make environmental and community concerns central to oil exploration, which have led to the inclusion of a section on Environmental Management, Health and Safety, and Community Issues (EMHSCI) in EPA plans. On February 1, 2011—note that this was about two months after the commencement of oil drilling in December—EPA announced that it had finalised guidelines to regulate the oil and gas industry (Ghana News Agency 2011).

Although some baseline surveys have been conducted for the purpose of planning and some environmental assessment guidelines developed (Ayittey, 2010), however, a number of tangible steps to be taken to achieve these aspirations remain undeveloped. According to the minister, the National Oil Spill Contingency Plan (NOSCP) is still “being strengthened.” Given that, in the words of the minister, a plan “sets out clear definition of the responsibilities of the major participants” (Ayittey 2010), the absence of a complete NOSCP casts doubts on the claim that the country is prepared for oil exploration. Also, as noted by the minister, “Currently, the EPA is reviewing the last set of requirements submitted to it by the operator of the Jubilee field.”5 Again, although the Ministry has made effort to organise public hearings to understand people’s concerns about the environmental angle of oil, “… [some of the] issues raised at the public hearings

The

However, most of the laws about oil were enacted over two decades ago when Ghana was not producing oil in commercial quantities, so there are fears that most of these laws are not relevant to the current situation. For instance, Cavnar (2008) has argued that the fundamental petroleum policy of Ghana is too vague about how the oil industry can be regulated. Most of the existing laws, such as the Petroleum (Exploration and Production) Law of 1984 (PNDC Law 84) and the Petroleum Income Tax Law of 1987 (PNDC Law 188), were promulgated in the 1980s when Ghana was governed by military dictatorship, so they were not subjected to broad public scrutiny, parliamentary debates, discussions, or popular approval (Gary 2009).

These issues have several implications. First, they open up the possibility that the oil companies may act in ways which are socially suboptimal (Adu 2009). Second, they provide a basis for avoidable litigation. Take, for example, the oil activities in Ghana’s exclusive economic zone (200 miles from shore), for which there are no clear laws. Ghanaian laws are applicable to Ghana’s territorial sea (12 miles from shore), a subset of the economic zone; however, sections of the zone are covered by public international law (e.g., the Law of the Sea) rather than local laws (Allan 2009). As such, questions could be raised about whether Ghana has exclusive rights over portions of the oil field. Indeed, officials from Cote d’Ivoire, which shares its border with Ghana, have made claims to this effect. According to them, Cote d’Ivoire should properly be regarded as part owner of “Ghana’s oil field” in the Western Region because there are no clear legally-binding boundaries that separate the territorial waters of Cote d’Ivoire Coast and Ghana in that region. This situation brings to mind the conflict which erupted between Nigeria and Cameroon over the Bakassi Peninsula. As such, public opinion pressured the Government of Ghana to adopt every possible “friendly” and “diplomatic” measure to nip a potential conflict with Cote d’Ivoire in the bud (Koomson 2010).

Resolving this problem was difficult. By law, the Government of Ghana could appoint a commission of experts to lead such negotiations with Cote d’Ivoire only if there were another legal basis on which the commission could be established. No such law was in place. Therefore, under a certificate of urgency, the Ghana Boundaries Commission Bill was sent to parliament, discussed, passed into an act, and became a law after the president assented to it. This law has now paved the way for Ghana to negotiate with Cote d’Ivoire about the respective interests of the two neighbouring countries in the oil field (Koomson 2010).6

Some observers (e.g., Cavnar 2008; King 2009; World Bank 2009, pp. 27-30) have expressed worry about the insufficient number of institutions and civil society organisations that are available to scrutinise the activities of oil companies and government officials. They contend that, in a country with a high level of illiteracy, absence of such institutions may facilitate corruption. Ghana’s decentralised system can help reduce the likelihood of corruption that emanates from excessive centralisation. While Ghana has a mature and established decentralisation as noted in the introduction, Crook (2003) has found that it is administrative, rather than political or fiscal, decentralisation that is effective in Ghana.

Other curses lie at the local level. Three of them are particularly pressing. First, expectation of oil-related investment opportunities has led to a rush by investors to purchase land and rent houses in the local communities adjacent to where oil drilling is taking place. Some landlords have increased the price of rental housing which, in turn, has led to the ejection of low-income tenants who are incapable of paying the higher new rents (Yalley and Ofori-Darko, 2012).

Second, statements from government officials about transparent management of oil revenue usually depict the oil industry as one that has only two stakeholders, namely, government and oil companies. This characterisation neglects the role that local communities can play in ensuring effective control and management of oil resources (Cavnar 2008). Third, when government officials vaguely mention “the third stakeholder,” they do so under the rubric of making oil benefit “all Ghanaians.” Given the disproportionate impact on the “oil communities,” however, there are concerns that such communities need to be given a bigger share of the oil rents in terms of investment (Obeng-Odoom 2012). Constitutionally, ownership of natural resources lies with the population of the country as a whole. According to article 257 (6) of the constitution of Ghana, “Every mineral in its natural state in, under, or upon any land in Ghana, rivers, streams, water courses throughout Ghana, the exclusive economic zone and any area covered by the territorial sea or continental shelf is the property of the Republic of Ghana and shall be vested in the President on behalf of, and in trust for, the people of Ghana.”

Yet, the concern for equity and social justice would require that those people who suffer more may need to have proportionate benefits. In effect, this is a reverse polluter pay principle (as suggested in the Nigerian case by Obi [2010]). A section of the Western Regional chiefs recently petitioned parliament to give the region preferential treatment when the Parliament of Ghana was formulating the Petroleum Revenue Act. According to the chiefs, given that the oil is being drilled from their region, 10 per cent of the oil revenue should be used solely for the development of that region. However, the recommendation was rejected by parliament because the oil revenue is for national, not regional, development (Gadugah 2010; Gyampo, 2011). While there have been attempts to improve the situation, such as establishing PIAC, PIAC’s own report reveals that it is deprived of dependable resources to do its work of tracking oil revenues (see, for example, PIAC [2012], pp. v, vii). Furthermore, there is the problem of streamlining the activities of the various institutions established to strengthen the management and regulation of the oil industry (see, for example, PIAC [2012], p. ix).

2This is assuming the government reference exchange rate of GHC 1.5 = $1 (see PIAC 2012, p. 10, footnote in the PIAC report). 3As already indicated based on figures released by the Ghana Statistical Service, it is more likely that the real growth rate was 13.6 per cent (MOFEP 2011). 4Fund set aside for use by “future” generations. See section 10 (2a) of Act 815. 5It is not clear whether the announcement by the EPA that it had finalised its guidelines for the oil and gas industry implies that the specific case of the Jubilee field is complete as well. 6Now that Cote d’Ivoire is in political crisis, the issue is no longer being discussed.

Conclusion and Policy Reflections

While this paper does not argue that the resource curse thesis is wrong, evidence from Ghana shows that the thesis is rather simplistic. There is cause to be simultaneously optimistic and pessimistic and, even, unsure about the political economy of oil. These multiple and co-terminous possibilities impact various actors in different ways. From this perspective, excitement over the discovery of oil must be tempered, but the feeling of excessive fear of a curse is also unfounded.

The state, assuming it is willing, can consider a three-step interrelated and mutually reinforcing strategy that emphasises proactive public policy making, empirical research, and local empowerment. As part of the agenda, more work is needed on problematising the resource curse thesis. The studies cited in this paper were based on preliminary evidence but, now that oil drilling has actually begun, more studies are needed because the effects of oil are variable. It also follows that there is the need for periodic evaluation. Beyond evaluations of presence or absence of a curse, there is the need to look at the uncritical assumption that a stabilisation fund is a panacea. More studies are needed to know whether good governance and transparency are sufficient. More careful and systematic studies of the environmental dimension of the curse are also needed, including how the oil rents can be used to create environmentally friendly jobs.

Although a framework, the resource curse approach to analysis hides other aspects of the effects of the oil industry on development and society. It neither reveals possible contestations about peri-urban and urban land, nor shows changes in house prices and labour issues in areas where oil is drilled. Beyond claiming that “local content” is high in terms of employment in the industry, there is the need to ascertain which types of job local people obtain, as well as to analyse the gender aspect of employment. A political-economic way of viewing socio-economic phenomena is more appropriate for exploring the implications of such questions. It can help to reveal the role of capital in shaping the society, environment, and economy of oil communities. Also, it does well in helping to unearth questions of equity and how they are likely to be re-configured due to oil production.

More systematic studies are also needed about global interests in the oil industry. Particular attention needs to be given to the role of China in the oil industry, mainly because little is known of this aspect of China’s investments and global expansion. Finally, scholars from economic geography and the new economic geography may generate new insights by looking at topics such as urban transport, particularly whether oil exploration will impact oil prices and, in turn, the desire to drive. Some of the pertinent questions are whether currently latent vehicles are likely to be drawn into use or whether the fixed cost of running cars will remain prohibitive. Would motorcycles be more likely? What about public transport?

Policy makers can benefit from the research findings on these questions by making more systematic studies the basis of public policies. Meanwhile, local oil community empowerment programs can be initiated by both agencies of the state and civil society organisations in several ways, such as holding discussions on new oil laws and research findings in small local meetings.